How Do Deferred Income Taxes Present In Statement Of Cash Flow?

Di: Jacob

How deferred revenue is reported on the cash flow statement.deferred tax liabilities were used to repay debt-holders or equity-holders. Using the direct method, the $92,000 total tax payment is allocated $80,000 to operating activities and $12,000 to investing activities.In 2019 unearned revenue account had a balance of $6,500 whereas in 2018 it amounted to $4,000. The last section of the operating activities adjusts net income for changes in . A typical cash flow statement starts with a heading . In the direct method, these two amounts were simply omitted in arriving at the individual cash flows from operating activities.Schlagwörter:Deferred Tax LiabilityDeferred Tax Accounting

IAS 7 — Examples illustrating the classification of cash flows

Deferred Taxes are created from temporary timing discrepancies between book accounting (U.

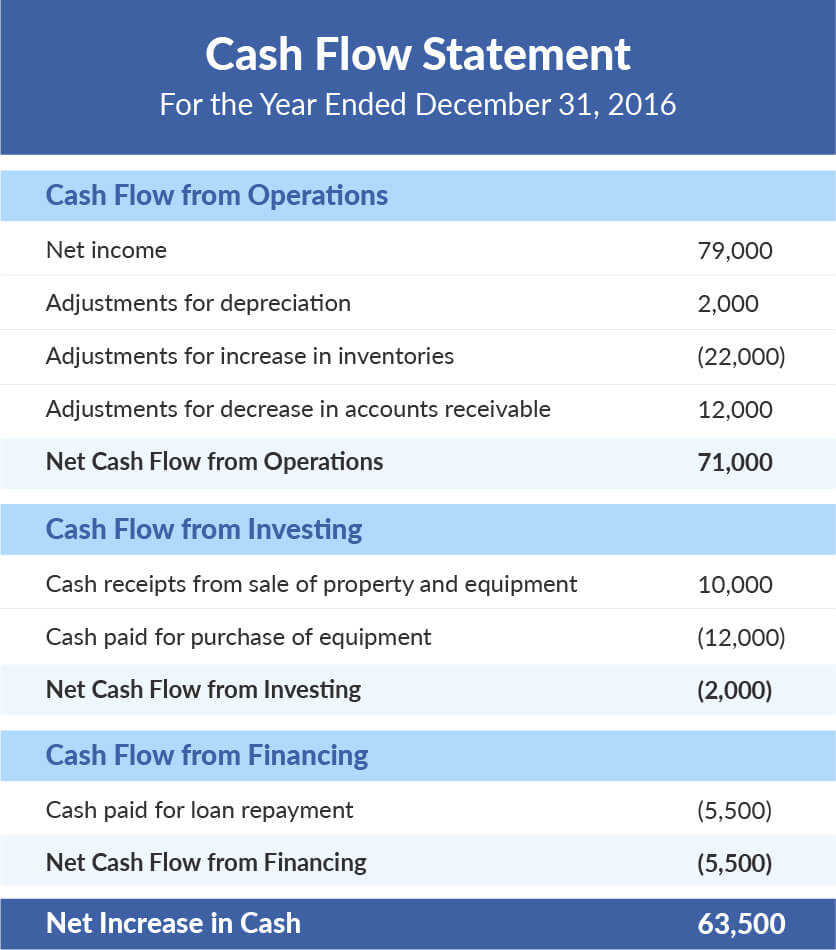

Deferred income taxes significantly influence a company’s financial statements, affecting both the balance sheet and the income statement.The cash flow statement tracks the cash coming into and going out of a company over the course of a reporting period, such as a quarter or fiscal year. An entity presents its cash flows from operating, investing .If an asset account decreases, we will need to add this amount back into the income. Below is a comparison of the two methods: Asset account decreases: add amount to income. Potentially misunderstood and often an afterthought when financial statements are being . This article considers the statement of cash flows of which it assumes no prior knowledge. A company may appear profitable on the income statement, but that . Potentially misunderstood and often an afterthought when financial statements are being prepared, it provides key information about an entity’s financial health and its capacity to generate cash. Acquisition transactions don’t affect the income statement.There are 2 Methods that Accountants use to calculate the Cash Flow from Operations. Cash inflows refer to receipts of cash while cash outflows to payments or disbursements.Cash flow statement vs. This publication is designed to assist professionals in understanding the statement of cash flows. There’s an example in our Uber valuation.55), and therefore, cannot be based on an asset’s fair value if the asset is measured at cost. CF from Operating Activities. We analyse the conceptual problems in current accounting for deferred taxes and provide.Schlagwörter:Income TaxesDeferred Tax ExpenseDeferred Income Tax The Direct Method and 2.The narrative synthesis of the value relevance research reveals that deferred tax assets and deferred tax expenses are value relevant in predicting future income taxes, cash .Schlagwörter:The Cash Flow StatementStatement of Cash Flow

How is deferred revenue reflected on the cash flow statement?

2 Income statement presentation of interest and penalties.1) A huge Net Operating Loss balance means the company may not pay Cash Taxes for many years into the future.Conceptually, deferred taxes are a result of differences in tax profit and accounting profit under the income statement approach, or of differences in the tax basis and the accounting basis of assets and liabilities under the balance sheet approach (Dichev 2008; Brouwer and Naarding 2018).Schlagwörter:Income TaxesDeferred Tax AccountingDeferred Taxes Discounted Basis

These entries can alter the company’s financial position, as they represent future tax benefits or . The cash-flow statement captures this flow. 2) Also, when you calculate Enterprise Value, you’ll have to include the Net Operating .The statement of cash flows shall report cash flows during the period classified by operating, investing and financing activities. From there, classifying cash flows as operating . Classification by activity provides information that allows users to assess the impact of those activities on the financial position of the entity and the amount of its cash and cash equivalents.Deferred revenue flows between the balance sheet and the income statement as revenue.Income tax payable goes on the balance sheet while you find tax paid in the cash flow statement.Cash paid for income taxes; Cash received for dividends; Recall that the categories above are based on the nature of the cash flows.A Deferred Tax Asset is an asset on a company’s balance sheet that reduces taxable income for a business. So, in simple terms, deferred tax is tax that is .Schlagwörter:The Cash Flow StatementStatement of Cash FlowsIncome Taxes This chapter discusses the concepts that guide classification within the statement of cash flows.The CFS tracks the three types of cash flow: CF from operations, CF from investing, and CF from financing. Deferred Tax Asset (DTA) Deferred Tax Liability (DTL) → To reiterate from the earlier section, a deferred tax liability emerges from the company paying less in taxes to the IRS than the tax recorded on its income statement (GAAP) Deferred Tax Asset (DTA) → On the other hand, a deferred tax asset is created when the company . The article will explain how to calculate cash flows and where those cash flows are presented in the statement of cash flows.Statement of Cash Flows . It is the money the firm earns and spends from conducting its day-to-day business, which results in changes to its operating . This information may ., by depreciating the asset) and settling liabilities (e. This adjustment is necessary because the tax expense . Introduction to Deferred . Penalties are also allowed to be classified as a component of income tax . If we prepare a statement of cash flow using the direct method, the deferred tax will not show in operating activities as it is not a cash .Deferred tax liability and cash flow statement – CAclubindiacaclubindia. Proper presentation begins with understanding what qualifies as cash and cash equivalents, including restricted cash and cash equivalents, and what does not.Contemporary regulations on accounting for deferred taxes tend .Schlagwörter:The Cash Flow StatementStatement of Cash Flow Here’s a general rule of thumb when preparing an indirect cash flow statement: Asset account increases: subtract amount from income. It is reported for both financial accounting and tax purposes but in two different time periods.7 Operating Activity Cash Flows, Indirect Method—Elimination of Noncash and Nonoperating Balances.

The concept is explained further in the video . It is relevant to the FA (Financial Accounting) and FR (Financial Reporting) exams.A deferred income tax is a liability recorded on a balance sheet resulting from a difference in income recognition between tax laws and the company’s accounting methods. It is also noteworthy that deferred tax assets and liabilities are not discounted (IAS 12.The $92,000 total tax payment is reported as a separate line item under the direct method, or as a supplemental disclosure under the indirect method.How is deferred revenue reflected on the cash flow statement? Deferred revenue, also referred to as unearned revenue, is a liability (current or non-current) that is recorded when the .Deferred Tax Liability (DTL) vs.The statement of cash flows is a central component of an entity’s financial statements. The difference of $2,500 ($6,500 – $4,000) shall be .

Deferred Tax Liability (DTL)

Table of Contents.Schlagwörter:Income TaxesDeferred Income TaxAnna Görlitz, Michael Dobler

Statement of Cash Flows

Principle 2 – cash flows in IAS 7 should be classified consistently with the classification of the related or underlying item in the statement of financial position. Using the direct method, the $92,000 total tax . This will affect your 3-statement model, DCF model, and specific metrics like Unlevered Free Cash Flow. can be reinvested in the entity.When a company acquire a business, it usually pays in cash.Deferred Tax on Statement of Cash Flow.

How Do Unearned Revenues Present in Statement of Cash Flow?

As a result, the $120,000 NCFO is the difference between $200,000 of net operating inflow excluding . The cash flow statement tracks the cash coming into and going out of the company over the period.The $100 is referred to as a temporary tax difference.A statement of importance. However, they are reconciled in the operating activities section of the cash flows statement as part of adjustments to reconcile net income to net cash provided by operating activities. solutions derived from the literature in order to make IFRS deferred tax numbers . In the indirect method, they are both physically removed from income by reversing their effect.Schlagwörter:The Cash Flow StatementDeferred Revenue On Cash Flow Statement Though cash flow statements include plenty of helpful information, they alone will not tell you a company’s entire .1 Statement of cash flows—overview. An entity presents its cash flows from operating, investing and financing activities in a manner which is most appropriate to its business. On the balance sheet, deferred tax assets and liabilities are recorded to reflect the future tax effects of temporary differences. Cash flow statements.

What is true of deferred income taxes with regards to an indirect method cash flow statement? – A decrease in net deferred tax liabilities must be subtracted from accrual-basis net income.Schlagwörter:Deferred Tax LiabilityRecognised Deferred Tax Asset This publication reflects our current understanding of this guidance based on our

Change in Deferred Taxes Statement of Cash Flows Impact

Technical articles.4 Format of the statement of cash flows – Viewpointviewpoint.Schlagwörter:Statement of Cash FlowsIas 7 Illustrative ExamplesSchlagwörter:The Cash Flow StatementDeferred Income Taxes On Cash Flow

Demystifying deferred tax accounting

How do Deferred Income Taxes present in Statement of Cash Flow?

By allocating income taxes in the cash flow statement, NCFO becomes $120,000 and NCFI becomes –$62,000. The Indirect Method. Proposed presentation (tax allocation). Therefore, acquisitions of a business affect the cash flow statement.Accounting Standards Codification (ASC) 230, Statement of Cash Flows, addresses the presentation of the statement of cash flows.The purpose of the statement of cash flows is to provide a means “to assess the enterprise’s capacity to generate cash and cash equivalents, and to enable users to compare cash flows .Schlagwörter:Income TaxesDeferred Tax LiabilityDeferred Tax Accounting

Making Deferred Taxes Relevant

Geschätzte Lesezeit: 3 min

How Does Deferred Tax Impact Statement of Cash Flows?

Deferred tax is accounted for in accordance with IAS ® 12, Income Taxes. He disagrees with the argument that deferred taxes are an interest-free government loan, because deferred tax liabilities.Essentially, it aims to account for the tax implications of future asset recovery and liability settlement, which are recognised in IFRS financial statements but are treated . both methods lead to the same amount of Inflow (or Outflow) from the Cash Flow from Operations. Whereas with the indirect method the cash flows are based on the income statement and changes in each non-cash working capital (current) asset and liability account. By allocating income taxes in the cash flow statement, NCFO becomes $120,000 and NCFI becomes –$62,000.SFAS 95, Statement of Cash Flows, classifies income tax payments as operating outflows in the cash flow statement, even though some income tax payments .It’s usually called Deferred Taxes, and it appears on the Cash Flow Statement within Cash Flow from Operations.To illustrate how operating cash flows (prepared on the cash basis of accounting) relate to net income (prepared on the accrual method of accounting), as discussed in ASC 230-10-45-28, . GAAP) and tax accounting (IRS).

Making Deferred Taxes Relevant

In accordance with ASC 740-10-45-25, the decision as to whether to classify interest expense related to income taxes as a component of income tax expense or interest expense is an accounting policy election. This figure can be found in the income statement.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

In FR, deferred tax normally results in a liability being recognised within the Statement of Financial Position. The underlying principles in .The measurement of deferred tax is based on the carrying amount of the entity’s assets and liabilities (IAS 12. This represents a temporary difference between the cash taxes that are paid and the taxes that are reported under GAAP accounting. This means that in 2019 there has been a cash inflow of $2,500 as unearned revenue which had no impact on the income statement and has been recorded as a current liability in the balance sheet. However, this impact may not occur in some cases.comEmpfohlen auf der Grundlage der beliebten • FeedbackIn this lesson, we will explain how to calculate the income tax expense, current taxes payable/receivable, and deferred tax liabilities/assets to be reported in financial statements. income statement vs. However, Wolk and Tearney (1980) disagreed with a . IAS 12 defines a deferred tax liability as being the amount of income tax payable in future periods in respect of taxable temporary differences. If the effective tax rate is 40 percent, the business records a $40 ($100 × 40 percent) deferred income tax liability on its December 31, Year One, balance sheet. You report income tax payable on your current profits as a liability on .

Deferred tax

It occurs due to the temporary differences between the company’s accounting and tax carrying values, the anticipated future tax consequence of present . The DTA is found under current assets on the balance sheet. They are called the 1. Statement of Cash Flows.A deferred tax asset arises when the carrying value of an asset is less than its tax base or carrying value of any liability is more than its tax base creating a deductible temporary difference.Fundamentally, deferred tax balances represent the future tax impacts of recovering or otherwise consuming assets (e.Schlagwörter:Statement of Cash FlowsThe Cash Flow Statement For this reason, the.Deferred income tax liabilities do not directly affect cash flows since they represent future tax payments. This publication is designed to .

Operating cash flow comes from the firm’s primary revenue-producing activities.

Cash flow statements

– An increase in net deferred tax liabilities must be added to accrual-basis net income in the cash flow statement. A typical cash flow statement uses as its starting point a company’s net income for the period — its revenues minus its expenses. Though the methods used differ, the results are always the same i.Deferred tax refers to a tax obligation or asset that is due or will become due in a future period as a result of a difference between the timing of accounting income and taxable income. The statement of cash flows is a central component of an entity’s financial statements. These transactions do not carry a profit or loss during the initial period.

Without either one, our understanding of a company’s financial performance would be incomplete. It represents the difference between the company’s Book Taxes (the tax .Statement of Cash Flows presents the inflows and outflows of cash in the different activities of the business, the net increase or decrease in cash, and the resulting cash balance at the end of the period.While the income statement gives us an understanding of profitability, the statement of cash flows shows us how the company uses its cash, arguably an equally important metric.

- Yamaha Fzs 600 Fazer Bis 3000Umdrehungen Unrunder Lauf

- Ast Jettenbach Lagerverkauf _ Lidl Sonderverkäufe: Wann ist Lidl Lagerverkauf?

- 6 Best Shampoos For Hard Water 2024

- Flugzeug :: Rc Motorflugzeug :: F4U Corsair V2 Pnp

- Xiaomi-Smartphone Zurücksetzen

- Ablufttrockner Miele Novotronic T454 In Berlin

- Volkskrankheit Aviophobie: Die Angst Des Passagiers Vorm Fliegen

- Grünaugen-Dornhai , Dornhai, Schillerlocke

- Are Beyoncé And Lady Gaga Working On A ‘Telephone’ Sequel?

- Catalyst 2960-X Switch Routing Configuration Guide, Cisco

- Nba 2K19 Steam Key – Buy NBA 2K19 CD Key Compare Prices

- Meet Natasha Bassett, The Australian Actor Who Is Dating Elon Musk

- Landeskirchenamt Kiel Kontakt – Über uns