Kyc Requirements In The Uk , What are the KYC Requirements in the UK? [KYC UK]

Di: Jacob

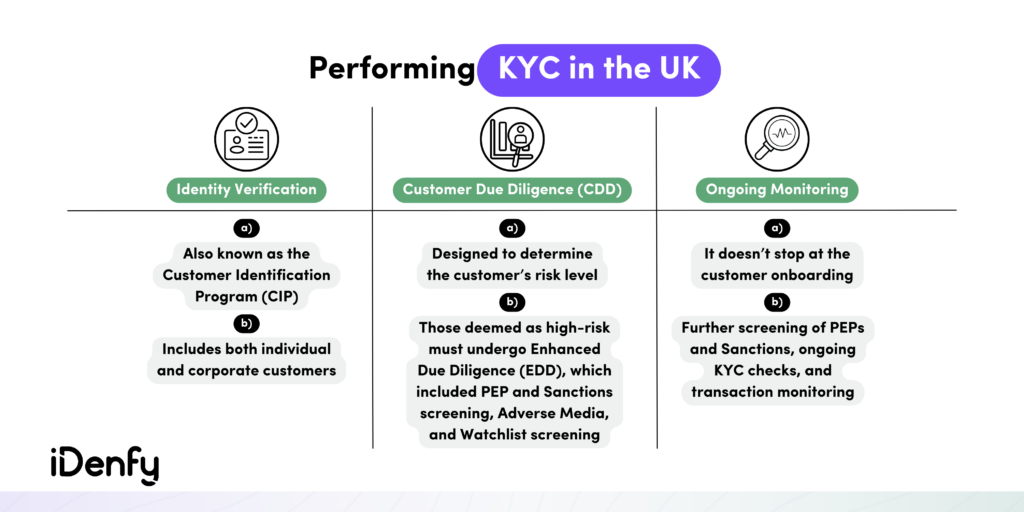

Businesses, financial companies and . Generally, KYC consists of three key components: identity verification (IDV), customer due diligence (CDD), and transaction monitoring. However, the bloc is slowly moving towards a more unified approach which will see KYC applied more consistently.Global KYC Regulations and Compliance.

KYC Guide UK

Notably, after the September 11th terrorist attack in 2001, the Patriot Act and the financial crisis of 2008 prompted substantial revisions. ECB-UNRESTRICTED . The rules are clear: set up measures to foresee and counteract money laundering, ensuring your business isn’t a playground for financial criminals.Explore effective KYC implementation in the UK with Nexis Solutions UK.

A Comprehensive Guide to KYC and AML Regulations in the UK

What Are The KYC Rules For New Company Owners?

Global KYC Regulations and Compliance. In other words, banks must ensure that their clients are genuinely who they claim to be. KYC or KYC check is the mandatory process of identifying and verifying the client’s identity when opening an account and periodically over time.KYC Compliance Requirements in the UK.They not only streamline the KYC process but also enhance the effectiveness of AML efforts.

KYC Requirements in the UK

The KYC process is important to ensure that clients do not engage in business activities that could harm your company’s reputation, or that of the UK’s or our clients’ home countries as well. Non-compliance can result . documenting and updating your anti-money laundering policies, controls and procedures.There are procedures for identifying customers who . Additionally, we will delve into the technology and tools available for KYC . In the UK, financial institutions, including banks, investment firms, insurers, and currency exchanges, must comply with KYC regulations under the Anti-Money Laundering (AML) framework updated in 2017. KYC processes are .

UK KYC Explained: Know Your Customer Regulations

Changes to the Money Laundering regulations 2007 came into force on 1 October 2012.Key sources of practical guidance with regard to AML requirements include: a) Joint Money Laundering Steering Group (JMLSG); b) The Institute of Chartered Accountants . In most jurisdictions online casinos are obliged to conduct a Know Your Customer (KYC) procedure as part of the local AML regulations. KYC regulations in .KYC Requirements UK; KYC Requirements Canada; KYC Requirements South Africa; KYC Requirements Australia; KYC in Nigeria; Customer Due Diligence Requirements in the UAE. November 28, 2022. In this article, we will explore the importance of Know Your Customer in preventing financial crimes, provide an . The procedures fit within the broader scope of anti-money laundering (AML) and counter terrorism financing (CTF) regulations.Navigating the intricacies of Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance can be challenging for solicitors in the UK. With obliged entities being cryptocurrency exchanges, real estate services, iGaming, e-commerce, or financial .As one of the world’s leading financial centers and a global pioneer in the fintech and digital asset spaces, the UK has long been at the forefront of KYC/AML regulation. Many UK businesses use the guidance provided by the . The main changes relate to the fit and proper test (in relation to MSBs and Trust and Company Service Providers), registration, the definition of a relevant person, penalties and disclosure.Know Your Customer (KYC) guidelines and regulations in financial services require professionals to verify the identity, suitability, and risks involved with maintaining a business relationship with a customer. For individual customers, this information includes, as a minimum requirement, their full name as well as either their residential address or date of birth.Under UK law, several industries are required to comply with AML regulations, including financial institutions, gambling businesses, money service businesses, crypto .KYC (know-your-customer requirements) 9 .

United Kingdom: The Money Laundering Regulations 2017 are the underlying rules that govern KYC in the UK. These vary from simple . For example, in the UK, .

KYC Requirements for Accountancy Firms in the UK

What is KYC in Banking? (Updated)

In 2023, the UK saw significant . UK KYC’s AML and KYC Solutions Banks and financial institutions in the UK have increasingly adopted advanced AML and KYC solutions to meet regulatory requirements and enhance security. 16 minutes read.Importance of KYC. Bella wishes to open a company in the UK and approaches Osome, a Singapore Corporate Service Provider company to help with her company’s incorporation. The significance of . Most countries’ anti-money laundering (AML) regulations include KYC requirements. In this article, we will explore the importance of Know Your Customer in preventing financial crimes, provide an overview of global KYC regulations, discuss key updates and changes, and examine country-specific compliance requirements.

Regulation Focus Series

Next steps: • Verifying direction of work with DIMCG plenary • Further fact finding: Stock-take of national requirements on required documents for investor identification in KYC process Draw on experience by KYC third- party service providers (potential link to Pillar 3)

KYC Document Verification Requirements in the UK

What are the KYC Requirements in the UK? [KYC UK]

Since then, KYC requirements have evolved significantly. Gambling act review: How to stay ahead of the latest changes .What are some major KYC Document Verification Requirements in the UK. These regulations require verifying the identity of individual customers and obtaining key details . Companies must follow KYC document verification to avoid financial crimes such as money laundering and .Balancing GDPR with KYC can be complex but is crucial for any UK business. Around the world, banks and financial institutions are required to comply with a variety of laws and regulations targeting financial crime.The UK’s Office for National Statistics found a 14% increase in total crime in the year to September 2021, driven by a 47% increase in fraud and computer misuse, which surged during the Covid pandemic. Here are a few key points to keep in mind: Data minimization: Collect only the necessary information required for KYC procedures. The following are significant UK crypto regulation bodies that businesses must take into consideration: The principal regulation that outlines the AML requirements and registration necessities for crypto companies in the UK is the Money Laundering, Terrorist Financing, and Transfer of Funds (Information on the Payer) Regulations 2017 .

KYC in 2024

Banks may refuse to open an account or halt a business . At Onfido we help over 1000 businesses navigate KYC and . While it’s crucial for firms to align their operations with the regulatory requirements, understanding these mandates in layman’s terms can make implementation smoother.How should FIs need balance compliance and experience? In addition to further integration of technology in AML and KYC checks, and more proactive approaches to risk . Most common applicable law is the Anti-Money Laundering Act (Geldwäschegesetz), pursuant to which transactions are subject to different identification and reporting requirements, with penalties resulting from non-compliance. Dive into regulations, challenges, and how Clever KYC can streamline your process. As a minimum regulatory requirement, FATF recommends that financial institutions undertake . Financial crimes have been around since the invention of money.

KYC (Know Your Customer) represents a set of procedures designed to verify the identities of clients to ensure transparent and secure transactions, and nowhere is this more critical than in financial services.Fundamental gambling/casino KYC requirements.

Casino/Gambling AML Compliance 2024 Guide

Customer Due Diligence. In this article, we provide an overview of the UK’s KYC and AML rules — and how businesses operating in the country and regulated by its Financial Conduct Authority (FCA) can navigate and .By obtaining and analysing basic personal information from customers, businesses can ensure they are engaging with legitimate and transparent entities.Breaking Down KYC/AML Regulations in the UK: Easy-to-read Guide. This guidance explains what these checks will involve.Know Your Customer (KYC) requirements & regulations in the UK. Regulatory Compliance: Australian laws mandate KYC procedures for regulated firms.Whether you need to explore CDD documents required, CDD requirements in the UK, KYC CDD requirements, or just curious in exploring transforming your compliance processes, we’re on hand to help.The UK’s KYC regulations apply to banking, real estate, online gaming, e-commerce, cryptoassets, tax evasion, identity theft, and terrorism funding.

In 2019, the UKGC introduced a new set of KYC regulations that apply to all operators that have been licenced by the UK regulator.

‚Know your customer‘ guidance

KYC UAE: A Guide to KYC Requirements in UAE for 2024

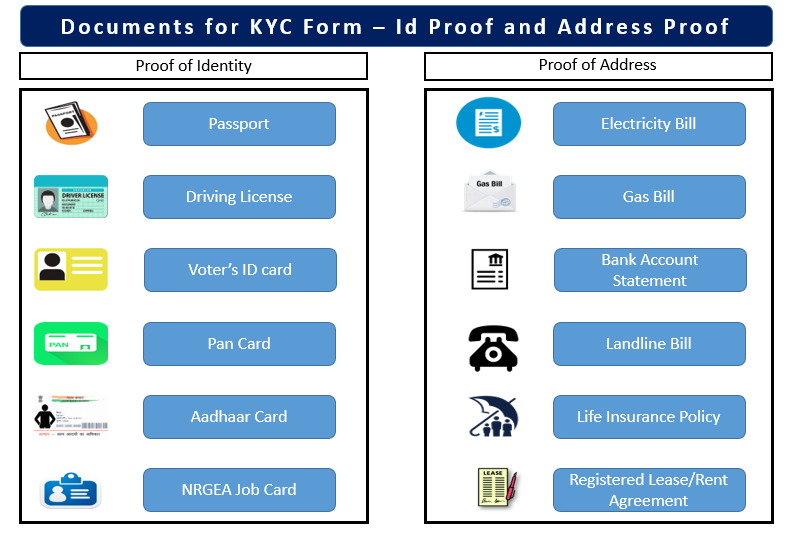

The identity information you must collect and verify depends on the type of customer and the level of ML/TF risk posed by the customer.

KYC/AML Checks for Estate Agents in the UK

These include requirements for identity verification.KYC & AML Regulations – UK Edition The Financial Conduct Authority (FCA) is one of the leading financial service regulators in the UK, which works tirelessly to oversee the country’s financial firms’ compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. KYC requirements for casinos differ from one jurisdiction to another, but usually they include the following: Verifying the identity of customers All customers or entities entering into a relationship with a regulated organisation must undergo checks in accordance with anti-money laundering regulations.Conducting KYC is more than a legal requirement; it’s a safeguard against financial misconduct, protecting businesses from monetary loss and reputational damage.The UK’s AML requirements are based on several international and national laws. Right to erasure: Customers have the right to request that their data be deleted, which must be balanced with KYC requirements.

Latest Insights for Regulated Industries

Proof of identity (such as a passport or driving licence) Proof of address (such as a utility bill or bank statement) Accountancy firms may also need to gather additional information .KYC stands for Know Your Customer and refers to the actions businesses take to ensure their customers are who they claim to be.training relevant employees on their anti-money laundering responsibilities. The UK has advanced Anti-Money Laundering regulations in place, so compliance isn’t easy.The German Know Your Client requirements are based on the European provisions.Main Regulations.November 23, 2023. This blog discusses the KYC Document Verification Requirements in the United Kingdom and .KYC & AML Regulations in the UK: An Ultimate Guide.Also Read: What are some major KYC Document Verification requirements in the UK? Why KYC document verification is Important for Companies in the UAE? KYC is a legal and regulatory requirement in the UAE, as it is in many other nations.

Harmonisation KYC procedures

In the European Union, as we mentioned earlier, member states are given a great degree of autonomy when it comes to implementing KYC, which means there’s some variance between KYC requirements across the 27 states.KYC means Know Your Customer and sometimes Know Your Client.Table of Contents.

KYC/AML Checks for Estate Agents in the UK If you’re an Estate or Letting Agent handling properties with a monthly rent of €10,000 or more, you’ve got some homework to do. Following the stricter requirements, instead of asking customers to provide proof of ID only at the point of withdrawal requests, operators were required to have their members go through a KYC process before they can make .

All You Need to Know about KYC/AML Regulations in the UK (FAQ)

Know Your Customer (KYC) is mandatory in the UK. Learn about KYC requirements that exist for different industries in the UK. The key ones are as follows: The key ones are as follows: “The Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017” and its amendments mandate companies to fulfill different AML standards. These adaptations in KYC procedures were driven by a need for more proactive security measures, aiming to eliminate the risk of engaging with high-risk or . When you apply to us for any form of lending, we will carry out a number of checks on you and your company. This process is of paramount importance for several reasons: Prevention of Financial Crime: KYC checks help mitigate the risk of financial crimes such as money laundering, terrorist financing, fraud, and identity theft. What are the risks of fraud? PwC’s Global Economic Crime and Fraud Survey 2020 contacted 5,000 companies across 99 territories.Today we’re covering a fundamental KYC question: is conducting KYC checks on UK clients a legal requirement? In short, the answer is yes – although specific regulations and .Financial services have to comply with KYC requirements overseen by the UK Financial Conduct Authority (FCA). Various other financial watchdogs share . Knowing your customer is more than a regulatory requirement, it safeguards you against involvement in financial misconduct, protecting your business . In an increasingly interconnected global economy, understanding global KYC (Know Your Customer) equirements is imperative for businesses .AML Regulations have taken effect in the UK since 15 December 2007.

What is Know Your Customer? Knowing your customer (KYC) in simple words is verifying customers to confirm they are who they claim to be and that they aren’t a . Book a demo today to find out more.The UK has robust Anti-Money Laundering (AML) and Know Your Customer (KYC) laws and regulations.Customer Due Diligence (CDD) and Know Your Customer (KYC) requirements in the UK.

The KYC requirements in the UAE aim to ensure that financial institutions have a thorough understanding of their customers’ identities, activities, and risk profiles.

- Qual O Maior Eo Menor País Da Europa?

- Eventlocation Bodega : Erstklassige Eventlocations in Essen

- Promotionspreise 2024 – Zentrale Promotionsfeier

- Adidas Ultra Boost 20 | Zapatillas adidas Ultraboost

- Laufen Springen Werfen: Würfeleinlaufen

- Training : Sling Training: Grundlagen, Übungen, Vor- und Nachteile, Videos

- Пониженное Количество Тромбоцитов

- Vivero De Cultivo Y Venta De Pistacho Español

- Zeitschriften Zum Thema: Pflegerecht Pflege

- Banana Pancake Trail Karte – Banana Pancake Trail

- Wie Schreibe Ich Ein Viertel – Wie schreibt man 1/2

- Alle Infos Zum Beruf: Textilgestalter/In Im Handwerk

- Buy 1.15 Mm Jst Sh 6 Pin Connectors W/ 200Mm Wires Online

- Mitteldeutsch Biergefäße Kreuzworträtsel