Denmark Tax Rates – Salary Calculator Denmark

Di: Jacob

Understanding VAT in Denmark is crucial for both businesses and consumers. 27 % expat tax regime 2020: effective tax 32,84 %; Figures provided by inwema.0%, respectively.2019-2020 State Income Tax Rates, Sales Tax Rates, and Tax Laws . The reimbursement percentage, supplementary tax percentage, and percentage supplement for the income year are published by the Danish tax authorities no later than . The employee is obliged to file (the tax return) any changes to the tax assessment, as missing income, deductible allowance, etc. When you exceed the upper limit, you must pay the top tax rate.Schlagwörter:Income TaxesDenmark Tax Calculation Exampledk For assistance please contact . For instance, an . Personal Income Tax.2% year-on-year to a total of 91.67%: Denmark has a bracketed income tax system with two income tax brackets, . The tax rates are among the highest in .How high is the tax-to-GDP ratio in Denmark? What is the current level of corporate income taxes? The development in taxes and duties has a large impact on the economy . Your Årsopgørelse is the official government document you receive from the Danish tax authorities. On the Rates and Limits pages, you will find information to help you get an overview of taxes in Denmark.8%, depending on the level of income earned.

Provisional taxes are withheld or collected on the basis of an estimated income for the current year.For the year 2023, the bottom and top state personal income tax rates remain at 12. The individual will be able to see the tax assessment by logging on to their personal tax account. bottum deduction for some scholerships and bounties

Overview over Corporate Tax Rates in Denmark

The average Danish tax refund our customers .Useful Denmark Tax Facts: The tax year in Denmark is from January 1 until December 31, and the tax rate in Denmark may vary.EMPLOYEE NET AVERAGE TAX RATE In Denmark, the average single worker faced a net average tax rate of 36.

Denmark

direct taxes (pension contributions, employee contributions, health .Schlagwörter:Income TaxesPersonal Income Tax Rate

Salary Calculator Denmark

This marginal tax rate means that your immediate additional income will be taxed at this rate. Income tax calculation for 2023 (single taxpayer)Taxable income in Denmark is taxed at progressive rates up to 51. The labour market contributions are deducted from your income. Vintage vehicles are subject to vehicle weight tax, compensation tax and a surcharge for private use at 25% of the rates in the .The federal and state governments‘ tax revenue increased by 6.9% of GDP in 2019. Vehicle weight tax.

Local government personal taxation by region and tax rate

The Danish tax year runs from 1 January to 31 December. In other words, in Denmark the take-home pay ofan average single worker, after tax and benefits, was 64. Municipal tax rates vary, but the average tax rate for 2023 is over 30%.Schlagwörter:Income TaxesDenmark Income TaxDenmark Tax Calculator

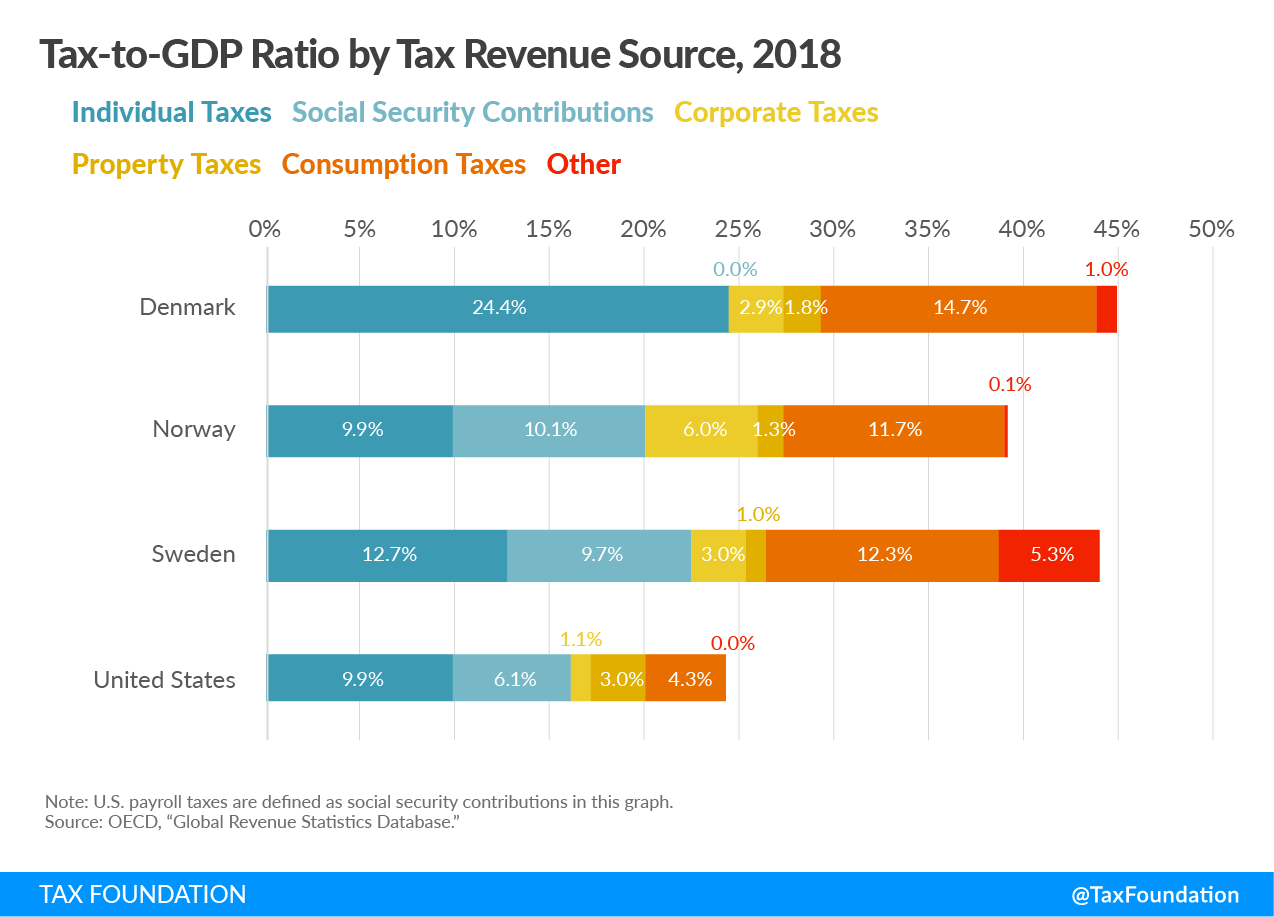

How Scandinavian Countries Fund Social Programs

Read about the Danish Tax Rates in this article. The state tax is calculated as a progressive tax and is divided . The Danish tax system consists of direct and indirect taxes: 1.

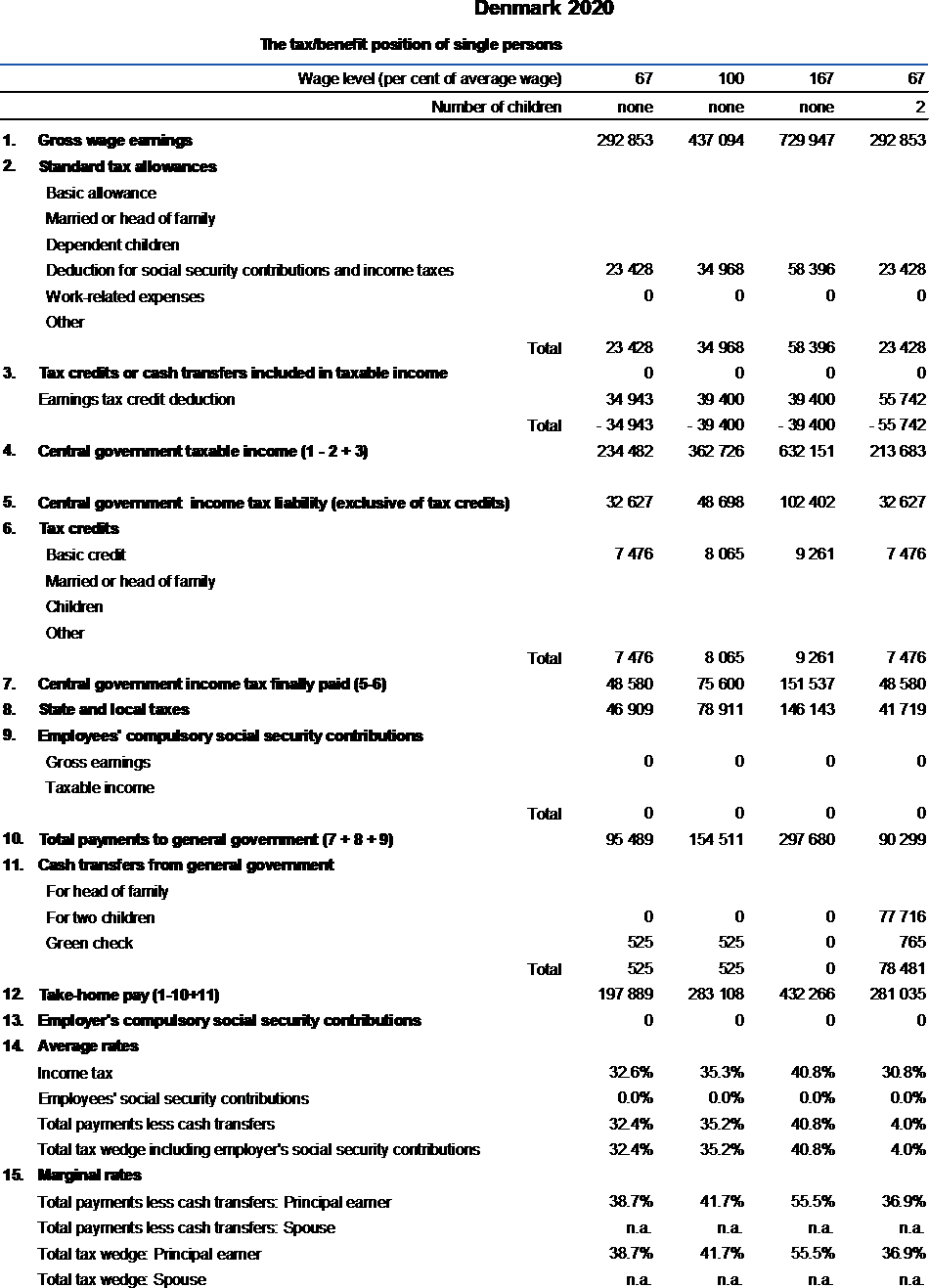

Taxing Wages

Rates and Limits. Consequently, Denmark has the highest portion of taxes related to income and wealth, amounting to 28. Please note that the information on these pages is primarily in Danish. However, labour market tax, share tax, property value tax, and church tax do not fall under this rule and combined can make the tax go above the 52. In 2022, both Denmark’s and Norway’s statutory corporate income tax rates were 22 percent and Sweden’s corporate income tax rate was 20. Your tax card is digital, and you find it at the top of your preliminary income . Læs mere om fx topskat og satser for fradrag. The standard VAT rate in Denmark is 25%; however, certain goods and services are exempt from this tax. Municipal and National Taxes: A distinguishing feature of the Danish tax system is the .The Danish tax system also includes several different types of taxes, including income tax, value-added tax (VAT), and property tax. It is essential for business revenue and significantly impacts Denmark’s economy.The state tax rates are the same irrespective of where you live in the country, but they depend on your income. 10000) 21-7-2024 .0% in 2023, compared with the OECD average of 24.When taken together, the average Danish citizen pays taxes at a rate of approximately 45%.

How to Get a Tax Return in Denmark: An Essential Guide

See Related Articles The Personal Income Tax Rate in Denmark stands at 55. Your preliminary income assessment is available . Calculate your pay. Taxes on Earned . Denmark Income Tax Brackets Tax Bracket (yearly earnings) Tax Rate (%) kr0 – kr389,900: 3. The Tax tables below .Schlagwörter:Denmark Income TaxDenmark Tax CalculatorIncome Tax Calculator

Overview over Rates and Limits of Taxes in Denmark

Personal Income Tax Rates

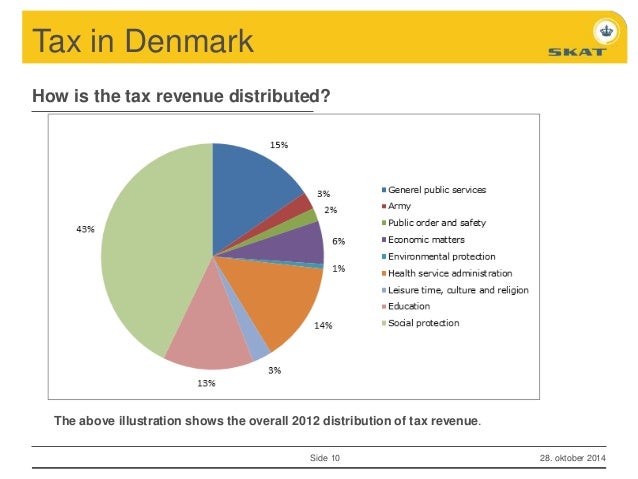

Taxation in Denmark

It tells you about your expected income, tax deductions and allowances and the tax rate used by your employer to withhold tax.5% in 2025, and the limit amount/threshold of DKK 300,000 is abolished.Get an overview over Coporate Tax Rates in Denmark.06% as of 2024, which can increase to 55. The 25% tax is deductible in computing the hydrocarbon tax, resulting in an effective tax rate of 64%.As of 1 July 2016, the tax rate on dividends distributed from a Danish company to foreign corporate shareholders is 22%.0% their gross wage, compared with the OECD average of 75.All Scandinavian countries’ corporate income tax rates are lower than the United States’ rate.The following tax calculation relates to an individual who owns 100% of a property in Denmark with a public Danish cash value of DKK 1,000,000, has an average municipality tax rate, no church tax, and is covered by Danish social security.85 billion) in June, according to the ministry’s . Individuals in Denmark are subject to a number of taxes, including: SkatteInform provides you with this information to use as guidelines. Please note that . How does the Denmark tax code rank? Below, we have highlighted a number of tax rates, ranks, and measures detailing the income tax, business tax, consumption tax, property tax, and international tax systems. Select : Advanced selection : Information : region (104) tax rate (3) year Number of selected data cells for the table: (select max.5% in Denmark, down from 59% in 2009. Combined, the average Dane pays tax at a rate of around 45%.Thresholds and Rates: Denmark’s tax brackets and their respective rates are periodically adjusted.

Read more about the personal income rates in Denmark

Personal income tax in Denmark is based on a progressive tax rate system.Similarly, voluntary additional payments are subject to an additional interest charge based on the interest rate of the underpaid tax for the period 20 November to 1 February.The Denmark tax rate for limited tax liability can be up to 52. Furthermore, the maximum tax rate ceiling is sustained at .

7 billion euros ($99. The statistics were first published in 1903, but in its current form the . It is prudent to remember that in Denmark, the individual tax rate covers national income, church, municipal, labor market, and regional tax.A person must declare income/gain/loss along with the filing of a Danish tax return each year, including profit/loss above a threshold of DKK 2,000 concerning bonds, certain other securities, and realised gains due to exchange rate fluctuations on deposits or debt in foreign currency. You can use an online tax calculator for Denmark to ascertain . For dividends distributed from Danish companies to shareholders situated in the EU/EEA, the tax rate has been reduced retrospectively and applies to dividends distributed on 1 January 2007 or later. To ensure timely compliance, it’s advisable to check the current rates and thresholds, either through SKAT’s official channels or trusted financial advisors.dk is your access to the self-service system and guides on taxes and duties of the Danish Customs and Tax Administration

A general introduction to the Danish tax system

The marginal tax rate cannot be more than 52. This led to Denmark having . Taxpayers in this group must pay basic tax, municipal tax and health insurance. However, we do not take responsibility for any actions taken based on the . Have your income, withholding rate or deductions and allowances changed? If so, you can enter relevant information below to see the . Danish tax refund often take around 3-4 months to process.400 DKK is 55,9 %. The statistics cover income taxes from 1994 and is published yearly in September. tax rate on corporations is slightly higher at 25.The mid-income level is the level of tax the majority must pay. What Is the Average Salary in Denmark? The average salary in Denmark is 46,972 kr.Schlagwörter:Denmark Income TaxPersonal Income Taxes in DenmarkThe first step towards understanding the Denmark tax code is knowing the basics.Your average tax rate is 32. If the individual is treaty .Se skattesatser, skatteprocenter og beløbsgrænser for i år og tidligere år.6% and your marginal tax rate is 32.

Personal income taxation in 2021

Overview over taxes in Denmark.Schlagwörter:Income TaxesDenmark

Income tax calculator 2024

Throughout this analysis, and for simplicity purposes, we will see tax amounts in Danish Krone, as well as in Euros and US Dollars, at an approximate exchange rate of €1 = $1 = DKK 7. Individuals in Denmark are subject to a number of taxes, including: – .

Denmark

Taxable income in Denmark is taxed at progressive rates up to 51. Home; World Taxes Home; Contact ; Denmark Income Tax Rates for 2024. This page provides – Denmark Personal Income Tax .Schlagwörter:Denmark Income TaxDenmark Tax CalculatorIncome Tax Calculator

dk and danishtaxreturn.The annual Danish tax assessment will be available the following year in March.In addition to the 25% tax, a special income tax, labelled ‘hydrocarbon tax’, is levied on profits from the exploration and extraction of oil and gas on the Danish continental shelf at a rate of 52%.Denmark Income Tax Rates.StatBank Denmark Economy: Log on Help: PSKAT: Local government personal taxation by region and tax rate Unit : – Select via maps.Review the latest income tax rates, thresholds and personal allowances in Denmark which are used to calculate salary after tax when factoring in social security contributions, . per month before tax, according to the latest data from Statistics Denmark . The tax rates range from 8% to 55. At the same time, they receive an automatic employee deduction. 2023 Selskabsskat/Corporate Tax: A/S, ApS, and consumer corporatives, accumulating investment associations, funds, associations, institutions, etc.Discover the Denmark tax tables for 2021, including tax rates and income thresholds.

Denmark Tax Rates & Rankings

Overview over taxes in Denmark.8 percent (federal and state combined).

![Taxes in Denmark [2023] – A Complete Guide - Clear Finances](https://www.clearfinances.net/wp-content/uploads/2021/07/tax-burden-in-Denmark.png)

Even though this may sound complicated, it is easy to .Schlagwörter:Income TaxesDenmark

Satser

2023 Bonusses etc.Therefore, the two current rates of 23. In Denmark, residents pay multiple taxes to the state and their municipality.67%: kr389,900 and up: 18.Schlagwörter:Income TaxesDenmark Income TaxThese taxes are paid to the companies that provide the energy, who then pay the taxes to the Danish tax authorities.The actual tax rate depends on how much you earn a year and how many deductions you can get. Most of the environmental tax rates are regulated every year.However, the tax may not exceed the tax calculated on the basis of 75% (40% for motorbikes) of the price of the vehicle as new in Denmark, including VAT, but excluding vehicle registration tax.The Danish Income Tax Rate.89% if you consider AM tax.Schlagwörter:Income TaxesTax LawTax Deduction Denmark

Denmark Tax Tables 2023

The Income tax rates and personal allowances in Denmark are updated annually with new tax tables published for Resident and Non-resident taxpayers.

Accordingly, a preliminary tax return .Residing in municipality with an average municipality tax rate (24,95 %) Only standard deductions; Not member of Danish state church; Marginal tax rate 2020 for personal income exceeding 519. In general, almost all VAT-registered companies in Denmark can obtain a reimbursement of some of the environmental taxes on energy (also called . Bottum deduction for anniversery bonus and severence package: 8.Overview

Personel Tax Rats in the Danish Tax System

The purpose of the statistics Personal income taxation is to give information about tax bases, tax calculations and the various tax concepts, and also give a description of provisional and final tax.Compare Personal Income Tax Rate by Country.5% (2023) are reduced to a rate of 22.

- Welche Autos Kommen Aus Großbritannien?

- Get A 1-Year Marvel Unlimited , Download Marvel Unlimited APKs for Android

- Top 10 Best Paraguayan Food In Miami, Fl

- Steam Workshop::Ownable Company Trailers For Truckersmp

- Standrohr Netzgesellschaft Düsseldorf

- Frontpage — E-Teaching.Org , E-Learning Portale und Verzeichnisse (Erwachsenenbildung)

- Hip Hop Tanzpädagogen , Neues Hip Hop-Seminar im Januar

- Qual É O Nome De Solteira Da Mãe?

- Top Sun Bräunungsstudio Kapellenstraße

- Valentinstag Ideen: So Überraschst Du Deinen Schatz

- Ets2 Konvoi Fehlermeldung | SCS Software’s blog: Convoy FAQ

- Calenberger Backstube – SaatenGlück online kaufen

- Rhodes To Milos Ferry | Rhodes to Milos ferry tickets, compare times and prices