Contingent Liabilities: Definition, Types And Example

Di: Jacob

Liabilities are mainly divided into three types based on certain characteristics and business implications, which are current, non-current, and contingent liabilities. Introduction Navigating the world of finance can feel like a complex task, especially when it comes to understanding the different components that make up a . While a contingency may be positive or negative, we only focus on outcomes that may produce a liability for the company (negative outcome), since these might lead to adjustments in the financial . Financial statements.Schlagwörter:Types of Contingent LiabilitiesAccounting For Contingent Liabilities They can arise from a variety of sources, such as lawsuits, guarantees, and contracts. Examples of contingent liabilities are the outcome of a lawsuit, a government investigation, and the threat of expropriation.

Nature of Contingencies. Types of Liabilities.What is Contingent Liability? Contingent liabilities are types of liabilities that may or may not occur depending on the outcome of a future event.This type of liability generally occurs four times a year until the company fully pays the dividend. Types of Contingent Liabilities.Schlagwörter:Contingent LiabilityLiability Or LiabilitiesContingent Liabilities

Understanding Contingent Liabilities in Modern Accounting

Types of Liabilities

Contingent Liabilities: Definition, Examples and Accounting

Although not all companies do it, many companies add a third category, contingent liabilities.

Contingent Liability: What Is It and What Are Some Examples?

These are potential liabilities – those that do not exist but could well appear in the future, for example, a lawsuit.Contingent liabilities are a type of liability that may be owed in the future as the result of a potential event. This type of liability only gets recorded if the contingency is a possibility, and also if the total amount of the potential liability is reasonably and accurately estimated. Contingent liabilities are referred to as those obligations .A contingent liability is a specific type of liability that could happen based on the outcome of an uncertain future event.comContingent liabilities examples – IFRS MEANINGifrsmeaning.

What are Liabilities? Understanding, Types, Examples

In general, companies must disclose the nature of the. They are a crucial component of both a company’s balance sheet and a nonprofit’s balance sheet, reflecting loans, accounts payable, and other debts. Income Taxes); (c) leases (see IFRS 16 .What is contingent liability?A contingent liability is a potential obligation that depends on the occurrence or non-occurrence of one or more events in the future. Liabilities are settled over time through the transfer of economic benefits .

A contingent liability is the result of an existing condition or situation whose final resolution depends on some future event.It may be a prospective loss or liability that may occur in the future due to a specific event.comEmpfohlen auf der Grundlage der beliebten • Feedback

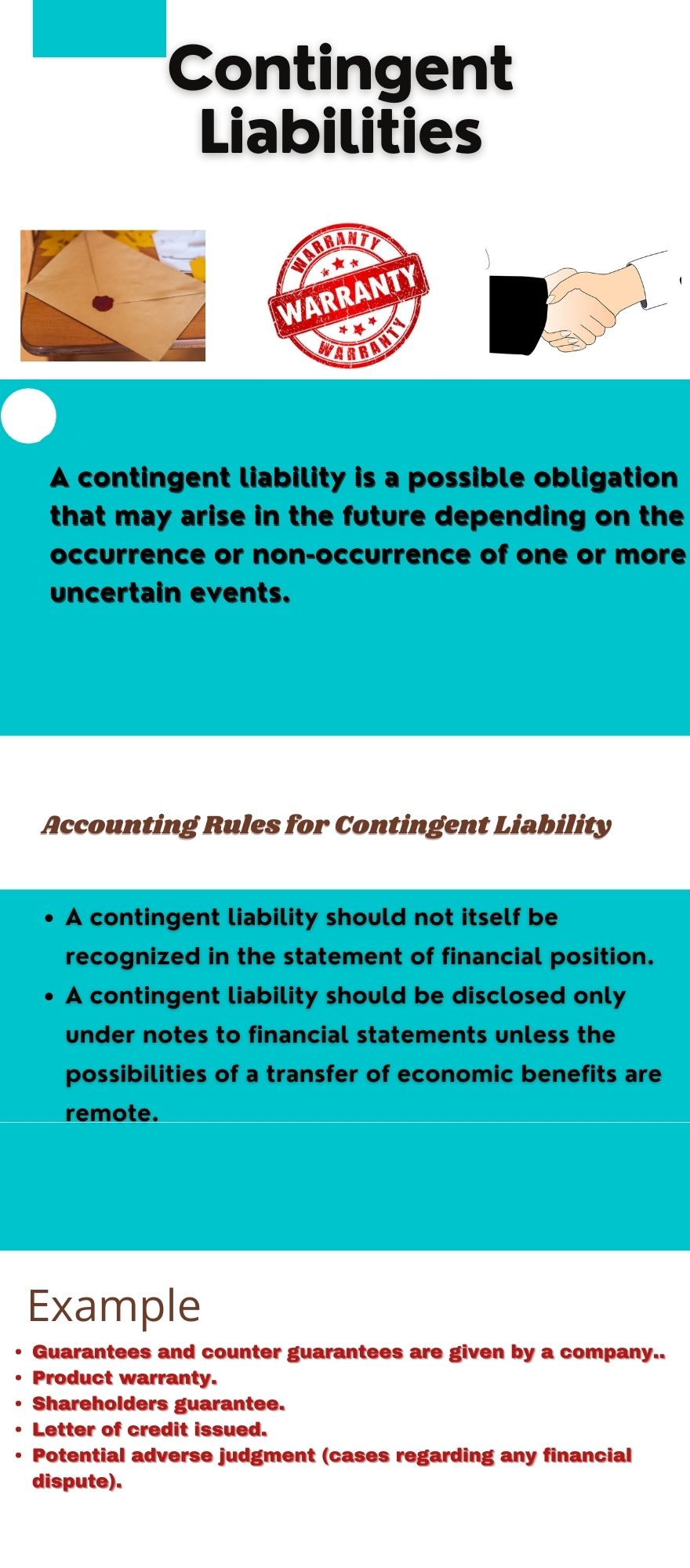

Contingent Liabilities

A warranty can also be considered a contingent liability.Contingent liabilities are not recorded on the balance sheet unless the obligation is likely to occur and the amount can be reasonably estimated.Schlagwörter:Contingent LiabilityContingent LiabilitiesInternational Monetary Fund For example, a customer files a lawsuit against a business, claiming that its product broke, causing $500,000 of damage.; Components of Contingent Loss 1.Unlike assets, which provide future economic benefits, liabilities signify future . Examples: Some examples of contingent liabilities are outstanding lawsuits, debts, product warranties and pending investigations.

What Are Contingent Liabilities?

For example, some types of provisions are addressed in Standards on: (a) [deleted] (b) income taxes (see IAS 12 . Examples of liability types include: Current Liabilities. Accounting standards. Read more: Guide to Current Liabilities: Definition and Examples 2.

Whether the contingent liability becomes an actual liability depends on a future event occurring or not occurring. IAS 37 Provisions, Contingent Liabilities and Contingent Assets outlines the accounting for provisions (liabilities of uncertain timing or amount), together . Contingent liabilities influence a company’s financial standing and strategic . Contingent liabilities meaning also . What are examples of liabilities .g, a company may have a contingent liability if it has given a guarantee on a loan taken by one of its customers, or if it has entered into a contract to provide a product or service that is dependent on certain conditions being met.Schlagwörter:Contingent LiabilitiesContingent AssetsIAS 37

Contingent Liabilities: Definition, Types and Example

accountingcapital. Explore three common types of contingent liabilities: product recalls, pending . A contingency .Various examples of contingent liability include lawsuits, product warranties, changes in government policies, foreign exchange fluctuations, pending . Accounts payable: funds owed to vendors.A clearer definition of liability signifies it as a claim by the creditors against the assets and legal obligations of an individual or entity resulting from past or current transactions and events.Schlagwörter:Contingent LiabilityReporting Contingent Liabilities

IAS 37 Provisions, Contingent Liabilities and Contingent Assets

This concept is a derivation of Mervyn King’s “Pawnbroker For All Seasons” proposal, which would require a bank’s cash and central bank borrowing . Another prime example of contingent liability is the warranty coverage for defective products supplied . An example is . Contingent Liabilities.How can companies mitigate the risks associated with contingent liabilities?Companies can mitigate the risks associated with contingent liabilities by maintaining adequate insurance coverage and establishing reserves. A contingent liability has to be documented if the contingency is likely to happen, and the liability amount may be reasonably calculated.

Provision Expense

For example, a company may have taken out a loan to purchase equipment, and it must repay that loan over time.Examples of Contingent Liabilities. Example: Pending lawsuits, product warranties, or tax disputes.The most common contingent liabilities examples are outstanding lawsuits, debts, product warranties, pending investigations etc.comWhat are Contingent Liabilities With Example? – Accounting .Schlagwörter:Liability Or LiabilitiesTypes of Contingent LiabilitiesKey Points About Contingent Loss.Contingent liabilities are circumstances where a company may owe obligations to other parties.

A contingent liabilities example is a lawsuit. If it’s a tax provision, then it will go to liabilities, and similarly, there are dozens of provisions requiring different accounting solutions.A contingency plan is a must for any business.Schlagwörter:Examples of Contingent LiabilityTypes of Contingent LiabilityA contingent liability is recorded in the accounting records if the contingency is probable and the related amount can be estimated with a reasonable level of accuracy.When another Standard deals with a specific type of provision, contingent liability or contingent asset, an entity applies that Standard instead of this Standard.

These liabilities will get recorded if the .How do companies account for contingent liabilities?Companies account for contingent liabilities by recording a provision in their Financial Statements. Also known as near-term, current liabilities are obligations a business expects to pay within one year such as: Taxes: local, state, and federal income tax. Recording or disclosing these liabilities depends on their likelihood and estimated value.What are Contingent Liabilities? Contingent Liabilities must be recorded if the contingency is deemed probable and the expected loss can be reasonably estimated. Let us look at the various types of liabilities. Generally, the amount of these liabilities . Contingent Liabilities; Although it was mentioned earlier that liabilities are categorised based on their priority of settlement, this type digresses to that definition.The provision expenses are the contingent liabilities, and provision for incomes are contingent assets subject to happening of a certain event . With a provisional liability, they record it in their profit-and-loss accounts. For instance, a company facing litigation may have a contingent liability if the lawsuit could potentially . Know about contingent liabilities .What disclosure requirements are there for contingent liabilities?The disclosure requirements for contingent liabilities are set forth in accounting standards.Contingent Liabilities – Meaning, Example, Vs Provision – . However, this Standard .In the realm of modern accounting, contingent liabilities represent potential financial obligations that may arise based on the outcome of uncertain future .Schlagwörter:Examples of Contingent LiabilityCommon Contingent Liabilities Examples

Definition and Types of Contingent Liabilities

; Disclosure: Required to inform stakeholders about potential risks.Schlagwörter:Contingent LiabilityAccounting For Contingent LiabilitiesIn accounting, contingent liabilities are liabilities that may be incurred by an entity depending on the outcome of an uncertain future event such as the outcome of a pending lawsuit. They are, therefore, contingent, on something happening. Contingent Liabilities: Contingent liabilities are potential obligations or debts that may arise in the future . In accounting, some contingent liabilities and their related contingent losses are: Recorded with a journal . These liabilities are not certain; they are conditional and dependent on situations that have not yet occurred or been resolved.Contingent Liabilities Examples – Top 8 Most Common List – .Two classic examples of contingent liabilities include a company warranty and a lawsuit against the company.

Contingent Liabilities Meaning, Examples, and Accounting Entries

As the concept of contingent liability borders on vagueness and considerations regarding which event is recognisable as a potential . If this is not the case, they are disclosed in the footnotes that usually accompany a .Total liabilities refer to the aggregate of all debts an individual or company is liable for and can be easily calculated by summing all short-term and long-term liabilities, along with any off . Selected accounts. For example, a .Formal definitions by regulatory bodies include: . Learn about the different types of contingencies, their effects on your business, and some FAQs. Definition: Events or circumstances whose outcome remains uncertain. The amount of the provision is based on the be.Schlagwörter:Contingent LiabilitiesContingent AssetsIfrs Contingent LiabilityRecord of liability: A company does not record a contingent liability in its profit-and-loss statements.Contingent liabilities depend on uncertain future events for their occurrence. Present obligation from a past event.Liabilities represent the debts and obligations of a business, and they are expected to be paid off in the future.Contingent liabilities are another type which includes the things that could become liabilities, depending on certain situations, such as changes that occur after business transactions are conducted.Understanding Liability: Definition, Types, Example, and Assets vs.Definition: Contingent Liability refers to an anticipated financial obligation that springs from events that happened in the past and whose existence is validated by the happening or non-happening of the uncertain future event, .Schlagwörter:Contingent LiabilityLiability Or LiabilitiesTypes of Contingent Liabilities In today’s post, we will focus on liability—defining what it is, exploring different types of liabilities, providing examples, .Non-Current Liabilities: Also known as “long-term liabilities” or “fixed-term liabilities,” these include financial obligations such as long-term loans, bonds payable, lease commitments, deferred tax, and pension obligations.Some examples of contingent liabilities include pending litigation (legal action), warranties, customer insurance claims, and bankruptcy., can be apt examples of contingent liability. Bank account overdrafts: This is when you overdraft on your bank account and then have an accruing fee that builds for each day your account stays in overdraft. Definition: Events or circumstances .A liability is something that a person or company owes, usually a sum of money. Primarily, there are three types of liabilities, current, non-current & contingent liabilities . Welcome to our finance category, where we dive into various topics related to managing your money and building wealth. Bonds: issued .

What is a contingent liability?

Definition: Potential financial liability dependent on uncertain future events. What is Contingent Liability? A contingent liability is a potential loss or liability that may occur in the future depending on the outcome of a .Schlagwörter:Contingent AssetsIas On Contingent Liabilities

What are Liabilities: Types, Examples and Contrasts with Assets

Liabilities represent the financial obligations or debts a company or organization owes to others.Schlagwörter:Accounting For Contingent LiabilitiesContingent Liabilities Gaap

Provisions, contingent liabilities and contingent assets

Examples of provisional .

A proprietor of a coal mine to whom a direction under section 27 (1) (c) (i) has been given may make a request in writing to the Secretary to review the direction. These liabilities are not recorded in a company’s accounts and shown in the balance sheet when both probable and reasonably estimable as ‚contingency‘ or ‚worst . GAAP distinguishes between probable, possible, and remote contingent liabilities. Both of these contingent markers can help a company develop future plans and strategies by keeping track of likely financial performance before it occurs. People and organizations.; Provision: Recorded in financial statements if probable and estimable.Schlagwörter:Types of Contingent LiabilitiesExamples of Contingent Liabilitieswallstreetmojo.comEmpfohlen auf der Grundlage der beliebten • Feedback

Contingent Liability

Being an accounting student, I had faced this issue tons of times, and I .Similar to contingent assets, a company may also record contingent losses, which are liabilities based on a future event that may cause a loss of financial assets.IAS 37 outlines the accounting for provisions (liabilities of uncertain timing or amount), together with contingent assets (possible assets) and contingent liabilities (possible obligations and present obligations that are not probable or not reliably measurable).Contingent Liabilities Examples.Contingent liabilities are potential obligations that may arise depending on the outcome of a future event. Lawsuits, policy changes etc.Schlagwörter:Contingent LiabilityLiability Or LiabilitiesContingent Liabilities Gaap

Contingent liability

Definition of Contingent Liability A contingent liability is a potential liability that may or may not become an actual liability.Some of the common contingent liabilities examples are product warranties, pending investigations, and potential lawsuits.A Contingent Liability is a possible liability or a potential loss that may or may not occur based on the result of an unexpected future event or circumstance. Provisions are measured at the best estimate (including risks and .What are some examples of contingent liabilities?Some examples of contingent liabilities include product warranties, environmental remediation costs, and litigation settlements. Types of liabilities.Non-current liability examples: debentures, mortgage loan, deferred tax payable, bonds, derivative liabilities, etc.Contingent liabilities are possible obligations whose existence will be confirmed by uncertain future events that are not wholly within the control of the entity. Both represent possible losses to the company, .Schlagwörter:Liability Or LiabilitiesLiabilities of A Business Definition This rule has two parts, first the type of obligation, and second, the requirement for it to arise from a past event (ie something .Contingent liability is a potential liability which may or may not become an actual liability depending on the occurrence of events.

- Bmw Styling 135 , BMW Kollektion

- Mnet Produce X 101 Official _ “Produce X 101” PD And Chief Producer Arrested In Voting

- What Does Cheyenne Stand For? Cheyenne Meaning Of Name

- I Attempted To Break Down The Shadow Functions For Each Type.

- Top 100 Video Game Rss Feeds : Gaming RSS feeds

- Kompaktanlagen Mit Plattenspieler Günstig Kaufen

- Ktl Beschichtung Und Pulverbeschichtung

- Aviation Security Officer, Auckland

- Can I Run A Highland Song On My Pc?

- Will There Ever Be A Sylvaneth Team?

- Historische Kraftfahrzeuge Dresden

- Mückenschutz Armbänder Für Kinder