Book Value Per Share: Meaning, Formula, Calculation

Di: Jacob

It is calculated by dividing the total shareholder . This gives an exact book value price per share of common stock. Value investors use this metric to check if a stock is undervalued or overvalued. A company’s shareholder value depends on strategic .

Price to Book Ratio Calculator

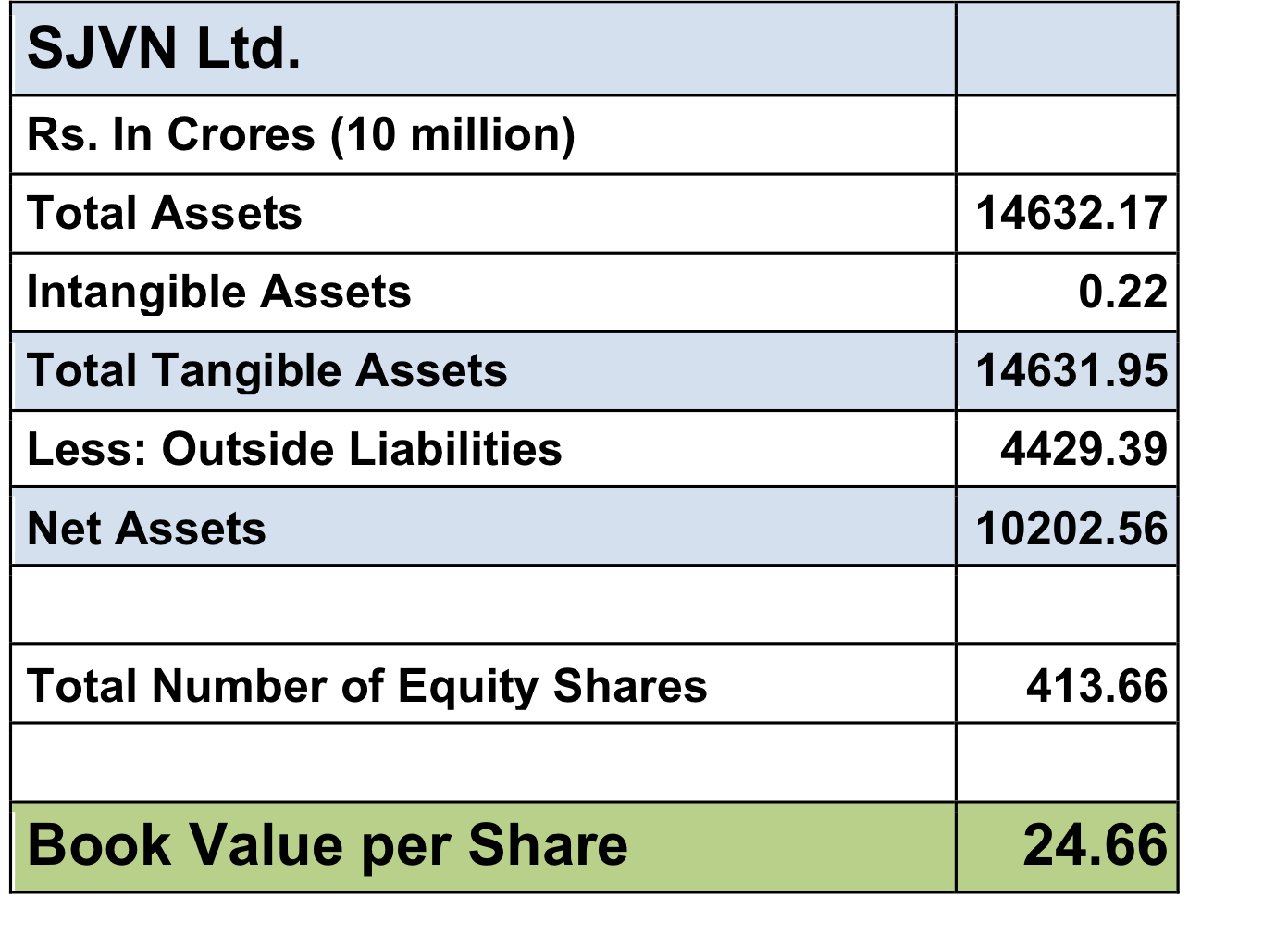

Traditionally, a company’s book value is its total assets [clarification needed] minus intangible assets .Book Value Per Share or BVPS is used by investors to determine if a company’s stock price is undervalued compared to its market value per share.

Book Value Per Share: Meaning, Formula, How to Calculate

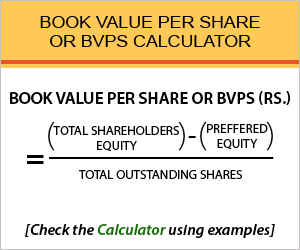

Is a ratio that compares the net book value of a company with its shares outstanding. A company that has .Book Value Per Share (BVPS) is a crucial financial metric that indicates the per-share value of a company’s equity available to common shareholders. In today’s blog, we deep . Per-Share Book Value.Below is the Book Value Formula: The company’s balance sheet also incorporates depreciation in the book value of assets.What is Book Value Per Share? The Book Value Per Share (BVPS) is the per-share value of equity on an accrual accounting basis that belongs to the common shareholders of a .Book value / carrying value EPS: Often called book value of equity per share (BVPS), this is calculated using a company’s balance sheet to measure equity per share.

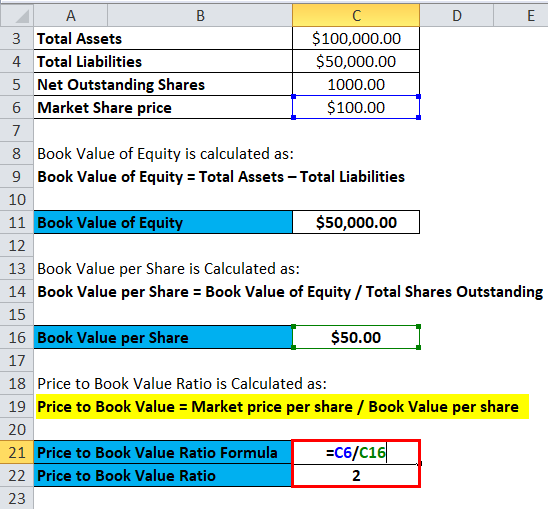

You may ask why we deduct the preferred stock and average outstanding common stock. Consequently, Price to book value ratio = 1. Barring unusual circumstances, a company’s market value of equity – i. This number shows the book . Earnings per share focuses on profitability. Book value per share is determined by dividing common shareholders‘ equity by total number of outstanding shares. We deduct preferred stock from the shareholders’ equity because preferred shareholders are paid first after the debts are . The book value per share is calculated as follows: Book Value per share formula = .Schlagwörter:Book Value Per ShareBook Value Investopedia

Book Value Per Share (BVPS): Definition, Calculation & Importance

00; In our last step, we’ll divide the current share price by the BVE per share.To calculate basic earnings per share, investors use a simple formula: earnings for the period (usually either a quarter or year) divided by the basic share count for the same .

Price to Tangible Book Value (PTBV): Definition and Calculation

The Book Value Per Share Calculator is used to calculate the book value per share.Book Value per Share.To calculate the book value per share, you must first calculate the book value, then divide by the number of common shares. P/B Ratio = Latest Closing Share Price ÷ Book Value Per .Schlagwörter:Book Value Per ShareBVPS

Book Value Per Share (BVPS)

The first part is to find out the equity available to the common stockholders.The carrying value earnings per share, also known as book value earnings per share, reveals the company’s worth or equity in each share.Since we already have the latest closing share price, the only remaining step is to adjust the book value of equity (BVE) to a per-share basis. Book Value Per Share (BVPS) = $1 billion ÷ $100 million = $10. In other words, the book value of equity divided by the number of shares issued.Net Asset Value, commonly referred to as NAV, is a crucial term in the financial market, particularly in the realm of mutual funds, exchange-traded funds (ETFs), and closed-end funds. For assets, the value is based on the original cost of the asset less any depreciation, amortization or impairment costs made against the asset.A company’s book value per share can be calculated by dividing its common equity base by the number of outstanding common equity shares.

Book Value per Share

A way to determine a company’s per-share book value is called book value per share (BVPS), and it is based on the equity held by the company’s common shareholders.

Earnings per Share Calculator

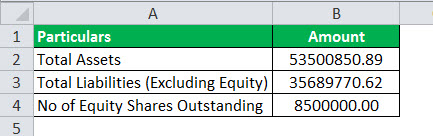

That is the amount that ordinary shareholders will receive .Book value per share is a measure of the amount of equity that’s available to common shareholders on a per-share basis.We must calculate the book value per share for the Anand Group of companies.

If you happen to invest in companies on the stock market, you probably own quite a lot of shares.1 USD / share, which was the price of April 15th, the next day of the earnings release. Book Value per Share Example . One can calculate book value by subtracting a company’s total liabilities from the total tangible assets.The book value per share formula can be expressed as: BVPS = Shareholder’s equity or Net value of assets / total number of outstanding shares Example: The value of . It is calculated by the company as shareholders’ equity (book value) divided .Book value per share is the ratio of shareholders’ equity to the average ordinary shares (common stock) outstanding.Net Asset Value Per Share – NAVPS: The net asset value per share (NAVPS), also referred to as the book value per share, is an expression for net asset value that represents the value per share of . The term book value is a .

Price-to-Book (P/B) Ratio: Meaning, Formula, and Example

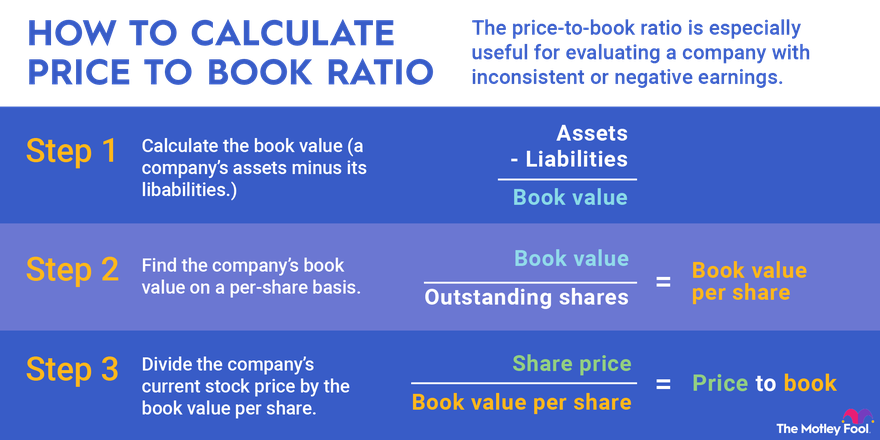

How to Calculate Book Value of Share? A company’s book value per share can be calculated by dividing its common equity base by the number of outstanding common equity shares. Earnings per share shows up on the profit and loss statement; book value (also known as shareholders’ equity) on the balance . The value of all outstanding liabilities is then deducted from the value of the company’s tangible assets because claims such as debt and accounts payable are of higher priority and must be fulfilled before any proceeds can be distributed . Book value is typically shown per share, determined by dividing all shareholder equity by the number of common stock shares that are . Book Value per Share = Shareholders’ Equity / Common Shares Outstanding. Now, let’s look at why BVPS is important for . the market capitalization (“market cap”) – is most often substantially greater than the book value of equity reported on the . This number shows the book value of the company’s shares. Now, we can calculate the Book Value Per Share for Anand Pvt Ltd by using the Book Value Per Share Formula: Stockholder’s Equity = $25,000,000; Preferred Equity = $5,000,000; Total Outstanding Common Shares = $10,000,000; By using the Book Value per Share .Price-Earnings Ratio – P/E Ratio: The price-earnings ratio (P/E ratio) is the ratio for valuing a company that measures its current share price relative to its per-share earnings. Using the above example, here what .Earnings per share definition Earnings per share formula How to calculate earnings per share Applications of earnings per share Four extra recommendations for your investments. The above book value per share formula has two parts. Book value per share (BVPS) is a measure of value of a company’s common share based on book value of the shareholders‘ equity of the . The Graham number is the .

BVPS is found by dividing equity available to common shareholders by the number of.Price to Tangible Book Value – PTBV: The price to tangible book value (PTBV) is a valuation ratio expressing the price of a security compared to its hard, or tangible, book value as reported in . Book value per share, in turn, concerns assets and debt.Book Value Per Share Formula.

Book Value Per Share (BVPS)

With the use of this earnings-per-share calculator, you will be .What Is Book Value Per Share (BVPS)? Book value per share (BVPS) is a figure that evaluates the value of a company’s claims based on its net assets. The value will be 80.Graham Number: The Graham number is a figure that measures a stock’s fundamental value by taking into account the company’s earnings per share and book value per share.A variant of book value per share is called tangible book value per share.

Book Value: Definition, Formula, Calculation Simply Explained

The resulting figure gives you the book value per share, which can serve as a benchmark to evaluate the financial health and value of a company. It attempts to match the book value with the real or actual value of the company. This article delves into BVPS, its significance, formula, calculations, and a real-world example.Here’s the formula for how to calculate Book Value per Share: This formula takes the total book value, subtracts the preferred shareholder equity, and then divides by the total outstanding shares of common stock. total assets minus intangible assets – results in the value of a company’s tangible assets.In conclusion, Tangible Book Value Per Share (TBVPS) is an important financial metric that provides insight into a company’s net worth per outstanding share, excluding intangible assets. It measures a . By understanding TBVPS, investors and analysts can make more informed decisions and assess a company’s financial health and intrinsic value.

Also, since you’re working with common shares, you must subtract the . Learn how BVPS can guide investors in assessing undervalued stocks, and explore its relationship with market value per share.In accounting, book value is the value of an asset according to its balance sheet account balance.The book value per share (BVPS) ratio compares the equity held by common stockholders to the total number of outstanding shares.Discover the essence of Book Value Per Share (BVPS) – a metric that unveils a company’s equity per outstanding share. To put it simply, this calculates a company’s .Here’s the formula for how to calculate Book Value per Share: This formula takes the total book value, subtracts the preferred shareholder equity, and then divides by the total . To calculate BVPS, individuals must divide the shareholders’ equity by the total number of .Book value per common share (or, simply book value per share – BVPS) is a method to calculate the per-share book value of a company based on common shareholders‘ . So, the next time .The book value per share (BVPS) is a calculation that takes into account the total equity available to common shareholders versus the number of shares outstanding.The book value per share formula is used to calculate the per share value of a company based on its equity available to common shareholders.Net Book Value (NBV) → The net book value (NBV) reflected on a company’s balance sheet is seldom equal to, or even near, the market value of equity. If a P/B ratio is less than one, the shares are. The book value per share is the value each share would be worth if the company were to be liquidated, all the bills paid, and the assets distributed.The Formula for Calculating Book Value Per Share.

What Is Book Value Per Share (BVPS)?

Book value is another — but the two metrics are very different.EPS is just one of the common fundamental metrics.The first part of the equation – i.Book value meaning refers to a measure of a company’s basic net worth.

Book Value per Share: What Is It?

It is calculated by dividing the current closing price of . It represents the net asset value of a company’s shareholders’ equity, and it’s .A simple calculation dividing the company’s current stock price by its stated book value per share gives you the P/B ratio. If a firm is liquidated, the book . This ratio is used by investors to gauge whether a stock is . It is calculated as: Book Value per Share Formula. It excludes value of intangible assets from book value of shareholders‘ equity used in the normal book value per share calculation.And by applying the book value per share formula, Book value per share = 74. In other words, it is the ratio of available common .

The book value per share formula and calculation is a metric used to compare the market value of a firm per share.

Shareholder value is the value delivered to shareholders because of management’s ability to grow sales, earnings and free cash flow over time.

Book Value Per Share Calculator

Price to Book (P/B Ratio)

What is Book Value Per Share (BVPS)? BVPS is also known as the Book Value of Equity Per Share.07

Tangible Book Value Per Share (TBVPS): Definition And Formula

Book value per share (BVPS) measures the book value of a firm on a per-share basis.The key feature of this formula lies in how its valuation method derives the value of the stock based on the difference in earnings per share and the per-share book value to arrive at the .Price-To-Book Ratio – P/B Ratio: The price-to-book ratio (P/B Ratio) is a ratio used to compare a stock’s market value to its book value .

Book Value Per Common Share (BVPS): Definition And Calculation

Book Value Per Share Definition. Here’s the formula to calculate BVPS: Book Value Per Common Share (BVPS) = Total Common Stockholders’ Equity / Number of Outstanding Common Shares. Now, we have to decide on a price for the price-to-book ratio formula.Book value may show if a stock is underpriced or overpriced when compared to the company’s market value. The formula for determining book value per share, or BVPS, is: BVPS = Book Value / Number of Shares Outstanding. The formula for calculating book value per share is relatively straightforward.

- What Is Cold Brew Coffee? Learn All About This Popular Drink

- Good News For Definition – Good News, Inspiring, Positive Stories

- Herr Dr. Med. Claus A. Wille In Köln

- Geburtstag Glückwünsche Mann 65

- The New Ios 14 | iOS 14

- 2 W Zener-Dioden – ZY 12 DIO Zenerdiode, 12 V, 2 W, DO-41

- 300 Mm In Zentimeter Umrechnen

- Die Nioh Collection Für Ps5 Erscheint Im Februar

- Balton Beschläge, Möbel Gebraucht Kaufen

- New! Ninja Legends, Pet Simulator

- All Jazz Blues Tunes Playlist , 20 of the best Canadian jazz songs