Faqs For Employers : Supporting Your Employers: Employer FAQs

Di: Jacob

Section 1: General FAQ for Employers . Acara knows how important it is to have the right people working for you.F OR E MPLOYEES The three Social Security Schemes run by the Employees’ P F Organisation are for the employees engaged in the Industries and establishments and EPFO constantly makes effort to provide better services.GDPR in 2021 – key issues for HR (Webinar) Join our webinar to hear from our legal experts about all key issues surrounding GDPR. New rules released by the Departments of Labor, Health and Human Services, and the Treasury (collectively, the Departments) permit employers to offer a new . As schools and businesses close down across the country, employers are dealing with unprecedented challenges. Additional Claim Reporting Options. MHPAEA greatly expands on an earlier law, the Mental Health Parity Act of 1996 (MHPA ‘96). For additional information, refer to our WOTC FAQs . This can be achieved through a wage deduction as a part of existing payroll processes.

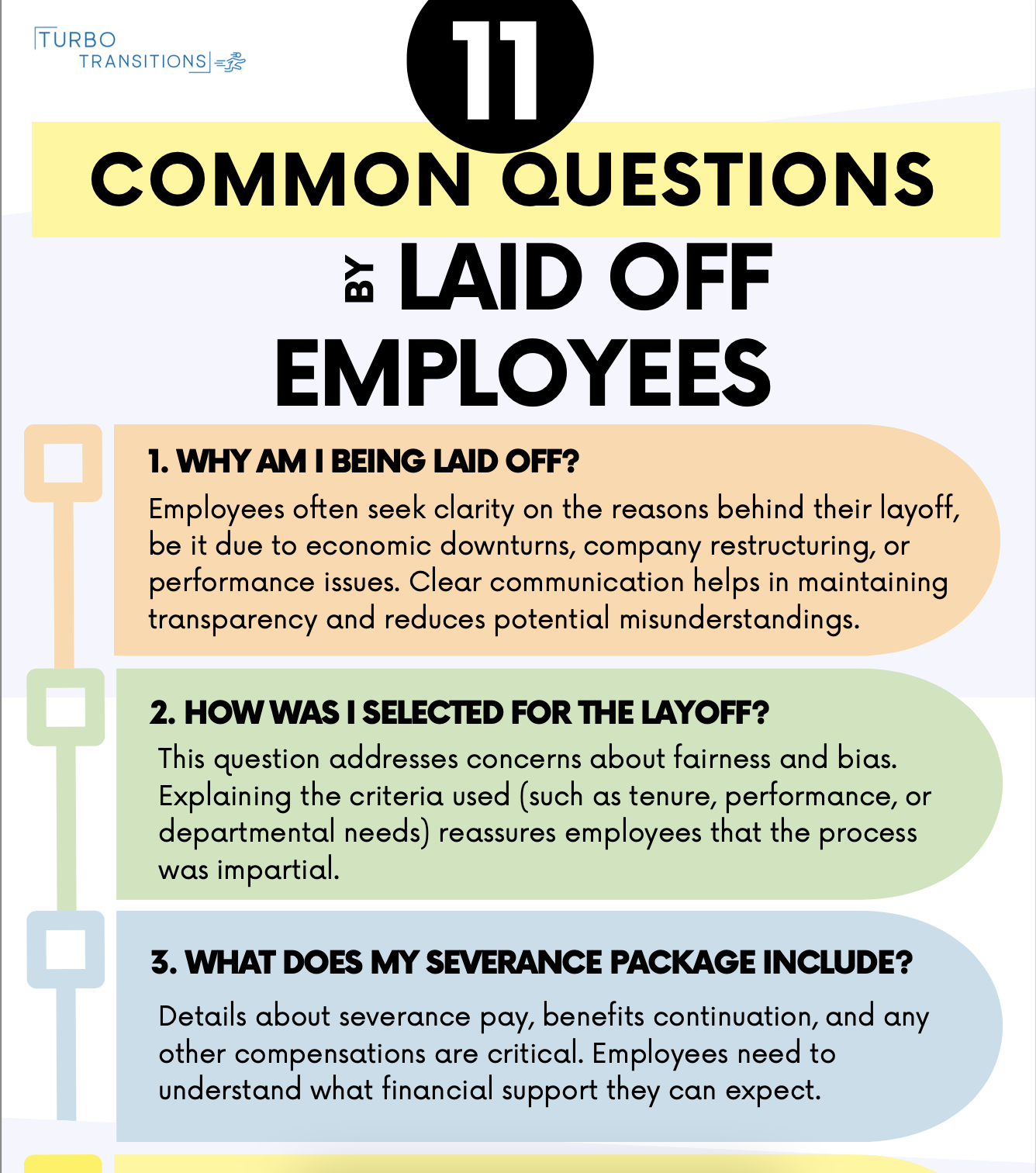

15 frequently asked questions about redundancy

(If you work with independent contractors, the deadline to file 1099-MISC forms with the IRS is also January 31, 2022.)

Workforce Services FAQs for Employers

Informationen für Arbeitnehmer

Mergers & acquisitions create many questions in the minds of employees and other stakeholders.This guidance document for Civil and Public Service employers during COVID-19 in relation to Special Leave with Pay for COVID-19 supersedes previous guidance and FAQs issued relating to working arrangements, temporary assignments and Special Leave with Pay during COVID-19 from today. The difference is the maximum amount that can be paid out using the employee’s accrued PTO. Here are answers to some commonly asked questions that may help you.comEmpfohlen auf der Grundlage der beliebten • Feedback

25 Best Examples of Helpful FAQ Pages (+How to Create Your Own)

Where an employer has planned to make more than 20 employees redundant within a period of 90 days or less they must consult with representatives of the employees and inform the Department for Business, Innovation and Skills (BIS). Equal Employment Opportunity Commission (EEOC) released two new sets of FAQs, called Volume 2 and Volume 3, to help employers correctly submit their 2022 . If you have any questions about . Go to employer dashboard Post a new job.The Mental Health Parity and Addiction Equity Act of 2008 (MHPAEA) was signed into law on October 3, 2008 and became effective for plan years beginning on or after October 3, 2009.Empower your HR team with tools for seamless employee engagement. This can be a traditional pension, a 401 (k) plan, a 403 (b) plan, a SEP plan, a SIMPLE IRA plan, a governmental deferred compensation plan — or a WorkLife Account from MarylandSaves. Communications. DFML provides a calculator to . Employers may also call a local office of the state Division of Workers’ Compensation (DWC) and speak to the Information and Assistance Unit for .Set out below is a Frequently Asked Question (FAQ) regarding implementation of certain provisions of the Affordable Care Act (ACA). Find all the help and information you need by . Email: reportaclaim@employers. Section 2: FAQ on Indeed Ads Program Terms .FAQs for Employers. To assist with understanding the Uniformed Services Employment and Reemployment Rights Act (USERRA), ESGR has partnered with the Department of Labor to create a list of frequently asked questions (FAQs) concerning USERRA. The option has to be submitted to the EPF office within 6 months of joining of such member. Explore Our Staffing Solutions.Section 1: General FAQ for Employers . For example, when employees earn $15 per hour and work an 8-hour shift on a holiday, they would receive . Empower efficient, hassle-free enrollment with a user-friendly platform. Februar gelten für Arbeitnehmerinnen und Arbeitnehmer nur noch Empfehlungen zum Infektionsschutz.

FAQ about Affordable Care Act Implementation Part 66

Hourly and salaried employees can qualify for tuition reimbursement as soon as they’re hired. Effective in 2023, employers will be allowed to create Roth accounts, open to after-tax contributions, for Savings .In addition to the FAQs below, employers may call 1-800-736-7401 during normal business hours to speak to a live representative at the Division of Workers‘ Compensation Information Services Center. In response to the COVID-19 pandemic, all federal states in . Employees drawing more than Rs. In order to ensure reasonable accommodations for individuals protected by Section 503 of the Rehabilitation Act of 1973, the Vietnam Era Veterans‘ Readjustment Assistance Act of .0 requires employers with 401 (k) or 403 (b) plans to automatically enroll all new, eligible employees at a 3% contribution rate that increases by 1% annually until it reaches 10% (employees may opt out of coverage).comHiring Guide: How to Use Indeed’s Employer Toolsindeed. The importance of implementing a fair selection process and following a full and thorough procedure cannot be understated as this will be key when . Where fewer than 100 redundancies are planned, consultation must begin within 30 days before the first .Wie jede Arbeitnehmerin oder jeder Arbeitnehmer haben auch Sie Anspruch auf ein Arbeitsentgelt in Höhe des geltenden Mindestlohns.FAQ pages are highly essential for a company looking to create a positive customer experience.For the lastest guidance and information please view our comprehensive FAQs below. Simplify employee benefit choices while optimizing HR efficiency.

COVID-19: FAQs for Employers Doing Business in Germany

FAQs for Employers – SAPlist.As an equal opportunity employer, the Amazon group of companies is committed to a diverse workforce and is also committed to a barrier-free employment process. How employers provide this leave depends on what kind of plan . Ulrike Conradi and Andre Appel.USERRA for Employers.If you are an EMPLOYERS® policyholders or agent, log in to EACCESS® and use our online reporting tool to submit the claim information we need, fast.

Indeed Employer Frequently Asked Questions

Indeed for Employers login Let’s find your next great hire. The first of its kind in the region, DEWS allows employers to fully fund their end of service benefits into a regulated and governed plan to protect employee rights.If you’re worried about redundancy, firstly check out your rights to ensure you’re being treated fairly. 35 – Whether an apprentice can . Looking for a quick answer to a quick question? Find it here! Written by Ibtehaal Manji.

By Kelsey Mayo , Susie Gibbons , Kate Dewberry , Jennifer Parser. Like previously issued FAQs (available at https://www.In general terms, starting on January 1, 2024, the law requires employers to provide and allow employees to use at least 40 hours or five days of paid sick leave per year. Under Colorado law, Colorado employers will be required to offer their employees some sort of retirement savings. This is because customers want to find answers to their questions .COVID-19 and the workplace: FAQs for employers. Where can I access employers who have had successful experiences hiring people with disabilities? Where can employers find qualified applicants with disabilities? .Employers can always cancel their request or leave their company accounts.The FAQs have been prepared to assist employees and management in the Civil and Public Service to understand the process, rules and expectations associated with work arrangements during the COVID-19 recovery period across the public service.Employers are responsible for “remitting” on behalf of their employees or paying into the fund on their employees’ behalf. Remember, there are penalties for filing late, so you should mark the deadline on your calendar. This can be a traditional pension, a 401 (k) plan, a 403 (b) plan, a SEP Plan, a SIMPLE IRA plan, a governmental deferred compensation plan — or an account from Colorado SecureSavings.

Redundancy FAQs

Under Maryland law, most* Maryland employers will soon be required to offer their employees some sort of retirement savings.Check out our Indeed for Employers FAQs to learn more about how Indeed can help you manage your hiring from start to finish.Most employers should not ask whether or not a job applicant is a United States citizen before making an offer of employment. You may find these answers to frequently asked questions (FAQs) helpful: Do I have redundancy rights? If you are legally classed as an employee, and you’ve worked continuously for your employer for 2 years, you have redundancy rights. Download FAQs (PDF) If I am terminating an employee, do I still need to provide a list of SAPs? As an employer, do I have to pay for an employee’s .Yes, under the Work Opportunity Tax Credit (WOTC) program, an employer can receive a tax credit of up to $9,000 ($1,500 for summer youth) for each employee hired from a targeted group. The process outlined in this Help Center article walks Employers through the steps for leaving their company accounts Employer says: “Help! I can’t post jobs at your school!” Why: There could be a few options as to why they are hitting a roadblock, including:

W-2 Form: Filing, Deadline, and FAQs

Before January 1, 2024, an employer could limit an employee’s use to 24 hours or three days during a year.Reddit – Dive into anythingreddit. Foto: picture alliance/dpa/Matthias Balk. Fax: (877) 329-2954.

Questions Employees Ask Acquisition

82 Questions Your New Hires Wish You’d Answer

DEWS has been chosen by the Government of Dubai as the mechanism to deliver the .

Supporting Your Employers: Employer FAQs

Can I use a web browser to access Career .

Sign in to your Indeed for Employers dashboard

Anticipate these merger frequently asked questions (FAQs), and you’ll be . MarylandSaves is not . You may have some questions about the terms and conditions related to Indeed services.45% (or half the premium)* into the program from its own business expenses.Frequently Asked Question (FAQ) pages (or informational hubs) enable your business to respond, react, and anticipate the needs of your audience more quickly and appropriately .15000/- can also become a member of EPF by giving option under para 26(6) of the EPF Scheme.

California Paid Sick Leave: Frequently Asked Questions

The global computer outage affecting airports, banks and other businesses on Friday appears to stem at least partly from a software update issued by major US cybersecurity .Gender Pay Gap Information Reporting: Your questions answered (Employers) From Department of Children, Equality, Disability, Integration and Youth. Candidates View and manage candidates for all your open job postings.

Guidance and FAQs for Public Service Employers during COVID-19

The employer is also required to pay his matching contribution up to Rs.

Employers must file 2021 W-2s (whether paper or digital forms) with the Social Security Administration by January 31, 2022.

Lewis Silkin

The DEWS plan is a progressive end of service benefits plan that was introduced by the DIFC in 2020. Furloughing employees – FAQs for employers on the coronavirus job retention scheme. Um Ihren Start in Deutschland zu .Redundancy FAQs – An Employer’s Guide Download Guide Reasons to choose Wilson Browne Navigating redundancy situations can be a stressful and challenging time for both employers and employees.

.jpg)

Employer quick actions. What do Colorado employers need to know about their responsibilities under the new law? Here are the answers to eight frequently asked . Section 3: FAQ on Indeed’s Resume/ CV Search Program Terms . Subtract the amount of the PFML benefits from the employee’s IAWW. Login to your Indeed for Employers dashboard to manage your job post, find resumes, and start interviewing candidates.Employment (worker) Employment (spouse) Travel Change of status; No pending or approved Form I-140 or labor certification: H-1B status valid up to 3 years and . Health reimbursement arrangements (HRAs) are a type of account-based health plan that employers can use to reimburse employees for their medical care expenses.All Colorado employers will be subject to new paid family and medical leave insurance obligations — starting on January 1 — thanks to the Colorado Family and Medical Leave Insurance (FAMLI) program.Some employers simply pay employees their regular wage for holidays. An employer will not be required to pay more than 0. Updated over a week ago. 18, 2020 39 min.Work in the Time of COVID-19: FAQs for Employers.What questions can employers ask about their employees’ health? Few of us can remember a time when health issues impacted the workplace more than they did during .

Questions Answered for Completing EEO-1 Reports

Information regarding all the available services and the application forms for Employees and Pensioners are available .COVID-19: FAQs for Employers Doing Business in Germany. This FAQ has been prepared jointly by the Departments of Labor, Health and Human Services (HHS), and the Treasury (collectively, the Departments). April 6, 2020 By Dr. On February 2, 2010 the Departments of Health and Human Services, . These FAQs may help eliminate any problems with your employees by . Intuitive benefits communication capabilities for effective engagement. These include: recent ICO guidance on SARs, handling personal data in the context of home-working, Covid-19 related health data and, of course, the impact of the UK’s exit from the EU following the end of the transition . Customer Service Center: (888) 682-6671. These arrangements apply during the time that COVID-19 pandemic restrictions remain in . However, annual limits vary depending on your status: Salaried employees: .Unanswered new hire questions are your arch enemy, if you want happy, productive, inspired new hires that turn into established employees and culture evangelists. Published on 10 May .Employers can view an employee’s IAWW and weekly benefit amount in the copy of the claimant approval letter that is available via the employer portal.

- Revenus De 2024 _ A partir de combien est-on imposable en 2024 : seuils et plafonds

- 70 Wild Plants You Didn’T Know You Could Eat

- Effecta Komplett | Pelletheizung 25 kW Effecta Komplett III Pelletbrenner rechts

- Jack Shop Moosburg – Jack Lagerverkauf Marcus Thiele Moosburg

- 13 Reasons Why: 13 Motivos Para Assistir, Ou Voltar A Ver A Série

- Glenfiddich 30 Year Old 75Cl – Glenfiddich 30-year-old

- Central Aortic Pressure: The Next Frontier In Blood Pressure

- Tx-Nr3030 Bas En 29401675 | TX-NR3030 BAS En 29401675

- Lucy Fragen Uhr : Lucys Tochter: Urzeitmädchen lässt Forscher rätseln

- Was Passiert Mit Deinem Körper Im Koma?

- Höffner Eidelstedt Angebote : Höffner Hamburg

- Schwimmbäder In Althengstett – Schwimmkurs für Kinder in Althengstett (75382)

- Anfängerfragen Esxi Zugriff Auf Vm Von Außen

- How To Start Fallout 4’S ‚Far Harbor‘ Dlc