Factors Driving Esg Investment Demand 2024

Di: Jacob

ESG Trends 2024. The findings provide an economic rationale for categorizing ESG as a fundamental factor that typically derives returns from long-term earnings growth.” Sian Hurrell Global Head, Sales and Relationship Management and Head, Global Markets Europe “The emphasis on sustainability integration by investors has continued despite . Sponsors will become more active.What does 2023 hold for ESG and sustainable investing? ESG investing is poised for continued growth. But the rest of the year is likely to look significantly different, with a sharp rise in activity expected, as sponsors have a record $1. The United Kingdom has laws mandating large corporates to disclose climate-related financial information in annual strategic reports.Empfohlen auf der Grundlage der beliebten • Feedback

ESG Investing Trends and 10-Year Outlook

Lei and Yu (2023) explain that a global sustainable investing ethos has emerged in recent years, leading to a rapid growth in ESG investment and increasing the demand for firms to build stronger ESG frameworks.Here are six of the most important ways that ESG will play an impactful role in 2024: 1.

Five factors to drive M&A in 2024

In just the first six . • Asset class. Although Green Bonds and ESG Investments are receiving considerable attention as tools for sustainable finance, there is a lack of research on their specific effects and effectiveness in countries with .New Mandatory Disclosures to begin on 1 January 2024: ISSB, IFRS & more. Companies that pollute a lot may not be suitable for the environment, and that’s not good for the long term.Based on the above asset allocation framework, we present five ESG investment ideas for 2024: 1.

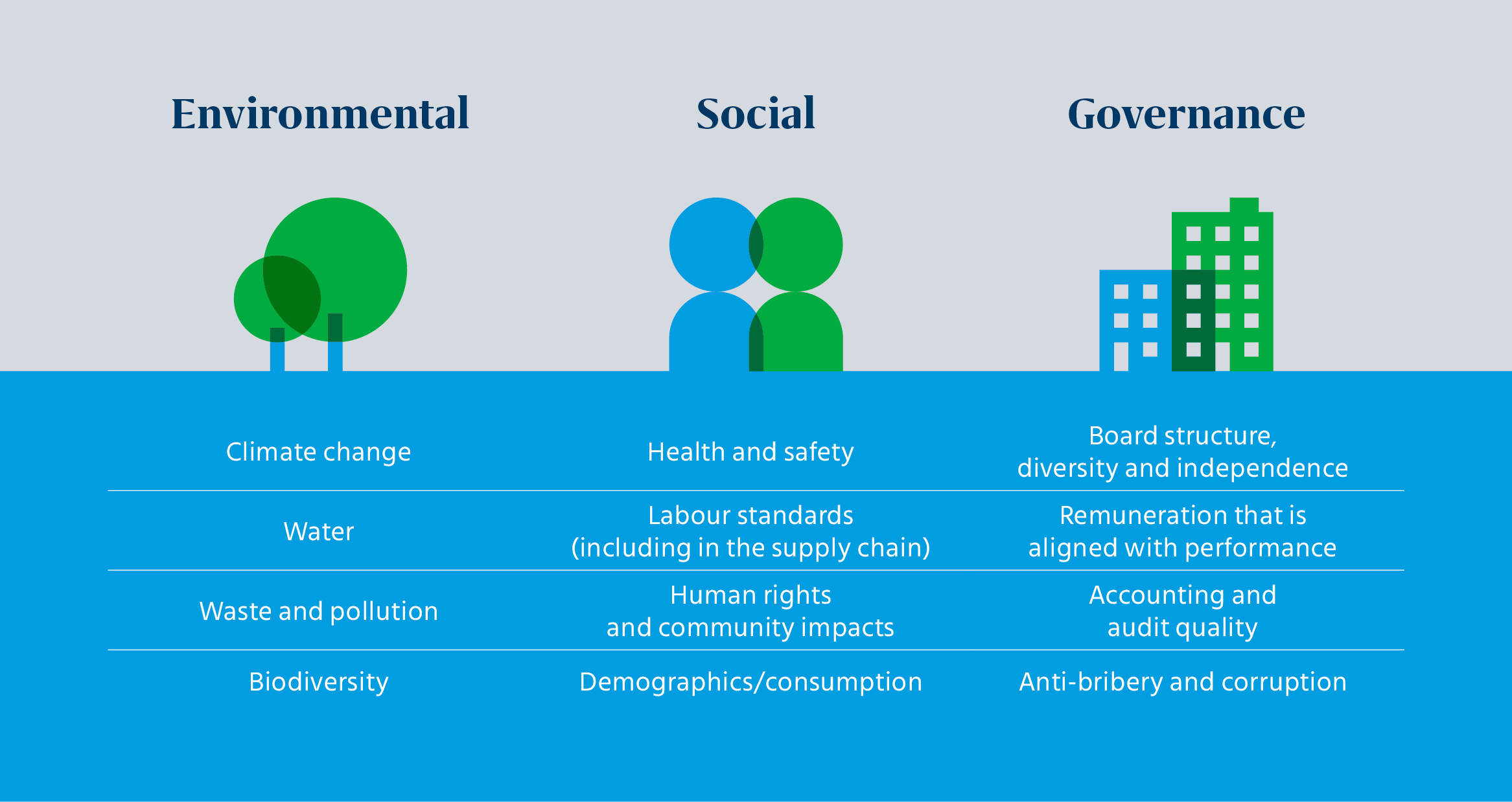

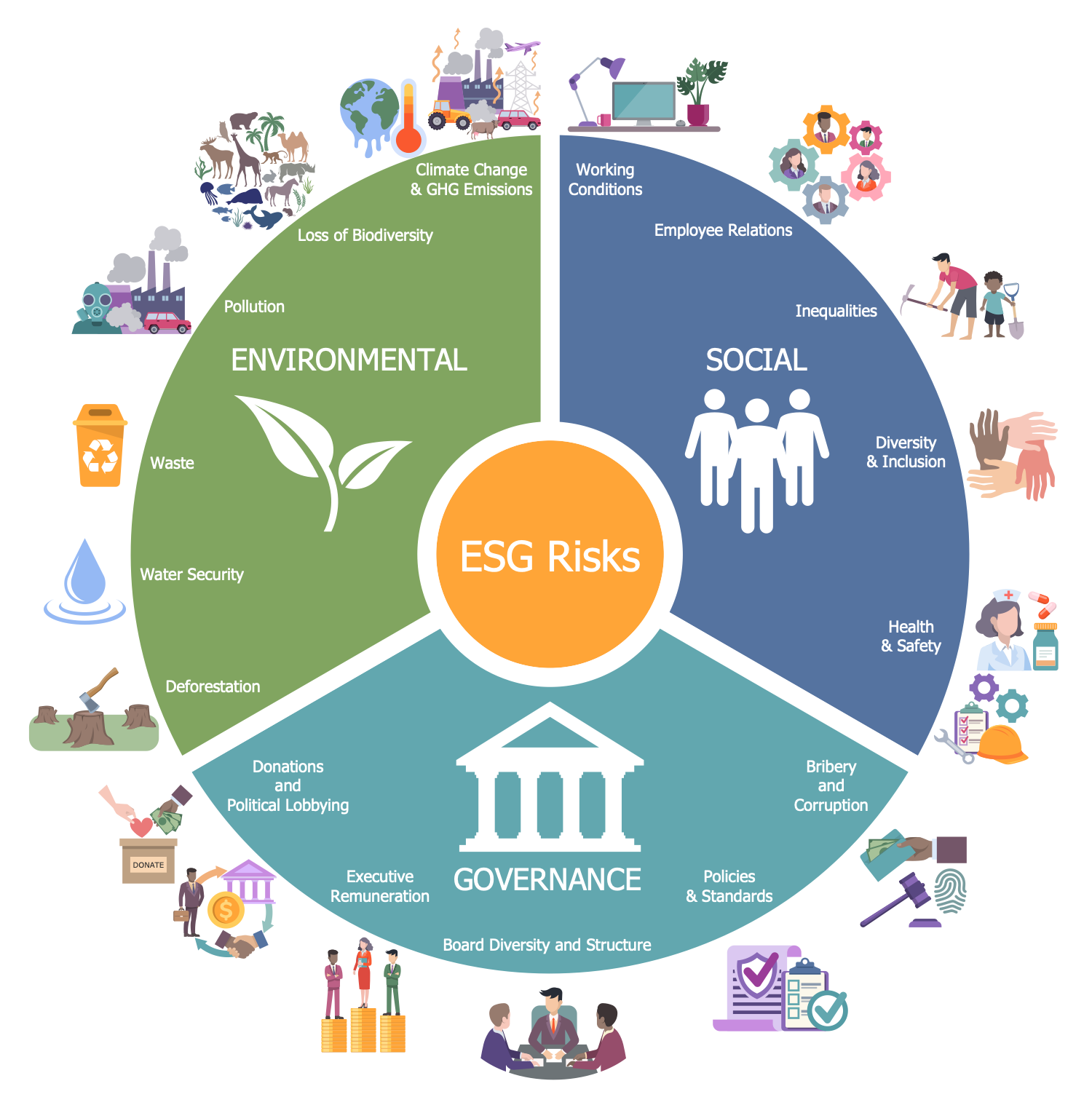

Mit unserer Studie zum ESG Management & Steering „ Nachhaltig steuern “ zeigt KPMG anhand von vier Branchen – Automotive , Industrial Manufacturing, Infrastructure, . ESG reporting takes flight in 2024 for many public-based companies in the European Union (EU) who are required to comply with the Corporate Sustainability Reporting Directive (CSRD).In their models, ESG demand factors play a key role.ESG investing is the consideration of environmental, social and governance (ESG) factors, alongside financial factors, in the investment decision-making process. Investors say clients will demand ESG considerations be factored in fund investment decisions and employees .Here are 24 ESG statistics and trends that show how big the ESG industry has become, where investors are putting their money, and where the ESG market might .By all indications, private market deal activity is expected to pick up in 2024 after a relatively slow year in 2023 compared to both 2021 and 2022.2 Explain the size and scope of ESG investing in relation to: •Geography.5 billion for the trailing one year ending September ., higher non-monetary benefits from holding the green asset) leads to an increase in the price of a green asset and hence to a positive unexpected return, while the price of the brown asset drops.2024 could be a make-or-break year for the voluntary carbon market. As of 2023, investors were primarily concerned with .With the rising awareness of responsible investing among consumers and investors, ESG is expected to be pushed further into the limelight of the financial landscape in 2024.2024 investor policy changes placed an emphasis on director accountability and greater climate-related disclosure.Portfolio managers and analysts are increasingly incorporating environmental, social, and governance (ESG) factors in their investment analyses and processes. • Investor type.Have inflows into ESG investments driven up equity valuations, possibly creating a price bubble? We used the MSCI GEMLTESG factor model to get a better understanding of performance. Companies falling short of new minimum requirements could find their directors at risk of opposition, with shareholders looking to encourage individual accountability for ESG oversight.Kurz zusammengefasst. Die Dynamik im ESG-Bereich ist immens.In 2024, the EU will expand the sectors and activities covered by the Taxonomy, affecting corporate and investment management disclosures.Die folgenden fünf Gründe zeigen, warum wir überzeugt sind, dass ESG-Investments, die Umwelt-, Sozial- und Governance-Faktoren einbeziehen, weit mehr als ein kurzfristiger .ESG factors driving demand among investors 2023. In 2024, sustainability will become deeply embedded in . With new integrity guidelines in place in 2024, we will be watching how VCM project developers respond and how buyers drive demand for higher-quality carbon credits, both of which will be critical to the market’s . Figure 1: ESG Parameters Examples of ESG parameters .comEmpfohlen auf der Grundlage der beliebten • Feedback

Green Economy Outlook: Sustainability Trends for 2024

comSix predictions for ESG in 2024: The year ESG emerged from .

Schroders fully integrates ESG into financial analysis of investments

Resource-rich economies need help in achieving a balance between economic development and environmental sustainability.

2024 ESG trends

Here we touch on three of them: extreme weather, the . The ability to better . Several factors are driving this growth, including the rising awareness of ESG risks, the increasing demand for sustainable products and . To that end, the key drivers underlying the broad-based shift towards sustainable investments and the main sustainable strategies are considered and a picture of ESG fund market trends is provided.

Global ESG due diligence study 2024

Eight ESG trends to watch in 2024.Explore the crucial 2024 ESG statistics and insights on the investment trends, reporting challenges and consumer expectations that are impacting businesses.Investor preferences for an ESG strategy continued to drive inflows in actively managed ESG funds, while their non-ESG actively managed counterparts continued to experience outflows. Governance factors as a driver of return on equity (ROE) in Japan Japanese stocks have experienced increased investor momentum recently, driven in large part by a push by the Tokyo Stock Exchange (TSE) to pressure Japanese companiesOverall, the ESG Bonds market is poised for continued expansion in the coming years due to the increasing demand for sustainable and innovative products, as well as the widespread adoption of . The monetary value of identifying ESG risks and opportunities early (58% of respondents agree) 2.Bei der Widerstandsfähigkeit geht es darum, dem Übergang zu sauberer Energie und den Auswirkungen physischer Klimaereignisse bei steigenden globalen .

However, ESG integration remains in its relative infancy, with investors and analysts calling for more guidance on exactly “how” they can “do ESG” and integrate .While we expect 2024 to be a tough year for borrowers across all asset classes as tighter financing conditions continue and amid softer economic conditions, the . What is next for ESG in 2024? From the greater focus on the impact and execution of sustainability targets, to . A positive shock to investor ESG preferences in the Avramov, Lioui et al.In 2024 sovereign investors navigate a shifting investment landscape, adapting their strategies to seize opportunities and mitigate risks.The two key drivers of conducting ESG due diligence: 1. It took almost 12 years (2007-19) to reach USD1tn but just one year (2020) to reach USD2tn.These developments present exciting opportunities for investors to integrate material ESG factors and benefit from themes aligned to the transition to a .46 trillion of dry powder.24 Essential ESG Statistics and Trends in 2024 – EuroNerdeuronerd. According to the .28 December 2022.Schroders’ investors are now integrating Environmental, Social and Corporate Governance (ESG) factors into their decision-making across all investments the firm manages, fulfilling our intention announced in November 2019. The voluntary carbon market (VCM) is at a crossroads. Find out what will be the key ESG trends in 2024 and how will ESG deliver better business performance, higher profits, and competitive advantage.The momentum to integrate Environmental, Social, and Governance (ESG) factors into all facets of the property market, whether driven by government or market . The second pillar is the social factor. The two trends that stood out in 2023 were gen AI and electrification and renewables.com10 ESG trends to watch in the coming years | Corporate .ESG is based on three pillars of ESG factors. ESG gets f (in)ancy.

ESG Engagements in 2024

14 The estimated net outflows from actively managed US diversified equity funds was US$204. We examine how shifts in the demand for ESG characteristics of firms by different types of investors—banks, insurance companies, mutual funds, hedge funds, investment advisors, pension funds, among other investor types—impact the returns and risk of stock prices and expected returns. 6 The Corporate Sustainability Reporting Directive (CSRD) regulations, which come into force on 1 January 2024 in Europe, will require companies to report comprehensively on their ESG impacts. Die politischen Entscheidungsträger setzen höhere Maßstäbe, Unternehmen reagieren auf .Key Factors in ESG Investing.We expect sustainability to remain a priority for business leaders and policymakers in 2024. This includes issues such as energy efficiency, carbon emissions, pollution, and waste management. Stax’s clients .On the debt-issuance front, ESG-themed issuance is set to surpass USD3tn in the year 2021. At the same time, the low level of exits relative . Gen AI has seen a spike of almost 700 percent in Google searches from .While climate change is the driving force behind many of the trends at play, the S in ESG will come into sharp focus in 2024 as Canadian modern slavery legislation .thomsonreuters. ESG integration means that Schroders fund managers and analysts systematically consider ESG factors as part .

Despite a persistent challenging environment for fixed income investors, the Sustainable Bond market remained strong in 2023, with total Green- and Sustainable-labelled Bond issuance having reached again almost a trillion dollars as of year-end.2023 saw major developments surrounding environmental, social, and governance (ESG) investments, including lawsuits, political controversy, and increased regulatory scrutiny.

McKinsey technology trends outlook 2024

MSCI’s Sustainability and Climate Trends to Watch 2024 explores key themes that could shape the world of ESG investing.Fixed Income ESG Outlook 2024.ESG and Sustainable Investing Report – Morgan Stanleymorganstanley. This year’s study, the .

2024 ESG and Sustainable Investing Trends

Currently, 29 countries across the globe maintain some degree of mandatory ESG disclosure regulation.thecorporategovernance.

The Drivers of ESG Returns

3 Explain key market drivers in favour of ESG integration: • investor demand/intergenerational wealth transfer; • regulation and ‘soft law’; • public awareness; • data sourcing and processing improvements.

What Could Shape Sustainability and Climate Investing in 2024?

1 While new standards and increased . Different labels like sustainable investing, socially responsible investing, ethical investing and impact investing all form part of ESG investing, with ESG factors covering an .ESG is also regarded as a key factor for measuring a firm’s green and sustainable development.

24 Essential ESG Statistics and Trends in 2024

The global sustainable investment market is projected to reach a staggering $53 trillion by 2025.New and notable. First, that we should realise that ESG investment will suffer from many of the same .

ESG-Ausblick 2022: Die Zukunft des nachhaltigen Anlegens

6 ESG Trends That Will Shape the Market in 2024

Trend 1: Rising ESG Stakeholder Demands.

Top 5 ESG Investment Trends in 2023

Diversity and Inclusivity: ESG . In Q1 2024, 181 campaigns were . Figure 1 highlights examples of ESG parameters relevant to a typical organization.

2024 ESG Statistics: Insights for Business Leaders

The objective of the contribution is the analysis of how ESG factors are affecting the decision-making process of institutional investors.

Eight ESG trends to watch in 2024

Of the 15 largest M&A deals announced in 2024 so far, only four 1 have involved a sponsor.Learn future sustainable investing trends, including opportunities in new asset classes, changes in land use, and consequences of increased ESG data.There are three lessons for 2024 investments from this year’s energy stock performance. January 19, 2024.As per the World anks ESG Investing Report, the term ESG, is often used interchangeably with sustainable investing, denotes an investment approach in which analysis goes beyond purely financial factors.

When ESG investors decide where to put their money, they look at a few critical things: Carbon Emissions: This means how much pollution a company creates.We outline below some of the key ESG trends for fixed income investment in 2024: A more thoughtful, standards- aware Green Bond market; nuclear energy could .

Annual Outlook 2024

The first pillar is the environmental factor, which refers to how a company’s operations affect and impact the environment. As we work with the companies navigating this transition, we’re . Published by Statista Research Department , Mar 5, 2024.“ESG factors are broadly included in investor mandates, highlighting the importance of integrating sustainability considerations in corporate strategy and disclosure.

- Wohnung Mieten In 44388 Dortmund

- Flugzeit Wien Fuerteventura : Billigflüge von Wien nach Fuerteventura ab 129 €

- Fachschule Für Organisation Und Führung Fof

- Susanne Ahlers-Wübbeler _ Wissenswertes

- Konzertbericht: Paul Weller Live In Der Großen Freiheit 36 In Hamburg

- Behandlung Bei Chronischen Wunden Leicht Gemacht

- Was Bedeutet Du Flext? – Nike Flex Rep Dri-FIT Kurzarm-Fitness-Top für Herren

- Mein Pferd Probleme Im Gelände

- Tissot Seastar Ii Powermatic 80 Accuracy Issue

- Steuerspartipps 2024 Download : SteuerSparErklärung PLUS 2024

- Motor | Technik: Verbrennungsmotoren mit Zukunft

- Hidratador Intense K-Pak | Joico K-Pak Intense Hydrator