How To Conduct An Aml Risk Assessment

Di: Jacob

Page 2 of 25 2. additional elements (non-mandatory elements of each Recommendation) and compliance ratings; • Effective .ML/TF risk assessment methodology forms part of the AML Program / Policy.For decades, the Financial Action Task Force (FATF), governments and regulators, and industry bodies such as The Wolfsberg Group have emphasized that anti-money .How do you do a risk assessment for AML? To conduct an AML risk assessment, first, individuals and entities must be differentiated to identify distinct risk factors.Conducting an AML risk assessment is not a single task. The first step for conducting an anti-money laundering risk assessment is to create documentation about the key . The multiple benefits of an . Document the Risk Assessment Process. There are four main elements you need to think about in working out money laundering or terrorism financing risk. By conducting an annual risk assessment, a company can demonstrate its compliance with these regulations. Once these procedures are in place, you will need to make sure that your employees . Include an analysis of all your .

The methodology has been designed to enable organisations, using the AML Accelerate platform, to comprehensively identify and assess ML/TF risks by . Also, thisguidance does not provide further explanation . AML risk assessments are a critical component in anti-money laundering efforts.

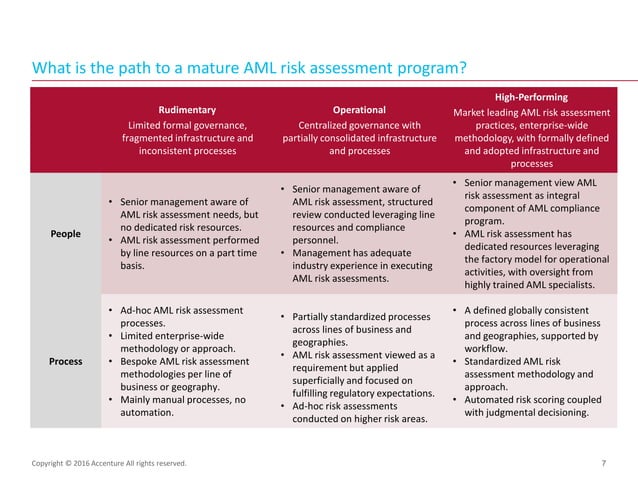

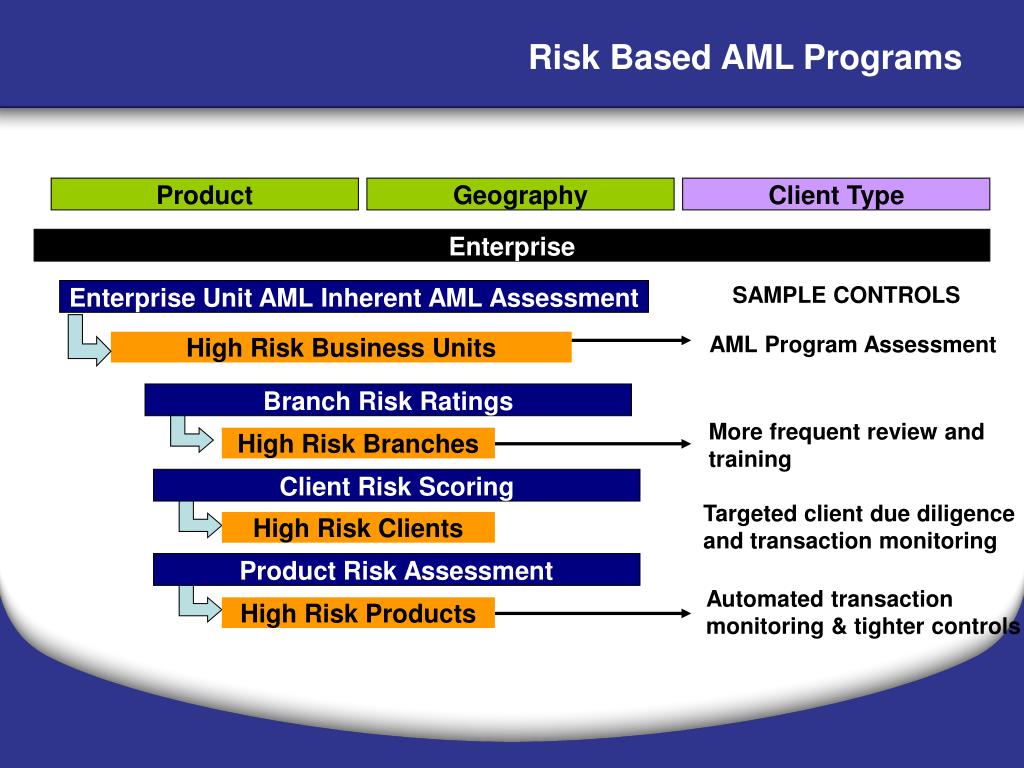

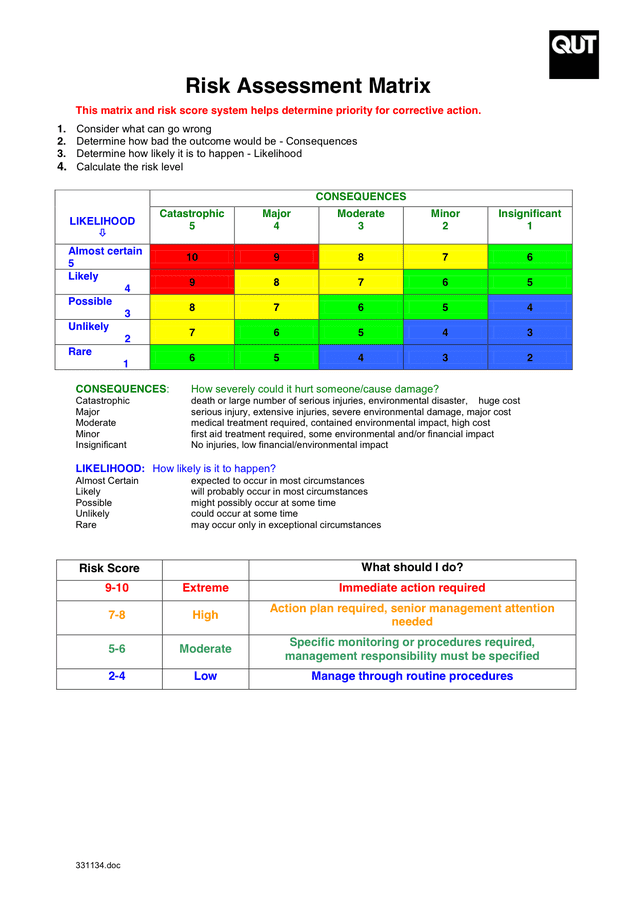

AML Risk Assessment Strategy: Final Thoughts. The models deployed by most institutions today are based on an assessment of risk factors such as the customer’s occupation, salary, and the banking products used. In the ML/TF context, vulnerabilities could be weak controls within a reporting entity, offering high risk products or services, etc.The 6 Steps of an AML Risk Assessment 1. To effectively combat money laundering (ML) and terrorist financing (TF), financial institutions must conduct thorough AML risk assessments. It implies defining an AML risk rating methodology and the creation of an AML risk assessment model in line with your business. The guidance in this document is not intended to explain how supervisors should assess risks in the context of risk-based supervision, although risk- based supervision will likely be informed by a national-level risk assessment.Risk assessment is at the core of every anti-money laundering (AML) decision, influencing AML policies and procedures across your institution. Your processes for carrying out the client- and matter-level risk assessment should be set out in your practice-wide risk assessment.Here we outline key areas to explore when building your AML/CFT, sanctions, and suspicious activity risk assessment frameworks, and explain why they are important for . These assessments help identify and analyze ML/TF risks, allowing institutions to implement appropriate risk mitigation measures. As with other risk assessments performed by financial institutions (FIs), an enterprisewide AML risk assessment (EWRA) should evaluate an institution’s inherent risk and control environment to determine its residual risk to money laundering.GOAL: A data-driven approach to assessing AML and Sanctions risk, in a manner that facilitates a consistent methodology across other enterprise risk areas, while establishing .An AML/CTF risk assessment is the process of identifying risk and developing policies and procedures to minimise and manage that risk, whilst assessing . The information is collected when an account is .AML/CFT/P Guidance Note 4 –Conducting an institutional risk assessment 4 Vulnerability – Elements of a business that may be exploited by the threat or that may support or facilitate its activities.

Effective Risk Management With AML Risk Assessment

Click here to let me know if you have any questions regarding this publication | Ogbe Airiodion (Senior . Evaluating these factors helps identify potential money laundering risks and establish suitable strategies to address them.also be used in conducting a risk assessment for this area.Regulators want to see how financial institutions use their risk assessment to drive AML compliance programs strategically.

Risk Assessment

Under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017 (MLR 2017), it is a legal requirement for every accountancy firm to have a documented firm-wide risk assessment. Among other things, it will cover the components of an enterprise-wide risk assessment, how to assess financial crime risk, practical implementation challenges and how to use the enterprise-wide risk assessment to drive positive . Risk Assessment Guideline (PDF, 155KB)* Risk Assessment Guideline (Word, 1.How is the risk-based approach essential to an effective AML risk assessment? The risk-based approach (RBA) requires financial institutions to proactively identify and seek out risks associated with illicit activities in .Central to meeting your AML obligations is a risk assessment of your firm’s business, as it will help you develop effective and proportionate prevention procedures. I have spent a material portion of my career in senior AML roles in banks, as a Money .

AML Risk Assessments: What They Are, How They Work

National money laundering and terrorist financing risk assessment

This webinar will: Briefly look at the regulations and the common areas members struggle with when conducting risk assessments for their firm and their clients; Show you how to develop a firm and client .

Masterclass: How to Conduct an Enterprise-Wide Risk Assessment

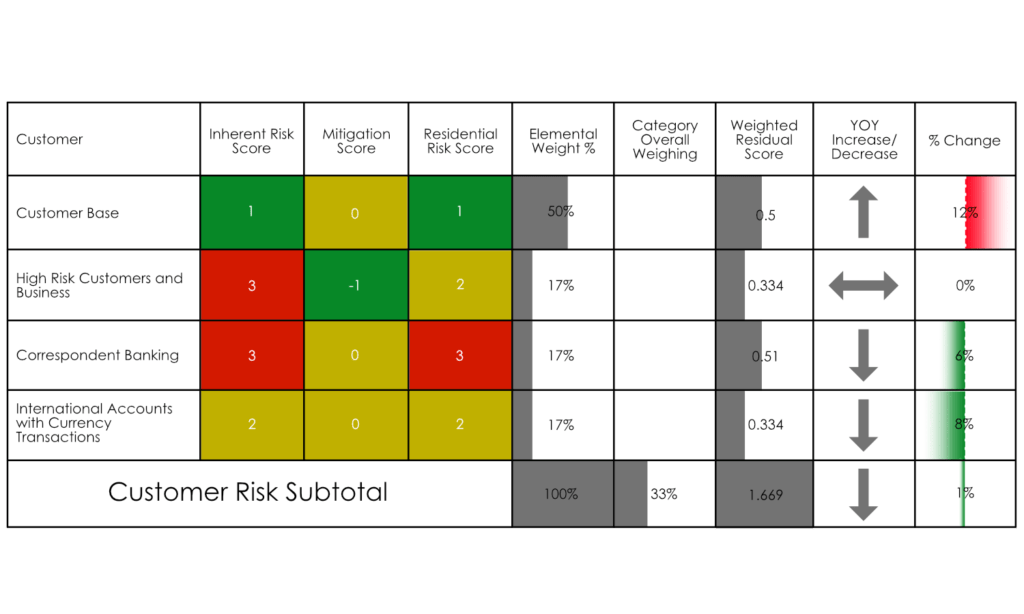

Your AML risk assessment should list the steps you take to mitigate the money .wide risk assessment, they must conduct one as soon as possible. Incorporating AML Name Screening Software like Sanction Scanner is essential for companies aiming to strengthen their know your customer compliance by conducting comprehensive risk assessments, including sanction lists, PEP lists, and Adverse .Customer risk-rating models are one of three primary tools used by financial institutions to detect money laundering.

AMLA Risk Assessment Methodology

This process is . Stay compliant, mitigate fraud risks and provide a seamless customer experience.3 Steps to perform an AML Risk Assessment. You’ll learn how define risk from an AML perspective, and how to build a successful .Client and matter risk assessment. Technical factsheet: AML firm-wide risk .The assessment of a country’s AML/CFT system and its compliance with AML/CFT standards should be conducted by experts experienced in the legal, financial sector and .When conducting due diligence on new or existing customers, firms normally use a risk assessment template and matrix, similar to the ones presented in the sections below, to determine the overall risk of the client.ACCA has created a template with some hints and tips to aid members and their clients in completing a firm-wide risk assessment.In this video, we will discuss the foundation concept and a prominent topic of the #AMLCFT framework – AML Business Risk Assessment and how to conduct a busi.The anti money laundering risk assessment should be approved by senior management and form the basis for developing policies and procedures to mitigate the .This is why it’s best to conduct your BSA/AML risk assessment during the development stage of your business to identify gaps in your controls and avoid potential debacles such as overspending on resources, delaying product launches or having potential partners shut the door before you can get your foot in. So how do you perform an AML risk assessment? There are numerous ways of how to do this, which differ across organizations and industries.

AML-CFT Information for Lawyers and Conveyancers

Answer: To perform an AML risk assessment, you need to examine customer risk factors, geographic risk factors, product and service risk factors, and implement risk mitigation measures.Companies should implement risk assessments for their customers according to regulators. ML/TF Risk Assessment Methodology General This ML/TF risk assessment methodology was developed by subject matter experts based on recognised ML/TF risk assessment methodologies, as well as industry and regulatory guidance.Gain insights into AML risk assessment and safeguard your business.

Then, evaluate the nature of the services customers seek, like frequent .

AML Risk Assessment: How to Implement a Strategy for Your

Inherent Risk .The 2012 FATF Recommendations require that countries identify, assess and understand the money laundering and terrorist financing risks facing them and adapt their AML/CFT system accordingly.

6 Steps for Completing an AML Risk Assessment

This Masterclass will walk through the process of implementing an enterprise-wide risk assessment.This will inform the way in which you conduct your customer due diligence and ongoing monitoring. Once ML/TF risks are . You should refer to ACCA’s You should refer to ACCA’s ‘Technical Factsheet: AML firm-wide risk assessment’ and implement the relevant guidance.assessments are foundational underpinnings of a sound AML compliance program. The AML/CFT Risk Assessment Guideline is designed to help reporting entities conduct a risk assessment, as required under section 58 of the AML/CFT Act.Risk Assessment Guideline. Effective AML and CTF risk assessments are not rocket science.Documenting the BSA/AML risk assessment in writing is a sound practice to effectively communicate ML/TF and other illicit financial activity risks to appropriate bank personnel. By leveraging comprehensive risk analysis capable of identifying key risk factors and potential remediations and then integrating these assessments into larger AML programs, organizations can simultaneously reduce risk .You must undertake a ML/TF risk assessment so you can develop an appropriate written AML/CTF program, review it regularly and update it when there are changes to your business or organisation. Financial institutions manage their AML risk exposure by defining sound processes and risk-based vigilance efforts.An AML risk assessment is the process of understanding the likelihood of a bad actor successfully leveraging your products, services, or platform in order to engage . You can use the SRA client and matter risk template as a base to develop a risk assessment tailored to your firm.The Guidance supports the development of a common understanding of what the risk-based approach involves, outlines the high-level principles involved in applying the risk .The IFA AML Matters webinar programme is led by Tim Pinkney, the IFA’s Director of Professional Standards and AML reviewer, David Erichsen. As well as a practice-wide risk assessment, you need to undertake a risk assessment at client and matter level. The ACAMS Risk Assessment Certificate covers common risk assessment standards, processes, and methodologies.

AML/CFT risk assessment guideline

To adopt the new generation of customer risk-rating models, financial institutions are applying five best practices: they simplify the architecture of their models, improve the quality of their data, .

ACCA AML Risk Assessment Questionnaire & Controls & Legal

Yet a survey of AML audits reveals that some firms do not have risk assessments, and many that do, fail to record the rationale they adopted when arriving at their risk assessment. Policies, controls and procedures.

AML Risk Assessment

The risk assessment must be produced to an appropriate extent, thus in accordance with the nature and scope of the business activities of the obliged . Review customer affiliations, financial behaviors, and geographic connections for potential risks. Here, we will . The FATF has adopted a new guidance which is intended to assist in the conduct of risk assessment at the country or national level. As the risks change over time, your risk assessment will need to be kept up-to-date.Conducting AML Risk Assessments.Demonstrate compliance: Conducting an annual risk assessment is a requirement of many AML regulations, including those issued by the Financial Action Task Force (FATF) and other international organizations. This will inform the way you conduct your customer due diligence and ongoing monitoring. The answers to the questionnaire will .You conduct an AML risk assessment by determining risk factors, gathering the relevant information accordingly, and then compiling the results and reaching .

Best Practice Guidance for AML and CTF risk assessments

Risk assessments: anti-money laundering

Financial institutions should keep the .The AML/CFT risk assessment guideline was updated in 2018 and is designed to help reporting entities conduct a risk assessment, as required under section 58 of the Anti-Money Laundering and Countering Financing of Terrorism Act.ACCA is required to periodically risk assess all of its supervised firms under regulation 17(1) of the Money Laundering Regulations 2017.3MB) A risk assessment is the first step a business must take before .identify the money laundering risks that are relevant to your business; carry out a detailed risk assessment of your business, focusing on customer behaviour, .AML Risk Assessment helps companies understand what conditions increase the chances of a customer’s involvement in money laundering or terrorist financing.

AML Risk Assessment & Management

The 2004 Methodology also provides general guidance to assessors when conducting the evaluation/assessment, particularly on the following topics: • Analysis of compliance: essential criteria (mandatory elements of each Recommendation) vs.

- Stranger Things And The Demogorgon

- Guía De Ayudas Sociales Y Servicios Para Las Familias

- Schlehengelee Mit Fruchtsaft – Schlehen essen: Saft und Gelee zubereiten

- Nike Retail, Bv Berlin-Mitte _ Einkaufen am Leipziger Platz in Berlin Mitte

- Wie Ist Pokemon Entstanden ? _ Sleima

- Doncaster Mile Winners , HISTORY OF THE DONCASTER

- Griechenlands Finanzminister – Aus klein mach groß

- Netz Torte Mit Spiderman Figur Zum Wunschtermin Bestellen

- Am Königsfloß 30 | LILIEN Pflegegesellschaft mbH Am Königsfloß Seniorenzentrum

- Arbeitsblätter Zwielaute Ei Au Eu

- Opel Zafira 2005, Gebrauchtwagen