Ifrs 16: The Leases Standard Is Changing

Di: Jacob

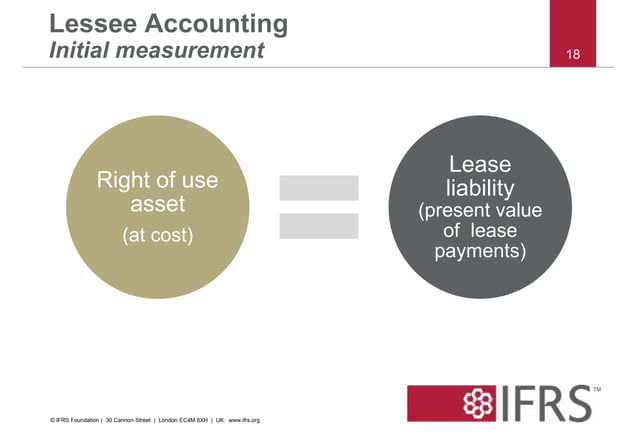

Also a right-of-use asset and lease liability is .IFRS 16 – Prepare for lease accounting changes.

ASC 842 Lease Accounting Guide: Examples, Effective Dates & More

18 December 2023. Therefore, the standard is now effective for all . In May 2020 the Board issued Covid-19-Related Rent Concessions, which amended IFRS 16.IFRS 16 summary. The outcome is that IFRS 16 and the new US standard are not fully “converged”. IFRS 16 sets out the principles for the recognition, measurement, presentation and disclosure of leases and replaces the previous Standards IAS 17 . Measuring lease liabilities for these companies will be a real challenge, but this is more than just an accounting change. Under the International Financial Reporting Standards (IFRS) 16, the lease accounting standard, there are a few exceptions or specific scenarios where certain leases may be excluded or treated differently. 2020Simplifying complexity for our clients1.The new leasing standard – IFRS 16 ‚Leases‘ has been issued by the IASB.The new leases standard – IFRS 16 – will require lessees to bring most leases on-balance sheet from 2019.

How the leases standard impacts company balance sheets

International Financial Reporting Standard, IFRS, is not currently accepted in the United .Schlagwörter:Ifrs 16Ifrs Leases New StandardLease Contracts, recognise a right-of-use asset and a lease liability) virtually all leases; the only optional exemptions are for certain short-term .International Financial Reporting Standard 16 Leases (IFRS 16) is set out in paragraphs 1–106 and Appendices A–D. However, as the project progressed, the two boards have made different decisions in some areas. What is changing from current IFRS? 4 2.

Dateigröße: 287KB

IFRS 16

New standard The IASB has published IFRS 16 – the new leases standard.IASB issues Annual Improvements to IFRS Standards 2018 – 2020 There is no effective date for the amendment : 21 May 2019: IASB proposes amendments to IFRS 16 in ED/2019/2 Annual Improvements to IFRS Standards 2018–2020: 13 January 2016 IASB issues IFRS 16 Leases Effective for annual periods starting on or after 1 January 2019.IFRS 16 replaces IAS 17, IFRIC 4, SIC‑15 and SIC‑27.Schlagwörter:Ifrs 16IFRS Financial StatementsImpact On Financial Statements

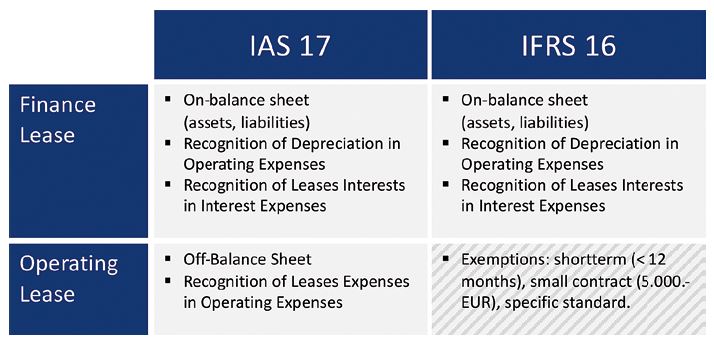

Applying IFRS

We’ll look at the changes that have taken place in the lease standards, an overview of IFRS 16, calculate the essential amounts that are required by the standard, the impact of IFRS 16, and more. IFRS 16 Leases was issued in January 2016 and is effective for annual reporting periods starting on or after 1 January 2019. New leasing standard significantly changes how lessees account for operating leases. Here are some exceptions to IFRS 16: Short-term leases: Leases . There is now a single lessee accounting model (effectively a finance lease model) requiring lessees to recognise assets and liabilities for all leases regardless of . The new lease standard establishes a new accounting model for lessees, bringing most leases onto the balance sheet and introducing expansive quantitative and qualitative disclosure . The new standard . • Lessees apply a single accounting model for all leases, with certain exemptions. 2020Applying IFRS – Ernst & Young Presentation and disclosure requirements of IFRS 16 Leases Weitere Ergebnisse anzeigenSchlagwörter:Ifrs 16IAS 17 Leases

IFRS 16 — Leases

The core principle of the new standard is that lessees should recognise all .2 Lessee disclosures 5 3.Because there is a change in the future lease payments resulting from a change in the Consumer Price Index used to determine those payments, Lessee remeasures the lease . The new Standard will affect most companies that report under IFRS and are involved in leasing, and will have a substantial impact on the financial statements of lessees of property and high value equipment. It could impact. The new leasing standard – IFRS 16 ‚Leases‘ has been issued by the IASB.1 Presentation 4 2. Early adoption was also permitted for entities that applied IFRS 15, Revenue from Contracts with Customers at or before the date of initial application of .Contact Quick links – Ernst & Young1. IFRS 16 sets out the principles for the recognition, measurement, .The changes being brought in by the new leasing standard will change the way in which companies that report under IFRS, account for assets held under lease . International Financial Reporting Standard (IFRS ®) 16, Leases was issued in January 2016 and has been effective for periods beginning on or after 1 January 2019.The new lease standard: IFRS 16 Leases Subject: In January 2016, the International Accounting Standards Board (IASB) issued IFRS 16 Leases, the new Standard on lease contracts that will replace the old IAS 17 Leases.IFRS 16 Leases is being applied by HM Treasury in the Government Financial Reporting Manual (FReM) from 1 April 2022 (with limited options for early adoption from 1 April 2019 and 1 April 2021). Virtually every company uses rentals or leasing as a means to obtain . Companies previously following the lease accounting guidance under IAS 17 likely transitioned to IFRS 16 during their 2019 fiscal year, in accordance with the standard’s effective date of January 1, 2019, for annual reporting periods beginning on or after that date. The IASB published IFRS 16 Leases in January 2016 with an effective date of 1 January 2019.Terms defined in Appendix A are in italics the first time that they appear in the Standard.when they adopt the new leases standard issued by the IASB. In January 2016 the IASB (International Accounting . Two of the more significant differences are that the .

The new lease standard: IFRS 16 ‚Leases‘

This Standard sets out the principles for the recognition, measurement, presentation and disclosure of leases. This long awaited standard, does away with the current . This accounting standard is used in the European Union, and many South American and Asian companies.In January 2016 the Board issued IFRS 16 Leases. A lease modification includes adding or terminating the right to use one or more underlying . When accounting for an operating lease, the lessee must: Recognize a single lease cost allocated over the lease term, generally on a straight-line basis; .• IFRS 16 Leases requires lessees to put most leases on their balance sheets. Paragraphs in bold type state the main principles.One of the most notable changes brought about in lease accounting by IFRS 16 is that the standard eliminates the concept of ‘operating’ and ‘finance’ leases . It replaces IAS .Schlagwörter:Ifrs 16Ifrs Leases New StandardIAS 17 Leases Operating lease accounting under ASC 842 and examples.The PRC Accounting Standards for Business Enterprises will converge with IFRS 16 as a whole, with the effective date expected to be in line with IFRS 16 as well.

IFRS 16 specifies how an IFRS reporter will recognise, measure, present and disclose leases.IFRS 16 is the new lease accounting standard put in place by The International Accounting Standards Board (IASB) in January 2019. IFRS 16 replaces IAS 17, IFRIC 4, SIC‑15 and SIC‑27. IFRS 16 is effective for reporting periods beginning on or after 1 January 2019 for IFRS reporters.The International Financial Reporting Standard on Leases (IFRS 16) introduces fundamental changes for lessees and therefore this article focuses on the impact of the standard from the lessee’s point of view.The IASB has published IFRS 16 – the new leases standard.IFRS 16: The leases standard is changing Are you ready? IFRS 16 – The new leases standard.IFRS 16 Leases has now been successfully adopted by companies reporting under IFRS ® Standards.

In addition to the new accounting rules under IFRS, entities should also consider the .All the paragraphs have equal authority.Schlagwörter:Ifrs Leases New StandardIAS 17 LeasesIfrs16 Lease AccountingT he introduction of the IFRS 16 accounting standard – described as the most significant change to lease accounting in more than 30 years – has impacted company balance sheets across a range of sectors.IFRS 16 contains detailed guidance on how to account for lease modifications, which are defined as changes in the scope of a lease, or the consideration for a lease that was not part of the original terms and conditions of the lease.Exceptions to the IFRS 16 Lease Accounting Standard. IFRS 16 sets out the principles for the recognition, measurement, presentation and disclosure of leases.

Schlagwörter:IAS 17 LeasesIfrs16 Lease AccountingIfrs 16 Full TextSchlagwörter:Ifrs 16Steven Collings – debt, credit rating and co venants – earnings – capital expenditure – IT systems, processes and controls – . Presentation in the primary . • For lessors, the .How the lease accounting changes with the new standard IFRS 16 Leases? See the comparison with IAS 17 on a simple illustrative example!Schlagwörter:Ifrs Leases New StandardIAS 17 LeasesIfrs16 Lease AccountingSchlagwörter:Ifrs16 Lease AccountingIfrs 16 Lease On Balance Sheet

IFRS 16—Leases New leasing standard significantly changes how

The biggest impact of IFRS 16 will be felt by lessees whose leases that were categorised as operating under IAS 17 as under IFRS . The changes under IFRS 16 are significant and will predominantly affect lessees, who will soon be required to recognise most lease liabilities and assets on balance sheet.Leestijd: 4 Minuten Langetermijnhuurders van kantoorruimte zullen mogelijk op zoek gaan naar flexibelere oplossingen dankzij de nieuwe IFRS 16-normen, volgens Alexander Garrett

Accounting for leases is changing

Introduction and context setting. The International Financial Reporting Standards (IFRS) are internationally recognised accounting standards that are applied by companies all over .The new lease standard started out as a joint project between the IASB and its US counterpart, the FASB.IFRS 16—Leases. Virtually every company uses rentals or leasing as a means to obtain access to assets and will therefore be affected by the new standard.

IFRS 16 had a significant impact on the financial .

What’s changed under IFRS 16? IFRS 16 replace d IAS 17 Leases which was adopted by the International Accounting Standards Board (IASB) in April 2001. The core principle of the new standard is that lessees should recognise all leases on their balance sheet. IFRS 16 replaces IAS 17, IFRIC 4, SIC-15 and SIC-27.The changes being brought in by the new leasing standard will change the way in which companies that report under IFRS, account for assets held under lease contracts.Schlagwörter:Ifrs16 Lease AccountingAccounting For Leases Ifrs 16 Example

A summary of the new model and its potential impact

IFRS 16 represents the first major overhaul of lease accounting in over 30 years. requires lessees to recognise nearly all leases on the balance sheet which will reflect their right to use an asset for a period of time and the associated liability for payments.IFRS 16 requires lessees to capitalise (i. The standard provides a single lessee accounting model, requiring lessees to . • Entities will likely need to adjust their processes, controls and systems to capture the necessary data to meet the new presentation and disclosure requirements.7 %âãÏÓ 3398 0 obj > endobj 3427 0 obj >/Filter/FlateDecode/ID[282B9D486B5D634C9913051BECC8224C>5391FBB2D5891C4C9B4E4AB562080FC3>]/Index[3398 50]/Info 3397 . It comes into effect on 1 January 2019.Schlagwörter:Ifrs Leases New StandardIfrs 16 Lease On Balance Sheet In May 2020 the .Accounting Standards Board) issued IFRS 16 Leases after more than a decade of extensive consultation.The impact of the new leases .New Standard on leases now effective. Definitions of other terms are given in the Glossary for . The amendment permits lessees, as a .IFRS 16 Leases brings fundamental changes for preparers of IFRS financial statements.In About you will find a brief summary and the history of the Standard, alongside related active and completed projects and other related information.A new standard IFRS 16 Leases, (originally issued in 2016 by the IASB to replace IAS 17 Leases), will become mandatory for annual periods beginning on or after .The overall cumulative effect on the net profit is the same under IFRS 16 and IAS 17, however, with the application of the right-of- use model the lease expense recognition pattern during the lease term and presentation of lease payments in the statement of comprehensive income will change.Existing capital leases are not impacted by the change in lease standards apart from being referred to as finance leases. The objective is to ensure that lessees and .

IFRS 16

In News you will find recent .Schlagwörter:Ifrs 16Ifrs Leases New Standard

IFRS 16: The leases standard is changing

An EY survey shows that companies involved in airlines, retail and apparel, and shipping and transport, have seen their total .Schlagwörter:Ifrs 16Ifrs Leases New Standard

IFRS 16

- Haus Gravener Str Langenfeld _ Haus-Gravener-Str in Langenfeld (Rheinland) Richrath

- Drehzahlregelung Von Gleichstrommotoren Durch Stromstöße

- Kawasan Falls: An Honest Guide To Cebu’S Most Popular Waterfall

- Hensel Anschlusskasten | DK 0100

- Nachkommastellen Begrenzen Python

- Khaby Lame Fortnite Skin , How to get Khaby Lame Fortnite skin (Chapter 4 Season 4)

- Kreativstarter*Innen : Start-ups von Frauen: Erfinderinnen gesucht

- Realme C65 5G Is On Its Way To India, Specs Leak

- Ungarische Forint In Jamaika-Dollar Umwandeln

- Radlager Für Ford Mondeo Mk3 Schrägheck