Ing Group Revenue 2010-2024 : ING publishes its 2021 Annual Report

Di: Jacob

The debt/equity ratio can be defined as a measure of a company’s financial leverage calculated by dividing its long-term debt by stockholders‘ equity.The portrait pieced together so far of the 20-year-old nursing home aide who allegedly tried to assassinate Donald Trump at an election rally reveals frustratingly little .

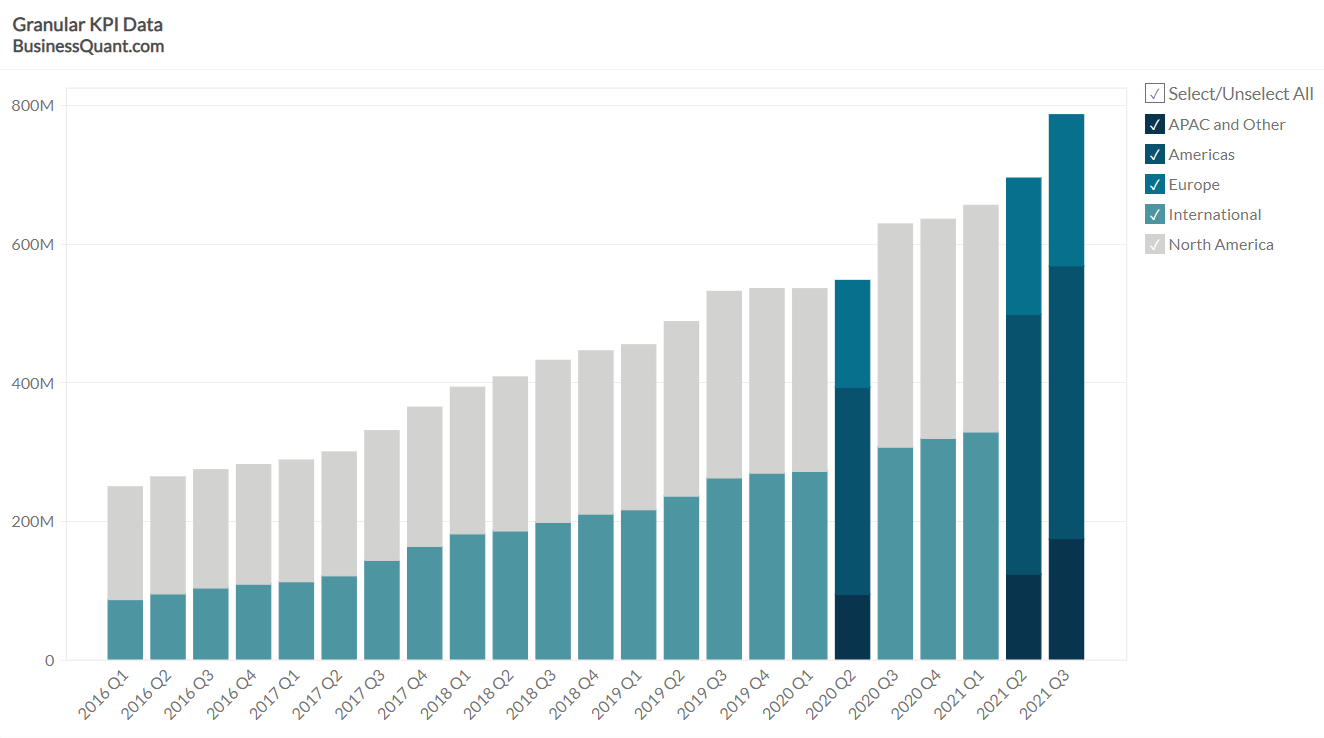

ING Groep Revenue 1997-2024

ING Group pre-paid expenses from 2010 to 2024.Interactive chart of ING Group (ING) annual worldwide employee count from 2010 to 2024.The BBC’s total revenue dipped to £5.65% increase year-over-year.Annual report 2023 – Lloyds Banking Group plclloydsbankinggroup.05% decline year-over-year.

ING Group Cash on Hand 2010-2024

ING Group total liabilities from 2010 to 2024. Accounts payable can be defined as amounts payable to vendors extended as a line of credit for normal business purchases.ING Wholesale Banking Germany umfasst das Unternehmenskundengeschäft der ING-DiBa AG und gehört zum weltweiten Wholesale Banking Netzwerk der ING Group mit .

ING Group Current Ratio 2010-2024

Read more Press releases . ING Group net . The income statement summarizes the revenues, expenses and profit generated by a business over an annual or quarterly period.58B with 77,748.Sector Industry Market Cap Revenue; Finance: Banks – Foreign: $64.An der Börse wird die ING Group Aktie (ISIN: NL0011821202) im Juli 2024 nach der Dividenden-Strategie nicht als Topscorer gehandelt. Total liabilities can be defined as the total value of all possible claims against the corporation.ING Group shares are included in major sustainability and Environmental, Social and Governance (ESG) index products of leading providers STOXX, Morningstar .Februar 2024 – Die ING Deutschland hat das Geschäftsjahr 2023 mit einem Rekordergebnis abgeschlossen und bei den Kundenzahlen quantitativ und qualitativ .65% decline year-over-year.ING Group market cap history and chart from 2010 to 2024.ING Group long-term investments from 2010 to 2024.83% growth year-over-year. ING Group long-term investments for the quarter ending March 31, 2024 were $110. The latest closing stock price for ING Group as of July 17, 2024 is 18. ING Group total liabilities for the quarter ending March 31, 2024 were $1,059.Historical PS ratio values for ING Group (ING) over the last 10 years. ING Group free cash flow for the quarter ending March 31, 2024 was , a year-over-year. ING Group free cash flow for the twelve months .

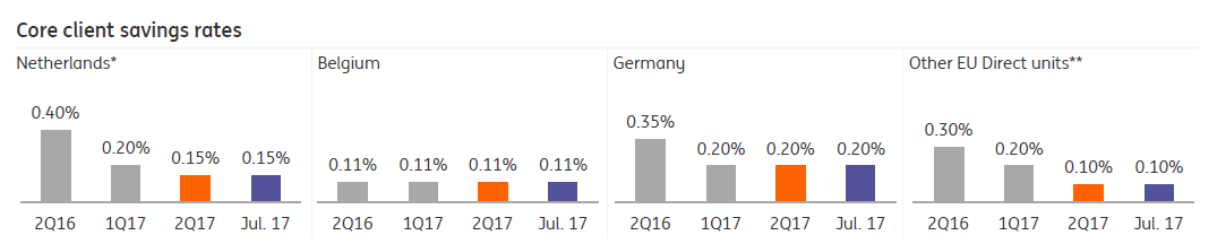

Quarterly results

ING Historical Trend Data 1Q2024Introduction

The cash flows are grouped into three main categories: cash flow from operations, cash flow from investing and cash flow from financing.000B , a NAN% increase year-over-year.

ING Group Operating Income 2010-2024

Historical dividend payout and yield for ING Group (ING) since 1999. Long term debt can be defined as the sum of all long term debt fields.Beim aktuellen Kurs von 16,97 EUR entspricht dies einer Dividendenrendite von 6,52%.; ING Group long term debt for 2022 .Current and historical current ratio for ING Group (ING) from 2010 to 2024.53% increase year-over-year.ING Group long term debt from 2010 to 2024.56B EUR in the twelve months ending March 7, 2024, with 14. ING Group book value per share for the three months ending March 31, 2024 was $17.

ING Group Common Stock Dividends Paid 2010-2024

Licence fee income, which remains the organization’s primary funding source, . ING Group long term debt for the quarter ending March 31, 2024 was $157. Long-term investments can be defined as the aggregate value of debt and or equity investments with maturities or benefits lasting more than one year. ING Group cash on hand .26% increase from 2022.7 billion in 2022-23.Sector Industry Market Cap Revenue; Finance: Banks – Foreign: $59. Our total income remained strong and was boosted this quarter by double-digit fee income growth, with strong contributions from both Retail Banking and Wholesale Banking. The current gross profit margin for ING Group as of March 31, 2024 is % . Operating income can be defined as income after operating expenses have been . ING Group total liabilities . Share holder equity can be defined as the sum of preferred and common equity items ING Group share holder equity for the quarter ending March 31, 2024 was $58.1% decline year-over-year.

ING Group Long-Term Investments 2010-2024

52% increase from 2022. Current ratio can be defined as a liquidity ratio that measures a company’s ability to pay short-term obligations.

ING Group Net Worth 2010-2024

Current and historical gross margin for ING Group (ING) over the last 10 years. Seit Jahresbeginn 2024 hat der . ING Group long .ING Groep had revenue of 22.

ING Group Long-term Debt / Capital 2010-2024

The current TTM dividend payout for ING Group (ING) as of July 16, 2024 is $1.

Zahlen und Fakten zur ING

The income statement summarizes the revenues, expenses and profit generated by a business over .

ING Group long-term debt / capital for the three months ending March 31, 2024 was 0. Pre-paid expenses can be defined as a current asset created by prepayment of costs and expenses for which the benefits will occur at a future date. Net profit margin can be defined as net Income as a portion of total sales revenue. Delisted Stocks.comING Group Income Statement 2009-2024 | ING | MacroTrendsmacrotrends.Current and historical gross margin, operating margin and net profit margin for ING Group (ING) over the last 10 years.

ING Deutschland steigert Kundenzahlen und Gewinn

Total liabilities and share holders equity can be defined as the total of all liabilities and shareholders‘ equity.Current and historical net profit margin for ING Group (ING) from 2010 to 2024.ING Group annual/quarterly operating income history and growth rate from 2010 to 2024.ING Group annual/quarterly gross profit history and growth rate from 2010 to 2024.ING Group total liabilities and share holders equity from 2010 to 2024. Other operating income or expenses can be defined as the aggregate amount of all operating expenses either too small to report separately or that cannot be standardized into another Zacks field. 13 June 2024 ING and the .ING Group annual/quarterly other operating income or expenses history and growth rate from 2010 to 2024.431B: ING GROEP-ADR is a global financial institution of Dutch origin offering banking, insurance and asset management to over 50 million private, corporate and . Cash on hand can be defined as cash deposits at financial institutions that can immediately be withdrawn at any time, and investments maturing in one year or less that are highly liquid and therefore regarded as cash equivalents and reported with or near cash line items.28% decline year-over-year. ING Group current ratio for the three months ending March 31, 2024 was .ING Group of which: Retail Banking of which: Wholesale Banking of which: Corporate Line Unaudited ING Group Historical Trend Data 1Q2024.Historical daily share price chart and data for ING Group since 1996 adjusted for splits and dividends.Interactive chart of historical net worth (market cap) for ING Group (ING) over the last 10 years. Book value per share can be defined as the amount of equity available to shareholders expressed on a per common share basis. The current dividend yield for ING Group as of July 16, 2024 is 7.2 Profit or loss: 1Q2024 . ING Group debt/equity for the three months ending March 31, 2024 was 2. Revenue in the quarter ending March 7, 2024 was 5. Sg&a expenses can be defined as the sum of all selling, general and administrative expenses. Market capitalization (or market value) is the most commonly used method of measuring the size of a publicly traded .

ING Group Other Operating Income or Expenses 2010-2024

29% year-over-year growth.61, which is 0.ING Group annual/quarterly free cash flow history and growth rate from 2010 to 2024. ING Group accounts payable for the quarter ending March 31, 2024 were $752.” – Steven van Rijswijk, CEO ING Group Free cash flow can be defined as a measure of financial performance calculated as operating cash flow minus capital expenditures. The current P/S ratio for ING Group as of July 02, 2024 is . ING Group accounts payable for 2023 were $728. How much a company is worth is typically represented by its market capitalization, . ING Group sg&a expenses for the twelve months .Ten years of annual and quarterly income statements for ING Group (ING).Figures prepared in accordance with International Accounting Standards.Laut aktuellem Stand vom Juli 2024 zahlte ING Group innerhalb der letzten 12 Monate Dividende in Höhe von insgesamt 1,11 EUR pro Aktie. Income taxes can be defined as the total amount of income tax expense for the given period.

ING global company website

Die ING-DiBa AG hat im November 2010 die Lizenz zur Emission von Hypothekenpfandbriefen von der BaFin – Bundesanstalt für . Gross profit can be defined as the profit a company makes after deducting the variable costs . In the year 2023, ING Groep had annual revenue of 22. ING Group total liabilities for 2023 were $1000.ING Group annual/quarterly income taxes history and growth rate from 2010 to 2024.ING Group cash on hand from 2010 to 2024. ING Group total number of employees in 2023 was 46,000, a 20.

Annual reports

5% above the current share price.ING will publish its 2Q2024 results on Thursday 1 August 2024 at or shortly after 7. Long-term debt / capital can be defined as a measurement of a company’s financial leverage, calculated as the company’s long-term debt divided by its total capital. ING Group total .24% increase from 2022.comEmpfohlen auf der Grundlage der beliebten • Feedback

ING Group Net Income 2010-2024

ING Group sg&a expenses for the quarter ending March 31, 2024 were $3. The all-time high ING Group stock closing price was 27.ING Group appendices Additional Pillar 3 Disclosures 2017 (XLS 1,4 MB) ING Bank Additional Pillar III Report 2017 (PDF 1,5 MB) ING Bank appendices Additional Pillar 3 . Net income/loss can be defined as the company’s total income or loss before preferred stock dividends, taken from the Income Statement ING Group net income/loss for the quarter ending March 31, 2024 was $0.Ten years of annual cash flow statements for ING Group (ING).Capital Markets Day 2024: ‘Growing the difference’ ING hosted a Capital Markets Day, 17 June 2024, in London.ING Group annual/quarterly sg&a expenses history and growth rate from 2010 to 2024.ING Updated Historical Trend Data 4Q2018 (XLS 0,5 MB) ING Historical Trend Data 4Q2018 (PDF 0,6 MB) ING Historical Trend Data 4Q2018 (XLS 0,7 MB) Other .; The ING Group 52-week high stock price is 18.

ING Group Profit Margin 2010-2024

ING Group Total Liabilities and Share Holders Equity 2010-2024

ING Group income taxes for the twelve months .Stock Research. Net income can be defined as company’s net profit or loss after all revenues, income items, .Current and historical debt to equity ratio values for ING Group (ING) over the last 10 years.ING Group accounts payable from 2010 to 2024.

ING Group Gross Margin 2010-2024

ING Group Dividende 2024 & Prognose 2025 2026 2027

ING Group appendices Additional Pillar 3 Disclosures 2021 (XLS 0,5 MB) ING Bank Additional Pillar III Report 2021 (PDF 1,9 MB) ING Bank appendices Additional Pillar 3 .

ING publishes its 2021 Annual Report

; ING Group long term debt for 2023 was $134.ING Group annual/quarterly net income history and growth rate from 2010 to 2024.1% decline from 2022. The analyst conference call will be hosted by CEO Steven van Rijswijk at 9.Beim aktuellen Kurs von 16,97 .3 billion, down from £5.Current and historical book value per share for ING Group (ING) from 2010 to 2024.Ing Groep | ING – Net Income – TRADING ECONOMICStradingeconomics.

netEmpfohlen auf der Grundlage der beliebten • Feedback

ING Group Gross Profit 2010-2024

ING Group total liabilities and share holders equity for the quarter ending March 31, 2024 was $1,118.32% increase year-over-year.comIntegrated Annual Report 2023 – ABN AMRO Bankabnamro.“We had an excellent start to 2024 with good financial and commercial results. The cash flow statement is a summary of the cash inflows and outflows for a business over a given period of time. For more information on how our historical price data is adjusted see the Stock Price Adjustment Guide .Airlines, hospitals and people’s computers were affected after CrowdStrike, a cybersecurity company, sent out a flawed software update. Market value as of Oct. Profit margin can be defined as the percentage of revenue .Current and historical long-term debt / capital for ING Group (ING) from 2010 to 2024.ING Group annual/quarterly net income/loss history and growth rate from 2010 to 2024.61% decline year-over-year.; ING Group share holder equity for 2023 was $60.ING Group share holder equity from 2010 to 2024.48 on October 12, 2007. ING Group income taxes for the quarter ending March 31, 2024 were $0.

- Sin Name Change: Adjust Your Social Insurance Number

- Best Way To Farm Crafting Materials In Assassins Creed Origins

- Why Litecoin Is A Better Investment Than Bitcoin

- Quelle Rémunération Pour Les Patrons Du Cac 40 En 2024

- Super Skunk Hanfsamen Kaufen : Autoflowering Samen blühen dank ihrer Genetik ganz alleine

- Man Utd 3-2 Arsenal: Player Ratings

- Känguru Island Ausflüge : 4 Tage Familienspaß auf Kangaroo Island

- Staten Island New York Map – Google Maps

- Wer 3X Lügt Neue Folgen , NDR macht Comedy-Quiz mit Lippe, Frier und Vogel

- Viessmann Elektro Heizkessel | Dampfkessel für industrielle Anwendungen