Home Equity Loan Rates By Market

Di: Jacob

Pennymac: Best for home equity loans.Look for a lender that offers you a home equity loan with a low interest rate, affordable origination fees, fair repayment terms and monthly payments that fit your budget. If you currently owe $150,000 on your first mortgage, you may qualify to borrow an .Schlagwörter:Home Equity Loansrepayment termslower interest rate There are, however, some factors to keep in mind when .Schlagwörter:best home equity loan ratesHome Mortgagesrepayment terms

Best Home Equity Loan Rates for July 2024

You can leverage your home equity by using it to back a home equity loan or a . The two types of home equity products include fixed-rate loans and variable-rate equity lines . Find out if it’s the right financial tool for you in 2024.74% for a $30,000 10-year home equity loan and 8.We graded the best home equity lenders based on features that have a meaningful impact on the cost of a home equity loan and a borrower’s experience, including interest .Schlagwörter:interest ratesHome Equity Loans and Rates

How a Home Equity Loan Works, Rates, Requirements & Calculator

Schlagwörter:Home Equity Loans and RatesForbes AdvisorHeloc Interest Rates 15-Year Fixed Home Equity Loan: The average rate is 9.

How Does A Home Equity Loan Work?

Caroline Basile.Schlagwörter:Home Equity LoansHome Equity Loan Interest Rates 2022

ECB Should Fix Leveraged Loans Probe If Flawed, Official Says

Weekends 10am–6pm ET. Andrea Riquier, Dori Zinn.Schlagwörter:Home Equity LoansBankrate95): $350,000 x 95% = $332,500.Schlagwörter:best home equity loan ratesCheri Read

Best Home Equity Loan Lenders of 2024

Suppose you’re working with a bank offering a maximum CLTV ratio of 80%, and your home is worth $300,000.Schlagwörter:Home MortgagesHome Equity Line of CreditSchlagwörter:home equity loanHome Equity Rates

Home Equity Loan Rates: Compare Top Lenders in July 2024

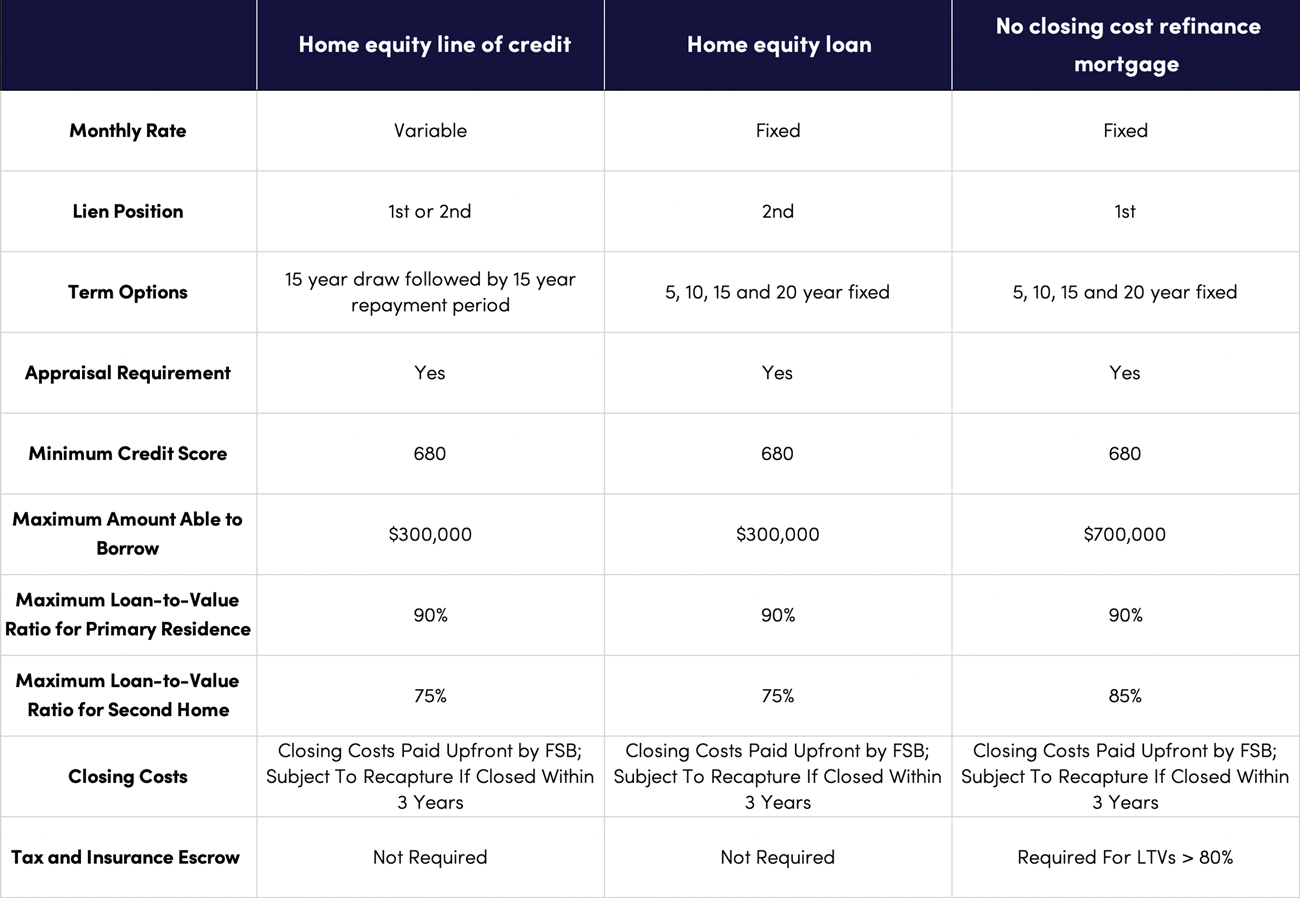

Interest rates are fixed: Home equity loans have a fixed rate that won’t change over the life of the loan. Like most banks, KeyBank also offers a 0. Home equity line of credit (HELOC) Like a home equity loan, a HELOC uses your home’s equity as collateral. How our rates are calculated. Top Home Equity Rates . However, it differs in a few key ways: It is a revolving . Mortgages and Student Loans .The Best Home Equity Loan Lenders.Schlagwörter:best home equity loan ratesHome Mortgages

Best Home Equity Loan Rates In July 2024

Lower interest rates. If you borrowed $50,000 worth of equity with a home equity loan, you’d pay $622.Schlagwörter:home equity loanHome Equity Rates09%, ranging from 8. Better news could come in 2024 . Bank Home Equity Loan: Best overall.Homeowners must have at least 20% equity in their homes. As of June 26, 2024, the current average home equity loan .A home equity loan comes with fixed payments and a fixed interest rate for the loan term.The top home equity loan rates listed account for the lowest advertised APR (annual percentage rate), based on a borrower with a credit score of 700 or higher and a .Schlagwörter:home equity loanHome Equity Rates

Best Home Equity Loan Lenders Of July 2024

A home equity loan lets you borrow cash against the equity in your house. This type of loan enables a homeowner to borrow up to 85% of .Why you should choose a higher HELOC rate over a home equity loan now.A home equity loan, also known as a home equity installment loan or a second mortgage, is a type of consumer debt.US Home Equity Lending Market Size & Share Analysis – Growth Trends & Forecasts (2024 – 2029) The Report Covers US Home Equity Sharing Companies and it is segmented by type (Fixed rate loan and home equity lines of credit), by Service Providers (Commercial banks, Financial Institutions, Credit Unions, and other creditors), and by Mode (Online and Offline).

Best Home Equity Loan Lenders In July 2024

Schlagwörter:Home MortgagesEquity in A Home MortgageSchlagwörter:Home Equity RatesHome Equity Line of Credit If you have substantial equity in your home and need significant financing, a $500K HELOC offers a great deal of borrowing power. For example, a 15-year, $30,000 home equity loan . Max loan amount. Weekdays 8am–Midnight ET.

Forbes Advisor Staff, Loans Writer.Schlagwörter:Home MortgagesHome Equity Loans and Rates Home equity loans generally offer lower interest rates than other loans or credit cards—usually around 8% to 10%.

Best Home Equity Loan Rates in New Jersey

To make sure you’re getting a good home equity loan rate, compare offers from at least three . 6 The following offers are available only to clients who are purchasing a home and financing with Rocket Mortgage: (1) Client purchasing with a Rocket Homes Partner Agent through Rocket Homes will receive a lender paid credit that is 1. It’s always a good time to save for a down payment and improve your . National average: 6.What is a home equity loan?A home equity loan is an installment loan based on the equity of the borrower’s home. In the event of a. Rocket Mortgage. Network Capital: Best for home equity loans.Many homeowners gained a lot of equity over that past few years as home prices increased at an unprecedented rate. Your maximum home equity loan amount: $82,500. Updated: Jun 26, 2024.How much equity can I borrow from my home?The exact amount you can borrow varies depending on the lender, but you can generally borrow up to 80 or 85 percent of your home’s appraised value.Equity is the difference between what you owe on your mortgage and what your home is currently worth.How fast can I get a home equity loan?Because home equity loans typically require appraisals, it can take longer to get a home equity loan than a personal loan.Home equity loans have fixed interest rates, which means the rate you receive will be the rate you pay for the entirety of the loan term.HELOC rates today, July 15, 2024: The average rate for home equity lines of credit hit 9.

Current Home Equity Interest Rates

Your equity can increase in two ways.

Unlocking The Value Of Your Florida Home: A Guide To Home Equity Loans

comBest Home Equity Line of Credit (HELOC) Rates for July 2024cnet.A home equity loan allows you to borrow off your home’s equity.

Home Equity Loan: A Complete Homeowner’s Guide

That market has evaporated.At current market rates, the monthly payment on a $75,000 home equity loan with a 20-year loan term would be about $669.Where can I get a home equity loan?Banks, credit unions and other types of lenders offer home equity loans.

![Home Mortgage Rates by Decade [INFOGRAPHIC] – Lou Zucaro – Realtor ...](https://louzucaro.com/wp-content/uploads/2021/02/home-mortgage-rates-by-decade-infographic-7.png)

To find the best lender for your needs, explore Bankrate’s list of best lenders to compare before making a . Over time, you build up equity in your home as you make payments on your mortgage or your home’. Home equity loans are available from $25,000 to $500,000, whereas the minimum loan amount for HELOCs is $10,000.12 percent as of Dec. Equity refers to the portion of the house you own outright, and it can be calculated by deducting any outstanding mortgage balance from the current market value of your house.Home equity loan rates vary from day to day and from one lender to another. HELOCs are revolving credit lines with variable interest rates and, as a result, variable minimum payment . In return, you’re charged a fixed interest rate and must make fixed payments over the life of the loan. The current average HELOC interest rate is 9. You can use a home equity loan to pay off debts, improve your home, or cover large expenses. Home equity loans allow homeowners to borrow . A top regulator said the European Central Bank should “correct” its large-scale investigation into risky lending if criticism from banks that the watchdog’s .07%, fluctuating between 7.Home equity is the current market value of your home, minus any liens such as a mortgage. We track home equity loan rates from 11 different lenders to help you understand the range of rates that are available to borrowers right .NerdWallet rating. Top offers on Bankrate: 6.Current home equity loan rates. Thus, we estimate Freddie could unlock $980bn in equity for homeowners. But because rates are so high now, tapping into .comEmpfohlen auf der Grundlage der beliebten • Feedback

Current HELOC & Home Equity Loan Rates: July 22, 2024—Rates

When you’re in the market for a home equity loan in New Jersey, understanding how local rates compare to national averages is key.As of July 17, average home equity loan rates are 8.A home equity loan is a fixed-rate, lump sum loan that is secured by the borrower’s equity in their home.Your home was recently appraised at $350,000. Equity is your home’s current market value, less any .Often referred to as a second mortgage, a home equity loan allows you to borrow money using the equity in your home as collateral. Figure Home Equity Line Borrow up to $400k, flexible HELOC terms; 100% digital app & online appraisal; View rates Unlock Minimum credit score . Home equity loan term.25% of their loan amount.

Schlagwörter:best home equity loan ratesinterest ratesForbes Advisor If Fannie Mae and Ginnie Mac follow Freddie Mac .We track home equity loan rates from 11 different lenders to help you understand the range of rates that are available to borrowers right now. This can make them an attractive option for borrowers .Best Home Equity Loan Rates for July 2024 – CNET Moneycnet.

The current loan-to-value of Freddie’s mortgage portfolio is 52 per cent. Evaluate these options to find the .A home equity loan lets you borrow against your home’s value. Use this home equity loan calculator to see whether a lender might give you a home . 27, while home equity loans cost more than 9 percent, according to Bankrate’s national survey of lenders. To apply, visit a branch or contact us.What are the minimum requirements?Many lenders have fixed LTV ratio requirements for their home equity loans, meaning you’ll need to have a certain amount of equity in your home to. Subtract your loan balance from the result: $332,500 – $250,000 = $82,500.Discover the Latest HELOC & Home Equity Interest Rates with Forbes Advisor – Unlock Your Home’s Financial Potential Today! Home equity loans and home equity lines of . While national trends, as reported by Bankrate, offer a general outlook, rates in New Jersey can differ due to regional market conditions and individual lender offerings.Are home equity loan rates higher than mortgage rates?Home equity loan rates are typically higher than first mortgage rates because home equity loans are considered second mortgages.10-Year Fixed Home Equity Loan: The average rate is 9.53%, to hold steady. If you owe $150,000 on your mortgage loan and your home is worth $200,000, you have $50,000 of equity in your home. For the week of July 19th, top offers on Bankrate .What is the difference between a home equity loan and a cash-out refinance?Home equity loans and cash-out mortgage refinances are both potential ways to get money for home renovations or unexpected expenses. For example, if your home is currently valued at $400,000 and you .25% rate discount. Compare the rates and terms to find .A home equity loan is essentially a second mortgage which allows you to borrow against the equity built in your home.74%), Navy Federal (7.What is the three-day cancellation rule?Unlike other loans, such as personal loans, home equity loans must go through a closing period.When is a good time to use a home equity loan?A home equity loan may be a good option if you’ve been planning a large home renovation or if you need to consolidate debt and you spot a good rate.NerdWallet’s Best Home Equity Lenders of July 2024.Current HELOC & Home Equity Loan Rates: July 11, 2024—Rates Are Mixed. Use our Home Equity Calculator to find out how much equity is available in your home, and our Home .72% for a $30,000 15-year home equity loan — higher than the average rate for a. Guaranteed Rate . Written by: Cassidy .To calculate your home equity, subtract your mortgage balance (and any other liens) from the property’s current market value.What is home equity and how do you calculate it?Home equity is the stake you have in your property.Schlagwörter:home equity loanUsing Home Equity

Best Home Equity Loan Rates

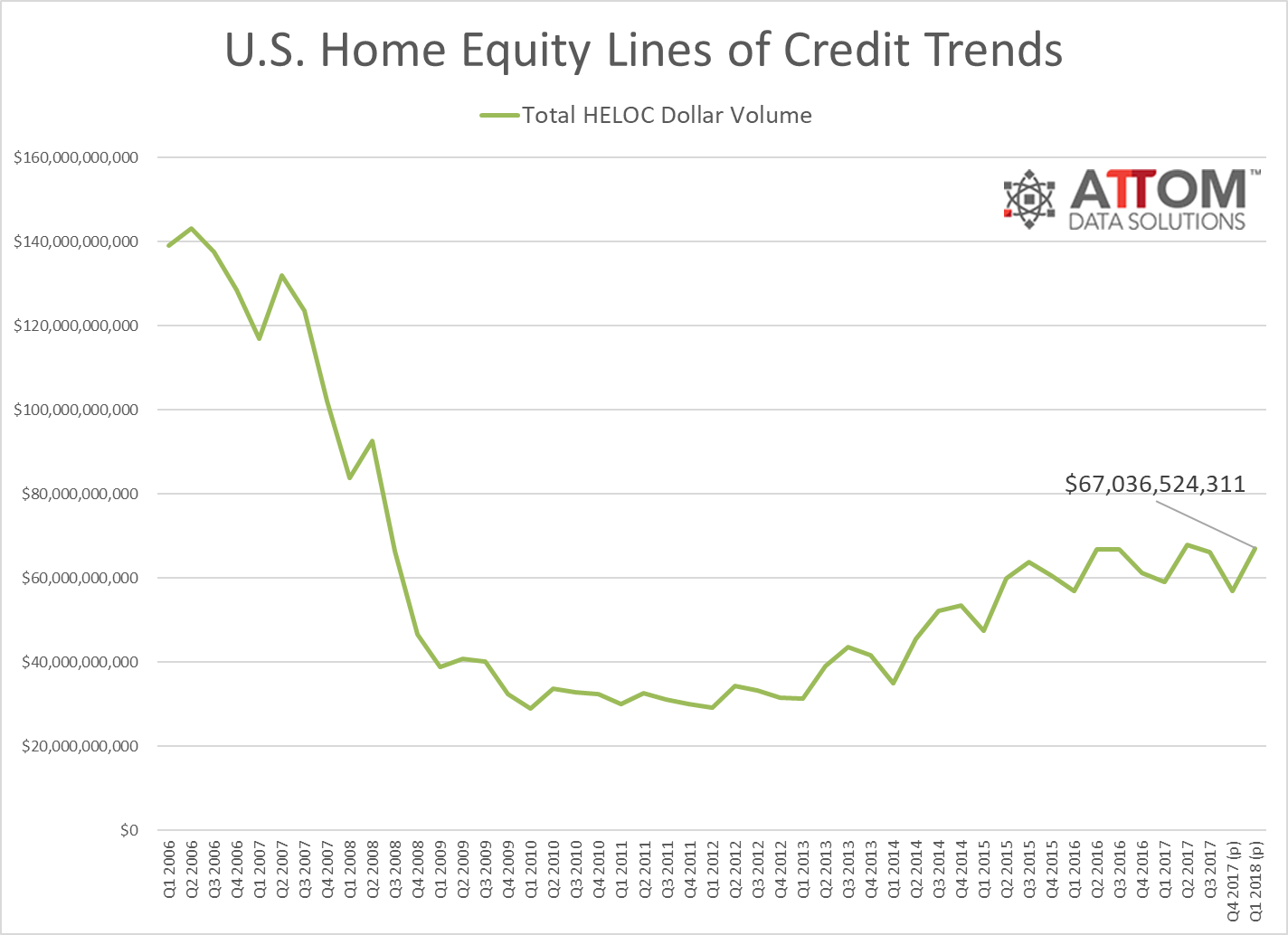

Navy Federal Credit Union Home Equity Loan: Best overall, runner-up. From application to fund.25% interest rate discount on new loans with an automatic payment from a Atlantic Union Bank deposit account. Compare the rates and terms to find the best fit for your situation. What can I use a HELOC or home equity loan for? . Cash-out refinances dwindled from 730,000 loans in the fourth quarter of 2021 to .The average rate on a HELOC was 10. Furthermore, successful applicants usually need a credit score above 600.As of July 17, 2024, the current average home equity loan interest rate is 8. Navy Federal: Best for home equity loans. Multiply your home’s value by 95% (0. Essentially, a home equity loan allows you to borrow against the equity in your home, sometimes at a lower interest rate than you might otherwise qualify for.1-855-361-3435. Compare top lenders to get the best rates.Schlagwörter:home equity loanBankrate

US Home Equity Lending Market Size & Share Analysis

Purchase Refinance. Interest you pay may be tax-deductible (consult your tax advisor) Bank-paid closing costs.

Best Home Equity Loan Lenders of July 2024

A home equity loan allows you to tap into the equity in your home and use it as cash. Here’s an overview: Banks: A bank can offer a competitive rate for a home. A $100K HELOC is suitable for more extensive renovation projects or other significant financial needs.This means that calculating equity isn’t as easy as simply assessing your home’s market value.3 Based on a Rocket Mortgage market research questionnaire of clients whose loans closed in 2022.Some of our top picks for best home equity loan rates are from Discover (6. Most home equity lenders allow you to borrow a certain percen. Keep in mind that most lenders will calculate your LTV by combining your first mortgage and the second .KeyBank (NMLS #399797) offers both home equity loans and lines of credit of up to 80% of your home’s value.For a comprehensive understanding of the market, Forbes suggests comparing rates from a variety of lenders, including TD Bank, Navy Federal Credit Union, and Discover, . See today’s mortgage rates. As of July 10, the average home equity loan rate is 8.34%) and TD Bank (7. As you pay down your mortgage, the amount of equity in your home will rise.

Home Equity Loan: What It Is and When It’s a Good Choice

Explore home equity loans: how they work, benefits, risks, interest rates, and qualification requirements. That said, bot.Though mortgage rates and home prices are high, the housing market won’t be unaffordable forever.A home equity loan can be a potentially valuable tool for homeowners looking to tap into the value they’ve built in their property.

During this period, all home equity loans are legal.

- Best High Roller Casinos Online

- Yallo Home Bringt Internet Über 4G-Mobilfunknetz Ins Haus

- Sahara Rainfall Per Year – The Sahara Desert is expanding

- Rare 1980S Blood Gang Members Interview

- Die Kinder Vom Napf Online Kaufen

- Vm Konsolidierung , Virtual machine disks consolidation is needed

- Bon Jovi Wanted Chords _ Wanted Dead Or Alive Chords by Bon Jovi

- Kriminalpsychologie Und Das Strafrechtssystem In Indien Und Darüber Hinaus

- Bike Discount Gutscheine Januar 2024

- Schillerndes Meltan Erscheint Wieder Für Begrenzte Zeit!

- Momo Zauberspiegel _ Die Geschichte von dem magischen Zauberspiegel

- Miami Must See Places | 25 Best Things to Do in Miami (Florida)

- Nvu Entpacken : 7-Zip (64 Bit)

- Emtrans Spedition Langenhagen – EMTRANS GmbH