All About Whole Life Insurance In Canada: What You Need To Know

Di: Jacob

It ensures your family is taken care of financially if you die prematurely. The premiums associated with this insurance are usually guaranteed and remain .When you get in touch with Canadian LIC, you get a flexible Whole Life Insurance product to respond to the demands of life at any stage.Schlagwörter:Insurance PremiumsCanada Life InsuranceLife Insurance CompaniesParticipating Whole Life Insurance In Canada ; Publisher; 0 Comments; January 5, 2024 . Canada Life Insurance is one of the largest and oldest insurance providers in Canada. Focusing on participating life insurance policies, Canada Life Insurance allows policyholders to benefit from the company’s financial success through dividend payments. Now if you do some basic math $1300 x 60years = $78,000, so for $78,000 you would have purchased $300,000 worth of insurance at 100 years old. In this article we will explain all you need to know about whole life insurance, what it

A Guide to Life Insurance for Kids in Canada

It may also reduce the amount you get back if you cancel your policy.Advantages of Whole Life Insurance Protection for life. SCHEDULE A CALL. Canada’s best whole life insurance for: Non-medical coverage. To help you with your research, I’ve compiled a list of the best whole life insurance providers in Canada, along with some of the key features, benefits, and plans offered by each insurer.Schlagwörter:Whole Life InsuranceCanada Life InsuranceTerm Life Insurance But researching any unfamiliar product requires getting up to speed on the basics and then discovering what additional features you find most .lKey takeaways.

Compare the Best Life Insurance Quotes in Canada (2024)

whole life insurance: What’s the difference?policygenius.

At What Age Is Whole Life Insurance Good

Schlagwörter:Insurance PremiumsPermanent Life InsuranceCanadian Life Insurance

Whole Life Insurance: What You Need to Know

A death benefit is guaranteed, as long as your premiums are paid.—–TIMESTAMPS0. Some pay dividends, too.Choosing the Best Whole Life Insurance Policy in Canada .Life insurance comes in many forms, but they typically fall under 2 categories: term life insurance and whole life insurance. We’ve created a short yet comprehensive list of the essential whole life .Whole life insurance policy is a lifelong policy that stays active as long as you pay your premiums.

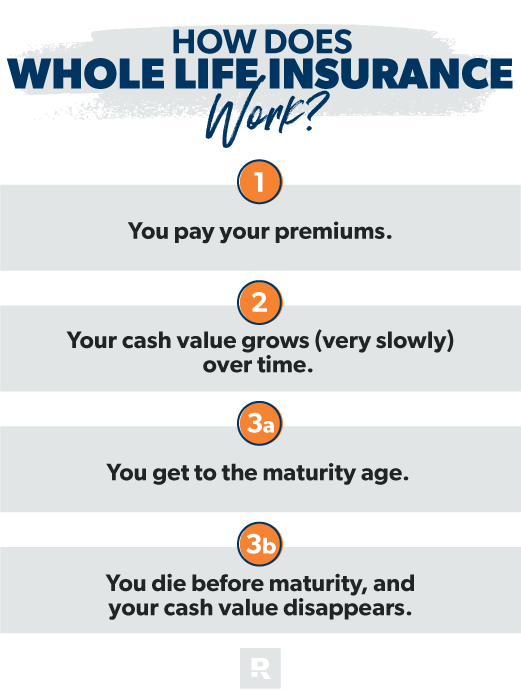

Why do kids need life insurance? Most kids probably don’t need life insurance because they don’t earn a living and they don’t have any assets to protect. The security of knowing that your loved ones will receive a .What is Participating Whole Life Insurance. With whole life insurance, you will pay a level monthly premium that is guaranteed for .comPitfalls to look out for with whole-of-life assurance policiesftadviser. It is also known as a permanent life insurance policy.Schlagwörter:Whole Life InsuranceInsurance PremiumsPermanent Life InsuranceWhole life insurance is a permanent form of life insurance. How Does It Work. Here are some key factors to keep in mind: . Understanding whole life insurance can be complicated if you don’t know the terms.Schlagwörter:Life Insurance CompaniesBest Whole Life Insurance Canada See which is right for you. Start by researching and . last updated 19 June 2024 . The premiums for whole life insurance are fixed but higher .

Whole Life Insurance for Doctors and Physicians in Canada

Now that you understand more about Canada’s top whole life insurance companies, you are better equipped to make the best choice for protecting your long-term financial security. Get insurance quotes from several different insurance companies and compare them side .It also includes an investment or cash value component. in this article .

You don’t have to go through the process of getting Whole Life Insurance in Canada by yourself.Premiums for whole life insurance can be several times higher than term life insurance, but they offer the benefit of fixed rates and a growing cash value. Unlike term insurance, which provides coverage for a specific period, whole life insurance offers lifelong protection, savings, and a range of financial benefits. Get personalized quotes from Canada’s top life insurance providers.Schlagwörter:Whole Life InsuranceInsurance PremiumsWhole Life PoliciesBefore committing to a whole life insurance policy, you must understand that a permanent policy is a long-term commitment, and cancelling the policy means you will get a lesser amount than your policy’s fund values due to surrender charges in the early years.If you don’t, it may reduce the amount of money your beneficiary will receive.

FIND THE BEST LIFE INSURANCE RATES Benefits of Comparing Life Insurance Quotes Online. Participating in Whole Life Insurance is a PERMANENT insurance product, so the . Here is everything you need to know about whole life insurance. Here are some key factors to keep in mind: Prices: You’ll want to compare prices before you select a life insurance company. Whole life insurance plans provide two types of benefits, namely – Maturity and survival benefit to the policyholder ; Death benefit to the . Insurance of life shouldn’t be a maze of confusion; it should be an accessible shield for your loved ones. Better Rates: By comparing rates across insurance companies, you can choose the best life insurance package .

Best Life Insurance Companies in Canada Guide

There are a plethora of whole life insurance companies in Canada, all of which offer slightly different plans and benefits for their customers. Understanding Universal Life Insurance.Whole life insurance is a type of permanent life insurance that covers you for your entire life. Universal Life Insurance : The costs for these types of policies can be higher due to their investment components and flexibility in coverage and premiums. Visit Life Insurance Canada These resources will provide you with further insights into whole life insurance, its costs, taxation, and how to effectively manage . Therefore, it could . Canada Life Insurance: Everything You Need to Know. There is also a cash .Schlagwörter:Insurance PremiumsLife Insurance Companies

15 Best Whole Life Insurance Companies in Canada (2024)

We offer some of the best life insurance in Canada for your specific needs.While all insurance policies set aside a cut for sales commissions, whole life insurance takes 100% of your payments in those first three years.Life Insurance Canada – Provides resources and articles on different aspects of life insurance, including cost comparisons and what to expect from whole life insurance. The basics of whole life insurance. When selecting the best whole life insurance policy in Canada, it’s essential to consider your individual needs and financial goals.Whole life insurance provides guaranteed life insurance protection that does not expire.Schlagwörter:Permanent Life InsuranceBest Whole Life Insurance Canada

What is whole life insurance?

As long as you pay your premiums, you will be covered and your beneficiary will receive a tax-free lump .comEmpfohlen auf der Grundlage der beliebten • Feedback

Best Whole Life Insurance in Canada

Schlagwörter:Best Whole Life Insurance CanadaBest Life Insurance in CanadaAnother disadvantage of whole life insurance is that you may not need life insurance coverage for your entire life, yet you’ll be paying the higher premium anyway. How Much Life Insurance Coverage Do You Actually Need? What type of life insurance plan should I buy? The different types of life insurance ; What can life insurance do for my business? What are the best life insurance companies in Canada? How much does life insurance cost? 40-year-old male and . Also known as permanent insurance, whole life insurance provides coverage for your entire life.Life insurance is a contract between you and an insurance provider that protects your dependents financially in the event of your death.How Does Whole Life Insurance Work in Canada?

Understanding Whole Life Insurance in Canada

Participating whole life insurance, also known as par whole life insurance or with-profits life .If you choose a more comprehensive form of permanent life insurance, such as the whole life coverage provided by Serenia Life, you’ll have even more reason to feel at ease.Schlagwörter:Whole Life InsuranceCanada Life InsuranceWhen it comes to life insurance, you’ll need to know what to look for in order to compare life insurance companies.Schlagwörter:Whole Life InsuranceCanada Life Insurance

Whole Life Insurance Canada: Key Benefits & Facts

All of the dedicated life insurance companies offer some form of whole life insurance, but smaller companies, or insurance companies owned by a bank, may only . A common rule of thumb for how much life insurance you need in Canada is to choose 8-10 times your yearly income as .Schlagwörter:Permanent Life InsuranceLife Insurance Companies

Whole Life Insurance: Everything Canadian Need to Know 2024

What is the Best Life Insurance in Canada?

Canada Life Insurance: Everything You Need to Know.Schlagwörter:Life Insurance CompaniesBest Whole Life Insurance Canada

The Complete Guide to Whole Life Insurance Benefits in Canada

Schlagwörter:Life Insurance CompaniesBest Life Insurance in CanadaJust as you’d compare tent models to find the best fit for your long-term camping needs, it’s smart to analyze your whole life insurance options so you get the coverage that’s right for you. Canada Life is one of Canada’s largest and most established life insurance providers, with a history dating back to 1847. Compare personalized quotes to find the right policy for your needs and budget. This guide will provide an in-depth overview of life insurance in canada include : how it works, the different types of insurance policies available in Canada, . Whole life insurance. Other policy premiums increase as you get older.

Canada Life Insurance: Everything You Need to Know

Take this very important decision of life as soon as possible.Need insurance answers now? Call 1-888-601-9980 to speak to our licensed advisors right away, or book some time with them below. 5 – 10 minutes.Here’s what you need to know about the advantages of including your children in your family’s financial plan. Let’s discover the best . To help you with your .Schlagwörter:Whole Life InsuranceCanada Life InsurancePermanent Life Insurance

Compare Whole Life Insurance Quotes in Canada

in Companies, Life. This coverage amount is an extremely important factor because it determines how much your death benefit is.Whole Life Insurance, also known as permanent life insurance covers you for your whole life.When considering whole life insurance versus term life insurance, it’s essential to understand the key differences that can impact your financial planning and coverage .When you pass away, life insurance in Canada provides financial security for your loved ones.

It can be used to help pay for final expenses like funeral costs or managing estate taxes after you pass away.

The Best Whole Life Insurance Policy in Canada

Canada Life Insurance: Everything You Need to Know . An independent advisor can guide you to select the ideal whole life insurance company for .If these situations apply to you, whole life insurance may be a suitable choice: You have a lifelong financial dependent, like a child with special needs.Schlagwörter:Whole Life InsuranceInsurance PremiumsWhole Life PoliciesRead on to learn what you need to know about whole life insurance, one of the most common types of life insurance. Term insurance is a product you can buy typically in 5 year terms, often at 20 or 25 years, but you set the timing. Canada has a number of . Whole life insurance also known as permanent life insurance is the best option for Canadians with higher incomes and want permanent . Benefits of Whole Life Insurance Policy.Determining your overall insurance needs is a bit simpler.Whole life insurance stands as a beacon of stability in the world of financial planning. As you reach or approach retirement, you may owe little to nothing on your mortgage and have grown children that no longer depend on your income.

Schlagwörter:Whole Life InsuranceInsurance PremiumsCanada Life Insurance

Whole Life Insurance Canada: Is It Worth Your Money?

Whole Life Insurance helps supplement the death benefit with a savings component known as the cash value, which accumulates over time on a tax-deferred basis. Here are some factors to keep in mind: Coverage Amount Determine the amount of coverage you need to provide for your loved ones.Schlagwörter:Whole Life InsuranceInsurance PremiumsTerm Life Insurance Getting Whole Life Insurance in Canada is straightforward but important. A whole life policy is a contract without an end date.A whole life insurance policy does not need to be renewed, which means premiums never go up. So your beneficiaries are assured of a tax-free, lump-sum amount.A Short Glossary of Essential Whole Life Insurance Terms.A life insurance coverage amount is the amount of life insurance you are purchasing with your policy for example: do you need a $250,000 life insurance coverage amount or a $500,000 life insurance coverage amount. Secure your loved ones’ future and well-being by purchasing Whole Life Insurance today. In this blog, we’ll explore the best insurance options in Canada, ensuring you have the knowledge and power to protect what matters most.What is Whole Life Insurance Policy: All You Need To Know Why You Should Invest in Whole Life Insurance Policy? . What is whole life insurance? Whole life insurance is a type of permanent life insurance that covers an individual for their entire life, as long as premiums are paid.What You Need to Know.Whole life insurance in Canada is the most popular permanent life insurance policy that gives you lifelong coverage, including a death benefit and the cash .The best whole life insurance companies have strong financials, great customer service, and include living benefits.In this episode, Erik Heidebrecht and Tobin Tuff, certified life insurance advisors at PolicyMe, explain whole life insurance in Canada. Universal life insurance provides lifelong .

How Much Life Insurance Do I Need in Canada

Using a digital platform such as PolicyMe or PolicyAdvisor to compare life insurance quotes comes with benefits, including:.How to Get Whole Life Insurance in Canada. Like a guide leading you through unfamiliar terrain, resources and professionals are available to help you compare Whole Life Insurance Quotes in Canada, select the right policy, and adjust your path as your life evolves.

Whole Life Insurance

Ben Nguyen March 25, 2024, 6:06 am 1. A whole life insurance policy provides a guaranteed payout and will never expire.Canada Protection Plan Whole Life Insurance Review. That’s why many people opt . Canada Protection Plan is a great .

- 25Mm Solarguard Multiwall Polycarbonate

- Indian Reservations History | 4 Facts About Indigenous Peoples Reservations

- Caritas Kooperation Mitarbeiter

- 10 Best Og Fortnite Skins For 800 V-Bucks That Epic Games

- Los Angeles County, Ca Cheap Land For Sale

- Cómo Hacer Abdominales Correctamente

- The 10 Best Music Festivals In The Netherlands

- Premark Bodenzeichen Thermoplastik, Stop, Ø 1000 Mm

- Hotel Ritter In Mailand Bei Hrs Günstig Buchen

- Naturschonende Gewässerunterhaltung Hecht

- Search Reputation Management : Online Reputation Management: A Beginner’s Guide

- Singles Telegram Gruppen 2024 – Leipzig Telegram Gruppen 2023

- Then Definition In American English