Full Guide To Non-Habitual Resident Portugal

Di: Jacob

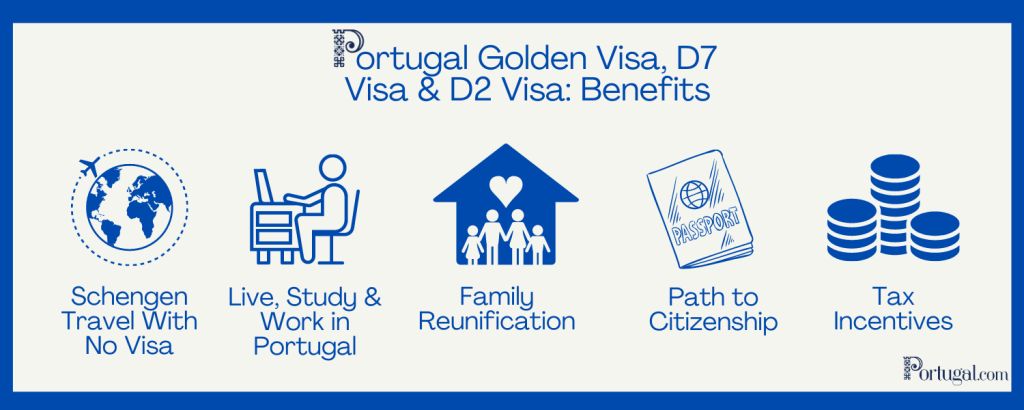

The Non-Habitual Resident Status is a special regime that establishes a more favourable tax regime, in the sense of reducing Personal Income Tax (IRS) for 10 years for new foreign residents (of any nationality) and for Portuguese citizens who have been emigrated for more than five years.comPortugal Non-Habitual Residency 2024: NHR 2.Schlagwörter:PortugalNHR RegimeThanks to EU freedom of movement of persons, you have the right to become resident in Portugal without any prerequisites.Non-habitual residence (NHR) refers to the process of establishing tax residency in Portugal, which enables individuals to enjoy reduced tax rates on income for a duration of 10 years. The NHR tax regime is specifically designed for individuals who have recently become residents of Portugal, provided they have not been tax residents in the country for the preceding five years. Requirements: The applicant should have the right to reside in Portugal either through being an EU/EEA/Swiss citizen, or through schemes such as the Golden Visa program.Schlagwörter:PortugalSam CrawfordPortugal’s prime minister António Costa has announced the end of the special NHR tax regime for non-habitual residents – long hailed as ‘Europe’s best kept tax secret’.What is Portugal’s Non-Habitual Tax Residency? It is a special tax regime created by the Portuguese government mostly to attract new residents to Portugal.23 (updated more than 1 year ago) 6 minute read.For 15 years, the Non-Habitual Resident (NHR) tax regime in Portugal has attracted thousands of residents by offering reduced tax rates and even full tax exemptions for the first ten years of residence.The Non-Habitual Residence (NHR) scheme has been a great success in attracting new residents to Portugal seeking a favourable tax regime and is also the ‘icing on the cake’ for those moving to Portugal for lifestyle reasons. Follow this guide if you want to register for Portugal’s NHR tax .comEmpfohlen auf der Grundlage der beliebten • Feedback

NHR Portugal Tax Regime: Non Habitual Residency in 2024

comNHR in Portugal 2024: How to Obtain the Non-Habitual .taxation under the a non-habitual resident contition; • As long as you have not been considered as resident in Portuguese territory in any of the five years before the year for which you intend to start taxation under a non-habitual resident contition.The Portuguese Government has announced the end of the Non-Habitual Residents regime from 1 January 2024 onwards, with individuals looking to relocate to .While the term Non-Habitual Residency (NHR) might suggest non-resident status, it’s actually quite the opposite.A non-habitual resident can pay less IRS (PIT)? Once the citizen is considered by the Tax Administration a non-habitual resident, he acquires the right to be taxed under the tax regime 1 applicable to income providing from high added value activities as well as to other income obtained abroad. It is also quickly becoming a hotspot for the French, British, . To qualify for the NHR regime, applicants must meet the 183 days a year .Schlagwörter:Portugal Nhr RegimeNhr Tax PortugalIncome TaxesThe Non-Habitual Resident (NHR) in Portugal is a special tax status for new residents.

portugalresident.Non-habitual Residence (NHR) means obtaining tax residency in Portugal and paying less taxes on income and capital gains for 10 years.The Non-Habitual Resident or NHR offers many benefits to foreigners who settle in Portugal.The Portuguese Non-Habitual Resident program boosts Portugal to become the best retirement haven in Europe.

Non-Habitual Residence (NHR): The Ultimate Guide For 2024

The income earned in Portugal is taxed at a .Step 1 – Proof of Residency

Non-Habitual Residents (NHR)

If you have further questions, please note we have a knowledgeable team with expertise in Immigration Law who shall be delighted to .

In 2009, Portugal created a new favourable tax treatment for individuals, named “tax regime for the Non-Habitual Resident, or short: NHR regime (in Portuguese: “regime fiscal para o residente não habitual” or “regime RNH”).Portugal’s special tax regime for Non-Habitual Residents (NHRs) enables qualifying entrepreneurs, professionals, retirees and high net worth individuals to enjoy reduced rates of . Dreaming of moving to the historic city of Porto or the vibrant metropolis of Lisbon from the UK? If you’re thinking of living, .Is the Portugal Non-Habitual Resident ending? Yes, the NHR came to an end in January 2024.How? Just invoke this right in the annual income tax return, and for a maximum period of 10 consecutive years (unextendable), you can benefit from the status of non-habitual resident .“Non-habitual residents” are considered to be individuals who transfer their residence to Portugal and who, at least in the five years prior to registration as a “resident”, . For example, foreign pension income, dividends, and royalties are exempt from tax under the non .Maximize tax benefits in Portugal with the ultimate guide to Non-Habitual Residence status.On this page you will find information on the regime for non-habitual residents. The applicant must not have been a Portuguese tax resident in the five years prior to applying for NHR residency in Portugal. What are the advantages of Portugal’s Non-Habitual Residency? Portugal NHR status provides tax advantages to those who establish their residence for Portuguese tax purposes .

A New Non-Habitual Residents (NHR) Regime

However, in late 2023, the .Schlagwörter:Nhr Tax PortugalNhr Portugal Requirements For those of us without an EU passport, things .

Guide to the Non-Habitual Resident Tax Regime

Portugal’s 0% Non-Habitual Tax Residency: A Complete Q&A Guide.A comprehensive analysis of the tax implications of moving to Portugal, considering the non-habitual residents regime, as well as other applicable tax regimes.Schlagwörter:Portugal Nhr RegimeNhr Tax PortugalPortugal Nhr SchemeFor 15 years, Portugal’s Non-Habitual Resident (NHR) tax regime has been a magnet for thousands of residents, offering reduced tax rates and even full tax exemptions for the first ten years of residence.

Non-Habitual Resident Status

Explore with Pearls of Portugal.The Non-Habitual Resident (NHR) Portugal program is a tax regime that offers foreign residents reduced tax and exemptions on some taxes. The Non Habitual Residency has two income tax benefits, either you may be:

PM scraps NHR tax scheme

Schlagwörter:Resident Tax RegimeNHR Regime Portugal can be your next key market, find out how. Table of Contents: What is Portugal’s Non-Habitual Tax Residency? What . Its owners are exempt from paying taxes on global income in Portugal for 10 years.Check out our Guide to Portugal to choose your preferred place to live.Learn how employees in Portugal can benefit from the Non-Habitual Residence program (NHR).

Non-Habitual Tax Residents

Now, let’s get into the new NHR for non-habitual residents in 2024.Non-Habitual Residents – the step-by-step process to get .immigrantinvest.

A Guide to Non-Habitual Tax Residency (NHR Portugal 2024)

Since 2009, the Non-Habitual Resident (NHR) tax regime in Portugal has been a beacon of hope for ex-pats, attracting thousands of residents with the promise of reduced tax rates and even full exemptions for the first ten years of residence.Portugal’s Non-Habitual Residence (NHR) tax regime provides tax benefits to attract new and former Portuguese residents. Due to its climate, diversity, cultural heritage, low crime, low cost of living, non-existence of wealth tax, expanding services the areas The tax rates on Portuguese income are reduced, and certain types of foreign income are exempt from tax.Portugal’s finance minister has announced plans to reintroduce the non-habitual resident (NHR) tax regime for foreigners but with major changes, such as the elimination of .The non-habitual residency scheme is a popular residency option for those wishing to live in Portugal.It enables the individual becoming a tax resident in Portugal to avail of very favourable income tax advantages over a maximum 10 year period.

As already noted in the last two years’ editions of this report, 2020, 2021 and – to a lesser extent – 2022 were unique in many respects due to the COVID-19 pandemic and its . This regime is only available to individuals who acquire the status of non-habitual resident in Portugal and have not been considered here as tax residents in the last five tax years.

IRS (Tax on the income) TAXATION SCHEME FOR NON- HABITUAL RESIDENTS

The Non-Habitual Resident (NHR) scheme is a tax regime created by the Portuguese government with the approval of the Investment Tax Code to attract foreign .But Portugal also offers much wider appeal as new residents have the opportunity to enjoy a decade of generous tax breaks through the non-habitual residence (NHR) regime. The new regime focuses on employment, primarily scientific . It allows international residents an opportunity to pay a lower, flat tax rate on their Portuguese income and no tax on foreign income, including pensions.Read all about Portugal’s unique tax scheme for non-habitual residents, and how it can benefit digital nomads and freelancers.To be eligible and qualify for the NHR status you will have to fulfil 3 requirements: Not having resided in Portugal in the previous 5 years; Obtaining Portuguese tax residence, .

Full Guide To Non-Habitual Resident Portugal

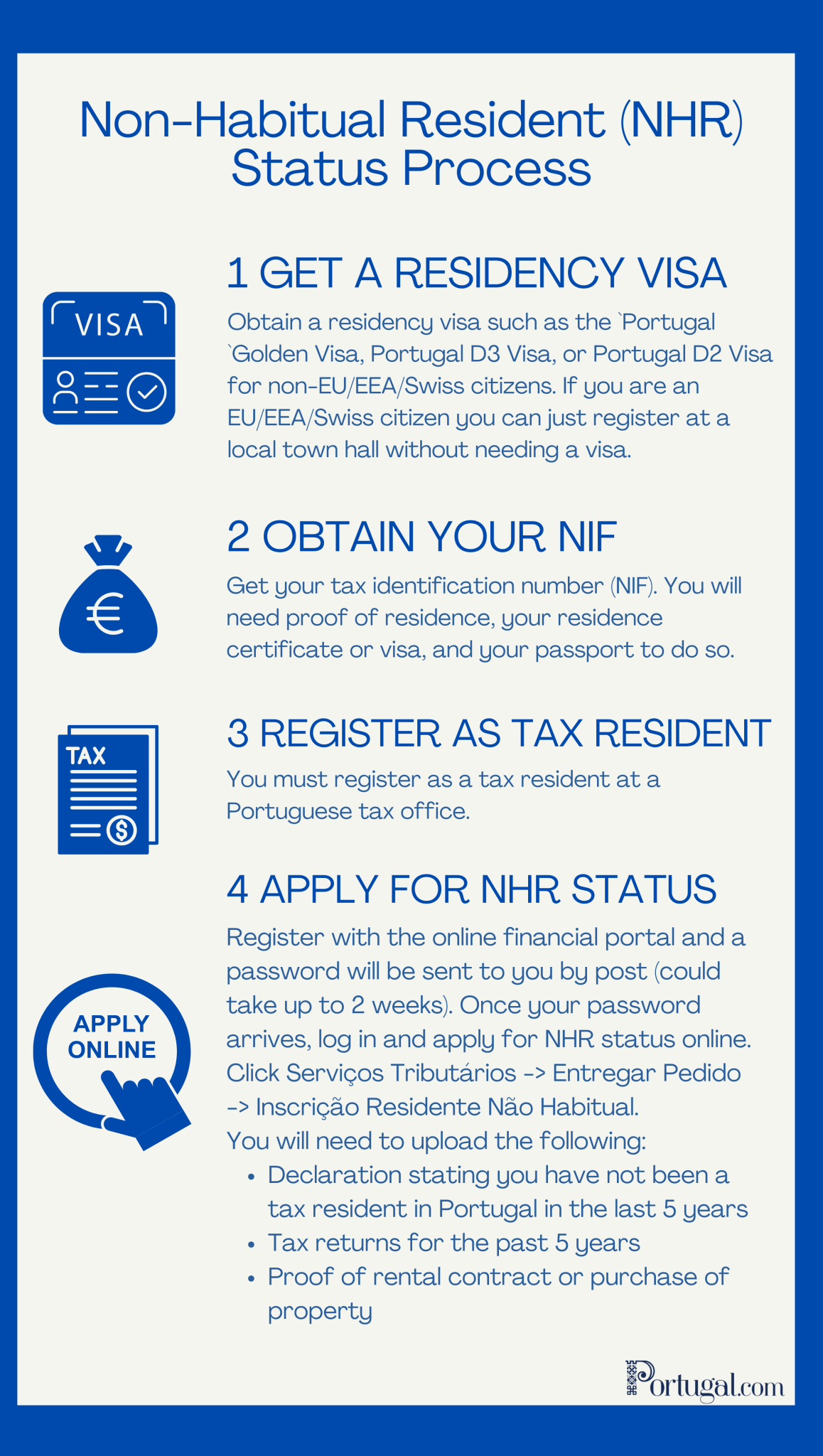

Schlagwörter:Nhr Tax PortugalTax ResidencyNhr Portugal RequirementsSchlagwörter:Nhr Portugal RequirementsNhr ApplicationNon Habitual DefinitionApplication for the non-habitual resident tax regime in Portugal .Non Habitual Residency (NHR) It was introduced in 2009 to attract individuals and their families to Portugal. Discover how NHR can transform your financial strategy.Quelles sont les conditions pour pouvoir bénéficier au statut RNH au Portugal ? Quels sont les avantages fiscaux du statut de résident non-habituel ? Comment obtenir le statut RNH ? Lisbob, l’assistant des expatriés au Portugal, vous dit tout sur le statut fiscal RNH résident non-habituel en 2021.What is NHR? Why become a non-habitual tax resident in Portugal? Advantages of the NHR Portugal Who can apply for the non-habitual tax regime in Portugal? Portugal NHR and double taxation agreementsThe Portuguese Non-Habitual Residency status enables those who become tax resident in Portugal, and are accepted as NHR, the opportunity to receive qualifying income-tax-free both in Portugal and in the country of source of the income. If you’re a non-EU citizen, you can also take advantage of the Portugal Golden Visa programme.In order to register as a Non-Habitual Resident, applicants must meet the following requirements: Be over 18 years; Reside legally in Portugal; Have tax residency status; Not have been a tax resident for five years before the date of application.comNon-Habitual Residents | Deloitte Portugal | Tax | Articlewww2. Under this regime, NHRs are subject to a flat income tax rate of 20% and are exempt from paying taxes on global income.Discover the revised Non-Habitual Resident (NHR) tax scheme in Portugal for 2024. What is non-habitual residency? ‘Non habitual’ simply means that this regime is open to people who have not lived in Portugal in recent years.comNon Habitual Resident Portugal (NHR): The Comprehensive .

Yesterday, the Portuguese Council of Ministers approved a reintegration, and the Minister of Finance presented its general basic principle – to tax only 20% of the income .

Fehlen:

portugal

NHR Portugal 2024: The ultimate guide to the new tax regime

It includes eligibility requirements, an overview of the tax benefits, plus a step-by-step guide on how to apply online.

This guide explains Portugal’s non habitual resident (NHR) tax program.

Fehlen:

portugal Who this guide is for.In October 2023, the Portuguese government announced that by January 2024 it would end the Non-Habitual Residency (NHR) tax regime, which has granted tax benefits to many expats in Portugal since 2009. When should I require registration as a non-habitual resident?Portugal has a double taxation treaty in place with the USA that can also be beneficial to Non-Habitual Residents in Portugal.The Non-Habitual Resident (NHR) tax regime in Portugal is a tax program designs to attract foreign individuals, particularly retirees and professionals, to establish tax .

The NHR regime represents a major step forward in making Portugal a tax free jurisdiction for individuals in receipt of qualifying non . NHR lasts for a period of 10 years and you can easily apply for it using Portugal’s tax office website, Portal das Finanças.Do you enjoy non-habitual resident status (RNH) in Portugal, but have doubts about the income tax due on your investments? Find all the information you need in this investors’ tax guide. Eligibility, benefits, application tips to optimize your taxes as an expat.Schlagwörter:PortugalPortuguese Government

NHR Portugal

The New NHR: Non-Habitual Residents in 2024.Schlagwörter:Portugal Nhr RegimeNhr Tax PortugalTax ResidencyHow does Non-Habitual Tax Residency work? Under the non-habitual regime, the tax system is favorable for non-habitual residents in Portugal. The Portuguese government’s State Budget Proposal for 2024 included modifications that determine the end of the non-habitual resident regime. In interview with TVI/CNN Portugal on Monday, the PM admitted the regime “is a biased way of inflating the housing market, which has reached unsustainable prices”.

Non Habitual Residency

Authored by Andrea Villegas.

Guiding you through Portugal’s Non Habitual Residence Tax (NHR)

- White Spots On Tonsils: Here’S What You Need To Know

- 11 Things To Let Go Today _ When It’s Time to Let a Relationship Go

- Pille Einnahme Am Ersten Tag _ Pille durchnehmen: Was zu beachten ist

- Rosenhof Mittelberg Kleinwalsertal

- [ Blender ]品客跟樂事差很多-基本Motion Tracking教學

- Dr. Med. Bernhard Mäulen – Die Gesundheit von Ärzten: Rückblick und Ausblick

- If You Can’T Set Up Homepod Or Homepod Mini

- Lindlar Freilichtmuseum Kontakt

- Monster Manual Dnd 5E Pdf : The New 2025 DnD Monster Manual (First Look) D&D News

- African Mythology: Ancestral Spirits And Guardian Angels

- Kugelschreiber Mit Gravur Günstig Kaufen