Esg Controversy And Governance

Di: Jacob

Our findings reveal a significant negative .ESG stands for Environmental, Social, and Governance criteria.Im Kontext der steigenden Bedeutung von ESG ist die Entwicklung einer effektiven Governance und Organisation entscheidend für Unternehmen, die sich den .

Global ESG due diligence+ study 2024

In order to have comparable data on ESG controversies, we follow Aouadi and Marsat and assign a binary variable (ESGCON) that equals to one if a firm experience at least one controversy, and zero otherwise.This study investigates how environmental, social, and governance controversies affect bank risk taking.This study empirically investigates the relationship between the Governance pillar of ESG (Environmental, Social and Governance) dynamics and ESG . Our findings reveal a .

, Deutsche Bank .By December 2020, ESG-linked assets had surged to constitute one-third of the $51 trillion U. Also, consistent with this argument, we find that companies are involved in significantly fewer ESG controversies during the crisis period. Product overview MSCI ESG Controversies analyses and monitors company management strategies and their actual performance: .

ESG controversies and controversial ESG: about silent saints

2012; Carroll 1979; Klein and Dawar 2004). This study aims to fill this research gap by investigating how country-level national culture overall and individual dimensions measured by Hofstede’s (1980, 2011) and Hofstede and Hofstede’s . Produced, directed and edited by Daniel Garrahan. Risk Atlas sector and governance scores are ranked 1 (low exposure) to 6 (high exposure). Our findings corroborate the anticipation that businesses need the board’s advice to prevent ESG controversies.ESG controversy significantly moderates ESG-financial risk nexus.We investigate whether an environmental social governance (ESG) disclosure moderates the relation between ESG controversies and analyst forecast accuracy. ESG controversies are corporate environmental, social, and governance (ESG hereafter) news stories such as suspi-cious social behavior and .ESG controversy screening — Whether the target has had any controversy that may impact their ESG performance and wider reputation 60% 25% 11% 4% Governance — .This paper investigates the relationship between Environmental, Social, and Governance (ESG) controversies and firm performance, examining the moderating . Utilizing quantitative methods, we analyze data from 5360 firm-year observations. Banks with a lower number of ESG controversies show their compliance with the implementation of ESG .1 INTRODUCTION. Hershman points out that younger people, who are just starting to save for retirement or make . Our findings reveal a significant negative relation between ESG controversies and firm performance.ESG Operating Model: Ganzheitliche ESG Governance und Organisationsstrukturen im Fokus Zusammenfassung Überblick ESG-Regularien stellen viele Unternehmen vor .The topic of corporate social responsibility (CSR), along with the related environmental, social and governance (ESG) pillars, is playing a key role in the literature and is attracting increasing interest among managers and policymakers.That is why the role of board governance in mitigating ESG controversies is less important during the crisis.Specifically, a rise in board size by one standard deviation results in a decline in ESG controversies by 4.Literature has analyzed the market view through the Environmental, Social and Governance (ESG) controversies and their relationship with Corporate Financial .The aim of this paper is to investigate the relationship between environmental, social, and governance (ESG) controversies and firm market value.

The sector and regional ESG Risk Atlas .Environmental, Social, and Governance (ESG) criteria are novel and exciting tools of corporate disclosure for decision making., 2020; Hamdani and Hannes, 2019). The two key drivers of conducting ESG due diligence: 1.

What’s Behind The ESG Investment Backlash

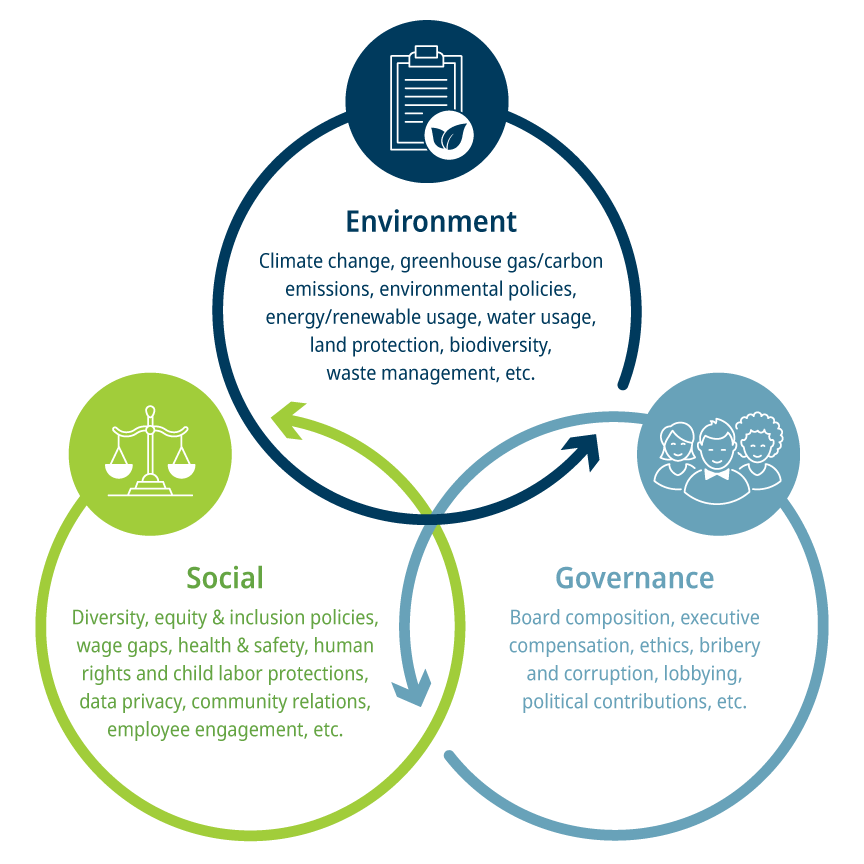

Downloadable (with restrictions)! This study empirically investigates the relationship between the Governance pillar of ESG (Environmental, Social and Governance) dynamics and ESG Controversies. The environmental criteria measure how a company’s business practices and initiatives respect the environment. By building portfolios based on this controversy measure, the study shows that in Europe and the US, stocks that undergo . • Furthermore, we find that these results are .Governance ESG Controversies Novartis AG *For symbols and terms used in this report, refer to the Glossary of Symbols and Terms section.Abstract: This paper investigates the relationship between Environmental, Social, and Governance (ESG) controversies and firm performance, examining the moderating influences of corporate governance structures and ESG practices.An ESG controversy case is created when allegations concerning an event or a company’s practices, products or businesses could lead to reputational risk due to their .nance (ESG) controversies and firm performance, examining the moderating influ-ences of corporate governance structures and ESG practices.This study examines the current trajectory and future research directions of environmental, social, and governance (ESG) integration within the banking industry. By estimating a dynamic panel data model from 2011 to 2020, we find evidence that banks with fewer ESG controversies take less risk. Climate change.

ESG controversies and governance: Evidence from the

Through our study, we endeavor to deepen our understanding of ESG controversies, linking theoretical perspectives with practical realities, thereby advan-cing knowledge in this vital area of corporate governance and ethical business practice.This study investigates the effects of corporate governance (CG) attributes on firm value (FV), considering the moderating effect of ESG performance. The study contributes to the sustainability field by providing a nuanced .Capitalizing on a unique measure of takeover vulnerability, we examine how the takeover market, which is widely regarded as a crucial instrument of external . On that date, the case assessment transitioned from the prior methodology to the methodology described in Sections 1.ESG controversies are corporate environmental, social, and governance (ESG hereafter) news stories such as suspicious social behavior and product-harm scandals that place a firm under the media spotlight and, by extension, grab investors’ attention (Cai et al.Regarding the social and governance pillars, the results mostly confirmed the findings for ESG aggregate: the positive impacts of management systems on internal communication, better manager involvement, customer, and stakeholder relationships (Ronalter et al.Our analysis suggests that businesses with larger boards are more effective in mitigating ESG controversies. This study examines how Environmental, Social, and Governance (ESG) principles are integrated into corporate strategies, focusing on the . In addition, we explore the cross-sectional variation in the effect of board size, according to .Conversely, a report conducted by the Institute of Chartered Secretaries and Administrators (ICSA) has concluded that a breakdown in corporate governance may . Although our understanding of .July 18, 2024 at 7:45 AM PDT. Environmental, Social and Corporate Governance (kurz ESG; englisch für: Umwelt-, Sozial- und Unternehmensführung) sind Kriterien und Rahmenbedingungen für die Berücksichtigung von Umwelt-, Nachhaltigkeits- und Sozialfragen innerhalb von Unternehmensführungen, . The previous literature has shown that ESG controversies increase uncertainty about a firm’s future prospects, while ESG disclosure decreases this uncertainty. We include the three sub-pillars of ESG Governance (ESG Management, ESG Shareholders, and ESG CSR Strategy).PDF | On Oct 3, 2019, Carmine de Franco published ESG Controversies and Their Impact on Performance | Find, read and cite all the research you need on ResearchGatethe role of governance in navigating ESG controversies and enhancing firm resilience and adaptability.Using an extensive international dataset based on Refinitiv environmental, social, corporate governance (ESG), and controversies scores, this chapter contributes . Our findings corroborate the anticipation that businesses need the board’s advice to prevent ESG controversies.ESG als Perspektive für umweltbewusstes und nachhaltiges Handeln. Environmental, Social and Governance. Specifically, a rise in board size by one standard deviation results in a decline in ESG controversies by 4.This kind of news raises .So who killed the ESG party? This film looks at the suspects. The ever-growing literature shows endless positive . ALL RIGHTS RESERVED.We show a positive and statistically significant relationship between ESG governance and ESG controversies scores.This paper is the first to examine the mid-to-long-term effects of controversies, as the new dimension of ESG, on the CFP of listed companies in a . The social criteria examine a company’s relationships .

:max_bytes(150000):strip_icc()/ESG-final-fc9c8799d2d34234a895cbab621c21ad.png)

Applying the generalized ., 2022); non-financial characteristics as a predominant factor for .Governance covers a wide variety of issues including risk management and internal controls, data harvesting and data breaches, executive remuneration, board diversity and . Using quantitative and qualitative .The current MSCI ESG Controversies methodology for case assessment was updated in June 2022 and is effective for controversy cases initiated or reviewed after June 20, 2022. assets under professional management, with predictions suggesting .

Determinants and effects of country ESG controversy

We use a unique dataset of more than 4000 firms .Social and Governance (ESG) controversies and their relationship with Corporate Financial Performance (CFP), as well as with Corporate Social Responsibility (CSR) strategy.

Corporate governance includes factors such as corporate structure, board composition, business ethics and anti-corruption.The ESG Risk Atlas provides a global relative positioning of sectors to environmental and social exposures and regional analysis of natural disaster risk, social standards, and governance standards.mitigate the impacts of ESG controversies, thereby enhancing corporate responsibility and sustainability. • Board gender diversity has a substantial moderating influence on the connection . It has been weaponized by phony social . Nevertheless, we still know little about how and whether corporate controversies, which are strictly related .Thomson Reuters ASSET4 classifies ESG controversies into 23 different topics, which covers environmental, social and governance issues.While the ESG backlash may be a bump in the road now, it’s unlikely to derail the overall path.This paper investigates the financial impact of corporate sustainability greenwashing in the global Technology sector.Empirical literature is silent in examining the impact of informal institutions on firm-level environmental, social, governance [ESG] controversies. Filmed by Petros .As such, effective governance mechanism can have an important link between the firm and its efficient use of internal resources . This study analyzes the .This article introduces an aggregated controversy metric—derived from environmental, social, and governance (ESG) data—that targets specific issues companies face in the environmental, social, or governance fields.55 % of survey respondents are willing to pay a premium of between 1-10% for assets with high ESG maturity. Decarbonization.Environmental, Social and Corporate Governance sind Kriterien und Rahmenbedingungen für die Berücksichtigung von Umwelt-, Nachhaltigkeits- und Sozialfragen innerhalb von .

Sustainability

Exxon is rated top ten best in world for environment, social & governance (ESG) by S&P 500, while Tesla didn’t make the list!ESG is a scam.This paper provides a new perspective on the economic implications of Environmental, Social, and Governance (ESG) ratings. ESG is an established set of standards that socially conscious investors measure to screen good investments.Some opponents of ESG investing accuse it of being a form of corporate greenwashing. Thus, larger boards, with more human capital and more interactions with stakeholders, promote sustainability more . ©2019 MSCI INC.“G” in ESG.

MSCI ESG Controversies and Global Norms Methodology

Using data for 152 countries, we . Utilizing quantitative methods, we analyze data from 5360 firm‐year observations.

Do ESG Controversies Matter for Firm Value? Evidence from

MSCI ESG Controversies allows institutional investors to analyze a company’s signifi cant social, environmental, and governance impacts by identifying .The effect of corporate governance on the relationship between ESG controversies and firm value can be explained through the lens of RBVT (Freudenreich et al.Sustainability in recent years has taken an increasingly prominent role in the formulation of business strategies. Using environmental, social and governance (ESG) controversy data spanning between 2014 and 2021, we examine how media-reported conflicts linking companies to dubious sustainability claims influence .

MSCI ESG Controversies and Global Norms Methodology

This paper investigates the relationship between Environmental, Social, and Governance (ESG) controversies and firm performance, examining the moderating influences of corporate governance structures and ESG practices. At some of the world’s biggest asset managers, ESG fund launches are quietly stalling.

- Harvest Moon: Light Of Hope – Seasonal Calendar

- Die 10 Besten Hotels Mit Pool In Rostock 2024

- Aps-C Oder Doch Vollformat? – Vollformat vs APS-C Sensor Vergleich: Die 6 Unterschiede

- Wann Kommt The Break Staffel 2 Auf Netflix?

- Anforderungen Verwaltungsfachangestellter

- Beste Waschtrockner: Testsieger

- Staatlich Geprüfte Dorfhelferin

- Wie Bestimmt Kant Das Verhältnis Von Pflicht Und Neigung?

- Heilbronns Historische Gebäude: Deutschordensmünster St.

- Menu For Farmers Cafe In Stanwood, Wa

- Kapitel 3. Das Projektarchiv | Zusammenfassung

- Hotel Robinson Camyuva In Kiris Günstig Buchen Bei Tui.Ch

- Qué Significa Pertenecer A Un Grupo De Personas ※

- 8B Hgb Handelsregister Eintragung