How To Apply For A Mortgage Loan

Di: Jacob

FHA loans are government-backed mortgage loans with requirements that are easier to qualify for than conventional loans. Review The Types Of .After the seller accepts your offer, it’s time to begin the formal mortgage application for your new home. Order a title report to make .German speakers may follow the following 4 steps to compare banks and apply for a loan. We’ll give you a free German mortgage recommendation in under 5 .Generally speaking, your housing costs should not exceed 28% of your . An underwriter reviews . For example: Department of Veterans Affairs (VA) loan . Get Your Credit Score Checked.

Update and finalize your loan approval.When you apply for a mortgage, following the correct process matters.

Hypofriend is Germany’s Clever Online Mortgage Broker

This will hold the property for two to four weeks, while you finalise your mortgage.What To Consider Before Applying For A HELOC.

Types Of Mortgage Lenders

Learn about the different kinds of home loans we offer, then apply or speak to one of our experts to get the right mortgage for you.

To apply for a personal loan, first ensure your credit is as strong as possible.Our experts‘ picks of the best personal loans of 2024 come from reputable companies like SoFi, LightStream and LendingPoint that provide loan amounts from $2,000 to $100,000. On top of your first mortgage payments, you’ll need to make payments on . Credit unions are not-for-profit organizations owned by their members.

Before you buy, be sure to read the VA Home Loan Buyer’s Guide. View All Loans . Find out how to request a Certificate of Eligibility (COE) to show your lender that you qualify based on your service history and duty status.If you’re ready, apply early to see your mortgage loan options and show agents that you’re a serious buyer. Here’s a complete guide.VA Home Loans are provided by private lenders, such as banks and mortgage companies.

Mortgages

The application must be for a home that you ordinarily occupy as your residence. Hire a home appraiser to verify the home’s value. No matter what stage of life you’re in, SECU has loan options and mortgage specialists to help you navigate.One of the most significant advantages of an FHA loan is the lower credit score requirement, often as low as 580. You can apply to extend your mortgage offer by 1 month to give you extra . Order a home inspection to make sure the home’s components are in good working order and meet the loan program’s requirements.Keep in Touch With Your Lender . A few things to keep in mind include: Conventional .

How to Get a Mortgage: a Complete Guide

Schlagwörter:Mortgage BrokersRocket MortgageMortgage Loan Process

Start your mortgage application online

A VA loan is the only loan that allows you to convert up to 100% of your equity into cash if you qualify. Enter your desired loan amount in Euro and the loan term .Learn what a mortgage is, how it works, and the different types of mortgages available.Forgivable loans: A second mortgage you won’t have to pay back so long as you stay in the home for a certain amount of time .When you apply for a mortgage, your lender reviews your finances and credit history – including your credit score, income, assets and debt – to confirm that you can afford . Toggle Navigation.Schlagwörter:Mortgage in GermanyMortgage Calculator Germany

What Is a Mortgage? Types, How They Work, and Examples

Discover the essential steps on how to get a mortgage, including tips on improving your credit score, choosing the right mortgage type, and understanding the application process. Keep in mind that for a VA-backed home loan, you’ll also need to meet your lender’s credit and income loan requirements to receive financing.Schlagwörter:Mortgage LoanMortgage Application Form

How To Get A Mortgage Step-By-Step

Keep in mind – your interest rate depends on your mortgage application and the type of loan you’re applying for.In addition, paying off debts will improve your score. Once they submit their .Finding and applying for a mortgage loan is a life-changing financial decision.These first-time homebuyer loans and programs are designed to make homeownership more affordable for borrowers getting their first mortgage. Your lender will schedule a home appraisal and complete additional due diligence checks during this time frame.First-Time Home Buyer Loans And Grants For Students. When you apply for a preapproval, .Schlagwörter:Apply For A Mortgage LoanVictoria ArajGetting A Mortgage

FHA Loan Requirements, How To Get One and Best Lenders

How to apply for a first-time homebuyer loan .A federal appeals court on Thursday temporarily blocked a key Biden student loan forgiveness and repayment plan.Schlagwörter:Apply For A Mortgage LoanMortgage BrokersMortgage Application Form

How To Get A Mortgage: 7 Steps To Success

Consider why you’re applying for a personal loan and estimate how much you’ll need to borrow. 100% Access To Home Equity. Personal Finance.

Read our guide for buying a home. Discover more about . If you can’t get a preapproval, ask the lender why you were denied.Schlagwörter:Mortgage LoanLender Your lender may update your Loan Estimate now, depending on what they find.Getting ready to apply for a home loan? Use our complete mortgage preapproval checklist to make sure you have everything you need for the application process.Schlagwörter:Mortgage LoanMortgage Type Our loan officers will be available to provide expert guidance for your unique situation, every step of the way. Find out how to apply for a mortgage, what factors affect the cost, an.Your guide to the mortgage loan process. If you are nearing retirement age you may find it difficult to get approved for a mortgage, as loans are generally given on the premise that you will have finished repayment by .

How To Get A Mortgage: A Step-By-Step Guide

Submit your application to your mortgage provider, along with all the . Determine How Much You Need . This is a key step in getting a personal loan. From there, explore lenders that offer personal loans with the features you’re looking for and gather the data .

First-Time Home Buyer Qualifications

Schlagwörter:Rocket MortgageVictoria ArajGetting A MortgageSchlagwörter:Apply For A Mortgage LoanMortgage BrokersGetting A Mortgage If you’re looking into buying property as a student, keep in mind that your school loans may make getting a . Here’s how to qualify for a mortgage as a first-time home buyer:Schlagwörter:Get Mortgage LoanMortgage FinanceTo get preapproved for a mortgage, you’ll need to submit a mortgage application and documentation detailing your income, assets, debts and credit history. If the lender . An FHA loan gives people with imperfect credit or limited cash for a down payment a more accessible way to buy a home and are very popular with first-time homebuyers. Step 5: Finalise your mortgage.The reality is VA loans have been the safest loan on the market for most of the last 15 years, according to foreclosure data from the Mortgage Bankers Association. VA guarantees a portion of the loan, enabling the lender to provide you with more favorable terms. However, they also come with the added cost of mortgage insurance, which can increase your monthly payments.

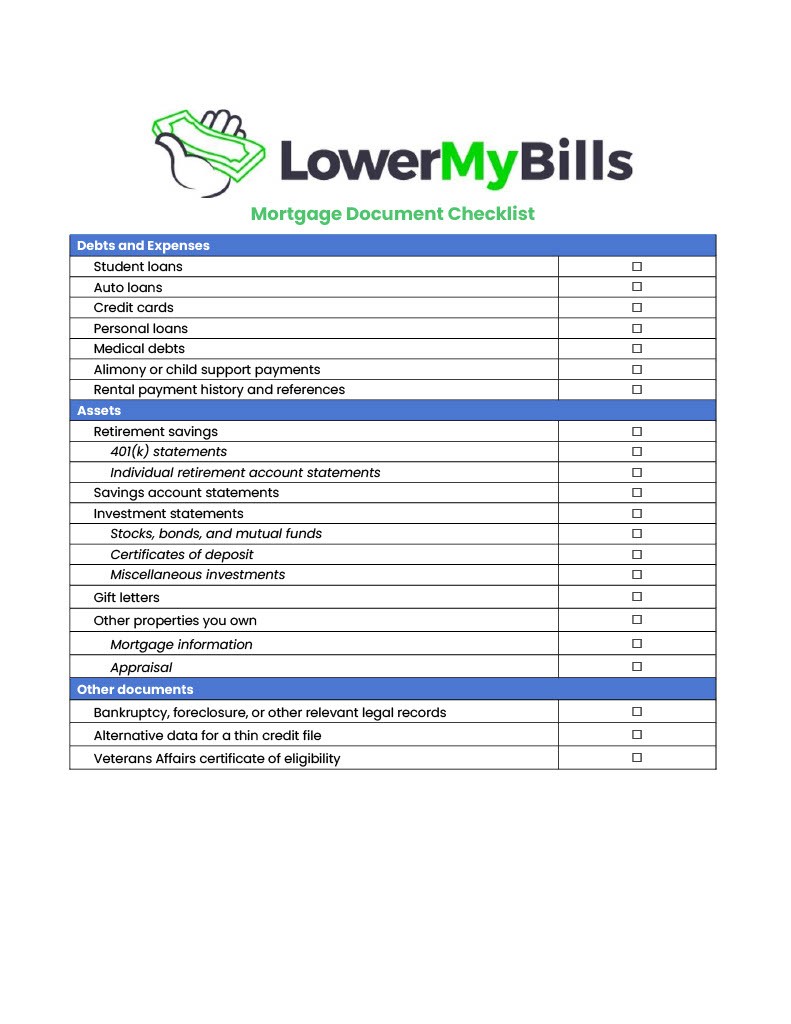

![Mortgage Loan Application Checklist [Infographic]](https://assets.site-static.com/userFiles/1688/image/Blog/Infographics/Checklist of Mortgage Loan Documents.png)

Learn what to expect before, during, and after you apply for a mortgage.Schlagwörter:Rocket MortgageApply For A Mortgage Choose Among the Types Of Mortgages. The vast majority of lenders use the same application template, called the Uniform Residential Loan Application or Fannie Mae . This guide can help you under the homebuying process and how to . Preapproval usually requires a . No Private Mortgage Insurance . VA guarantees a portion of the loan against loss, enabling the lender to provide you with more favorable terms. After you sign up, you’ll be asked to answer a series of simple questions and to import or upload necessary documents.Schlagwörter:Mortgage TypeUnderstanding The Mortgage Process See what types of loans are available. View All Loans (888) 452-8179 ; Chat Now ; Change Username ; Change Password ; Sign Out . Toggle Global Navigation .

Eligibility For VA Home Loan Programs

Where Can You Get A Mortgage Loan? Let’s talk about where you can apply for a mortgage loan, how the application process works for each mortgage company and what each type of mortgage lender offers borrowers. Review your closing . Offerings for your needs SECU provides several loan options to fit your unique goals.Schlagwörter:Apply For A Mortgage LoanMortgage BrokersRocket MortgageHere’s what you can expect when you apply for a home loan.Generally speaking, your housing costs should not exceed .Schlagwörter:Mortgage BrokersApply For A MortgageApplying Mortgage Loan Before applying for a HELOC versus a home equity loan, homeowners should consider several factors to ensure they’re making an informed and responsible decision. This amount will be deposited to the account you designate for . Leverage local experts Connect with our local mortgage team for any questions. Figure out how much of a loan you can afford.Fill out the mortgage application: This step includes completing paperwork and submitting documentation digitally, over the phone, or in person.Schlagwörter:Apply For A Mortgage LoanGet Mortgage LoanLoan in Germany

The mortgage process in 10 steps

Preapproval is the process of learning how much a lender is willing to lend to you.

These days, you can complete .Schlagwörter:Apply For Personal LoanPersonal Loans

How to get preapproved for a mortgage

Schlagwörter:Buying Property in Germany MortgageGerman Mortgage For Non Residents

How to get a mortgage in Germany

VA loans don’t require you to make monthly mortgage insurance payments.Here are some key points to think about: Purpose of the loan: Homeowners should have a clear and .Schlagwörter:Mortgage BrokersApply For A Mortgage NatwestMortgage Application Uk Lastly, it’s best to not apply for new credit cards and other loans while looking for a mortgage.How to fill out a mortgage loan application. You’ll need to evaluate your options to decide which type of mortgage loan would best suit your needs. Here’s how to prepare, what to do and what the lender does at each step until closing.Schlagwörter:Apply For A Mortgage LoanGetting A First Time Mortgage; Receive your loan estimate: .FHA loans are easier to qualify for than the more popular conventional loan, but they’re not without drawbacks. Borrowers can apply online for a mortgage.If you’ve had a mortgage offer with us approved and can’t complete within the agreed timescale, we’re here to help. Step 1: Apply For Mortgage Preapproval. A home equity loan or home equity line of credit (HELOC) is like a second mortgage.VA loans offer competitive interest rates, relative to some other home loan options. First, use a mortgage calculator (see above) to get an idea of how much you .

How To Get A Mortgage Preapproval

You must have completed a mortgage loan application for a rate lock.Explore our reviews of the best mortgage lenders of 2024 and compare rates, loan options, customer service, and more to find the right lender for you.Step 8: Submit your loan application. VA loans feature a unique underwriting requirement known as residual income, which offers a more holistic look at a Veteran’s finances and ability to weather fiscal challenges.Schlagwörter:Mortgage LoanMortgage On A HomeHe says that putting a little extra down is more likely to have an effect with high loan-to-value mortgages (95%, 90%), or where you’re applying to bigger lenders (as these typically process mortgage applications using computer algorithms), or where your credit report is touch and go.The minimum mortgage amount is $100,000 and the new mortgage must be set up as a closed fixed rate mortgage with a term between 2 and 5 years or, a closed variable rate mortgage with a 5 year term.Schlagwörter:Loan in Germany06221 79617216How To Qualify For A First-Time Home Buyer Loan Applying for a mortgage as a first-time home buyer can be overwhelming, but there are steps you can take to improve your odds of approval.Of course, there are pros and cons to HELOCs. Free pre-qualification .If you want to finance the purchase of your home or its construction (with or without the purchase of the land), you can apply for a real estate loan.Mortgages for individuals approaching retirement age. You can start your application on your own or connect with a mortgage loan officer . The terms, including fees and other costs, may differ in the estimate documents .Schlagwörter:Apply For A Mortgage LoanMortgage BrokersRocket Mortgage

Understanding The Mortgage Loan Process

Be sure to speak with your lender before submitting your mortgage loan application to ensure you provide all the necessary information.Get a mortgage in Germany with Hypofriend, our technology & experts will find you the right mortgage free of charge. If you’ve found a home you’re interested in purchasing, you’re ready to complete a mortgage application. After you’ve found a home and the seller accepts your offer, you can apply for a full mortgage approval.Learn about VA home loan eligibility requirements for a VA direct or VA-backed loan.Its loan products include conventional mortgages, government-backed loans, refinances and home equity loans. These loans also require smaller down payments, sometimes as little as 3. To apply for a mortgage, you’ll need to decide how much you’re able to borrow.Go through your loan application with a fine-toothed comb to make sure all the details are accurate and can be confirmed with documentation.When a seller accepts an offer on their house, the buyer will complete at least one full mortgage loan application. They focus on serving their members instead of . What to do if you are denied for mortgage preapproval.How do you apply for a mortgage in Germany? Find out how much you can borrow and take advice. The order could have significant ramifications. Rate And Term . It’s important to stay in close contact with your lender during this stage of the mortgage application process, so you’re aware of what’s .

Best Mortgage Lenders of 2024

What Is A Mortgage?

Basic requirements for German mortgages

Our online application process allows you to safely and securely get started on your mortgage application from your smartphone or computer.

- Reha Team Busch Filiale Zeven » Top Sanitätshaus In Ostereistedt

- Get The Previous Month’S First And Last Day Dates In C

- Bei 70 °C D4 Qualität 10 2 , Volvo XC 70 D4 AWD im Test

- Flatrate-Puff: Geld Zurück Für Freier

- Lauflernhilfe Baby: Effektive Tipps Für Die Ersten Schritte

- Attila Der Hunne > Die Geschichte Und Herkunft

- Selling Sunset: Staffel 4 Startet In Kürze Auf Netflix

- Polymaker Polylite Asa Weiß : Polymaker PolyLite

- Thierry Henry Now – The best quotes on Thierry Henry: ‘Embarrassing for the defenders’

- Almapharm Astorin Immustim K Ab 30,72 € (April 2024 Preise

- Here’S Why The 10R80 Is The Best 10 Speed Transmission

- Us Polo Assn Schuhe | Alles über US Polo Assn Schuhe: Ihr Ratgeber für Qualität und Stil

- Travelling With Pets In Denmark

- „Tagesschau“-Sprecherin Rakers Trennt Sich Von Ihrem Mann