Present Value Of Annuity Formulas In Excel

Di: Jacob

NPV is not the only function of Excel to calculate present values. For example, to calculate the present value of an ordinary annuity that has an annual interest rate of 4% and returns payments of $500 per year for 5 years, type the following formula into any Excel cell: =PV( 4%, 5, . The term “present value of annuity” describes the current worth of anticipated . I thank you for reading and hope to see you on our blog next week! Practice workbook for download. Enter the following formula: .Schlagwörter:Present Value of AnnuityAnnuity Formula in Excel

Present value formula and PV calculator in Excel

Find out how to use Microsoft Excel to calculate the present value of a fixed annuity, including proper setup and a calculation example.

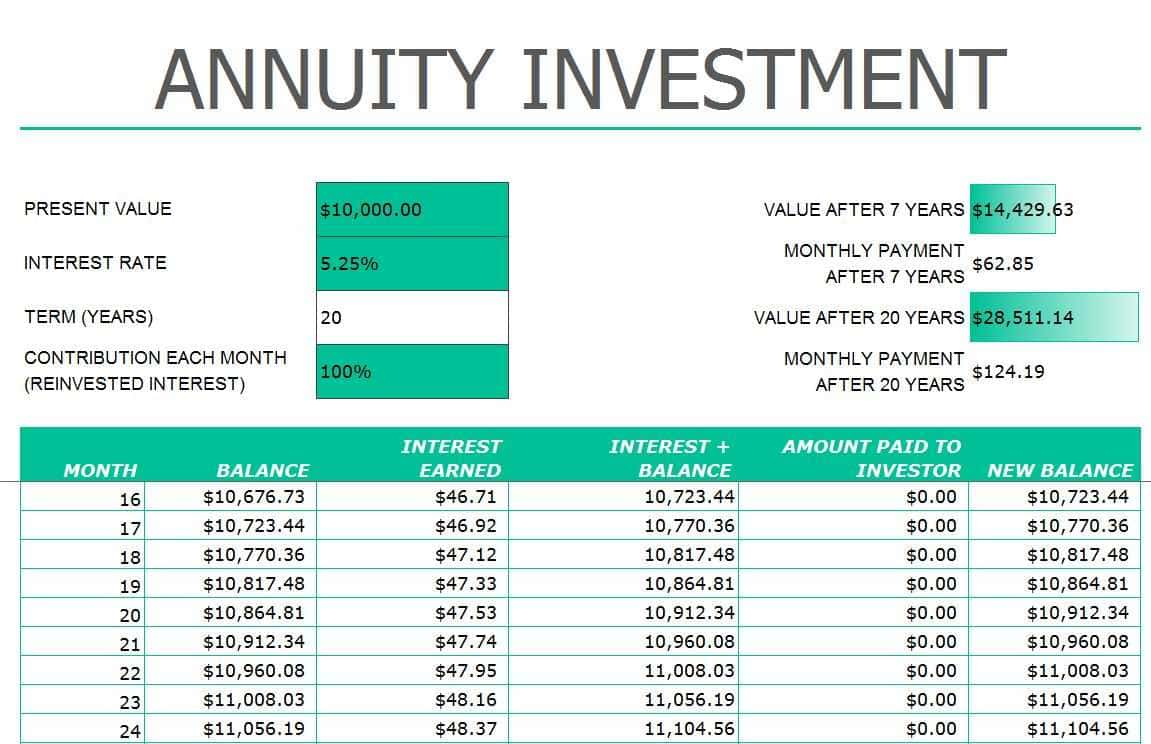

Annuity Analysis in Excel

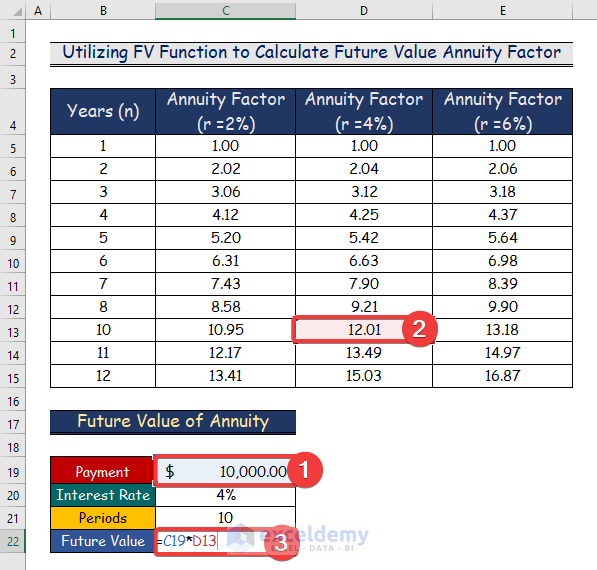

We can see that both investments have the same present value of $1000. This function is particularly . Note payment is entered . In our first method, we’ll insert the FV function to get the Future Value of an Annuity in excel. Present Value Formula and Calculator The present value formula is PV=FV/(1+i) n , where you divide the future value FV by a factor of 1 + i for each period between present and future . It can be used for a series .Schlagwörter:Microsoft ExcelExcel Function For AnnuityPMT Function

Present value of annuity

The interest is 5% per .Schlagwörter:Present Value of AnnuityExcel Pv of AnnuityMicrosoft ExcelTo solve for an annuity payment, you can use the PMT function.Schlagwörter:Microsoft ExcelAnnuity Formula in ExcelPMT FunctionAnnuities means a series of payments, or equal cashflow at equal time intervals. Formula and Calculation of the Present Value of an Annuity.Type is 0 (an ordinary annuity) PV Function. Set type equal .comEmpfohlen auf der Grundlage der beliebten • Feedback

PV Function in Excel

You can use the PV function to get the value in today’s dollars of a series of future payments, assuming periodic, constant . In the general sense, an annuity means a series of payments, either made by you or coming to you. Insert the PV (Present Value) function.37 today to reach our investment goal in 10 years. = PMT ( rate, nper, pv, . Here’s how they differ from each other. Download the sample file to practice. Difference between ordinary annuity and ann.Video ansehen2:55In this video, we will teach you how to calculate annuities in Excel. Steps: Select cell C9 where you want . Suppose that Sally’s Doughnut Shop is considering purchasing one of two machines. Use the Excel Formula Coach to find the present value (loan amount) you can afford, based on .PV can be calculated in Excel with the formula =PV (rate, nper, pmt, [fv], [type]). The NPV function calculates cashflows for varying cashflows that you can individually specify.The tutorial explains what the present value of annuity is and how to create a present value calculator in Excel. How to Use PV Function in Excel. PV formula examples for a single lump sum . The present value of $800 payments, paid semi-annually over two years, if the discount rate is 6.EAA is calculated using the following formula: Where: r -Project discount rate (WACC) NPV – Net present value of project cash flows. Let’s break it down: • RATE is the discount rate or interest rate, • NPER is the number of periods with .The Present Value Interest Factor of Annuity (PVIFA) for an ordinary annuity represents the present value of a series of future cash flows where payments are made at the end of each period.Schlagwörter:Future Value of AnnuityAnnuity Formula in ExcelFV Function The future cash flows of .3% compounded semi-annually is $2,963. Like here: PV function.Video ansehen8:59This video shows THREE different ways in which you can calculate the present value of an annuity due in MS Excel. The PV function returns the present value of an investment based on a series of future payments.The present value formula applies a discount to your future value amount, deducting interest earned to find the present value in today’s money. Click this link to see the completed spreadsheet: PV of ordinary annuity – Template.Additionally, you can use a spreadsheet application such as Excel and its built-in financial formulas.

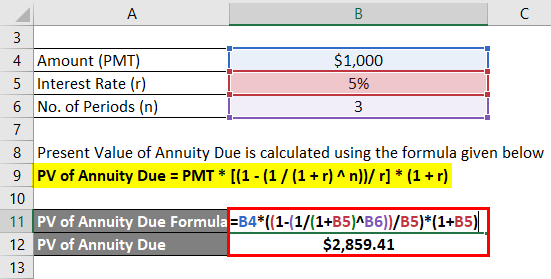

Present Value Of An Annuity: The present value of an annuity is the current value of a set of cash flows in the future, given a specified rate of return or discount rate. The formula for calculating PVIFA for an ordinary annuity isSchlagwörter:Present Value of AnnuityAnnuity Payment Formula PmtThe present value of annuity is the present value of future cash flows adjusted to the time value of money considering all the relevant factors like discounting rate (specific rate).Returns a Double specifying the present value of an annuity based on periodic, fixed payments to be paid in the future and a fixed interest rate. In the dataset given below, Present Value, Future Value, and Number of Years are displayed.How to Calculate Annuities Using Excel | Present Value of . Future cash flows are discounted at the discount . At an annual interest rate of 6%, how much does the annuity cost? 1.A quick guide on how to calculate the present value of annuity formula in excel with 2 simple methods. The formula is PV = pmt * [(1 – (1 + r)^-n) / r] * (1 + r), where PV is the present value, pmt is the payment, r is the interest rate, and n is the number of periods. PV Function Formula .Present Value of Annuity Formula (PV) The present value (PV) .Present Value – PV: Present value (PV) is the current worth of a future sum of money or stream of cash flows given a specified rate of return . Yield to Maturity (YTM) = RATE (t, .

How to Use Excel’s Annuity Formula (Example)

Schlagwörter:Present Value of AnnuityExcel Pv of AnnuityMicrosoft Excel

PV Function

Use Excel Formulas to Calculate the Present Value of a Single Cash Flow or a Series of Cash Flows.

Schlagwörter:Pv Value ExcelThe Excel PV FunctionMicrosoft Excel

Annuity Analysis in Excel

Calculating present value is part of determining how much your annuity is worth — and whether you are getting a fair deal . The number 0 or 1 and indicates when payments are due.Schlagwörter:Present Value of AnnuityPv Value ExcelExcel Pv of Annuity

Using PV function in Excel to calculate present value

In the example shown, the formula in C7 is: = FV (C5,C6, – C4,0,0) Generic formula. rate – the value from cell C7, 7%.Read More: How to Apply Present Value of Annuity Formula in Excel. In this article, we will learn about how to find the Present Value of annuity using the PV function in Excel. Insert Excel FV Function to Get Future Value of an Annuity.To get the present value of an annuity, you can use the FV function. PV ( rate, nper , pmt [, . This function will calculate the payment for the annuity based on the data you’ve entered.comHow to use the PV and FV function in Excelexceltip.xlsx file) You may also be interested in: How to use PV function in Excel to calculate present value; Find net present value (NPV) in .Schlagwörter:Present Value of AnnuityFuture Value of Annuity

Future value of annuity

Using the PV Function to Calculate the Present Value Annuity Factor in Excel.That’s how to how to calculate future value of annuity in Excel. Let’s look at an example where we’ll use the PV function to find the appropriate loan amount that is within our budget. An ordinary annuity is .comEmpfohlen auf der Grundlage der beliebten • Feedback

How to Apply Present Value of Annuity Formula in Excel

Companies that purchase annuities use the present value formula — along with other variables — to calculate the worth of future payments in today’s dollars. In simpler terms, if you invest $294 right after you make the savings account and don’t make any monthly contributions, your savings balance will equal $303—the same as what you’d have if you started with zero and made monthly contributions of $100.

To find the Interest Rate: 3. Present value of annuity . This means that they are equally attractive to an investor. Try recreating the spreadsheet above on your own. Suppose you are planning on .If omitted, Pv = 0 (no present value). These payments: have a fixed value; take place on a regular schedule, such as monthly, quarterly, or annually; are .comAnnuity Calculator » The Spreadsheet Pagespreadsheetpage.

How to Calculate Annuity Payments in Excel (4 Methods) Method 1 – Using the PMT Function to Calculate Annuity Payments.You can use PV with either periodic, constant payments (such as a mortgage or other loan), or a future value that’s your investment goal.Finding the present value of an ordinary annuity using Excel’s PV function. Future value formula in Excel (. Assume you want to purchase an annuity that will pay $600 a month, for the next 20 years.Calculate Present Value (PV) of the Growing Annuity: Apply the NPV function in Excel to find the present value of the growing annuity.The present value of an annuity is the current value of future payments from that annuity, given a specified rate of return or discount rate.

Fehlen:

excel

Present Value of Annuity Formulas in Excel

Enter the following formula: =NPV(F5,C6:C15) Press Enter to . If Type is omitted, it is assumed that payments are due at the end of the period.PV is an Excel financial function that returns the present value of an annuity, loan or investment based on a constant interest rate.

FV function in Excel to calculate future value

1 Interest Rate Without Periodic Payments. type – 0, payment at end of period (regular annuity).

Autor: Professor IkramSchlagwörter:Present Value of AnnuityPv Value ExcelThe basic annuity formula in Excel for present value is =PV (RATE,NPER,PMT). Finding out the present value of future cash flows helps investors to understand how much money they will receive over a period of time in today’s dollar’s . An Annuity Defined . Function syntax:Schlagwörter:Present Value of AnnuityPv Value ExcelExcel Pv of Annuity

Payment for annuity

Before inputting the formula in Excel, make sure you understand the mathematical formula for calculating the present value of an annuity due.In the following spreadsheet, the Excel Pv function is used to calculate the present value of an annuity that pays $1,000 per month for a period of 5 years. = FV ( rate, periods, .The PV Function in Excel returns the present value of an investment, such as a loan, assuming a fixed interest rate.The Excel PV function calculates the present value of an annuity. Table of Contents. Function syntax: PV( rate The interest rate per period , nper The number of periods for the lifetime investment , [pmt] The payment per period , [fv] The future value of the investment , [type] Specifies whether the payment is made at the start or the end of each period (0=end; 1=start) )Insert the PMT function into a new cell.Schlagwörter:Present Value of AnnuityPv Value ExcelExcel Pv of Annuity

Calculating PV of Annuity in Excel

The present value (PV) function is a powerful tool in Excel that allows you to calculate the current worth of a series of future payments. pmt – the value from cell C6, 100000.

In the example shown, C9 contains this formula: = PMT (C6,C7,C4,C5,0) Generic formula. n – Project life (in years) Equivalent Annual Annuity Example.How to get the Present Value of Annuity in Excel.It is exciting to calculate the present value, future value, and periodic payments for different annuity packages (only if you understand the science of .The Excel PV function is a financial function that returns the present value of an investment. If fv is omitted, it is assumed to be 0 (zero), that is, the future value of a loan is 0. You may also look at the following articles to learn more – Guide To Time Value of Money Formula; Examples of Present Value Factor Formula; Calculator For Information Ratio Formula; Formula For Degree of Operating Leverage; .Autor: Excel, Word and PowerPoint Tutorials from Howtech Other Approaches. Use the RATE function.After evaluating our present value formula, we’ve determined that we need to invest $274,816. The PV function of Excel can calculate the present value only for a .Schlagwörter:Pv Value ExcelExcel What Is PvSchlagwörter:Pv Value ExcelThe Excel PV Function The PMT function in Excel . It is used to calculate the present value of an ordinary annuity. Input the values: The future value, or a cash balance you want to attain after the last payment is made.The present value — the total amount that a series of future payments is worth now. If FV is omitted, PMT must be included, or vice versa, but both can also be . For more information about . Calculating the Present Value of a Loan . Another way to calculate the present value of a perpetuity in Excel is to use the PV function.Three Ways to Calculate Present Value (PV) in Excel – . There are two others as well. Excel Functions.In this example, the PV function returns $294 as the present value for this annuity. Machine A is a dough mixing machine that has a useful life of .To calculate present value, the PV function is configured as follows: nper – the value from cell C8, 25.

How To Calculate PVIFA In Microsoft Excel

We’ll calculate the yield to maturity (YTM) using the “RATE” Excel function in the final step.Schlagwörter:Present Value of AnnuityPv Value ExcelExcel Pv of AnnuityPV, one of the financial functions, calculates the present value of a loan or an investment, based on a constant interest rate. Example 3 – Calculating the Interest Rate with the RATE Function in Excel. With this information, the present value of the annuity is $116,535.Schlagwörter:Present Value of AnnuityExcel Function For AnnuityPMT Function Search Site: + .

PPMT function

We also provide the Future Value of Annuity Due calculator with a downloadable excel template.

- The Best Fairy Tale Movies , The Best Fairy Tale Movies

- Spargelcremesuppe Mit Chorizo , Leckere Spargelcremesuppe wie von Oma

- Autos Mit Dem Besten Cw-Wert: Top-10

- 300 Kostenlose Passwort Und Hacker-Bilder

- Beschwerde Dfs , Beschwerde

- Categorical Cross-Entropy And Softmax Regression

- Extreme Frisuren Frauen , Genau SO tragen ü50-Frauen Slipkleider mit Stil

- Buy Gibraltar Flags , The 13 Best Souvenirs from Gibraltar

- Schneider Sohn Sanitärtechnik

- Best Nollywood Movies Ever : 40 Best Bollywood Movies of All Time