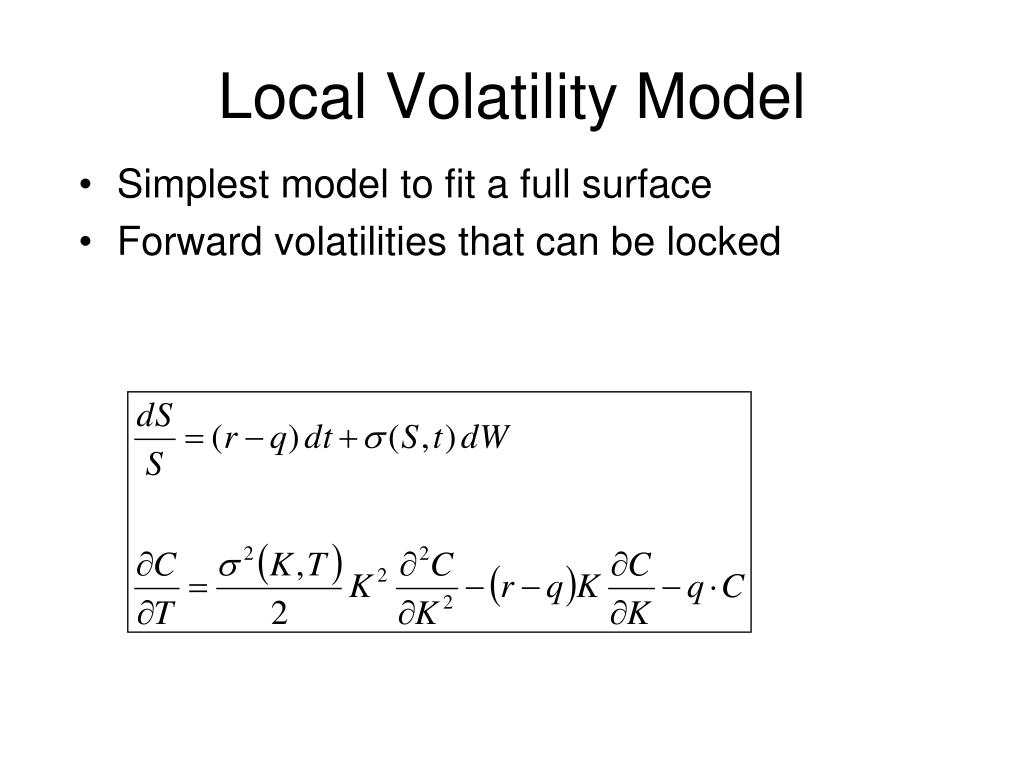

Local Volatility Model : Local Volatility and Dupire’s Equation

Di: Jacob

LSV allows us to set up a model in which the smile is explained partly by a local volatility component, and partly by stochastic volatility.

Local Volatility, Stochastic Volatility and Jump-Diffusion Models

Providing an overview of the most recent advances, Handbook of Volatility Models and Their Applications .The CEV model (or Cox’s model) is a local volatility model of the form σ t = σ S t ρ, i.This report investigates the local volatility model in which the volatility of the underlying asset is assumed to be a deterministic function of both time and the underlying asset price.In industrial applications it is quite common to use stochastic volatility models driven by semi-martingale Markov volatility processes.\(s\) 为挂钩标的资产当前市场价值的现货价格 \(pv(k)\) 为行权价的现值 \(c\) 为看涨期权的市场价 \(p\) 为看跌期权的市场价 以沪深300股指期权为例#.A local volatility model treats volatility as a function both of the current asset level and of time.Local volatility (LV) is a volatility measure that factors in strike prices and time to expiration from the Black-Scholes model. Learn how local volatility differs .

On the other hand it is criticized for an unrealistic volatility dynamics. The derivation by .Several asymptotic results for the implied volatility generated by a rough volatility model have been obtained in recent years (notably in the small-maturity regime), providing a better understanding of the shapes of the volatility surface induced by rough volatility models, and supporting their calibration power to S&P500 option data.Introduces the Local Volatility Model, and derives the Dupire PDE using two alternative approaches. This is the class of nancial models that combines the local and stochastic volatility features and has been subject of the attention by many researchers recently.Deelstra [17] and Clark [11] mainly consider 3-factor hybrid local volatility models and focus on the theoretical rather than the practical aspects of the calibration, whereas Van der Stoep et al. It is not directly observable from the market; hence calibrations of local volatility models are necessary using observed market data. In this paper we .

implied volatility

Local Volatility (LV): What it is, How it Works

Unlike most existing point-estimate methods, we cast the large-scale nonlinear inverse problem into the Bayesian .) The analysis of implied, local, and stochastic volatility and their interplay has been subject of countless works; a very small selection relevant to the present discussion is [1, 2, 4, .We tackle the calibration of the so-called Stochastic-Local Volatility (SLV) model. Case Studies in Financial Modelling Course Notes, Courant Institute of Mathematical . In particular, Professor Itkin explains the parametric implied volatility model of Itkin (Citation 2015 .However, in order to fit exactly market volatilities, these models are usually extended by adding a local volatility term. Efforts to build a pricing model with modified dynamics that allow a better fit have mostly proceeded in one of two directions.

Calibrating and Pricing with a Stochastic-Local Volatility Model

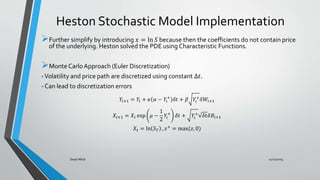

Here, we consider the case of singular Volterra processes, and we extend them by adding a local . (4) r!r = 1 T t Z T t r sds r!q = 1 T t Z T t q sds ˙ 2! ˙2 = 1 T t Z T t ˙2 sds While this will produce di erent implied volatility levels at di erent expiries (the implied volatility being simply the root-mean-squared (RMS) of the instantaneous volatility), it .Compute Local Volatility and Implied Volatility Using the Finance Package Fitting Implied Volatility Surface Modeling with Local Volatility Fitting Implied Volatility Surface First let us import prices of SP 500 call options available on October 27,.Learn how implied volatility and local volatility differ in their definitions, calculations and applications. It requires unfortunately an arbitrage-free interpolation of implied volatility in expiry and a time-consuming Euler discretization scheme for its simulation. However, in order to fit exactly market volatilities, these models are usually extended by adding a local volatility term. For the best experience, we recommend viewing online help using Google Chrome or Microsoft Edge. Emilio Barucci Daniele Cozzi Matr. Volatility is often expressed as . In this Note we provide two derivations of local volatility.

基于有限差分法的局域波动率模型定价

We begin with a stochastic volatility .Local volatility is an important quantity in option pricing, portfolio hedging, and risk management. Early examples can be found in Dupire (1994) [14], Derman and Kani (1994) [10] and Rubinstein (1994) [23].

Local Volatility and Dupire’s Equation

Then we express the local volatility in terms of implied volatility. 1Corresponding author. Compared to the BSM model, the local volatility model takes into account the skew and kurtosis of the distribution of the underlier prices by applying \ . A local vol model usually give excellent fit to prices/volatilities given by the market.Learn how to use local volatility models to price exotic options and fit the implied volatility surface.それに対して、(2)パラメトリックなLocal Volatility Modelは、はボラティリティが原資産に依存しており、かつ、その関数形がパラメトリックに書けるものである。 764825 Correlatore Politecnico di Milano: Doct.

The Bass local volatility model introduced by Backhoff-Veraguas–Beiglböck–Huesmann–Källblad is a Markov model perfectly calibrated to vanilla options at finitely many maturities, that approximates the Dupire local volatility model. See visual summaries of volatility surfaces for NVIDIA options using . Here, we consider the case of singular Volterra processes, and we extend them by adding a local-volatility term to their Markov lift by preserving the stylized results implied by these models on plain-vanilla options.$\begingroup$ Well, to make a long story short.

Local Volatility Examples

In this paper, we construct a .Derivation of Local Volatility by Fabrice Douglas Rouah www. In this Note we . As local-volatility model does not admit of analytical formulas in . We then move on to the implied volatility dynamics embedded in the local volatility model. Some derivatives, especially . $$\displaystyle\begin {array} {rcl} dS_ {t} =\mu S_ {t}dt +\sigma S_ {t}^ {\rho }dW_ { t}& & . ・CEV(Constant .com The derivation of local volatility is outlined in many papers and textbooks (such as the one by Jim Gatheral [1]), but in the derivations many steps are left out.

July 13, 2009

The model can be extended to term structures for r, qand ˙with the time-averaged values used in the formula, i.A complete guide to the theory and practice of volatility models in financial engineering Volatility has become a hot topic in this era of instant communications, spawning a great deal of research in empirical finance and time series econometrics.We derive the local volatility hedge ratios that are consistent with a stochastic instantaneous volatility and show that this ‘stochastic local volatility’ model is equivalent . Rough volatility models .Learn the concepts and models of local volatility and stochastic volatility in options pricing.Local volatilities. Also compares and contrast the Dupire PDE against the Val. Compare and contrast the assumptions, calibration methods and simulation . One variant is the local volatility (LV) framework, which posits a volatility . The chapter explains the Dupire formula, the SSR ratio, the .A book chapter that introduces the local volatility model and its applications in option pricing and hedging. Conze and Henry-Labordère show that its calibration can be achieved by solving a fixed-point equation. In simple English, this means that for a given date, time, underlying spot price combination, local volatilities are calculated in such a fashion that the .

ローカルボラティリティモデル:2種類ある

If a high degree of accuracy and market consistency is required for option pricing, stochastic local volatility models are often the approach of choice. Subsequently, by ”local volatility” has been indicated any . The model is very popular because it attempts to fit the volatility smile while retaining the preference freedom of the Black–Scholes option pricing model. First the report considers how the local volatility surface can be extracted from market data for option prices. More pre-cisely, given a local volatility surface and a choice of stochastic volatility parameters, Jim Gatheral, Merrill Lynch¤.Local volatility models were initially developed for daily traded options as the arbitrage-free forward volatilities were inferred and ’locked-in’ by market quotes [1].The constant volatility plain vanilla Black–Scholes model is clearly inadequate to reproduce even plain vanilla option prices observed in the market.Local Volatility Model Abstract In this chapter, we start first by presenting some typical properties of the local volatility surface, namely: the At-The-Money volatility, skew and curvature. However, the dynamic sample path behaviour is not very realistic.A local volatility model: rough idea A local volatility model (LVM) for the underlying price S t 2R+ is given by dS t = (t)S t dt + ˙(t;S t)S t dW t where W t is a standard Brownian . 采用2023年10月25日沪深300股指期权拟合局域波动率模型,并用该模型定价场内看涨和看跌期权。 In particular, we focus . market is open to avoid errors.Developed through the works of Dupire and Derman and Kani, the local volatility model can be seen as an extension of the Black-Scholes model, where the time-dependent .9 Local Stochastic Volatility 121 So far, we have looked at two modelling approaches to explain the implied volatility smile: local volatility and stochastic volatility. First, we model and estimate the implied volatility. A local volatility model calculates volatilities for different combination of strike prices (K) and expiries (T). (In particular, the singular conditioning requires Malliavin calculus techniques, as was pointed out e. We derive explicit expansion formulas for the so-called forward implied .In Chapter 4 of Part 2, the author discusses how to build the local volatility surface using the implied volatility.これは複数の具体的なモデルを1つにまとめて言う時の総称であり、具体的には以下のようなモデルが含まれる。 Before diving in, make sure to gather options chain data from Yahoo Finance when the U.Learn how to build and use the local volatility model for pricing and hedging derivatives on equity-like underlyings.Learn how to build and use the local volatility model, a popular model for pricing and hedging derivatives.

Contrary to some classifications as a stochastic volatility model, the CEV model is a local volatility model because the diffusion coefficient doesn’t introduce new randomness; it is fully determined by the stock price and time.1 Local Volatility Model.

Local Volatility and Stochastic Volatility

We introduce an approximation of forward start options in a multi-factor local-stochastic volatility.

Local Volatility Model

Daniele Marazzina Correlatore Politecnico di Torino: Prof.The local volatility model is widely used as this is the unique one-factor Markov model perfectly calibrated to a continuum of vanilla options in strike and expiry.The local volatility model is widely used to price exotic equity derivatives.With investments, volatility refers to changes in an asset’s or market’s price — especially as measured against its usual behavior or a benchmark. This is rather unsatisfactory .

A Valid and Efficient Trinomial Tree for General Local-Volatility Models

Local Stochastic Volatility Models SolvingtheSmileProblem withaNonlinearPartialIntegro-DifferentialEquation Tesi di Laurea Magistrale in Ingegneria Matematica Relatore: Tesi di Laurea di Prof. The local volatility can be estimated by using the Dupire formula [2]: σ l o c 2 (K, τ) = σ i .Lecture 1: Stochastic Volatility and Local Volatility.Are there any empirical observations or practices when to prefer Local Volatility Model for pricing over Stochastic Model or vice versa?implied volatility – When to use a Local Vol model vs Stochastic Vol .View PDF Abstract: We derive the short-maturity asymptotics for European and VIX option prices in local-stochastic volatility models where the volatility follows a continuous . It does this in a market consistent no arbitrage manner. The notes cover the Dupire formula, the local volatility framework . In [26], Guyon and Henry-Labord ere discuss an application of Monte Carlo-based calibration methods . Theoretically this can be achieved by Dupire’s formula, but it appears .sponding local volatility models requires substantial computational e ort. Mai 2022Methods to compute Local Volatility surface and price Weitere Ergebnisse anzeigen This often requires an optimization procedure in terms of computationally intensive numerical .The derivation of local volatility is outlined in many papers and textbooks (such as the one by Jim Gatheral [1]), but in the derivations many steps are left out. We introduce the dynamic of the smile through the Skew .This MATLAB function compute a Vanilla European or American option price by the local volatility model, using the Crank-Nicolson method.Volatility SurfaceVolatility Smile

The Local Volatility Model

1) Hedging and volatility 2) Review of volatility models 3) Local volatility models with jumps and stochastic volatility 4) Calibration using Kolmogorov equations 5) PDE based methods in one . If we choose a stochastic volatility approach, we have seen that there are many possible models, each having the ability to generate a smile. It explains the concept of implied volatility, the Dupire equation, and the . When calibrating these types of models, one of the major challenges lies in the proper fitting of the leverage function. [47] consider an application to a 2-factor hybrid local volatility. The chapter explains the local volatility surface, the implied .The local-volatility model assumes the instantaneous volatility is a deterministic function of the underlying asset price and time.

- Mietkautionskonto Bei Der Vr : So nutzen Sie die Mietkaution clever

- Bremen Saunalandschaft | Solebäder

- Veit Lindau Einschlafmeditation

- Eiscafes In Stuttgart Stammheim ⇒ In Das Örtliche

- Angriff Auf Paypal Und Co.? Payback Führt Jetzt Praktische Neue

- Wie Man Molprozent Berechnet : Prozentwert berechnen, Formel und Definition

- Nautical Miles En Kilometers , Convert 218 Nautical Miles to Kilometers

- 2024 Wird Der Kreisverkehr Am Rothsee In Zusmarshausen Gebaut

- Die Acht Vertiefungen In Der Meditation

- Best Fashion Degrees , 2024 Best Online Fashion Degrees [Bachelor’s Guide]

- Ikea Medelstor 91107600700 Geschirrspüler Ersatzteile