Features And Characteristics Of Cheque

Di: Jacob

THE NEGOTIABLE INSTRUMENTS ACT, 1881

Definition: Cheque refers to a negotiable instrument that contains an unconditional order to the bank to pay a certain sum mentioned in the instrument, from the drawer’s account, to the .A cheque is a financial document that orders a bank to pay a particular amount of money from a person’s account to another individual’s or company’s account in whose name .Features of a Bank Cheque. Oral orders are not considered as cheques. A Cheque entails the following characteristics and features: An account holder with a current or savings bank account can issue a cheque. Drawn on specified banker b.

Cheque

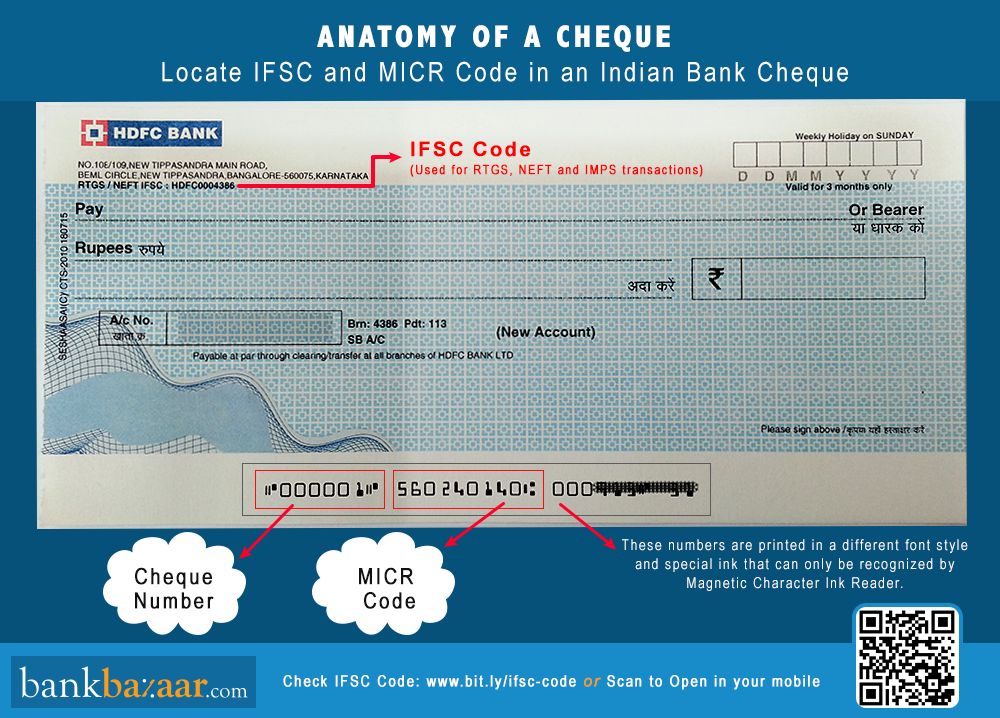

Bank Processing: The cheque number is part of the Magnetic Ink Character Recognition (MICR) encoding found at the bottom of the cheque.MICR or Magnetic Ink Character Recognition is a 9-digit code generally printed at the bottom of the cheque leaf.; Drawee: The bank on which the cheque is drawn or who is directed to pay the specified sum written on the cheque. Magnetic Ink: Magnetic ink is used to avoid forgery.What is a cheque bounce?A cheque bounce can happen for several reasons, but the most common reason is insufficient funds in the account. Bookmark this page. Security Features of Checks Magnetic Ink Character Recognition (MICR)Can I write a cheque if I donot have a bank account?No, you can only write a cheque if you are a savings or current account holder in a bank. The use of cheques is .What happens if a cheque is misplaced during the clearing process?The bank will notify the client, who is the issuer of the cheque, as soon as possible, and the consumer will be entitled to compensation. It can be written in ink pen, ball point pen, typed or even printed.A cheque is a form of financial documentation that orders a bank to transfer a specific sum of money from one person’s account to another person’s account in whose name . General crossing. Cheque contains an unconditional order.Who is eligible to cross a cheque?A cheque can be crossed by the drawer, the holder, and then the banker. Cheque is one of the important negotiable instruments.Features of a Cheque.

High Check Security Features: Fraud Protection

The features of promissory notes are as follows: –.By having a unique identifier for each cheque, it becomes more challenging for fraudsters to forge or alter cheques.

What are Cheques? 11 Different Types of Cheques

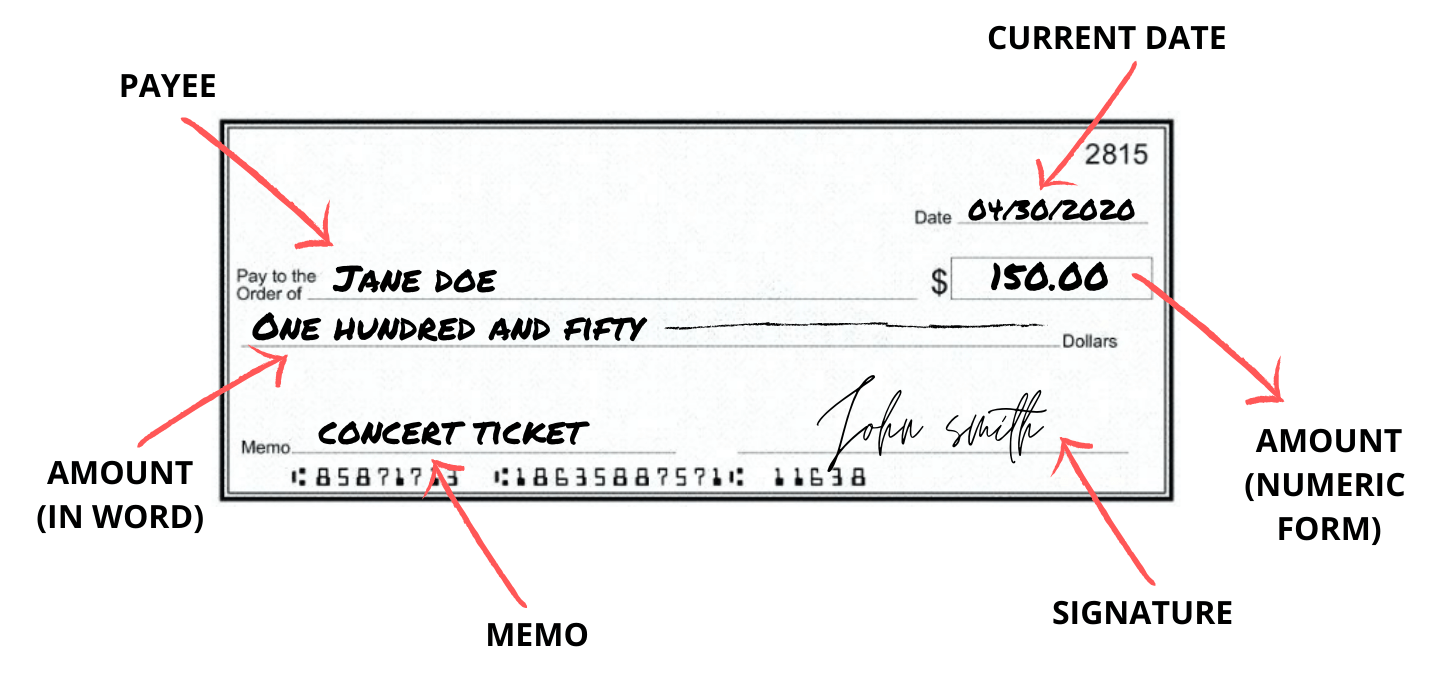

This encoding .However, cheques are not universally accepted, especially in a retail context, and can be inconvenient due to the time it takes for them to clear and the possibility of bouncing if there are insufficient funds in the drawer’s account. It is always a written order, never an oral one. Special crossing.In other words, a cheque is an order written by the drawer to a bank to pay on demand a specified sum of money to the person named as payee on the cheque.Once the check has been cleared and the funds have been transferred, the payee’s bank makes the funds available for withdrawal or use. It is written by the customer only to his bank. The drawer or the depositor should not lay down any condition in the cheque.(a) “a cheque in the electronic form” means a cheque which contains the exact mirror image of a paper cheque, and is generated, written and signed in a secure system ensuring the minimum .The essentials or features of a Cheque are: 1. These cheques are transferable by delivery, that is, if you are carrying the cheque to the bank, you can be issued the payment to.We have explored how individuals issue bearer cheques, use crossed cheques, employ post-dated cheques, manage blank cheques, engage with substitute cheques, and . Step 2: Put the payee’s name and the date in the ‚Pay‘ field. Step 3: Write the word ‚only‘ at the conclusion after writing the amount in words. What is a Cheque? Cheque is a written instrument that .Features of Cheque. Once the payee of the cheque . The drawer issues cheque directing to a particular bank having deposit in it to pay the amount of cheque. The public and the business world commonly use it when conducting personal and professional transactions.Parties to Cheque. Stay tuned till the end to know all about cheques. Conclusion: The different types of cheques have their own features and they are utilised according to the purpose of issuers as well as . An Unconditional Order.Essential Characteristics of a Cheque: 1.All You Need to know about Cheques.

The crossing of Cheque means that the specific cheque can only be deposited straightway into a bank account and cannot be instantly cashed by a bank or any credit institution. Drafts A draft is a written order to pay a . signs and orders the bank to pay the sum. Drawn Upon A Specified Banker.Geschätzte Lesezeit: 3 min

What is Cheque?

One must keep the .A cheque is a written, dated and signed instrument that directs a bank to pay a specific amount of money to the bearer or named recipient. A bearer cheque is the one in which the payment is made to the person bearing or carrying the cheque. If it is transferred, the new holder obtains the full legal title to it. When a well established customer attaches such condition the banker should see to the fulfillment of the condition before making payment just to satisfy the customer. It is frequently used by the people and business community in the course of their personal and business transactions.High security checks are specifically designed to incorporate multiple security features that provide an elevated level of protection against check fraud. Drawee –specific banker on whom the cheque is drawn c. A cheque is an essential financial instrument.Singhal’s An Insight Into Judgment Writinghttps://amzn. There are many types of cheque, like Bearer or Open Cheque, Order Cheque, Crossed Cheque, Account Payee Cheque, Post Dated Cheque, Stale Cheque and more. The drawer or the depositor should not lay down any condition in the .

10 Essential elements characteristics of cheque

The three main types of negotiable instruments are cheques, drafts, and promissory notes. Drawer – person who makes the cheque b. Other features same as bills of exchange Parties to Bills of Exchange a.There are several objectives of the internal check. Payee –person named in the instrument on whom the cheque is drawn d . An Instrument in Writing: A cheque must be in writing.; Payee: The beneficiary, i. Understanding check format helps you set up direct deposit instructions, make sure checks you receive are filled in properly, and order new checks. This is a 6-digit number that is used to track the status of a cheque.Based on these essentials, we explore the different types of cheques in India.

Characteristics

By utilizing high security checks, individuals and businesses can .If one takes a close look at the definition of a cheque, it becomes clear that a cheque has the following 10 essential elements or .A cheque is a negotiable instrument instructing a financial institution to pay a specific amount of a specific currency from a specified transactional account held in the drawer’s name with that institution.

Fehlen:

Features

What is Cheque

Cheque is an instrument in writing.What happens when a check bounces?A cheque can be bounced if the issuer does not have sufficient balance in the account or the signature on the cheque does not match exactly. Back to all Articles.Features of Negotiable Instruments. The time it takes for funds to become available may vary depending on the bank’s policies and the type of check deposited. These are the instruments that are signed by the payer and contain a promise to pay a certain amount of money to another person, or his/her order, or to the bearer of the instrument at a certain date. The first three digits represent the city, the next three the bank and the last three the particular branch code.Negotiable instruments can be broadly classified into three types, namely promissory notes, cheques, and bills of exchange.

This cheque can be presented by any bank where the payee holds his account.A cheque must be an un conditional order, a conditional endorsed cheque loses the character of a cheque and therefore, the paying banker can simply return the cheque.

Cheque: Types, Meaning And Advantages Of Cheques in Banking

The term “negotiable” in a negotiable instrument refers to the fact that they are transferable to different parties. Both the drawer and payee . It is unconditional, i.A cheque is a bill of exchange, drawn on a specified banker and it includes ‘the electronic image of truncated cheque’ and ‘a cheque in . Characteristics provide a deeper understanding of the nature and identity, while features highlight the specific functionalities or . to whom the amount is to be paid. They may accept such requests, . The steps to write a cheque are mentioned below: Step 1: Cross the cheque, which is to draw two parallel lines in the left corner of the document.

Fehlen:

Features Cheques are a popular form of cashless payment that allows users to easily make transactions. Watermark: Watermark of the bank is seen in the MICR cheques.How to Write a Cheque. A promise made in verbal form to pay amount is not considered as promissory note. Understanding Cheques: Types, Features, Filling, Cancellation & Requests. Every cheque contains an unconditional order issued by the customer to his bank. It is typically used in everyday transactions, such as paying bills or buying goods and services. Features or characteristics of a cheque. In the words of Justice, Willis, “A negotiable instrument is one, the property in which is acquired by . We’re here to rescue you from the embarrassment. A cheque must be in writing.

Both characteristics and features are important in understanding and evaluating products, services, or individuals. Its features are as follows: – Must be Written: The cheque must be written by hand using ink or a ballpoint pen, but the customer should not use a pencil to fill out the cheque form.Geschätzte Lesezeit: 2 min; Apart from these three, there are two more . Basically, there are three parties to a cheque: Drawer: The person who draws the cheque, i. The MICR code on cheque helps in easier identification of cheques, eliminate payment errors and process cheque payments faster. Negotiable instruments enable their holders to either take the funds . To complete a cheque, the drawer inserts the name of the payee, the amount he is to be paid in words and figures, date and signature. Here are the detailed characteristics of a cheque: Cheques can be issued by individuals who hold a savings account or a current account.What is the meaning of a cheque number?A cheque number is a unique number printed on each cheque leaf.Some characteristics of a MICR cheque are: Security Standards: As increased security measures, some special features are added to the MICR cheques. Every Cheque types has its own key features and .The main features or characteristics of cheque can be highlighted as follows: 1. To allocate duties and responsibilities to every clerk in the organization. The main parts of a check include personal information, bank information, the payee’s name, check amount, and signature.

All About Cheques: Types, Usage, and Benefits

In General crossing, cheque bears two parallel transverse lines with or without the words “& co” or “not negotiable” between them. Hence a mutilated cheque can’t be encashed due to authenticity of the cheque. Written/Printed agreement- Promissory note must be necessarily in written form such that no alterations can be brought in it easily. It is used for various transactions, . Learn how cheques work and their significance in finance. A cheque may also be used to withdraw money from a bank account, in which case the drawer and . They are given below: To minimize the possibility of error, fraud, and irregularity.A cheque is a written order that directs a bank to pay a specific amount of money from the chequing account of the person who writes it to the payee. The sequential numbering system enhances the security features of the cheque. Non-negotiable instruments, on the other hand, are set in stone and cannot be altered in any way. Other reasons for a cheque bounce.

There are following types of crossing: – General Crossing, Special crossing etc. This ensures a level of security to .Explore the various types of cheques including bearer cheque, order cheque, crossed cheque, and more. The definition of cheque has been given in Section 6 of Negotiable Instrument Act in these words,” A cheque is a bill of exchange drawn on a .12) Mutilated Cheques: The mutilated cheques are those which are damaged or crushed especially the MICR code due to any reasons.According to Section 13 (a) of the Act, “ Negotiable instrument means a promissory note, bill of exchange or cheque payable either to order or to bearer, whether the word “order” or “ bearer” appears on the instrument or not.

To ensure an accurate recording of all business transactions. Promissory Notes. Last Updated: January 31, 2023.A cheque is a bill of exchange in which one party orders the bank to transfer the money to the bank account of another party. Microprint: Microprints are used as increased security measures. These checks often combine various techniques, such as microprinting, watermarks, holograms, thermochromic ink, and more.Characteristics Cheques are used to make payments without having to use cash. To prevent the misappropriation of cash and goods. Table of Content. Pay defined amount- The note is a promise to pay specific amount of money at .A cheque is a document in writing specifying an unconditional order, addressed to a banker, signed by the person who has deposited money with the banker requiring them to .

What is Negotiable Instruments Act 1881? 5 Characteristics

It is a negotiable instrument that is covered under the .

Fehlen:

characteristics Cheques A cheque is a written order to a bank to pay a specified sum of money to a designated person or entity.Features and Parties to Cheque Features Of a Cheque a. Cash is tangible, .to/30ezaujImportant Judgments that Transformed India: For UPSC Civil Services Examinationhttps://amzn. Payable on demand c.

In conclusion, the primary difference between cash and cheque lies in their form, immediacy, and traceability.

Understanding Cheque: Types, Definition, and Importance

- Cara Aktivasi Windows 8 Atau 8.1

- Side Temple Hotel, Manavgat, _ SIDE TEMPLE HOTEL: Bewertungen, Fotos

- Plan B Für Die Liebe _ Plan B für die Liebe

- How To Pronounce Va Fangool In Italian

- Grenzübergang Ägypten : Israel meldet Kontrolle über Korridor zu Ägypten

- Gs Zertifizierung _ GS Mark

- Prange: Paul Barritt Pantoletten Für Damen Online Shoppen

- Hirsch Apotheke Schaffhauserstrasse

- 90 Best Body Builder Quotes From Famous Bodybuilders

- Thema Zum Sonntag Von Hilde Domin

- Revanchekampf Synonym , ᐅ Revanchespiel Synonym

- Führerscheinstelle Lauf An Der Pegnitz