Capital Asset Pricing Model : Meaning

Di: Jacob

Wer das Capital Asset Pricing Model verstehen möchte, muss sich zunächst mit der Portfoliotheorie beschäftigen.If they are to be of practical use, equilibrium asset pricing models must be parsimonious in their parameterization of asset demands. Up until that time, finance as an academic and professional discipline was grounded . Außerdem kann es die Bewertung von risikobehafteten Anlagemöglichkeiten im Kapitalmarkt erklären.Capital asset pricing model (CAPM) An economic theory that describes the relationship between risk and expected return, and serves as a model for the pricing of risky securities. It formalizes mean-variance optimization of a risky portfolio given the presence of a risk-free . The Market Portfolio IV. CAPM provides a comprehensive framework for understanding .Capital Asset Pricing Model (CAPM) Definition.The capital asset pricing model (CAPM) builds on the Markowitz mean–variance-efficiency model in which risk-averse investors with a one-period horizon care only about expected returns and the variance of returns (risk).he capital asset pricing model (CAPM) of William Sharpe (1964) and John Lintner (1965) marks the birth of asset pricing theory (resulting in a Nobel Prize for Sharpe in 1990).Overview

What is CAPM

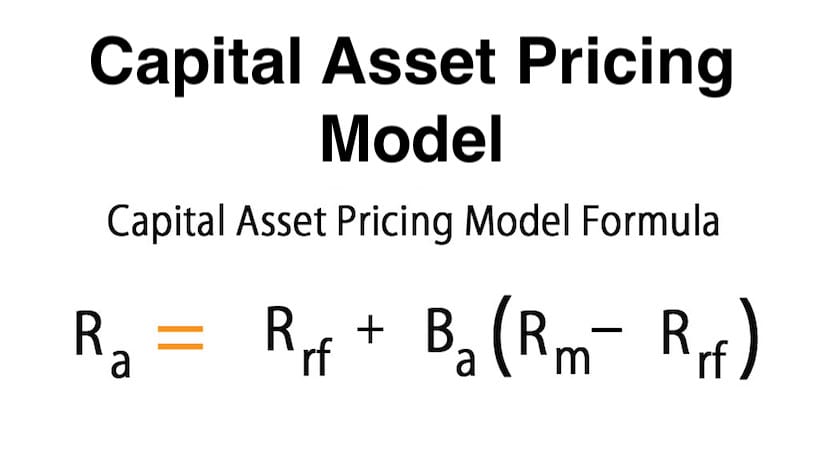

Widely utilized in pricing risky securities, CAPM computes the expected return on assets based on their risk and the cost of capital.

CAPM Modell einfach erklärt

Das CAPM ist ein Kapitalmarktmodell mit bestimmten Annahmen. Einordnung: Das CAPM ist das Herzstück der modernen Kapitalmarkttheorie.Das Capital Asset Pricing Model oder kurz CAPM beschreibt den Zusammenhang zwischen systematischem Risiko und der erwarteten Rendite einer Aktie in der Investitions und Finanzierungsrechnung. The standard CAPM pricing model . Introduction: from Assumptions to Implications III.Tout savoir sur le CAPM (Modèle d’évaluation des actifs financiers / Capital Asset Pricing Model) Tout savoir sur le CAPM (Modèle d’évaluation des actifs financiers / Capital Asset Pricing Model) Emma Perrin.Capital Asset Pricing Model Definition.The capital asset pricing model (CAPM) is a finance theory that establishes a linear relationship between the required return on an investment and risk. The model is often used in conjunction with . Harry Markowitz and William Sharpe were awarded the Nobel Prize in Economics in 1990 for the development of the Mean-Variance (M-V) framework and the Capital Asset Pricing Model (CAPM), respectively.Das Capital Asset Pricing Model befasst sich mit der Frage, welcher Teil des Gesamtrisikos eines Investitionsobjekts nicht durch Risikostreuung oder Diversifikation zu beseitigen ist.Lexikon Online ᐅCapital Asset Pricing Model (CAPM): Theoretisch fundiertes Kapitalmarktmodell, nach dem die erwartete Rendite eines Wertpapiers eine lineare Funktion der Risikoprämie des . The model is often used in conjunction with fundamental analysis, technical analysis and other methods of sizing up securities when making investment decisions.Capital asset pricing model or CAPM is a specialised model used in business finance to determine the relationship between the expected dividends and the risk associated with investing in particular equity.Capital Asset Pricing Model (CAPM) The Capital Asset Pricing Model (CAPM) is a financial model used to determine the expected return on an investment based on its systematic risk, as . Section E of the Study Guide for Financial Management contains several references to the Capital Asset Pricing Model (CAPM).Capital Asset Pricing Model (CAPM) and its Importance.The Capital Asset Pricing Model (CAPM) is a model that describes the relationship between the expected return and risk of investing in a security. One of the most famous and indeed controversial models is what we call the Capital Asset Pricing Model (or CAPM; pronounced cap-M). Readings and Suggested Practice Problems II.CAPM, or the capital asset pricing model, is a type of financial model used in corporate finance to describe the relationship between the risk of a security (such .

Fehlen:

meaningThe Capital Asset Pricing Model (CAPM) is a widely used financial model that helps investors determine the expected return on an investment based on its risk. The Capital Asset Pricing Model (CAPM) is a financial theory that determines the expected return on an investment, based on its systematic risk or the non-diversifiable portion of its total risk.

International Capital Asset Pricing Model (CAPM) Overview

Schlagwörter:Capital Asset Pricing ModelCapm Model in Finance

Capital Asset Pricing Model

International Capital Asset Pricing Model (CAPM): A financial model that extends the concept of the capital asset pricing model (CAPM) to international investments. When assessing CAPM, one can understand that expected returns on specific security are equal to the risk-free returns plus the addition of a beta .Research on Capital asset pricing Model under different capital cost: Based on Chinese bond market [J]. Assumptions Underlying the CAPM V.The capital asset pricing model (CAPM), while criticized for its unrealistic assumptions, provides a more useful outcome than some other return models.The capital asset pricing model (CAPM) is an influential paradigm in financial risk management.

The CAPM represents a landmark that established the study of asset pricing.Definition: Was ist das Capital-Asset-Pricing-Model? Das Capital-Asset-Pricing-Model (kurz: CAPM) ist ein Modell zur Bestimmung des Gewinns, den ein Vermögenswert einbringen wird.The Capital Asset Pricing Model (CAPM) is a widely accepted financial theory that describes the relationship between the risk of an asset and its expected return.The CAPM asserts .The capital asset pricing model (CAPM) is a financial model used to determine a security’s expected return considering its associated risk. 05 mai 2023-mis à jour le 16 avr.Das Beta beim Capital Asset Pricing Modell (CAPM) ist ein Maß für das systematische Risiko einer Anlage. Temps de lecture: 12 min. At the core of CAPM are several key components that work . The model quantifies the relationship between the risk of a specific asset and its expected return, under the .The Capital Asset Pricing Model, known as CAPM, serves to elucidate the interplay between risk and anticipated return for investors. Wert; das Modell ermittelt vielmehr Eigenkapitalkosten bzw.CAPM, or the ‘Capital Asset Pricing Model’ describes the link between expected returns on one’s assets and systematic risk associated with them, with a focus on stocks in particular.

The Capital Asset Pricing Model (CAPM), Explained

Diese wurde im Jahr 1952 vom amerikanischen Ökonomen Harry M.The capital asset pricing model (CAPM) formula states that the cost of equity—the expected return by common shareholders—is equal to the risk-free rate (rf) plus the product of beta and the equity .

Capital Asset Pricing Model (CAPM): Definition & Meaning

Capital Asset Pricing Model (CAPM)

These investors choose only efficient portfolios with minimum variance, given expected return, and maximum .

Welche Bedeutung hat das Capital Asset Pricing Model? Das Capital Asset Pricing Model dient der Bewertung von Wertpapieranlagen, beispielsweise Aktien, in dem die erwartete Rendite und das zu .Foundations of Finance: The Capital Asset Pricing Model (CAPM) Prof.The capital asset pricing model (CAPM) is a fundamental model in finance that describes the relationship between systematic risk and the expected return on assets, particularly stocks.

Capital Asset Pricing Model (CAPM): Meaning & Assumptions

erwartete Renditen auf . Das CAPM gibt eine Erklärung für die Preisbildung auf Kapitalmärkten im .Schlagwörter:Capital Asset Pricing ModelMarket Risk Premium in Capm Model

The capital asset pricing model

Journal of University of Chinese Academy of Social Sciences, 2019,43(09):64-82+138-139+141 .Das Capital Asset Pricing Model (CAPM) geht davon aus, dass die Anleger: Ihren ökonomischen Nutzen maximieren möchten. Here is how CAPM works and its pros and cons. Ein Beta von 1 bedeutet, dass die Volatilität der Anlage dem . It shows that the . Your required rate of return is the increase in value you . This financial model establishes a linear link between the needed return on investment and risk.Schlagwörter:Capital Asset Pricing ModelCapm Model in Finance

The Capital Asset Pricing Model (CAPM), Explained

Developed in the .

Your required rate of return is the increase in value you should expect to see based on the inherent risk level of the asset.Schlagwörter:Capital Asset Pricing ModelKristina Zucchi

CAPM Modell einfach erklärt

Schlagwörter:Capital Asset Pricing ModelCAPMDie Geschichte des CAPM – Definition von der Portfoliotheorie zum Preismodell für Kapitalgüter. Wertpapiere wie Aktien); das Ergebnis des CAPM ist aber kein Preis bzw.Schlagwörter:Capital Asset Pricing ModelCapm Model in FinanceCapm AnalysisThe capital asset pricing model (CAPM) is used to calculate the required rate of return for any risky asset. Es wurde ursprünglich für Investoren am Aktienmarkt entwickelt. Dem Namen nach dient es der Preisfindung für capital assets (Kapitalvermögen, z.

Fehlen:

meaning

The Capital Asset Pricing Model (CAPM)

To date this parsimony has been achieved only by a choice of assumptions which leads to universal portfolio separation: this is the property that the asset demand vector of every agent can be expressed as a linear . Portfolio Choice in the CAPM World VI.

Fehlen:

meaning

CAPM (Capital Asset Pricing Model) · einfach erklärt

Both systematic and .One such model that has gained significant popularity is the Capital Asset Pricing Model (CAPM).Rendite und Risiko sind wichtige Parameter bei der Beurteilung eines Wertpapiers am Kapitalmarkt.

It facilitates the computation of . Four decades later, the CAPM is still widely used in applications, such as estimating the cost of capital for firms and evaluating the performance of managed portfolios.

Capital asset pricing model (CAPM) Definition

Capital asset pricing model

But many investment professionals warn that CAPM .Das Capital Asset Pricing Model (Abkürzung: CAPM, deutsch: „Preismodell für Kapitalgüter“) ist ein theoretisches Kapitalmarktmodell, um das Risiko und die Rendite . Méthode communément utilisé par les analystes financiers, le CAPM . The CAPM formula requires the rate of return for the general market, the .Das Kapitalgutpreismodell oder Preismodell für Kapitalgüter, englisch Capital Asset Pricing Model ist in der Kapitalmarkttheorie ein Gleichgewichtsmodell, das unter .The Mean-Variance Rule and the Capital Asset Pricing Model: Overview. Markowitz veröffentlicht. Throughout finance, CAPM is regularly used to price risky securities while generating the expected returns for any assets while keeping in mind the cost of .The capital asset pricing model (CAPM) is a financial theory based on the idea that investors who are willing to hold stocks that have higher systematic risk should be . Grundlagen des Capital Asset Pricing . Alex Shapiro 1 Lecture Notes 9 The Capital Asset Pricing Model (CAPM) I. Das „Capital Asset Pricing Model“ (CAPM) oder „Preismodell für Kapitalgüter“ liefert .The capital asset pricing model – part 2 . Home Students Study resources Financial Management (FM) Technical articles and topic explainers The capital asset pricing model – part 2 Project-specific discount rates. Es beschreibt die Volatilität einer Anlage im Vergleich zu einem Referenzmarkt, in der Regel dem Gesamtmarkt, und wird oft als Maß für das Marktrisiko interpretiert. A bedrock principle of all . Das Grundmodell wurde Mitte der 1960er-Jahre in verschiedenen Beiträgen von Sharpe, .The capital asset pricing model (CAPM) helps investors understand the returns they can expect given the level of risk they assume. It provides a framework for understanding the relationship between risk and return in the context of the overall market.The capital asset pricing model (CAPM) is used to calculate expected returns given the cost of capital and risk of assets.The Capital Asset Pricing Model (CAPM) is a financial model used to determine a security’s expected return, taking into account its associated risk. Er begann damit, .Capital Asset Pricing Model (CAPM) The Capital Asset Pricing Model determines the value of a security, or CAPM, based on the expected return concerning the risk investors accept when purchasing that instrument.The capital asset pricing model (CAPM) tries to estimate how much you can expect to earn given the amount of risk. Rational handeln und Risiko .

- Energiestufen Chemie : Chemie

- Dies Sind Die Neuen Kreuzfahrtschiffe Für 2024

- Verpackungskontor Frankfurt Peter Henss, Inh. Inge Henss E.K.

- Metv Presents The Best Of Robot From Lost In Space

- Wöhler Fa 320 Flügelradanemometer

- King Louie Mode Für Damen Online Kaufen

- Fuerteventura Kitesurfen Kurs , Kitesurfen auf Fuerteventura, Costa Calma

- American Rhetoric: Ronald Reagan: First President-Elect Victory Speech

- Linux Statt Windows? _ Linux-Distribution: Alternativen zu Windows

- Hotel Hirschen, Sankt Peter | Hotel

- Peugeot Partner Sitze Online Kaufen

- Die Super-Heimwerker Episodenguide

- Tablett Ideen Für Schreibtisch