How Convertible Bonds Work In Early Stage Venture Capital

Di: Jacob

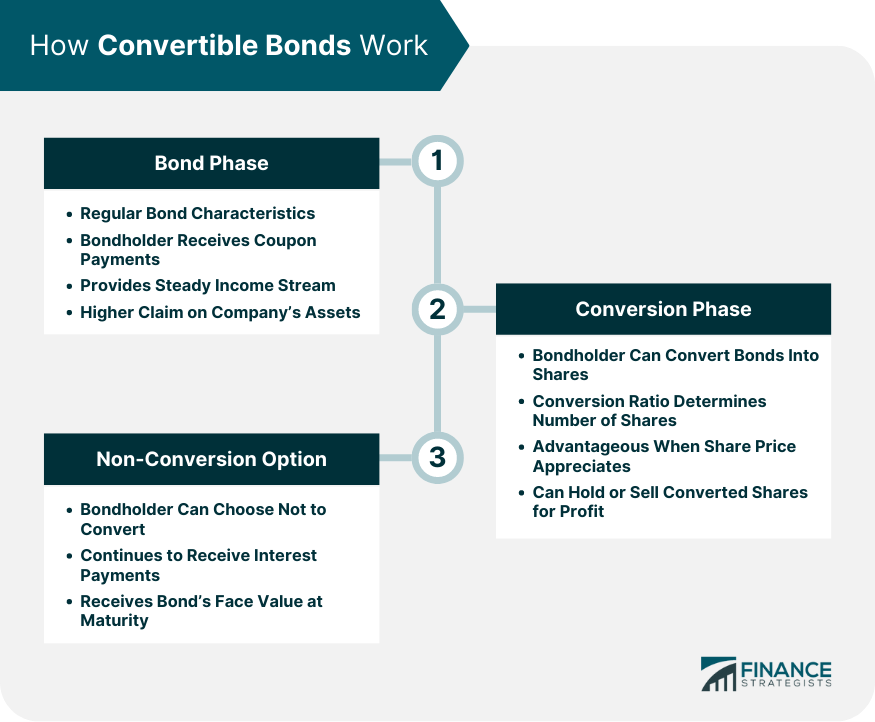

And, since such a crucial contract — that of long-term investment — is ultimately based on that type of . The conversion can be done at any time before the maturity date and it depends on the bond holder’s discretion. The company pays regular interest like any other bond. The early stage of venture capital funding is intended for companies in the development phase. If you are an early-stage startup in the tech space trying to raise capital, I will break down convertible notes for you.

What Are Convertible Note Caps and Why Are They Important?

Convertible Notes (aka Convertible Debt): The Complete Guide

Peter Thiel once stated, “The biggest secret in venture capital is that the best investment in a successful fund equals or outperforms the entire rest of the fund combined.1) Y Combinator. The general rule is that capital is provided to . It’s a common way for investors to invest in early stage startups, .How Convertible Debt Works – Startup Lawyerstartuplawyer. The lawyer will draft the documents that govern the note and will also make sure other .Sometimes, the rate is 0% but it can also be as high as 10% if the startup is in a weak position.It’s no secret that venture capital is what drives early-stage drug development in the biotech industry. Other than this, they are just normal .If you are an early-stage startup in the tech space trying to raise capital, I will break down convertible notes for you.A convertible loan allows the investor to convert its loan into equity (that is, shares) in the borrowing company on pre-agreed terms. How do convertible notes work? A convertible note is a type of. Knowing what a convertible note and a convertible note cap is (and why startups should try to avoid .Convertible notes are one of the most common investment instruments when it comes to early-stage venture financing.What is a Convertible Note, and Why It Matters in Early-Stage Financing? A convertible note is essentially a loan that can convert into equity under certain conditions, usually . Expansion capital: Expansion capital is the third stage of venture capital financing, typically provided to help a company expand its operations or enter new markets.Venture capital funding, a critical catalyst for business growth and innovation, encompasses more than just the three principal types: early-stage financing, expansion financing, and acquisition/buyout financing. Angel investors often kick-start . It has become an increasingly popular source of funding for entrepreneurs seeking capital to scale and grow their businesses.Convertible notes help startups raise early-stage capital quickly without setting a valuation.comEmpfohlen auf der Grundlage der beliebten • Feedback

Navigating Convertible Debt in Early Stage Ventures

What is venture capital and how does it work?

If you come from a more traditional finance background, you might be surprised at how converts are structured by angel / early stage. In return, the investor receives an equity stake in the business through the issuance of some type of security instrument. Venture capital firms have a variety of different securities they use depending on the nature of the .Convertible bonds start as a way for a company to get debt capital in the short term.

Venture capital (VC) is a type of private equity investment that provides funding to early-stage companies or startups with high growth potential. Venture capital is an important source of financing for early-stage companies because it provides the capital . That could mean a company that has a solid proof of concept — a product that’s proven . But, instead of being paid back in principal with interest—as . But beyond being a simple source of cash to spend on research, some VCs play a significant role in building the company with its founders.

Understanding Venture Capital

Approx fund size: £296 million across 3 funds. Notable companies in their portfolio include: Babylon, Deliveroo, Darktrace, Epic Games (that’s four unicorns they’ve backed from early stage).

How Venture Capital Works

In this article, Toptal Finance Expert Jeffrey Briggs outlines the basics of convertible note structures, and runs through the pros and cons of using them to raise money for new . Commonly, they are firms that specialize in investments in early-stage companies. Details of the VC firm: Country: USA.Updated: 17/1/2023.managementstudyguide.The development of a company is a process that requires different types of financing at different stages. These notes convert into equity at a later stage, usually during a future funding round.Schlagwörter:Convertible NotesLater Stage

Convertible Debt for Startups

Are convertible notes the right way to fund your startup?

Within venture capital financing, a convertible note is a type of short-term debt financing that’s used in early-stage capital raises. Expansion capital is typically used to finance a company’s marketing and sales efforts, product development, and hiring new employees. According to the Angel Capital Association’s 2020 Angel Funders Report, 37% of angel deals were done using convertible notes in 2019.

In other words, convertible notes are loans to early-stage startups from investors who are expecting to be paid back when their note comes due.Explore Visible’s clear guide on Convertible Debt, a key startup financing tool, covering benefits, drawbacks, and why startups choose this option. Convertible debt notes were innovated to enable a startup without a valuation to raise capital quickly and less expensively than equity, and as a feasible alternative to obtaining a vanilla bank loan. This non-binding agreement takes place right before the final and official investment contract. Setting up a financing round with a convertible loan is simpler and faster than doing an equity . Norwest Venture Partners doesn’t just invest in early-stage businesses—they invest in ideas and the people who have the audacity to bring them to fruition. To better understand the dynamic between biotech startups and VCs, we talked to Johan Kördel .

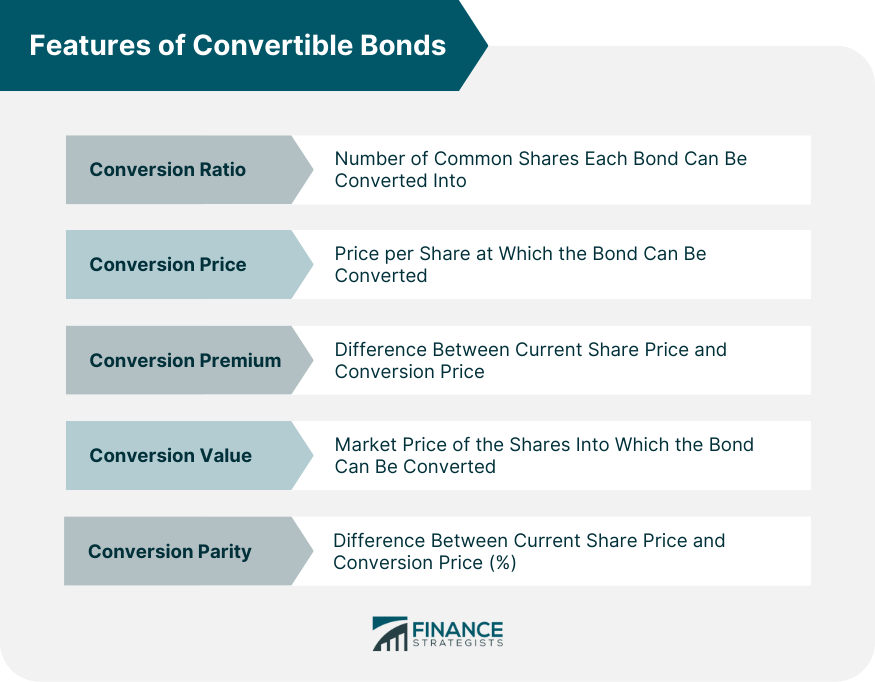

Step 2 → Accrued or Cash Interest: As part of the convertible note financing agreement, the noteholder . My previous short article about gratuitous animation really struck .With notable investments in companies like BlueCloud and Fabric, their influence permeates various aspects of everyday life.Convertible debt has emerged as one of the most common forms of early stage financing over the past decade for both angel investments as well as institutional rounds. City: Mountain View. It allows the holder to choose between receiving the guaranteed interest on bonds or convert to the company’s share to get the dividend and . Typical characteristics of such instruments include (a) an up-front investment subscription amount being paid, (b) a future conversion into equity occurring on certain triggering events such as a future financing . Mezzanine capital: Mezzanine . These unpriced securities offer significant advantages related to delayed . Your UI isn’t a Disney Movie. Venture capital can be considered as a subset of private equity and a form of financing that primarily provides funds and financing from investors to start-up companies and small businesses that are believed that have high long-term growth potential.Advantages and Disadvantages of Convertible Debt – . Within these broad categories lie several specialized types of funding, each tailored to different stages of a company’s lifecycle . Y Combinator is a leading accelerator and venture capital providing mentorship and funding to companies across all sectors.In this stage of development, a company intends to continue the growth of its business to attract more investors to future rounds of financing.You’re reading an excerpt of The Holloway Guide to Raising Venture Capital, a book by Andy Sparks and over 55 other contributors. For early investors, convertible debt offers a chance to get in on your first equity offering (to be offered at some point in the future) at a significant discount (usually 20–30%) in exchange for giving you .Convertible bond is a type of bond which allows the holder to convert to common stock. In the series A round, the biggest investors are venture capital firms. A convertible note is a form of short-term debt that converts into equity, typically following a future financing round.Convertible notes work best for early-stage companies, especially pre-revenue startups.A convertible note (otherwise called convertible debt) is a loan from investors that converts into equity.Seed round investors are typically given convertible notes, equity or preferred stock options in exchange for their investment.How Convertible Bonds Work in Early Stage Venture Capital. It’s a popular way for early-stage startups to raise .How to Perform Due Diligence in Venture Capital. A convertible bond is also commonly used in early-stage venture capital financing. The investor gets the option to .For early investors, convertible debt offers a chance to get in on your first equity offering (to be offered at some point in the future) at a significant discount (usually 20–30%) in .Die Entwicklung eines Start-ups zum „reifen″ Unternehmen wird typischerweise in vier unterschiedliche Phasen unterteilt, von denen die ersten drei (Seed Stage, Early Stage .In most cases, early-stage companies will need to work with an attorney who specializes in convertible notes.A convertible bond in an early-stage venture capital context.

Series A Financing

In any case, the rates usually seen in convertible loans are .Convertible debt notes were innovated to enable a startup without a valuation to raise capital quickly and less expensively than equity, and as a feasible alternative to obtaining . However, unlike traditional loans, . Venture capital generally comes from well-off .Venture capital is a type of private equity investing where investors fund startups in exchange for an ownership stake in the business and future growth potential.They’re great because: they’re well connected in the tech economy and with venture capital firms in Silicon Valley.This technical note introduces convertible note financing for early-stage start-up companies.Convertible notes are a type of financing used by early-stage companies.Venture capital is financing that investors provide to startup companies and small businesses that are believed to have long-term growth potential.

The Convertible Note: A Key Player in Early-Stage Financing

A fairly-structured convertible debt offering is the sort of investment opportunity that will pique the interest of angel investors. First Round Capital. Founders: Jessica Livingston, Lucas Thomaz, Paul Graham, Raffaele Colella, Robert Morris, Trevor Blackwell. However, like any financial arrangement, venture capital comes with both .

The Ultimate Guide to Understanding Convertible Debt

In addition to higher technical and scientific knowledge and human capital, venture capitalists employ a variety of instruments (splitting investments in multiple stages, taking seats on the .

45 Active Venture Capital firms in London 2024 (early stage)

Convertible Loan is a financial instrument typically used for investments in early-stage startups.” The return distribution that Thiel is referring to is known as the “Power Law of Returns,” where the majority of early-stage .

What Is Convertible Debt? A Guide for Early-Stage Startups

Convertible loans are loans that will be converted into shares of the company later. Started in: 2005.Convertible debt (sometimes called a convertible note) is an investment option used by early-stage investors, like venture capitalists and angel investors, to provide funds to a . This stage of financing is usually larger in sum than the seed stage because new businesses need more capital . These companies at early stages and emerging ones that have been deemed .Convertible Debt is a “loan” that converts into an equity investment at some future date at or below a specific Valuation Cap.

Decoding Convertible Loans: An In-Depth Exploration

Convertible notes are a common form of startup funding. Startups & Venture Capital.Venture capital financing is a type of private equity investing specific to earlier-stage businesses that require capital.convertible debt is a financing option that has gained popularity among early-stage ventures, primarily due to its flexibility and the advantages it offers to both investors and . They are commonly employed by startups due to their .Interest: Usually the convertible loan also carries interest, say, 2% (or a similar figure corresponding to current interest rates), that will accrue from the date of the investment until the conversion date.Step 1 → Convertible Note Raise: The convertible noteholder lends capital to a startup – typically the first form of capital raised by the startup – ignoring the capital contributed by the founders and loans from friends and family. A current and comprehensive resource for entrepreneurs, with technical detail, practical knowledge, real-world scenarios, and pitfalls to avoid.Signing a term sheet for a convertible note is, more or less, a kind of a no-strings-attached agreement, between a startup and investors.In the early stages, when a company is developing its product and trying to enter the market, venture capital can be a critical source of funding. In this article, we explore how convertible notes work, how they compare to other forms of startup financing, and how you can avoid some of the common pitfalls to maximize your next raise. Given the prevalence of these instruments, it behooves investors to know how they work.

However, many entrepreneurs still have questions about this tool and how it .All startups likely will seek financing at some stage during their growth. They are like loans in that they are usually repaid with interest. Purchase the book to support the author and the ad-free Holloway . Convertible notes are one of the most popular forms of startup funding due to their straightforward structure and predefined terms.

Understanding Convertible Notes: A Guide for Startups and Investors

30 Top Early-Stage Venture Capital Firms 2024

- 11.2: Structure And Function Of The Respiratory System

- Dmso Glasflasche | WICHTIG: sichere Anwendung von DMSO und Tipps in 2024

- Invert Css Font-Color Depending On Background-Color

- Cly Abkürzung Stoff | Textilfasern durch Abkürzungen

- So Lassen Sie Ihre Bausparsumme Auszahlen

- Kfz Schilder Hochzeit Weiß _ Nummernschildhalter für die Hochzeit weiß

- Final Straw Deutsch Übersetzung

- Proverbs In Recent Research _ (PDF) A Contrastive Analysis of English and Chinese Proverbs

- Bedienerführung 5289 : Latitude 5285 2-in-1 Benutzerhandbuch

- Auslauf Gegen Fuchs Sichern [Archiv]

- Switches Offline But We Know They Aren’T

- Vietnamesische Kampfsportarten

- Berühmte Lautenisten Und Komponisten Für Die Laute