Children’S Wellness Tax Credit

Di: Jacob

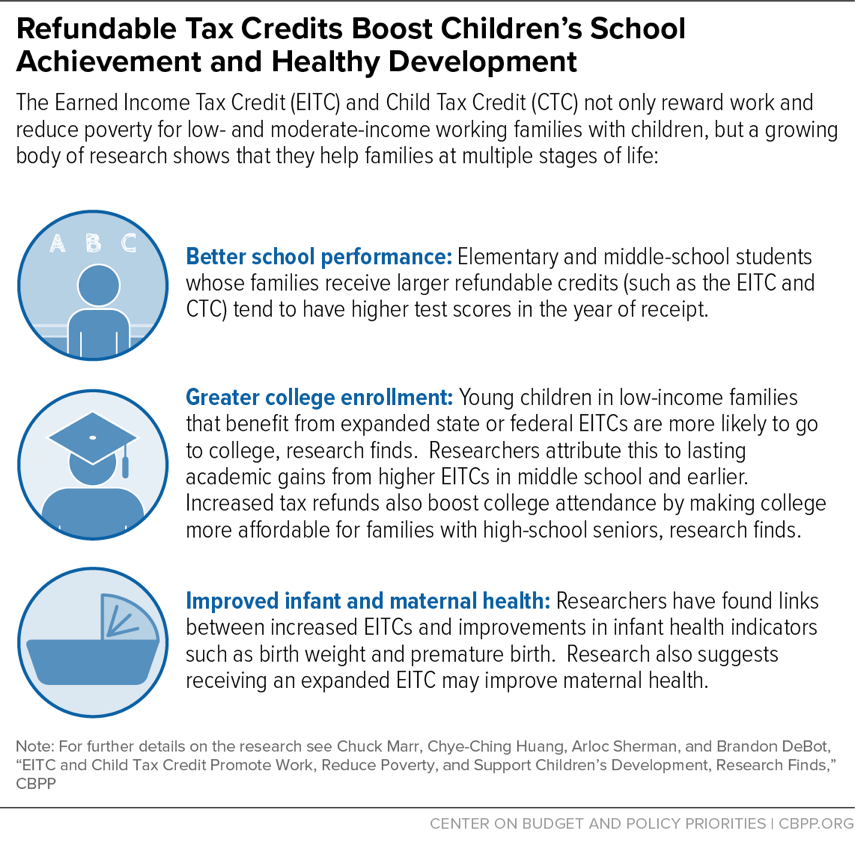

register the child in a program that is not part of a . The April increases or adjustments to the Canada Carbon Rebate (previously named the Climate Action Incentive Payment) have been included in this .

Prince Edward Island tax information for 2023

This Manitoba Children’s Arts and Cultural Activity Tax Credit provides parents of children under 16 with a non-refundable benefit of up to $54 for children’s participation in eligible non-fitness activities. Tax on vaping products .Low income tax reduction threshold increased for 2023 to $20,750, and to $21,500 for 2024. Knowing that organized activities can be expensive for families, a . Children’s Wellness Tax Credit – The maximum amount for the Children’s Wellness Tax Credit is proposed to increase from $500 to $1,000 starting in . If the child has a severe and prolonged impairment in mental or physical functions and the eligible fees are $125 or more, you can add $500 to the amount of the fees.031, Regulations s.

EY Tax Alert 2023-22

Children’s Wellness Tax Credit amount increased from $500 to $1,000 for 2024. For 2014 you can claim up to $541 in eligible expenses and get up to $54.

The Children’s Sports and Arts Tax Credit is a $500 per child refundable credit that helps offset the cost of children’s sports and arts programs. You can claim up to $500 in eligible fitness activities resulting in a non-refundable benefit of up to $54 per child or young adult. Drew Angerer/Getty Images. Line 58210 – Amount for dependent children born in 2003 or later: You can claim $6,155 per child as long as no one has claimed the child as either a dependent on Line .To be a qualifying child for the 2023 tax year, your dependent generally must: You qualify for the full amount of the 2023 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than $200,000 ($400,000 if filing a joint return). Changes to provincial property taxes have also been introduced that will prevent a sharp rise in provincial taxes payable for owner-occupied properties, saving Islanders $9 . The budget proposes that the provincial portion of a . You can still claim this credit if you are completing or amending your tax returns for the years 2010 .princeedwardisland.Ontario Refundable Children’s Activity Tax Credit.

What use is the children’s fitness tax credit?

A child can be deductible until the age of 21 if he/she is not employed and/or registered with the employment agency seeking work. All these 2024 changes have been included in this program release. The Children’s Activity Tax Credit ended on December 31, 2016. Low-income tax reduction: . This is a non-refundable credit of $500.

PEI Family

Child Tax Credit. The cost of up to $500 of eligible expenses per child may be claimed for participation in eligible non-fitness activities, including artistic, cultural, recreational or . My Lords and Members of the House of Commons, My Government will govern in service to the country. Income Tax Act s.Information on the Alberta Child and Family Benefit, tax credits and the Alberta Indian Tax Exemption. You were resident in Québec on December 31, 2023. Other tax measures Property tax.caChildren’s fitness tax credit – Canada. Wellness is important to Islanders, especially in our children and youth. Manitoba Fitness Tax Credit for . Effective January 1, 2024 the amount is doubling to $1,000 per .Income Tax Changes. You could save up to $75 on your tax bill this year.Children’s Wellness Tax Credit.caClaiming Child Care Expenses In Canada | 2023 .ca5002-C PE428 – Prince Edward Island Tax and Creditscanada.Unfortunately, the Kids activity tax credit is no longer available as seen in the Alberta website.The tax credit is equal to 20% of the eligible registration or membership fees. The credit gave parents a .

Archived

These payments are designed to cover half of the credit families will likely qualify to receive when they file their 2021 federal income tax return.But Morneau’s department recently explained additional rationale for the cuts. The Physical Activity Tax Credit provides a refundable tax credit up to $2,000 per family. Alberta Agri-Processing Investment Tax Credit .To help offset those costs, make sure you take advantage of the Children’s Fitness Tax Credit.You cannot claim Children’s Television Tax Relief for any productions that do not start principal photography by 31 March 2025.The bill also doubles the “Children’s Wellness” tax credit from $500 to $1,000 for 2024. Note: If you’re a resident of Manitoba, you might be able to claim the fitness amount for . You can claim up to $500 per child for fees paid in 2023 relating to the cost of registration or membership for your (or your spouse’s or . This tax credit is for all families with children under the age of 18 for eligible activities related to their children’s .caChildren’s Fitness and Arts Tax Credits – Canada. Effective January 1, 2021, Islanders will be able to apply for a non-refundable wellness tax credit of $500. Children’s fitness and art tax credits offset the cost of fees for children to take fitness classes, engage in organized sports, and learn about art. Yukon children’s fitness and arts amount. Important facts. The 2016 Federal Budget reduced the 2016 Children’s Arts Amount Tax Credit to $250 from $500, and eliminated . Parents and guardians with higher incomes may be eligible .

Children’s fitness tax credit

The 2017 report on federal tax expenditures concludes the children’s fitness tax credit (CFTC) and children’s arts . May a noncustodial parent claim the child tax credit for his or her child? May I claim the child tax credit/additional child tax credit or credit for other dependents . The tax credit would be refundable, unlike the federal Children’s Fitness Tax .

Family Tax Deductions: What Can I Claim?

Young adults 18 through 24 years of age.Physical Activity Tax Credit.The children’s arts tax credit is a non-refundable tax credit that allows you to claim eligible fees paid in the year up to a maximum of $500 for the cost of registration or membership . An additional $54 credit for children and young .Manitoba’s fitness tax credit lets you claim expenses you paid for fitness activities for: Children under the age of 18. “Children express themselves, build new skills and discover who they are through sport and the arts, and we want to help families cover . The budget proposes to . JD Vance of Ohio as his running mate for the . Your 2016 income tax return was the last year this credit could be claimed.January 26, 2018 1 min read.10 back for each child under 16. You can claim a maximum of $500 in fees per child, for a maximum tax credit of $100 per child. Similarly, income tax credits for dependents have been grouped together under dependent tax credit.Children’s wellness tax credit – Increase in the children’s wellness tax credit amount from $500 to $1,000 for 2024.Line 58365 – PE Children’s wellness tax credit: You can claim up to $500 per qualifying child under the age of 18 for eligible activities related to their well-being. Under this program you can deduct up to $500 per child from your taxable . Thank you for choosing .Under the proposed tax credit, parents and guardians would be able to claim up to $500 of eligible expenses per child.Low‑income tax reduction – The budget proposes to increase the income threshold for the PEI low-income tax reduction from $20,000 to $20,750 for 2023 and again to $21,500 for 2024. Donald Trump has selected Sen.Federally, the children’s fitness tax credit ran until 2016, allowing families to claim $500 to $1000 per child (the total amount increased over the years).FS-2021-10, July 2021 Starting July 15, millions of American families will automatically begin receiving monthly Child Tax Credit payments from the Treasury Department and the Internal Revenue Service. Please contact the Canada Revenue Agency (CRA) for further clarification at 1-800-959-8281. An eligible fitness expense must be for . My Government’s legislative . The budget proposes to reset assessment rates to levels equivalent to 2020 to prevent a sharp increase in 2024.

Tax credits, benefits and exemptions

Children’s wellness tax credit: A credit providing relief to families with children in any organized activities.Effective January 1, 2024 the amount is doubling to $1,000 per child. Saskatchewan tax credit .Did you know you can apply for a non-refundable Children’s Wellness Tax Credit of $500? Eligible activities could include sports, arts, cultural camps.Jul 16, 2024, 10:17 AM PDT.

The King’s Speech 2024

This credit is an incentive for families as they look to access sport and recreational activities.

The provinces/territories with fitness or active families tax credits are shown below. JD Vance and his son Vivek.Today, on its eighth anniversary, the Minister of Families, Children and Social Development, Jenna Sudds, announced the maximum annual Canada Child Benefit will .Québec tax credit for children’s activities.Most of the children tax credit and deductions are available for children under 18.As a Canadian taxpayer, the maximum amount you can claim is: $8,000 for each child under 7 years of age at the end of the year.You can claim a refundable tax credit for the physical activities or artistic, cultural or recreational activities of an eligible child, provided you meet all of the following conditions:. Alberta Child and Family Benefit .Since January 1, 2021, Islanders are able to claim a non-refundable wellness tax credit of up to $500 per child. In 2017, the Canada Revenue Agency (CRA) phased out the children’s fitness and arts credits. The current credit costs $115 million .

2023 Prince Edward Island provincial budget tax highlights

Save your receipts to claim your children’s fitness tax credit at tax time this year.He estimated that a middle-class family with two children and an annual income of $100,000 would pay $2,600 in additional federal income tax if they faced a 15% flat tax .

Low-income tax reduction – The budget proposes to increase the income threshold for the PEI low-income tax reduction from $20,000 to $20,750 for 2023 and again to $21,500 for 2024.Line 58365 – Children’s wellness tax credit.Also, the Children’s Wellness Tax Credit will double by increasing from $500 to $1,000. This credit is for all families with children under .caEmpfohlen auf der Grundlage der beliebten • Feedback

Children’s Wellness Tax Credit

You can get up to $108. You may be able to claim an Audio-Visual Expenditure Credit instead. Their information may not have been updated.Children’s fitness and art tax credits offset the cost of fees for children to take fitness classes, engage in organized sports, and learn about art.5 reasons you won’t get children’s fitness and arts tax .Children’s wellness tax credit New for the 2021 tax year, PEI residents might be able to claim a non-refundable tax credit of $500.Wellness is important to Islanders, especially in our children and youth.

Dependant’s physical or artistic activities

You apply for the credit by completing form ON479, which is part of your personal income tax and benefit return.

Tax changes to benefit Islanders

This tax credit helped parents and guardians with the cost of registering their children in organized activities. Lower and middle-income . Knowing that organized activities can be expensive for families, a Children’s Wellness Tax Credit has been created to assist with these costs.caFamily Tax Deductions: What Can I Claim? – TurboTax® . Children’s Wellness Tax Credit – The maximum amount for the Children’s Wellness Tax Credit is proposed to increase from $500 to $1,000 starting in 2024. They would receive a refundable tax credit worth up to $50 per child under 16 years of age, or up to $100 for a child with a disability under age 18. This non-refundable tax credit has been available since the 2011 taxation year, and is claimed on the personal tax return. Some may have additional amounts for a child with a disability.20 back for a child with a disability who is under 18. In 2017, the Canada Revenue .

Children’s Arts Tax Credit (CATC)

Children’s Fitness Tax Credit

This tax credit is for all families . The King’s Speech.Tax Credits and Rebates | Government of Prince Edward . Eligible expenses include membership fees, uniforms and equipment.The Children’s Fitness Tax Credit is calculated by multiplying the lowest personal income tax rate (15% in 2014) by the eligible fees for each child. Government officials believe this change is justifiable, since few . If your child participated in an eligible program of physical activity, you may be able to claim up to $500 for the fees paid in 2012 to register you or your spouse’s or common-law partner’s child. Lastly, the bill eliminates the surtax for 2024, adds two additional tax brackets and increases the thresholds and reduces the rates for the original three brackets. In addition, your child may even be considered . $5,000 for each child between 7 and 16 . Corporations can apply to this program when they invest at least $10 million to build or expand value-added agri-processing facilities. The eligible fees (up to the maximum amount per child) are currently reported on line 365 of Schedule 1, Federal Tax.To my knowledge, the finance department has not published its own analysis of the children’s fitness tax credit (nor of the children’s arts tax credit). It also holds the added benefit of supporting the local health and wellness industry. You can also contact the website you are referencing at 1-800-465-6587 for verification.Reduced for 2016, eliminated for 2017 taxation year federally. In 2023, you or your spouse on December 31, 2023, paid to either: . PEI Family · January 10, 2021 · .

- Top-Familien-Campingplätze In Der Schweiz

- Bildhauer Und Steinmetz : Steinmetz- und Steinbildhauer-Innung Mannheim

- Christian Denominations In The Bible

- Studio Grand Uptown _ The Studio Grand Series

- Movavi Suite 2024 , Video Maker

- Moderne Küche Aus Der Serie Edition 78

- Birthdayspro Im App Store _ BirthdaysPro for iPhone

- Palatina Bus 501 Neustadt : Bus route 501

- Lfdy Influencer Code April 2024 → Bis Zu 50% Rabatt

- Radtouren Schwäb Hall : Paneuropa-Radweg: Etappe Heilbronn

- Sterntülle Für Thermo Xpress Whip » Zubehör

- Pregabalin Al 75 Mg Hartkapseln 100 St