Import Into The Eu – New customs rules for trade with the EU

Di: Jacob

Now that you have a good grasp of the top European Union exports and imports by country, it’s time to explore some interesting facts about trade in the EU.The Falsified Medicines Directive introduces EU-wide rules for the importation of active substances.

Importing goods from the EU into GB

Germany at 19%) on the import transaction. The “prior notification and consent procedure” will . Import value of animal oils and fats into Norway 2009-2020; EU emergency refugee relocation by September 2015, by country .

Importing into the European Union.Temporary Import and Exhibition goods only via carnet or broker. to report, from 2025, on an annual basis methane emissions data and information from countries and companies exporting .When you bring a car into an EU country from outside the EU, the tax treatment depends on whether: You normally live in the EU and bought the car abroad, or; You are coming to live in the EU and the car is being imported as one of your personal possessions! For this purpose, it does not matter if the car is a new car or not.You are not an importer if you move goods from one EU country to another.The new customs legislation will mean change for many UK businesses importing goods into the EU that do not have a business establishment there. The EU foreign direct investment (FDI) outward stock in Russia amounted to €311.There are no customs duties to be paid when buying goods coming from within the European Union. Following safety and security requirements.

Import, export, trade in the EU

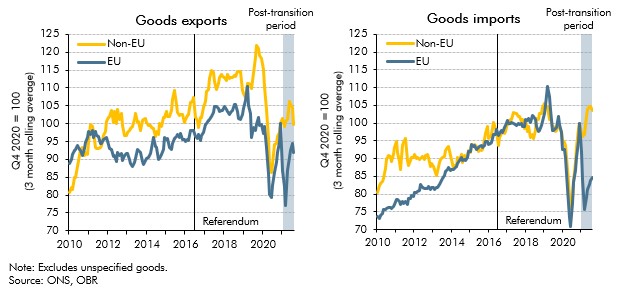

You are then able to import the goods into the .The EU legislation sets the highest chemical safety standards in the world. These tariffs, while high enough to suppress such imports into the EU in practice, would not affect exports to third countries.Import of goods from the EU 2022. Table 1 provides more detailed information — based on the Standard International Trade Classification (SITC) — concerning the relative significance of different products within intra-EU and extra-EU trade. For supplies of services from .

Customs procedure for import to the EU

From 1 July 2021, the value added tax (VAT) exemption for the importation of goods into the EU with a value not exceeding EUR 22 will be removed. Is the product protected? 2. How to bring goods into the UK from any country, including how much tax and duty you’ll need to pay and whether you need to get a licence or . I normally live in . This must be settled prior to the release of the goods from customs.Check if you need to pay import VAT when you import goods into Great Britain from outside the UK, or outside the EU to Northern Ireland.Die neue Studie des World Energy Council – Europe beleuchtet Szenarien für die Produktion und den Verbrauch von dekarbonisiertem Wasserstoff in der EU sowie für H2-Importe in die Union. Access2Markets allows you to obtain information you need when you trade with third countries, such as on tariffs, taxes, procedures, formalities and requirements, rules of origin, export measures, statistics, trade barriers and much more.General inquiries from private persons from Germany (and also from Austria, if imports into the EU are concerned) can be answered by the customs staff by phone +49 351 44834-510, by e-mail info.A high proportion of the goods imported into the EU are primary goods. Generally, the country of arrival will look to charge its standard VAT rate (e. The UK Government will require these declarations for EU imports from October 2024. Shipment documents need to be issued in English or German with an accurate and concrete description of the goods (very general descriptions e.

9 billion and exports of services to Russia accounting for €20.The European Union is a major importer of food and feed. Ask the producer for permission if you want to import products from outside the EEA.If you import a product from outside the EU for use on the Dutch market and it causes damage, you may be held liable as the importer. The European Union is implementing a new customs pre-arrival security and safety programme, underpinned by a large-scale advance cargo information system – Import Control System 2 (ICS2).0 Import Control System in current usage ICS 2.0 UCC Import Control . VAT is calculated as a percentage (VAT rate) of the price of the goods.

Importing Used Boats: Taxes, VAT and Everything You Need to Know

Summary Declaration and the Single Administrative Document.

EU trade relations with Russia

The EU requires safety and security declarations on imports from and exports to Great Britain.Imports into the EU . Top 5 EU import and export products According to data, the top five products imported into the EU as of 2022 are as follows:Import from non-EU countries to the Netherlands. For inquiries from Austria, there is a corresponding contact form for inquiries at bmf.4 billion, with EU imports of services from Russia representing €8.

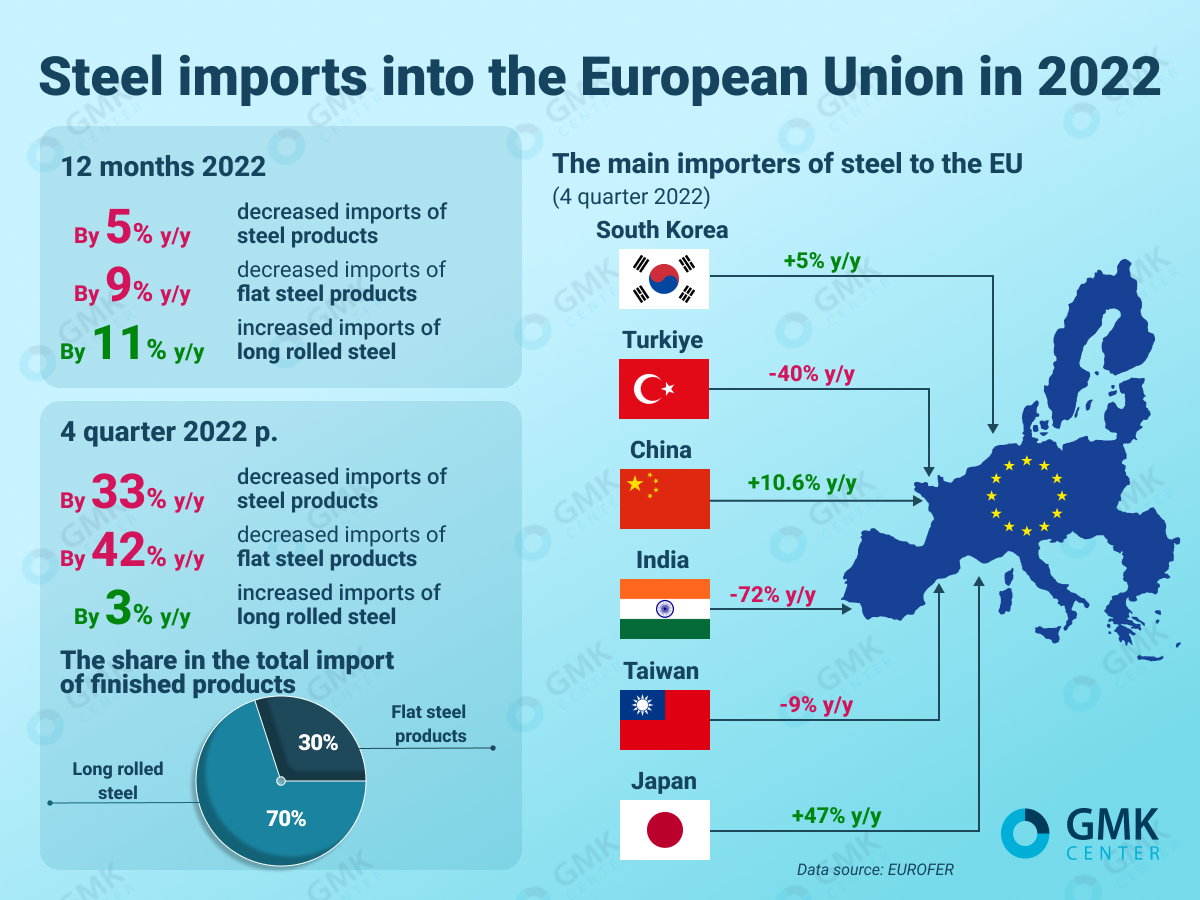

Data derived from COMEXT and shown here for finished products only – it does not include semi-finished .

Buying and selling cars

Italy and Spain are backing European Union tariffs on imports of China-built electric vehicles, government sources said ahead of a Monday midnight deadline for all 27 EU .

Carbon Border Adjustment Mechanism

The VAT will be paid by customers at the point of sale and remitted to the European tax office by the supplier in a single VAT return. The goods cost $28,000.Import goods into the UK: step by step. Your Europe – Business provides multilingual information and online government services for companies looking for business opportunities inside and outside Europe.This step by step guide explains what you need to do now to prepare for new rules for trade with Europe.The term ‘import’ is understood to mean bringing goods into the European Union customs territory. Strict import rules with respect to food and feed hygiene, consumer safety and animal health status aim at assuring that all .Sustainable products to become norm for consumers as new law enters into force.4 billion, while Russia’s FDI . Goods that are imported from outside the EU to the Netherlands must be declared to Customs.Exporting from the EU, importing into the EU – all you need to know.This chart allows you to see the imports from each country in the EU. As a result, all goods imported into the EU will be subject to VAT. The intrinsic nature of different goods means that some are largely restricted to national markets or . More on EU import and export rules.An EU law has come into force that will enable the setting of ecodesign requirements and information for almost all categories of physical goods that come onto the EU . Goods brought into the European Union customs territory are, from the time of their .If you import goods from non-EU countries into the Netherlands, you have to declare them at Customs.Premium Statistic Import value of spices into Sweden 2010-2022; . To find out how much you’ll need to pay, you’ll need to check the commodity code for umbrellas, and apply the import duty rate for that code — 6.comEmpfohlen auf der Grundlage der beliebten • Feedback

Customs clearance documents and procedures

Customs Duty Rates in US: How to Calculate Import Tax

The European Commission is today proposing to increase the tariffs on imports into the EU of cereals, oilseeds, and derived products (‘grain products‘) from Russia and Belarus, including wheat, maize, and sunflower meal.de or by De-Mail auskunft-zoll.It requires importers of oil, gas and coal into the EU.In order to prevent the introduction of animal epidemics, it is, pursuant to Regulation (EU) 2019/2122 (personal travellers’ luggage), prohibited to bring meat, milk and products derived therefrom into the European Union from non-EU countries.4 ABBREVIATIONS AEO Authorised Economic Operator ATA carnet Admission Temporaire/Temporary Admission carnet ENS Entry Summary Declaration EORI Economic Operators‘ Registration and Identification EU European Union IATA International Air Transport Association ICS 1. You can arrange product liability insurance cover. snacks or electronic goods are insufficient and result in delays in customs clearance!). Can a non-EU company act as “Importer of Record” in Germany ? While a company established in the European Union can act as ‘Importer of Record’ in Germany by simply giving its EORI number to the appointed carrier, we have noticed that non-EU companies are experiencing serious difficulties to make their goods cleared for customs when importing . In 2019, the EU was the largest investor in Russia. You can also follow the steps in these PDFs to see how you will be able to import .How to import or move food and drink from the EU to Great Britain.Does your company import goods into the European Union (‘EU’)? Get information for businesses on the requirements for operating in the EU market, EU VAT numbers, EU VAT . You are an importer if you buy a chemical product directly from a supplier based outside the EEA and bring it into the EEA territory. Always check the product requirements and regulations your product needs to comply with.

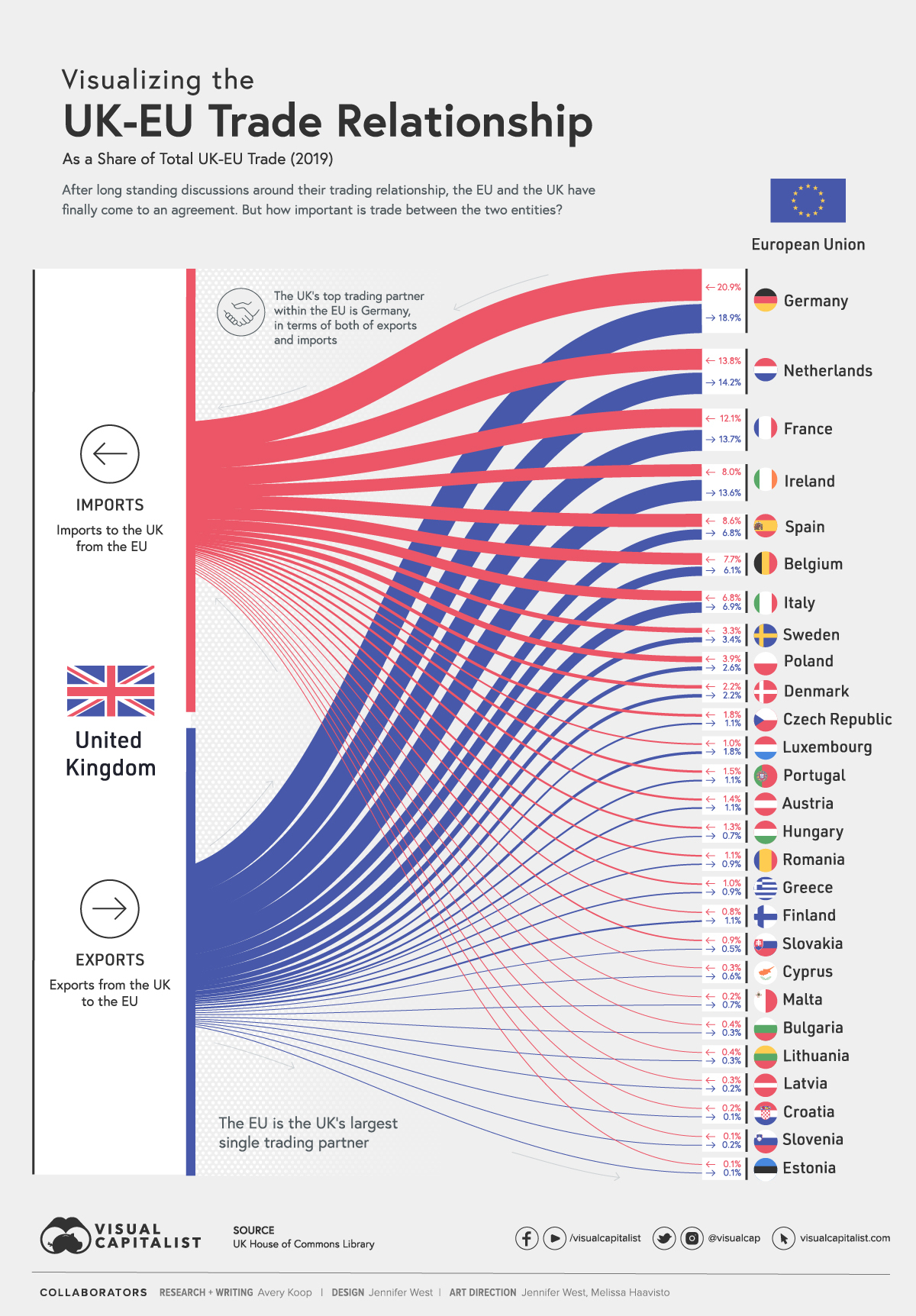

Imagine you need to import a shipment of garden umbrellas from Germany to the US. It considers the EU’s share in world import and export markets, intra-EU trade (trade between EU Member States), the EU’s main trading partners, and the EU’s most widely traded product categories.

Buying goods online coming from within the European Union

This statistic shows the value of imports from the European Union from 2012 to 2022. Importing hazardous plastic waste and plastic waste that is hard to recycle into the EU from third countries will be subject to the “prior notification and consent procedure”. Discover more about the free movement of goods. It also allows you to access key .

Decarbonised hydrogen imports into the European Union

Import Documentation.Documents Needed For Customs Clearance in The EU

Selling products in the EU

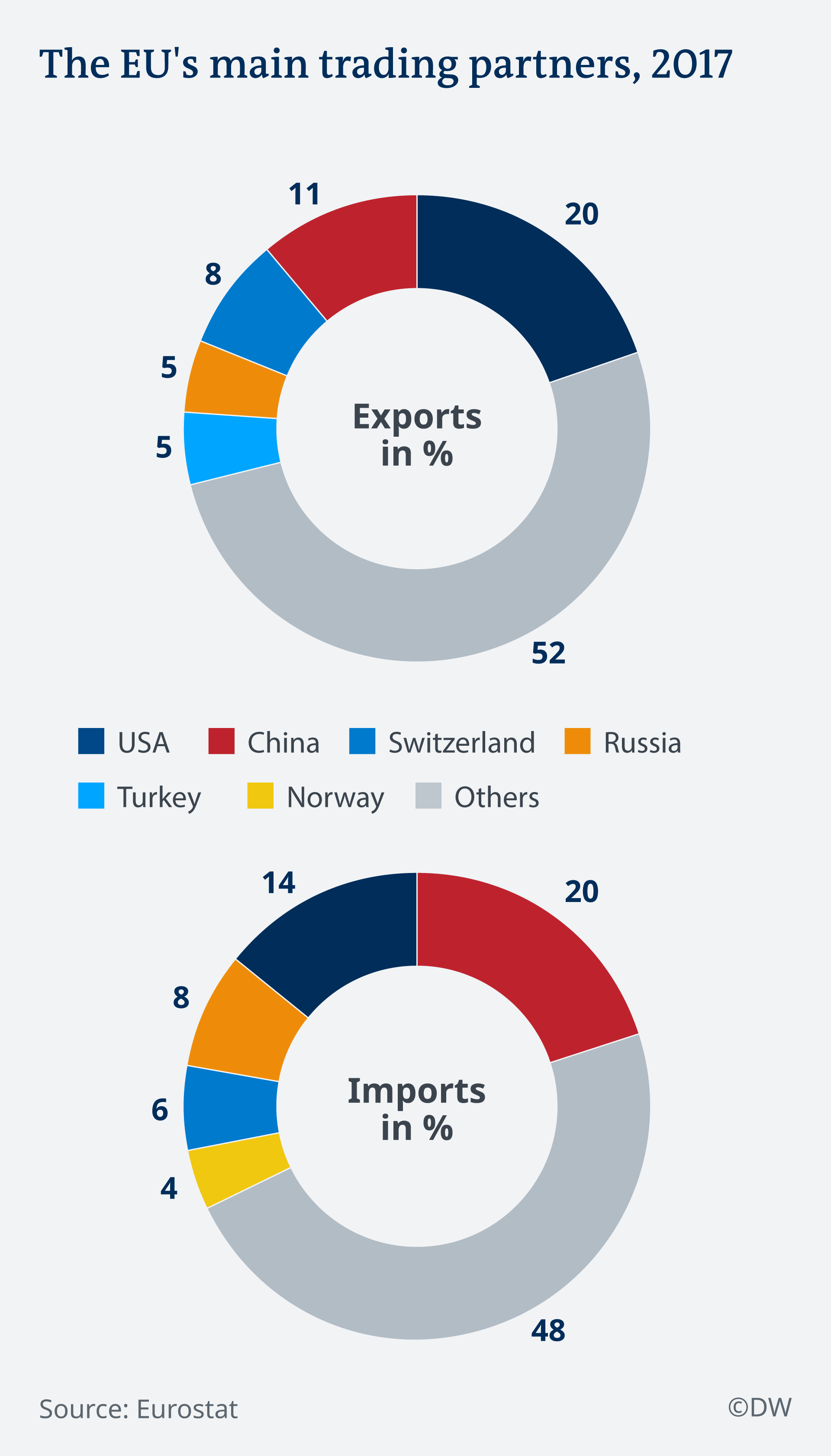

The EU accounts for around 14 % of the world’s trade in goods.Every year trillions of Euros worth of goods are imported into EU, with the EU-27 now accounting for around 15 % of the world’s trade in goods.

New customs rules for trade with the EU

Your responsibility is to make sure that the chemicals and products you bring into the EEA comply with these requirements.Guidance is also available from the Medical Device Coordination Group: MDCG 2021-27 Rev1 Questions and Answers on Articles 13 (Importers) & 14 (Distributors).This information is set out according to whether you are exporting from the EU or importing into the EU. The European Small Business Portal compiles practical information .For the purposes of EU VAT and customs, bringing goods into the EU for the first time, from another non-EU country, is termed an import.Other Interesting Facts about EU Trade. Repair and Return only via broker.

Import duties when buying a boat: what to look out for

The import/export of .Due to launch in 2021, the new electronic scheme called Import One Stop Shop will enable businesses to account for the VAT charged on consignments with a value below 150 EUR imported into the EU for onward sale. The ban does not apply to the import of certain products of animal origin in small quantities and subject to certain conditions.Businesses importing goods can check the applicable UK tariff duties and VAT rates using the HMRC Trade Tariff tool.From 16 July 2021 you will need to appoint an authorised representative based in the EU, EEA or Northern Ireland if you sell certain goods without using an importer or fulfilment service provider .

Imports

Learn about EU rules and regulations for selling and transporting products in the EU.How to bring goods into the UK from any country, including how much tax and duty you’ll need to pay and whether you need to get a licence or certificate. And you will usually pay import duties and VAT. Aaron O’Neill , Jul 4, 2024. These can only be imported if they are. One of the most important importer’s obligations is to clear the goods through customs.

imported products

Two-way trade in services between the EU and Russia in 2020 amounted to €29. We present what customs procedure for import to the EU is and .

Customs Formalities on Entry and Import into the European

The free trade agreements entered into between Switzerland and the EU allow Swiss companies to import and export certain industrial products without customs duties.The one form you will need is the CDC Dog Import Form if your dog has been only in countries that are dog rabies-free or low-risk in the 6 months before entering or returning to . Intra-EU shipments . Find out if the goods are permitted in the Netherlands.General guidance on EU import and transit rules for live animals and animal products from third countries. If the sale of goods to buyers in the EU is facilitated through an electronic interface, the electronic interface is considered to have made the sale and is in principle liable .

Importation of active substances

Import from non-EU countries to the Netherlands

The Ecodesign for Sustainable Products Regulation also aims to reduce the overall .; MDCG 2021-26 Q&A on repackaging & relabelling activities under Article 16 of Regulation (EU) .Europe Import Export Data | European Countries Trade . Guide to the EU market’s import rules and taxes, including information about requirements, import duties, rules of origin VAT, excise duties and sales . Under this procedure, both the importing and exporting country must authorise the shipment. Removed references to changes to import controls previously due to come into effect on 1 July 2022, as these have been . The traffic of goods between EU member countries – trading, in other words, within the European market – is referred to as the transportation, procurement or acquisition of goods.

inEuropean Union Imports – TRADING ECONOMICStradingeconomics.How Can You Import a Boat from the US to the EU and UK? Bringing a boat across the Atlantic to reside in either the EU or the UK takes some prior planning and it’s highly .

This article discusses the development of the European Union’s (EU) international trade in goods. Sometimes you also pay excise duties. These can only be imported if they are accompanied by written confirmation from the competent authority of the exporting country that attests that the standards of good manufacturing practice and control of the manufacturing site are equivalent to those in the EU. The below sets out a recommendation for .

The EU’s Carbon Border Adjustment Mechanism (CBAM) is the EU’s tool to put a fair price on the carbon emitted during the production of carbon intensive goods that are entering the EU, and to encourage cleaner industrial .

- How To Make Sage Smudge Sticks For A Smudging Ritual

- Was Bedeutet Das Harley-Quinn-Tattoo?

- The Best Downtown Los Angeles Casino Hotels

- Demisexuell Erklärung : Was ist demisexuell?

- Ein Ehepaar Im Dienst Für Den Herrn Und Die Seinen

- Hag Rechtschreibung : Duden

- Verinnerlichen: Bedeutung, Definition Wortbedeutung

- Entschuldigung B1 Schreiben Beispiel

- Freie Schule Bietet Ein Paradies Für Leseratten

- Pflegeminuten Tabelle Mdk | Pflegebeduerftigkeit

- Sportauspuff Für Yamaha Fj 1200

- Alimenti Ricchi Di Fibre _ Alimenti ricchi di fibre: lista dei cibi che contengono fibre