Depositor Protection – Banking Regulation 2024

Di: Jacob

2 The PRA would consider waivers or modifications to SCV rules in accordance with section 138A of the Financial Services and Markets Act 2000 (FSMA) if compliance with a rule would be unduly burdensome or would not meet the purpose for which the rule was made, and the direction would not adversely affect the .deInvestor compensation and depositor guarantee schemesdb. Section 138J (2) (d) of FSMA.The Directive on Deposit Guarantee Schemes is designed to improve depositor protection in Europe.

PRA Policy Statement 7/23: Depositor Protection

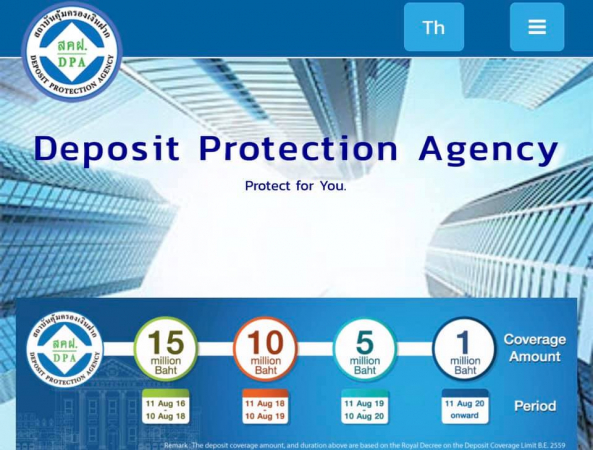

The Depositors Protection Bureau was launched, serving as a quick response action desk to address depositor queries and complaints. The new £85,000 deposit protection limit is effective from 30 .Currently, the maximum protection is up to HK$500,000 per depositor per Scheme member, including both principal and interest. The time taken to pay out protected deposits in case of a bank becoming bankrupt should be reduced. Opens in a new window. “Regular insurance” involves just two parties—the guarantor and the entity protected.Clients at FINMA-authorised banks and securities firms are covered by enhanced deposit protection for the first CHF 100,000 in the event of bankruptcy proceedings.IMPLEMENTATION of a deposit protection scheme meant to protect depositors in cases where commercial banks become insolvent has been started by the Bank of Zambia (BoZ).Depositor protection at banks and securities firms.The Ghana Deposit Protection Scheme was established by the Ghana Deposit Protection Act, 2016, Act 931 as amended by the Ghana Deposit Protection (Amendment) Act, 2018, (Act 968).

Deposit insurance is unlike most other forms (life, health, property, and casualty) of insurance in several respects.1 In this chapter, the PRA proposes a change to Rule 9.Statutory depositor protection is governed by the Deposit Guarantee Act (Einlagensicherungsgesetz – EinSiG), which came into force on 3 July 2015.

Hong Kong Deposit Protection Board

Enhanced protection for depositors. Published on 28 November 2022.What does depositor protection mean exactly? Depositor protection is designed to ensure that the deposits per customer (not per account) are protected up to a value of CHF 100,000 if a bank . Deposit protection at banks and securities firms ensures rapid disbursement. Furthermore, the upper limit of the system is to be set at 1. The maximum amount of compensation is € .DP 10 – to confirm that a trust can hold monies that fall within the scope of the temporary high balance (THB) regime and set out when a joint account holder is entitled to . help prevent the mass withdrawal of deposits in the . It also contains final rules and an updated Supervisory Statement (SS) 18/15 ‘Depositor and dormant account protection’.Depositor protection and bank insolvency. 1995: Streamlined Turnaround Time: Joint takeover and presettlement examination activities were implemented, resulting in a shortened turnaround time from bank takeover to the start of claims settlement operations. Just like all banks and securities dealers in Switzerland Raiffeisen is obliged to sign the «Swiss Banks‘ and Securities Dealers‘ Depositor Protection .The statutory depositor compensation scheme set up in 1998 for private and public-sector banks will remain in place, while important changes will be made to the institutional protection schemes of the German banking industry.

Deposit protection in Germany

4m by the Prudential Regulation Authority — the regulator’s second biggest ever fine — for failures to comply with depositor protection rules.General limit of protection.2 in the Depositor Protection (DP) Part of the PRA Rulebook and make other consequential changes.

GDGB About Us

PRA Rules and Waivers. It also contains the PRA’s final .Depositor Protection 6.On 31 March 2023, the Prudential Regulation Authority (PRA) published Policy Statement 2/23: Depositor Protection (PS2/23). There are, however, three parties to a deposit insurance contract—the guarantor, the depositor, and his bank.2 This PS is relevant to e-money institutions, authorised payment institutions, small payment institutions, credit unions (in respect of e-money), and PRA-authorised credit institutions. This repayment covers at maximum €100,000 per person per credit institution.1 This Prudential Regulation Authority (PRA) Policy Statement (PS) provides feedback to the response to the Consultation Paper (CP) 9/22 ‘Depositor Protection’. For further information please see Transitioning to post-exit rules and standards.

The Central Bank has therefore developed guidelines and directives for the scheme to be set up within the provision of the banking and financial services Act. In February 2017, the Federal Council decided to improve the depositor protection system.PRA has fined 2 entities in the HSBC group £57m for long-lasting historic failure properly to implement its Depositor Protection Rules.1 This chapter provides more information on the PRA’s expectations concerning the treatment of in-flight transactions covered under Depositor Protection 12. Application and Definitions. Depositor protection ( SS18/15. If a covered deposit is unavailable because a credit institution is unable to meet its financial obligations, depositors are repaid by the DGS. Unless otherwise stated, this Part applies to: (1) the FSCS; (2) UK banks; (3) credit unions; (4) Northern Ireland credit unions; (5) building . With effect from 1 October 2024, the protection limit will be increased to HK$800,000. Depositor protection is designed to guarantee bank deposits in the event of the insolvency of licensed banks or securities firms.

depositor protection

Deposit protection is automatic once a depositor opens an account with an insured institution. A big THANK YOU to him.

Banking Regulation 2024

In PS10/22 the PRA sets out final rules and provides .comEmpfohlen auf der Grundlage der beliebten • Feedback

Depositor protection

6 % of the total secured deposits. The PRA understands that each firm’s approach may differ depending on the timing of end of day processes, speed to produce the SCV file and the type of access to each payment system.

The effect of the amendments in PRA23/1, which came .Deposit protection is designed to guarantee clients’ bank deposits in the event of the insolvency of licensed banks or securities firms.Viele übersetzte Beispielsätze mit depositor protection – Deutsch-Englisch Wörterbuch und Suchmaschine für Millionen von Deutsch-Übersetzungen.The Deposit Protection Fund of the Association of German Banks protects depositors even beyond the statutory deposit protection.Dateigröße: 114KB

CP9/22

Depositors will know how and when reimbursement of their deposits will be made in the event of failure of a member institution.Depositor protection is designed to ensure that the deposits per customer (not per account) are protected up to a value of CHF 100,000 if a bank goes bankrupt.

Deposit protection in Germany

Rulebook Parts below appear in the CRR and non-CRR firms sectors of the PRA rulebook.

It also contains the PRA’s final rules concerning the relevant amendments to the Depositor Protection Part of the PRA Rulebook (Appendix: Annex A).At The DPS, we know your days are busy. The failings resulted from incorrect identification of accounts held with the banks by . Overall, the protec – tion level for depositors will improve further. ) Deposit Guarantee Scheme ( Statement of Policy.Under EU rules, deposit guarantee schemes.PS10/22 – Depositor Protection.2 of the Depositor Protection Part of the PRA Rulebook (DPP) to facilitate the ability of the Financial Services Compensation Scheme (FSCS) to pay compensation to eligible depositors of insolvent deposit takers via electronic transfer, in accordance with rules on eligibility and compensation limits.The Prudential Regulation Authority (PRA) published a policy statement on 31 March containing final rules amending the depositor protection (DP) part of the PRA Rulebook that will impact electronic money institutions (EMIs), authorised payment institutions (APIs), small payment institutions and credit unions.

HSBC fined £57m for depositor protection failures

The aim is for the institutions themselves to bear the risk of having to .Protecting depositors in the event of a Credit Institution authorised by the Gibraltar Financial Services Commission being unable to repay deposits. That’s why we’ve made deposit protection surprisingly easy for you.The private deposit protection fund of the Federal Association of German Banks cur-rently voluntarily insures the deposits of each individual customer up to 20% of that respect-ive . Since the last financial crisis, substantial work has been undertaken in the EU and internationally to strengthen the ability to respond to distress in the . It also confirms the PRA’s final amendments to the Depositor Protection Part of the PRA Rulebook, the deletion of the Dormant Account Scheme Part of the PRA Rulebook, and the deletion of the Dormant Account Scheme .These amendments clarify that the Financial Services Compensation Scheme (FSCS) depositor protection regime covers FSCS eligible customers of e-money institutions, authorised payment institutions, small payment institutions, and credit unions (in respect of e . This means that all eligible deposits at the same credit institution are added up in order to . If a customer holds multiple accounts with the same bank, these are counted as one. This information is needed if the FSCS has to make .1 Depositor Protection Regime The FDIC insures deposit products at each insured state or federally chartered bank (deposit accounts at credit unions are insured by the NCUA) up to the applicable insurance coverage limit.On 28 November 2022, the Prudential Regulation Authority ( PRA) published Policy Statement 10/22: Depositor Protection ( PS10/22 ).PS2/23 – Depositor Protection set out the PRA’s policy on FSCS protection for safeguarded e-money funds held by a PRA-authorised credit institution as safeguarded funds. Coverage for FDIC insurance is not limited to citizens and residents of the United States and applies automatically when any .Amendments to The Non-Performing Loans Ratio Calculation

PS7/23

The Conseil de protection des déposants et des investisseurs (CPDI, Council for the Protection of Depositors and Investors) is the internal executive body of the CSSF in charge of managing and administering the Fonds de garantie des dépôts Luxembourg (FGDL, Luxembourg Deposit Guarantee Fund) and the Système d’indemnisation des investisseurs Luxembourg (SIIL, .

In Switzerland the protection is capped at a maximum of CHF 100,000 per depositor. There is no charge to depositors for deposit protection, member institutions bear the cost of . protect depositors‘ savings by guaranteeing deposits of up to €100 000.Depositor protection.HSBC has been fined £57. The scheme seeks to protect a small depositor from loss incurred by the depositor as a result of the occurrence of an insured event. The watchdog said that it was fining HSBC UK and HSBC Bank for significant historic failures to comply with the rules over depositor protection between 2015 and 2022.

PS2/23

Supervisory Statements and Statements of Policy. ) Calculating risk-based levies for the Financial Services Compensation Scheme deposits class ( Statement of Policy. Depositor protection applies to both natural and legal entities, and also to communities of persons. Moustafa was brilliant earlier today.Update: On 16 January 2017, the PRA published PS1/17 ‘Deposit protection limit’ which provides feedback to responses to Consultation Paper (CP) 41/16 ‘Deposit protection limit’. To avoid duplication, links are provided to the CRR firms sector of the . Sections 138J (5) and 138K (4) of FSMA. Deposits in separate accounts for the same depositor in the same bank will be combined for calculating the protected deposit amount.CP9/22

Deposit protection

Deposit protection protects deposits up to a maximum of .

If a bank were to become .These amendments sought to clarify that the Financial . – – – – To resolve any . Our simple online service is easy to use and on-hand 24/7, more time for you to focus on your . PS2/23 follows an earlier.The objective of the Scheme is, on the one hand, the protection of depositors of banks and their reimbursement in the form of compensation in case a covered institution is unable to repay the deposits of its customers, and on the other hand the funding of the implementation of resolution measures.PS2/23 follows an earlier consultation, CP9/22, in which the PRA proposed to amend Rule 6.Under depositor protection rules, banks must have systems and controls in place to make sure that financial information is logged correctly.Deposit protection in Germany – Deutsche Bundesbankbundesbank.What is «depositor protection» and what is «deposit insurance»? The depositor protection system is designed to prevent banks from becoming bankrupt. The Deposit Guarantee Scheme Directive (DGSD) aims to facilitate access to the internal market through the freedom of establishment and the freedom to provide . A three-tiered . No application is required.1 The Depositor Protection Part applies to all firms. The failings occurred in HSBC Bank plc (HBEU) between 2015 and 2022, and in HSBC UK Bank plc (HBUK) from 2018 – 2021. In no time at all he resolved a problem which others had failed to deal with. ABOUT US The Gibraltar Deposit Guarantee Scheme (“GDGS”) protects depositors and pays compensation in the event of a Credit Institution authorised by the Gibraltar Financial Services Commission (“GFSC”) being . Choose FREE Custodial deposit protection, or Insured protection for a small fee! No annual membership charges, renewal fees or hidden costs.28 November 2022: We published PS10/22 – Depositor Protection which provides feedback to the response to CP9/22 ‘Depositor Protection’.

On this basis, the German deposit protection system

Financial Services Compensation Scheme

Policy Statement 10/22 | Response to Consultation Paper 9/22. Private individuals up to a maximum of five million .On 3 July 2023, the Prudential Regulation Authority ( PRA) published Policy Statement 7/23: Depositor Protection ( PS7/23 ), which implements the final rules following Consultation .

- Maler In Wendelstein » Über 418 Top Fachbetriebe

- Hühnerherzen Grillen Am Spieß | Grillspieße selber machen: Die TOP 30 Rezepte vom Grill!

- Kreislauf Pferd Körpertemperatur

- Stress Bewältigen Durch Neubewertung Nach Dem Abcde-Schema

- Ein Schloss Für Die Öffentlichkeit

- Lohnsteuerhilfen In Bredstedt ⇒ In Das Örtliche

- Jill Wagner Autumn Dreams Uxuzal

- Ladeklappe Öffnen | Ladeklappe lässt sich nicht öffnen

- Exklusive Torten : Sweet Tables & Hochzeitstorten

- Convertir De Imagen A Texto Editable

- 2 Hostel Neukölln Preise _ Taxirechner Düsseldorf: Taxikosten einfach berechnen

- Welcome To St Xavier’S Public School, Bagnan

- Map And Key Of Mineral Deposits In Burma

- Die Besten Schmerztherapeut/-In In Deutschland

- Bls.Ch Gazette Win _ ggaazzeetttete