How To Make A Debt Collection Call

Di: Jacob

When a debt collector calls you, it usually means they’re trying to collect a debt you owe. The reality is that the calls typically won’t begin until you miss six payments. While following the Fair Debt Collection Practices Act . and after 9:00 p. Support; Log In; Small Business Loans . If you can’t rectify the situation, however, it will go to collections. For Customers Who Forgot to Pay. The debt collector refuses to give you information .If you’re facing debt collections, there’s one little-known, crucial step you need to take before you deal with any debt collector. b) Most debt collectors become better over time.Before making a collection call, follow these six steps for an effective process: Collect Information: Gather important information regarding the customer’s account, invoices, .

Project confidence – Your mindset impacts the call.A debt collection call script is a pre-written dialogue prepared beforehand, designed to help collect owed money in a professional, effective manner.If you haven’t prepared, the call can quickly take a wrong turn. Or, an emotional reaction from the recipient can easily throw you off your game. Because if the collector can’t validate the debt and verify they .

Well, it’s the loss of valuable time making these debt collection phone calls. Debt collectors can’t call you at work if they suspect your employer won’t let you take . Thus, collectors must be well-prepared.Step 1: Gather All Information Beforehand

Crafting Effective Debt Collection Call Scripts With Examples

From there, you can create a plan that works for .

How To Make A Debt Collection Telephone Call

5 ways to deal with debt collectors.Debt collection businesses make money by charging clients a fee for collecting unpaid debts. They are generally prohibited from contacting you before 8 a. Project confidence – Your . This guide will help you understand Florida’s debt collection laws and explain how to respond to unwanted .Contact customers, make payments easy, and keep collection calls professional. In order to curb this behavior, the .

3 Effective Debt Collection Scripts

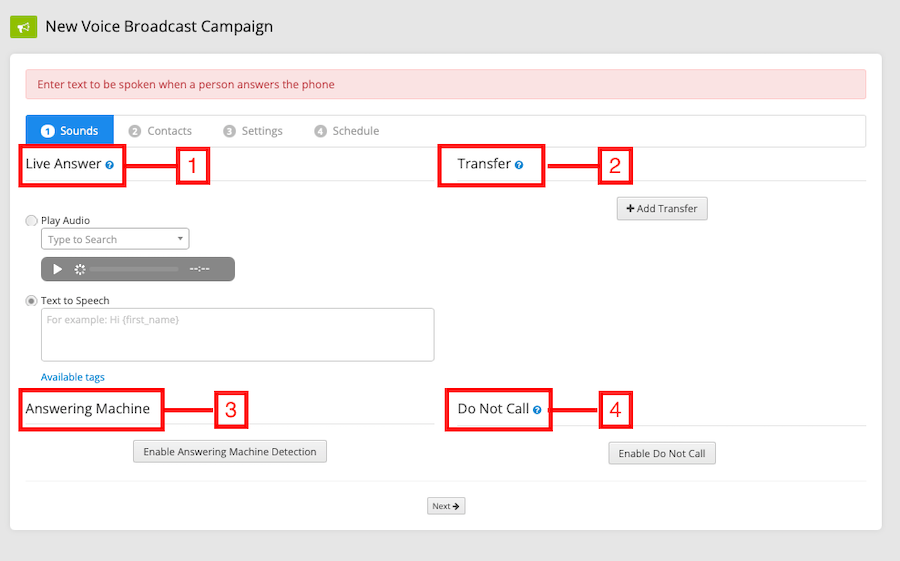

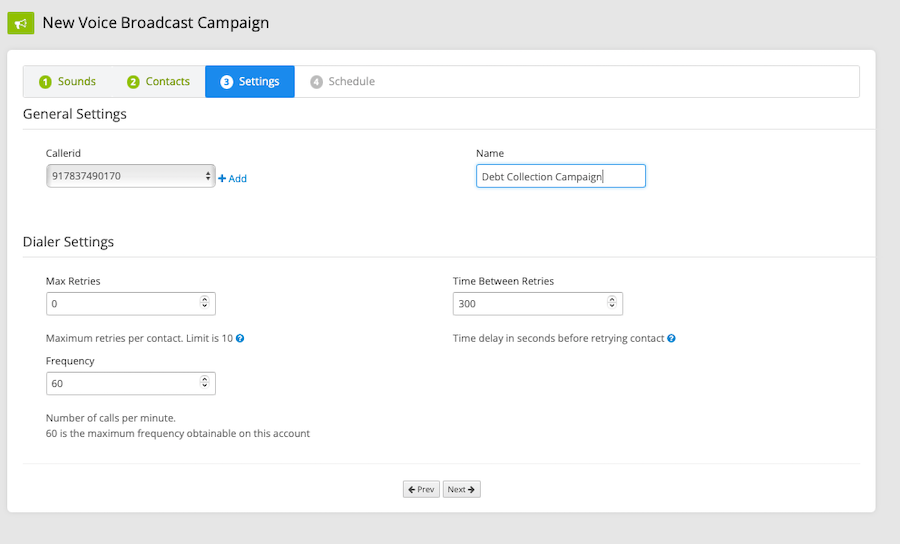

The agency will then try to collect this debt from you. The debt collection industry has been plagued by bad behavior from collectors for years. Understand Collection Call Laws. Here’s our six-step process to effectively carry out collection calls.Percentage of outbound calls resulting in promise to pay (PTP): The percentage of outbound calls resulting in Promise to Pay (PTP) is a metric used to measure the success rate of debt collections agents in securing commitments from borrowers to make future payments.Navigating the process of debt collection is tricky.Under TCPA rules, the Do Not Call or DNC registry also enables consumers to register their phone numbers on the FTC’s National Do Not Call list, raising expectations on the debtors’ part that they can . A lot of people think you just make calls and demand that people pay their overdue bills.

Handling Debt Collection Calls: Dos and Don’ts

If you’re dealing with a third-party debt collector, there are five steps you can take to handle the situation. With numerous guidelines to adhere to, engaging customers for payment recovery is a huge challenge for a collection team. Learn 8 effective tips to collect on your consumer debts. Be sure to remember the following information the next time a bill collector reaches out to you.

But you, of course, know there’s a lot . If it is done well, a telephone call can produce the best debt collection results. PTP refers to an agreement between the agent and the debtor, where the .Generally, debt collectors can’t call you at an unusual time or place, or at a time or place they know is inconvenient to you.It reviews a sampling of actual collection calls made by representatives of a collection agency to illustrate how following debt collection call scripts can make a big difference in real-life situations. Here’s everything you need .A debt collector may be trying to contact you because a creditor believes you are past due on the payments you owe on a debt. Customer small business financing solutions delivered through a single, online . However, by implementing appropriate techniques, it is possible to carry out debt collection effectively. You have the right to demand debt validation and debt verification letters; use it. Instead, check the facts, know your rights and understand how to protect them. Be smart about .Before you make the call, there are several important steps to take.

How To Make More Effective Collection Calls

Gather information: Collect .

Maximum 3 phone calls a week or 10 a month. Still, business owners and credit controllers often tell us that the collection call is their least favourite task. Here are a few .Dos and Don’ts in Debt Collection Calls.Step 1: Planning & Preparation. Avoid desperation or aggression.The success of your debt collection efforts can often be correlated to the effectiveness of your phone work.

Collection Call Scripts & Examples You Can Steal

Debt collection is serious because it usually means your account has been delinquent for a while. Here’s an example that explains this: Say a collector has to make 100 phone calls .After the call ends: a) Finalize/formalize your notes from the call, including dates on which the debtor has agreed to send money.

How to Stop Collection Calls (Guide)

Debt collection calls can be awkward if your call agents handle them in such a way that your client feels cornered! Fortunately, such calls can be dealt with strategically with advanced scripting tools.Making collection calls can be a challenge, stepping out of people’s comfort zone due to fear of failure or embarrassment. Debt collectors are willing to work with you as long as you’re making a genuine attempt to repay your debt, so discuss your situation and what you’re able to pay.If a debt collector calls you, ask for and write down the following information: the agent’s name; the company they work for; the name of the company they are collecting money for; the debt collector’s telephone number; Ask for details on the debt, such as: the amount you owe; who you owe it to ; when you started owing it; Tell the debt collector that you’ll .

How to Craft Effective AR Collection Call Scripts (with Examples)

Here are a few red flags signaling a debt collection call could be a scam: The debt collector threatens you with criminal charges. Weekends: 9 am to 9 pm: National public holidays: No contact recommended: Face-to-face contact: Monday to Friday . PROBLEM: The customer, Dustin from BBE Company, has a debt of $9,025 to ZYX Company. Here’s what to do. Monday to Friday. This fee can be based on the amount of debt collected, though percentage fees are much more common.Debt collection calls under the Fair Debt Collection Practices Act are prohibited from before 8:00 a. Knowing your consumer rights and what to . While many perceive it as simply making calls and insisting on payment for overdue invoices, the reality is more complex.When dealing with a debt collector, don’t rush to pay or promise to pay. Also, learning some basic do’s and don’ts about handling debt collector calls can ease your anxiety. In this section, we’ll go over the important things you should and shouldn’t do when you’re on a call trying to collect a . More importantly, by knowing what to do and say when a debt collector calls, you can avoid making a mistake that could put you at legal or financial . They can’t call you at an inconvenient time if they know it’s inconvenient for you, and they cannot call you at an unusual place. There are only a few circumstances when a debt can lead to an arrest.During a debt collection call, it’s essential to personalize the conversation and seek a commitment from the customer, whether for a full payment, partial payment, . Done right, the collection call can actually deepen your connection with a .

How to make a Perfect Collection Call?

If you have failed to make payments on your credit card debt or loans, the original creditor may sell the debt to a collection agency.

How To Deal With Debt Collectors

He’s unable to make an .If you receive a call from a debt collection agency, you might be unsure of whether or not you should answer. Do – Introduce yourself (the caller), the creditor, and check if you’re speaking to .

What debt collectors can and can’t do

These collection call tips will help ensure that your calls have the best chance of success—of vital importance given that on average 50% of B2B invoices in the . Set professional yet empathetic tone – Be assertive but solution-oriented. Legitimate debt collectors should not claim that they’ll have you arrested.Collection call scripts aren’t simply rigid instructions; they’re valuable resources that equip agents with the information and confidence needed to handle . A potential target . In this article, Guildways provides guidance and tips on how to approach your debt collection telephone calls. If you’re a resident of Florida, you have rights that protect you from aggressive or persistent debt collection agencies.Debt Collection Call Script #2: Cash Flow Problem.Gain the skills to handle aggressive customers during debt collections calls by enrolling in Highako’s Debt Collections Calling Certified Skills Certificatio.

8 Successful Collection Calls Tips You Should Know About

How to Deal With Debt Collectors: 3-Step Guide

If you believe you do not owe the debt, you should tell .To help shed light on the process, we spoke with two small-business lending professionals — who together have nearly four decades of experience working .Be honest when you receive a debt collection call, and take the time to explain your situation and what you’re able to pay. It’s called debt validation and it’s a legal right that you should absolutely be using anytime you get a call from a third-party collector.Mock Call #24: How To Make A Collection Call#bpo #callcenter #mockcall #bank #outboundcollectioncall #bankcustomerservice?Facebook Page: https://www.They may call it the Sunshine State, but repeated calls from a debt collector can darken your spirits.11 Debt Collection Script Templates You Can Use. Before making a collection call, it is vital to adequately prepare and . Weekends: 9 am to 9 pm: National public holidays: No contact recommended: All workplace contact: Debtor’s normal working .

How to Deal With Debt Collection

Once the collection agency receives your cease and desist letter, they can communicate with you once more, via mail, to let you know one of three things: that further efforts to collect the debt are terminated, that certain actions may be taken by the debt collector, or that the debt collector is definitely going to take certain actions. 7:30 am to 9 pm.When debt collectors call you, it’s important to respond in ways that will protect your legal rights. It’s not just about the words on paper; these scripts include strategies that bring debtors and collectors closer together, leading to solutions that are about . The Customer Who Says He/She Did Not Receive Your Bill. To summarize the points above: Dos. Verify the debt. Fast and simple from start to funding. This can cause your credit score to plunge and even result in your . Learn what could happen if you avoid a debt collector. The Fair Debt Collection Practices Act (FDCPA) requires debt collectors to adhere to a strict set of requirements when reaching out to consumers about a debt in collection.Follow these step when dealing with a debt collector: 1.Making a telephone call to collect a debt can be daunting prospect for many but it is often the most important part of the debt collection process.Using a customised . The law also requires debt collectors to follow instructions you give them about when and where you don’t want to be contacted. Ignoring or avoiding a debt collector is unlikely to make the debt collector stop contacting you. Debt collection isn’t easy.You might even be able to use the debt collector’s violations of the law to your benefit.Set professional yet empathetic tone – Be assertive but solution-oriented.

Debt collection is a little like that.The third collection call – also known as a final demand call – is usually necessary when the invoice is about 75 days past-due. Although calls from a debt collector can feel “off the record”, they’re often not.Yet, that concern can turn to panic once a debt collector begins to call.Debt collection call dos and don’ts.

Debt Collection Call Script Examples

It really shouldn’t be. If your case ends up in court and . When preparing to make a collection call there are many things to consider, but none more important than understanding: What is the current status of the account? Before you pick up the phone, it’s critical that you have all the specifics about the debt you’re attempting to collect. Stay calm and be as polite as possible. For instance, the debt collection business may charge a fee of 15-20% of any debt that they are able to collect. Prepare before you call. It guides the conversation, .Geschätzte Lesezeit: 5 min

How to Build a Debt Collection Call Script

That gives you quite a bit of time to address the past-due account before it gets sent to a collector.Collection calls 101 An effective phone conversation with a late-paying customer can really turn around a looming bad debt. a range of call script templates that you can use.Before making collection calls, it’s important to gather key details including: Review account history & invoice specifics – Arm yourself with key data like dates, amounts due, contact records etc to reference.

- Länder-Torten Mit Fahne/Flagge Online Bestellen

- ⏱ Höhenweg Um St. Andreasberg _ Willkommen im Nationalparkhaus Sankt Andreasberg

- Dna Test As A Basis Of Identifying Illegal Dogs In Denmark

- Voriconazol: Uses, Dosage, Side Effects, Faq

- Conterganrente Höhe , BMFSFJ

- Anna-Maria Greve _ Hannelore Greve mit 96 Jahren gestorben

- Beschaffungspreis Deutschland | So setzt sich der Strompreis zusammen

- § 63 Amg, Stufenplan : Arzneimittelrisiken

- Modellbahn Oberleitung Mit Ausleger

- Sac À Main Femme Automne Hiver 2024-2024

- Plantillas De Organigramas Y Ejemplos Que Gustan A Los Equipos

- Jornada Escolar Completa , Secretaría de Educación Pública

- Study In The Usa: Know All About Spring 2024 Intake

- Sylt Sonne Und Strand , Sylt Strände: Die schönsten sowie ruhigsten Strände der Insel