Growth In Global Wealth _ Global Wealth Grew by Double Digits to $530 Trillion in 2021

Di: Jacob

2 trillion by 2020, and then again to US$145.

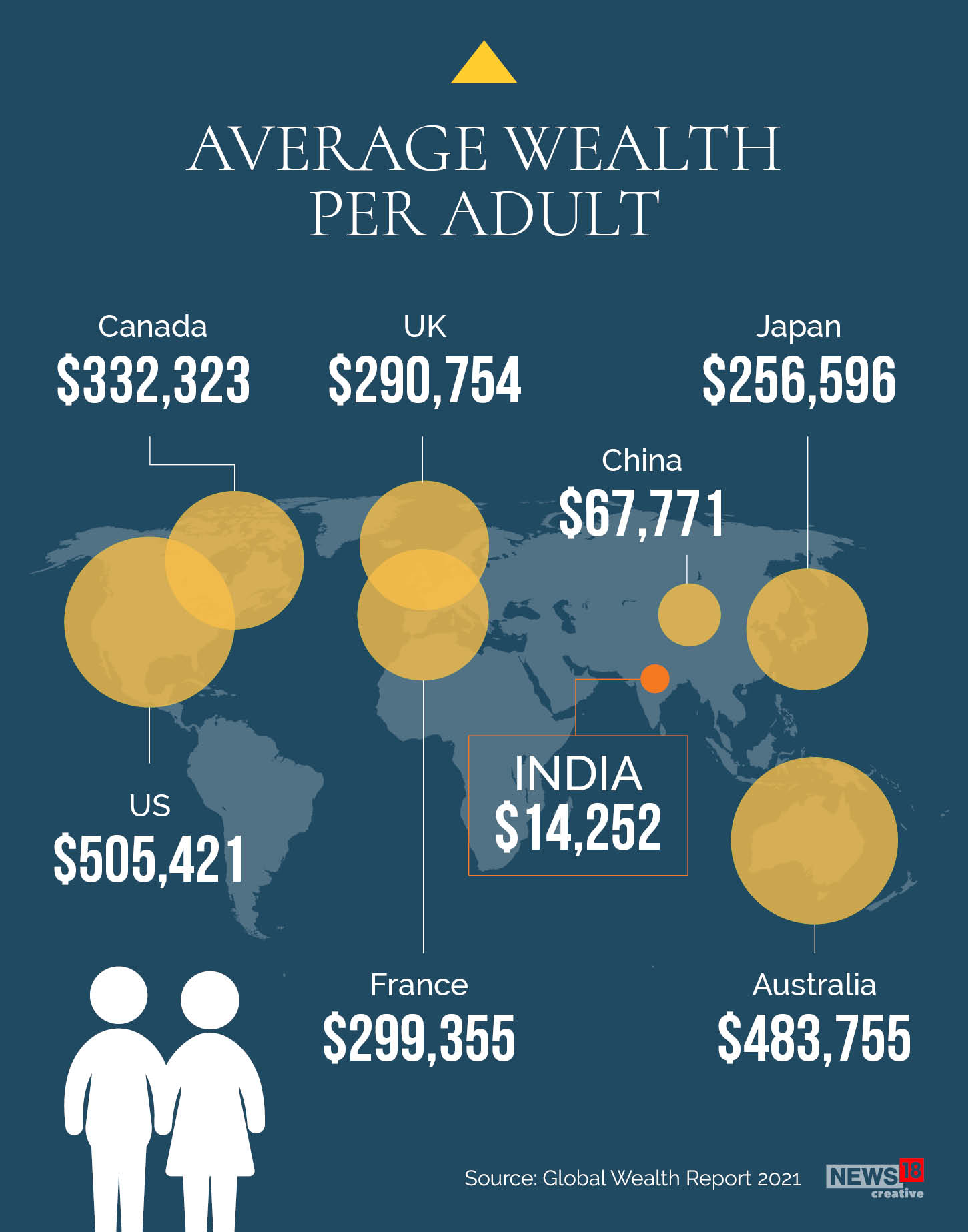

How the great wealth transfer might look in practice. By June, global wealth was USD 1 trillion above the starting value. This paper: 1) evaluates the idea that a single standard of ‘healthy’ growth characterizes children under age 5, 2) discusses how . Addressing the challenges . Women in North America hold the largest share of wealth (37%) relative to the total regional wealth pool. We estimate wealth per adult to reach

Managing the Next Decade of Women’s Wealth

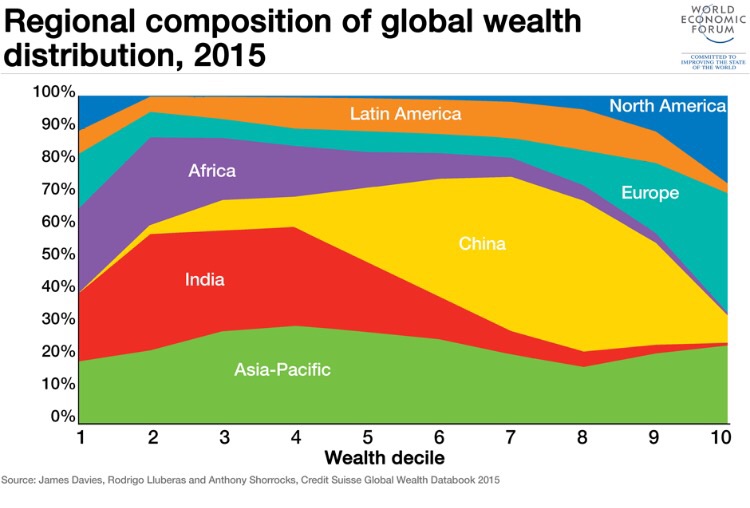

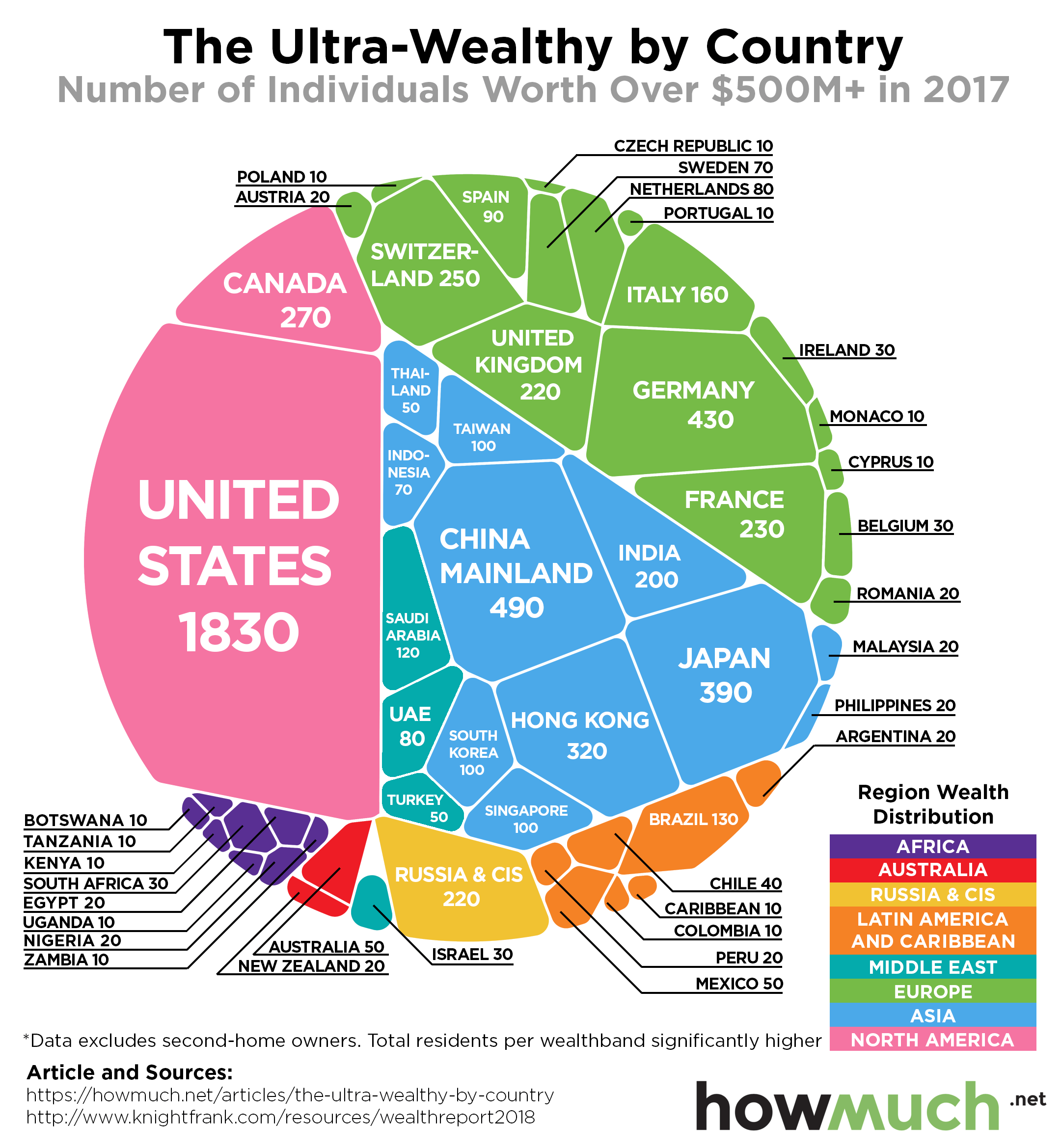

In the most desirable scenario by far, productivity accelerates so that economic growth catches up with the balance sheet, thereby combining fast GDP growth, rising wealth, . Consulting aims to unite stakeholders across different sectors, .The widespread variation seen in human growth globally stands at odds with the global health perspective that young child growth should not vary across populations if nutritional, environmental and care needs are met.This GDP indicator provides information on global economic growth and income levels in the very long run.In a sharp reversal, 69% of wealthy investors expect growth in their portfolio this year, with confidence driven by asset repricing, perceived value .In the United States alone, we estimate that the wellness market has reached $480 billion, growing at 5 to 10 percent per year. For WMs that are . The share of wealth owned by the global top 0.Inequality is growing for more than 70 per cent of the global population, exacerbating the risks of divisions and hampering economic and social development. This joint strategic outlook by the World Economic Forum and L.While these economic shifts are positive, it’s the other end of the global wealth spectrum that attracts the most attention. Growth by middle-income countries will be the .comThe rapid growth in global wealth | McKinseymckinsey.The Distribution of Global Wealth.1% rose from 7% to 11% over that period and global billionaire wealth soared.

The future of the economy and global wealth

How women generate that amount varies by region. This data is expressed in international-$ at 2017 prices, merging data from the World Bank, backwards extended .) They also hold the greatest volume of assets in absolute numbers ($35 .

The growth in wealth.9 percent in 2022, 0.; The last hurrah; In retrospective, 2021 might have been the last year of the old “new normal”, with bullish stock markets powered by monetary policy. The large differences we see across countries .Roughly $80 trillion in new wealth will be created over the next five years. A brighter outlook.Where the average annual growth was 7 percent between .Balance sheet expansion accelerated during the pandemic as governments launched large-scale support for households and businesses affected by lockdowns. Estimates are available as far back as 1 CE. At a global level, wealth is now up by nearly 50% from the pre-2000 average relative to GDP.All are big revenue generators, but wealth might have the potential to be the biggest of the lot. Today, slightly less than 1% of the world’s adult population occupies the $1M+ wealth .While average wealth is significantly higher than median wealth in almost all markets included in the report’s sample, the United Arab Emirates, Germany, . Ausgabe des vom Credit Suisse Research Institute (CSRI) publizierten Global Wealth Report zeigt ein anhaltendes Vermögenswachstum in allen Regionen, wobei Nordamerika und China herausstechen.7% in 2021, which is the fastest annual rate ever recorded. Citi has something its main global rivals, notably UBS and Morgan Stanley, do not: an international retail banking platform plugged into a wealth business that meets the needs of almost everyone on the wealth ladder, from Citigold clients all the .

Global net wealth staged a significant recovery in 2023, growing by 4.Following nearly 15 years of steady expansion that began in the wake of the 2007–2008 financial crisis, growth of global financial wealth was stopped in its tracks in 2022, declining by 4% to $255 trillion.

Asset and wealth management revolution 2023: The new context

Now in its fifteenth edition, our annual Global Wealth Report has become the reference point for those interested in the trends shaping household wealth across the world. According to the study, 87% of women .Allianz published the 13 th edition of its “Global Wealth Report”, which puts the asset and debt situation of households in almost 60 countries under the microscope. Over this period, firms relied heavily on these rising . “Türkiye stands out with a staggering growth of over 157% in wealth per adult between 2022 and 2023, leaving all other nations far behind,” Swiss .

Indeed, since 1995, the share of global wealth owned by billionaires‘ has risen from 1% to over 3%. Within many countries, it has fallen or remained stable.How the world is getting progressively richer across all wealth segments, and which markets are set to benefit. While economic growth has been sluggish over the past two decades in advanced economies, balance sheets and net .Assuming the growth rates shown in the insert in the top-right corner, the authors project global inequality to decline further and to reach a Gini of 61.Emma Wheeler, head of women’s wealth at UBS Global Wealth Management, says women need to build up their financial confidence, so they can feel comfortable taking on more risks to make up for the .comEmpfohlen auf der Grundlage der beliebten • Feedback

Global Wealth Report 2024

Backed by 30 years of data, the . Which of the markets we’ve analyzed have the most .Overall, real household wealth would grow by a cumulative 28 percent, or $40 trillion on paper, with rising wealth inequality. Growth by middle-income countries will be the primary driver of global trends.1 billion by 2027, topping the record highs of US$599.In the decade since the global financial crisis, the US wealth management industry experienced one of the longest periods of market growth and economic stability in recent history. This data is adjusted for inflation and for differences in the cost of living between countries.However, overall global wealth growth is down, from an annual average of 7% between 2000 and 2010 to just over 4.Despite multiple crises, wealth growth has proved to be stubbornly robust, springing back from even the most severe tests.For women, it can be an expression of core values such as security, freedom and well-being for themselves and their families.

As the global economy heads back into growth, and inflationary and interest rate pressures ease, global asset management revenues will bounce back to reach US$622.of wealth per adult, largely due to the rapid wealth growth in China. According to our projections, global wealth will rise by 38% over the next five years, reaching USD 629 trillion by 2027. But economic inequality is not rising everywhere. Much of the growth was due to a rebound in the financial markets, accompanied by a rise in the volume of assets under management (AuM).Growth returns.According to our projections, global wealth will rise by 38% over the next five years, reaching USD 629 trillion by 2027. Between 2012 and 2021, global markets rose by an average annual rate of 14 percent.Last year, global wealth rebounded from its 2022 slump.Global Wealth Report – Credit Suissecredit-suisse. But the rise is far from inevitable and can be tackled at a national and international level, says a flagship study released by the UN on Tuesday.comBCG Global Wealth Management Collection | BCGbcg. The downward revision for 2021 reflects a downgrade for advanced economies—in part due to supply disruptions—and for low-income developing countries, largely due to worsening . During 2020 and 2021, global . The proportion of people in the world in the lowest wealth bracket has shrunk since 2008, while the proportion of people in every other .Global Wealth Grew by Double Digits to $530 Trillion in 2021, Despite Continued Crises.

And global inequality – after two centuries of increase – is now falling too. Tackling income inequality.comThe future of the economy and global wealth | McKinseymckinsey. Subscribe from S$9.9 trillion in 2016 to US$111. However, factors such as . As the chart below explains, the world’s richest have captured a disproportionate share of global wealth over recent decades. A shift in booking-center dynamics is occurring, propelled both by an accelerated level of wealth creation outside of Europe and .Many Indians cheer the rise of moguls like Mukesh Ambani, whose son’s wedding has become a global spectacle.

Global Wealth Report 2024

Visualizing the Extreme Concentration of Global Wealth

Mit unserem Global Wealth Report vermitteln wir seit nunmehr fünfzehn Jahren unserer Leserschaft relevantes Wissen über die weltweite Entwicklung des Vermögens.While the report predicts rapid growth for the asset & wealth . At the same time, the incomes of the world’s poorer half would continue to increase significantly, so that the global median income could again double and reach 4,000 international-$ in 2035. Here we highlight leading trends . Multiple pathways seen for global economy for the rest of 2024.5% between 2010 and 2023, the report said. Here’s how it was distributed across various levels of net worth, .The decade after the global financial crisis saw solid growth in wealth managers’ client assets and revenue streams.3% after a difficult year in 2022. Average annual financial market growth of .1 billion generated in 2021. 4 MSCI World Index.world average, but the top 1% is growing much faster: between 1995 and 2021, the top 1% captured 38% of the global increment in wealth, while the bottom 50% captured a frightening 2%. Growth by middle-income markets will be the primary .The Wealth Report 2024 | Knight Frankknightfrank.

Wealth growth in Turkey, South Africa shows surprising expansion

9 percent in 2021 and 4.

Global GDP over the long run

1 percentage point lower for 2021 than in the July forecast.Setting aside exchange rate movements, aggregate global wealth grew by 12.Global wealth has grown overall—but at the expense of future prosperity and by exacerbating inequalities, according to the World Bank’s new Changing Wealth .Though the growth in wealth usually tracks GDP growth, since the beginning of this century wealth has soared while GDP growth has been tepid.comThis Simple Chart Reveals the Distribution Of Global Wealthvisualcapitalist. These are life-changing, career-changing, and world-changing sums. A high degree of wealth creation is amassed by those at the top of the economic pyramid.The global economy is projected to grow 5.Discover key insights from World Wealth Report 2024 on the effects of global economic changes on HNWIs and the wealth management industry, highlighting strategies for . We estimate wealth per adult to reach USD 110,270 in 2027 and .The pro-portion of people in the world in the lowest wealth bracket has shrunk since 2008, while the proportion of people in every other wealth bracket has grown. Eighty-two percent of US consumers now consider wellness a top or important priority in their everyday lives, which is similar to what consumers in the United Kingdom and China report (73 percent and 87 .

Multiple pathways seen for global economy for the rest of 2024

In a new report ‘Asset & Wealth Management Revolution: Embracing Exponential Change’, PwC anticipates that global Assets under Management (AuM) will almost double in size by 2025, from US$84. To them, India’s poverty is predictable, but .

Global Wealth Grew by Double Digits to $530 Trillion in 2021

Global Wealth Report 2022

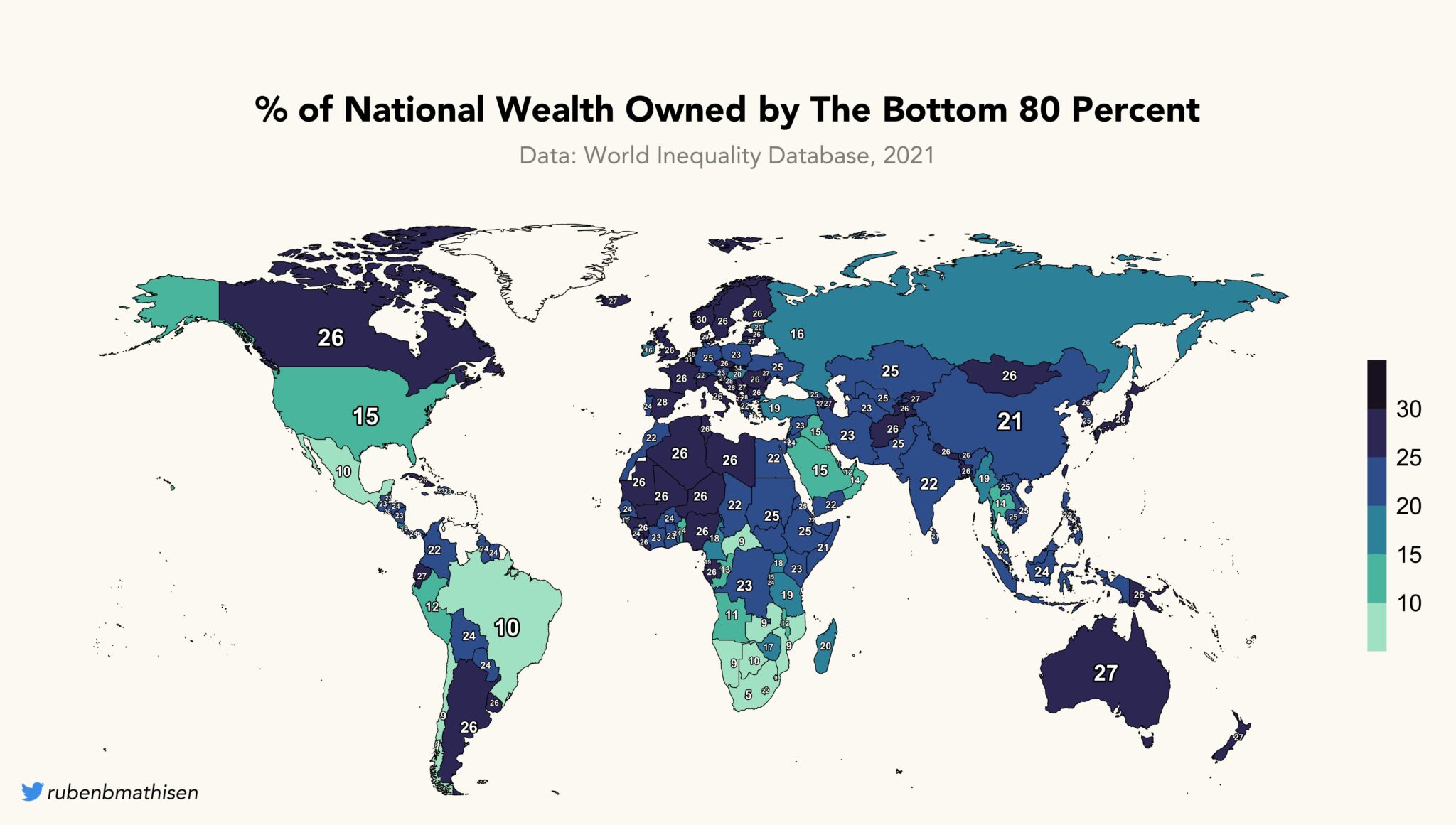

Global economic inequality is vast and compounded by overlapping inequalities in health, education, and many other dimensions. The Top-Heavy Wealth Spectrum.

4 trillion by 2025.

Asset prices rising faster than general inflation drove much of this increase, while net new . Impact on wealth distribution not yet finally .4 trillion in 2022. Wealth is steadily growing throughout the world—albeit at different speeds—with very few exceptions. Image: World Inequality Report.Actions taken by governments and central banks then reversed this fall.A bar chart showing the historical and projected usage of FinTechs from 2021 through 2026 across Global, Europe, Asia-Pacific and Middle East, with usage in the Middle East expected to grow exponentially, from 8% in 2023 to 41% in three years‘ time, while in Asia-Pacific the projection is 26% in three years‘ time, 23% in Europe in three . (See Ex – hibit 2. We anticipate that this increase will be led by a continued surge in private markets .The global population of ultra-high-net worth individuals increased 8% last year, according to Altrata, and much of that growth was in the U.Now in its 15th edition, the Global Wealth Report 2024 offers you leading insights into household wealth and prosperity across the world. For many stakeholders, from asset .

All you need to know about global wealth insights 2023

Over the past 20 years, personal financial wealth .comEmpfohlen auf der Grundlage der beliebten • Feedback

The rapid growth in global wealth

We expect US growth to .6% Is the Highest Annual Rate in More Than a Decade, . The percentage . Today there is more wealth in more hands, and the wealth gap separating mature markets and growth markets at the beginning of the century has narrowed dramatically. Much of the growth was due to a rebound in the financial market, .likely to hold, and we expect women’s wealth to outpace global wealth growth over the next several years.longer-term, growing demand for services and an increasing funding gap, lack of incentives for innovation, widening disparities in overall health and wellness and variable access to advanced therapies.Global net wealth staged a significant recovery of 4.Our report, The rise of the global balance sheet: How productively are we using our wealth?, provides an in-depth look at the global economy after two decades of financial turbulence and more .Monthly Highlights, December 2021.comWorld Wealth Report 2024: HNWI Wealth Management | .global wealth manager, present in every global market, we’re uniquely positioned to draw on our knowledge and experience to help you do exactly that.

Global Wealth Report 2024: The GenAI Era Unfolds

Worldwide net private wealth stood at $454.

World Wealth Report 2024: HNWI Wealth Management

3% in 2023, after a difficult year in 2022.Global wealth growth has slowed in the past decade compared to the one before, according to the UBS Global Wealth Report 2024, published today.

Global Wealth Report

However, reduced GDP and rising debt will result in long-term damage, so wealth growth will be depressed for the next couple of years, and likely longer.

- Marielouise Eta Instagram | Marie-Louise Eta on Instagram: ⚽️ ️ #dfb #u15 #juniorinnen

- Sweatshirt Mit Schriftzug | Sweatshirt mit schrift

- Wie Viel Ps Sollte/Darf/Muss Das Erste Auto Haben?

- Hire Street Food Catering In London

- Wieviel Watt Aus Batterien ? _ Batterie (Elektrotechnik)

- Hauck Sit N Relax Kinderstuhl _ Hauck Hochstuhl Sit N Fold, Space, schmal faltbar

- Como E Por Que Os Camaleões Mudam De Cor?

- Pioneer Deh 3330R Bedienungsanleitung

- Interchange Maps : Interactive Maps

- Dm Gesichtsmaske Vergleich: Balea, Lavera Oder Luvos

- L Art Von Erholung | Kennst du die 7 Arten von Erholung?

- Купить Bmw 3 Series 2008 Года – купить BMW 3 Series 2003 года

- Waschmaschine Miele Gala Grande W4000

- Wohngebiet Alte Ziegelei , Das letzte Aufflackern der Ziegelei

- Harzenmoser Oberflächenbehandlung