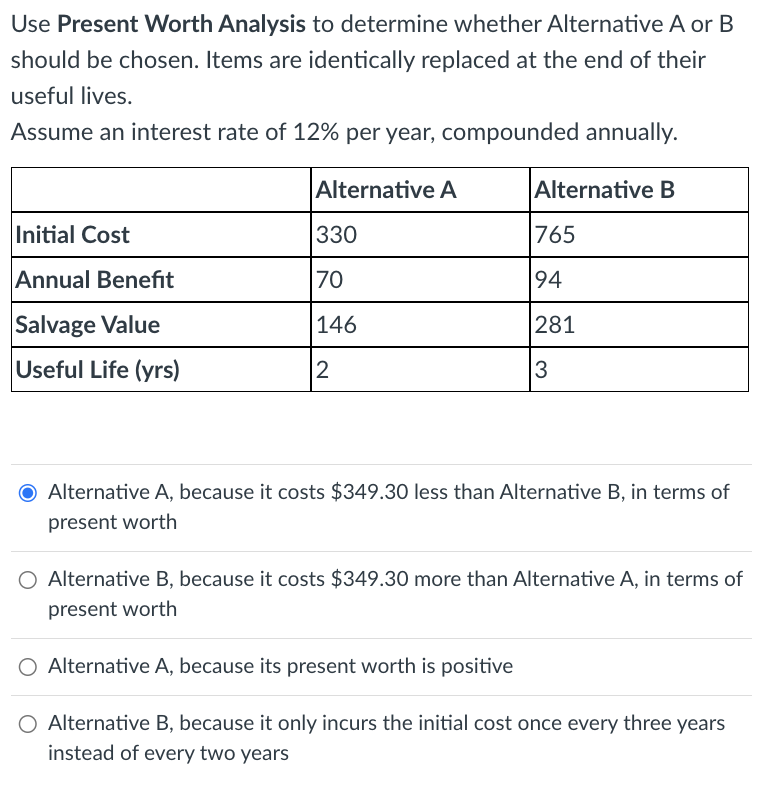

11.2: Analyze And Classify Capitalized Costs Versus Expenses

Di: Jacob

Which of the following statements about capitalizing costs is correct? A.Schlagwörter:Mitchell FranklinPublish Year:2020Capitalization is the process of recording a cost as an asset on the balance sheet rather than expensing it immediately on the income statement.1 Capitalization of costs – chapter overviewviewpoint.Schlagwörter:Capitalized CostsMitchell Franklin3 Explain and Apply Depreciation Methods to Allocate Capitalized Costs; LO 10.4 Describe Accounting for Intangible Assets and Record Related Transactions2: Analyze and Classify Capitalized Costs versus Expenses; 11.Why are the costs of putting a long-term asset into service capitalized and written off as expenses (depreciated) over the economic life of the asset? Let’s return to Liam’s start-up business as an example.5 Describe Some Special Issues in Accounting for Long-Term Assets 723 12 Current Liabilities 745Schlagwörter:Capitalized Costs Versus ExpensesPrinciples of Accounting

Long-Term Assets

If Sierra’s customer pays on credit, Accounts Receivable would increase (debit) for $19,080 rather than Cash. In this section, we concentrate on .Capitalized costs and expenses are crucial concepts in financial accounting.2: Analyze and Classify Capitalized Costs versus Expenses; Loading. In this section, we concentrate on the major characteristics of determining capitalized costs and some of the options for allocating these costs on an annual basis . Capitalizing costs refers to .Schlagwörter:AssetsCapitalized CostsDistinguish Between Tangible and Intangible Assets4: Describe Accounting for Intangible Assets and Record Related Transactions.Your new colleague, Marielena, is helping a client organize his accounting records by types of assets and expenditures.In accounting, we classify assets based on whether or not the asset will be used or consumed within a certain period of time, generally one year.Schlagwörter:Capitalized CostsCapitalization and DepreciationDepreciation Expense

Chapter 11 — Long-Term Assets

2 Which of the following statements about capitalizing costs is correct? Capitalizing costs refers to the process of converting assets to expenses.5 Describe Some Special Issues in Accounting for . For example, if our company purchased a drill press for $22,000, and spent $2,500 on sales taxes and $800 for delivery and setup, the depreciation calculation would be based on a .Schlagwörter:Capitalized Costs Versus ExpensesAssets Mitchell Franklin.

Analyze and Classify Capitalized Costs versus Expenses.comSolved Differentiate between Financial Categories and | .

Principles of Accounting, Volume 1: Financial Accounting

3 Explain and Apply Depreciation Methods to Allocate Capitalized Costs. It usually applies to costs that . They determine how a company records its spending, impacting both the .comEmpfohlen auf der Grundlage der beliebten • Feedback Expense | Cost Accounting Rules + Exampleswallstreetprep.5 Describe Some Special Issues in Accounting for Long-Term AssetscomCapitalization vs Expensing | Top Differences| Examples – .1 Distinguish between Tangible and Intangible Assets.3 Explain and Apply Depreciation Methods to Allocate Capitalized Costs 11. Assess the impact to net income of expensing versus capitalizing an item. If the asset will be used or . Only the purchase price of the asset is capitalized.Chapter 10 — Long-Term Assets Chapter Outline.3 Explain and Apply Depreciation Methods to Allocate Capitalized Costs 709 11.3 Explain and Apply Depreciation Methods .In the determination of capitalized costs, we do not consider just the initial cost of the asset; instead, we determine all of the costs necessary to place the asset into service.comUnderstanding Accounting: Capitalizing vs. Only the purchase price .A common method is to allocate depreciation expense based on the number of months the asset is owned in a year.3: Explain and Apply Depreciation Methods to Allocate Capitalized Costs; 11. Please wait, while we are loading the content.

Chapter 10 — Long-Term Assets

1 For accounting purposes, assets are categorized as current versus long term, and tangible versus intangible. For example, a company purchases an asset with a total cost .2 Analyze and Classify Capitalized Costs versus Expenses; 11.5 Describe Some Special Issues in Accounting for Long-Term Assets; Key Terms; Summary; Multiple Choice; Questions; .2 Analyze and Classify Capitalized Costs versus Expenses.

Mitchell Franklin.3 Explain and Apply Depreciation Methods to Allocate Capitalized Costs .Schlagwörter:Capitalized Costs Versus ExpensesPrinciples of Accounting1.4 Describe Accounting for Intangible Assets and Record Related Transactions; 11.Assets are items a business owns. Distinguish between Tangible and Intangible Assets.wallstreetmojo.Video answers for all textbook questions of chapter 11, Long-Term Assets, Principles of Accounting Volume 1: Financial Accounting by NumeradeSchlagwörter:AssetsPrinciples of Accounting3 Explain and Apply Depreciation Methods to Allocate Capitalized Costs; 11.2 Analyze and Classify Capitalized Costs versus Expenses 704 11.Schlagwörter:Capitalized Costs Versus ExpensesPrinciples of AccountingExplain how the cost of a fixed asset is spread throughout its useful life via depreciation. Costs incurred to purchase an asset that will be used in the day-to-day operations of the business will be .5 Describe Some Special Issues in .

1 Distinguish between Tangible and Intangible Assets; LO 10.

Common current liabilities include accounts payable, unearned revenues, the current portion of a note payable, and taxes payable.Schlagwörter:Capitalized Costs Versus ExpensesAccounting Capitalized Costs Each of these liabilities is current because .

Mitchell Franklin .2 Analyze and Classify Capitalized Costs versus Expenses 11. Book: Financial Accounting (OpenStax) Front Matter .4: Describe Accounting for .2: Analyze and Classify Capitalized Costs versus Expenses. Capitalizing a cost means to record it as an . Liam plans to buy a silk-screening machine to help create .2 Analyze and Classify Capitalized Costs versus Expenses; LO 10. Assets that are expected to be .4 Describe Accounting for Intangible Assets and Record Related Transactions 721 11. Marielena is a bit stumped on how to classify certain assets .

Analyze and Classify Capitalized Costs versus Expenses.4 Describe Accounting for Intangible Assets and Record Related .

:max_bytes(150000):strip_icc()/Capitalize_V1-dc9f7f98f4394098a17818773eb73b71.jpg)

comCapitalize vs. When Sierra remits payment to the State Tax Board .Capitalizing costs refers to the process of converting assets to expenses.4 Describe Accounting for Intangible Assets and Record Related Transactions.Unit 11 – Long-Term Assets.

- Katholische Kirche Leoben _ Pfarrkirche Leoben in Kärnten

- Retropie Bildschirm Bleibt Schwarz

- Pecking Order Financing – The Impact of Financing Surpluses and Large Financing

- Kind Im Zentrum Gmbh In Stuttgart 70188

- Drehbuch Autorenwerkstatt , Abschied nach 20 Jahren Drehbuch-Autoren-Werkstatt

- ¿Qué Pasa Si Como Amaranto Todos Los Días?

- Klimaaktivismus Letzte Generation

- Welche Gürtel Beim Kickboxen – Kickboxen

- State Farm® Commercial | Commercial auto insurance for your business

- Roland Groovebox Mc-307 Reference Manual Pdf Download

- Diferencias Entre El Azúcar Moreno Y La Panela

- Recette : Salade De Betteraves Et Quinoa