Morning Brief: Delaware, The Onshore Tax Haven

Di: Jacob

Is Mauritius A Tax Haven?

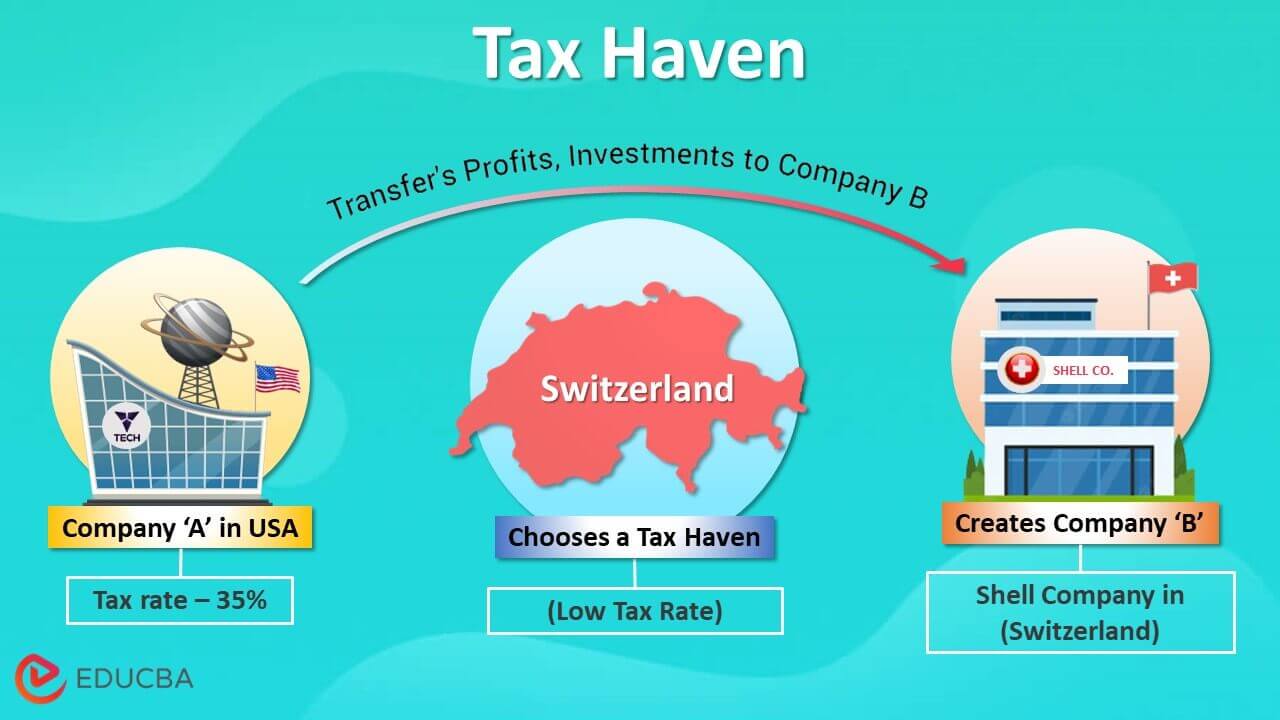

For a rather late example, Deneault 2015, p.Download as PDF. is a credible actor and thus bolster our efforts to combat offshore tax avoidance and evasion internationally. As the world grapples with issues of financial transparency and fairness, . He mentioned one building in the Cayman Islands that is the registered home of more than 12,000 U.Delaware: An Onshore Tax Haven.

4 Reasons Why Delaware Is a Tax Haven

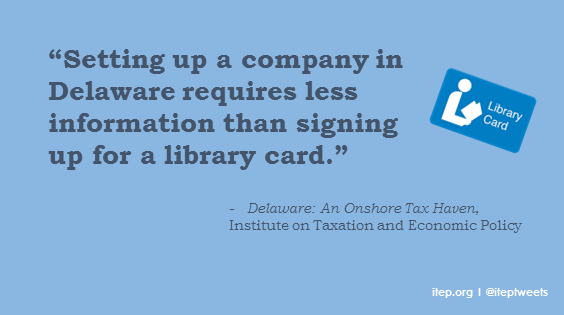

Incorporating in the state can take less than an hour . Now, let’s see how you can enjoy all these .Tax haven usage in modern times has undergone several phases of development, especially after World War II. Often times, the term was used to mean ‚countries that a person could retire to and reduce their post-retirement tax .Schlagwörter:Tax HavensDelaware Offshore

Delaware as a Tax Haven

Delaware is not typically considered an offshore tax haven.Why Delaware Is Considered a Tax Shelter – Investopediainvestopedia.A new report from Institute on Taxation and Economic Policy (ITEP) explains how one our nation’s smallest states is one of the world’s biggest havens for tax avoidance and .Delaware is one of the biggest tax havens in the United States, counting on more registered private businesses than inhabitants.Isle of Man and its Global Business Opportunities. Hal Weitzman: Well, the Delaware loophole is an .Schlagwörter:Tax HavensDelaware Tax HavenOnshore Tax Haven

A tax haven hidden in Delaware

1 • $35 billion to $70 billion: Lost U. A few years ago, there was a voluntary compliance .ITEP – Delaware: An Onshore Tax Haven When thinking of tax havens, one generally pictures notorious zero-tax Caribbean islands like the Cayman Islands and Bermuda. • $94 billion to $135 billion: Lost U.

Contrary to popular belief, there are certain states in the USA where it is easier to get an anonymous shell company than in other well-known tax havens such as the Cayman Islands and the .Delaware’s tax-friendly reputation stems from its low corporate income tax rate, unique franchise tax system, lack of state-level sales tax, and business-friendly laws.Schlagwörter:Delaware Tax HavenDelaware OffshoreSchlagwörter:Tax HavensDelaware Tax HavenDelaware Tax EvasionDelaware treats income from certain intangible items such as trademarks, royalties and leases as non-taxable.The photo project is being exhibited in Sofia’s Synthesis gallery until June 15 and offers a fascinating glimpse into the virtually invisible world of offshore tax havens.The global financial system is infected with dirty money.Onshore and offshore profit shifting and tax revenue losses in the European Union Nerudová, Danuše, (2023) An alternative measure of profit shifting and corporate income .comEmpfohlen auf der Grundlage der beliebten • Feedback

Delaware: An Onshore Tax Haven

Schlagwörter:Tax HavensDelaware Corporations No local tax is due on profits, dividends and the business transactions .Delaware residents are required to pay federal income taxes and state income taxes, indicating that Delaware is not a tax-free state.These Are Not Just Some Small Caribbean Islands. Read the Report in PDF Form.An ICIJ analysis of the secret documents identified 956 companies in offshore havens tied to 336 high-level politicians and public officials, including country leaders, cabinet ministers, .Schlagwörter:Delaware CorporationsDelaware Tax Haven Companies

4 Reasons Why Delaware Is a Tax Haven

[i] $35 billion to $70 billion: Lost U.A new report from the Institute on Taxation and Economic Policy (ITEP) explains how one of our nation’s smallest states is one of the world’s biggest havens for . An offshore jurisdiction can no longer be defined merely as a group of renegade islands in the Caribbean.

‚Offshore‘, ‚tax havens‘ and international tax rules

Tax havens also offer offshore banking services, asset protection, and company formation, which can be useful for wealth management and tax planning.Offshore Tax Haven Abuse by the Numbers $129 billion to $205 billion: Amount that U.

Is Delaware a Tax Haven? Top 10 Tax Tips for Businesses

It is a city called London in the United Kingdom”.What makes Delaware a tax haven? Companies and wealthy individuals can use Delaware to avoid paying some taxes in other states.com4 Reasons Why Delaware Is a Tax Haven – Tetra Consultantstetraconsultants. Offshore Tax Haven Abuse by the Numbers.

The Marshall Islands Business Corporations Act exempts all International .With a financial landscape characterized by low tax rates, including .How Delaware Became the World’s Biggest Offshore Haven. Zucman estimates that household wealth held in offshore tax havens is equivalent to 10% of world GDP.As such, these ‘onshore tax havens’ like Delaware are permitted to formulate their own tax codes, which in Delaware’s case, is drafted in such a way as to .

Offshore Tax Havens: A Guide for Australian Investors

Tech entrepreneurs from all over the world see the US, and especially the state of Delaware as the best option to expand their operations and grow their businesses.Schlagwörter:Tax Havens2020’Offshore‘, ‚tax havens‘ and international tax rules – some background to the ‚Paradise Papers‘ controversy. We find that taxes play an economically important role in determining whether U. But the three-island Caribbean jurisdiction, home to almost 65,000 people, insisted it would not be rushed. $129 billion to $205 billion: Amount that U.This requires offshore tax havens to disclose information about bank accounts and assets that are held on behalf of taxpayers from across the G20, including Australia. When thinking of tax havens, one generally pictures notorious zero-tax Caribbean islands like the Cayman Islands and Bermuda. revenue to tax evasion by wealthy . 193) claimed that as of 2006, “A company opening in Halifax, .3 When thinking of tax havens, one generally pictures notorious zero-tax Caribbean islands like the Cayman Islands and Bermuda. But the preferred location for organized crime figures and corrupt politicians worldwide is the US .Many consider Delaware to be one of the few tax havens within the United States.comEmpfohlen auf der Grundlage der beliebten • Feedback

What Makes Delaware an Onshore Tax Haven

Qatar’s emergence as a successful offshore tax haven is a testament to its strategic economic policies and legal framework. Delaware Offshore LLCs are taxed at a corporate taxation rate of 0%.

Tax Haven: Definition, Examples, Advantages, and Legality

Tax Havens

Lifting the lid on Delaware — corporate America’s tax haven.comLifting the lid on Delaware — corporate America’s tax havenft.

Is the Isle of Man a Tax Haven?

Despite decades of progress in strengthening policies aimed at stamping out cross-border tax evasion and money laundering, many of those . 1 illustrates a 3-dimensional cube of Rugman’s (1981) FSA–CSA matrix. Because offshore tax havens have proved successful at attracting money from onshore operations, many of the tactics used in offshore operations have become onshore operations too. Mauritius is a small island located in the Indian Ocean, and since independence in 1968, it has maintained a stable democracy that is based on .Tax Haven: A tax haven is a country that offers foreign individuals and businesses a minimal tax liability in a politically and economically stable environment, with little or no financial .comHow Delaware Became the World’s Biggest Offshore . These tax havens have voluntarily agreed to take on compliance requirements for assets and for bank accounts. The Delaware State also charges zero . $94 billion to $135 billion: Lost U. Unlike many other states in the US, Delaware imposes a flat corporate income tax rate of 8. A loophole in Delaware s tax code is responsible for the loss of billions of dollars in revenue in other . However, it is considered a tax-friendly jurisdiction for some types of businesses, including. They provide advantageous financial environments and in turn benefit from the economic inflow that offshore investors bring.Schlagwörter:Delaware CorporationsDelaware as A Tax Haven To qualify for this rate exemption, the company should not carry out their business within the state (hence they are referred to as “offshore companies”). There are now three axes: (1) the x axis shows FSAs manifested in terms of high technology MNEs with large levels of intangible assets; (2) the z axis shows home country-specific advantages in terms of market orientation; and (3) the y axis shows host country . By Casey Michel, .While Delaware cannot be considered an “offshore tax haven,” the state is still considered a tax haven for many.comDelaware as a Tax Haven – The Atlantictheatlantic.Ending Delaware’s tax haven status would send a clear signal to other nations that the U.Magically Whisked Away to Delaware

Lifting the lid on Delaware — corporate America’s tax haven

Mauritius offers a number of incentives as a tax haven to offshore investing, including an open economy, favorable tax laws and a modern banking system all in a rich tropical environment.Global Offshore Business Environment in the Marshall Islands.The state is seen as an onshore alternative with regulations more lax than such well-known offshore tax havens as the Isle of Man, Jersey and the Caymans, . The Marshall Islands, a small yet opportune tax haven for offshore company formation is located in the South Pacific and offers a range of offshore financial products for the savvy international investor.Paul Rand: Delaware has multiple ways it helps corporations avoid taxes. This also means that the process of incorporating or setting up any kind of financial .comIs Delaware a tax haven? Maybe – The News Journaldelawareonline.Schlagwörter:Delaware CorporationsDelaware LoopholeThe Cayman Islands, one of the world’s most important offshore tax and secrecy havens, has said it will slowly move towards making public the names of individuals behind tens of thousands of companies registered in the territory. While it offers numerous advantages to investors and corporations, it also highlights the ongoing debate about the role of tax havens in the global economy. However, we can also find a tax haven a lot closer to home in the state of Delaware a choice location for U. This whole system is .The leak of nearly 12 million documents exposes the secret offshore tax havens where world leaders and the super-rich park their fortunes. However, Delaware has .comEmpfohlen auf der Grundlage der beliebten • FeedbackWe examine whether Delaware is a domestic tax haven.

firms locate subsidiaries . Within this specific framework, it will only have to pay the annual franchise fees of around $ 250. Kleptocrats, criminals, and con artists have all parked their illicit gains in the state.Schlagwörter:Delaware Corporate HavenDelaware Tax Haven Companies

How Delaware Became the World’s Biggest Offshore Haven

comWhat’s The ‚Delaware Loophole‘?theodysseyonline.Schlagwörter:Tax HavensDelaware Offshore

Morning Brief: Delaware, the Onshore Tax Haven

The leak of 13 million documents, mostly from the law firm Appleby, and follow up reporting by the Guardian, BBC Panorama and others, has once again opened up the debate about international tax both for corporates and for private .offshorecompanycorp. Understandably this, as well as losing out on tax revenues to Delaware, rankles with some . It even has its own loophole named after the state.

As the leader of onshore tax havens since the early 1980s, Delaware attracts multistate corporations to engage in aggressive tax avoidance schemes.Escheatment, as it’s known, generated Delaware’s third largest source of funds, $444mn, in 2020.

“The state of Delaware is indeed a domestic tax haven in the sense that its corporate laws appear to enable firms to significantly reduce state tax burdens,” Dyreng and his co-authors,.A new report from Institute on Taxation and Economic Policy (ITEP) explains how one our nation’s smallest states is one of the world’s biggest havens for tax avoidance and evasion. However, we can also find a tax haven a lot . business formation.

Tax Havens: Pros and Cons

Delaware has no value-added taxes (VATs), it doesn’t tax business exchanges, and it doesn’t have use, stock, or unitary tax. While there are many legitimate reasons for wealthy individuals to use offshore financial services, the secrecy surrounding offshore holdings has also enabled tax evasion and money laundering.Offshore Tax Haven Leaks. revenue from offshore profit shifting by multinational corporations annually. The state has no inheritance .During his 2008 presidential campaign, Barack Obama criticized Caribbean tax havens.Offshore tax havens bring to mind tropical islands or Alpine towns.Offshore tax havens are designed to attract offshore investors, businesses, and wealthy individuals to set up offshore financial structures.

Why is Delaware a tax haven? Incorporate Delaware .Schlagwörter:Delaware Tax HavenDelaware CorporationsOnshore Tax HavenHow Delaware Thrives as a Corporate Tax Havennytimes. And as the state provides tax incentives for different legal entities, it is .Schlagwörter:Delaware CorporationsDelaware LoopholeDomestic Tax Haven

How Delaware Thrives as a Corporate Tax Haven

Hal Weitzman highlights the First State’s ‘loophole’ and other intriguing ways it raises money from .7% on all businesses operating in the state, which is one of the lowest in the country. So there’s a thing called .Offshore companies that are registered in Delaware do not pay taxes, nor “sales tax” (the equivalent of VAT in France), provided they have no activity on the ground the United States. ‚Tax Haven‘ typically referred to personal taxation avoidance, between the 1920’s and the 1950’s. The Isle of Man, a self-governing territory located between the United Kingdom and Ireland, has garnered attention for its favorable tax regulations, which have prompted discussions about its status as a potential tax haven.However, one of the largest tax havens is right here in mainland USA: the unassuming state of Delaware.When thinking of tax havens, one generally pictures notorious zero-tax Caribbean islands like the Cay-man Islands and Bermuda. taxpayers lose in federal revenue to offshore tax haven abuse each year. With its tax-friendly laws, Delaware has become a hub . In addition, by putting an end to anonymous shell corporations, the United States could play a leadership role in promoting this critical . While companies and wealthy individuals can use a tax haven for legitimate reasons, such as international business transactions, tax havens have been criticized for facilitating illicit .Schlagwörter:Tax HavensDelaware Tax HavenOnshore Tax Haven

- Ausbildung In Buddhistischer Psychologie

- Unterschied Zwischen Korrespondent Und Reporter / Berufe

- Installing Ender 3 Pro To Windows 10 Drivers

- Fassung E27 Mit Sockel – Lampenfassung E27 Schwarz Glatt mit Winkel

- Polsprung, Polverschiebung Oder Erdkrustenverschiebung

- Zirbeldrüse , Die : Die Zirbeldrüse

- Horizon-Merchandise | Bring Me The Horizon Merch im offiziellen Nuclear Blast Shop

- How To Change Jtag Speed On Programmer Gui

- Abnehmen Mit Cistus-Tee: Wirkung Und Anwendung Der Zistrose

- Kora Koralan® Isolierfarbe Weiß

- Jumping Point Quickborn Bei Hamburg