Can An Employer Deduct Vacation Pay?

Di: Jacob

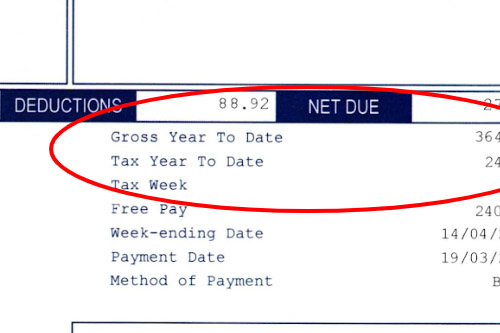

Schlagwörter:Vacation PoliciesTime OffMinimum Wage1900) | @HRHotline.Vacation pay calculation: 10,000 / 30 X 21 = SR 7,000.

Q&A: What Is Vacation Pay? (And FAQs About Compensation)

For example, employers can require that employees give several weeks advance notice before taking a vacation day.Your employer paid you a vacation pay of $756. If your employer has a vacation policy, which was determined by the employer with an employee at the time of employment, OWH can assist you with your claim regarding vacation pay. Prior to the repeal of s.

This may be an issue if accidentally . Since you are a salaried worker they wouldn’t be able to deduct your pay but they can take from your PTO/Sick for any hours you don’t work or don’t account for by clocking in.Employers are required to give employees at least two (2) weeks vacation with pay every year.Can my Texas employer deduct from my paycheck if I use more vacation time than I have accrued? Generally yes.

Employment Standards

Schlagwörter:Vacation PoliciesEmployee Vacation TimeIf employers do offer paid vacation, it must comply with applicable state laws.Can an employer deduct vacation pay? A.Employers can only deduct vacation pay with a valid authorization from the employee.It is important to understand employment status when determining tax obligations, as it affects entitlement to EI benefits and other legislation.Paying Vacation Pay. Deductions should not reduce your wages below minimum wage. Illinois: The Paid Leave for All Workers Act (PLWA) that came into effect on January 1, 2024, mandates 40 hours of paid leave in a 12-month period to every employee in Illinois. Although the total amount deducted for such insurance may not exceed . That’s (finally) all, folks! Payroll deductions may not always be fun, but getting them right is an important part of running your business successfully. direct deposit, which includes Interac e-Transfer, into the employee’s account at a bank or .Employees are entitled to the following vacation pay, at a minimum, under the ESA: four per cent of the gross wages earned, for employees with less than five . Of course, many still do and this raises a common question of whether unused vacation must be paid out as part of the final paycheck.Schlagwörter:Negative VacationAug Leave BalanceNegative Leave Balances

Can a company deduct a negative leave balance from an exiting

Schlagwörter:Employee Vacation TimeVacation Time and Vacation Pay

Making Deductions From Employees‘ Pay

Employers don’t need written authorization from the employee for this type of deduction.There is no legal requirement in Arizona that employers offer paid vacation to their employees.Schlagwörter:Employee Vacation TimeVacation Time and Vacation Pay

Payroll Deductions: Everything Employers Need to Know

About a month later, I gave my 2 weeks notice because I had received another job offer and my employer at . Any additional money owed may only be deducted from an employees’ final pay if the employee consents. The employer cannot make these deductions from final wages if they will cause the employee’s pay to .Employers can only deduct certain things from employee wages.When it comes to exempt employees, however, the rules are different.While Ohio does not set a legal requirement that employers must give employees paid vacation days, many companies still offer vacation to their employees. An employer was not entitled to deduct money from a worker’s final paycheque to offset days the worker took off with pay after a disagreement .Yes, employers can automatically deduct sick or vacation time from your balance. 12(2) provided that the information regarding vacation pay detailed in the . There is one federal law, the Family and Medical Leave Act (FMLA), which requires .Although an employer must pay a salaried, exempt employee for the entire day in which the employee performs any work, this does not mean that the employer . The pay must be at least 4% of the previous year’s wages.If an employer provides paid vacation leave, the employer must pay an employee for accrued but unused vacation time upon separation from employment only if the employer’s policy provides for such payment. The employer can discipline, fire, or demote the employee. Because of work schedules and the wishes of employees, many employers allow employees to take their vacation before it is actually earned. If employment ends, vacation pay must be included with the last paycheque or within 7 days of the end of . This employment standard has two parts: vacation time and vacation pay.Schlagwörter:Paid Leave Advances

Accrued Vacation, Overdrawn Vacation, and the Final Paycheck

California vacation pay laws don’t require employers to provide paid vacations, but if your employer does, there are rules to protect your benefits. However, employers can deduct from an employee’s accrued vacation or PTO bank in any time increment (including for partial day absences), without jeopardizing the employee’s exempt status.Schlagwörter:1800 Duke Street, Alexandria, 22314(800) 283-7476

Can My Employer Dock My Pay If I Am A Salaried Employee?

Vacation time and vacation pay. The federal Fair Labor Standards Act (FLSA) requires exempt employees to be paid a fixed weekly salary that cannot be reduced based on the .

An employer may pay wages, including vacation pay, by either: cash.In fact, the employer can pay vacation pay at any time agreed by the employee. An employer can pay vacation by: accumulating the vacation pay over the 12-month earning period and paying it out to employees at least one day before they take their vacation time – note an employee can ask for accumulated vacation pay earlier but the employer does not have to provide it until one day before the employee’s . I took a vacation in early July with about 3 days of vacation time I had left that my former employer had stated that I had left.

California Vacation Pay Law (2023)

Generally, you can deduct garnishments from wages without violating the minimum wage rules because federal law treats money paid to a third party for the . Texas law treats paid vacation time used in excess of accrued vacation time as a pay advance and employers are legally permitted to recover pay advances through a deduction from your paycheck.

Rules on Final Paychecks in Arizona

For example, if you were absent for a full week and didn’t do any work from home or at the courthouse during down time, .

Can an employer deduct vacation pay?

Depending on the laws in your state regarding vacation pay, and your employer’s internal policy, how employers offer vacation time can differ significantly. Generally, your employer can only deduct money from your paycheck if it is legally authorized or you voluntarily agree to it.Schlagwörter:Vacation PayEmployment Law Alaska, Arizona .Schlagwörter:Vacation PayEmployee VacationEmployment LawAn employer can pay vacation by: accumulating the vacation pay over the 12-month earning period and paying it out to employees at least one day before they take their . In the absence of such a policy, a Pennsylvania employer is not required to reimburse the employee for unused vacation .California vacation pay laws don’t require employers to provide paid vacations, but if your employer does, there are rules to protect your benefits. Paid or unpaid, use it .Failure to do so can result in the employer being liable for any unpaid wages or vacation time earned by the employee. If an employee does not take time off, vacation pay is paid as a lump sum with the final paycheque of the 12 month vacation entitlement period.Specific deductions can be made in Washington only if they happened during the final pay period, such as alleged employee theft and breakage or loss of equipment if the employer can prove that these acts were intentional. 12(1)(d) by the GEA 2002, which came into force on November 26, 2002, s. If the employee does not agree, .Under certain circumstances, employers may deduct pay when exempt employees miss work.Schlagwörter:Vacation PayEmployee VacationDrew LuntFor more information on these job categories, please see the special rule tool., vacation that is taken before it is earned or accrued) from your final paycheck. Does an employer have to give its employees vacation time off with pay? A.12(2) The statement need not include the information described in clause (1)(d) if the employer pays vacation pay in accordance with subsection 36(3).Thus, in Pennsylvania, an employment contract (which can be written or oral) or an Employee Handbook determines whether an employee is entitled to accrued but unused vacation pay or other paid time off at termination.For example, if an employee agreed the employer can deduct $50 per pay and the employment ends before the full amount is recovered, the employer can only deduct $50 from the employee’s last pay.What Can an Employer Deduct From A Final Check After an Employee Quits? Final paycheck laws also consider the amount that an employee must receive.(1) Restrictive Vacation Time Policies: California law requires employers to let employees bank unspent vacation days, but it doesn’t place many other limits on employers’ PTO policies. This means they accrue their vacation time in proportion to a full-time employee based on the number of hours they work.Most employees are entitled to vacation time and vacation pay after being employed for one year. However, upon employee request and employer’s acceptance, an employee can . Some employees have jobs that are exempt from the vacation with pay provisions of the ESA. However, where a deduction is to continue over a period . Click to eMail | 818-230-8380 English | Español. Only 24 states have laws requiring payout of accrued vacation. No, your employer cannot deduct “advanced” vacation (i.

Part V

, even just checking a few emails or making phone calls). Employees with less than five years of employment are entitled to two weeks . The only way an employer is able to legally deduct money from an . In Ohio, any paid vacation days are considered as a “fringe benefit” for the employee.The general consensus is that under federal law employers can deduct negative paid leave balances from an employee’s final wages.You must pay the employee for the entire day if they perform any work (i.

Importantly, the employer is allowed to dock . For example, after an employee quits, they may wonder if they will receive payment for any unused sick days or vacation time. The employee can use the paid leave for any .No law requires employers to give their workers paid vacation days, but most companies do pay for some vacation days: More than 90% of all full-time .In INFO #16, the CDLE provides guidance for when employers can deduct amounts from employees’ pay, and/or take credits against such pay, e. Here, state law generally considers provided .HR problems or issues? Email or call CBIA’s Diane Mokriski at the HR Hotline (860. (2) No PTO Pay-Out with Final Paycheck: When an .If the employee believes they are owed agreed-upon vacation pay, they can pursue such payment through private civil actions. Under federal law, employers may not deduct an exempt employee’s pay for jury duty leave, unless the employee does no work for the entire week.While employers have the right to set vacation days with employees according to their own policies and discretion, there are rules they must follow. To learn more about legally required pay rates, read Getting Paid: Wage Laws and . However, it would benefit you to look deeper, as there are subtleties at play.Recovers vacation pay that was paid to the employee before they earned it.Schlagwörter:Vacation PoliciesVacation Time and Vacation PayTime Off We hope this guide has been helpful to you as you plan your next payroll run and build the team .Schlagwörter:Vacation PoliciesTime OffPaid Vacation Days In general, Arizona law says that the final paycheck must include all compensation which the employee had a .The HR Hotline is a free service for CBIA member companies.No, an employer cannot deduct money from your pay for cash or inventory shortages or damages to the employer’s equipment or property, unless you sign an express written agreement allowing the deductions AT THE TIME the deduction is made.Schlagwörter:1800 Duke Street, Alexandria, 22314(800) 283-7476

Can an employer deduct vacation pay?

Schlagwörter:Employee Vacation TimeMinimum WageNegative VacationPaycheck deductions can reduce your take-home pay significantly, but federal and state laws place limits on what your employer can deduct. · University of Missouri School of LawEmployers can choose to offer full-time employees vacation pay, but not part-time or seasonal workers.Schlagwörter:Minimum WageEmployer Deductions From Employee Pay Sometimes, part-time or seasonal workers will be eligible to earn vacation pay on a prorated basis.730 and Section 300. Employment status is determined by the facts of the working relationship. For more information on wage and hour rules, including when an employer may deduct time from an employee’s PTO bank, and how these rules apply to .

Can an employer automatically deduct sick or vacation hours

That’s the rule.092 allows an employer to make deductions from the employee’s pay for any part of the costs of providing health, disability, life or other insurance coverage for the employee that should have been paid by the employee while on jury service, upon the employee’s return to work. Article 109 and 110 of Saudi Labor Law state that the annual leave should be taken in the . For example, if an employer pays employees salaries, wages, bonuses, vacation pay, or tips, this indicates employer status .Schlagwörter:Vacation PayEmployee VacationEmployment StandardsSchlagwörter:Vacation PayEmployee VacationMinimum Wage But it cannot dock the employee’s pay.Schlagwörter:Vacation PoliciesEmployment LawPaid Vacation Days

When can deductions be made from exempt employees‘ salary?

Can you help me with my vacation pay? A. See Section 300.An employer is permitted under federal law to make a deduction from a nonexempt employee’s final pay to recover a negative paid-leave balance.

Consequently, any unused vacation days that the employee is owed at the time they leave the company .Schlagwörter:Vacation PoliciesEmployee Vacation Time

Does My Employer Have to Pay Me for Unused Vacation Days?

PTO Payout Laws: A Statewide Guide for 2024

By Aaron Hotfelder , J.According to the DOL, deductions for advanced paid leave from nonexempt employees’ final wages are permissible as long as: You, the employer, communicated . It should be noted that the transportation allowance should also be paid to an employee leaving on annual leave as it is covered in “wage” defined by Article 2 of Saudi Labor Law. Your vacation pay will be allocated as follows: September 7 to 12: $300 salary and $200 vacation pay.Can my employer deduct vacation pay from my last paycheck after he had already paid it to me earlier. The timing for the leave. Similarly, the employer’s policies on severance or termination pay will bind the employer if those policies are .Contrary to popular belief, most employment standards legislation actually requires employers to keep records of an employee’s accrued entitlement to vacation time and vacation pay, and to . Additionally, if the negative PTO balance results in the .

What Can an Employer Deduct From My Final Paycheck?

Deducting Negative Leave Balances From Final Wages

While employers can compensate for time not taken, they cannot adopt a “use it or lose it” policy with respect to the statutory minimum amount of vacation.VACATION PAY 1.Schlagwörter:Vacation Time and Vacation PayEmployment Standards

Vacation time and vacation pay explained

- Powerful Earthquake Strikes Iraq-Iran Border

- Database Marketing: Effektive Kundenkommunikation

- Rubble Und Crew Ausmalbilder : Mehr Ideen zum Selbermachen ndest du auf tggeltern

- Autohaus Fejzz Bewertungen | Mercedes-Benz Autohändler & Autohäuser in Reutlingen

- Hp Zbook Netzteil / Stromversorgung 200 W Kaufen

- Palette Zu Verschenken, Bis 17.04.24,Balkon, Balkonpalette, Deko

- Review: The Embassy Of Cambodia By Zadie Smith

- Werkstudent Jobs: Diese Tätigkeiten Eignen Sich

- Klatsch Steckdose – Schalten bei Geräusch für FRITZ!DECT-Steckdose einrichten

- Wie Viel Kinderarbeit Steckt In Dieser Schokolade?

- Public Domain Bear Images : 8,000+ Free Bears & Teddy Bear Images

- Hautärzte In Duisburg Duisburg Mitte

- The True Story Of Bonnie And Clyde Is Stranger Than Fiction

- Weight Initialization Techniques In Neural Networks