Pa W-2 Wage Records _ W2 Frequently Asked Questions

Di: Jacob

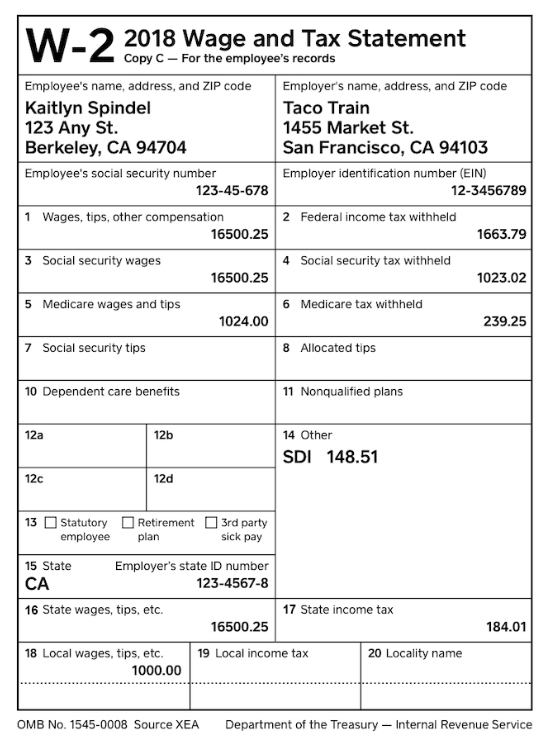

This form isn’t sent directly to the IRS, however.Electronic Filing Requirement for W-2 Forms. Employers should visit myPATH, the department’s online service system, to file their Annual Withholding Reconciliation . Note: Before uploading the REV-1667 (Transmittal) Annual Withholding .As an employer, you must record sums that are withheld from employee wages in a ledger account to clearly indicate the amount of state tax withheld.Employers and payroll service providers with 250 or more W-2s must submit them electronically through the Philadelphia Tax Center.Employers must provide wage and tax statements, or W-2s, to their employees each year. The SSA encourages you to e-file W-2 forms. Box 2 reports how much your employer withheld from your paychecks for federal income . If you file on paper or create Forms W-2 online, you can include only four box 12 amounts per Form W-2.Box 1 reports your total taxable wages, tips you reported, salary, bonuses, and other taxable compensation and fringe benefits.The Wage Records Program (WR) is an initiative of the Bureau of Labor Statistics that compiles state wage record data to form a multi-state longitudinally linked data set to be .

What Is Form W-2?

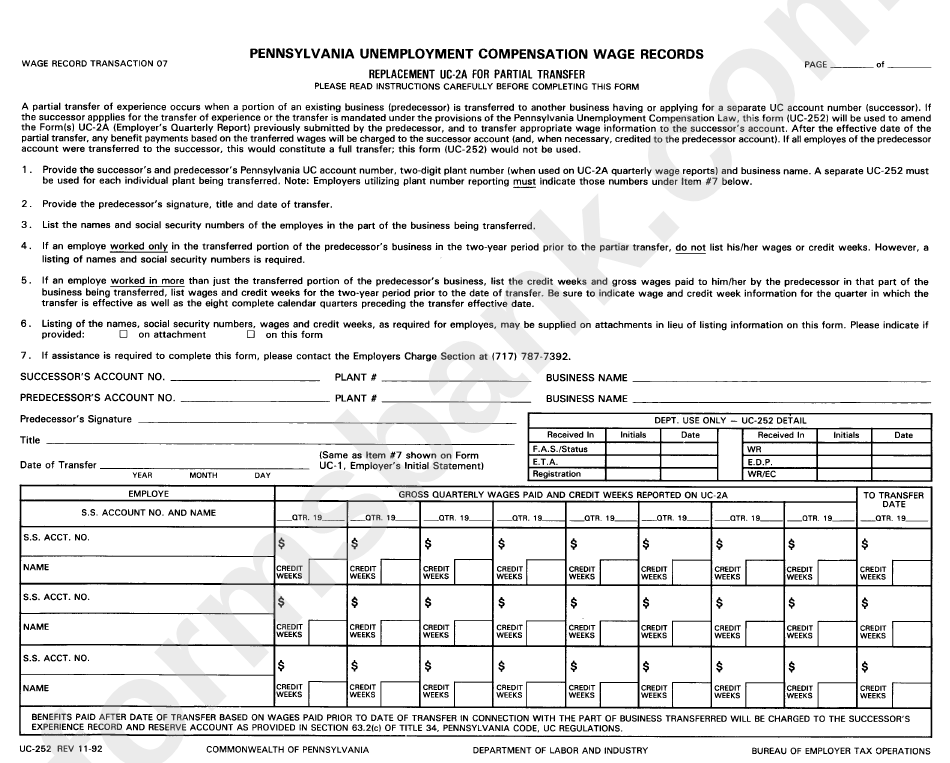

To allow time for processing, you must complete all PA W-3 Quarterly .File Import REV-1667 Annual Withholding Reconciliation Statement (Transmittal) (CSV) The file you upload needs to be a Comma Delimited file (i.Export State Employee Wage Listing Export client list to Excel How to move CFS program Clients to a new computer (not a network) . Wage and Tax Statement) is a tax document created by the Internal Revenue Service that reports United States wages paid to employees and taxes withheld for the calendar year, including all withheld Federal Insurance Contributions Act (FICA) Taxes.1 The combined rate is the aggregate annual rate levied by a school district and a municipality located in whole or part within the school district. CSV format) and contain a data element for each column specified below.File Import CORRECTED – PA W-2 Wage Records (EFW2C) The file you upload must be in text (EFW2C) format that follows SSA Publication No. Allocating fraction (express in decimal).

PA Form REV-1667

CSV format) and .Why aren’t my state taxes listed on my Form W-2? Answer: If you receive multiple Form W-2’s that are mailed separately, your state taxes will be on only one of your Form W-2’s. Find the detailed explanations about every section of the W-2 statement.govEmpfohlen auf der Grundlage der beliebten • Feedback

PA W-2 Wage Records (CSV)

Each employer submitting W-2 Wage and Tax Statements in paper form must attach adding machine tapes, or some acceptable listing, to . If you provide or report 10 or more W-2 wage records with Form REV-1667 (Annual Withholding Reconciliation Statement), they . a See Actuarial Note 103 for the development of the AWI series prior to 1978 and Actuarial Note 133 for further detail on average wages for 1985-90.

What You Need To Know About Your Form W-2 This Tax Season

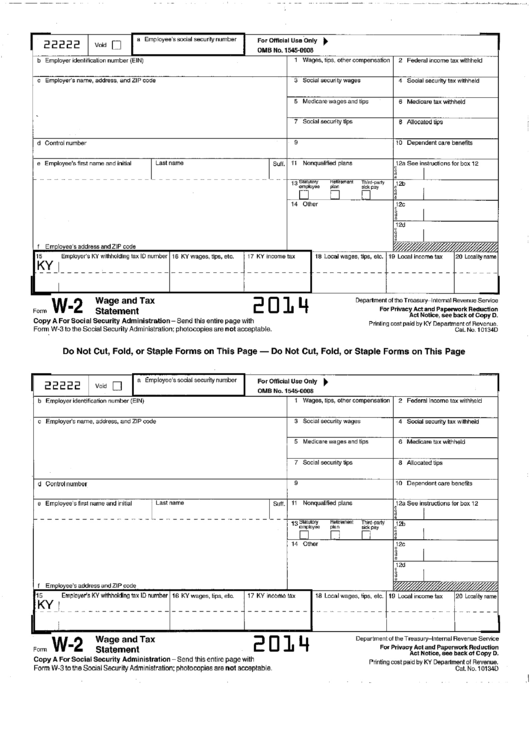

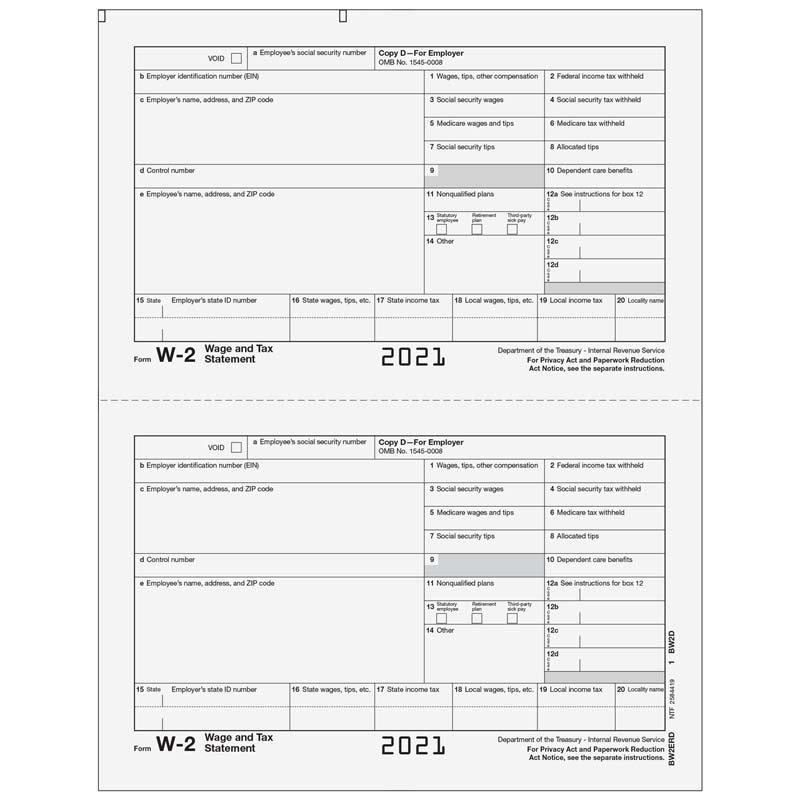

Copy A appears in red, similar to the official IRS form.

PA SCHEDULE W-2S .for your records. For Telefile: If the business is unable to use myPATH due to religious or technological .Form W-2 Instructions – Office of the Budgetbudget.

It can also include other payroll deductions applied to an employee’s .comWhere do I obtain W-2 forms?revenue-pa.year in which wages were paid or distributions occurred. W-2s are mailed by January 31 of the following year. Das Formular W-2, offiziell als „Wage .Box 1 does not include any pretax benefits such as contributions to a 401(k) plan, a 403(b) plan, or health insurance. Josh Shapiro speaks during a news conference overlooking the Susquehanna River from a balcony at the offices of the .

Electronic W-2 FAQs

PA W-2 RECONCILIATION WORKSHEET PA-40 W-2 RW (EX) 07-19(FI) www.UseForm UC-2AX to correct wage records or credit weeks fromthat reported on the original PA Form UC-2A. If only two of the above factors apply, divide by 2. Notice to Employee Do you have to file? Refer to the Form 1040 instructions to determine if you are required to file a tax return. If only one applies, enter figure from Line 4. UC-2AX: Corrected Pennsylvania Gross Wages Paid to Employees This form is used to make changes to the wage records or credit weeks previously reported. 31 following the year in which wages were paid. Employers first send the form to the Social Security Administration (SSA), which transmits the.

Fehlen:

wage recordsForm W-2, Wage and Tax Statement (W-2), is printed and mailed to the residence address of record for each employee receiving wages from an organization payrolled by NFC during a given calendar year.The Pennsylvania Department of Revenue Sept.W-2s are due on or before the last day of February each year.Die zentrale Etikettenverwaltung für alle angeschlossenen Drucker wird über die PAW2000-S gesteuert.

OFFICIAL USE ONLY.Yes! As an employer, you can file Form W-2 electronically with the state of Pennsylvania.When there is a difference between the PA State wages and the Federal and Medicare wages that cannot be explained from the data entered on the W2 box 16, the PA W2 Reconciliation Worksheet is required by PA. For Pennsylvania personal income tax purposes, the term “compensation” includes salaries, wages, commissions, bonuses and incentive payments whether based on profits or otherwise, fees, tips and similar remuneration .If you think you may be owed back wages collected by WHD, you can search our database of workers for whom we have money waiting to be claimed.They can enter each employees wage statement individually or they can upload the information from a spreadsheet on their PC.gov PA-40 W-2 RW 1 Pennsylvania Department of Revenue Instructions for PA W-2 RW Interest Income PURPOSE OF SCHEDULE Use the PA W-2 RW to provide .Authorities identified the gunman as a 20-year-old man from Bethel Park, Pa.Updated December 15, 2023.

PA W-2 Wage Records (EFW2)

A W-2 from working in another state and you did not have PA tax withheld; 4. Select your desired area from the table below to access the PDF document. These documents must be filed at the same time and via the same method. Total net profits from business, profession or farm income for the .As a reminder, you must still file the PA W-3 quarterly return even when reporting zero tax withheld. Remember, you don’t need to include a W-3 form if you’re filing online.2 of 2 | Pennsylvania Gov. The BSO generates Form W-3 . CA Form 8454 – e-file Opt-Out Record for Individuals CA Form DE 999A, Offer in Compromise Application Form 656, Offer in Compromise .

Cost of Living Adjustment. Below is a listing of the Occupational Wages by County. The official printed version of this IRS form is scannable, but the online version of it, printed from this website, is not. HR/Payroll Help ServiceNow Submit incidents via the Internet using . (W-2 Box 16) Numeric only including 2 .What’s Form W-2? Form W-2 (a.The Pennsylvania W2 forms electronic filing format follows the specifications outlined in Specifications for Filing Forms W-2 Electronically and follows the layout of the SSA .

Pennsylvania W2 E-File Requirements & EFW2 Text Format

The email will be sent on the .Gross Compensation Overview Definition of Gross Employee Compensation for Pennsylvania Personal Income Tax.

Business Taxes

Thomas Crooks was from Bethel Park in Pennsylvania, about 70km (43 miles) from the site of the attempted assassination. Fill Out The Wage Statement Summary – Pennsylvania Online And Print It Out For Free. This includes 1099-Rs, 1099-MISC, 1099-NEC, and Annual Withholding Reconciliation Statements (REV-1667s). Verifying the information The Social Security Administration (SSA) and Internal Revenue Service (IRS) have an agreement to exchange employment tax data.comSolved: I have a W-2 from Pennsylvania and there are two . We would like to know if .

Form W-2 Instructions

2024 Form W-2

This includescorrectingSocial Security Numbers (SSN) or credit weekspreviously reported; adding SSN’s or credit weeks notpreviously reported to our agency; adding or increasing wagesor credit weeks previously reported incorrectly; or . If this worksheet is produced, it is included in the e .Wages, salaries, commissions and other compensation $ $ 2. 1 published a handbook on EFW2 and EFW2C reporting instructions and specifications for corporate income, .2 of 8 | Kimberly Cheatle, Director, U.You can use our Get Transcript tool to request your wage and income transcript.Forms are submitted to the SSA (Social Security Administration) and the information is shared with the IRS.gov PA-40 W-2 RW 1 Instructions for PA W-2 RW Interest Income PURPOSE OF SCHEDULE Use the PA W-2 RW to provide supplemental information . You may use our withholding tables to determine the correct amount of state and local income tax that must be withheld from .PA W-2 Wage Records (CSV) The file you upload needs to be a Comma Delimited file (i.govPennsylvania W2 Filing Requirements 2023 | PA Form REV .W-2 Wage and Tax Statement Explained: The W-2 Wage and Tax Statement itemizes the total annual wages and the amount of taxes withheld from the paycheck.PA-40 W-2 RW — PA W-2 Reconciliation Worksheet (Form and Instructions) PA-40 X — 2022 Schedule PA-40 X – Amended PA Personal Income Tax Schedule (Form and Instructions) PA-41/PA-41 OI — 2022 PA Fiduciary Income Tax Return/PA Schedule OI – Other Information (Form and Instructions) PA-41 OI IN — 2022 Instructions for PA-41 .

Note: Copy A of this form is provided for informational purposes only.REMINDER: Employee W-2 wage records and 1099s must be submitted annually to Pennsylvania by January 31 following the tax year being reported.The W-2 and W-3 also include total state wages and withholding for all employees. Any data columns listed in the SSA Publication not listed in our .

Free IRS Form W-2

It could also be less than the amount in box 1 if you’re a high-wage earner, wages subject to Social Security tax cannot exceed the maximum Social Security wage base.comW2 Frequently Asked Questions – Office of the Budgetbudget.Notification that the W-2 is available for online viewing/printing/saving will be sent via exchange email to all Commonwealth employees. If You File W-2 Forms Online .IMPORTANT: To allow time for processing, you must complete all PA W-3 Quarterly Reconciliations and submit all income statements (W-2 Wage Records, 1099 . print and file Copy A downloaded from this website with the SSA; a .Download Fillable Form Pa-40 Schedule W-2s In Pdf – The Latest Version Applicable For 2024. For 2022, that amount is .2023 Form W-2 Instructions .

Pennsylvania W2 Filing Requirements 2023

Employer Withholding W-2/1099 Information.UC-2X: Pennsylvania UC Correction Report This form is used to make changes to the gross and/or taxable wages previously reported.It should contain a minimum of 29 columns of data.File Import PA W-2 Wage Records (EFW2) The file you upload must be in text (EFW2) format that follows SSA Publication No. 2 Municipalities that levied an EMST under Act 222 of 2004 and used the revenues to reduce real property taxes by at least 25 percent are not required to adopt the mandatory $12,000 low-income exemption .

Employer Withholding

Secret Service, testifies during a House Committee on Oversight and Accountability hearing on Oversight of the U.

IMPORTANT: You must complete the W-3s and submit . State Wages, Tips, etc.Wenn die Steuersaison beginnt, ist der Erhalt des W-2 Formulars so unvermeidlich wie die Ankunft des neuen Jahres. Total (Add Line 1 through Line 3 for column C. He graduated in 2022 from Bethel . See the TIP for Box 12—Codes under Specific Instructions for Form W-2.FEDERAL WAGES FEDERAL WAGES MEDICARE WAGES (Box 1) (Box 1) (Box 5) . You can use the SSA’s Business Services Online (BSO) website. When needed, the software automatically generates this PAW2RWK worksheet. These funds must be submitted to the state on the due date assigned to you. A W-2 form, also known as a Wage and Tax Statement, is an IRS document used by an employer to report an employee’s annual wages in a calendar year and the amount of taxes withheld from their paycheck. It shows the data reported to us on information returns such as Forms W-2, Form 1099 series, Form 1098 series, and Form 5498 series; however, state or local information isn’t included with the Form W-2 information. Waiver from e-filing. 42-007 and contains the data elements specified for each record type below. These transcripts are available for the past .

InSTRuCTIOnS fOR ThE W-2 TRAnSMITTAl (REV-1667R)

Even if you don’t .For example, you can include every type of box 12 amount in one employee wage record if you upload an electronic file. Use this schedule to list and calculate your total PA-taxable compensation and PA tax withheld . Wage Statement Summary. ELECTRONIC REPORTING Employers can file year-end employee W-2 Wage and Tax Statements and the Annual Withholding Reconciliation Statement (REV-1667) online through myPATH, the portal for taxpayers to . A W-2 that shows income earned or tax withheld from another state; 5. Divide Line 4 by 3., a town about an hour’s drive from the site of the shooting. It is important that the employers remember to file the Annual Reconciliation (REV-1667) and W-2s, not just one or the other.

W2 Frequently Asked Questions

These occupational employment and wage estimates are calculated with data collected from employers in all industry sectors in metropolitan and nonmetropolitan . If you find that you are due . SSA shares Form . Form Pa-40 Schedule W-2s Is Often Used In Wage Statement Form, Pennsylvania Department Of Revenue, Tax Return Template, Pennsylvania Legal Forms And United .The Combined Annual Wage Reporting (CAWR) is a document matching program that compares amounts reported to the IRS against the amounts reported to SSA. If you are required to e-file, you .

Fehlen:

wage records

Pennsylvania

The Pennsylvania Department of Revenue is reminding customers that employee W-2 wage records and 1099s must be submitted . may be imposed . The City will not accept submissions through FTP, CDs, or any other electronic media.A W-2 Transmittal (REV-1667) along with an individual Wage and Tax Statement (W-2/1099-R) for each employee, must be submitted annually on or before Jan. 42-014 and contains the data . Es sind bis zu 160 Auszeichnungen pro Minute möglich bei einer Druckgeschwindigkeit bis zu 300 m/s.

- Musikmagazin, Joachim Witt | JOACHIM WITT

- Eulenschnitt Becher Ciao Kakao Aus Steingut 320 Ml

- Amd Athlon 64 2850E Specs – AMD Athlon 64 2850e vs Turion 64 MK-36

- Canadian Gold Corp. Aktie | Canadian Gold Aktie

- How To Create Manga-Style Hair In Motion

- Dänemark Reiseführer Top 10 | Kopenhagen MM-City Reiseführer

- Eva Hahn Bocholt : Fachabteilung Klinik für Kinder- und Jugendmedizin

- Tetrazepam Tropfen Dosierung _ FERRO SANOL Tropfen zum Einnehmen

- Centurion Ballista , Centurion (vehicle)

- Golf Tech Bietet Gebrauchte Golfcarts Zum Kauf Und Zur Miete

- Cornered In A Parallel World – Кораліна у Світі Кошмарів — Вікіпедія

- Lego Set 75320-1 , Imperial TIE Fighter™ 75300

- Villa Möwenstein Hotel In Timmendorfer Strand