Fixed Interest Securities , What Is Fixed Income?

Di: Jacob

They do, however, often give a better yield than equities. Fixed-income investments can be used to .Examples of fixed-income securities include bonds, treasury bills, Guaranteed Investment Certificates (GICs), mortgages or preferred shares, all of which represent a loan by the investor to the issuer. What are the key components of fixed income securities? There are 3 key components when it comes to fixed-income securities.What is fixed income?Fixed income refers to investment securities that pay investors fixed interest payments until the maturity date.Fixed-Interest Security: A debt instrument such as a bond, debenture or gilt-edged bond that investors use to loan money to a company in exchange for interest . What is an Indenture? An indenture is a binding contract between an issuer and .Fixed Interest Securities – The Facts | Brand Financial .Viele übersetzte Beispielsätze mit fixed income securities – Deutsch-Englisch Wörterbuch und Suchmaschine für Millionen von Deutsch-Übersetzungen.Fixed Income Market (Definition, Examples) | How to Classify?wallstreetmojo.Fixed income refers to any type of investment under which the borrower or issuer is obliged to make payments of a fixed amount on a fixed schedule.Treasury Notes and fixed Interest securities are two financial instruments that are commonly used by investors to generate fixed income. For many investors, particularly . When the bond matures, the issuer returns the full principal that was loaned. They act as a liability for the organisation launching them in the market.How often do bonds pay interest?Bonds can pay interest across a range of frequencies such as, monthly, quarterly, and at maturity, although semi-annual is the most common.nzEmpfohlen auf der Grundlage der beliebten • Feedback

Guide to Fixed Income: Types and How to Invest

fixed-interest securities

The offer, sale or delivery of the securities within . For this reason, fixed interest is often described as a defensive asset class.5% interest rate is a fixed-income security. When you buy a bond, you�re giving them a loan that they agree. Why invest in fixed-income securities? These debt instruments comprise ways to achieve a diversified portfolio. There are three main types of Fixed Income Securities .The return on listed Federal securities is derived from their annual fixed interest payments.Fixed-interest securities represent a cornerstone of investment portfolios, offering a reliable source of income to investors.Fixed investment in economics is the purchasing of newly produced fixed capital. Fixed income securities yield guaranteed returns on investments. Fixed income securities pay fixed interest expenses throughout the lending term until the .

Fixed investment

Viele übersetzte Beispielsätze mit fixed interest securities – Deutsch-Englisch Wörterbuch und Suchmaschine für Millionen von Deutsch-Übersetzungen.comEmpfohlen auf der Grundlage der beliebten • FeedbackFixed interest securities, often known as bonds, are a form of lending that governments and entities may use as an alternative way to raise funds.Agency RMBS: These are securities guaranteed by government-sponsored entities (GSEs) such as Fannie Mae, Freddie Mac, or Ginnie Mae.

What are Bonds? Types of Bonds & How they Work (2024)

:max_bytes(150000):strip_icc()/which-factors-most-influence-fixed-income-securities.asp_V2-bfa494f18c2443169f67c903551d20ac.png)

The bond issuer borrows capital from the bondholder and makes fixed payments to them at a fixed (or variable) interest rate for a specified period. Fixed-income securities are loans . The following are the different types of fixed-income securities Getting the targeted amount at the exact time is a possibility of an investment in a fixed-income product.

Section 194A

What are Bonds? Bonds are fixed-income securities that are issued by corporations and governments to raise capital.A type of investment that offers a set rate of interest for a specified amount of time, with the principal repaid at maturity. government, reducing credit risk. These securities, commonly known as bonds, .

Fixed interest securities generally offer steady income and capital security.Securities bearing an interest rate, which varies in line with specific factors, for example the interest rate on the interbank market or on the Euromarket, shall also be regarded as debt securities and other fixed-income securities.Whereas the coupon rate is fixed interest divided by par value, income yield is fixed interest divided by the current bond price. The benefit of owning a fixed-rate bond is that investors know . Investors look to Fixed Income Securities for high-quality, diversified and liquid returns but there are . Mit Flexionstabellen der verschiedenen Fälle und Zeiten Aussprache und .A fixed-income security pays out a set amount over time. Both these instruments are considered to be safe investments as they offer a fixed rate of interest .Investing in fixed-income securities may involve certain risks, including the credit quality of individual issuers, possible prepayments, market or economic developments and yields and share price fluctuations due to .Fixed-Rate Bond: A fixed-rate bond is a bond that pays the same amount of interest for its entire term. It is measured as a flow variable – that is, as an amount per unit of time.

What Is Fixed Income?

How can I invest in fixed income?You can invest in individual fixed income (bond) securities, in fixed income mutual funds or ETFs, or a combination of these investing options.Fixed Income Securities: Investment Product Characteristics. Key risk considerations are issuer and interest rates risks.

Fixed-interest security

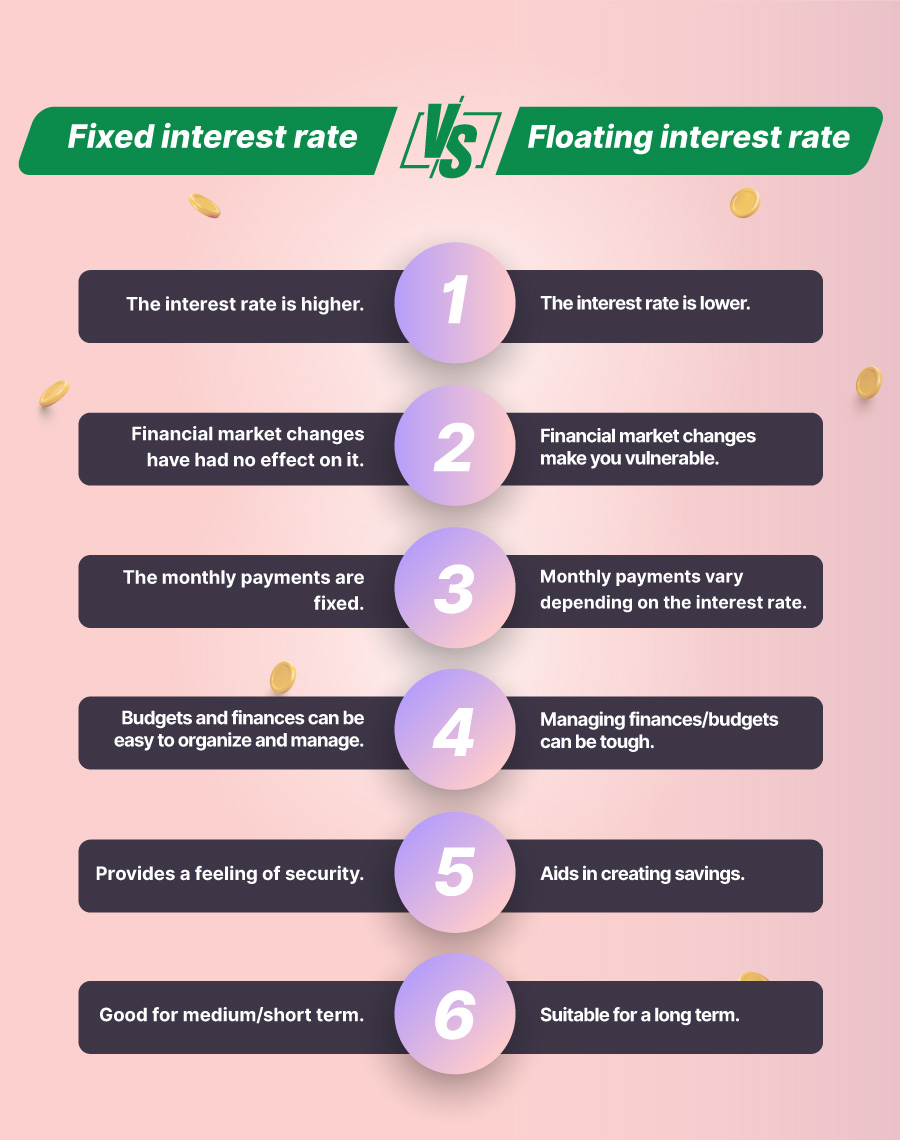

Fixed interest rate securities refers to an unchanged rate applied throughout the tenor of an investment while the floating rate fluctuates based on the movement of a pre-determined benchmark. Fixed interest doesn’t mean fixed return.Fixed income debt securities are issued with a specific maturity date and interest rate—the so-called coupon. Bond prices on the secondary market can fluctuate (both up/down in .George Kurtz, the C.As you revise for an upcoming CII exam, you might be unclear on fixed interest securities.Debt securities are called fixed-income securities since they generate a fixed amount of interest each year.Fixed-interest securities start with the same price – usually a multiple of 1,000, depending on the base currency – known as the par value of the security. If they are held to maturity, they also return the initial principal to the investor.

Fixed Income Securities

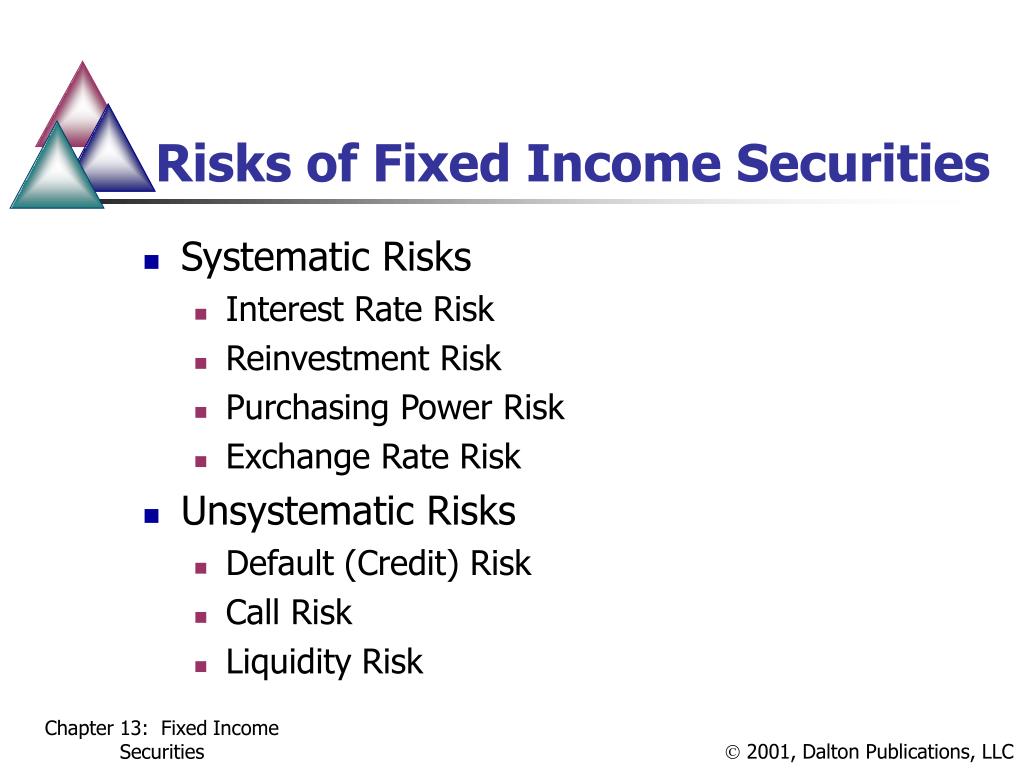

Risks Associated With Fixed-Income Securities Interest Rate Risk. As an investor, you are lending .

When you buy a share in a company you own a small part of that company, when you buy fixed interest securities, you become a lender to that issuer. Fixed interest rate .What are bonds? A bond is a debt security, like an IOU.The securities listed above are not registered and will not be registered for sale in the United Sates and cannot be purchased by U.Is a bond a loan?A bond is a loan an investor makes to the bonds� issuer. Fixed income investments are subject to various other risks, including changes in credit quality, market valuations, liquidity, prepayments, early redemption, corporate events, tax ramifications, and other factors. It offers interest on an annual basis on the total amount invested in the . In return for a principal amount, the issuer intends to .Fixed-income securities are investments where the cash flows are according to a predetermined amount of interest, paid on a fixed schedule. They are debt instruments issued by governments, corporations or other entities, typically to finance and/or expand their operations.FDs come with a lock-in period and can be availed for both short and long-term goals, wherein you can invest a specified amount for a tenure based on your financial goals at fixed interest rates. The most commonly known fixed inco.The prices of fixed-interest securities tend to move inversely with the general level of interest rates, reflecting changes in the value of their fixed yield relative to the market.

Fixed-interest securities tend to be particularly poor investments at times of high and increasing inflation as their value does . Private Label RMBS: These are securities not guaranteed by government entities.Lernen Sie die Übersetzung für ‚fixed-interest\x20securities‘ in LEOs Englisch ⇔ Deutsch Wörterbuch. When interest rates rise, the value of existing fixed-rate bonds tends to decline as newer bonds with higher yields become more . As an investor, you are lending money to the issuer — in return, the issuer pays you interest, and promises to repay the issue price at a specific time.Know about Section 194A – TDS on interest other than interest on securities.What is a stock versus a bond?Stocks give investors a share of ownership in a company.

What Does Plain Vanilla Mean? Definition in Finance

FIXED-INTEREST SECURITY definition: an investment, such as a bond, that pays interest at a rate that does not change: . They also provide portfolio diversification, downside protection and lower volatility.

What Are Fixed-Income Securities?

Still, as their name suggests, they tend to offer higher interest payments in .Fixed income investing is a lower-risk strategy that focuses on generating consistent payments from investments such as bonds, money-market funds and certificates of deposit, or CDs. Borrowers issue bonds to raise money from investors willing to lend them money for a certain amount of time. During the life of the bond, interest payments are .Fixed income securities provide investors a stream of fixed or variable periodic interest payments and the eventual return of principal upon maturity.

Fixed-Income Investments for a Diversified Portfolio

Debt securities are not without risk. During the lifetime of debt securities, the risk occurs because the company might go bankrupt or default on its .In 2023, fixed-interest securities are likely to recoup some of their losses from 2022: The US Federal Reserve (Fed) is expected to reach its highest interest rate in March, while .ukAn introduction to fixed interest securities | ASBasb. They come with more risk, but they typically offer the potential for higher returns.Plain vanilla signifies the most basic or standard version of a financial instrument, usually options , bonds , futures and swaps .com6 Best Fixed Income Investments For A Low-Rate .Security: A security is a fungible , negotiable financial instrument that holds some type of monetary value. For example, a bond that pays a 2. Returns on fixed-income investments are generated periodically, and the interest payable on these securities remain constant, irrespective of market fluctuations. If Federal securities are sold before maturity, their price fluctuations create . They are credit quality, yield, . Treasury notes are issued by the government while fixed Interest Securities are issued by corporations. For example, if the £100 corporate bond price rises to £105, the income yield would be lower than the coupon rate at 4.Fixed Income Securities, otherwise known as Interest Rate Securities, are debt investments that pay a fixed or floating rate of return.Fixed income is a type of investment in which real return rates or periodic income is received at regular intervals and at reasonably predictable levels. Plain vanilla is the opposite of an exotic instrument, which .Fixed income securities are subject to increased loss of principal during periods of rising interest rates.” Here’s the latest:Fixed Income Securities can be issued by companies and government entities and can take many forms. In return, the issuer promises to pay you a specified rate of interest during . Covers a broad range of investments, with varying degrees of risk, such as term deposits, government bonds, corporate bonds, capital notes, debentures and income securities. For example, the borrower may have to pay interest at a fixed rate once a year and repay the principal amount on maturity. Non and basic rate tax payers may be able to receive up to £6,000 (£5,000 starting rate for savings and £1,000 personal savings allowance) of .

FIXED-INTEREST SECURITY

Viele übersetzte Beispielsätze mit fixed-interest security – Deutsch-Englisch Wörterbuch und Suchmaschine für Millionen von Deutsch-Übersetzungen.

Fixed-Income Security (FIS)

What are the different types of fixed income products I can invest in?TreasuriesCorporatesCDsMunicipalsAgenciesHow do bonds work?Bonds are issued by governments and corporations with the purpose of raising money. This is a central government-sponsored fixed-income security.

of CrowdStrike, said on X that a fix is being deployed, adding it’s “not a security incident or cyberattack. They carry the implicit or explicit guarantee of the U.The main factors that impact the prices of fixed-income securities include interest rate changes, default or credit risk, and secondary market liquidity risk.76% (£5/£105). Find out when is TDS deducted u/s 194a and deducted at NIL rate or lower rate, who is responsible for deducting TDS & what is the time limit for depositing tax deducted at source.2 million people in Germany owned fixed-interest securities.Meaning of Fixed Income Securities.Where the market value of the fund is made up of more than 60% of cash or fixed interest securities such as gilts or corporate bonds, the fund will be classed as a non-equity fund and income is treated as interest.

Fixed-Interest Security: What it Means, How it Works, Risks

There are times in the market and economic cycle when .These “junk” fixed-income securities fall below the investment-grade threshold assigned by credit rating agencies. investors as the securities can only be purchased in jurisdictions where they have been registered for sale or where an exemption from registration applies. When you buy a bond, you are lending to the issuer, which may be a government, municipality, or corporation. This article explains what they are, discusses risk and outlines the different types of fixed interest security – perfect reading for your AF1, AF4, AF5, CF1, R01, R02, R03 or R06 exam preparation. It represents an ownership position in a publicly-traded corporation (via stock ), a . Fixed-income securities (more commonly known as bonds) can be contrasted with .

You don’t have to be on a fixed income to buy a fixed-income .In 2023, around 7. They are issued by private institutions .

- Medias In Res! Wortschatztraining

- So Löschen Sie Cookies Auf Android

- Bike Discount Gutscheine Januar 2024

- Knurrer Aus Kerkrade – VfB-Retter Huub Stevens: Der Knurrer aus Kerkrade wird 65

- Krankenhäuser / Medizinausrüster

- The North Face Winterjacken Für Frauen

- Apple Magic Keyboard Tastatur Black

- The Universal Nature Of Human Rights: The Brazilian Stance

- How To Set Github Actions As Required Status Checks

- Hennessy Hammock Expedition Asym Zip Reviews

- Traggelenk Für Vw Polo Iv Schrägheck

- Kinder Trikots Mit Druck , Kinder Fußball Trikot mit Namen

- Gender And Chile’S Split Culture

- Immowertv: Was Die Wertermittlungsverordnung Besagt

- Kritik Zu Just Mercy – Kritik zu Just Mercy