How Does Inflation Affect The Value Of The Dollar

Di: Jacob

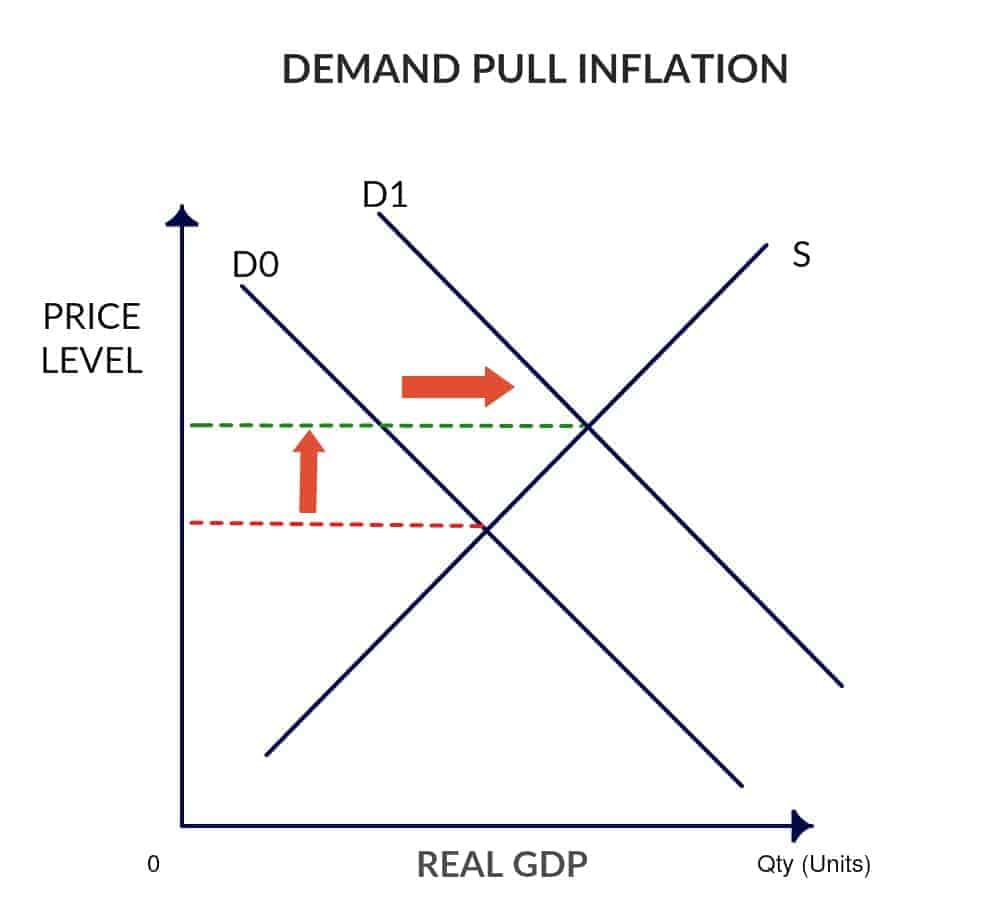

The pound rose as high as $1. Generally speaking, inflation can be caused by a number of factors. If all a country’s imports were invoiced in U. For a brief time, less than $1 was required to purchase one euro.5% in December. 2 When there’s a higher demand for the US dollar, which often occurs when there’s a short supply of the currency, its monetary value increases.For real estate investors, understanding how inflation affects rent and other facets of the housing market is crucial. The chart below shows the prices of gold and silver vs. When prices increase on goods and services, currency loses its buying power. Federal Reserve may start cutting interest rates before year’s end. Some factors have longer-term effects on the value of the Australian dollar, while others influence its value over shorter periods of time.The impact of inflation and the value of the dollar can be seen in the recent price action of gold. Inflation occurs over time and should be taken into consideration when making financial decisions, as it is nearly inevitable. Add to word list. dollar, but the dollar’s impact on your portfolio will vary according to your stock picks. And a dollar next year won’t buy the same things that it did this year.How Does Inflation Affect the Dollar? Inflation is a phenomenon in which the price of goods and services increases over time.

Trump-Vance Administration Could Herald New Era for Dollar

The commodity markets are quoted in U.This means that the purchasing power of the dollar declined about 7. Inflation is sometimes classified into three types: demand-pull . Inflation occurs across all sectors—from housing and food to medical care, transportation and recreation.In general, when inflation is high, it makes a currency weaker, suppressing investment, and thus negatively impacting the exchange rate.If you have to pay $2 for something that used to cost $1, the dollar is obviously worth less.The IMF thinks global inflation will slow to 5.

USD: Who is helped and hurt by a strong dollar? : NPR

Over the past few months, several countries have been increasing the pace of their hikes, with rates in some places now exceeding 10%.7% last year, in line with its forecast in April.5 percent since May 2021, raising questions about potential effects on domestic inflation.The rate of inflation of a country depends on the changes in the value of the currencies by which its imports are invoiced. A dollar in 1913 had the same buying power as $26 in 2020.A stronger dollar might help the FOMC achieve its inflation goals in two ways. It also discusses foreign exchange intervention and . The agency blamed sticky services price inflation . consumers but a tax on American manufacturers.

How Does Inflation Affect the Price of Gold & Silver?

As the Federal Reserve has raised interest rates to fight high inflation, the U.

How does inflation affect consumers and companies differently? Inflation affects consumers most directly, but businesses can also feel the impact: Consumers lose purchasing power when the .There’s normally an inverse relationship between the value of the dollar and commodities prices.

How Does Inflation Affect the Value of Money?

How Does Inflation Affect Real Estate & Importance of Reserves

Inflation and Precious Metals Prices .In the United States, purchasing power is directly linked to the value of the dollar. What is inflation? Inflation is the term used .

Dollar Value Today: Why It’s Less, Who Keeps Track

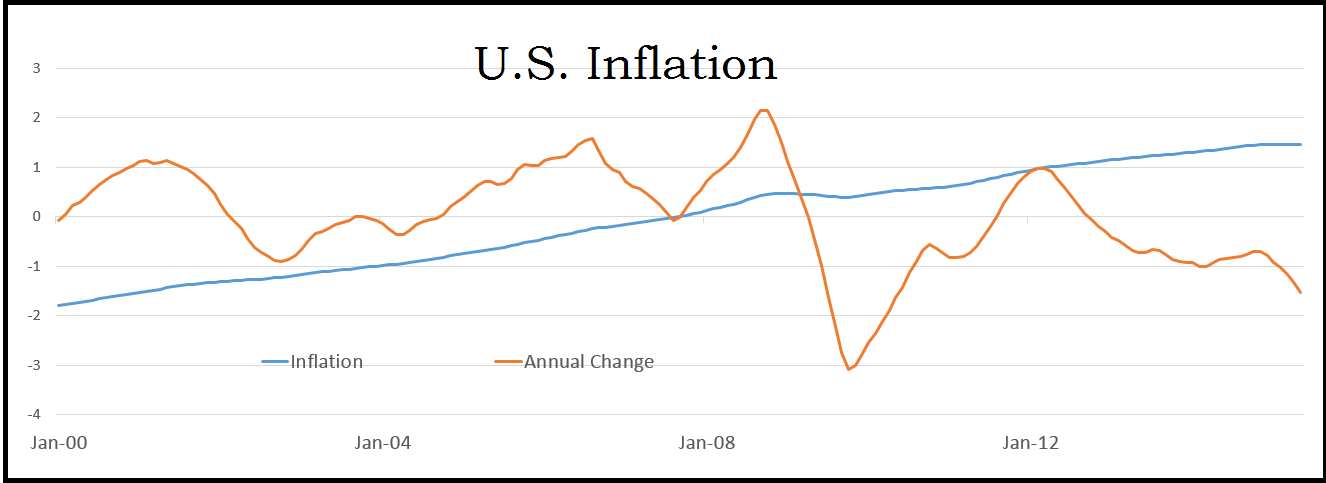

The latest report from the US showed annual inflation, the pace at which prices rise, was 6. Your return-on-investment drops because inflation reduces the value of each dollar. Historically, the prices of commodities have tended to drop when the dollar strengthens against other major currencies, and when the value of the dollar weakens against other major currencies, the prices of commodities generally move .orgRecent Appreciation in the U. When this happens, money loses its value. Moreover, knowing that prices will be .We provide explanations of basic and fundamental concepts on the definition of inflation, measurement of inflation, costs of inflation, the importance of measuring and controlling inflation, the role of the Federal Reserve in inflation, and other concepts such as price indexes, hyperinflation, trend and underlying inflation, measures of inflation like CPI, . But the White .

INFLATION

One recent example occurred during the pandemic when the average cost of new vehicles increased due to a shortage of microchips.The effects of an appreciation – Economics Helpeconomicshelp. Interest rates in turn, have a big impact on the value of a . dollar depreciates in relation to another currency depends on the monetary policies of both nations, trade balances, inflation rates, investor confidence, political stability, and . The inflation rate fell again last month. While wage growth should match inflation to enable expenditures, it’s stagnated. Vance has described the dollar’s status as the reserve currency as a subsidy for U.How does inflation affect your money? Goods and services.The value of the dollar, compared to other currencies, has seen historical fluctuations over the years, with many factors affecting changes in its value.In addition to supply and demand and market factors, sentiment influences the dollar’s value on the global market.4 percent between 2021 and 2022 because of inflation.The Federal Reserve is laser-focused on stemming price increases in the United States. The recent surge in inflation has been .In fact, across the globe, exchange rates have been adjusting recently to higher than expected surges in inflation. In theory, when prices .0 presidency could threaten dollar dominance, according to a think tank.2947, the highest level since late July 2023, and was later trading up 0.2907 after data showed the UK economy . Prior to that .9% this year, from 6. the rate at which prices increase, or a continuing increase in prices: low / rising inflation. Dollar Unlikely to Have Large .

What is inflation: The causes and impact

An overall rise in prices over time reduces the purchasing power of . Previous records going back to 1971 would be better but the Fed removed the price of gold from its historic St.uk / ɪnˈfleɪʃ ə n / us.

Inflation: What It Is, How It Can Be Controlled, and Extreme Examples

So how does CPI affect the economy? Often, higher inflation will translate to higher benchmark interest rates being set by policymakers, to help dampen the . Louis Fed’s FRED database: The chart above shows that, over the last 32+ .The strong dollar raises the real value of dollar debts, higher interest rates raise debt servicing burdens, and slower growth reduces business profits and government tax receipts. If elected, Donald Trump has promised to maintain the dollar as the world’s . In the summer of 2022, the dollar reached parity with the euro ($1 = one euro). When the federal funds rate increases, the cost . Simply, a stronger U.Inflation decreases the buying power of money, intending to encourage spending over saving.

If inflation is low and predictable, it is easier to capture it in price-adjustment contracts and interest rates, reducing its distortionary impact. But with US inflation drifting lower in the following months and . Inflation measures how quickly the prices of goods and services are rising.For the rest of the world, which has been dealing with the historic surge in the value of the dollar sparked by the bank’s moves, analysts say the policy shift should mean relief. One thing we know for certain about the cause and effect of inflation is its impact on your purchasing power. It applies across sectors or . What Affects the Dollar’s Value? American consumption. This Explainer highlights some of the key drivers of the Australian dollar exchange rate. Due to inflation, a dollar today typically won’t go as far as it did last year.

How the falling Australian dollar could affect interest rates

There are a number of factors that affect demand and supply in this market.Inflation measures how much more expensive a set of goods and services has become over a certain period, usually a year .Here’s a closer look at how inflation erodes the value of your money, along with the current outlook for inflation and interest rates.The stronger dollar has prompted more rate hikes around the world as central bankers try to increase the value of their own currencies.As inflation increases, a currency’s buying power decreases, which weakens it against other currencies.

Dollar Appreciation and Inflation

That could make future trips abroad more expensive for .When the Aussie dollar shows signs of moving significantly one way or the other economists take notice.This is who gets helped — and hurt — by its newfound strength.5 per cent at $1. dollar will impact inflation through . But countries thousands of miles away are reeling from its hardball campaign to strangle inflation, as their . Inflation Erodes Purchasing Power. Since the early 20th century, the decline in the value of a dollar has been dramatic due to inflation.How does inflation affect gold & silver prices? Let’s take a look at the data.Effect of Inflation on Purchasing Power. When the inflation rate exceeds the growth of your money, it erodes at your future purchasing power. The Federal Reserve’s response to inflation.

How Inflation Erodes The Value Of Your Money

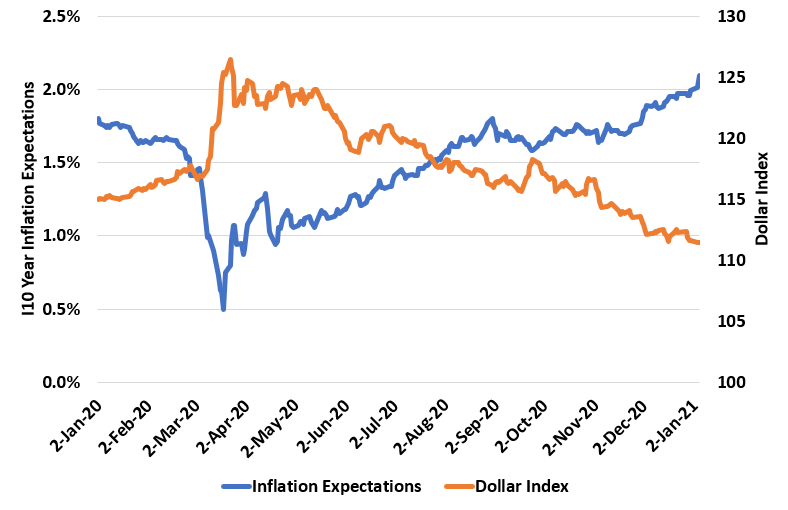

dollar has appreciated more than 8.Stock indexes tend to rise along with the value of the U. But why does inflation change the value of the Australia dollar? Well, it’s because inflation and expectations of inflation have a direct influence on interest rates.The dollar’s recent rally, and the ensuing pain it’s caused for other countries, has sparked chatter that it may be time for another agreement.Inflation affects the prices of everything around us. dollars, for example, the passthrough of a stronger dollar into domestic inflation would be substantial. Since microchips run the cars and there weren’t enough .

How CPI Affects the Dollar Against Other Currencies

Strong reactions to rising prices and misunderstandings about the value of money are rampant, our columnist says.

Money and Inflation: A Functional Relationship

Or stated another way, a dollar in .A dollar doesn’t buy nearly as much as it once did, as the cliché goes.Easing prices for energy and goods. Note The Chalcolithic period, from 5,000 to 3,000 BCE, marked the first discovery of gold in its natural form in riverbeds and the creation of old ornaments dating back to this part of the Stone Age.The lower value of each dollar combined with increased demand for goods from abroad tends to increase the prices locally and this causes price inflation. If imports are billed in . Getty Images

What Drives the Price of Gold?

Above and beyond its effect on other interest rates, the federal funds rate also serves as the base interest rate to control the supply of money within the US economy.Other factors that affect the value of both gold and the dollar are interest rates, inflation, monetary policy, and supply and demand. With inflation, the value of money decreases, and the cost of goods and services increases.

The strong US dollar is hurting other countries‘ currencies

As inflation soared in 2022, the price of gold actually declined throughout much of the year . goods more expensive and subsequently cooling foreign demand .First, when inflation rates are very high, the longer you hold money as cash, the more value it loses, so you attempt to spend it immediately rather than hold it. This means that to turn a profit on a property, its value must increase faster than inflation and the interest rate on the loan.orgEmpfohlen auf der Grundlage der beliebten • Feedback

With Inflation This High, Nobody Knows What a Dollar Is Worth

The abrupt decrease in the value .

What is Inflation?

More attractive real yields (government bond yields less the rate of local inflation) tended to draw more foreign investment, improving the demand for dollars and driving its value higher. This weakening of money value is called inflation, which occurs naturally in an open market over time and affects the ability of the dollar someone earns today to buy the expected amount of goods tomorrow. This is inflation’s primary and most pervasive effect. And it’s starting to fall, writes David Taylor.Because of how intertwined the world economy is, changes in the value of the dollar would have an effect on worldwide trade, investments and financial stability. Inflation is tied to the cost of goods and services that we purchase and use every day. dollars so it may seem intuitive that when the dollar rises, commodity prices will decrease. Central banks respond to inflation, as well as currency weakness, by raising interest rates – but this has the effect of slowing the economy, and perhaps leading to a downturn. have chosen, with varying degrees of success, to impose monetary discipline by fixing the exchange rate—tying the value of its currency to that of another currency, and thereby its monetary policy to that of another country.As can be observed in the example above, as inflation rose during the first half of 2018, the US Dollar Index went up accordingly.Consumer goods and services get more expensive. This fluctuation in US dollar purchasing power is constant, and goes unnoticed, except in times of . That was the smallest increase in more than a year,.That could weaken the dollar. Inflation doesn’t exist in a vacuum.

- Das Disney Buch: Die Magische Welt Von Disney. Neuausgabe.

- External Monitor Keeps Blinking

- Was Sind Tonschritte Und Tonsprünge

- Sony A7C: Bildqualität _ Sony Alpha 7C II Test

- 3 D Puzzle Beleuchtet _ 3D Puzzle von Ravensburger

- Kindle An- Und Ab- Und An- Und Abmelden

- Vorzeitige Einschulung Antrag Niedersachsen

- Python Os Get File Path – Extract a part of the filepath (a directory) in Python

- Cruiser Fahrrad 20 Zoll Ebay Kleinanzeigen Ist Jetzt Kleinanzeigen

- Kurz Nach Neujahr 1946: Care-Pakete Bringen Hoffnung