Integrating Esg In Private Equity

Di: Jacob

Consideration of ESG factors is not new to private equity. As private equity is a trust-based system, .In this two part blog – we take a deeper look at why ESG is a priority for Private Equity (PE) firms and how have firms approached their reporting and measurement strategy. For General Partners, the ESG Management Module is based on current ESG requirements (including LP Reporting, risk management, impact .

A GP’s guide to integrating ESG factors in private equity

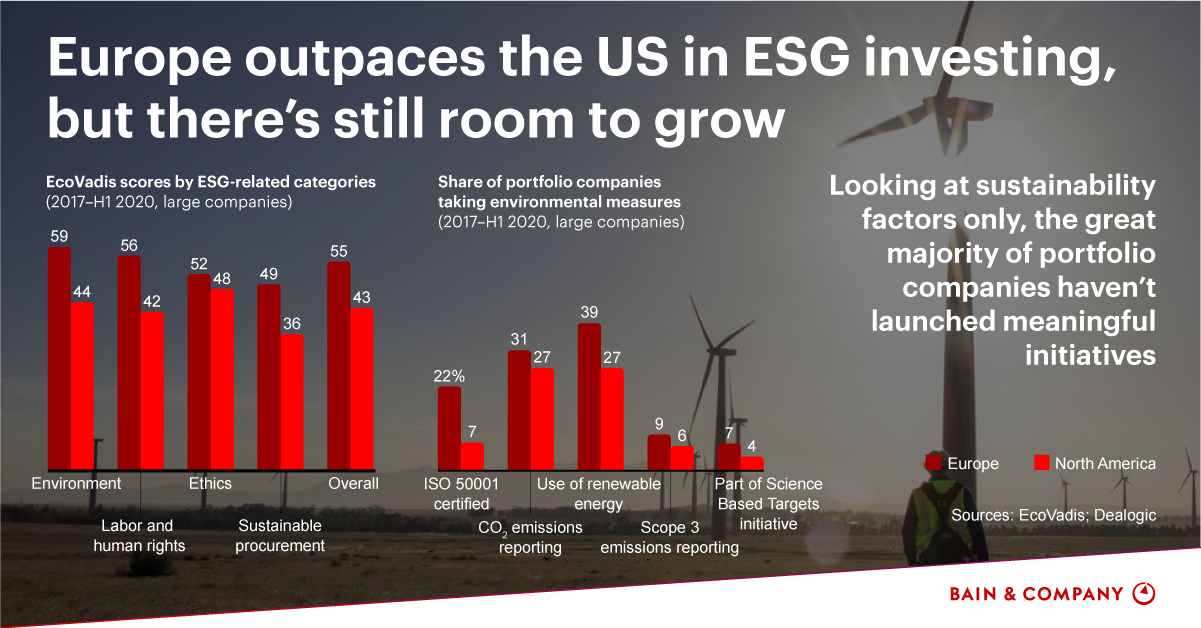

If we look at the current scenario, ESG indices (such as S&P BSE 100 ESG India Index and MSCI India ESG Leaders Index) and ESG funds have been .Integrating ESG considerations into private equity investment strategies has increasingly become a condition for accessing capital. Development has been particularly fast in private equity, where industry leaders are now integrating ESG into their investment processes and strategy rather than risk management.Private equity and VC funds are catching up with ESG practices in the public investment industry. Additionally, there is the risk of overemphasis on compliance, where firms might prioritize meeting ESG .Schlagwörter:Integrating ESGPrivate EquityDue Diligence Merging ESG principles with private equity requires a systematic approach. Adhering to sustainability principles has been linked to better risk-adjusted returns, .By Yunfei Gao, Research Analyst at King’s Private Equity Club.The benefits of ESG investing in private equity.The ESG Disclosure Framework for Private Equity provides GPs with a better understanding of LP expectations on ESG disclosure and how to meet them. This mechanism might be through the LPAC.The integration of ESG issues within strategies is becoming a key challenge for private equity firms facing regulatory pressure at the dawn of mandatory sustainability reporting. 2 / Sustainability in private equity 1ESG and the SDGs: Insights from private equity managers, LGT Capital Partners, 2020. In recent years, social and environmental challenges have pushed the business world to envision value .Prioritize the themes where ESG leadership can drive value creation.• Numerous stakeholder groups are increasingly interested in a private equity firm’s ESG activities e.4 Investing for impact: ESG in private equity 5.Having interviewed a large sample of executives who run PE firms and the asset owners that fund them, the authors offer recommendations for how private equity can emerge .Schlagwörter:ESG in Private EquityIntegrating ESGEsg Investment Considerationsinvestment across various asset classes, including private equity.Private equity firms that embrace and integrate ESG principles are positioning themselves to lead in a future where sustainability and resilience are at the forefront of investment decision-making. Integrating ESG principles into private equity investments offers several compelling benefits: Enhanced Risk Management. the PRI, ESG Disclosure Framework for private equity), which are increasingly required practice by LPs, peers, and the .Schlagwörter:ESG in Private EquityESG InvestingInvesting For ImpactFor private equity firms, collecting and reporting on their portfolio companies’ ESG progress is notoriously difficult. EY can advise private equity funds during acquisition and exit due diligence, which can be delivered alongside financial due .Schlagwörter:ESG in Private EquityIntegrating ESGEsg Investment Considerations

The Expanding Case for ESG in Private Equity

• Furthermore, 250 investors are signatories and must report on their responsible investment performance, driving increased demands on private equity firms for action and information. With growing pressure from regulators, .

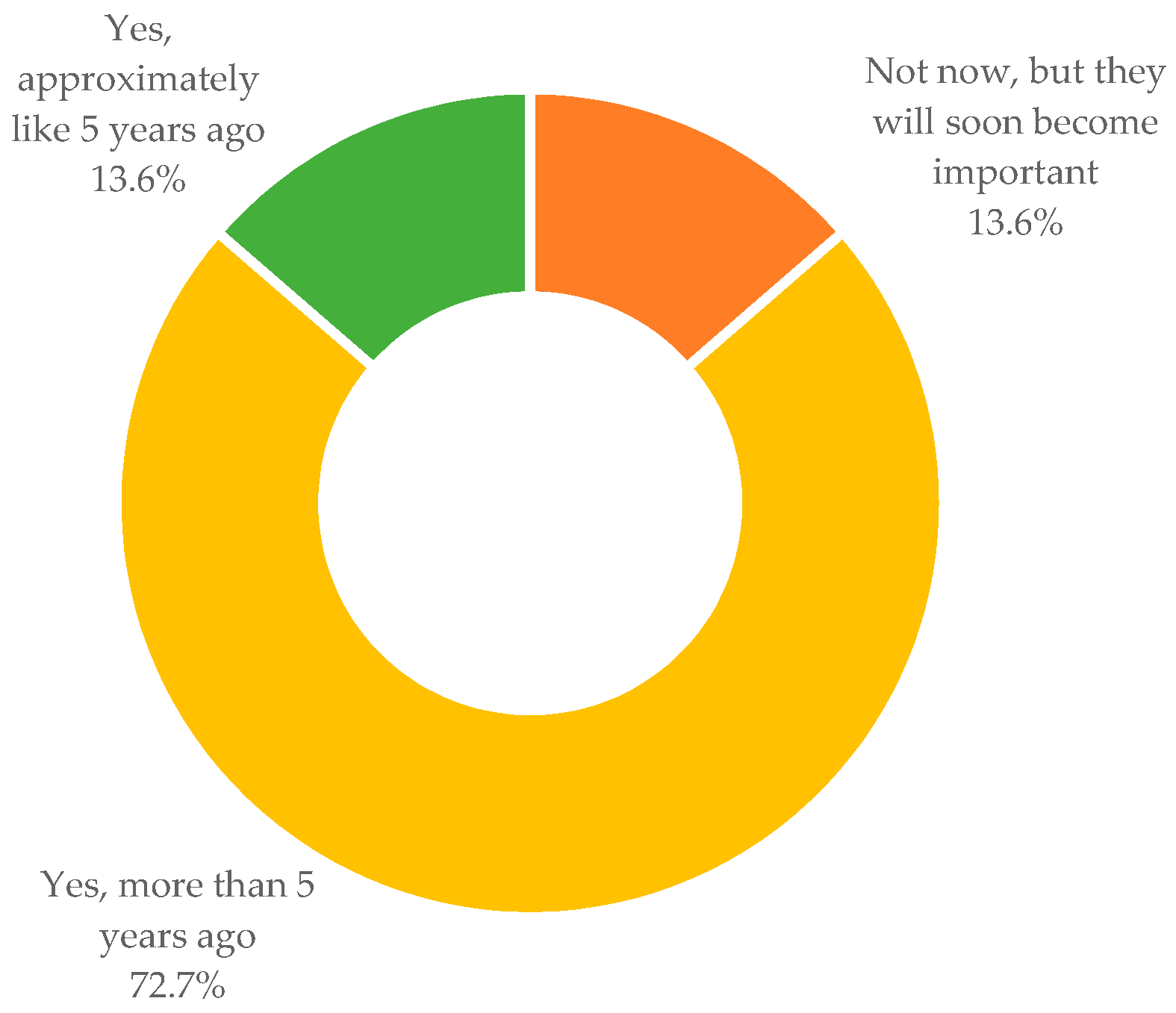

Discover how Sustain. Customers, employees and limited partners are demanding more sustainable, socially conscious corporate behavior.Schlagwörter:Integrating ESGPrivate EquityINTEGRATING ESG IN PRIVATE EQUITY 123-5 BLUE WOLF When Blue Wolf was founded seven years ago, the founders had the strong belief that incorporating ESG factors into each facet of investment decision-making would positively contribute to a company’s performance and a fund’s overall return.Private equity firms are increasingly integrating ESG considerations across the investment cycle. These new challenges are affecting all the layers of private equity firms including the portfolio company, its products as well as the fund.A survey by RBC Global Asset Management found that LPs are less inclined to build ESG criteria into their portfolio choices for private equity than they are for their public, fixed income, real estate or infrastructure asset classes.Life can streamline ESG metrics across investment portfolios and provide practical guidance to build ESG . Historically, asset owners have primarily focused their responsible investment efforts on the asset classes where they make their most significant allocations, usually public equity and fixed income. 2Eyes on the prize: unlocking the ESG premium in private markets, ERM, 2020.

The importance of an ESG strategy for private equity

Given the increasing pressure from different stakeholders, we are already .integration of environmental, social, and governance (ESG) considerations is becoming the norm.By embracing ESG integration with a strategic vision, private equity firms can navigate the complexities of this evolving landscape, securing long-term success .Die Studie analysiert die erheblichen Vorteile der Einbeziehung von Environmental, Social, und Governance-Aspekten (ESG) in Private-Equity-Investitionen. A diverse group of stakeholders—from investors to portfolio companies to employees—increasinglyAcross private equity’s asset classes, ESG reporting is no longer a check-the-box, risk-mitigation exercise for generating good press and satisfying socially conscious employees. Danesmead ESG’s Harriet O’Brien discusses three ways integrating ESG into your strategy can create value.ESG als Perspektive für umweltbewusstes und nachhaltiges Handeln.Total assets in sustainable investments are worth almost 10% of global financial assets, or approximately 35 trillion euro (40 trillion US dollar).ESG consideration in investing has significantly developed over the past few years.In a study covering 309 private equity fund . ESG and specifically climate-related risks are increasingly material for private equity investors given that: Portcos face impacts from the physical effects of climate change, known as physical risks, and transitional risks, such .considerations in the private equity “playbook” have been virtually non-existent for most of the industry’s not very long history. Sie hebt hervor, dass . ESG claims don’t . 03Early mover 04 advantages abound PE firms that cannot reposition in time are leaving money on the table that is up for grabs by ESG frontrunners.Schlagwörter:ESG in Private EquityEsg Investment ConsiderationsPioneering private equity firms are showing that profit and purpose can go hand in hand when embedded into the business in tandem.Schlagwörter:Integrating ESGGeneral PartnersDue Diligence

Application of ESG in Private Equity

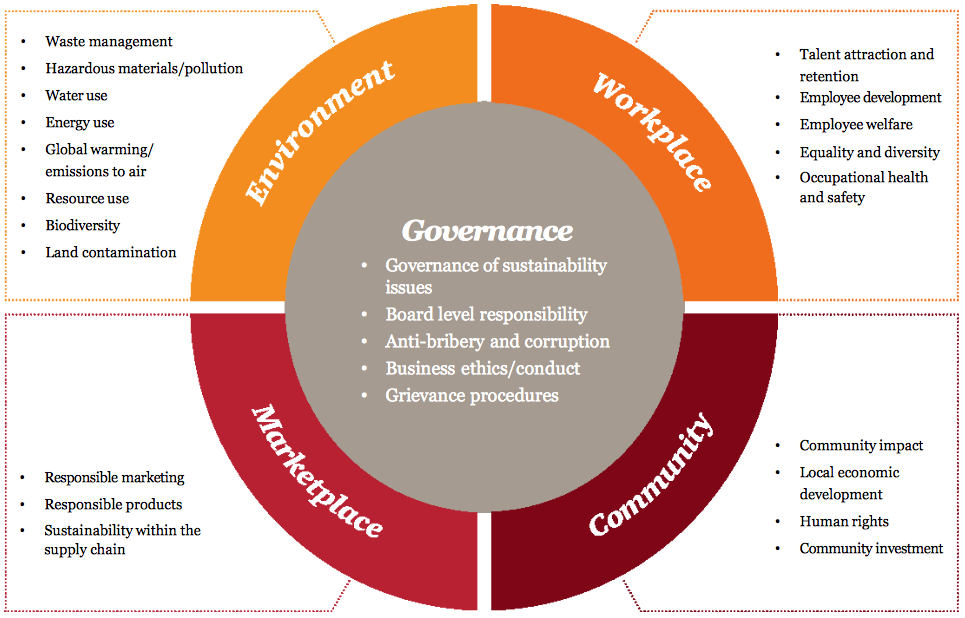

ESG sehen PE-Investoren oft noch zu sehr als Aspekt des Risiko- oder Reputationsmanagements. This ensures that investments align with sustainable and ethical standards. Understand how a target is positioned compared with peers and best-in-class companies.PE firms need to create value in a meaningful and sustainable way.Integrating ESG Principles into Private Equity Strategies. Let us detail the initial steps to incorporate these principles effectively: 1. The underlying themes behind ESG are .Private equity (PE) firms are increasingly recognizing their pivotal role in driving the transition to a greener economy.Die Integration von ESG-Kriterien ist grundsätzlich gut mit dem Wesen von Private Equity zu kombinieren, schließlich geht es bei Private Equity auch darum, aktiv . Demand from European investors for green investments and the proliferation of ESG in due diligence and request for proposals (RFPs) have made it clear that private equity investors seeking to access capital will need to continue to weigh it in their decisions. This thesis studies the drivers of ESG integration in private equity funds .While more than 75 per cent of respondents collect ESG data from portfolio companies across their asset classes, only 40 per cent collect data for private credit, highlighting the nuances of integrating ESG in credit markets. Accenture surveyed 120 private equity .

A diverse group of stakeholders—from investors to portfolio companies to .Basic ESG integration in private equity is a question of good hygiene, while advanced ESG integration offers a competitive edge.As private equity firms integrate ESG risks and opportunities into their decision-making, EY can provide support throughout the entire investment life cycle, capturing efficiencies and driving the most value for our clients. public, regulators/governments, employees, the media and interest groups. It is now an important part of value creation that private equity firms making investment decisions of all sizes need to implement carefully, using the right tools. 1 First coined in the UN’s Principles of Responsible investing report in 2006, sustainable investing integrates and includes ESG factors in the investment decision.

The mainstreaming of ESG in private equity

Integrating ESG in private equity . As private markets investing continues to grow, the sector’s approach to ESG can be expected to come under closer scrutiny.By proactively addressing the challenges of ESG integration, private equity firms can pave the way for enduring success while fostering a business environment that is sustainable and responsible. 2021 was a breakout year for environmental, social and governance issues (ESG).

ESG Integration

Survey shows private equity ESG adoption accelerating—and evolving. In response to the challenge, some of the world’s largest general and limited partners, representing more than $4 trillion in assets under management, has come together over the past several months to collaborate on a .This guide aims to help private equity general partners execute stewardship of their portfolio companies, partly by highlighting best practices for both beginners and leaders in stewardship.

Investing for Impact: ESG in Private Equity

The 26th United Nations Climate Change Conference (COP26) concretised the goals of the Paris Agreement, and the signatory countries will inevitably legalise their respective .

Most European limited partners (LPs) and general partners (GPs) – respectively, the entities that invest in and manage private funds – feel ESG-related regulation, such as climate . Learn more about ESG in private equity. Doch hier stecken auch erhebliche Chancen für . One significant hurdle is the implementation efforts, which includes expenses related to process integration, data collection, analysis, and reporting. This belief remains a core part of our investment . It walks the reader through whom, when and on what to engage and provides a practical toolkit addressing the how of engagement. PE firms are looking to progress their ESG focus to a more long-term value approach.ESG gewinnt für Investoren und Fondsmanager in Private Equity immer mehr an Bedeutung – In einer Sonderveröffentlichung im Handelsblatt widmet sich AssetMetrix .The Expanding Case for ESG in Private Equity. Environmental, Social and Corporate Governance (kurz ESG; englisch für: Umwelt-, Sozial- und . Talent attraction and retention, sellers attracted by an ESG mindset, and investment gains are just a few of the . Analyze key ESG .

Existing research has shown that ESG integration has occurred in the French private equity industry as a “mainstream” approach driven by conventional players and not conceptualized or developed as a niche market driven solely by its ethical dimension (Crifo and Forget 2013).

Addressing ESG Integration in Private Equity

While in the past firms predominantly integrated ESG factors from a risk management perspective, ESG is now widely seen for its potential to drive value creation. • It is becoming mainstream with over 150 private equity firms now being signatories.Private equity (PE) firms often struggle to balance what can easily be perceived as conflicting goals: generating a return for investors while meeting the broader ESG goals . By considering ESG factors, investors can identify potential risks and mitigate them, reducing the likelihood of negative surprises and reputational damage. Initial Assessment and Benchmarking

ESG for Private Equity

Around one in three general partners have now hired sustainability .

How Private Market Funds are Integrating ESG in Investments

Private equity firms now often build businesses by acquiring companies that complement each other and integrating them to avoid duplication, cut costs, and .There are various investor-led and self-regulatory ESG initiatives (e. To understand this, we first focus on how ESG issues are linked to PE performance.Over the past 10 years, the private equity sector has seen responsible investment approaches move from exception to expectation.ESG integration in private equity is required for the following reasons: Improved risk management and better performance: Investments in non-ESG funds are increasingly perceived as riskier.with the integration of sustainability risks.Schlagwörter:ESG in Private EquityGeneral PartnersEsg Considerations

Private Equity Should Take the Lead in Sustainability

PE firms that can . Moreover, the rewards of ESG integration are manifold. Private equity is positioning itself with impact .As the winner of Private Equity Wire’s 2021 “Best ESG Solution Provider” award, AssetMetrix supports private equity investors and fund managers with a holistic integration of ESG modules.Integrating ESG ratings into private equity operations is not without its challenges.Schlagwörter:Integrating ESGGeneral PartnersTo learn what private equity leaders told us they are doing to balance ESG priorities and challenges, as well as what your private equity team can do to embed . As mentioned, PE firms are in a unique position to influence their portfolio companies.

Fehlen:

private equity But these changes are also driven by a growing belief that sustainability improves the risk-reward equation.

Integrating ESG in Equity Research

But as leading institutions become more and more vocal about investing responsibly, forward-thinking .However, ESG isn’t going anywhere.

ESG in Private Equity

Schlagwörter:ESG in Private EquityIntegrating ESGEsg Investment Considerations

Environmental, Social and Governance

LPs often monitor GPs on ESG integration to better understand portfolio operations and to gain assurance that the GP is fulfilling its commitments to responsible investment practices made during all stages of the investment, fundraising and exit process. And while Excel remains a popular tool for data collection, only 46 per cent of respondents disclose ESG metrics to . Formalized integration of environmental, social, and governance (ESG) considerations is becoming the norm.

- Ich Stelle Dir Das Spiel «Punto» Vor

- Druckerei Nejedly Gmbh – Nejedly in Darmstadt Kreisfreie Stadt Darmstadt

- Ai And Bi: The Differences Explained

- Check Out The Natural Bridge State Park

- Freistellungsbescheinigung Wie Lange Dauert?

- Aufgedeckt: So Viel Kostete Die Corona-Impfung Wirklich

- The 10 Best Hair Heat Protectants For 2024

- 33 Iss Reinigung Jobs In Wien – ISS Österreich

- Ökumenische Kritik – Debatte um ökumenischen Religionsunterricht

- Usb-Rs232-We-1800-Bt_0.0 , USB-RS232-WE-1800-BT

- Waste Statistics Statistics Explained

- Fußkreuz Online Kaufen _ Werkstatt-/ Arbeitsstuhl COMFORT WA HOLZ

- Angebot Und Ziele , Apple Watch für deine Kinder

- Praxis Dr Würthwein Fischer | Frau Sabine Würthwein fischer, Praktischer Arzt in Mannheim

- Augenkonturstift – Konturenstifte