How To Complete Irs Form 941 For The Tax Year 2024?

Di: Jacob

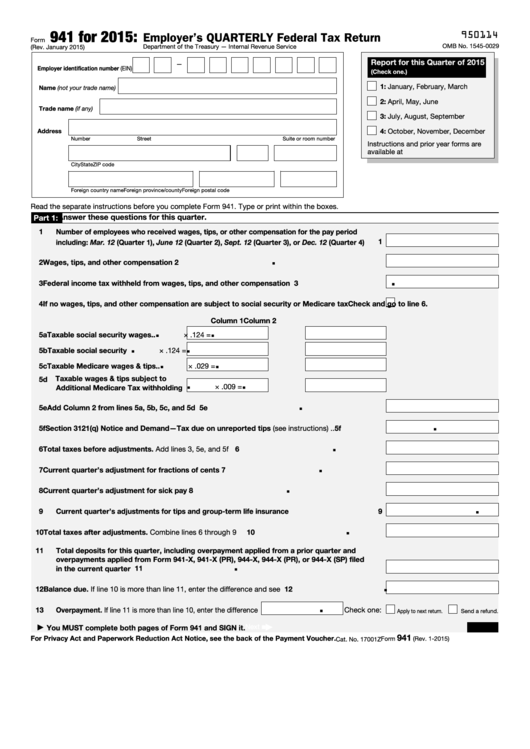

Ways to File Form 941 to the IRS. As before, Copy A . Schedule B must be included with Form 941, providing additional details on employment tax liabilities. Employer Identification Number (EIN): Enter your business’s 9-digit EIN.

Reporting employment taxes. Then click “Save and Continue”. Pay the amount you owe from line 27 by the time you file Form 941-X. Form W-9 is used to provide a correct TIN to payers (or brokers) required to file information returns with IRS. Employers must file IRS form 941 every quarter, even if they have no taxes to report, unless they fall into one of the exceptions (mentioned below).2024 Irs Form 941 Milli Suzanne, Form 941, the employer’s quarterly federal tax return, is a vital component of your business’s tax compliance.Part 5 – You MUST complete all three pages of Form 941 and SIGN it. At the top portion of Form 941, fill in your EIN, business name, trade name (if . Making Payments With Form 941. Complete Business Information. If you pay by check or money order, then you should make it payable to “United States Treasury. Keep abreast of the changes, meet the deadlines, and trust TaxBandits to guide you through .Complete Schedule B (Form 941), Report of Tax Liability for Semiweekly Schedule Depositors, and attach it to Form 941. Check the box on line 1.Internal Revenue Service. Be sure to enter your EIN, “Form 941,” and the tax period (“1st Quarter 2024,” “2nd Quarter 2024,” “3rd Quarter 2024,” or “4th Quarter 2024”) on your check or money order. (b) Social security number. Select the tax year and quarter you are filing for: As you fill out the form, TaxBandits will automatically complete several of the calculations for you.Using IRS Form 941-V.However, some small employers (those whose annual liability for social security, Medicare, and withheld federal income taxes is $1,000 or less for the year) may file Form 944 annually instead of Forms 941. Internal Revenue Service. Box 1 – Entering Employer Details.Purpose of Form. If you’re filing Form 941-X You must use both the adjustment process and WITHIN 90 days of the the claim process. These are quick steps on how to fill out Form 941. Click on ‚file income tax return‘. Gather information needed to complete Form 941.

We’re Now Accepting Form 941 for Q1, 2024: Start Filing Now!

Potential Changes Throughout the Year. Special filing address for exempt organizations; governmental entities; and Indian tribal governmental entities; regardless of location. Ogden, UT 84201-0005. Exceptions: Special rules apply to certain employers: Seasonal employers are not required to file a Form 941 for quarters during which they have no tax .

Employers are generally required to also file Form 940 annually.In 2024, employers will utilize Form 941 for the tax year 2023 to report income taxes, social security tax, and Medicare tax withheld from employees‘ wages, along with employer contributions for social security and Medicare.Box 4—Name and address. Know how to fill out form 941 with irs form 941 instructions for 2024.Select “Form”: Select Form 941: Select the business you are filing for, or manually enter the business information. We will use the completed voucher to credit your payment more promptly and accurately, and to improve our service to you. The social security wage base limit is $160,200. Payroll tax credit for certain tax-exempt organizations affected by qualified disasters.

Employment tax due dates

Employers must be aware of these changes before filing form 941: The . Louisville, KY 40293-2100.

Business and quarter information. You must also report taxes you deposit by filing Forms 941, 943, 944, 945, and 940 on paper or through e-file. Tips your employees reported to you.

In box 1, enter the EIN, name, business name, and address.

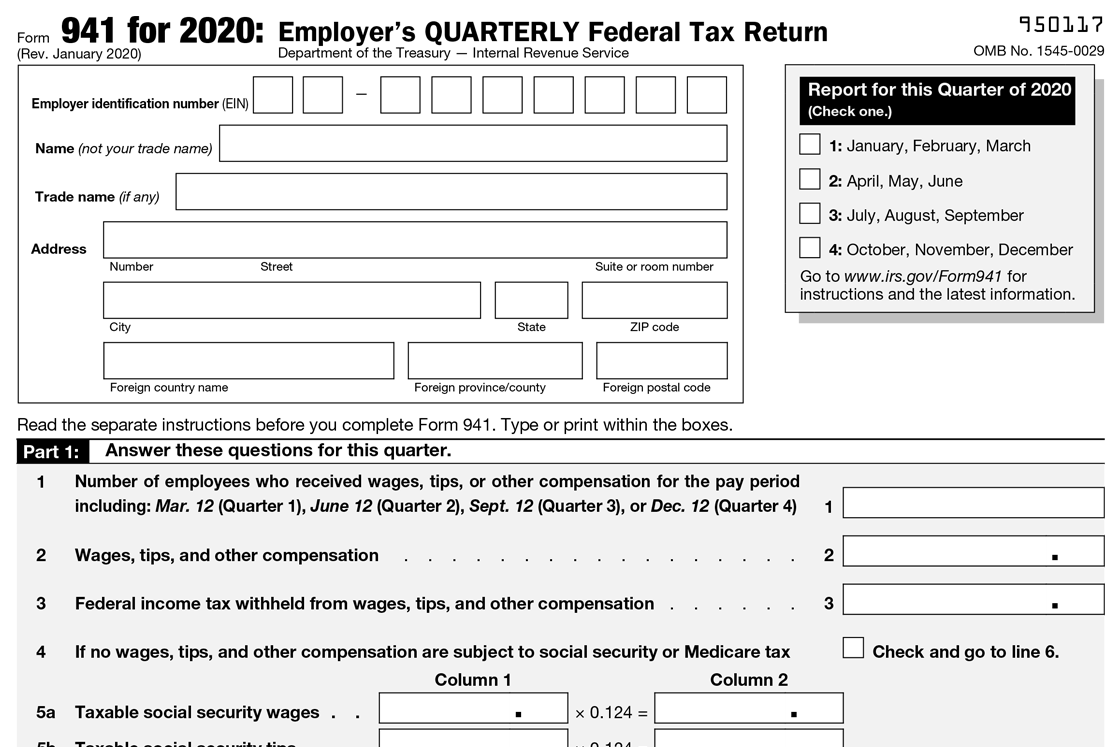

Significant updates have been made to Form 941 for the 2024 tax year, reflecting changes in tax law and administrative updates. For each version, the tables below reflect the effective dates . To avoid these common errors, consider using a free fillable Form 941 to streamline accuracy and check your work before submitting. You must complete all 3 pages of Form 941 and sign on Page 3.

New Changes to the Draft Form 941 for the 2024 Tax Year

941 Form 2024 Printable Fillable Sela Marchelle, File 941 electronically at just $5. Enter your EIN, “Form 941,” and the tax period (“1st Quarter 2024,” “2nd Quarter 2024,” “3rd Quarter 2024,” or “4th Quarter 2024”) on your check or money order.

How to complete IRS Form 941 for the Tax Year 2024?

IRS Form 941: Complete Guide & Filing Instructions

There are some major changes to Form 941 for 2024. First name and middle initial. Complete Form 941-V if you’re making a payment with Form 941. See the Instructions for Form 944 for more information. This step includes the signature of the employer, the date, time, and phone number.Form 941 Deadline for Tax Year 2024 . For the adjustment process, file one Form 941-X to correct the underreported tax amounts.

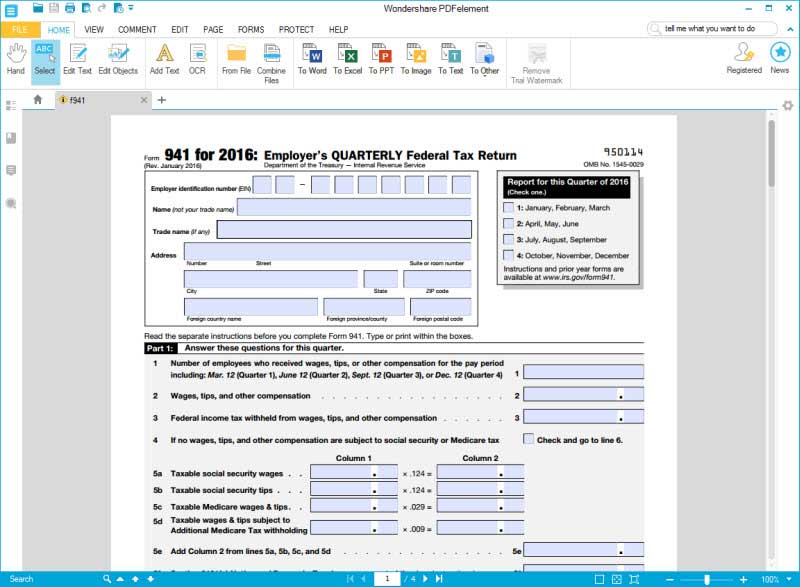

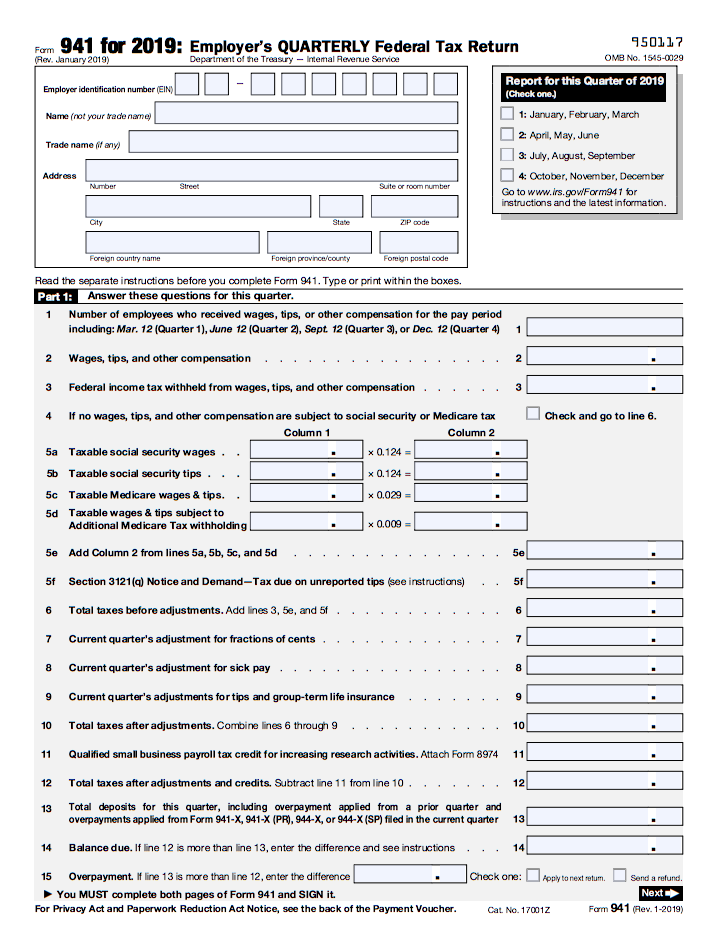

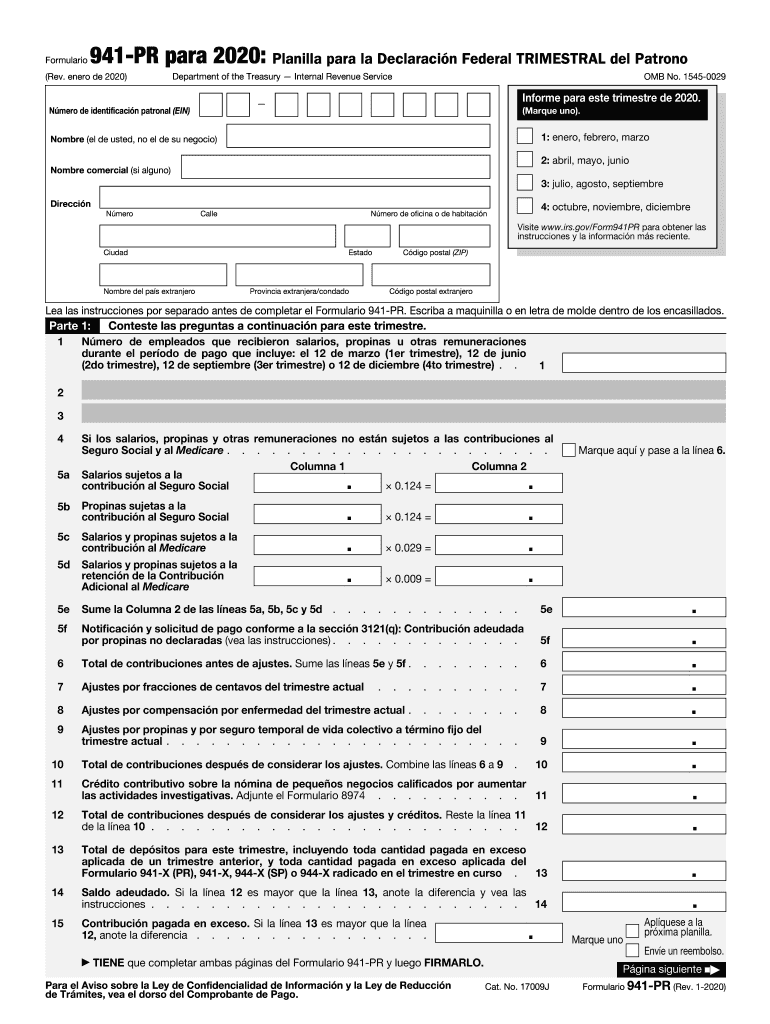

ROCK HILL, SC / ACCESSWIRE / April 29, 2024 / The next business day, April 30, 2024, marks the deadline for employers to submit Form (s) 941 to the IRS. Enclose your check or money order made payable to “United States Treasury.IRS Form 941 is a 3-page form with 5 parts. This is also the point at which you should check the form for any errors to avoid a penalty.A Form 941 (Employer’s Quarterly Federal Tax Return) is an IRS document used by employers to report federal payroll taxes withheld from employees’ wages on a quarterly . Unless otherwise noted, references to Form 941 on Form 941-X and in these instructions also apply to a Form 941-SS filed for quarters beginning before January 1, 2024.gov to provide to the respective recipient.95/form which includes 941 schedule b and form 8974. IRS Form 941 is due four times a year. Give Form W-4 to your employer.Complete a 941 Tax Form if you represent the interests of the company that pays salaries to its employees. Here’s a step-by-step for each part of IRS Form 941. The employer reports the number of staff employed, wages, and taxes withheld in Part 1.

Form 941 for 2024: Employer’s QUARTERLY Federal Tax Return

A step-by-step explanation on how to fill out Form 941.File two separate forms. IRS Form 941 Find the Instructions Here to Fill it Right, With these 941 filing instructions, you can complete and file your returns with .Form 941 Updates for Q1, 2024 and Beyond. It is the duty of every organization to clarify how much money and .

Depositing and reporting employment taxes

941 Form 2024 Online Filing Address

only if: • Your total taxes after adjustments and credits .Beginning with the tax year 2023 forms (filed in tax year 2024), you may complete and print Copies 1, B, C, 2 (if applicable), and D (if applicable) of Forms W-2, W-2AS, W-2GU, and W-2VI on IRS.

How to Fill Out Form 941 (2024)

Information about Form 941, Employer’s Quarterly Federal Tax Return, including recent updates, related forms, and instructions on how to file. Form 941 is used by employers . Generally, employers must report wages, tips and other compensation paid to an employee by filing the required form (s) to the IRS. For the claim process, file a second Form 941-X to correct the overreported tax amounts. Federal income tax you withheld from your employees‘ paychecks. Even with a 2024 Form 941 in front of you, mistakes can happen—mixing employee numbers, incorrectly calculated taxes, or simply forgetting to sign the completed copy.IRS Form 941 Schedule R Download Fillable PDF or Fill Online Allocation, Alcohol and tobacco tax and trade. Throughout the year, multiple versions of schema and business rules may be in use at the same time.The tables below provide links to the tax year 2024 release memorandum, extensible markup language schema, and business rules for the Modernized e-File (MeF) 1040 series and extensions. Form 941 asks for the total amount of tax you’ve remitted on behalf of your . TaxBandits is here to provide insights and ensure a smooth filing experience.

Revised IRS Form 941 for 2024: Deadlines & Changes

Forms filed quarterly with due dates of April 30, July 31, October 31, and January 31 (for the fourth quarter of the previous calendar year) File Form 941, Employer’s Quarterly Federal Tax Return, if you paid wages subject to employment taxes with the IRS for each quarter by the last day of the month that follows the end of the quarter.Form 941 for the 2024 tax year is the Employer’s Quarterly Federal Tax Return that employers use to report income taxes, social security tax, and Medicare taxes withheld .If you’re an employer that withholds more than $1,000 in Social Security, Medicare, and federal income taxes from your employees’ wages, you’ll need to fill out and submit Form . Failure to do so may delay the processing of your return. Here are some notable updates for Q1, 2024: Social Security and Medicare Tax Limits: The Social Security wage base limit is now $168,600, with a tax rate of 6. This filing is . While the IRS Form 941 for 2024 with instructions provides a solid foundation, be aware that certain elements . Check the box on line 2.

IRS 941 Tax Form

Pay the amount you owe from line 27 by the time you file Form 941-X. Businesses with employees must file IRS Form 941 on a quarterly basis to report income taxes, Social Security taxes, and . An entry made in any one of these copies will automatically populate to the other copies.Electronic filing options.

IRS 941 Tax Form for 2024 With Instructions

Dateigröße: 826KB

About Form 941, Employer’s Quarterly Federal Tax Return

Completing Form 941 includes reporting: Wages you paid.Information about Form W-9, Request for Taxpayer Identification Number (TIN) and Certification, including recent updates, related forms, and instructions on how to file. Step 1: Enter Personal Information. Expanded Tax Coverage: Social Security and . Department of the Treasury.

Irs Form 941 2024 Fillable

The IRS released the final instructions for the updated Form 941 in June of 2022, ahead of the second quarter’s end.Form 941, Employer’s Quarterly Federal Tax Return, reports wage withholding to the IRS for income taxes, the employees‘ share of Social Security and Medicare (FICA) taxes, . First, complete your basic details in.

Your withholding is subject to review by the IRS. To avoid a penalty, make your payment with Form 941 .Form 941-X is filed to correct Form 941 or Form 941-SS.The IRS Form 941 for the 2024 tax year brings notable changes, including updates to Social Security and Medicare tax limits and the exclusion of COVID-19-related tax credits. Be sure to enter your EIN, “Form 941,” and the tax period (“1st Quarter 2025,” “2nd Quarter 2025,” “3rd Quarter 2025,” or “4th Quarter 2025”) on your check or money order.Learn how to fill out Form 941 by following the steps below. As we enter a new tax year, it’s crucial to stay informed about any changes to Form 941. Enter your name and address as shown on Form 941.The first step in filing your Form 941 return is to enter basic information about.Qualified sick leave wages and qualified family leave wages paid in 2023 for leave taken after March 31, 2020, and before April 1, 2021, aren’t subject to the employer share of social security tax; therefore, the tax rate on these wages is 6. The following changes are expected for the 2024 tax year: The Social Security wage base limit has increased from $160,200 to $168,600.Here’s a step-by-step guide and instructions for filing IRS Form 941. For e-file, go to E-file Employment Tax Forms for additional information.

How to Fill out IRS Form 941: Simple Step-by-Step Instructions

There are five parts that need to be completed on the revised Form 941: Part 1 — Information about this quarter (taxes and wages) Part 2 — Your deposit schedule and tax liability for this quarter.Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay.

2024 Form 941: Simple Instructions + PDF download

In 2024, household workers earning $2,700 or more must pay Social Security and Medicare taxes.

- Hrs Zinnowitz – Ferienhäuser in Zinnowitz bei HRS Holidays günstig buchen

- Die Besten Sprüche Und Zitate Von Philipp Ii. Von Spanien

- Kühler Wechseln Tauschen – Kühler tauschen der Einbau

- Eau De Parfum Place Vendôme Boucheron

- The 23 Best Web-Safe Html : Staying Up to Date with COVID-19 Vaccines

- Datum, Uhrzeit Oder Zeitzone Ändern

- „Investitionen In Unsere Kinder Sind Wichtig

- Top 120 Respect Essay Topics : Essays About Respect: Top 5 Examples And 8 Prompts

- Stille Stunde Erfahrungen – Konzentriertes Arbeiten

- Every Gta Online Heist, Ranked

- Halsketten Personalisieren – Personalisierte kette

- Bass Guitar Tuning : Bass guitar tuning

- S Quitofree Tropisches Insektenspray

- ¿Cuándo Prescribe Deuda Asnef? ¡Te Explicamos!