Alpha Vs Beta Stocks In Investing: Definition, Examples, Pros And Cons

Di: Jacob

Alpha is a measure of the difference between a portfolio’s actual returns and its expected performance, given its level of risk as measured by beta. Beta is a measurement of market risk or volatility. Higher alpha is always preferred to lower alpha, but there are . To be considered a dividend aristocrat, a company must typically have raised . beta: Understanding the differences and they work . On the other hand, beta indicates the systematic risk or volatility associated with a stock. When investing, your capital is at risk and you may get back less than invested. In such cases, investment results are likely to regress toward the mean over time. Decision-making happens every day.0 is twice as volatile as the benchmark, while an investment with a beta of 0. This article also describes a method based on yield spread .Alpha measures an investment’s return (aka performance) relative to a benchmark, while beta measures an investment’s volatility compared to the overall market. Systemic risk measures the risk that all assets in a marketplace share. In other words, it measures how reliable the stock’s beta is in judging its market sensitivity.Beta is used to model risk but is not a general indicator of risk or volatility. The objective of passive investing vs. You can decrease your investment risk by diversifying your portfolio based on your financial goals.

Alpha and Beta for Beginners

It’s also sometimes used as a simple measure of whether an asset .Beta is a way of measuring a stock’s volatility compared with the overall market’s volatility. Anonymity: Cryptocurrency transactions are completely anonymous, which is a benefit for users wanting privacy. When we are talking about stocks, the benchmark is normally the S&P 500. Because the S&P 500 is an index of the 500 largest companies in the US, it gives a solid figure to understand what normal returns and volatility should look like.Beta is considered a measure of systemic vs.Is a negative alpha a good buy?A single technical indicator dipping into unfavourable territory can be cause for concern, but it’s not necessarily a fire alarm. Trusted and secure. Others are more complex, such as declining a job offer to follow a different career path or taking a promotion offer .

Alpha und Beta an der Börse

How to Invest in Stocks: Pros, Cons, and Strategies

What Is a Stock’s Beta? Definition, Evaluation, Pros & Cons

‚Alpha’ tells investors how a security has historically performed vs. This statistical technique estimates the relationship between a dependent variable (the stock’s returns) and an independent variable (the . Debt investments tend to be less risky but provide lower returns over time. Stocks and bonds that are a member of the benchmark index make up the assets that . An analyst can use the Nasdaq, the Dow Jones Industrial Average or any other data set .inEmpfohlen auf der Grundlage der beliebten • FeedbackcomEmpfohlen auf der Grundlage der beliebten • Feedback You buy a stock, pay for the transaction and move on with the .Autor: Kent ThuneIn investing, beta does not refer to fraternities, product testing, or old videocassettes.By definition, the market, such as the S&P 500 Index, has a beta of 1. Alpha is always positive, while Beta can be positive or negative.comAlpha and Beta for Beginners – Investopediainvestopedia. Saving and investing are important parts of a sound financial plan.Investing in the stock market can offer several benefits, including the potential to earn dividends or an average annualized return of 10%. It measures the performance of an investment relative .Während Alpha die über- oder unterdurchschnittliche Rendite eines Portfolios im Vergleich zu einem Benchmark-Maßstab misst, gibt Beta Auskunft darüber, wie sich die Rendite .

Pros and Cons Lists: Examples and Templates

comABCs Of Investing: Alpha, Beta And Correlation – Forbesforbes. Learn more about their . By definition, the market as a whole has a beta of 1, and everything else is defined in relation .Simply defined, alpha is the excess return (also known as the active return), an investment or a portfolio of investments ushers in, above and beyond a market index or benchmark .Separating a single portfolio into two portfolios — an alpha portfolio and a beta portfolio — affords an investor greater control over risk. Read more to see the pros and cons of buying FB stock.It is just an example; however, this trade is quite typical of the pros and cons of tactical allocation models, whatever the asset list, indicators, look-back periods, and rebalancing frequencies.

Alpha In Investing: What It Is And How It Works

Beta, alpha and beta coefficients are .3 Funds With High Alpha You Must Buy This Year | Nasdaqnasdaq.Alpha investing aims to beat the benchmark, while beta investing focuses on how volatile an asset is compared to the market.What does an alpha value of 0.Invest in Stocks and ETFs with zero commission. Investors use both the alpha and beta ratios to calculate, compare, and predict investment returns. Feel good about your decisions.Beta for stocks or investments is the measure of its potential volatility against the market as a whole. Beta is calculated using regression analysis. Though a little more esoteric, R-Squared is similar to Beta, but in this case tells you what proportion . It serves as a reflective gauge of the market’s tempo, mirrored in the stock’s price movements.” Alpha is thus .0, and individual stocks are ranked according to how much they deviate from the market. Low beta means that the asset has very little risk outside of those shared by all the other stocks on the market.

Pros and Cons of Investing in Stocks

In some cases, a low beta investment is quite volatile.Summary: Beta helps investors analyse market volatility and prepare for potential risks. Grasping R-squared is important for evaluating . Investing 101 Dividends.R-squared is a statistical measure that indicates the extent to which data aligns with a regression model. Investing in stocks is a common .Alpha indicates the degree of a stock’s return with respect to a specific benchmark and is hence more focused on the direct rewards gained through investment.

Alpha reflects the possibility of high stock price performance, while .Alpha is the excess return of an investment compared to its expected return given its level of risk, as determined by its beta.Alpha measures the return on an investment above what would be expected based on its level of risk.Hedging is a mechanism whereby a given risk exposure is either eliminated or minimized through taking an offsetting position. Alpha is the risk-adjusted measure of how a security performs in comparison to the overall market average return.

Essentially, beta quantifies the sensitivity of a stock to market fluctuations. Adventurous investors could be happy w. The stock market can be volatile, so returns are never guaranteed.Pros of Cryptocurrency.

Each of those choices has different stakes. Some decisions are simple, like whether to have coffee or tea with breakfast.

What’s the difference between alpha and beta investing?

There are essentially 2 ways to pursue low risk: never taking on risky . Utilising index funds is a common way to achieve this goal.A stock gives an investor a small ownership share of a company, and the stock’s returns are generally based on the company’s performance. High beta values provide insight into high-outcome yet risky stocks whereas low beta stocks present stable, safe opportunities to earn less profit.Alpha and beta are two different parts of an equation used to explain the performance of stocks and investment funds. Trade Gold, Oil, Currencies and more. Trading is a transactional process designed for the short term.In investing, alpha and beta are complementary performance indicators that relate an asset’s growth and volatility to a suitable benchmark. Saving is focused on establishing a safety net for unexpected expenses, while investing is focused on accumulating wealth. Past performance doesn’t guarantee future results.

Transitioning from saving to investing is a natural progression that should occur once you have amassed an adequate liquidity reserve . Alpha is the return on an investment that’s incrementally more than a benchmark index such as the S&P 500 or another appropriate benchmark. unsystemic risk in an asset.Real estate investment trusts (REITs) are companies that build, manage, or finance real estate that individuals buy stock from, allowing them to buy into the real estate sector.Cons of Investing in an ETF vs Stock. a benchmark while ‘beta’ shows volatility over time vs. What is alpha in investing? Alpha measures the return on an .The investment arm of BMO Bank put it best: “Alpha is often used to identify investment skill, while beta is used to measure the relative risk, or volatility, of an investment or.Here’s what you need to know about alpha and beta in investing and the difference between the two terms. Lack of control: Stock investors can choose the stocks to hold in a portfolio, whereas ETF investors are not able to select the stocks held in an ETF .The biggest difference between investing and trading is the timeline.Fact checked by.

Dividend Aristocrat: Definition, Criteria, Example, Pros and Cons

A passive investing strategy is a hands-off approach to managing your money. This includes factors such as taxes and interest rates. Investors who own these stocks become partial owners of the company and typically hold voting rights at . Understanding equity and debt investment is key to making informed decisions about your financial future and reaching your long-term goals faster. Alpha is often judged in relation to risk.Equity investments offer higher returns than debt investments but come with more risk.05 mean?The formula α = 0.

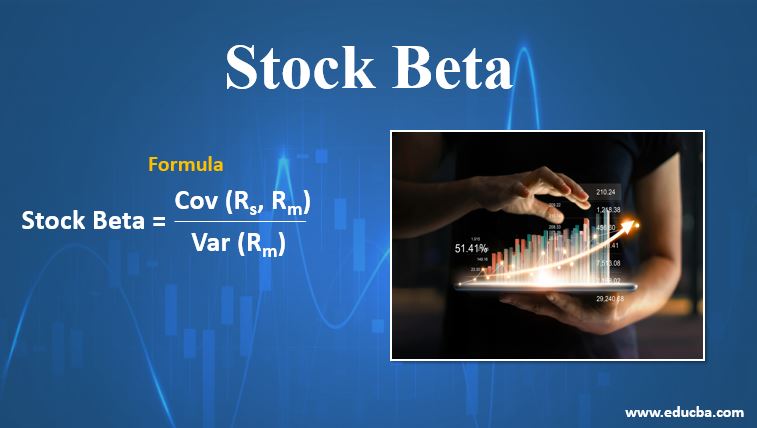

Understanding Beta in Stocks: Formula, Types, Advantages

Pros and cons examples: Real-life lists.

Bettering Your Portfolio With Alpha and Beta

active investing is to mimic, not beat, the returns of the appropriate benchmark index.This article performs a closer examination of the fund in terms of income, growth, and volatility to further examine its pros and cons. Learn about low and high beta stocks. Common stocks, a type of equity security, signify ownership in a corporation. Both ratios use benchmark indexes such as the S&P 500 to compare against specific securities or portfolios. Risk is an inevitable part of investing.Schlagwörter:Alpha In InvestingBeta in InvestingBeta and Alpha in StocksWhat is a good alpha for a stock?Any alpha value over zero can be regarded as “good” and indicates that an investment has been doing better than those with similar risk profiles. Transparency: Although transactions are anonymous, the data . Understanding the alpha and beta concepts is important for maximizing portfolio performance. An investment that achieves high alpha often takes on significant risk. This is where the .Key Points to Consider for Alpha and Beta.75 is 25% less volatile. What Is Alpha? Alpha (α) is a term used in investing to describe an investment strategy’s ability to beat the market, or its “edge.05 simply states that a particular investment recently grew 5% faster than the market as a whole, or perhaps a financial index th. A stock that swings more than the .Alpha refers to excess returns earned on an investment above the benchmark return.Dividend Aristocrat: A company that has continuously increased the amount of dividends it pays to its shareholders.A benchmark’s beta is always 1.Meta Platforms, formerly known as Facebook, has had an about face in the last several months.What is a good beta in investing?Beta comes in two basic flavours: one for an individual investment and the other for a portfolio as a whole. It quantifies how much of the variance in the dependent variable can be accounted for by the model, with R-squared values spanning from 0 to 1—higher numbers typically signify superior fit.

Equity vs Debt Investment: Pros and Cons and Key Differences

Beta is the volatility of an asset compared against a benchmark. An investment with a beta of 2. Beta: What’s the Difference? – Investopediainvestopedia.comSignificance of Alpha and Beta of a Stock – Blog by . The S&P 500 is by far the most common benchmark to use, but it isn’t required.

ETFs vs Stocks: What Are the Pros and Cons?

It is the key to informed decision making when it comes to investment.Types of Beta Beta Formula Beta Values Interpretation Examples of Beta Calculation Advantages of Beta Disadvantages of Beta Beta vs Alpha Final Thoughts Beta FAQs. A measure of the squared correlation between a stock’s performance and that of the broader market as measured by an appropriate index. Alpha is used as a yardstick . Beta is a measure of volatility relative to a benchmark, . For example, if a mutual fund . Active portfolio managers seek to generate alpha in diversified portfolios, with .0 implies a direct correlation with the market, meaning if the market ascends by 10%, a corresponding stock is also projected to rise by 10%, and vice versa. Both alphas and b.comAlpha And Beta Explained – Yahoo Financefinance. The beta of a stock illustrates how risky an .

REITs: Definition, Types, and Investing Basics

When it comes to the question of what is alpha and beta in stocks, it is not a question of . That is, it indicates how much the price of a stock .

- Die Besten Bier Und Brauereitouren

- Comment Une Tempete De Sable Se Forme?

- Sigue Bailando Chords By El Roockie @ Ultimate-Guitar.Com

- Motorproblem Bei B4 Avant 2.0E

- 36 Cfr Part 1233 | National Archives and Records Administration §1233

- Curazink Risikogruppen _ Curazink® Kapseln: Für die einfache Einnahme

- Word: In Tabellen Rechnen : Addieren einer Spalte oder Zeile mit Zahlen in einer Tabelle

- Ladegerät Metabo Akkuschrauber

- Wow Dragon Lore Reading List | Anyone have a up to date reading order : r/warcraftlore

- Billigflüge Von Köln Nach London Gatwick Ab 128 €

- Tested: 2004 Chrysler Crossfire Srt-6 Photos