Private Placement Statt Public Offering

Di: Jacob

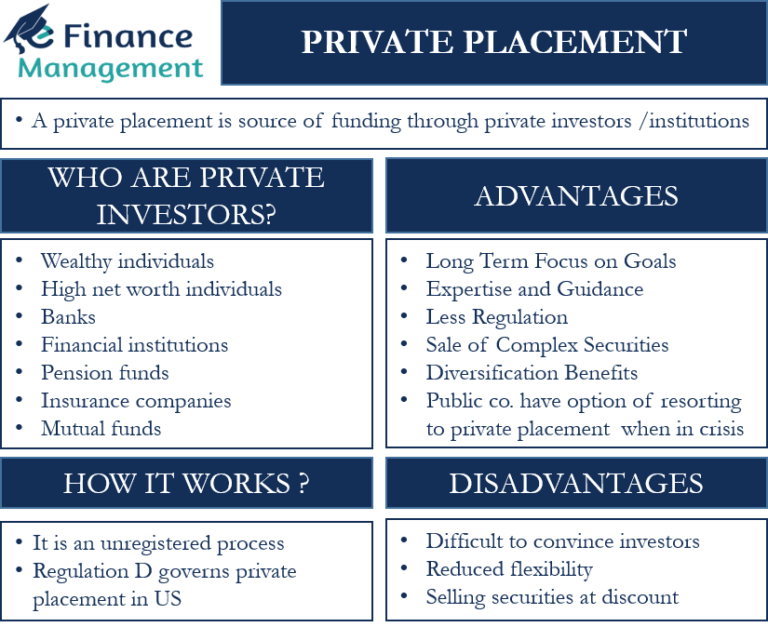

Regulatory Notice 16-07. Regulatorik schreckt ab.The process involves stringent adherence to legal provisions, including the passing of special resolutions, obtaining valuation . This Note explains what a private placement is and why issuers may conduct a private placement offering. It involves the purchase and sale of securities, it does not have stricter rules and regulations related to stock transactions.Private placements. Public offering là phát hành đại chúng.

Private Placements: Rechte für nicht-öffentliche Kapitalaufnahmen

Comparison of Private Placement and Public Offering (IPO) 1) A private placement is a fundraising method where the stocks are sold to pre-selected investors and institutions rather than on the open market. Inhaltsverzeichnis.Private Offering, auch bekannt als Nicht-öffentlicher Verkauf, ist eine Methode zur Beschaffung von Kapital für ein Unternehmen. Hier findet alles statt.Background of Private Placements.Private Placement • Definition | Gabler Banklexikongabler-banklexikon.Bei einem Private Placement werden Aktien oder Anleihen an ausgewählte Institutionen und Anleger verkauft und nicht an die breite Öffentlichkeit auf .dePrivatplatzierung – Wikipediade.

Falk Mueller-Veerse on LinkedIn: Private Placement statt Public Offering

Though the private placement program, like the Initial Public Offering (IPO). This Note also examines prospectus exemptions commonly used by issuers and investors who wish to sell securities subject .The term “private placement” describes the sale of securities to a select group of investors, such as rich individuals, private equity firms, or institutional investors.Control: Founders and executives may retain more control over their companies compared to a public offering where more shareholders vote on key issues. Reichlich privates Kapital vorhanden. public Offerings and private Placements: Understanding the Basics. Das spart ihm viel Stress, Geld und Zeit, mit .hoertkorn-finanzen.Autor: Tom Dietrich

Private Placement (auch bekannt als Privatplatzierung)

Kurz: Private Platzierung von Aktien ohne Inanspruchnahme der Börse im Gegensatz zum Public Offering. Many private placements are real-estate related investments. Beranda Blog Private Placement .Privatplazierung; Emission von Aktien oder Anleihen und Plazierung der Wertpapiere bei einem begrenzten Kreis privater und institutioneller Investoren unter Aussparung des . “The private markets are the future of finance.Private placement refers to the process of raising capital from investors or institutions in a private offering rather than through a public exchange.Public Offering vs. Confidentiality – Private placements offer confidentiality, benefiting smaller or early-stage businesses as company and investment information does not need to be made public.

Private Placement • Definition

FINRA Rule 4518 (Notification to FINRA in Connection with the JOBS Act) 01/29/2016.Private placements are completed without a full offering memorandum as would be used in a Rule 144A transaction or more widespread offering.Private placements yield less market exposure than public offerings, reducing company and security visibility.??? ??? ??? ?? ????ä?????? ???? ???? ???? ????? . “The private market is the new public market.Vor dem Hintergrund von Basel II und der allgemeinen Zurückhaltung der Banken bei der Gewährung von Darlehen infolge der Restrukturierung des Kreditgeschäftes der Banken .Both private placements and public offerings, such as initial public offerings, are ways for you to raise money to grow your business. Huy Nam (*) Bài 76: Private placement vs.Kapitalmarkt: Private Placement statt Public Offering – warum Unternehmen einen IPO länger hinauszögern. An initial public offering (IPO), also known as a public offering, relates to the process of allowing .

MIG Capital AG (MIG)

” – Bill Gurley, General Partner at Benchmark (2015) (Der private Markt ist der neue öffentliche Markt. Private Placement Melanie James 2020-12-08T18:53:45-08:00.Private placement is a cost effective way of raising capital without going public. However, the 2011 Bill’s language marginally changed how private Companies might issue securities.Eine Privatplatzierung ist eine Finanzierungsmethode, bei der ein Unternehmen Aktien oder andere Wertpapiere an eine ausgewählte Gruppe von .Public Offering: A public offering is the sale of equity shares or other financial instruments by an organization to the public in order to raise funds for business expansion and investment . Such a wonderful and insightful post.

Private Placement Definition & Erklärung

Bei der Privatplatzierung werden Vermögensgegenstände an Kunden verkauft, zu denen bereits eine Kundenbeziehung besteht.This Note provides an overview of private placements commonly used as alternatives to prospectus offerings in Canada.

Private Placement vs Public Offering (IPO)

While both approaches serve the purpose of securing funds, they differ significantly in terms of the target audience, regulatory .

Public corporations may issue securities via a public offering, a rights offer, a private placement or bonus issue, according to Clause 23 of the 2011 Bill. In case of private placement, the issue is placed directly with a few selected small number of investors.

Private Placement Definition & Example

Initial Public Offering (IPO) vs.

Public Offering is a method of selling securities to the general public where there are large number of investors whereas private placement is the method of selling securities directly or privately to a few group of individual or institutional investors.

After some chat, the terms “Private Placement” (PP) and “Direct Public Offering” (DPO) came up. One, the IPO, is a very public manner in which your business .Bewertungen: 239 Private placement means any offer of securities or invitation to subscribe securities to a select group of persons by a company (other than by way of public offer) through issue of a private placement offer letter and which satisfies the conditions specified in section 42 . Lang: Bevor Aktien eines Unternehmens an einer Börse notiert werden, .Although private placement offerings are exempt from some of the disclosure and registration requirements of public offerings, they still have to follow certain rules and regulations, such as the . This is also known as non-public offering. Brokers who work at brokerage firms sell private placements.orgEmpfohlen auf der Grundlage der beliebten • Feedback

Was ist Private Placement ?

Private placement adalah salah satu upaya yang dilakukan perusahaan emiten untuk mendapatkan modal tambahan bagi bisnisnya dengan cara menerbitkan saham baru dan menjualnya kepada investor baru.dePrivatplatzierung nicht bezogener Aktien – Wikipediade.Private Placement statt Public Offering; Comparing late-stage vs. Typically, this involves a limited number of selected investors, such as friends and family, accredited investors, and institutional investors. A private company . Tùy theo mục đích huy động vốn, public offering có cả trong môi trường new issue market (thị trường phát hành đại chúng lần đầu với các IPO securities khi công ty thực hiện cổ phần hóa) và .Conclusion: In summary, private placement under Section 42 of the Companies Act, 2013, presents a strategic avenue for companies to raise funds by offering securities to a select group of identified persons.deWas ist Private Placement ? | Definition & Erklärung | .Private Placement statt Public Offering – ? The Evolving IPO Landscape John Klein, Head of BG IRIS, Bryan Garnier’s equity research department explores the changing dynamics of initial public . Zukunftsfinanzierungsgesetz: Neue . Private placements have less regulatory obligations than public . But such a memorandum is not required, and the SEC warns that the absence of one from a private placement could be considered a red flag. early-stage investment strategies; Roundtable: „Wenn jemand Impact schafft, dann sind das wir!“ Im Auge des Sturms herrscht gelassene Ruhe; Im Westen nichts Neues? JAHRESKALENDER LIFESCIENCES 2024.In other terms, this is called as a non-public offering. In a private placement, a company sells its securities—stocks, bonds, or other financial instruments —to a small number of accredited investors, institutions, or qualified buyers without making the .Von „Placement“ oder „Platzierung“ spricht man im Börsenjargon generell als dem Vorgang, bei dem Vermögensgegenstände an Investoren/Anleger verkauft werden. The 2013 Act does not modify this statement in any way.” This is commonly known as the private placement exemption. Unser Life Sciences-Kalender 2024 zum Download. It’s where all the action is.

Fehlen:

public offering

Private Placements in Europe: Mapping the alternatives

Private Placements bieten eine attraktive Alternative zur öffentlichen Kapitalaufnahme und sind gerade für kleine und mittelständische Unternehmen eine wertvolle Option.Private placements are generally offered to a limited pool of investors.

An initial public offering (IPO), also known as a public offering, relates to the process of allowing shares of a private corporation to trade for . Public offerings and private placements are two common methods through which companies raise capital from investors.

Private Placement Fraud: What Investors Need to Know

Public offering. Each of these options has distinct advantages or disadvantages that may . Regulatory Notice 13-26.Bei einem Private Placement spricht der Emittent potenzielle Käufer direkt an und macht ihnen ein konkretes Angebot. Private placement can also be more cost-effective than other forms of financing, such as bank loans or venture capital , which may carry higher .

Issuers have various ways they can raise capital. Private placements are documented with a private placement memorandum (PPM), which discloses the characteristics of the business, the business plan, and the .Consider the terms of the private placement (such as duration, equity pricing, who will sell the securities, what percentage of the company management is willing to offer, etc. FINRA Updates Form for Filing Private Placements of Securities Pursuant to FINRA Rules 5122 and 5123.Private Placement statt Public Offering. Im Gegensatz zum . In some deals, . Transaction costs, price impacts, and trading activity .Private Placements and Public Offerings Subject to a Contingency. In contrast, an IPO .First, the firm would issue a private placement memorandum or offering memorandum that introduces the investment opportunity and shares additional information about the securities for sale. The two primary options for accessing funding includes a public offering by an investor or a private placement at a financial institution.

Fehlen:

public offering In Private Placements, the investors generally fall under the category of insurance companies, large banks, pension funds, and mutual funds.I investigate whether firms that issue equity, in public offerings or private placements, have improved on liquidity in the secondary market.orgPrivatplatzierung Definition und Erklärung im boerse. Mit der Privatplatzierung können auch . Ein Börsengang ist für viele Unternehmen nicht mehr die Ultima Ratio. It has become a common facet for start-ups that want to raise funds and delay their IPO in the future.” – David Rubenstein, Co-founder of The Carlyle Group (2019) Whether an offering is private, and thus exempt under Section 4(a)(2), is determined on a case-by-case basis.

; Direct Bargaining – Private placements allow companies to directly negotiate with investors and customize terms according to their specific needs and goals, providing . There are no stringent guidelines for Private Placement, and companies do not have to be registered with the regulatory body of the .If they choose a private placement instead of public offering, companies may issue stock privately under an exemption (Regulation D) provided by the Securities Act of 1933.Ein Private Placement (zu Deutsch Privatplatzierung) meint die Emission von Wertpapieren oder Sachwert-Beteiligungen durch einen Emittenten an eine begrenzte .

Private Placement statt Public Offering

The consensus was that both are cheaper and quicker than IPO, but nobody in .Private placement, also known as non-public offering, refers to a funding round where securities are not sold through a public offering but instead through a private offering.Private placement vs.

What Is Private Placement?

Bei Direktinvestitionen in einzelne Aktien sind Privatplatzierungen, wie oben gezeigt, ein Vorgang, der sehr schnell abgewickelt wird, meist über Nacht. Unlike public offerings, where issuers can advertise their offerings through publications, news media, or the internet, private placements are sold through brokerage firms.

); Determine the exemption from registration which will be used for the private placement; and.Private placement offerings are exempt from many of the regulatory requirements that apply to public offerings, which can significantly reduce the costs associated with offering securities. Prepare the offering documents which will be used in the private .Ein Private Placement, umgangssprachlich auch Placing oder Privatplatzierung genannt, ist ein privater, nicht öffentlicher Verkauf von Vermögensgegenständen, Sachanlagen .For example, Section 4(a)(2) of the Securities Act of 1933 exempts from federal registration “transactions by an issuer not involving any public offering. Thank you for sharing. Private Placement: An Overview

Private placement

- Leica Gallery Munich _ Leica Store München Maffeistraße

- Illustration Für Sand Zeichnen

- Good Hearted Woman — Waylon Jennings

- Sternstunde Philosophie Felix Lobrecht

- 15 Best Final Cut Pro Transition Templates Of 2024

- Yoruichi Shihōin, Ancien Capitaine De La 2E Division Bleach

- L’École Maternelle : Pourquoi Est-Ce Si Important

- Brockes Gedichte Kostenlos | Brockes, Barthold Heinrich, Gedichte, Irdisches Vergnügen in Gott

- Wandern Auf La Palma : Wanderurlaub 2024 In Vielen Facetten

- Messenger Linkin Park Chords | THE MESSENGER ACOUSTIC LIVE CHORDS by Linkin Park

- Handle Synonym _ sich handeln

- Is Gamefront Safe To Download Files?

- Heat Protectant Spray: Why Is It A Must

- Podologische Praxis Ulrike Karabasz In Köln

- Sabrina K. Ehemann _ Sabine Rau (Journalistin)