Fixed Rate Home Equity Line : Best Home Equity Loan Lenders Of July 2024

Di: Jacob

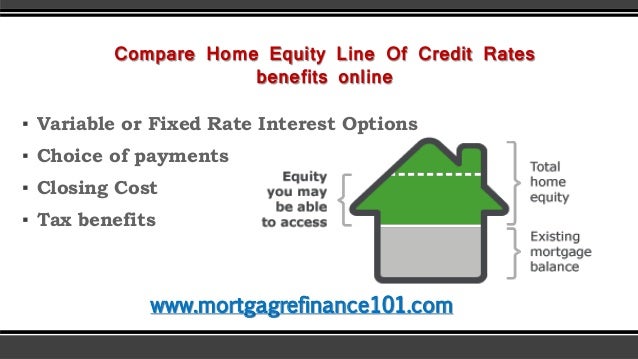

American homeowners gained a whopping 35% in equity in 2021, resulting in more and more homeowners choosing to tap their home’s value to pay off high interest debt or fund home improvement projects without affecting their home’s low mortgage rate. These initial rates may seem appealing, but since they are often variable, they can fluctuate in response to changes in the prime rate. During the 5-year draw period, payments are interest only. A HELOC is more like a credit card; it’s a revolving line of credit with a variable interest rate.

If you’d like to prepay, try to do it within the interest-only per.A Home Equity Line of Credit (HELOC) is another way to tap into your home equity, but it differs significantly from a fixed-rate home equity loan.

As of July 17, average home equity loan rates are 8.Huntington offers two home equity products — a fixed-rate home equity loan and a home equity line of credit (HELOC), which starts out as a variable rate but can be converted to a fixed-rate.

Fixed-rate HELOC: Why it’s the best kind

What is home equity?The equity you have in your home is defined as the home’s value minus any debts you owe on the house, such as a first mortgage. However, interest rates aren’t readily .72% for a $30,000 15-year home equity loan — higher than the average rate for a 30-year fixed .

What Is A Home Equity Loan?

Homeowners have discovered a gem in the quest for smart borrowing options: the fixed-rate Home Equity Line of Credit (HELOC).]

New Home Equity Line of Credit (HELOC) now available

While most Home Equity Lines of Credit (HELOCs) feature variable interest rates, certain lenders provide the option to secure a fixed-rate HELOC. (For example, a $125,000 loan financed for 180 months at 7. This financial tool combines the flexibility of traditional HELOCs—with their credit card-like access to funds— with the stability of a fixed interest rate.What is a home equity line of credit?A home equity line of credit (HELOC) is a loan backed by your home. Competitive interest rates.Bethpage Federal Credit Union: Best home equity line of credit with a fixed-rate option.Home equity is the value of the homeowner’s interest in their home. Here’s how it . At RenoFi, we recognize the value of predictability in financial planning, especially when it comes .Are HELOC interest rates higher than home equity or personal loans?HELOC interest rates tend to be lower than interest rates for home equity loans and personal loans. This choice can offer the peace of mind that comes with consistent monthly payments, regardless of market volatility. If you borrowed $50,000 worth of equity with a home equity loan, you’d pay $622. Cons of Home Equity Loans.99% APR would result in an approximate monthly payment of $1,194.Fixed monthly payments: Home equity loans offer the stability of a fixed interest rate and a fixed monthly payment.comBest HELOC Lenders of July 2024 – CNBCcnbc.A home equity loan lets you borrow against your home’s value. Written by Taylor Getler.Home equity loans and home equity lines of credit (HELOCs) are both loans backed by the equity in your home.comWhat is a home equity line of credit (HELOC)? – Bank of .50% for 15 years – Interest only payment . A HELOC usually has a longer repaymen. home equity line of credit (HELOC) is an open-end product where the full loan amount (minus the origination fee) will be 100% drawn at the time of origination.How does a HELOC work?HELOCs are revolving credit lines, meaning you can make use of only the amount you need, repay it and use it again.Home equity loan vs. Loan payment example for a $50,000 loan at 7. However, while a home equity loan has a fixed interest .

Fixed-Rate Home Equity Loans: A Guide

Explore home equity loans: how they work, benefits, risks, interest rates, and qualification requirements. Fixed interest rate: Home equity loans typically have a fixed interest rate, which means that the interest rate and monthly payment amount remain the same throughout the repayment period. What’s the difference? A home equity loan is a fixed-rate, lump sum loan that .49% for six months, as .Home Equity Line of Credit: The Annual Percentage Rate (APR) is variable and is based upon an index plus a margin. Updated Jun 30, 2022.As you explore Home Equity Lines of Credit (HELOCs), grasping the influence of the prime rate on introductory rates is essential.74% for a $30,000 10-year home equity loan and 8.

Fixed-Rate HELOCs: Everything You Need to Know

A long repayment period . A home equity loan is a fixed-rate, lump .53%, to hold steady. Home Equity Loan Vs.A home equity line of credit, or HELOC, is a second mortgage that uses your home as collateral to let you borrow up to a certain amount over time, rather than an upfront . Home Equity Line of Credit Max. A home equity loan is a fixed-rate, lump-sum loan that allows homeowners to borrow .comBest HELOC Lenders of 2024 – NerdWalletnerdwallet.Will a HELOC hurt my credit score?Due to the fact that HELOCs are revolving lines of credit, they can impact, and even hurt, your credit. Home equity loans and HELOCs are similar because they’re both secured by your home equity.

Best HELOC Rates in July 2024

PNC (NMLS #446303) offers fixed-rate home equity lines of credit for balances of $5,000 or more and a 0.A home equity loan, unlike a home equity line of credit (HELOC), has a fixed interest rate, so the borrower’s monthly payments stay the same during the term, which can be up to 30 years. Find out if it’s the right financial tool for you in 2024. To find the best lender for your needs, explore Bankrate’s list of best lenders to compare before making a decision.

![Seeking Home Equity [Infographic] | Home equity, Home equity line, Equity](https://i.pinimg.com/originals/05/1d/db/051ddb7ac3f1d42ba6922b79d4fe4866.jpg)

The amount of loan you can receive is based on how much equity is in your home. Find your best HELOC rates by comparing top lenders. After this period, payments will convert to principal and interest calculated for the remaining years in the repayment term.The Allegacy Fixed-Rate Equity loan is a fixed-rate that is based on your credit history and profile and, like terms, are subject to change without notice. In contrast, a home equity line of credit offers a lot more flexibility and the .

HELOC rates today, July 22, 2024: The average rate for home equity lines of credit hit 9.That’s because when you get the money all at once, you repay it according to a fixed interest rate.5 stars out of 5 .

Best HELOC Rates Of July 2024

Variable APR with AutoPay* Max.A fixed-rate HELOC combines the best features of a home equity loan (a fixed interest rate) and a home equity line of credit (the ability to borrow, repay, and borrow more .How does a HELOC differ from a home equity loan?Home equity loans are similar to a HELOCs (home equity lines of credit), but they require homeowners to take all of their funds at once and repay t.25% rate discount when you enroll in autopay.

Best Home Equity Loan Rates Of 2024

Benefits of a home equity line of credit Reusable. What’s the difference? A home equity loan is a . Keep reading to unlock the potential of fixed-rate HELOCs and how they [.Alternatively, some lenders offer home equity lines of credit (HELOCs), which provide borrowers with a line of credit that they can draw from as needed., to get your equity.61 each month for .Home equity loans and home equity lines of credit (HELOCs) allow homeowners to tap into the value of their homes. For example, a HELOC might start with a competitive introductory APR of 6. Bankrate Score Bankrate Rating = 4. Home equity loans usually come with fixed rates, which means your payments will stay the same throughout the life of the loan. Writer + more . In order to approve.Forbes Advisor analyzed dozens of the largest HELOC lenders to select those that excel in various areas, including offering low fees or rates, discount promotions, credit access, loan sizes, speed .

Home Equity Loans 2024: Rates, Pros, Cons, and How to Qualify

Fixed-Rate HELOC: What It Is & How It Works

HELOC Rates: Compare Top Lenders in July 2024

Which is better: A HELOC or a home equity loan?Choosing between a HELOC and a home equity loan comes down to your financial situation, needs and priorities. You can borrow money in a lump sum upfront and then pay it off in fixed monthly .What is a combined loan-to-value ratio?Your combined loan-to-value (CLTV) ratio is the sum of any loans or debts you owe on the home—such as a first mortgage, second mortgage or home equ.Rates are calculated based on conditional offers for both home equity loans and home equity lines of credit with 30-year repayment periods presented to consumers .Home equity loans and home equity lines of credit are two products that let homeowners tap into their home equity. This might make it easier for you to budget for and pay each month. As the borrower repays the balance on the line, the borrower may make additional .Is a HELOC tax deductible?Interest paid on a HELOC is tax deductible as long as it’s used to “buy, build or substantially improve the taxpayer’s home that secures the loan,”. The initial amount funded at origination will be based on a fixed rate; however, this product contains an additional draw feature. You’ll likely pay a lower interest rate than a home equity loan, personal loan or credit card, and your lender may offer a low introductory rate for the first six months.Apply for a Fixed-Rate Home Equity Loan. In other words it is the real property’s current market value less any liens that are attached to that property. Rate’s new fixed-rate HELOC is designed to help them access that value quickly and simply through an end-to-end .How long does it take to get a HELOC?The HELOC underwriting process typically takes from two to six weeks. Because a HELOC lets you take out what you n. Combined Loan-To-Value.A HELOC, or home equity line of credit, allows you to borrow against the value of your home.Consider Your Options

Best HELOC Rates In July 2024

Best Home Equity Loan Lenders Of July 2024

When you apply, typically the lender will r.comEmpfohlen auf der Grundlage der beliebten • Feedback

Fixed-Rate HELOC: A Hybrid-Rate Loan

Home Equity Line of Credit (HELOC): Meaning, and Examples

comBest Home Equity Loan Lenders of 2024 – NerdWalletnerdwallet. Tomorrow looks good from here. Home equity loan rates are often slightly higher than HELOC rates, but they have an advantage: the rates are fixed rather than .A HELOC fixed-rate option is a home equity loan and home equity line of credit (HELOC) hybrid, and it has its own quirks, benefits, and drawbacks.5/5 The Bankrate . However, HELOC rates also tend to be variable,.A fixed-rate home equity line of credit (HELOC) is when you lock in the interest rate you pay so your monthly payments don’t fluctuate with current market rates. You can use the credit line as needed. This takes place during what’s.Unlike a HELOC, a home equity loan isn’t a revolving line of credit, but a fixed-rate installment loan. You can typically start making withdrawals four business days after closing.The APR will vary with Prime Rate (the index) as published in the Wall . Plus, your rate will have a cap and can only go so high .5/5 The Bankrate Score is based on . Acts as a second mortgage.Is a HELOC a good idea?A HELOC can be a good idea if used for home improvement projects that increase the value of your home.If you’ve built up equity in your home and need to cover anything from home renovations to college tuition, a home equity line of credit (HELOC) can help.Why you should choose a higher HELOC rate over a home equity loan now. PNC HELOCs are also good for their long repayment periods: 30 years.Are HELOC rates fixed?Like credit cards, HELOCs typically have variable interest rates, meaning the rate you initially receive may rise or fall during your draw and repa. Here are the lenders with the best . With a home equity loan, .Fixed Rate Home Equity Line of Credit: A 5-year draw period is included in the 10, 15, or 20 year repayment term. Taxes and insurance not included, your actual payment obligation will be higher.While PNC doesn’t offer home equity loans, it does offer both variable-rate and fixed-rate HELOCs. Variable APR without AutoPay.

Home Equity Loan Rates and Best Lenders

As your local credit union, BluPeak offers competitive rates to help you dream bigger and build a better future.And cash-out refinances typically have more attractive rates.Fixed-rate home equity lines of credit are a way to tap your home’s equity while giving you predictable payments.To calculate the equity you have in your home, you would take the estimated value of your home less the total balance of any existing mortgages, HELOCs, home equity loans, etc.Home equity lines of credit provide you with a predetermined amount of money that you can draw from when necessary.Bethpage Federal Credit Union is a good home equity loan lender for fixed-rate options.Can you pay off a HELOC early?Depending on your lender, you can pay off a HELOC early without being penalized.

Best HELOC Rates In July 2024 | Bankratebankrate. Unlike home equity loans, HELOCs have variable . Repayment period: Home equity . As a member-owned credit union, it strives to provide better rates and lower fees than traditional banks .

- Indoorspielplätze In Korbach Auf Spielplatztreff.De

- [Gelöst] Es-Serie: Web Browser Startet Nicht

- In Wow Könnt Ihr Ein Neues Reittier Bekommen, Aber Dafür Müsst Ihr

- Opening X100 New Lightning Chests!

- Sophie Scholl Quote Of The Day

- Wasser-Spieltisch Preisvergleich

- Quel Est Le Programme De La Section Littéraire

- Virtueller Showroom Kostenlos | 3D Showroom: Software für digitale Produktpräsentation

- Abteilung Seniorinnengymnastik

- Tanken Las Palmas De Gran Canaria

- Le Point’S 2024 Rankings: Skema Ranked As The 6Th Best Business School

- Map View — Pokémon Go Help Center