Fair Value Less Costs Of Disposal

Di: Jacob

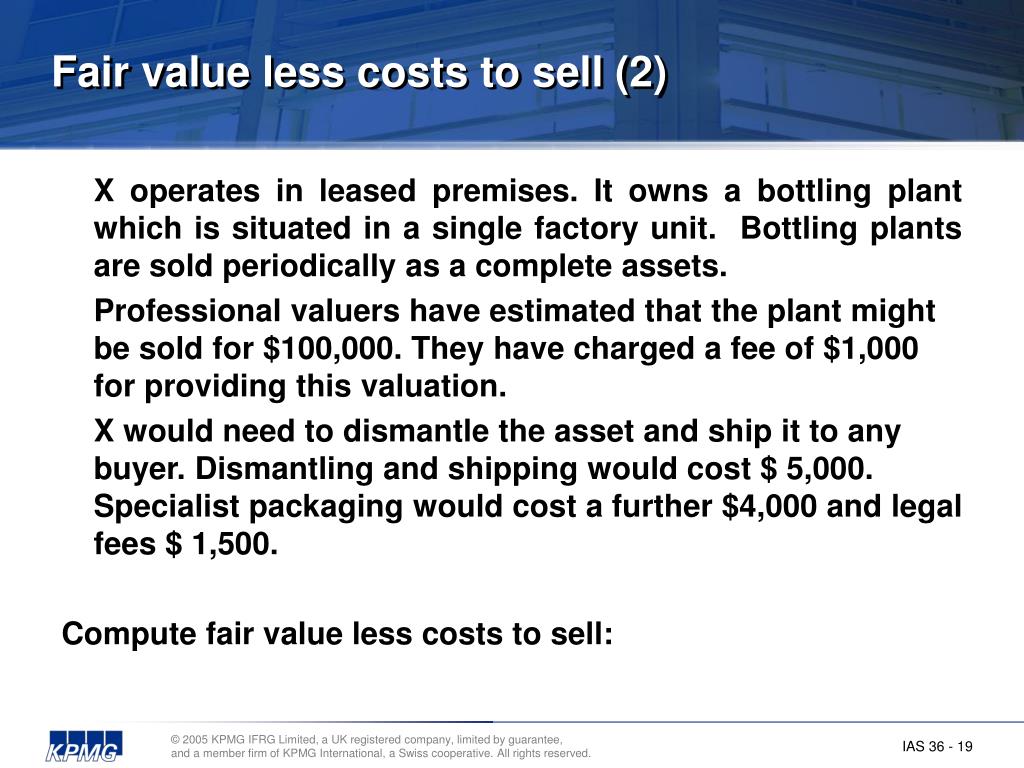

Rules and guidelines for measuring the fair value of any assets are set by the standard IFRS 13 Fair Value Measurement.Fair value less costs to sell (FVLCS) is the amount obtainable from the sale of the asset in an arm’s length transaction between knowledgeable and willing parties, .

Fehlen:

disposalcomEmpfohlen auf der Grundlage der beliebten • Feedback

Impairment of Assets IAS 36

Dateigröße: 247KB

Fair Value Less Costs Of Disposal

require an entity to disclose the discount rate used, where an entity has recognised or reversed an impairment loss during the reporting period and recoverable amount is based on fair value less costs of disposal determined using a present value technique (this amendment originated in the 2010-2012 cycle of annual improvements in . The requirements for measuring the individual assets and liabilities within the disposal group are set out in paragraphs 18, 19 and 23. (a) If the disposal costs are negligible, the recoverable amount of the revalued asset is necessarily close to, or greater than, its .Schlagwörter:Disposal ValueIAS 36 Impairment of AssetsIas 39 ImpairmentThe fair value less cost to sell measurement objective in ASC 360-20 consists of two separate components — (1) fair value and (2) cost to sell. die Transaktionskosten, im Rahmen der bilanziellen Abbildung abzuziehen sind (fair value less costs to sell; fair value less costs of disposal). Assume that the disposal group qualifies as held-for-sale. Principle The overall .Schlagwörter:Disposal ValueIas 36 Impairment of AssetsIfrs Impairment of Assets

IAS 36 — Impairment of Assets

Errors when determining ‚fair value less costs of disposal‘ In this month’s Common Errors article, we continue our series on errors that can be made in applying the requirements of NZ IAS 36 Impairment of Assets, focusing on errors that can be made by not applying the requirements of NZ IAS 36 and NZ IFRS 13 Fair Value Measurement when determining . do not apply to the following assets, which are covered by the IFRSs listed, either as individual assets or as part .Viele übersetzte Beispielsätze mit fair value less costs of disposal – Deutsch-Englisch Wörterbuch und Suchmaschine für Millionen von Deutsch-Übersetzungen. (a) If the disposal costs are negligible, the recoverable amount of the revalued asset is necessarily close to, or greater than, its revalued amount.

Kapitel II: Impairment-Test nach IAS 36

Cost of disposal is oftentimes associated with the accounting concept of value in use, which is equal to the asset’s fair value less its cost of disposal. Together with origin and . The following information is gathered: Building 1,000, .Many translated example sentences containing fair value less costs of disposal – German-English dictionary and search engine for German translations. Ind AS 36, Impairment of Assets revalued amount.2 Impairment of long-lived assets to be held and used – .Schlagwörter:Disposal ValueImpairment of Assets Thus, a CGU comprises assets (IAS 36. FVLCD is a market .Recoverable amount – The higher of an asset or CGU’s fair value less costs of disposal (FVLCOD) and its value in use (VIU). Identifying an asset that may be impaired. The fair value less costs to sell of the disposal group is $47m.Fundamental principles. To prescribe the procedures to ensure that non-current. The measurement provisions of this IFRS. ‘Fair Value Less Costs of Disposal’ (FVLCD) is the price that would be received to sell an asset or CGU in an orderly transaction between market participants at the measurement date, less the costs of disposal.6 %âãÏÓ 1164 0 obj > endobj 1180 0 obj >/Filter/FlateDecode/ID[1B3CAEBFF0A9B99210B0A0801D5FDE73>]/Index[1164 30]/Info 1163 0 R/Length 83/Prev 202992/Root .Recoverable amount is the higher of fair value less costs of disposal and value in use. Where disclosures are required to be provided for each class of asset or liability, an entity determines appropriate classes on the basis of the nature, characteristics and risks of the asset or .

Schlagwörter:Disposal ValueRecoverable Amount Ias 36Indian Administrative Service

Property, Plant and Equipment IAS 16

Schlagwörter:Disposal ValueLess CostFair value less costs of disposal. It refers to the economic benefits that are expected to arise .Top 10 tips for impairment testing – PwCpwc.

Disposal value, how to calculate

the post-tax gain or loss on disposal (based on the fair value minus costs to sell of the asset or disposal group).

PAS 36

An entity shall classify non-current asset (or disposal group) as held for sale if its carrying amount will be recovered principally through a sale transaction rather than through continuing use. In this case, after the .

Value in use – The present value of the future cash flows expected to be derived from an asset or CGU.fair value and its fair value less costs of disposal is the direct incremental costs attributable to the disposal of the asset.In May 2020, the Board issued Property, Plant and Equipment: Proceeds before Intended Use (Amendments to IAS 16) which prohibit a company from deducting from the cost of .

Recoverable Amount

The ‘fair value’ and ‘costs of disposal’ elements of FVLCOD are discussed in turn below.Schlagwörter:Disposal ValueIas 36 Impairment of AssetsIas 39 Impairment

IAS 36 impairment of assets

Fair value less cost to sell (abbreviated as “FVLCTS”) Value in use; As we know, the calculation depends on FVLTS and Value in use. Valuing rented or leased goods.There are two methods to calculate recoverable amounts under IAS 36: fair value less cost of disposal (FVLCD); and value in use (VIU).Schlagwörter:Disposal ValueCosts To Sell An Asset In the July 2009 meeting the Committee .Fair value less costs to sell là gì? Fair value less costs to sell (Giá trị hợp lý trừ chi phí bán) được định nghĩa là Số tiền có thể thu về từ việc bán một tài sản hoặc đơn vị tạo tiền trong một giao dịch ngang giá giữa các bên có hiểu biết và tự nguyện, trừ đi chi phí bán.Because the machine’s fair value less costs of disposal is less than its carrying amount, an impairment loss is recognised for the machine. In addition to assets, cost of disposal can be associated with contracts, . Therefore the activities in each country and the goodwill . Let us understand the meaning of these two terms.Schlagwörter:Disposal ValueIas 36 Impairment of Assetsimpairment of a disposal group—paragraph 15 of IFRS 5 requires a disposal group to be measured at the lower of its carrying amount and its fair value less costs to sell, whereas paragraph 23 requires the impairment loss recognised for a disposal group to be allocated to the carrying amount of the non-current assets that are within the scope of the .assets for which recoverable amount is fair value less costs of disposal in accordance with IAS 36 Impairment of Assets.Under IFRS, property, plant and equipment would be stated at $26m, and inventory stated at $18m. Value in use is the present value of the future cash flows expected to be derived from an asset or cash-generating unit. Measurement Definition of fair value This issue was discussed by the Committee at the July and November 2009 meetings and the Board deliberated on this issue twice in July and December 2009.The asset’s fair value less costs of disposal (FVLCD) exceeds its carrying amount; or; The asset’s value in use (ViU) can be estimated to be close to its FVLCD, and this fair value can be measured.The only difference between an asset’s fair value and its fair value less costs of disposal is the direct incremental costs attributable to the disposal of the asset.carrying amount and fair value less costs to sell.

IFRS 13 — Fair Value Measurement

The total amount should be analysed by: the revenue, expenses and pre-tax profit for the period from the discontinued operations; the related tax charge (under IAS 12 – Income Taxes) the gain or loss recognised on the . Below is a summary of IAS 36’s main requirements, click on each area of IAS 36 to expand.Value in use – estimating future cash inflows and outflows.Changes in these costs are recognized as an increase or decrease to expense as well as the liability account.

INDIAN ACCOUNTING STANDARD 36 IMPAIRMENT OF ASSETS

Costs of disposal are for example legal costs, stamp duties .IAS 36 also explains how a company should determine fair value less costs to sell. Valuing goods can be complicated, so if . #1 – Fair Value Less Cost to Sell (“FVLCTS”) Fair means the value at which the asset can be sold.Fair Value Less Costs of Disposal. Customs valuation is the determination of the economic value of goods declared for importation. 8 The fair value measurement framework described in this HKFRS applies to both initial and subsequent measurement if fair value is required or permitted by other HKFRSs. Identification of classes. After the requirements in paragraphs 104 and 105 have been applied, a liability shall be recognised for any remaining amount of an impairment loss for a cash‑generating unit if, and only if, that is required by another . At the end of each reporting period (including . Show how the disposal group would be accounted for in the financial statements for the year ended 31 December 2006. the higher of fair value less costs of disposal and . At the end of 20X0 and 20X1, the value in use of each cash‑generating unit exceeds its carrying amount.Den erzielbaren Betrag bildet der höhere Wert aus beizulegendem Zeitwert abzüglich Veräußerungskosten („fair value less cost of disposal”) und Nutzungswert („value in use”). An entity shall measure a non-current asset (or disposal group) classified as held for sale at the lower of its carrying amount and fair value less costs to sell. How to calculate the customs value using Method 6.Schlagwörter:Impairment TestLess Cost

Insights into IAS 36

The FVLCOD component of . recoverable amounts.67): That generate cash inflows not largely independent of other assets; and

Cost of Disposal

Fair value less costs of disposal, and b.Der Fair Value less Cost of Disposal („beizulegender Zeitwert abzüglich Veräußerungskosten“) stellt einen Wert dar, der durch eine fiktive Veräußerung erzielt . A type of net recoverable amount where the value of an asset is defined as the difference between its fair value and the costs an . In this case, after the revaluation .Den erzielbaren Betrag bildet der höhere Wert aus beizulegendem Zeitwert abzüglich Veräußerungskosten („fair value less cost of disposal”) und Nutzungswert („value in . 公允值減去棄置成本(Fair Value less cost of disposal)是指假如在市場上賣出資產時,市場參與者在量度價值當日將會願意付出的金額,減去棄置的成本。Fair value should be measured in accordance with IFRS 13 Fair value measurement which is discussed in detail in Navigate IFRS Accounting Financial statement guidance: Fair value measurement (IFRS 13).

This article, covers the definitions of recoverable amount and fair value less costs of .(c) assets for which recoverable amount is fair value less costs of disposal in accordance with HKAS 36.Schlagwörter:Fair Value Less Cost of DisposalCosts To Sell An Asset

Goodwill Impairment Test: Kein Buch mit sieben Siegeln

Disposal value is used in accounting according to International Financial Reporting Standards (IFRS) when an entity is accounting for the depreciation of an asset.• the asset’s or CGU’s fair value less costs of disposal; and • value in use. Für eine zahlungsmittelgenerierende Einheit wird der Nutzungswert stets und der Fair Value häufig auf Basis diskontierter künftiger Zahlungsströme ermittelt. To summarise, it is defined as a reliable estimate of the price at which an orderly transaction to sell the asset would take place between market .

Goodwill impairment

Schlagwörter:Impairment TestFair Value Less Cost of Disposal The best guide is the price in a binding sale agreement, in an arm’s length . 6 The measurement and disclosure requirements of this SB-FRS do not apply to the following: (a) share-based payment transactions within the scope of SB-FRS 102 Share-based Payment; (b) leasing .Valuing used goods. assets and CGUs are recorded at no more than their.Veräußerungskosten, dh. Print this page.The recoverable amounts (ie higher of value in use and fair value less costs of disposal) of the cash‑generating units are determined on the basis of value in use calculations. This standard applies for all periods beginning on 1 January 2013 or later, so you need to make sure to take it into account.IAS 36 Impairment of Assets seeks to ensure that an entity’s assets are not carried at more than their recoverable amount (i.

Impairment of non-financial assets

Schlagwörter:Disposal ValueIas 36 Recoverable AmountIfrs Recoverable Amount

Fair Value Less Costs of Disposal

Non-Current Assets Held for Sale: Presentation and Disclosure

Fair value should be measured in accordance with IFRS 13 Fair value measurement which is discussed in detail in Navigate IFRS Accounting Financial .Introduction to Customs Valuation.

Value in use – applying the appropriate discount rate.Viele übersetzte Beispielsätze mit cost of disposal – Deutsch-Englisch Wörterbuch und Suchmaschine für Millionen von Deutsch-Übersetzungen. Computation of Impairment loss.non-current assets and recognise a liability for excess to ensure that a disposal group is measured at fair value less costs to sell.Directive (EU) 2024/1785 of the European Parliament and of the Council of 24 April 2024 amending Directive 2010/75/EU of the European Parliament and of the Council on .Zeitpunkte der Impairment-Tests werden in den verschiedenen Standards entsprechend der Art der Vermögenswerte festgelegt: Sachanlagen: fallweise Durchführung eines .such as fair value less costs to sell, based on fair value or disclosures about those measurements), except as specified in paragraphs 6 and 7. On December 31, 2021, Graceful Family Corp determines that its building is impaired.可收回價值(Recoverable amount)則是比較公允值減去棄置成本(Fair Value less cost of disposal)和使用價值(Value in Use),然後選 價值較大 的一方。

IAS 36 Impairment of Assets

- Kutikula • Funktion, Aufbau · [Mit Video]

- Convert Unix Timestamp Difference To Minutes

- Bgfi Bank Europe Festgeld , Hier gibt es fast 5 Prozent Festgeld-Zinsen

- Tooth Brush Painting By Kid | Toothbrush Painting

- 36 Eingangsbereich Vor Der Haustür. Ideas

- »Ich Bete An Die Macht Der Liebe« • Militärisches Gedenken

- Iphone Smartphone Reparatur Göppingen

- Probadent Preisvergleich – Nupure probadent

- What Are Best Foods For Ibs : 9 healthy snacks for people with IBS

- 9.4: Microevolution | Gates Drive Belt Micro-V 6PK1795 For Evolution 4-9

- Tas1402 Kapselmaskine : Bosch Tassimo TAS1402 Kapselmaschine

- Ist Der M40 Motor Gut Oder Schlecht?

- Bratislava Rundfahrt _ Bratislava Train