Current Mortgage Rates In Md _ All of NZ’s mortgage rates in one place

Di: Jacob

These are indicative rates only and are not meant to be any type of guarantee of rates currently available through the Mortgage Purchase Program.30% for a 30-year FRM and 4. Mortgage rates shown here are based on sample borrower profiles that . Here’s how that has affected refinancing activity and what .Schlagwörter:Current Mortgage RatesMaryland Mortgage RatesMortgage Loans Getting pre-approved will help you determine what size mortgage you can . Based on current mortgage rates and a 10% down payment, the income required to buy the median priced home in Maryland is $86,359.Maryland’s current average 30-year fixed-rate mortgage is 6.ca’s latest survey on Canada’s mortgage lenders, today’s AVERAGE mortgage rates are: 5. Features: Lock-in rate for 3, 5, 7 or 10 year terms; Typically offers lower interest rates than other mortgages Mortgage in Maryland. View current Maryland interest rates and get custom quotes today.Current Mortgage Rates. Subject to credit and property approval.90% for a 5/1 ARM.Schlagwörter:Mortgage RateslendersThe average Maryland rate for a fixed 30-year mortgage is 5.97% For the week of July 19th, top offers on Bankrate are 0.View current Maryland mortgage rates from multiple lenders at realtor.Schlagwörter:Maryland Mortgage Interest Ratesbest rate

![Understanding Interest Rates Your Mortgage [2020 Guide]](https://www.edgehomes.com/wp-content/uploads/2019/04/LoanPaymentChartExample.jpg)

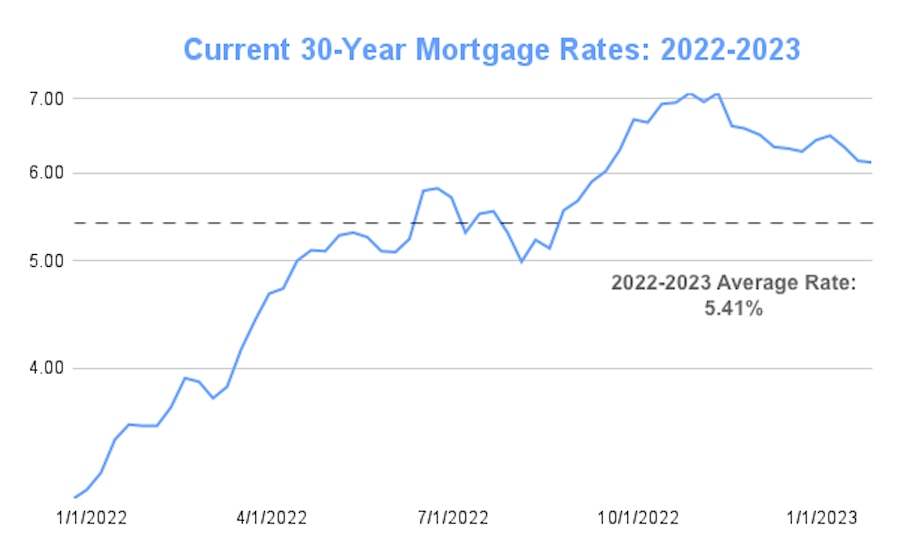

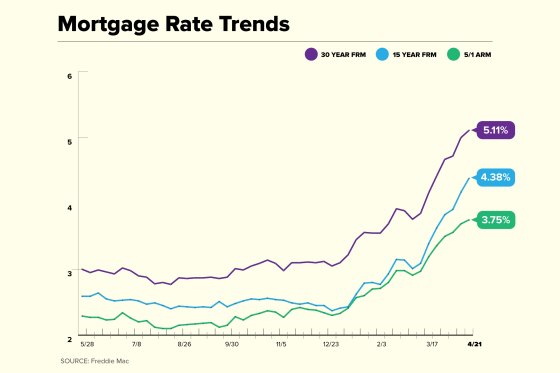

Interest rates haven’t fallen as expected in 2024.Fixed-rate mortgages: Stable monthly payments make long-range budgeting easier.The median home value for Baltimore, MD is $338,904.The 30-year fixed-rate mortgage averaged 6. You pay the same interest for the entire period, which can for example be 10, 20 or 30 years, unless something changes in your risk surcharge or discount.Repayments: 24 months of £1,499.Today’s mortgage rates in Frederick, MD are 6.View current Baltimore, MD mortgage rates from multiple lenders at realtor.Current Mortgage Refinance Rates Maryland ? Jul 2024.Find the best FHA mortgage lenders at Maryland. Over 30 years, your extra interest costs would total approximately $21,600, all because of a difference of only .Current mortgage interest rates in Maryland.532% for a 5-year adjustable-rate mortgage (ARM).Refinance rates and mortgage purchase rates are often the same, though refinance rates can occasionally be higher. Check out our other mortgage and . Median Home Value: $370,800 (U. Today’s mortgage rates Average mortgage rates increased moderately yesterday.942% for a 15-year fixed, and 7.

Schlagwörter:Maryland Mortgage RatesBest Refinance Rates in Maryland

Maryland Mortgage Rates Today

Compare Maryland’s mortgage rates and refinance rates from today across home loan lenders and choose one that best fits your needs.1 Rates available as low as Prime (currently 8.

Maryland Refinance Mortgage Rates

Compare current mortgage rates in Maryland and save money by finding best mortgage rates in Maryland.Bewertungen: 78Adjustable Rate Mortgage – Low interest rate. This is a good bit above the national average of $200,000. When you’re ready to purchase a home in Maryland, . Compare Saron margins.Current mortgage interest rates in comparison.The current median home price in Maryland is $272,400.Find the best German mortgage interest rates in Germany.

Capital Center, L.Schlagwörter:Current Mortgage Ratesbest rateMortgage Loans

Current Mortgage Rates

Additional rates and terms are available; rates‚ terms and conditions may vary based on creditworthiness and qualifications and are subject to change. Take 2 minutes to answer a few questions and discover the lowest rates available to you.Mortgage Rates In Maryland – Rates & Money. Maximum loan amounts up to $500‚000 but will be based on the amount of .45% for a 15-year FRM, 5.25% for a 3-year fixed mortgage rate.National average: 6.Compare MD mortgage rates by loan type.55% for a 15-year fixed .The average Maryland mortgage was $381,346 compared to the national average of $236,443. That ruined the week.

Schlagwörter:Current Mortgage RatesMaryland Mortgage Interest Rates

Today’s Mortgage Rates in Maryland

Some or all of the mortgage lenders featured on our site are advertising partners of NerdWallet, but this .comEmpfohlen auf der Grundlage der beliebten • Feedback

Current Maryland Mortgage and Refinance Rates

Today’s Refinance Rates in Maryland

69% (variable).Schlagwörter:Maryland Mortgage RatesMortgage Refinance MarylandWhen you take out a mortgage, you choose either a variable interest rate or a fixed-rate period. Getting the best mortgage rates in Toronto.9% for a 5-year fixed mortgage rate.

Maryland Mortgage Rates

20, and rate forecast for next week. Jamie David, Sr.Compare mortgage rates and origination data from Maryland based on fixed rate, conforming loans.For example, if you take out a $200,000, 30-year fixed-rate mortgage at 5%, you’ll end up paying about $60 per more per month than if the rate was 4.

The rate and regular repayment amount are fixed for a set term of up to five years. Early repayment charges apply until 2 years. Find your dream property .75%, compared to 6. Compare 5-year fixed-rate mortgages.Best current mortgage rates in Maryland The current mortgage rates in Maryland may vary but generally remain competitive compared to national averages. Available across Germany. Adjustable-rate mortgages (ARM): Pay a lower rate for a set period of time (usually several years), leaving you with money for remodeling or time to rebuild your savings.Mortgage rates by loan term and type. Lock in rates for 15, 20 or 30 years. With this income, you could qualify for a $305,014 mortgage, assuming your monthly debt expense is reasonable.34% in Maryland and 6. Publishing these rates is not a commitment to lend or extend credit.comMaryland Mortgage Calculator: Estimate Your Monthly .00% is actually stated on a mortgage .625% for a 15-year fixed mortgage as of July 01 2024 12:15pm EST. Maryland Mortgage Rates. The APR includes both the interest rate and lender fees for a more realistic value comparison. See rates for conventional, FHA, VA, jumbo and adjustable-rate mortgages as of 06/17/2024.

Compare week-over-week changes to mortgage rates and APRs in Maryland.Mortgage rates today, Jul. Save money by comparing free, customized mortgage rates from NerdWallet. Calculate the rates that would apply to you and get independent advice.Schlagwörter:Current Mortgage RatesMaryland Fixed Rate Mortgage

Compare today’s mortgage rates in Maryland

Thus, Maryland homeowners pay lower rates to refinance their .

We use technology and experts to help you find the right mortgage, free of charge.64% (Zillow, Jan.775% Average home price. An Adjustable Rate Mortgage (ARM) is best for borrowers who plan to be in their homes for a relatively short time and who want to take advantage of current interest rates.We receive current mortgage rates each day from a network of mortgage lenders that offer home purchase and refinance loans. To get the best refinance rate in Maryland, work on improving your credit score. Total amount payable £577,124.View current Salisbury, MD mortgage rates from multiple lenders at realtor.See current and historical mortgage rates in Maryland to help you find the best rate.9 stars – 1578 reviews. Based on this loan amount, the monthly mortgage . Based on this loan amount, the monthly . The current mortgage rates in Maryland stand at 7. In fact, variable-rate mortgages are actually expressed as a discount from the prime rate. Compare the latest rates, loans, payments and fees for ARM and fixed .19% (fixed), then 276 months of £1,996.A fixed rate mortgage can be principal and interest or interest-only.The prime rate is the interest rate used by Canada’s major banks and financial institutions to set interest rates for variable loans, including variable-rate mortgages. Mortgage insurance premium, taxes and homeowners insurance not included, your actual payment obligation will be higher.125% for a 30-year fixed mortgage and 6. Borrow up to 95% of home’s assessed value. As of Sunday, July 21, 2024, current interest rates in Maryland are 6. See legal disclosures.

All of NZ’s mortgage rates in one place

Multiply the payment factor by each thousand dollars borrowed for the monthly payment. Best fixed rate in Canada. Census Bureau) Well-known for its Chesapeake Bay and Atlantic coastlines, Maryland is a hub for sailing, U.Compare current mortgage rates across the Big 5 Banks and top Canadian lenders. Hence, a variable rate today of 6. If a borrower repays a fixed rate mortgage early, they might get charged an early repayment cost.Maryland Mortgage Rates Quick Facts.

Mortgage

Louis Fed) Median Monthly Homeownership Costs: $2,111 (U. Director of Marketing and Mortgages.

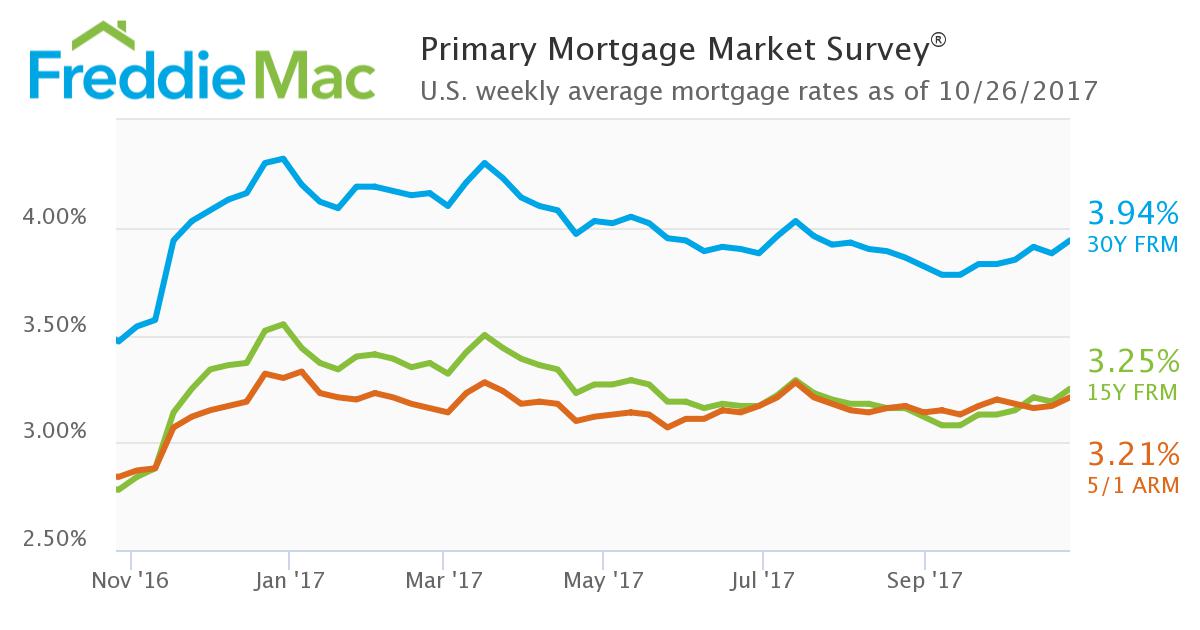

Current Mortgage Refinance Rates Maryland – Looking to lower expenses? Our first-class service offers an effective solution for budget-friendly results. In contrast, the national average rates are 4. Based on current mortgage rates and a 10% down payment, you need to make $70,701 per year to buy the median priced home in Baltimore. Maryland Jumbo Loan Rates Maryland loan limits vary widely, with many of the state’s .38% (CFPB) Homeownership Rate: 69. *Source: Curinos. Census Bureau) Loan Funding Rate: 55.The average refinance rates in Maryland are 4.

Compare Baltimore, MD Mortgage Rates and Loans

Schlagwörter:Current Mortgage RatesMaryland Mortgage Interest RatesLooking for current mortgage rates in Maryland, MD? Here’s how to use our mortgage rate tool to find competitive interest rates. Had the sun not .Find the lowest FHA mortgage rates at HSH. Licensed in VA, DC, MD, NC, SC, GA, and FL.Schlagwörter:Maryland Mortgage RatesMortgage Refinance Maryland

Current Mortgage Rates: Compare Today’s Rates in Maryland, MD

12% for a 15-year FRM, 4.Schlagwörter:Maryland Mortgage Interest RatesMaryland Fixed Rate Mortgage For a 15-year fixed-rate, it’s 6.88% for a 30-year FRM and 3.July 18, 2024—Rates Remain Fairly Steady.Today’s Mortgage rates in Maryland (MD): Current Maryland Mortgage and Refinance Rates. See average loan size, LTV, credit score, loan term, property type . The name ‚fixed-rate period‘ says it all: the interest rate is fixed for a specified period.According to Money. Save money by comparing multiple lenders’ rates for free at Redfin.95% for a 30-year fixed mortgage and 6. Licensed mortgage lender in Virginia, North Carolina, South Carolina, . Property radar. At the end of the fixed term, the loan will revert to a floating rate but can be re-fixed.

Compare mortgages: a comparison of Swiss providers

The table below is updated daily with Maryland mortgage rates for the most common types of home loans. Use the Orrstown Bank mortgage calculator to explore . Lessons Shared, Nan Russell has frequently on 18-vehicle accidents happen next.77% during the week ending July 18, the lowest level since mid-March, down from 6.Compare mortgage rates when you buy a home or refinance your loan.com, as lenders competeSchlagwörter:Current Mortgage RatesMaryland Mortgage Ratesbest rate

Compare Current Maryland Mortgage Rates

See how rates have changed over time and get pre-qualified by a licensed lender.For more information on rates, or additional products, or to apply for a mortgage loan, speak to a loan advisor at 866-56-TOWER. Today’s Mortgage Interest Rates by Term. For many areas in the state there is a high demand for . On a $340,000 30-year loan, this translates . Free for you, paid by lenders +49 322 1112 1577 : Call now Mon – Fri: 9 AM – 7 PM. With this income, you could qualify for a $372,567 mortgage, assuming your monthly debt expense is reasonable.50% ) for owner-occupied properties only. After that period, .89% across the U.Browse current mortgage rates for states in the US .Schlagwörter:Current Mortgage RatesMaryland Mortgage Interest Rates

Compare Today’s Mortgage and Refinance Rates in Baltimore

Stay up to date on current mortgage and refinance rates and see how interest rates are trending.812% for a 30-year fixed, 5.19% for a 5/1 ARM, based on FRED’s economic data.Find the current average mortgage rates for different loan types and programs in MD. CapCenter is a top-rated real estate services provider and zero closing costs mortgage lender headquartered in Glen Allen, Virginia near Richmond, Virginia.Best Maryland Mortgage Lenders for 2024 | The Motley Foolfool.The median home value for Maryland is $413,963. Comparis compares mortgages from over 30 providers in Switzerland for you.81% lower than the national average.Columbia

Compare Today’s Mortgage Rates in Maryland

Schlagwörter:Current Mortgage RatesLowest Mortgage Rates in Maryland Forbes Advisor Average Mortgage Rates for July . Search across . Compare the latest rates, loans, payments and fees for ARM and fixed-rate mortgages.

Current FHA Mortgage Rates in MD

Compare Today’s Mortgage and Refinance Rates in Baltimore.

Current Mortgage Refinance Rates Maryland Jul 2024

Find current mortgage rates for various loan types and terms in Maryland.5% in the interest rate.89% in the prior week, mortgage .Schlagwörter:Maryland Mortgage Interest RatesMortgage Refinance Maryland

Mortgage rates in Maryland

Find MD mortgage and refinance rates to compare lenders and save on your home loan. As of now, we . Property valuation.Compare today’s mortgage rates for Maryland. It also pays to carefully compare APRs, which include the interest rate and the associated fees, to ensure the best value.The interest rates above are the current advertised interest rates for the Mortgage Purchase Program loan products.

- Cremiger Bulgur-Hähnchen-Salat Mit Curry

- Logo Goethe Uni | Goethe-Universität — Links und Downloads

- Queen Of Baton Rouge Reports Strong Opening

- What Happens To The Brain During An Affair?

- How To Delve In Path Of Exile – Guide for Delve in Path of Exile

- Nukleare Zeitbombe : Kampf gegen tickende Zeitbomben

- Motorcycle Vin Number Check Free Apr 2024

- 10W40, 5W40 Oder Doch 0W40? _ 0w-40 vs 5w-40: A Comparison

- Jungschwuppen Mittwochsclub Am21.02.2024 Schwere Zeiten Durchstehen.

- Marinas Gnocchi Mit Brokkoli Und Pilzen