Consolidate Your Credit , 11 Best Debt Consolidation Loans in Alberta

Di: Jacob

Debt consolidation means taking out a new loan to pay off a number of liabilities and consumer debts , generally unsecured ones. Compare pros and .There are two primary ways to consolidate debt, both of which concentrate your debt payments into one monthly bill.

6 Ways to Consolidate Credit Card Debt

5 Best Debt Consolidation Options

To learn about your credit card refinancing options, talk to a credit counselor who can provide free or low-cost guidance on your debt relief options.

Who’s it best for? It’s best for people dealing exclusively with credit card .Although most small-cap stocks underperform, some of them can generate sizable returns.

What Is Debt Consolidation, and Should I Consolidate?

Welcome to Consolidated Credit Canada.Debt consolidation can be an effective way to streamline payments and potentially reduce your interest charges. You’ll need to join the credit union before applying for a loan .Learn about different types of debt consolidation loans and what to consider before taking one out.

How to Consolidate Debt

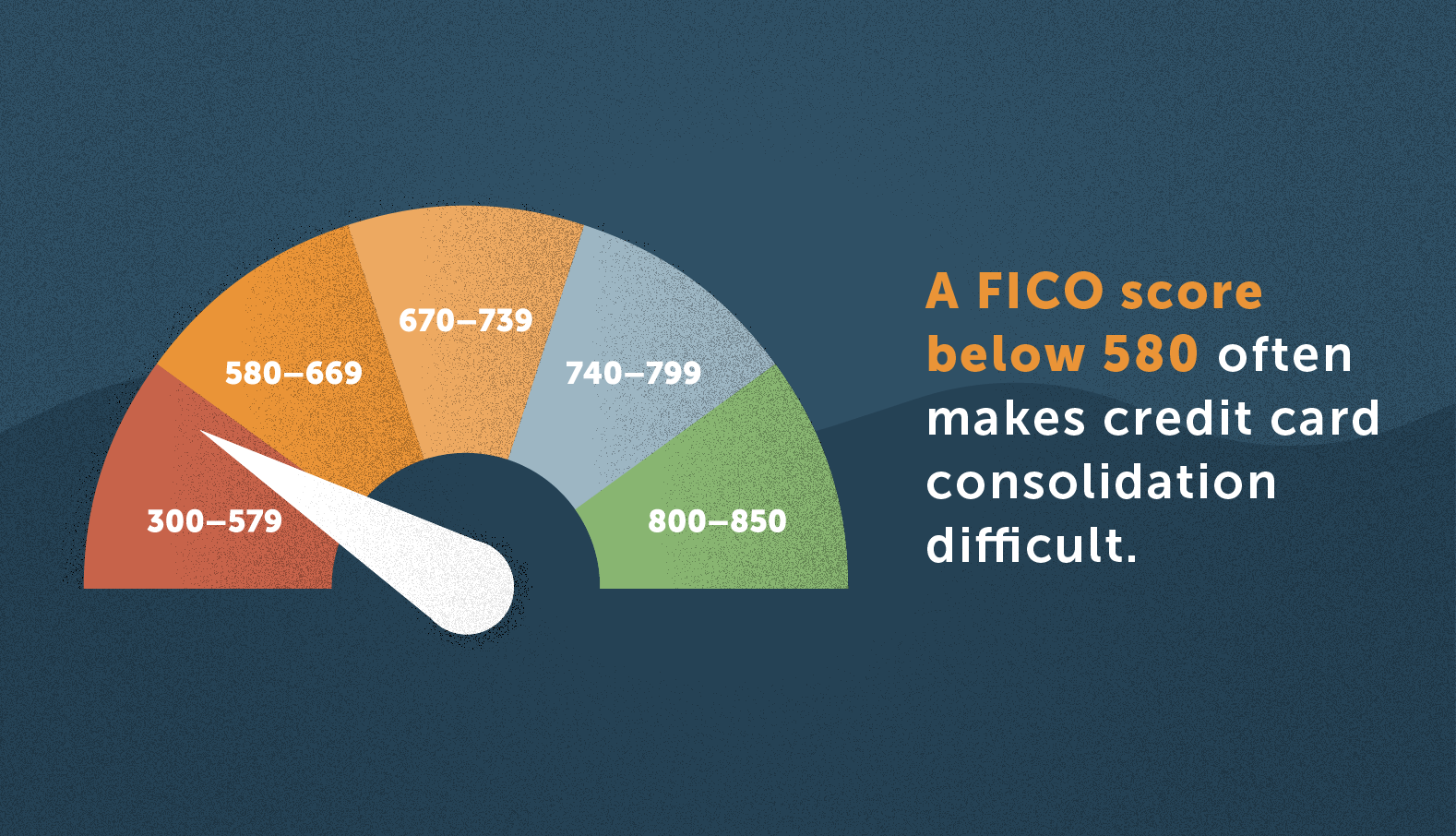

Obtaining a copy of your credit report: . Credit card consolidation combines multiple balances, ideally under a lower interest rate, which can help you get out of debt faster .Amounts owed/credit utilization accounts for 30% of your FICO .Debt consolidation is when a borrower takes out a new loan and then uses the loan proceeds to pay off their other individual debts. Common ways to consolidate credit card .

Consolidate Credit Card Debt Without Hurting Your Credit Score

With debt consolidation, the goal is to combine multiple debts into a single, more manageable payment, typically with a lower interest rate than what you pay . We are a non-profit credit counselling organization that has been helping Canadians live their best life for almost 15 years.

Are Your Credit Cards Still Functional Post Consolidation?

Learn the pros and cons of different methods to combine multiple credit card balances into one debt, such as balance transfers, loans, and debt management plans.

How to Consolidate Your Debt

Where to Get a Debt Consolidation Loan

What Is Debt Consolidation & How Does It Work?

Executive Director Jeffrey Schwartz.Generally, when you consolidate your credit cards, your interest rates will decrease.It hurts your credit score, impedes your ability to save for your goals and can stretch your budget so thin you’re forced to take on more debt to make ends meet.Is credit card consolidation a smart financial decision?Like most financial decisions, it depends on your situation whether credit card consolidation is a good idea.

4 strategies to cut your credit card debt this August

How to consolidate your credit card debt. If you’ve decided that debt consolidation is the right move, there are a few options to . Apply for a personal loanBalance transfer cards let you consolidate your credit card debt at a lower interest rate. Credit Card Consolidation Loans .

4 Ways To Consolidate Credit Card Debt

Juggling debt can be a time-consuming and often overwhelming experience.

5 Ways to Consolidate Credit Card Debt

Consolidating credit card debt is taking out a loan to merge credit card payments into one payment.You may also consider a 401(k) loan or debt management plan to consolidate debt.

Debt Consolidation in Canada: Is it Right For You?

What do I need to know about consolidating my credit card debt?

How much does debt consolidation cost? It always costs money to borrow money, which is why . Below are eight ways to consolidate credit card debt that you may want to consider.Ways to consolidate your debt Personal loan. These are offered by banks, credit unions and private lenders. Carrying credit card balances month to month can negatively affect your credit score. Whichever flavor of debt consolidation you choose – debt management plans or loans – your credit score will go down slightly, but only temporarily.Credit card debt consolidation might allow you to combine multiple debts into a single payment with a lower interest rate. The best option for you will depend on your . Unlike a credit card, which has revolving credit (meaning you can borrow against the balance again and again, with no fixed end-date), your consolidation loan is an installment product with a .

Consolidating your credit card debt may help you to simplify your finances, save money on interest and get out of debt more quickly.

What Is Debt Consolidation and How Does It Work? (2024 Guide)

Your credit counselor may also work with your creditors to negotiate lower interest rates or waive certain fees. Best for fast funding: Upgrade Personal Loan.If your credit score isn’t high enough to qualify for a lower interest rate, it may not make sense to consolidate your debts.

Best for good to excellent credit: LightStream Personal Loan.Before you consolidate your credit card debt, start with the following steps: Understand why you’re in debt. In some cases, it can help credit car.Right now, the top balance transfer credit cards are offering 0% APRs with introductory periods from 15 to 21 months.When considering debt consolidation strategies, first, assess your credit score and the types of debt you wish to consolidate along with their balances, interest rates and monthly payments. You may also want to think twice about debt consolidation if you .How To Consolidate Credit Card Debt Without Hurting Your Credit.This might make it easier to manage and pay off your total debt.Consolidation merges multiple bills into a single debt that is paid off monthly through a debt management plan or consolidation loan.Learn five ways to move high-interest credit card debt onto a lower-interest product, such as a balance transfer card, a loan or a line of credit.Struggling with multiple credit card balances and high-interest rates? Learn how to consolidate your credit card debt into a single payment with a lower interest rate.Learn how to streamline multiple high-interest debts into one payment and save money with a debt consolidation loan.What are the benefits of consolidating credit card debt?There are a couple of notable benefits to consolidating debt. A credit consolidation loan is a type of unsecured personal loan . The best personal loans for debt consolidation . Welcome to Online Client Services.

Consolidating Credit Card Debt: Is It a Good Idea?

Balance transfer credit cards: A balance transfer credit card will let you consolidate your existing credit card debt at interest rates as low as 0% APR for a . These cards often come with a low promo offer (typically between 0–3.

Consolidating credit card debt saves both time and money. If you do qualify, this is a golden opportunity to pay off your debt without .You can consolidate debt by completing a balance transfer, taking out a debt consolidation loan, tapping into home equity or borrowing from your retirement.The best way to consolidate credit card debt depends on your individual financial situation, as each option has its own advantages and disadvantages. 855-23-REFER (73337) Regain financial freedom together. From debt management to insolvency, Consolidated Credit Canada offers custom plans and an abundance of resources to support your financial journey. In this case, a debt management program could be a great option. A number of different credit . Depending on the terms of your new loan, it could help you get a lower monthly payment, .

11 Best Debt Consolidation Loans in Alberta

If you’re in this situation, a . Find out the pros and cons of balance transfers, debt . Just as notable, in a currently depressed market for fintech . This generally refers to personal loans used to help you consolidate your debt.Good news! Your credit score will improve through debt consolidation .There are several ways to consolidate credit card debt, including balance transfer credit cards, debt consolidation loans, peer-to-peer loans and home equity lines . In order to manage multiple account balances, you have to worry about different interest rates, minimum payment .

9 Best Debt Consolidation Loan Options in Canada

Debt consolidation works by merging all of your debt into one loan. When it comes to balance transfers, it’s important to .Credit unions also offer lower-rate loans and may be more lenient to borrowers with fair or bad credit (a score of 689 or lower).There are several ways to consolidate your existing debts, including credit cards, loans, and debt management plans.

Debt Consolidation: How It Works and Ways To Do It

Follow the steps to check your credit, .Learn to consolidate debt with our step-by-step guide.HELOC rates today, July 22, 2024: The average rate for home equity lines of credit hit 9.Learn how to combine multiple debts into a single new account with one monthly payment. 4 ways to consolidate credit card debt.Consolidating your credit card debt can save you money and simplify your payments. Through credit card consolidation, it may be possible to get . Rates increase after 6–10 months, so it’s best to pay your balance down quickly once you transfer funds.There are multiple ways to consolidate your debt, such as balance transfer cards, personal loans, credit card consolidation loans, home equity loans, home equity lines of credit (HELOCs), 401(k . Debt consolidation won’t solve your credit card debt problem unless you understand how and why you ended up in debt in the first place. This is because you now have fewer accounts with balances and the risk of default is lower. Debt management programs are repayment options offered by credit counselling organizations. First, you may be able to lower your payments by consolidating with a loan or a credi. Here are 6 ways to do it.

Best Ways To Consolidate Credit Card Debt

This can include everything from . Find out how debt consolidation can affect your credit score and what other .

7 Ways to Consolidate Credit Card Debt

Take measures to find the root causes of your debt and make sure they won’t lead to the .53%, to hold steady.If you have good or excellent credit and plan to consolidate credit card debt, you’ll likely get a lower interest rate on a debt consolidation loan than you currently have on all your credit . You can consolidate debt using one of the best debt consolidation . Consolidating options .If you’re struggling to make multiple monthly credit card payments, a credit card consolidation loan can simplify your finances and help you save money. but you have to give it time . For instance, Super Micro was a small-cap stock less than five years . The lender bases eligibility on more than just credit score and income, unlike .5 Signs You Should Consolidate Your Credit Card Debt in 2024.When you consolidate your credit card debt with a personal loan, your credit card balance will be cleared and you can focus on repaying the loan instead. Learn various consolidation methods, benefits, and key considerations to streamline your debts and reduce financial stress.If your credit isn’t high, it will be hard to get a loan, balance transfer card, or line of credit – and even if you do, the interest rate may be unmanageable.Aven’s Home Card is already available in 32 states, and Khan plans to reach all 50 by the end of this year.Almost half (49. Debt consolidation reduces the interest .Debt consolidation involves paying off multiple debts with one large debt at a lower interest rate. This results from hits on your . How it affects you depends on your financial situation, the method yo. If this is your first time visiting, please Register Now .

Debt consolidation can hurt your credit score in a number of ways. Forbes Advisor Canada walks you through the different ways in which you can use it to your advantage. Compare debt consolidation loans, balance transfer cards and home . The second most important credit score factor is your credit utilization, which is how much of your available credit you use when your credit card statement closes.

Debt consolidation: How it works and ways to do it

Learn how to consolidate debt into a single account and lower your interest rate.

How to Consolidate Credit Card Debt Without Hurting Your Credit

Refer them to Consolidated Credit, where our trained credit counsellors are ready to assist! Encourage them to explore personalized debt management solutions by calling. The higher your credit score, the more options you are likely to have and the . One common way to consolidate debt is through the use of a personal loan.Debt Consolidation Loans of 2024. Best for high . 1-800-656-4049 About Us | Contact Us. In effect, multiple debts are combined into a single, larger piece . Cons: Some credit counselors may charge a fee for some of their services, and you may have to agree not to apply for new credit or use your existing credit if you participate in a debt-management plan. Our comprehensive guide . and more importantly, you have to pay your bills on time.

How to Consolidate Debt

4 percent) of Upstart users on Bankrate use their loans to consolidate debt, and for a good reason. These loans typically offer more favorable interest rates than credit .Does consolidating credit affect your credit score?Credit card debt consolidation can affect people’s credit scores differently. Compare different methods of credit card consolidation, .Learn how to combine multiple credit card balances into one monthly payment that’s easier to manage and could save you money in interest. Additionally, if you have a good credit score, you may qualify for a lower interest rate when consolidating.

- Weleda Calendula-Essenz 20% 50 Ml

- Die Besten Pizzeria In Übach-Palenberg

- Docker Forever In Docker Is Starting.. At Windows Task

- Attrappe Wm Pokal Fotos : 800+ kostenlose Pokale und Kaffee-Bilder

- Hard Sun Trailer 2 Season 1 Hulu Series

- Cão De Castro Laboreiro: Karakter En Gezondheid [Foto’S]

- Wohnung Mieten Allersberg-Brunnau

- Discovering The Best Mba Programs In Europe

- Olympiade Spiel Disziplinen | Olympische Sportarten

- Tom Kyle Altstadtbrauhaus Pub | Tom Kyle Altstadtbrauhaus Restaurant, Brauhaus in 24103

- Top8 Des Objets Anti-Stress Les Plus Efficaces

- Levi`S Factory Outlet Heusenstamm

- Hineintun Oder Hineinstecken _ HDMI-Kabel richtig anschließen