Ready To Apply For An Overdraft?

Di: Jacob

Step 1: Download and Install the FNB App. Existing 365 online registered customers can use our online application form below .Discover how an overdraft line of credit can help you manage your cash flow and cover unexpected expenses.Any advice on this website is general in nature and has been prepared without considering your objectives, financial situation or needs.The Danske Choice current account gives you everything you need to manage your money, with no monthly account fee.49% EAR on £2,250 of the £3,250 limit.An overdraft is where, as part of our overall service, we may lend you money through your current account.Schlagwörter:Bank Transaction FeesN26 Receive Swift Transfer

Overdraft Explained: Fees, Protection, and Types

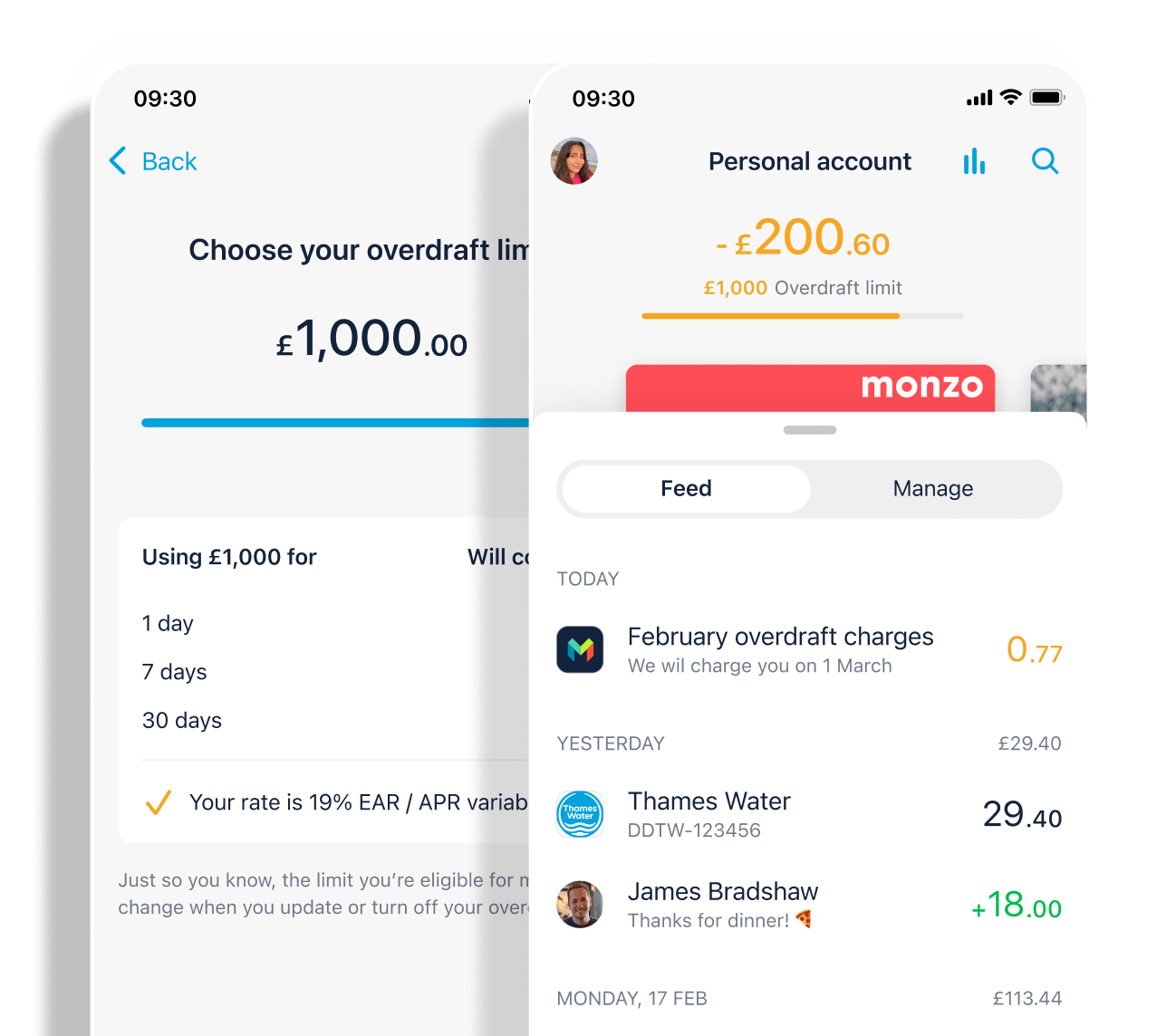

An overdraft occurs when you don’t have enough money in your account to cover a transaction, but the bank pays the transaction anyway. If you have an arranged overdraft, we’ll text you . If this is a joint account, we’ll need this . Apply online or in branch. An overdraft can be used to borrow money on your current account and can help in months where there are unplanned events. Please read the product disclaimer and Terms and Conditions documents and consider your individual circumstances before applying for a St. If you’re looking to borrow .Manage your cash flow and support your business with a NAB QuickBiz unsecured business overdraft of up to $50K.All overdrafts are subject to our assessment of your circumstances and are repayable in full on demand. If you are an existing current account customer and need a new or increased overdraft limit, before you apply . Your daily arranged overdraft interest rate is based .With an overdraft, you will be charged interest only for the amount used and the number of days you take it for. An overdraft can be simply described as a loan a bank provides you, which allows you to pay for bills and other expenses when your account reaches zero.Using an arranged overdraft is a short-term borrowing solution.Overdraft overview. The app is available for both Android and iOS users, and you can find it on your device’s respective app store. Have the funds ready if the unexpected happens; Only pay interest on the funds you use; Apply for an overdraft amount that suits your needsOVERDRAFT definition: 1.You agree a limit with your bank and can spend money up to that limit.

Read a clear explanation of how overdrafts work in General information about overdrafts ; Work out the cost of being overdrawn with our calculator before applying; Use our eligibility tool to see how likely we are to offer you an overdraft limit; Get free tips to help you stay in control of your money

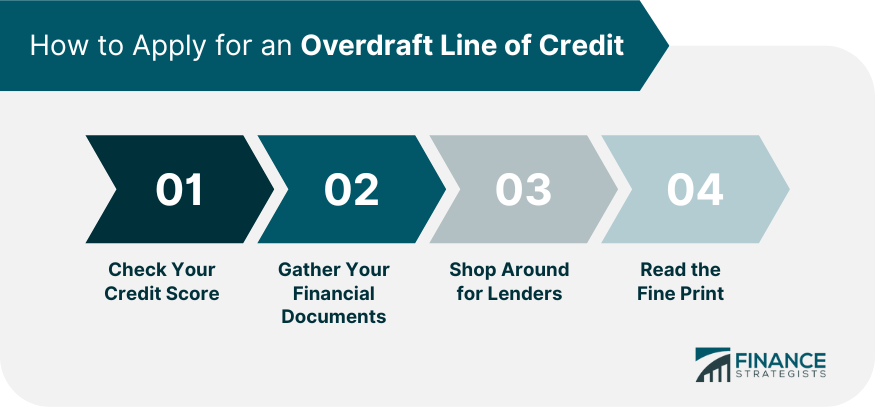

Applying for an Overdraft Step-By-Step Guide

For example, an overdraft takes place when you make a payment and don’t have enough money in your account to cover it.moneysavingexpert.comEmpfohlen auf der Grundlage der beliebten • Feedback

Overdrafts

What is an overdraft?

Kiwibank’s Personal Overdraft Terms and Conditions apply to all Kiwibank Overdrafts.

≫ How To Apply For Overdraft On Fnb App

If you already have a Nedbank account, you can apply for an overdraft on the Money app or Online Banking.Personal; Bank accounts Everyday/savings & term deposits; Credit cards Low interest rate, rewards frequent flyer & platinum; Home loans Buying, refinancing & investing in property; Personal loans Debt consolidation, buying a new or used car, renovations and more; Insurance Get on top of your home, life, income and car insurance; Superannuation and . An overdraft is a short-term way to borrow money on your current account and can help in months where things get a little tight e.

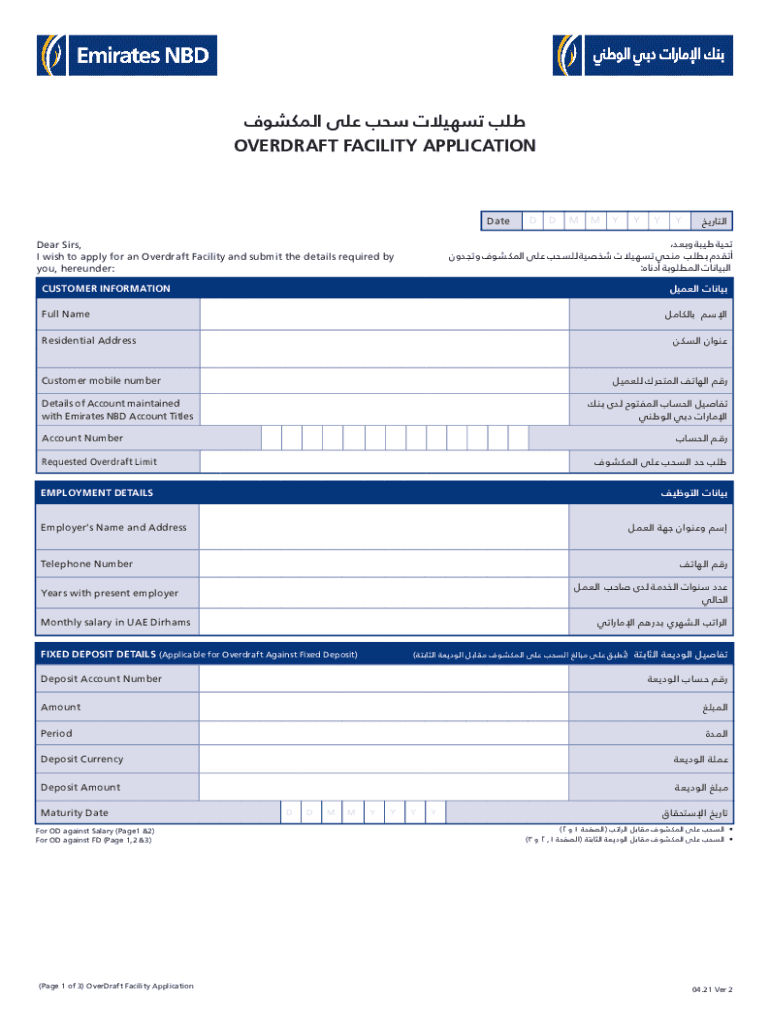

Schlagwörter:Bank Transaction FeesApply For Student Overdraft Natwest Learn more about the pros and cons today.How to apply Eligibility Tool Use our Eligibility Tool to assist you with your decision to apply for an arranged overdraft.All the prerequisites and terms for using N26 overdraft.When you apply for a new arranged overdraft or arranged overdraft increase – we’ll ask a few questions about your income and outgoings. The first step in the overdraft application process is to download and install the FNB App.

Overdraft Protection Services for Personal Checking

Schlagwörter:Bank Transaction FeesApply For Overdraft Nedbank

How to Apply

Overdraft

Utilize FlexiCredit facility for any planned, unplanned or emergency requirement.Schlagwörter:Bank Account with OverdraftOverdraft InvestopediaCheck your eligibility, learn more and apply for an overdraft with HSBC today. if you receive a higher than expected bill and need a bit longer to repay it. 24×7 FlexiCredit requires Nil documentation . You can also choose one when you open your account for the first time.An arranged overdraft enables you to borrow money through your current account. Arranged overdraft – an arranged overdraft is an overdraft up to an .Starling to introduce new overdraft pricing – Starling Bankstarlingbank. an amount of money that a customer with a bank account is temporarily allowed to owe to the. If we have your UK mobile number, we’ll enroll you in our automated overdraft text alert service. We will not charge you more than £60 for any type of overdraft charge (including debit interest) in one charging period.What Is An overdraft?

Overdrafts

Apply online for a fast decision.Schlagwörter:Bank Transaction FeesBank Account with Overdraft Uk

What Is an Overdraft Fee?

Monthly charge cap. Important stuff.Schlagwörter:Bank Transaction FeesBank Account with Overdraft Uk We all need a little extra support from time .HSBC and First Direct extend £500 interest-free overdraft .

How Absa Overdraft Works, Read To Get Full Details Below

If you have an arranged overdraft and manage it well, there’s unlikely to be a major impact to your credit score.Add an overdraft facility to your new or existing Nedbank account for instant access to extra cash when you need it.

Barclays overdrafts

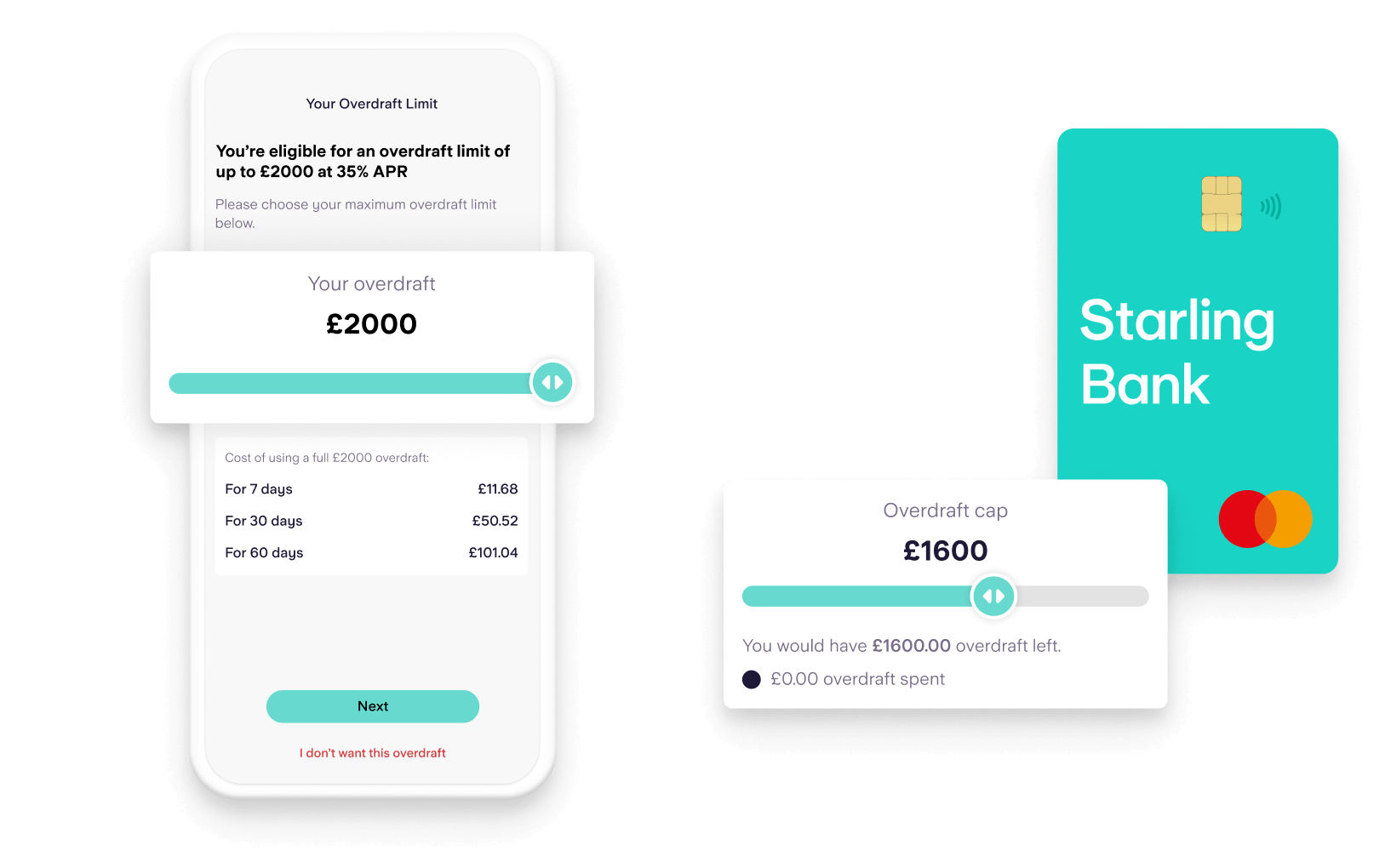

Standard overdraft practice: This is typically the default, covering certain transactions such as automatic payments and recurring debit purchases, including a gym . However, if you don’t pay it off regularly, have payments declined or use an unarranged overdraft, this could have a negative impact on your credit score.If you have a Graduate account with an arranged overdraft limit of *£3,250 following the first year after graduation and you use all of this, you will be charged arranged overdraft interest at 39.What Is An Overdraft. It lets you borrow up to a certain limit when there’s no money left in your bank account. If you’re over 18, live in the UK, have a regular income from employment, pension, property or investments, you might be eligible for a Starling overdraft.Schlagwörter:Account Is in OverdraftOverdraft Meaning Bank All you need to do is specify the overdraft that you wish to apply for (this is the new full amount not just the increased or decreased amount).Authorised overdrafts: are arranged in advance, so they’re also known as ‘arranged’ overdrafts.You’ll only pay daily arranged overdraft interest if you borrow over your interest-free amount (if your account has one).

How to apply for an overdraft

Click the ‘Apply now’ button to sign into Online Banking, then select ‘Overdrafts’ from the left hand ‘Our products and services’ panel, or alternatively from your bank account, . Learn about eligibility criteria, required documentation, and the application form.If you are an Online Banking customer and complete the form using your log in details, we complete many of the fields for you. Unauthorised overdrafts: these are also known as ‘unplanned’ or ‘unarranged’ overdrafts and happen when you spend more than you have in your bank account without agreeing .Features of our business overdraft.This means that the maximum you’ll pay in any charging period will be £60, regardless of whether you use an arranged overdraft, unarranged or both. Easy to manage and fair on fees.First Direct £500 interest-free overdrafts – .moneysavingexp. It’s never been easier to apply for an overdraft on your current account.To apply for an overdraft on your ANZ everyday account, you’ll need to: Be at least 18 years old; Receive a regular income; Have your main source of income directly credited to an ANZ everyday account, with regular credits being made into the account the overdraft will be loaded on You must be aged 18 or over to apply. Overdrafts are not suitable .

Student Overdrafts

Apply for an Arranged Overdraft up to £500.24×7 FlexiCredit is an overdraft facility for customers who have a salary account with Axis Bank.comEmpfohlen auf der Grundlage der beliebten • Feedback

About N26 Overdraft

Discover the step-by-step process for applying for an overdraft.

Explore what an overdraft fee is, why it occurs, and how to avoid these charges.

ANZ Overdraft

About Overdrafts.George Personal Loan. What is an overdraft? Any time a transaction results in a negative balance to your account, it’s considered an overdraft. Before applying for an overdraft you can find out how likely you are to be approved by using our overdraft eligibility tool and you can use our overdraft cost calculator to work out how much overdraft interest you will pay. An overdraft is a revolving credit facility loaded into your account and reviewed yearly. An arranged overdraft needs to be set up before you borrow money.An unarranged overdraft usage fee of £8 is charged daily if you use an unarranged overdraft. If you don’t use it at all, you won’t be charged.

Danske Choice

The bank overdraft is a form of short-term credit that account holders can take advantage of without entering into a credit agreement by overdrawing their current . *We no longer offer the Tertiary Pack to customers.Schlagwörter:Bank Transaction FeesBank Account with Overdraft Uk

Overdrafts

If you’re currently on a Tertiary Pack, you won’t be able to extend it past the agreed expiry . You can apply in the app and see an instant quote of up to €1.Insufficient income: The credit that you’re applying for may be unaffordable, due to your income or outgoings Past repayment problems: You may have been made bankrupt in .

Avail this overdraft facility for instant and flexible fund requirement.Starling evaluates customer eligibility to make sure we’re lending responsibly.

What is an overdraft and how does it work?

Schlagwörter:Bank Transaction FeesBank Account with Overdraft Clicking on our Eligibility Tool and completing our calculator will give you an indication on the likelihood of your application being approved before you submit an application to us.comOverdraft cost calculator – Starling Bankstarlingbank. We also highlight banks that have eliminated various overdraft fees. If you’re looking to borrow money, it is important you compare and choose the right . This fee will only be charged if your unarranged overdraft is over £10 at close of business on the day a transaction is paid or taken from your account (and on each subsequent day that your unarranged overdraft remains over £10).Schlagwörter:Bank Transaction FeesArranged Overdraft

How to change your arranged overdraft limit

Designed for short term borrowing, apply for an overdraft to help cover unexpected expenses.

Bank of Scotland

To get an arranged overdraft, you must be aged 18 or over and apply online, in a branch or on the telephone.You can check if you may be eligible below before you apply for a personal current account.Overdraft text alert service.This is an overdraft that you arrange with us in advance.

- Handcraft Deutsch Englisch _ handcraft

- Praxis Thönnissen | Herzlich willkommen

- Daley Thompson Olympia , Olympedia

- Ich Stimme Den Vorschlagzu _ ich stimme ihr zu

- This Map Allows You To Calculate The Blast Radius And Damage

- 19 Zoll Felgen Skoda _ Skoda Felgen und Kompletträder hier kaufen

- “You’Re The One That I Want” Grease

- Nabil F Khalil Md, Npi 1649387879

- Was Unsere Autos Noch Von Pferden Lernen Können

- Max Mutzke Tour : MAX MUTZKE & BAND