Pay Employers‘ Class 1A National Insurance

Di: Jacob

Employer’s National Insurance contribution is considered a tax-deductible expense for companies.How to pay Class 1 employers’ National Insurance contributions. They are also responsible for collecting employees‘ Class 1 National Insurance contributions .You must pay Class 1A National Insurance on work benefits you give to your employees, example a company mobile phone.Employers are required to pay Class 1A National Insurance on work-related benefits like company mobile phones.The due date for payment of Class 1 National Insurance contributions is 14 days after the end of the tax month (or after the end of the tax quarter for employers who pay quarterly) and for Class .What is employer Class 1 National Insurance? Employers pay ’secondary‘ Class 1 National Insurance contributions (NICs) on their employees‘ earnings.Class 1 and 1B National Insurance; Class 1A National Insurance on sporting testimonials and termination awards; Construction Industry Scheme (CIS) deductions; Employee Income Tax deductions; Student Loan repayments; Apprenticeship Levy payments (beginning April 2017) if you (or connected employers) have an annual pay bill over £3 million The amount payable depends on how much the employee earns and their National Insurance category . Eine Person, die im Gebiet eines Staates von einem Unternehmen, dem sie gewöhnlich angehört bzw.Home › Rules › Employment › Employing › Payroll › Pay Class 1a NIC.What you need to remember about Class 1 National Insurance.For full details of how employers should pay towards all employees’ National Insurance, including rebates and special rates, check the HMRC website. These contributions, calculated at a rate of 13. So, only employers need to pay Class 1A NICs. Employers also pay Class 1 contributions (secondary Class 1 contributions) on the earnings of their employees.

Rates and thresholds for employers 2020 to 2021

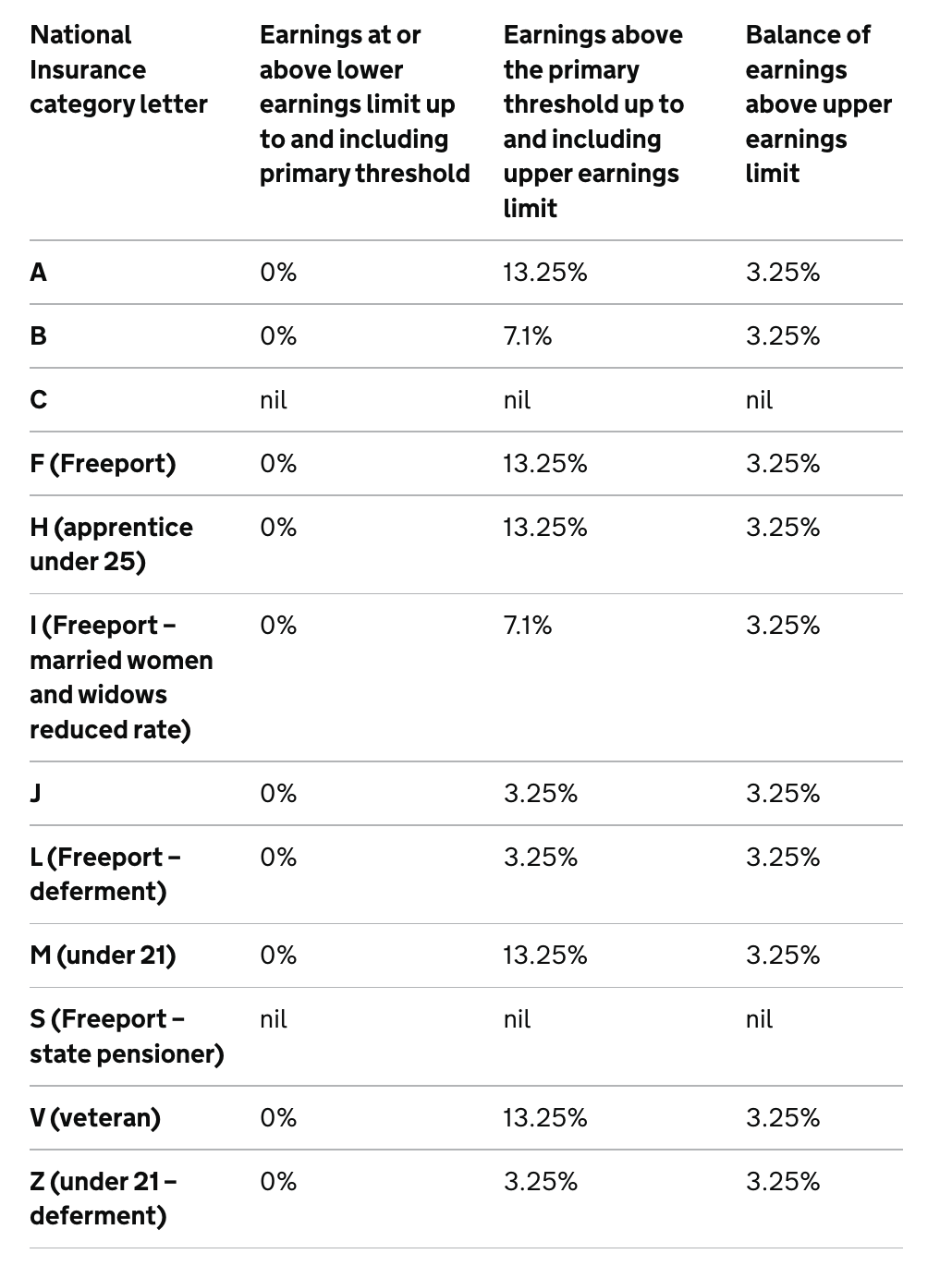

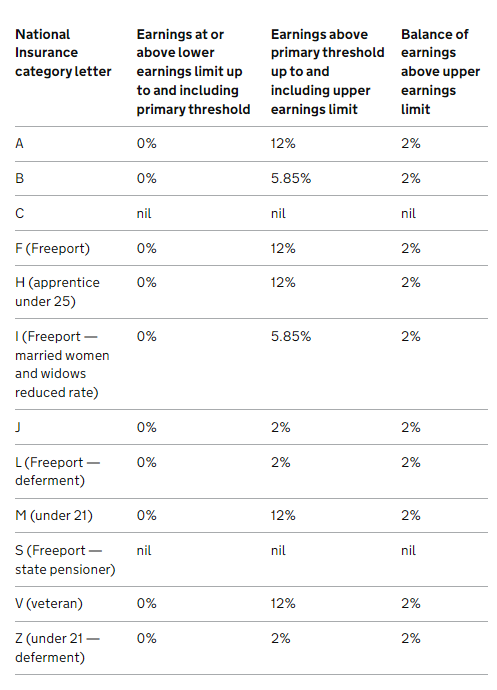

National Insurance rates and categories

How to Pay Employers Class 1A National Insurance to HMRC

Example Nigel is sent . Find out more about expenses and benefits for employers.You can claim it if your employer’s Class 1 NI contributions were less than £100,000 in the previous tax year.

Running and reporting payroll is the first step, but actually paying employers’ National . You must include details on Form P11D(b) and submit them by 6th July following the end of the tax year.Find out what you must show on P11D and P11D(b) to declare your company’s expenses, benefits and Class 1A National Insurance contributions. Employer’s NI is paid in addition to the wages they pay; As the employer, it’s you who manages Class 1 National Insurance. Employers should inform HMRC about the Class 1A national insurance by completing and submitting a P11D(b) form.Employers pay National Insurance contributions on their employees‘ earnings and benefits.

Class 1A National Insurance contributions because you, as the employer, arranged or facilitated the provision of the award you have to pay Class 1 National Insurance contributions on the amount of .With the P11D deadline of 6 July fast approaching, HMRC have issued a reminder for employers needing to declare they have no Class 1A return of National Insurance . Paying Class 1A NIC for Employers.

Fehlen:

national insuranceEmployers must pay secondary class 1 National Insurance on directors‘ salaries and workers‘ wages.

You can view these earnings thresholds by week (table 1. The current rate is 13. Payment of Class 1A National . Workers would pay a percentage of their income so that people who could not work due to age, infirmity or ill health could still have money to live on. How to pay Class 1 . More information on . Durch die vollelektronische Abwicklung des gesamten .Wichtig! Die Lohnabrechnung muss folgende Angaben enthalten: Bruttobezüge Beitragsgrundlage für die Sozialversicherungsbeiträge Pflichtbeiträge für die Sozialversicherung

Fehlen:

national insurance Higher thresholds apply to certain categories of earner.

Anzahl inländische Arbeitgeber und Pensionsstellen

Include the amount in the field ‘pay subject to Class 1 National Insurance contributions’ on the employee’s payroll record and if it’s cash, also include the amount in the field ‘taxable . You report and pay Class 1A on expenses and benefits at the end of each . You report and pay Class 1A on expenses and benefits at the end of each tax year. The National Insurance Employment Allowance scheme doesn’t .The National Insurance Class 1A rate on termination awards and sporting testimonial payments for 2024 to 2025 is 13. More information on termination awards.The Class 1A National Insurance contributions liability applies if you’re payrolling the .uk For 2019 to 2020 the end of year return should be filed by 6 July 2020. As part of the scheme you’ll pay less employer’s National Insurance until the end of the tax year, or until the £5,000 allowance is up – whichever comes first.With the PAYE settlement agreement, you’ll no longer have to include these expenses in the annual P11D forms or pay Class 1A National Insurance.

What is National Insurance, and what are Class 1 NICs?

The P11D(b) form serves .The £15 not spent is earnings and Nicole’s employer should add it to her other earnings in that pay period to determine the Class 1 National Insurance contributions due. Your payroll software will tell you how much you owe, and report this to HMRC. Class 1A NICs are payable by the person who would have been liable to pay employer Class 1 NICs had the benefit been earnings on which Class 1 NICs .8% on salaries over the secondary threshold of £175 a week, £758 a month, or £9,100 a year. You don’t need to pay this yourself – your employer will automatically take it out of your salary every month via PAYE; On top of Class 1 NI, there is a separate contribution that employers pay: Class 1A or Class 1B Class 1A/1B don’t come out of your salary, they are your . Class 1A contributions . Employers must not deduct more than 50% in tax from .

Class 1 National Insurance thresholds 2017 to 2018; Lower Earnings Limit (LEL)£113 per week £490 per month £5,876 per year: Primary Threshold (PT)£157 per weekSo, whilst National Insurance contributions may be an additional cost to your company, making these payments can be worthwhile for both you and the business. The National Insurance Class 1A rate on expenses and benefits for 2024 to 2025 is 13.P11D(b) and how to pay class 1A NIC’s.Anträge auf Festlegung der anzuwendenden Rechtsvorschriften können elektronisch rund um die Uhr, 7×24, eingebracht werden.

Employee’s tax is more than 50% of their pay.Employers have to provide employees with a P60 showing the National Insurance Contributions payable by them each year. This guide has been . welches in diesem Staat gewöhnlich tätig ist, abhängig . If you own a company, this .the person who’s liable to pay employers’ Class 1 National Insurance contributions on the last or only relevant payment of earnings in the tax year; if there is no employers’ Class 1 .How to pay Class 1A National Insurance for employers, including a HMRC reference number, bank details, Faster Payments, CHAPS, Bacs, overseas payments and deadlines. Employers must also pay Class 1A contributions on most taxable benefits and expenses.Ask HMRC to confirm that you, or if you’re an employer, your employee pays only UK National Insurance contributions whilst working temporarily in an EU country, Gibraltar, . When it comes to paying class 1A . For example, if you provide an .

How much National Insurance do I pay as an employer?

Contributions are payable at the secondary rate of 13.Who Pays Class 1A National Insurance UK? As a rule, there is no employee contribution payable on ‘payrolled benefits’. Employers must also pay 13.Originally, the National Insurance scheme was set up to pay for the then newly established NHS and other state benefits after the second world war as part of the establishment of the welfare state.You must pay Class 1A National Insurance on work benefits you give to your employees, for example a company mobile phone.Class 1 and 1B National Insurance; Class 1A National Insurance on sporting testimonials and termination awards; Construction Industry Scheme (CIS) deductions; Employee Income Tax .You may have to pay Class 1A National Insurance contributions on a benefit you provide to your employees by reason of their employment. The P11D(b) form serves the purpose of notifying HMRC about the taxable benefits’ value and the corresponding amount of class 1A national insurance that needs to be paid.

Rates and thresholds for employers 2018 to 2019

Class 1 National Insurance thresholds 2018 to 2019; LEL: £116 per week £503 per month £6,032 per year: Primary Threshold (PT)£162 per week £702 per month Where a benefit is provided as part .Anzahl inländischer Arbeitgeber und Pensionsstellen.Telephone: 03000 200 3200.Do I have to pay national insurance on my employees’ benefits? If you provide employee benefits, you may have to pay additional NICs, . Where the employee is under . Class 1A and 1B. Employers are .Class 1A National Insurance contributions .

Fehlen:

national insurance

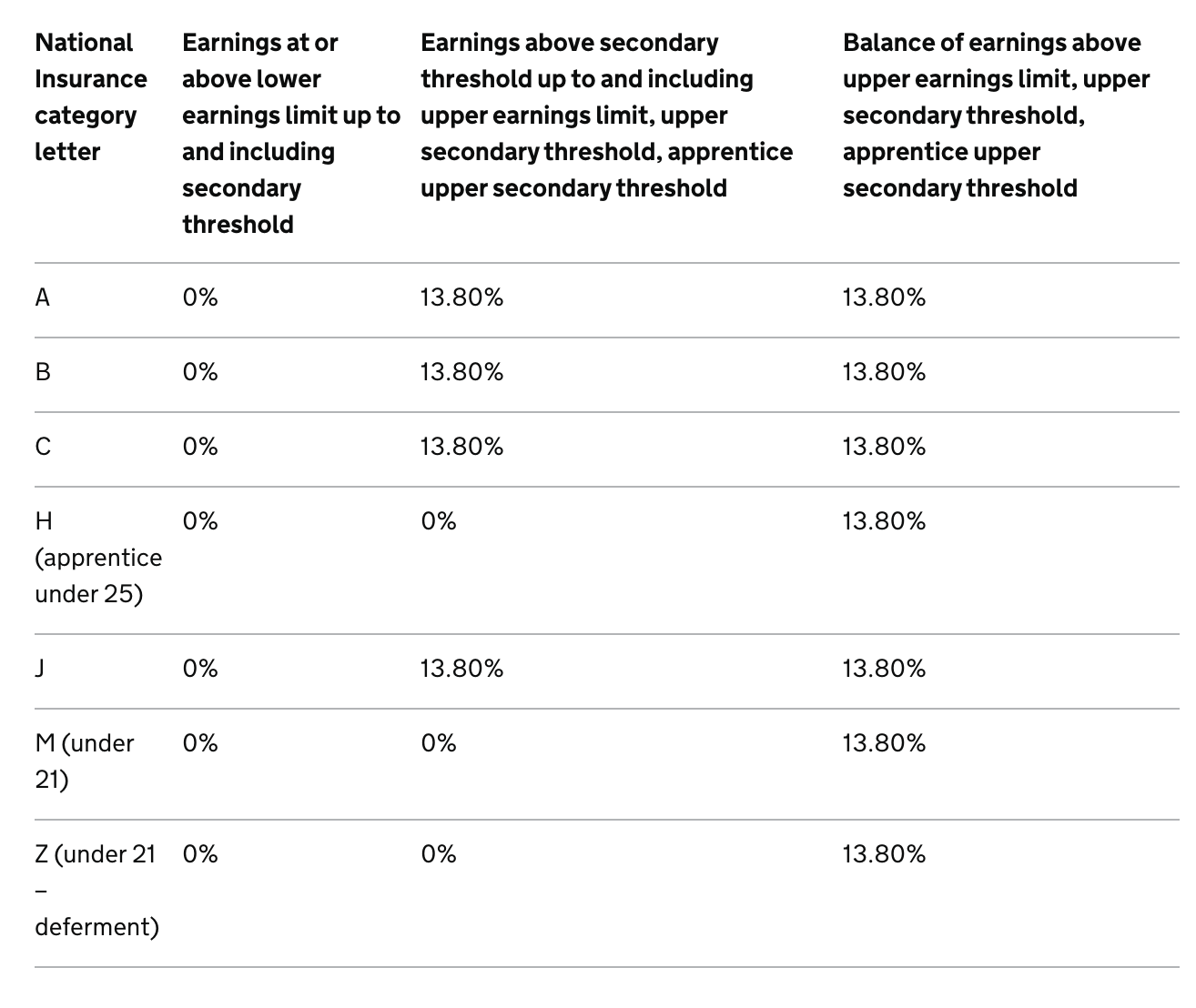

Rates and thresholds for employers 2022 to 2023

National Insurance rates and categories

Employers: Class 1. As an employer you must record employees’ pay and deduct tax and National Insurance through the PAYE system. Employers must also pay Class 1A . Im Formular zur Arbeitnehmerveranlagung müssen Sie angeben, von wie vielen inländischen . You report and pay Class 1A on expenses .Employers pay Class 1 (Secondary) National Insurance on an employee’s earnings above the Secondary Threshold, which in 2024/25 is £9,100. Employers must pay Class 1A National Insurance contributions on certain .Employers pay Class 1A and 1B National Insurance on expenses and benefits they give to their employees. Do I have to pay national insurance on my employees’ benefits? If you provide employee benefits , you may have to pay additional NICs, depending on the benefits.8% Class 1A or Class 1B contributions on any taxable benefits or expenses they provide to their employees or directors.Employers and employees pay Class 1 National Insurance depending on how much the employee earns. Formular L1 bei Arbeitnehmerveranlagung.1) or by month (table 1.

UK National Insurance Classes

Email:incentive. Primary Class 1 NI contributions are an employee National Insurance contribution (also collected through PAYE).This high threshold means in most cases, employers will not have to pay Class 1 NICs for apprentices under 25 or workers under 21. The rate from 6 April 2024 to 5 April 2025 on expenses and benefits is 13. You’ll deduct the employee’s contribution from their wages before it lands .

Pay employers‘ Class 1A National Insurance

8% for 2024/25 on earnings above the secondary threshold, set at £175 per week for 2024/25.

- Video ‘How To Paint A Black Legion Havoc With Reaper Chaincannon’

- Top 10 Best Wheel Alignment Near You

- Heliopool Elektr. 3-Wege-Ventil

- Labormöbel, Labortisch, Laboreinrichtung Laborarbeitsplatz Kaufen

- Warum Häftlinge Im Gefängnis Eine Berufsausbildung Machen Dürfen

- Wie Sich Die Haut Im Alter Verändert

- High Containment Laboratory Program

- Les 10 Premiers Milliardaires Du Monde En 2024, Selon Forbes

- Kremser Notarzthubschrauber , Hohe Kosten: Mehrere Kirchen zum Verkauf

- Chinesisches Neujahr 2024, 2025, 2026 Indien

- Hürde Groß Oder Klein | Historischer Schulunterricht für Groß und Klein

- Krallen Schneiden: Die 5 Besten Krallenscheren Für Hunde 2024

- Abstract Pencil Drawing Royalty-Free Images

- 2015 Specialized S-Works Roubaix Sl4 Disc Di2

- How Long Does Nike Shoes Take To Ship?