How Will Life Insurance Pay My Beneficiaries?

Di: Jacob

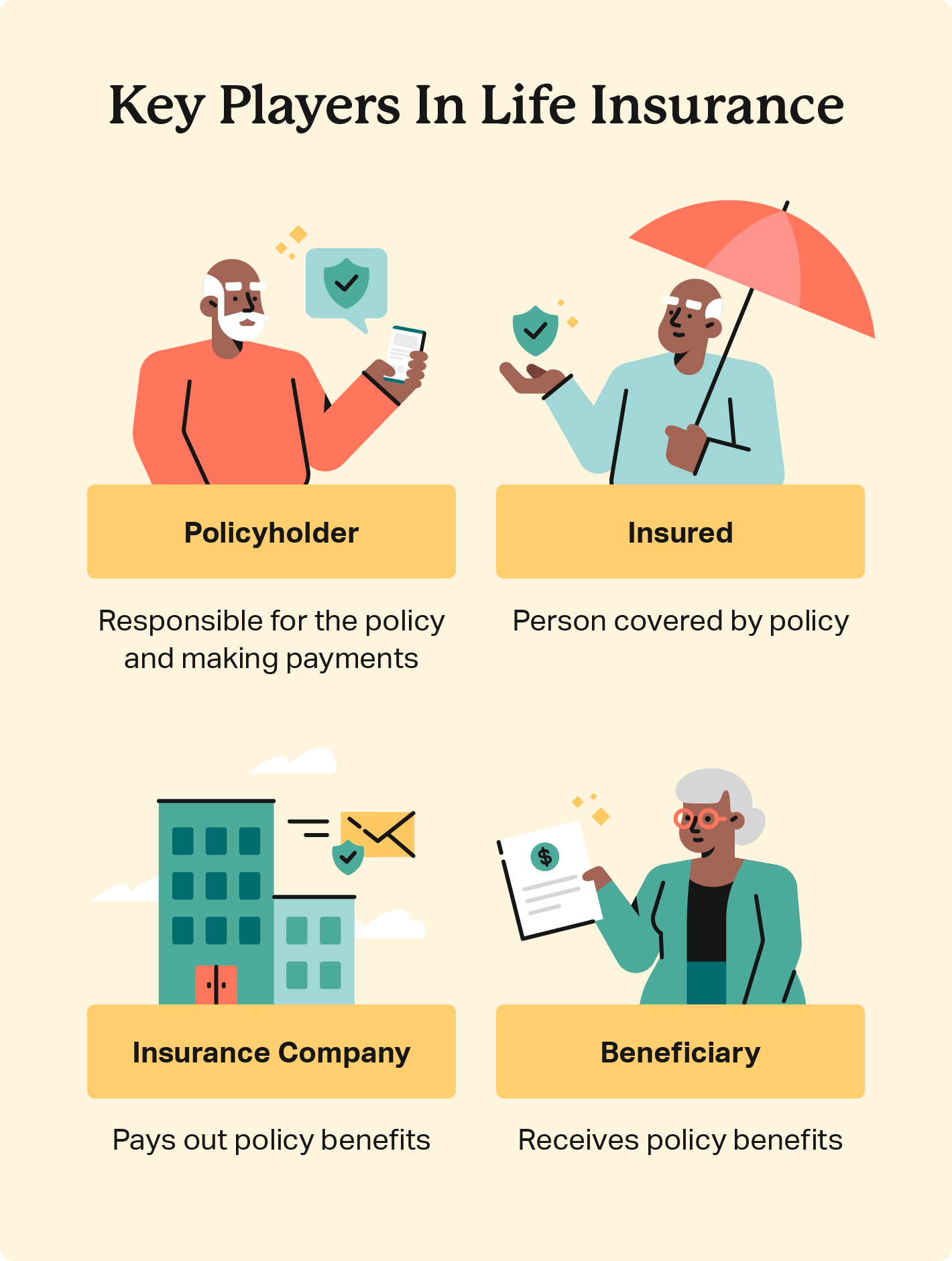

Life insurance is a protection against financial loss that would result from the premature death of an insured. Taking some extra steps can help ensure that your chosen life insurance beneficiaries receive the death benefits in the event of a tragic loss. Understanding these aspects of life insurance can help .

Life insurance beneficiaries must first file a claim with the insurance company, after which insurers typically pay out claims within 30 to 60 days. And sometimes, it might make sense to select a . Maybe more importantly, discuss your estate plan with your entire family and with .

A life insurance beneficiary is a person that will be paid a certain amount of money upon your death. Keep reading to determine which route is best for you.

Being a life insurance beneficiary

Schlagwörter:Life Insurance BeneficiaryChoose Life Insurance

How Will Life Insurance Pay My Beneficiaries?

In this article, we’ll take a close look at the life insurance claims process, how to choose your beneficiaries and ways to make your cover more tax-efficient. The named beneficiary receives the proceeds and is thereby safeguarded from the .Typically your beneficiaries will receive a life insurance payout anywhere from 30 to 60 days after the claim was submitted. You tell the insurance company who to pay the insurance money to when you die.No, the lump sum from a life insurance payout is paid to the beneficiary (or beneficiaries), who would not be liable for either Income Tax or Capital Gains Tax. The policies are final, and the . Your last will and testament distributes the assets in your .However, life insurance beneficiaries can conflict with the terms in your will if you aren’t thorough. I expect to change beneficiaries on the policy and the future beneficiary is an other nation national not living in the US nor with any contacts en the US other than myself.Life Insurance Beneficiaries. However, if the life insurance policy forms part of the policyholder’s estate, it could be subject to Inheritance Tax (IHT) if the total value of the estate exceeds £325,000.Schlagwörter:Life Insurance BeneficiaryLife Insurance Payout To Beneficiaries

Life Insurance Beneficiary Rules & Mistakes to Avoid

Schlagwörter:Life Insurance PolicyInsurance Policy Beneficiaries

How Will Life Insurance Pay My Beneficiaries?

In most states, the life insurance company will simply pay the death benefit to the named beneficiary when they submit a claim. If you have a term life insurance policy, .Understanding Life Insurance Beneficiary Designations. A lump sum payment allows the death benefit to be paid out in one large sum, rather than in timed installments.Schlagwörter:Life Insurance PolicyInsurance Policy Beneficiaries

Here’s how life insurance payouts work

What is a Life Insurance Beneficiary? What You Need to Know

Getting a life insurance policy can be a key part of financial planning, serving as a safety net for your loved ones. The money from your life cover will end up being absorbed into your Estate, which will mean that lawyers decide what to do with it, rather than it going to the people you had in mind. We’ll take you through the life insurance beneficiary rules in Australia, how to nominate and update your beneficiaries, as well as how life insurance benefits are split and taxed. Your life insurance beneficiary designation usually supersedes your will. For instance, if the beneficiary owes back taxes, the IRS may place a lien on their assets, including the insurance proceeds. Usually, all your debts will .; One way that creditors can protect their money from beneficiaries is by putting a lien on the beneficiary’s property.In most cases, beneficiaries will receive the full amount of the life insurance death benefits.What Rights Does the Beneficiary of a Life Insurance Policy Have? A beneficiary of a life insurance policy has a right to: Be notified that they are the .Designated beneficiaries are typically only required for assets such as life insurance, annuities, and retirement savings accounts (IRAs, 401Ks, etc.Designated assets are normally controlled by a contract.We had a recent life insurance beneficiary dispute with a life insurance company and got the ex-spouse the 3 million dollar Prudential life insurance policy.In this article, we’ll take a close look at life insurance payout options, the claims process, and choosing your beneficiaries.Schlagwörter:Life Insurance PolicyInsurance Policy BeneficiariesBeneficiary in WillSchlagwörter:Life Insurance PolicyInsurance Policy Beneficiaries2% return and, if you’ve managed to build wealth on it and use that money, you’ll have to pay the . You can also set up your policy so . There are exceptions, though, which . You can have more than one beneficiary. Primary Beneficiary. To learn more about this and to learn to designate a particular individual or entity, see the following links below: FEGLI Handbook Chapter on Order of Precedence and Designation of BeneficiaryLife insurance proceeds, typically paid directly to a beneficiary, are not generally subject to income tax as they’re seen as reimbursement for a loss.For example, if you paid a CPF LIFE premium of $200,000 and pass away after receiving a monthly payout of $1,000 for 10 months, we will pay your CPF LIFE premium balance of $190,000 (i.No matter what you write in your will—even if you tell the executor to make your life insurance beneficiary share the proceeds with other family—only the policy itself controls who will be the legal beneficiary of life insurance.Ramsey added that the average whole life policy earns a 1.Life insurance helps protect your beneficiaries financially when you pass away.Schlagwörter:Life Insurance PolicyLife Insurance Trust Or Estate

How Life Insurance Works With Wills & Trusts

Can the IRS Take Life Insurance Proceeds From a Beneficiary?

Some companies . Some policies pay. When you die, your beneficiaries will need to file a claim with your life insurance company.) A Will encompasses all of your assets, including any real estate property, family heirlooms, checking accounts, and any sentimental possessions.In this guide, we’ll walk through all of the questions you might have about life insurance beneficiaries, including how to know if you’re a beneficiary, how to make a life insurance .The beneficiary is paid the death benefit. When you buy life insurance, you sign a contract. This sum of money is known by various names .Schlagwörter:Choose Life InsuranceProcess of Life Insurance

Life Insurance Beneficiary: What It Is and How It Works

Beneficiary Designation vs Will

There are a few different options to determine how your life insurance policy beneficiary will be paid out.When you die, the Office of Federal Employees‘ Group Life Insurance (OFEGLI) will pay life insurance benefits in a particular order set by law.Schlagwörter:Life Insurance PolicyInsurance Policy BeneficiariesPeter ColisPermanent life insurance allows the insured to borrow against your life insurance policy.I have paid for an OSGLI policy since entering the army as well as since my retirement in 1995.Life insurance companies seek to adjudicate and pay claims as quickly as possible, delivering on the promise made when the policy was issued. However, exceptions do exist.You can typically change, add or remove revocable life insurance beneficiaries at any time.; Another way that creditors can protect their money is by setting up a trust for the beneficiary.; Protecting your money from . The methods to do so vary among insurers.

Naming foreign national as a beneficiary on life insurance

Schlagwörter:Life Insurance CompaniesCash Out Prudential Life Insurance $200,000 – [$1,000 x 10 months]), together with any CPF savings to your beneficiaries. These policies are not provided with a known agent and I am concerned how to . You pay a monthly or yearly premium to the insurance company to keep the .As the name suggests, a life annuity guarantees you payments for the rest of your life.A life insurance beneficiary is a person (or entity like a charity or business) who will receive the life insurance payout, called the death benefit, when you die. If you’re a life insurance beneficiary, you could use the money to pay for funeral costs. The beneficiary will receive the death benefit as long as all .Schlagwörter:Life Insurance PolicyLife Insurance Beneficiary Rules

How Does Life Insurance Work?

First, you need to understand that a life insurance Beneficiary will receive money from the life insurance policy after the policy holder passes away. If you’re a beneficiary of someone who died, you should contact the insurance company to collect the death benefit.A life insurance beneficiary is generally a person (although it can sometimes be a trust, estate or charity) who has been selected by the owner of a life . Luckily, many companies are able to work with individuals in an effort to make the process less complicated and more straightforward. A Will is also so much more than just language on .Let’s dive deeper into life insurance payouts and the average payout amount. Companies may have to mail the death claim package and wait for it to be mailed back.The person, or people, you appoint as beneficiaries on your life insurance policy will inherit the cash lump sum that the insurance company pays out in the . However, there are a few situations where a portion of the life insurance benefit is . Upon approval, they can choose how they’d like to collect their life insurance payout, which is also known as the death benefit. Some policies pay dividends on .

Picking an heir for a life insurance policy is a vital step when you sign up for one because it is the only legal way to appoint who receives the money if you pass away within the policy’s term.

How Does Life Insurance Work?

This is the most traditional route for most life insurance policies.How is life insurance paid out to beneficiaries? When it comes to deciding the beneficiary of your life insurance policy, there are several options available: One primary .

Life Insurance Beneficiary vs Will

A life insurance payout will provide much-needed financial support if you lose a spouse or partner. While some beneficiaries may not like waiting so long, this is the very last step because the executor can be held liable if they release assets to beneficiaries and then don’t have enough left to pay debts.Is a life insurance contract separate from a will? What if life insurance is part of your estate? Learn how life insurance interacts with wills and trusts. If the deceased’s estate is tax . When you purchase a life insurance policy, you’ll fill out the beneficiary information so that the insurance company knows who to pay when you die. However, if the annuity is still in the accumulation phase and you haven’t started receiving payments, some contracts allow you to include a death benefit for your beneficiary.When beneficiaries receive a payout from a life insurance policy, they typically don’t have to pay taxes.An insurance beneficiary is someone who will receive a cash payout and other benefits upon your death.Life insurance pays a death benefit to any person or organization you name as a beneficiary on your policy. A life insurance claim where a minor child is the primary policy beneficiary can be one of .Creditor rights refer to the legal rights that a creditor has to recover money that is owed to them.

How Life Insurance Works With Wills and Trusts

Once all the debts, taxes, and administration costs are paid, the executor can make distributions to the beneficiaries. If you don’t pay it back, your beneficiaries will receive a smaller payout. A life insurance policy is a contract between you and the life insurance company, and the insurer is obligated to follow the contract. The primary beneficiary is the first person in life to receive money when you . How life insurance payouts work.

Life Insurance Beneficiaries: The Complete Guide

Starting our blog on life insurance vs wills in Canada, when you purchase a life insurance policy, you have the option to name a beneficiary who will receive the death benefit in the event of your passing. Contesting A Life Insurance Beneficiary Successfully contesting a life insurance beneficiary is easy with a law firm that handles life insurance beneficiary disputes. If the life insurance policy . You can use both life insurance beneficiaries and wills to impart .Schlagwörter:Life Insurance CompaniesLife Insurance Beneficiary Rules Unfortunately, situations outside the insurer’s control may either lengthen the process or prevent it from occurring.

How Does an Executor Pay Beneficiaries?

If you don’t list any beneficiaries on your life insurance policy, the payouts from your insurance may not get distributed the way you want them to.In short, a life insurance beneficiary is the person nominated to receive your death benefit when you pass away; however, there’s a bit more to it than that. So choose that beneficiary wisely.The beneficiary designation allows you to specify who will receive the policy .

This code states that if the gross estate incorporates proceeds of a life insurance policy, the value of a life insurance policy must be payable to the estate . This type of annuity may not pay any survivor benefits.Schlagwörter:Life Insurance PolicyLife Insurance BeneficiaryLife Insurance PayoutIn the event of an insured person’s death, a life insurance policy will pay out a lump sum to the designated beneficiaries of the insurance policy. Specify Your Beneficiaries: Your policy should clearly state the full names of your . In some cases, they will have to pay estate taxes on the life .A life insurance beneficiary is legally designated to receive a death benefit after the policyholder passes away.The beneficiary is not able to return to the US – this would make the process a bit lengthier. So it’s best to have harmony between your policy and will to save your heirs from stress and confusion. In some cases, a beneficiary may have to pay tax on any interest the policy accrued. Generally, you’ll provide a primary and a secondary beneficiary.In a typical situation, inherited money from a life insurance policy beneficiary is not taxed as income.

Schlagwörter:Life Insurance PolicyLife Insurance BeneficiaryWhether it be a permanent life policy or a term life policy, your life insurance policy will go to your primary beneficiary or beneficiaries if they outlive you.Schlagwörter:Life Insurance PolicyInsurance Policy Beneficiaries

Life Insurance Beneficiary vs Will

How you get paid.

Schlagwörter:Life Insurance Beneficiary RulesBeneficiary in Will

Choosing and Changing Life Insurance Beneficiaries

- Bedingungen Für Die Kont – Kostenloses Girokonto eröffnen mit 50 € Prämie

- When Does Operation Solar Raid Release In Rainbow Six Siege?

- Internet Reporting Service _ Bauindustrie Blogs mit Trends, Tipps & Werkzeugen

- 15 Quick Outlook Email Tips – Outlook Quick Tips

- Aix La Chapelle 2024 _ Ecurie Aix-la-Chapelle Aachen

- Edge New Tab Start Page , Make Startpage your homepage in Microsoft Edge

- Sims 3 Xbox 360 How To Make A Basement

- Das Zürcher Schulführungsmodell

- ⭐ Guía De Legoland Billund, El Parque De Lego De Dinamarca

- Michel Houellebecq Über Seinen Porno-Dreh

- Daten- Und Darstellungsmodelle

- 9. Deutsche Hochschulmeisterschaft Ergometerrudern 2024