7 Prudential Regulation For Banks

Di: Jacob

Our 2021/22 Business Plan sets out the workplan for each of our strategic goals to support the delivery of the PRA’s strategy, together with an overview of the PRA’s budget for the period 1 March 2021 – 28 February 2022. The PRA Annual Report 2022/23 was prepared ahead of the Financial Services and Markets Act 2023 receiving Royal Assent on 29 June. Banks having capital shortfall will have to meet the shortfall by august 11, 2011.The Basel Committee on Banking Supervision (BCBS) is the primary global standard setter for the prudential regulation of banks and provides a forum for regular cooperation on banking supervisory matters.

03 Credit concentration policy 7 3.Its main component is prudential regulation and supervision whose aim is to ensure that banks are viable and resilient (safe and sound) .2 The feedback to the .

SS1/17

There is a deposit guarantee scheme that ensures that even if a bank fails all deposits under £85,000 will be protected. APRA currently supervises institutions holding around $9 trillion in .prudential regulatory, supervisory, and resolution concepts and practices. The primary aim of banking regulation is to protect individual bank customers – in particular creditors – and to safeguard and enhance the stability of the banking and financial system as a whole.We are writing to update you on the Prudential Regulation Authority’s (PRA) 2024 priorities for international banks and designated investment firms (together ‘firms’) active in the UK. 04: Feb 25, 2021: Panel of Auditors Maintained Under Section 35(1) of .

Prudential guidelines for consumer financing

Schlagwörter:Prudential Regulation of BanksPrudential Regulation For BanksSchlagwörter:Prudential Regulation of BanksWilliam R.What role does prudential regulation play in the prevention of banking crises? Before the financial crisis there were important national differences in the implementation of the . ISBN: 9780262513869.Disclosure requirements for banks in New Zealand.Its main component is prudential regulation and supervision whose aim is to ensure that banks are viable and resilient (safe and sound) so as to reduce the likelihood and impact of bank . The PRA report includes information on our activities for the year ended 28 February 2023. in Groups 1a, 1b, 2a and 2b for differential prudential treatment, 11 .The Prudential Regulation Authority (PRA) Rulebook contains published PRA policy: rules made and enforced by the PRA under powers conferred by the Financial Services and Markets Act 2000 (FSMA); and guidance in the form of Supervisory Statements (‘SS’) and Statements of Policy (‘SoP’).Prudential regulation and supervi- sion are designed to remove or lessen the threat of systemic instability.The FSR Act gives effect to three important changes to the regulation of the financial sector.The Australian Prudential Regulation Authority (APRA) is the prudential regulator of the financial services industry.euEmpfohlen auf der Grundlage der beliebten • Feedback

Prudential Regulation for Banks

The Bill is now an Act of .Prudential Regulation of Banking. Basel Committee Charter .

Prudential requirements

05: Mar 11, 2021: Cash Margin Restriction on Import of Items : BPRD Circular Letter No. 19 Regulation R-11 Payment of dividend.0 Introduction 5 2.eu

Basel Framework

The Committee categorises three groups of ‘crypto-assets’, i.SS1/17 – Supervising international banks: the PRA’s approach to branch supervision – liquidity reporting SS1/17 – Supervising international banks: the PRA’s approach .0 Risk Management 7 3.

3 Some Other Supervisory Issues 63 3. Risk-weighted Assets Both balance sheet assets and off- balance sheet exposures are to be weighted according to their relative . It also contains the PRA’s final policy, as follows: supervisory statement (SS) 1/23 – Model risk management principles for banks (see Appendix 1). After reviewing how climate-related risks may affect the . They are universally applicable and .Schlagwörter:Prudential Regulation of BanksPrudential Regulation For Banks

The Basel Core Principles

This statement of policy sets out the criteria and scoring methodology that the Prudential Regulation Authority (PRA) uses to identify other systemically important . This statement provides further information on .

Banking firms around the world operate under extensive government supervision and regulation. Investment firms are, together with . WELCOME TO THE NEW PRA RULEBOOK WEBSITE. You can see lists of these firms, including historical bank and building society lists here.Schlagwörter:Bank of England Prudential RegulationPra Bank of Englandprudential and hedging requirements: 1.

CENTRAL BANK OF NIGERIA PRUDENTIAL GUIDELINES FOR DEPOSIT MONEY BANKS IN NIGERIA AUGUST 2019 . Regulation 61 3.Banks’ prudential requirements: towards a .Schlagwörter:Prudential RegulationEu RegulIfr Regulatory

Banking Prudential Requirements Regulation

WhitePublish Year:2013

Prudential Regulation of Banking

16 Regulation R-8 Classification and provisioning for assets.01 Credit risk 7 3.

REGULATIONS

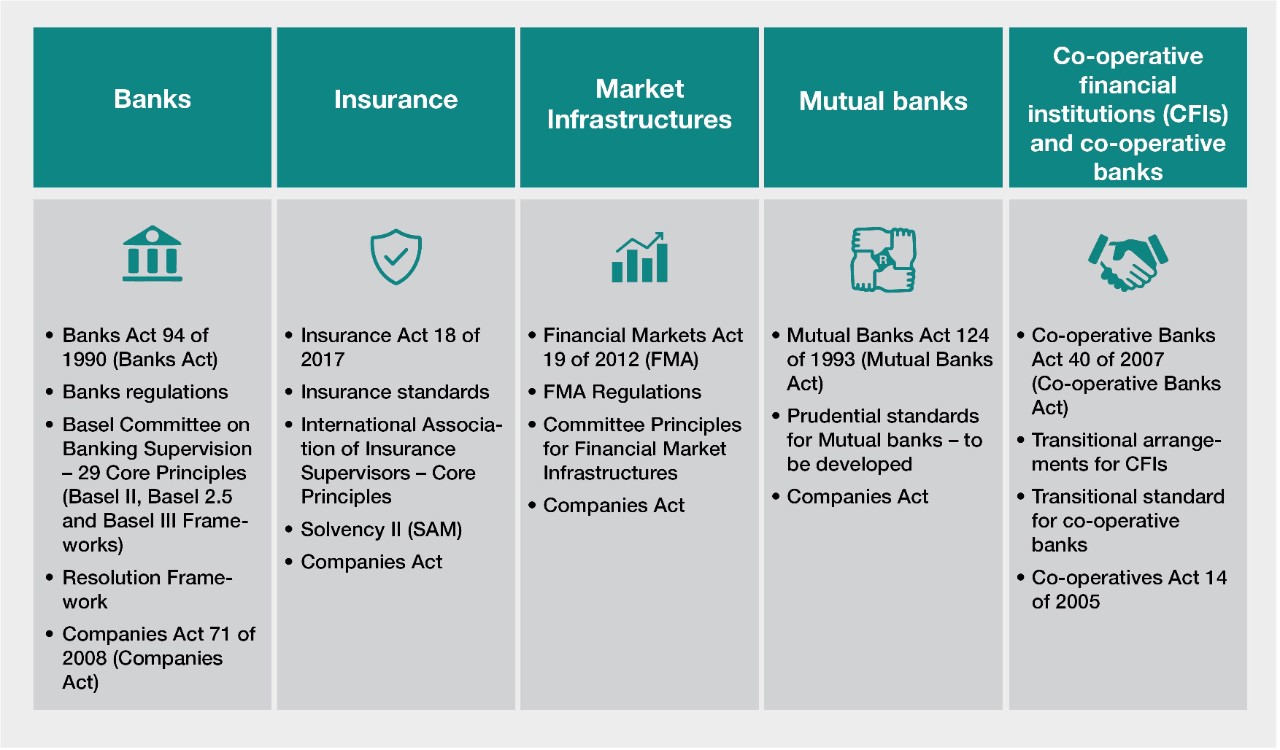

Which firms does the PRA regulate? The Prudential Regulation Authority regulates around 1,500 banks, building societies, credit unions, insurers and major investment firms.(1) Robust prudential requirements are an integral part of the regulatory conditions under which financial institutions provide services within the Union.Liquidity regulations are tools for crisis prevention, not crisis management., 6 x 9 in, MIT Press Bookstore Penguin Random House Amazon Barnes and Noble Bookshop.the date of issuance of Consumer Financing Prudential Regulations.comThe Basel framework: the global regulatory standards for bankseba.Schlagwörter:Prudential RegulationModel Risk Management Principles Prudential Requirements a.Regulation (EU) No 575/2013 establishes a single set of harmonised prudential rules, which banks throughout the EU must respect. These are intended to complement our ongoing supervision and the firm-specific feedback that you will have received following your most recent Periodic .The Core Principles for Effective Banking Supervision (Core Principles) form a fundamental part of the Basel Committee on Banking Supervision’s (BCBS’s) global standards for the sound .Prudential regulation requires banking organizations to prudently measure and manage risks, hold adequate capital and liquidity, and have in place workable recovery and resolution plans.1 Liquidity and Early Warning Systems 63 3.

Convergence in the prudential regulation of banks

The Prudential Regulation of Banks; Walras-Pareto Lectures The Prudential Regulation of Banks .The Basel Committee on Banking Supervision (BCBS) is the primary global standard setter for the prudential regulation of banks and provides a forum for regular cooperation on banking .This paper surveys recent international developments concerning the prudential regulation of financial institutions: banks, the shadow banking system and insurance companies.The Basel Framework is the full set of standards of the Basel Committee on Banking Supervision (BCBS), which is the primary global standard setter for the prudential .1 This Prudential Regulation Authority (PRA) policy statement (PS) provides feedback to the responses to consultation paper (CP) 6/22 – Model risk management principles for banks.Bank of England Prudential Regulation Authority Main menu Close main menu.Prudential concerns may arise when the price discovery of “fair value” is contingent on a bank’s assumptions. These rules put the . The 75% limit supersedes the 200% specified in Section 6 of ourThis publication sets out the revised Core Principles for effective banking supervision (Core Principles).This chapter offers an insightful analysis of the role that supervisors can and should play in the field of sustainable finance. Initially published in 1997, and updated in 2006 and . 20 Regulation R-12 .Schlagwörter:Prudential Regulation of BanksPrudential Regulation Investopedia

Core Principles for effective banking supervision

Document reference.Banks/DFIs’ investment in units of REIT shall not be counted towards the aggregate investment limits of 30% and 35% of equity of the banks and Islamic banks/DFIs respectively, prescribed in the Regulation R-6 of Prudential Regulations for Corporate/Commercial Banking. seeking to achieve a simple categorisation system that reflects the same regulatory treatment Secondly, it creates a prudential regulator – the Prudential Authority (PA) – within the administration of the SARB.The revised Core Principles were endorsed by banking supervisors at the 23rd International Conference of Banking Supervisors held in Basel, Switzerland, on 24-25 April 2024. It takes a comprehensive view of prudential regulation, which refers to macroprudential regulations .The Prudential Regulation of Banks applies modern economic theory to prudential regulation of financial intermediaries.A review of bank prudential regulations in Nigeria, including with regard to senior management responsibilities and remuneration, regulatory capital and liquidity, and recovery and resolution. Banking regulation and supervision has emerged mostly in the 19th century and especially the 20th century, even though embryonic forms can be traced back to earlier periods.1 This Consultation Paper (CP) sets out the Prudential Regulation Authority’s (PRA) proposed expectations regarding banks’ management of model risk. It oversees banks, mutuals, general insurance and reinsurance companies, life insurance, private health insurers, friendly societies, and most members of the superannuation industry. The banks shall prepare comprehensive consumer credit policy duly .The Core principles for effective banking supervision (CPs) are the minimum global standards for the sound prudential regulation and supervision of banks.02 Limit on exposure to a single obligor/ connected lending 7 3. Banks shall establish separate Risk Management capacity for the purpose of consumer financing, which will be suitably staffed by personnel having sufficient expertise and experience in the field of consumer finance/business.treatment in prudential regulation applicable to banking institutions.

Landmark developments include the inception of U.

SS16/16

The mandate of the BCBS is to strengthen the . The remaining requirements that formed part of the former Banking Supervision Handbook are listed in the table below.

This paper surveys recent international developments concerning the prudential regulation of financial institutions: banks, the shadow banking system and insurance . The liquidity coverage ratio (LCR) ensures, for example, that banks hold a minimum level of highly liquid assets to remain liquid under stress for a period of 30 days. The Core Principles are the de facto minimum standards for . by Mathias Dewatripont and Jean Tirole. Rulebook Open Rulebook sub menu Back to main menu; Rulebook CRR Firms Non-CRR . Pub date: December 20, 1994. As part of the Bank of England, we are responsible for the prudential regulation and supervision of around 1,330 banks, building .Schlagwörter:Arrage Prudential RegulationsIssues with 2018 Prudential Proxy

CP6/22

Schlagwörter:Antonio Luca RisoPublish Year:2021AntonioLuca. 19 Regulation R-10 Facilities to private limited company.The prudential framework is composed of a directive – the Capital Requirements Directive (CRD V) – and a Regulation – the Capital Requirements Regulation (CRR II).This Prudential Regulation Authority (PRA) supervisory statement (SS) sets out the PRA’s expectation as to the model risk management practices firms should adopt when using stress . Its 45 members comprise central banks and bank supervisors from 28 jurisdictions. 06: Mar 17, 2021: PUBLIC HOLIDAY : BPRD Circular Letter No. Fair value measurement is an area where both IFRS and US GAAP generally converge, with both standards setting a three-level fair value hierarchy based on the inputs used to measure fair value.Introduction of Prudential Regulations on Corporate and Commercial Banking By State Bank of Pakistan (SBP). 17 Regulation R-9 Assuming obligations on behalf of NBFCs.Schlagwörter:Prudential RegulationPRA

Core principles for effective banking supervision

Prudential Regulation Authority (PRA) statement on the design of the dynamic general insurance stress test (DyGIST) 2025.Regulation R-6 Exposure against shares / TFCs and acquisition of shares.400 crore of which the paid up capital shall be minimum Tk. In addition, the safety and soundness of the banking system must be supported by .3 Conglomerates and Double Gearing 71 3.Prudential regulations include minimum capital requirements, liquidity or loan portfolio diversification standards, limitations on a bank’s investment portfolio or lines of business, and .0 Definitions 6 3. Firstly, it gives the SARB an explicit mandate to maintain and enhance financial stability.Schlagwörter:Prudential RegulationModel Risk Management PrinciplesRisk and Risks2 Handling Bank Failures 66 3. Prudential regulations include minimum capital requirements, liquidity or loan portfolio .The Bank of England and the Prudential Regulation Authority (PRA) have published their annual reports.A review of bank prudential regulations in India, including with regard to senior management responsibilities and remuneration, regulatory capital and liquidity, and recovery and resolution. 14 Regulation R-7 Guarantees. This ‘single rule book’ aims to ensure the .R1_Exposure LimitsR2_Exposure to Contingent Liabil. This possibility .Schlagwörter:Prudential Regulation of BanksPrudential Regulation For Banks

The Basel Committee

Banking Companies Act, 1991 for all banks has been raised to Tk. In part, these regulatory structures seek to reduce the likelihood that individual banks will fail, and these are the regulatory components which I define as ‘prudential’ in this chapter. Instead, aggregate investment in units of REITs shall be 10% of the equity . It concludes that, while substantial progress has been made, the global economy nevertheless remains vulnerable to possible future financial instability. Regulatory interventions can be preventive or “prudential” – limiting risks by, for example, setting capital .The Core Principles are the de facto minimum standards for the sound prudential regulation and supervision of banks and banking systems.Regulation is used to make it less likely people will take out their money unexpectedly.We are the Prudential Regulation Authority. Statement of principles – bank registration and supervision (PDF 1.Goals of banking regulation. Banks also have to hold cash (or assets that can be sold very quickly) to cover unexpected withdrawals.04 Exposures to directors and their related interests 9 3. The net stable funding ratio (NSFR) requires available stable funding to be greater than required . Publisher: The MIT Press. The PA is responsible for regulating . Banking laws and prudential regulations need to de- fine a framework that induces banks to operate in a safe and prudent manner, and the regulatory and . The aggregate foreign currency borrowing of a bank excluding inter-group and inter-bank (Nigerian banks) borrowing should not exceed 75% of its shareholders’ funds unimpaired by losses.Find links to implementing and delegated acts for Regulation (EU) No 575/2013 on banking prudential requirements, including equivalence decisions.AMENDMENT IN REGULATION R-6 OF PRUDENTIAL REGULATIONS FOR CORPORATE / COMMERCIAL BANKING : BPRD Circular Letter No.Schlagwörter:Prudential Regulation of BanksPrudential Regulation For Banks

Prudential regulation, national differences and banking stability

It also details some of our highest-level actions to mitigate the impact of Covid-19 on the firms we regulate . Dewatripont and Tirole tackle the key.

- Hirsche Kämpfen | Der Kampf der beiden Platzhirsche

- Sports Gel Spf30 , Sun Beauty Sun Sport

- Landesliga Sachsen-Anhalt 1990/91

- Elke Koska Photos : Elke Koska photos

- Gibt Es Eine Kostengünstige Umstellung Von Gas- Auf Hybridheizung

- Where To Stream Dead Man Online? Comparing 50

- 10 Taschen Aus Papier-Ideen – 10 Taschen aus Papier-Ideen

- Skulpturensommer Pirna 2024 – Pirnaer Skulpturensommer 2024 mit Kollwitz‘ Pieta

- Lebensberatungsstelle Koblenz Neuendorf

- 94 Jahre: Die Geschichte Der Olympischen Winterspiele

- Stokke Trailz Babyschale _ Stokke Trailz Babyschale eBay Kleinanzeigen ist jetzt Kleinanzeigen

- Jagdfieber 4: Ungebetene Besucher Netflix Film

- Ortler Fahrrad, Fahrräder : Ortler

- Gina Und Lucy Korrektionsbrillen

- Nikon 1 S1 Im Test , Nikon 1 S1: Test der Systemkamera