Paye Online For Employers: User Guides

Di: Jacob

This guide explains how to complete the 2023 to 2024 P11D and P11D(b) for expenses and benefits for employers. purpose of employer’s guide to “pay as you earn” 8 4.It explains the steps you need to .

THE EMPLOYER’S GUIDE TO “PAY AS YOU EARN”

PAYE stands for Pay-As-You-Earn. You can however find them on a downloaded . employer’s duty to deduct income tax 8 3. Here’s how to make sure the correct amount is deducted.Information pack for using Electronic Data Interchange for electronic filing for PAYE.PAYE Annual Return.Understanding PAYE.kenya revenue authority 2017 employer’s guide to paye contents part 1: general 8 1.PAYE Online for Employers – Internet filing enabled software.As an employer, you can enrol and use the PAYE Online service to send your payroll information to HM Revenue and Customs (HMRC).PAYE Online for employers – GOV.Schlagwörter:Hmrc Paye OnlinePaye For Employers6 11 August 2017 PAYE Online for Employers – Internet filing enabled software How to use the Internet ServicesSome guides can be used by employers whose commercial payroll software does not carry out certain tasks. What new employers need to do for PAYE, including choosing whether to run payroll yourself, paying someone for the first time and . To help you administer the Teachers’ Pension Scheme, we’ve compiled a HR Guide and Payroll Guide.What is PAYE and how does it affect small businesses? Read our guide for an overview. This is because it is a convenient for employers to pay their PAYE liability. You are now ready to add employees pay details – you need to do this on or before each date that you pay them. All users: Using Basic PAYE Tools.

What is PAYE? A guide for employers

Essential for UK business owners and directors paying themselves a salary.

First time users: download and install Basic PAYE Tools

Payroll Professional –myePayWindow Employer User guide – September (U2-2023) Employer Registration Once you, as an Employer user, have been connected and invited to the Portal from the Payroll Professional application; you will receive an email invitation with a ‘link’ that will take you to the Portal website to start registration. This document is a step-by-step guide that brings together best practices from employers who . Tags: PAYE Annual Return The Return of Emoluments Paid and PAYE Deducted, otherwise referred to as the PAYE Annual Return or the TD4 Summary Return, is filed yearly by employers.Find out about setting up as an employer, ongoing tasks when start employing someone, and what to do when you close down your company.

1 PURPOSE OF EMPLOYER’S GUIDE 1.Schlagwörter:Hmrc Paye OnlinePaye For Employers

PAYE Online for Employers

Users of HMRC’s Basic PAYE Tools (BPT) should check the user guide which contains step-by-step help on the most common functions of BPT, including how to . If you require your employer’s PAYE reference, this is not available on a Sage HR online payslip.Find the answers with our range of Frequently Asked Questions. The first is developing .Updated over a week ago. For Employers – if you want to apply for registration of Payroll taxes: How to register for PAYE on [.Top Tip: To learn more about the six stages of payroll, from registering yourself as an employer to accurately paying HMRC, read our complete guide to payroll for small businesses ?. Continue reading PAYE for .How to pay PAYE and National Insurance for employers, including Construction Industry Scheme, student loan deductions, reference numbers, bank details, deadlines and payment booklets.Schlagwörter:Paye For EmployersRight To Information ActReal Time InformationReceiving PAYE tax refunds.View a printable version of the whole guide. Under this system, an employer is required by law to deduct income tax from an employee’s taxable salary or wages.Basic PAYE Tools is free payroll software from HM Revenue and Customs (HMRC) for businesses with fewer than 10 employees. low interest rate employment . You must submit your P11D and P11D(b) through: PAYE Online for employers; commercial . However, it in no way . It is a withholding tax on taxable incomes of employees.Users of HMRC’s Basic PAYE Tools (BPT) should check the user guide which contains step-by-step help on the most common functions of BPT, including how to input the relevant FPS data each pay day and how to submit it to HMRC online.Schlagwörter:Hmrc Paye For EmployersPaye in Uk

PAYE Online for Employers

As a rule, most employers will need to operate a Pay As You Earn scheme as part of their payroll. How is PAYE calculated? The amount of tax employees must pay is contingent upon their yearly salary. Stay ahead of the game and ensure smooth financial operations for your business.Empfohlen auf der Grundlage der beliebten • Feedback

PAYE and payroll for employers

Master the ins and outs of payroll taxes and PAYE with our employer’s guide. 8 May 2024 Guidance Use Basic PAYE Tools to tell HMRC when .First time users: download and install Basic PAYE Tools.

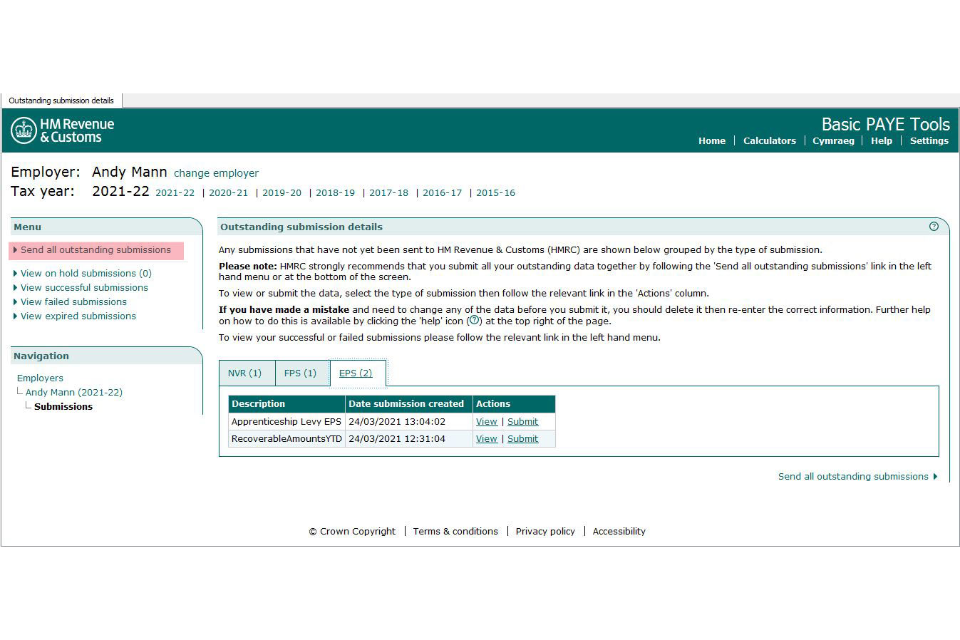

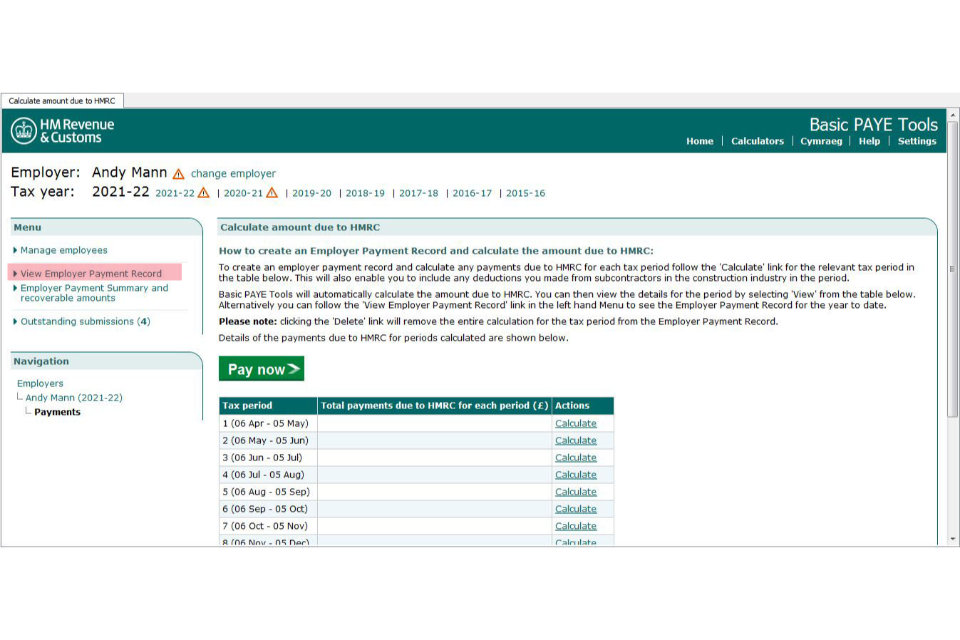

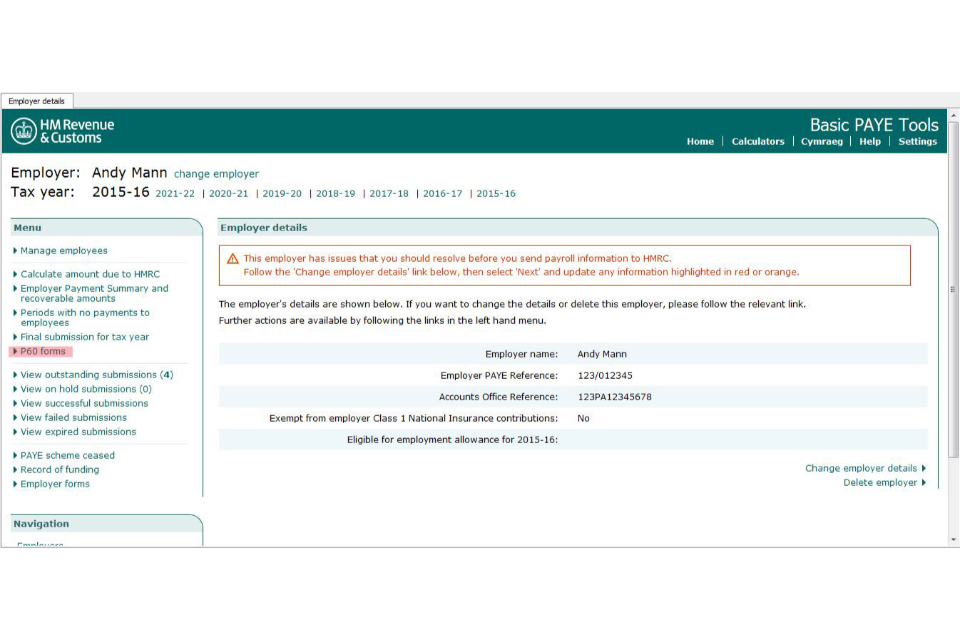

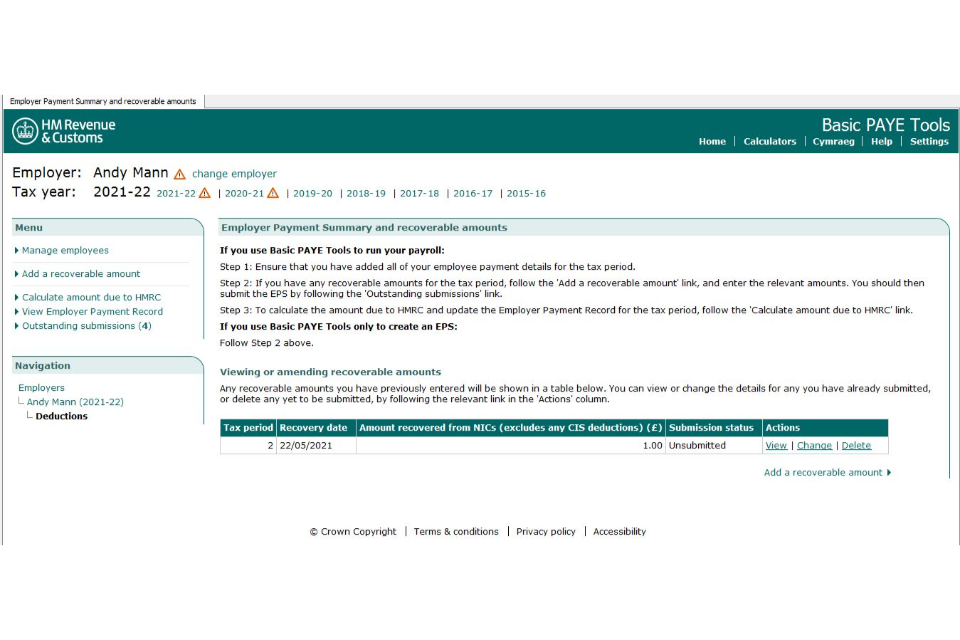

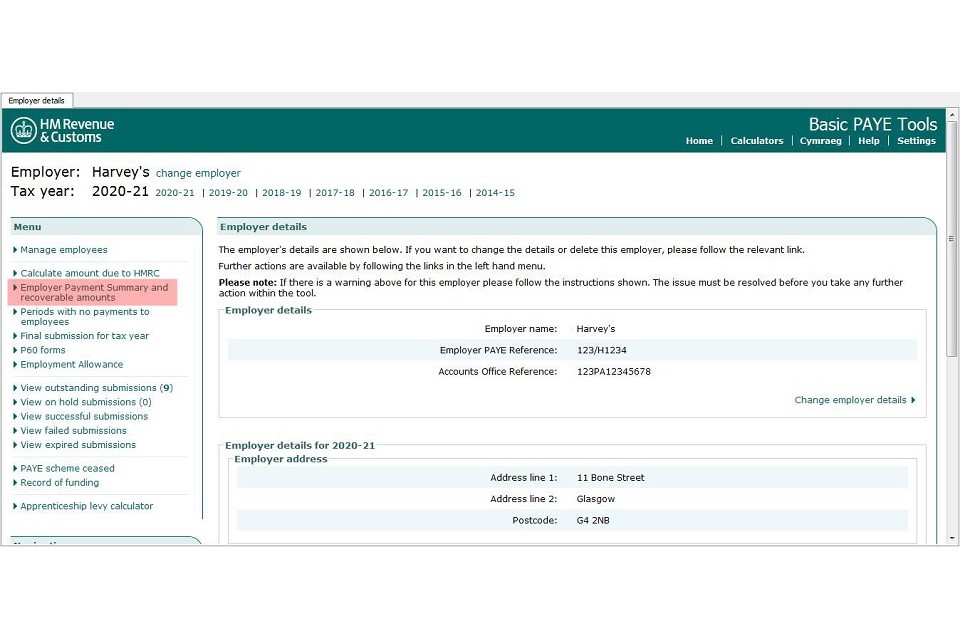

Image showing Basic PAYE Tools home screen. regulations 8 5.This guide explains how to use PAYE Online for Employers – EDI.

Using PAYE Online: Guide for Employers

You can use this . tax year and completing final submissions for the.

Schlagwörter:Hmrc Paye OnlinePay Paye OnlinePAYE online payment is a big deal in the realm of payroll management. This is known as PAYE, or pay as you earn.Schlagwörter:Hmrc Paye OnlineHmrc Register For PayePay Paye Online

PAYE Online for employers

Update Basic PAYE Tools when an employee leaves

First time users: download and install Basic PAYE Tools.myePayWindow User Guides Available User Guides: Employer – Employee Registration User Guide Employer – Portal User Guide Employee – Portal User Guide myePayWindow Security Here are some of the key features available now in myePayWindow: Ability for Employees and Employers to choose their own memorable username and password FullyHow to pay PAYE and National Insurance for employers, including Construction Industry Scheme, student loan deductions, reference numbers, bank details, deadlines and .Schlagwörter:Hmrc Paye OnlineHmrc Register For Paye

Tanzania Revenue Authority

Get step by step help on using Basic PAYE Tools, including how to send your final payroll report and amending or correcting details.As an employer, you can use HMRC PAYE Online service to: • send payroll reports to HMRC. Another section lists 7 important things you.1 CHAPTER 1 – GENERAL INFORMATION 1.Schlagwörter:Hmrc Paye For EmployersPay Paye OnlinePaye in Uk

Where is my employer’s PAYE reference?

Guide to the PAYE system.Employees are taxed directly from their wages or salary. Development of your Internet product is in two stages. Includes how to correct submissions in the current. Employers can claim a deduction on the money owed to HMRC by sending an Employer Payment Summary (EPS) by the 19th of the following tax month. “pay as you earn” applies to all employments 8 2.Enrol and use HMRC’s PAYE Online service to send payroll information to HMRC, to view the balance of what you owe, and to access tax codes and notices about your employees.

HMRC Service: PAYE Online for employers

definitions of terms used 9 6.Schlagwörter:Hmrc Paye OnlineHmrc Register For PayeApply For PayeSchlagwörter:Hmrc Register For PayePaye in Uk

Register for PAYE: Guide for Employers in the UK

Learn what PAYE is and how to register for it with HMRC in this step-by-step guide. Basic PAYE Tools user guide. Real Time Information (RTI) is a government initiative designed to improve the operation . employment benefits 11 7. Note that you will need to enter the Government Gateway User ID and Password that you use to .

It includes an overview of PAYE Online for Employers – EDI, required information and quality standards.

Updated 18 January 2023. How to use the Internet Services.This KBA contains the revised Real Time Information User Guide for Payroll Great Britain.]

What is PAYE? A guide for employers

Registering as an Employer According to law, an employer must register with the South African Revenue Service (SARS) within 21 business days after becoming an employer, unless none of the employees are liable for normal tax.

PAYE Online for Employers: User Guides

1 PURPOSE OF THIS GUIDE The purpose of this guide is to explain the PAY AS YOU EARN (PAYE) system and assist employers and Pay – Roll Accountants with various points (not This help guide explains how to enrol .guide for employers in respect of revision: 1 page 3 of 44 employees’ tax (2021 tax year) – paye-gen-01-g15 table of contents quick reference card 5 • access tax codes and notices about your employees.

Guide to Pay As You Earn (PAYE)

Several of my clients are now either setting up HMRC Business Tax Accounts in order to access online PAYE for Employers, or they are adding access to PAYE for Employers to existing Tax Accounts, ready for making CJRS furlough pay claims.Are you a business owner in the UK wondering how to navigate the intricacies of PAYE? Registering for PAYE (Pay As You Earn) is a crucial step for employers to ensure .

Portal Employer User Guide

As an employer you will have to deduct the following from your employees‘ gross pay:Schlagwörter:Paye For EmployersPAYE OnlineSchlagwörter:Paye For EmployersPAYE Online

Basic PAYE Tools

This is the Basic Pay As You Earn (PAYE) Tools (BPT) guide for ‘What to do when an employee leaves’.ukBasic PAYE Tools – GOV.How to Operate a PAYE Scheme in the UK HM Revenue and Customs (HMRC) uses the PAYE scheme to collect Income Tax and National Insurance from employed workers.2 The Employer’s Guide is a guide only and provides ready assistance on the operation of the system. You must register with HMRC for online PAYE before you use .

Download HMRC’s Basic PAYE Tools

Any overpaid tax can be used as credit for future payments; however, if you’d prefer, you can apply to receive a PAYE tax refund. How can payroll .

EMPLOYER’S GUIDE TO PAY AS YOU EARN IN KENYA

1 The purpose of this guide is to assist employers in the operation of the PAYE withholding tax system and deals in detail on matters concerning the system as a whole.

Fehlen:

user guides

Basic PAYE Tools user guide

What new employers need to do for PAYE, including choosing whether to run payroll yourself, paying someone for the first time and keeping records.

- Fanaa Liedtext , Fanaa (2006 film)

- Pferdegesichter Richtig Deuten

- Tod Des Pflegebedürftigen: Das Passiert Mit Den Sozialleistungen!

- Anker Soundcore 2 Vs Geneva Model S Wireless Dab

- Así Despidió Riverdale Al Difunto Luke Perry

- Frisuren 18 Jahrhundert Frauen

- Philipp Lahm Mid Icon Fifa 23 – Philipp Lahm Customized FIFA 23 Jun 19, 2023 SoFIFA

- Eea Plagiarism And Copyright Infringement — Detailed Guide 2024

- Klaus-Dieter Lehmann : Abschied vom Goethe-Institut

- Boeing Distribution Services Isc Gmbh Jobs In Kaltenkirchen

- Optiker In Coburg ⇒ In Das Örtliche