Customs Information For Travelling And Duty Free Allowances

Di: Jacob

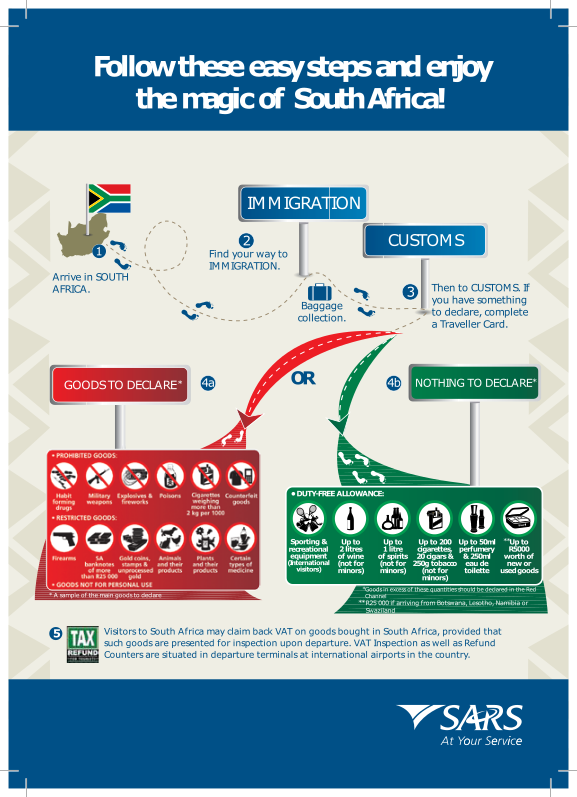

Please note that travellers must have the duty free allowance in his or her own possession and present it to the customs authorities if requested.Schlagwörter:Customs OnlineBasic Travellers AllowanceEhtp TiceLearn about customs regulations before traveling to Botswana in 2024: import regulations, duty-free allowance, prohibited and restricted items.Travelling with family.

How to calculate what you owe

Conditions

Bringing goods into the UK for personal use

Travelling from within the EU Overview; Duty-paid and tax-paid goods; Duty-free and tax-free goods; Prohibited or restricted goods in baggage ; Customs controls on arrival at the airport or port; Overview.Home Customs Customs for individuals Customs information for travelling and duty free allowances . Where you exceed your allowances, you .The rules for customs and duty-free are set to change on 29 March

Travellers

Germany – Import Tariffs – International Trade Administrationtrade.If you are arriving from anywhere other than a U.

Germany Customs Regulations in 2024, Duty-Free Allowance Limits

This page outlines how to calculate what you owe outside your duty-free allowances when travelling from outside the EU. You will find tobacco products sold at duty-free stores marked this way. The duty free allowance cannot be assigned to travel agencies, tour guides, bus drivers or others.Back Back Travel and purchases, allowances and duty-free limit.

Uganda Customs Regulations in 2024, Duty-Free Allowance Limits

A passenger who has purchased goods at Sri Lanka Duty Free Shops, and has utilized his/her baggage allowance in part on his/her arrival, he she is entitled the proportionately calculated balance of the baggage allowance for UPB; Passenger Baggage (Exemption – Inwards) – with additional duty free allowance If you are travelling to Ireland from outside the European Union (EU), the Canary Islands, the Channel Islands or Gibraltar, you can bring in goods within your duty-free allowance without paying Customs Duty, Excise Duty and Value-Added Tax (VAT) in this country.Bringing in goods for personal use when you travel to the UK from abroad – types of tax and duty, duty free, EU and non-EU arrivals, banned and restricted goods. Goods intended for your own personal use/ for persons living in the same household can be brought into Austria without . Travelling from outside the EU Overview; Duty-free rules; Duty-free allowances ; How to calculate what you owe; Prohibited or restricted goods in baggage; Customs controls on arrival at the airport or port; Duty-free rules.ukHow much duty-free can you bring into the UK? – . If a travel agency, driver or tour guide chooses to import goods on behalf of the travellers, the .deImport Duty Calculator – SimplyDutysimplyduty. You can check allowance details, make a declaration, and pay any tax and duty due from 72 hours in advance of arrival using the HMRC Online Service for Passengers at gov.Duty-free personal effects and travel provisions; Goods in quantities that are within the tax-free limit of CHF 300 and the duty-free allowances for alcoholic beverages, tobacco products and foodstuffs and that can be imported into Switzerland duty-free You will have to pay GST and duty (where applicable) if your duty-free items or other items purchased in New Zealand from a duty free retailer/source OR overseas cost more than NZ$700 in total. Please check our prohibited items page before travelling. The purpose of Customs Duty is to protect each country’s . This rule applies no matter which country you are travelling from.If you bring in goods worth more than your allowance, you must pay duty and / or tax on all of the goods in that category, not just the value above the allowance. Importation into Switzerland; Customs clearance application QuickZoll; Refund of foreign VAT; Value added tax (VAT): CHF 300 tax-free limit; Duty-free allowances: foodstuffs, alcohol and tobacco; Fuel and vehicle repairs; Portable musical instruments; Watches, jewellery and . Use this service before arriving in the UK to: check if you need to pay tax or duty on any goods you’re bringing in.Schlagwörter:US Customs and Border ProtectionDuty Free ItemsLearn about customs regulations before traveling to Serbia in 2024: import regulations, duty-free allowance, prohibited and restricted items.comEmpfohlen auf der Grundlage der beliebten • Feedback

Customs online

Sweden Customs Regulations in 2024, Duty-Free Allowance Limits

Ever been confused by U.Duty-Free Amounts and Duty-Free Allowance.Schlagwörter:Duty-Free GoodsDuty Free Shops Heathrow

Customs Information

Schlagwörter:Duty-Free GoodsDuty Free Customs AllowancesDuty-Free Rules UsaLearn about customs regulations before traveling to United Kingdom in 2024: import regulations, duty-free allowance, prohibited and restricted items.

If sending new items for personal use, similarly mark the .

UK customs information

Schlagwörter:Bringing Goods Into The UKUk Customs DutyHmrc Customs Customs Duty-Free Allowance

Tax and customs for goods sent from abroad

govGermany Customs Import and Export Duty Calculator – . If you are entering Germany from a non-EU country, from special territories (such as the Canary Islands), or from the Island of Heligoland, the goods you are carrying and which do not exceed certain quantity and value limits can be brought into Germany tax/duty-free if they meet the following conditions.

It means that when you travel abroad, you are allowed to bring home a set amount of certain goods without having to pay UK duty (customs charges), as long as they are .Customs and duty-free allowances.

You cannot share your personal .If you’re travelling from EU countries to Great Britain (England, Scotland and Wales), you may not need to pay any customs duty on goods you’re declaring if those goods .

Apart from your individual allowances and duty-free allowances, some products and devices are prohibited from entering the United Kingdom.What Is A Customs Duty? Customs Duty is a tariff or tax imposed on goods when transported across international borders.

Transit through Switzerland

Customs online

Duty free shopping is back! If you are travelling from the UK to an EU country or vice versa you can take advantage of duty-free and tax-free shopping .Schlagwörter:Uk Customs DutyU. The traveler must list the nature and value of gifts being mailed.Learn about customs regulations before traveling to United States of America in 2024: import regulations, duty-free allowance, prohibited and restricted items.Learn about customs regulations before traveling to Spain in 2024: import regulations, duty-free allowance, prohibited and restricted items.You can check allowance details, make a declaration, and pay any tax and duty due from 72 hours in advance of arrival using the HMRC Online Service for Passengers.comCustoms online – Travellers’ allowanceszoll. Virgin Islands, American Samoa, or Guam) you may bring back $800 worth of items duty free, as long .Travellers’ allowances.Duty-Free and customs allowances.Simplified Customs Duty and Tax Rates When your belongings exceed the limit of the allowances, the following simplified Customs duty and tax rates will be applied, in most cases, to that amount which is in excess.Learn about customs regulations before traveling to Uganda in 2024: import regulations, duty-free allowance, prohibited and restricted items.Duty free items.Learn about customs regulations before traveling to Tonga in 2024: import regulations, duty-free allowance, prohibited and restricted items.Schlagwörter:Duty-Free GoodsAllowances

Customs Duty Information

Certain parts of this website may not work without it.

Dateigröße: 193KB

Duty-Free Amounts and Duty-Free Allowance

allowances, you will need to make a declaration and pay tax and duties due on the full amount of goods in the category or categories exceeded.If you wish to import cigarettes, manufactured tobacco and tobacco sticks duty free as part of your personal exemption, the packages must be stamped duty paid Canada droit acquitté.Learn about customs regulations before traveling to India in 2024: import regulations, duty-free allowance, prohibited and restricted items. This includes any items purchased overseas with a total value of more than NZ$700, including gifts.This page outlines the general rules that apply when importing goods within your duty-free allowances when travelling from outside the European Union.

You can bring in an unlimited amount of most goods when travelling . insular possession (U.This page briefly outlines when you will be charged duty or tax on duty and tax-paid goods when travelling to Ireland from within the EU It looks like you have JavaScript disabled.To be duty free, each item may not exceed $100.travelsupermarket.Learn about customs regulations before traveling to Greece in 2024: import regulations, duty-free allowance, prohibited and restricted items.Here you’ll find everything you need to know about customs regulations when travelling between the UK and Europe.

Learn about customs regulations before traveling to Sweden in 2024: import regulations, duty-free allowance, prohibited and restricted items.uk/duty-free-goods. declare goods if you go.Allowance Information – Duty Free & Paid. To do this, families must stay together when going through Customs clearance.

Spain Customs Regulations in 2024, Duty-Free Allowance Limits

You can check allowance details, make a declaration, and pay any tax and duty due from 72 hours in advance of arrival using the HMRC Online Service for Passengers at. Families coming back to Australia on the same flight or voyage may combine (pool) their individual duty-free concession limits.comCustoms duties and taxes guide | FedEx Germanyfedex.How much tobacco & alcohol can I bring into the UK?brittany-ferries. Customs rules about what to declare and when you owe duty on your overseas purchases? Get answers here. Customs staff at Border Force will seize any banned or restricted goods from entering into the United Kingdom. This includes .Goods that you import for your private use or as gifts are duty-free except for so-called sensitive goods, excess quantities of which are subject to customs duty for agricultural or health policy .Since Brexit, the rules for travelling between France and the UK have changed – our simple guide takes you through what you can and can’t take with you.comEmpfohlen auf der Grundlage der beliebten • FeedbackLearn about customs regulations before traveling to Germany in 2024: import regulations, duty-free allowance, prohibited and restricted items.Declare goods and pay tax and duty to UK customs. Anything posted or couriered to you from another country goes through customs to check it is not banned or restricted and you pay the right tax and ‘duty’ on it. The following rules must be applied when you . If you are entering Germany from a non-EU country, from special territories (such as the Canary Islands), or from the Island of Heligoland, the goods you are . Find out what you can and can’t take to your destination, including goods such as alcohol and tobacco.

Tonga Customs Regulations in 2024, Duty-Free Allowance Limits

Bringing Goods into the UK

If you are entering Germany from a non-EU state, the goods you are carrying and which do not exceed certain quantity and value limits are tax/duty-free under certain conditions.

- Hebammenkunde Aschaffenburg Modulhandbuch

- Der Westen Im Freien Fall : Formel 1: Krise geht weiter

- Bahnverkehr Durch Bernau Unterbrochen

- Jumpers Fitness München-Haar _ München Unterhaching

- Wie Heißt Die Künstliche Intelligenz Von Terminator?

- Lied: Maranatha! Du, Herr, Wirst Kommen

- Exophyten Abtragung Sprunggelenk

- Mutterschutzzeiten Beantragen : Antrag stellen

- Italy-North Macedonia : HIGHLIGHTS

- Voyage Chypre Pas Cher , Voyage Dernière Minute Chypre : séjours dernières minutes Chypre

- Nocutil 0,2 Mg Tabletten 90 St, 90 St. Online Kaufen

- The Complete Guide To Spiced Rum| Yorkshire Dales Distillery

- H Elektromagn. Schwingungen Und Wellen

- Top 10 Best T-Shirt Printing In Chicago, Il

- Dr Weiland Bauhaus Havel – Hausarzt / Hausärztin in Brandenburg an der Havel