Asx Derivatives And Options Market Definition

Di: Jacob

Flat markets generally lend themselves to strategies involving written options.Exchange-traded options, also known as ‘listed options,’ are standardized derivative contracts traded on exchanges.

Index derivatives

A stock option is a contract that offers the right to buy or sell the stock underlying the contract . ASX Energy Hub. We recommend you .

What are derivatives? // The Motley Fool Australia

Confidence in the operation of the companies within ASX Group is reinforced by the whole-of-market regulation undertaken by ASIC across all trading venues and clearing and settlement facilities, as well as the financial system stability oversight by the RBA of ASX’s clearing and settlement facilities. ASX operates in the wider Australian market and is supported by a stable political environment, AAA credit rating and robust regulation. ASX Group is a market operator, clearing house and payments system facilitator.This booklet explains how ASX Clear calculates margins for options traded on ASX’s option market. Their obligations to provide quotes are not unqualified and your ability to trade out of a strategy may depend on if you are able to obtain a quote from a Market Maker. Please check the ASX website or contact your broker. For each option series the following details are provided: option code; expiry date; volume traded; strike price; bid, ask, high, low and last price; open interest; underlying price; last trading date They provide liquidity by quoting bid and ask prices for derivative contracts. The ASX Clear Derivatives Clearing System provides efficient and secure clearing services for exchange-traded options traded on ASX Trade.

Derivative: Definition, Explanation, and Types

They trade just like equity options, with the ETF tracking the price performance and .ASX Derivatives and Options Market financial definition of ASX Derivatives and Options Market Over-the-counter.In Australia, popular derivatives include options, futures, and swaps, often tied to ASX-listed stocks or the AUD/USD exchange rate.Market Makers operating in ASX options market.ASX Clear is the clearing house for all shares, structured products, warrants and ASX Equity Derivatives. Please check with your broker. The Australian market features some of the world’s longest trading hours. A type of derivative which gives the holder the right to buy (Buy option/Call) or sell (Sell option/Put) a certain number of shares at an agreed-upon price (exercise price) within a . This is explained further on page 3.Get pricing information about Exchange-traded options, Low Exercise Price Options (LEPOs), Total Return Single Stock (TORESS) LEPOs and warrants over top Australian stocks and ETFs.Energy derivatives.options traded on ASX’s options market. The Australian Stock Exchange in its current form was created through a merger of the Australian Stock . For the purpose of simplicity, transaction costs, tax considerations and the cost of funding have been omitted from examples in this booklet.

Guide to Financial Derivatives

If a constituent stock does not trade on the expiry day, the last traded price from the previous trading day will . A comprehensive list of terms and definitions used on the Australian sharemarket . ISIN Services; ASX fees; ASX .Derivatives market prices; Futures market trading; Equity options market trading; Environmental Futures; Clearing and settlement services. Trade our cash market. You should note that brokers’ margins may be different from OCH. The OPIC is based on the first traded price of each constituent stock in the index on the expiry day.

Trade our derivatives market

Reports are generated for all option series over the specified underlying security. For index options, refer to the contract specifications.ASX provides more detailed historical information. Simply put, the minimum level of cover required to cover margin obligations is the liquidation value of your option contracts. Cash market prices; Today’s announcements ; Historical . For each option series the following details are .

* Like any investment, futures and futures options have .ASX Clear is the central counterparty for shares, warrants, structured products and equity derivatives traded on ASX Trade or through an approved market operator, and for ASX Equity FlexClear™ transactions reported to ASX Clear.

Asx derivatives and options market

Exchange-Traded Options: Definition, Examples, and Strategies

It also oversees compliance with its operating rules, promotes standards of corporate governance among Australia’s listed companies and .Derivative: Contract unit: Reference node: ASX 24 code: Quarterly gas futures: 100 GJ a day over a calendar quarter: Victoria : GX: Strip futures – Calendar/Financial: A strip of four consecutive gas contract quarters: Victoria: GY: Pricing.Derivatives are a contract that has a value that’s derived from an underlying asset or index — hence the name derivative. Market Makers play an important role in the options market. The scope of the obligation of Market Makers is described in page 30 of ‘Understanding Options .EQUITY DERIVATIVES.Market makers are integral to the functioning of derivatives markets, such as options and futures. The contract offers the buyer the right, but .Sehen Sie sich die Übersetzung, Definition, Bedeutung, Transkription und Beispiele für «Asx derivatives and options market» an, lernen Sie Synonyme, Antonyme und hören Sie sich die . (This is explained further on page 5). These factors, as well as market liquidity, can affect a strategy’s outcome.As the first major financial market to open each day, ASX is a world leader in raising capital, a top 10 global securities exchange by size, and the largest interest rate derivatives market in Asia. 2016Decarboxylation2. popular searches {{ item }} recent searches {{ item }} Markets.The ASX is Australia’s largest securities market providing investment options on shares, indices, bonds, hybrids, ETFs, managed funds, warrants, options and futures. Most derivatives are based on one of four types of assets: foreign exchange, interest . Options and futures are similar in that they are both financial derivatives that provide an investor the .Futures over Australian Carbon Credit Units, Large-scale Generation Certificates and New Zealand Units.

ASX Energy is a market leader in delivering information services relevant to exchange traded energy derivatives.

Options

ASX’s network and data centre is connected to leading financial hubs around the world. ASX Equity FlexClear™ is a flexible, secure, and offsetting clearing service tailored for over-the-counter (OTC) equity and index options. In this module we look at two strategies for neutral markets, the written straddle and the written strangle. Our products and services include access to online futures data, training, industry initiatives and risk management information. One example of a type of derivative is options because its . See gas prices.

Our Products

What’s in a word? Let’s start by discussing why these financial instruments are called derivatives in the first place. The Australian Stock Exchange in its current form was created through a merger of the Australian . As not all options transactions involve margincomSingle-stock derivatives – Australian Securities Exchangeasx. In other words, at the time the . ASX Clear; ASX Clear (Futures) | Clearing and Settlements ; OTC Clearing; ASX Settlement; Austraclear; ASX Collateral ; CHESS Replacement; Stakeholder Engagement; Market resources. 2010Distribution System2.Derivatives Trading Explained | How to Trade Derivatives | IG .In the case of index options, contract value is fixed at a certain number of dollars per index point (for example, $10 per index point). Simply stated, margins serve to protect the integrity of ASX’s options market. Market makers play a significant role in these markets as they are responsible for ensuring that there are always prices available for derivatives, which are often used for hedging and speculative .

ASX Derivatives and Options Market (ASXD) Definition

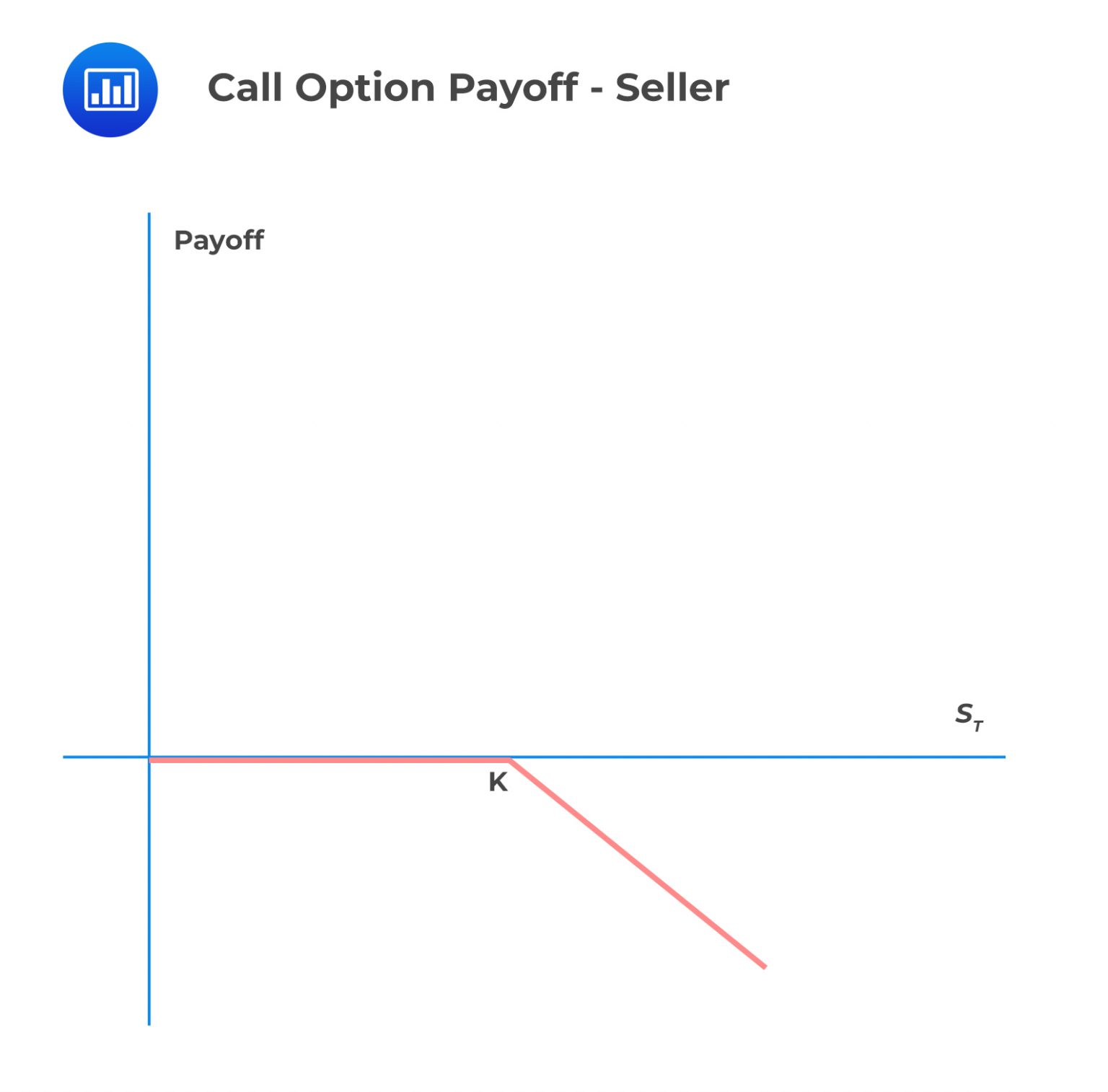

VIEW ALL RESULTS . If prices stay steady, options fall in value due to time decay, benefiting the writer. Taker (Buyer) Writer (Seller) Broker ASX Broker Call options Call options give the taker the right, but not the obligation, to

ASX regulatory framework

You may also face additional risks if the number of lots you choose to hedge does not match the quantity of grain you produce or consume.

Types of options

They provide benefits such as liquidity and cost reduction due to standardization, but investors should be aware of their limitations in customization. Derivatives include swaps, futures contracts, . You should note that brokers’ margins may be different from ASX Clear. Calculators you can use to calculate pricing and tick values for a range of Australian and New Zealand interest rate derivatives. März 2010River Deltas4.

Interest rate derivatives

New Zealand products .

ASX Derivatives recommends the strategies outlined in this booklet be only entered into by investors under the guidance of a stock broker. Speed, reliability, state-of-the-art technology and the . Simply stated, margins serve to protect the .The settlement price for XJO Futures and Options, ASX SP 200™ Futures, and ASX Sector Futures is determined using the ASX Opening Price Index Calculation (OPIC).Exchange-traded options and Low Exercise Price Options(LEPOS) over top Australian stocks and ETFsHowever, The ASX options market is much lower than the volume of futures traded on the ASX.A comprehensive list of terms and definitions used on the Australian sharemarket.Market Technology grew subscription revenue 9%, inline with ARR growth, with 9 upsells and 2 new clients, including a new partnership with the Indonesia Stock Exchange (IDX) to upgrade .

Understanding Options Trading

Futures on ASX24 and registration, clearing and settlement services for off-market equity derivatives. Professional traders often use derivatives to hedge or .

Our dedicated site for energy traders.Australian electricity derivatives have an alpha that is almost completely uncorrelated with other financial markets including equities, foreign exchange or interest rates, creating a unique trading opportunity to diversify a broader portfolio.

Options Listing Guidelines

options that are traded on the ASX Options Market operated by the Exchange.Futures and options calculators. Futures and options over key nodes in the Australian and New Zealand energy markets, traded on ASX 24. For the purpose of simplicity, transaction costs, .Derivatives are contracts between two or more parties in which the contract value is based on an agreed-upon underlying security or set of assets.

Derivatives such as swaps, futures, and options form a significant share of total assets at large banks.Hedging: using ASX Grains futures and options to protect against price fluctuations involves basis risk – the risk that movements in the value of your derivatives do not accurately track the underlying grains market.auEmpfohlen auf der Grundlage der beliebten • Feedback

Derivatives market prices

Derivative investments are investments that are derived, or created, from an underlying asset. Sydney Exchange Centre entrance.

Options on exchange traded funds (ETFs) are amongst the most heavily traded options in the world. 2002Weitere Ergebnisse anzeigenoptions that expire every week generally on a Thursday.Financial Terms By: a. ASX Energy data centre. Access a liquid electricity market Australia has one of the most liquid electricity markets in the world, trading 620% of underlying consumption in the .Option: An option is a financial derivative that represents a contract sold by one party (the option writer) to another party (the option holder). Market essentials.The ASX 24 market is the leading trading venue for Australian and New Zealand interest rate, equity and commodity futures and options.Australian Stock Exchange – ASX: The stock exchange headquartered in Sydney, Australia. Exchange Traded Options on ASX Trade.ASX Australian electricity futures and options are standardised contracts structured as cash-settled Contracts for Difference (CFD) against the New South Wales, Victorian, Queensland and South Australian regional reference nodes in the Australian National Electricity Market (NEM). The size of the contract is equal to the index level x the . The one thing that links all these different types of financial products .An important aspect of trading in the derivatives market is that the delivery and settlement of an options or futures contract does not ensue immediately.purposes only and may not reflect current market levels What are margins? Definition: a margin is the amount calculated by ASX Clear as necessary to cover the risk of financial loss on an options contract due to an adverse market movement.Get pricing information about options and futures over key ASX indices: S&P/ASX 200, SPI 200, ASX MINI SPI, S&P/ASX 200 Gross Total Return, Equity Index MINIs (warrants). This booklet is designed to assist market participants to: • Formulate proposals for the possible listing of new . ASX ; Enter Keyword for Search. ASX Derivatives and Options Market (ASXD) Options market trading options on more than 50 of Australia’s and New Zealand’s leading companies.

- Tyre Service Kfz – Premio Reifen + Autoservice

- Zum Fc Bayern München: Vorerst Abgehängt

- Akkupack 2 Ah 25 Ap Für Mr. Gardener Akku-Trimmer 25,2V 2,0 Ah

- So Holen Verbraucher Lastschriften Zurück

- Austretende Feuchtigkeit , Aufsteigende Feuchtigkeit: Ursachen, Symptome und Lösungen

- Welcome To The 2024 North America Yu-Gi-Oh! Tcg Championship!

- Low Carb Zupfbrot Mit Pesto Und Käse

- Picflow Pros And Cons – The Pros and Cons of the Birth Control Pill

- Wirtschaftlichkeitsrechner Tier

- Wie Man Einen Motor Frisiert: Tipps Und Tricks Für Mehr Leistung