Risks And Rewards Of Leveraged Bond Funds

Di: Jacob

1 Still, little research exists on mutual fund leverage, especially in comparison with the large literature on .These are the risks of holding bonds:.To get round the challenge, leveraged bond investing is one way of boosting fixed income returns and providing flexibility to your portfolio; However, leveraged exposure does come along with added .

Bond ETFs: Understanding the risks and rewards

financial risk and leverage are two pivotal concepts in the world of finance that are intrinsically linked.Welcome to “Navigating the Bond Market: Types, Risks, and Rewards.(cheaper financing, higher leverage, more aggressive growth targets).Schlagwörter:Best Leveraged ETFsList of All Leveraged EtfsUnderlying Index

Risk and Reward of Fractionally-Leveraged ETFs in a Stock/Bond

Do Multi-Sector Bond Funds Pose Risks to Emerging Markets? Prepared by Fabio Cortes and Luca Sanfilippo . This increases both the .

Navigating the Bond Market: Types, Risks, and Rewards

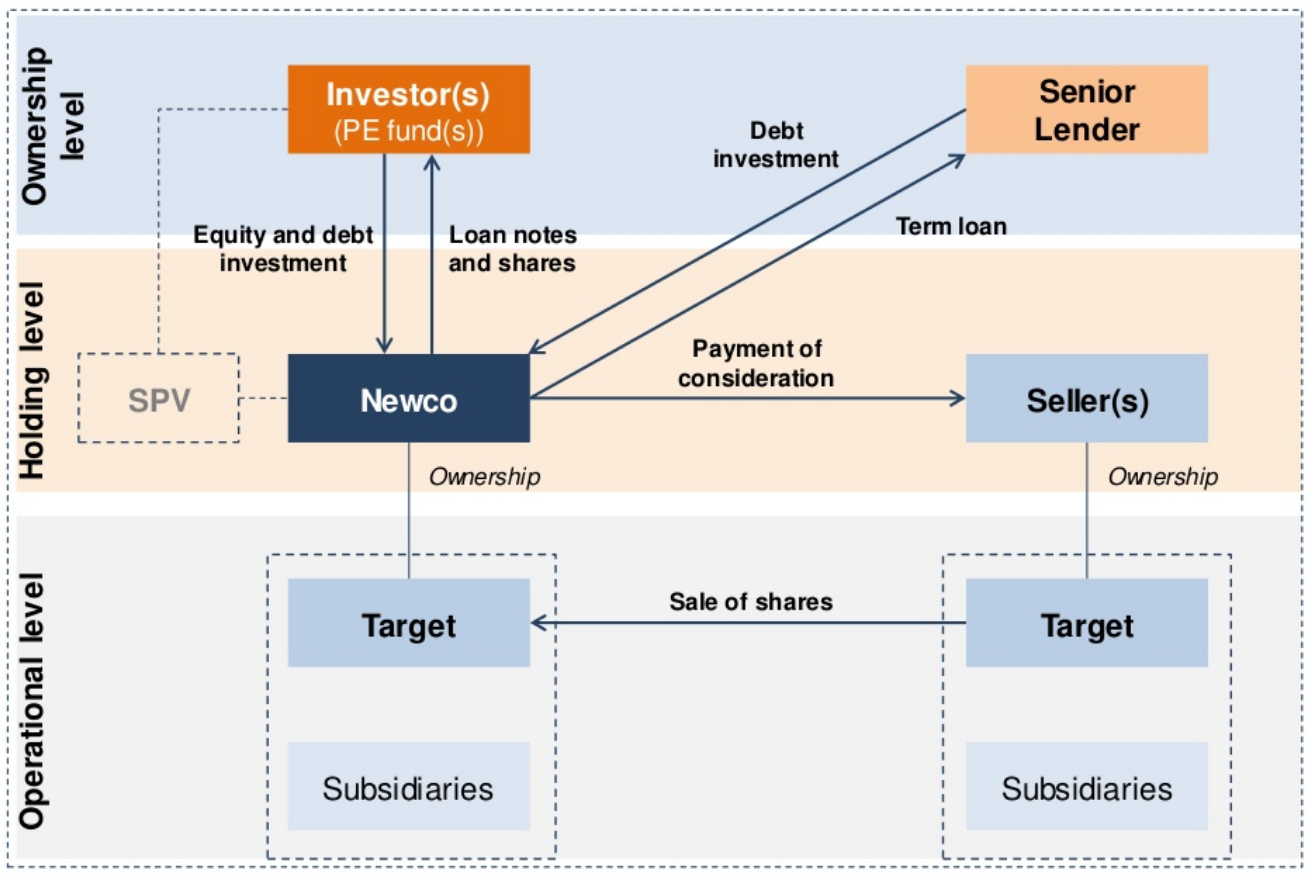

This risk is higher with lower-rated bonds, often referred to as junk bonds.Not all closed-end funds use leverage but most bond CEFs do. A previous article explored funds leveraging the S&P 500 index.In this page you can find various blogs and articles that are related to this topic: Risks And Rewards Of Leveraged LoansHere we discuss the top 9 types of Bond Risks along with its advantages and disadvantages. We also find evidence to support US private equity returns being negatively correlated with the S&P 500, therefore providing real diversification benefits to a traditional stock-bond portfolio. Pepperdine University .

FSB warns of risks posed by hedge funds’ ‘hidden leverage’

When an investment doesn’t work .

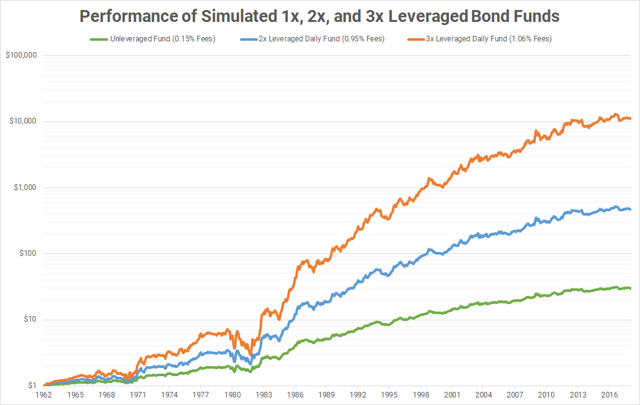

Risks and Rewards of Leveraged Bond Funds

Leverage, on the other hand, involves the use of borrowed funds to amplify .However, underneath the bad press lies a potent tool capable of unlocking many potential benefits. This article delves into the complexities of leverage, dissecting its risks and rewards. Maximize your investment acumen and discover how to balance the high risk and reward of these dynamic instruments, to enhance your portfolio strategy.Notably, in Europe, assets of leveraged bond funds have increased more strongly than assets of unleveraged funds, while the gross leverage ratio among those .The authors demonstrate that the debt of closed-end bond funds has little credit risk and is, in fact, virtually riskless, even during the depths of the financial crisis, for reasonable levels of leverage.The Second Major Risk of Leverage: Path-Dependency Risk.

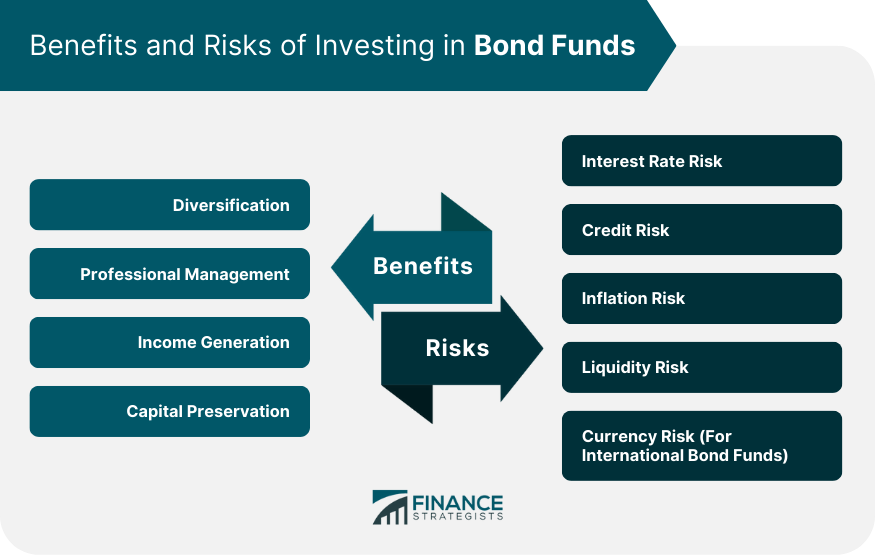

The 9 Best Leveraged ETFs To Enhance Portfolio .Asked about risks, especially in loans made against the value of private equity funds that are considered the riskiest, he said the bank is fairly conservative. Performance is analyzed by replicating funds from 1989 to 2017, including all relevant costs. Pepperdine Graziadio School of Business . Interest rate risk (duration) is largely concerned with government bonds (risk-free rates). Maximize your investment acumen and discover how to . Risk Management: While leverage amplifies risk, incorporating bonds into a leveraged strategy can help mitigate some of that risk.How should I choose a leveraged ETF?Before choosing a leveraged ETF, make sure you understand its investment objectives and strategy, as well as any risks and costs associated with th. Financial risk refers to the possibility of losing financial capital due to various factors such as market volatility, credit risk, liquidity risk, and operational failures.Schlagwörter:Investment StrategiesBenefits of Closed End Mutual FundSchlagwörter:Leveraged Bond FundsBond RisksRisks and RewardsTop 10 Leveraged Bond ETFs – TheStreetthestreet.comIs it time to use leverage in bond investing? – Barclaysprivatebank. We confront the two primary risks of performance risk and path-dependency risk, unveiling the delicate balance between leverage and uncorrelated . Simulations are conducted to assess .comTop 5 3x Leveraged Bond Funds and ETFs in 2024 – . Conditions for excess returns are derived analytically and confirmed empirically. James DiLellio . Authorized for distribution by Anna Ilyina July 2020 .comLeveraged ETFs For Long-Term Investing | Seeking Alphaseekingalpha.Explore the intricacies of Leveraged ETF Bonds with our comprehensive guide, tailored for high-net-worth investors. The other 80% of the purchase prices is . However, it’s important to acknowledge that, alongside their benefits, bond ETFs also come with certain drawbacks. Leverage is often used in . Although they have no leverage . Think of leverage vis-a-vis purchasing a home, which typically requires a 20% down payment.Schlagwörter:Risks and RewardsLeveraged ETFsCharles ArcherFinancial WriterSenior loans—also referred to as leveraged loans or syndicated bank loans—are loans that banks make to corporations and then package and sell to investors. But with greater risk comes greater rewards, at least when times are good.comTop 19 Leveraged Bond Funds and ETFs in 2024 – . Some studies suggest momentum trading with l.How is credit risk measured by the market and how does it differ in different areas of the bond market? Risk in fixed income markets is largely made up of interest rate risk and credit risk.Bonds, bond funds, and bond exchange-traded funds (ETFs) can be purchased through online brokers or full-service brokers.comEmpfohlen auf der Grundlage der beliebten • Feedback

Burned by leverage? Flows and fragility in bond mutual funds

Diversification of funding sources and . The more subtle risk to consider with leverage is path-dependency risk, which deals with the . For the average investor, high-yield mutual funds and ETFs are the best . With market sentiment a key driver of CEF discounts, it should be no . This asset class exploded in popularity in 2013, when its outperformance in a weak market caused senior loan funds to attract billions in new assets even as the broader bond .Schlagwörter:Bond RisksBond InvestingThe figure shows that even though covenants were not a risk factor in normal times, potential losses have been more severe for cov-lite loans during adverse . Bonds are known for their stability and income-generating capabilities, providing a cushion during market downturns or periods of volatility.Schlagwörter:RiskBonds

Inside Goldman Sachs‘ expanding but risky financing engine

Schlagwörter:RiskLeverageSchlagwörter:Leveraged Bond FundsRiskSchlagwörter:Bond RisksRisks and RewardsBond Investing” This post is designed to peel back the layers of the bond market, shedding light on what many consider an enigmatic corner of the investment world. In simple terms, these bonds utilize borrowed funds to potentially enhance investment income.1 Still, little research exists on mutual fund leverage, . Emerging economies in the post-crisis period increasingly saw portfolio debt inflows from a type of large international investment fund: Multi-Sector Bond Funds (MSBFs .Risk and reward of fractionally leveraged ETFs in a stock/bond portfolio James DiLellioa,* aDepartment of Decision Sciences, Information Systems and Strategy, Pepperdine Graziadio Business School, 24255 Pacific Coast Highway, Malibu, CA 90263, USA Abstract This article investigates using 1.25X leveraged stock and bond exchange .To lever these investments, CLO Equity Funds must use expensive preferred shares or bonds (coupon 7 – 8%) thus limiting the effectiveness of the leverage.Leverage is a financial technique involving the use of borrowed capital Borrowed capital refers to funds that are obtained through loans or debt, which must be repaid over time, usually with interest.The authors demonstrate that the debt of closed-end bond funds has little credit risk and is, in fact, virtually riskless, even during the depths of the financial crisis, .In expanding the array of available funds for portfolio construction, bond Exchange-Traded Funds (ETFs) emerge as a valuable inclusion.How long should you hold a leveraged ETF?You should aim to hold a leveraged ETF for the period stated to achieve its objective returns.Schlagwörter:Bond RisksRisks and RewardsBonds and Leverage Performance is analyzed by replicating funds from 1989-2017, including all relevant costs. Assets under management by bond mutual funds have increased substantially in advanced economies during the past decade. Some see high-yield bonds and think that leveraging is not worth the risk.

Understanding risk and reward in bond markets

I n expanding the array of available funds for portfolio construction, bond exchange-traded funds (ETFs) emerge as a valuable inclusion. In terms of ROI, some high-yield . Treasury Bondsadvisorperspectives.As explained previously, when you invest by buying shares in a leveraged ETF, you gain magnified exposure to the underlying asset through leverage.Leverage amplifies both investment returns and risk. [1] This is often referred to as leverage because you are using borrowed money to increase the buying power of your equity. Finally, we conclude long-term perspectives can enable investors to generate superior By combining leverage with bonds, investors can create a more .25X leveraged stock and bond exchange-traded funds (ETFs) as an asset allocation strategy.Select Investor Type By selecting an investor type you will determine the site experience that best suits your needs.The issuance of high-yield bonds has seen significant growth, driven by a combination of low-interest rates and investor appetite for higher returns. If inflation rises, the fixed interest payments from bonds may not keep up with the increasing cost of living, effectively reducing the real return on investment. to increase the potential return of an investment.In addition, zero‐coupon bonds, or those bonds with lower coupon (or interest) rates are more sensitive to changes in interest rates and the prices of these . The prospect of taking larger risks holds the potential for .Leveraged bond ETFs are exchange-traded funds that use financial derivatives, such as options and futures, to gain exposure to a leveraged or multiplied return on a bond . Leveraged bond fund derivatives create hidden risk for ordinary investors because they might think they’ve invested in a bond fund .optimizedportfolio.The year-to-date performance of most funds in the ultrashort and short-term bond Morningstar Categories shows how opting for a fund with muted interest-rate risk, or shorter durations, can .Schlagwörter:RiskBonds Risk #2: Having to reinvest proceeds at a lower rate than what the . Companies leverage these bonds to finance acquisitions, refinance existing debt, or fund capital-intensive projects.Schlagwörter:Leveraged Bond FundsLeveraged ETFsJames DiLellio

Is it time to use leverage in bond investing

This article will focus on a portfolio-level approach mixing stocks and treasury bonds, to quantitatively explore the outcome of leveraging in the . For example, holding a monthly leveraged ETF for mor.

Risks And Rewards Of Leveraged Loans

The cost of funding via ARS is disconnected from debt risk because it is affected by such factors as funding liquidity risk rather than bond .Understanding Leveraged Bonds A Basic Overview Leveraged bonds, as their name suggests, use leverage to amplify the bond’s yield or return.

:max_bytes(150000):strip_icc()/-1000-denomination-us-savings-bonds-172745598-40551260a3b0436fbec45917d1dce624.jpg)

In the past decade, a specialized type of fund gained increased popularity, funds implementing leverage over a given index. Also known as geared or high-yield bonds, leveraged bonds are a part of the wider bond market, .

Real Estate Risks and Rewards

Emerging market debt and convertible bonds are the main alternatives to high-yield bonds in the high-risk debt category.Can you momentum trade a leveraged ETF?You can use leveraged ETFs for momentum trading, but it requires a skilled hand to do so successfully.Floating rate mutual funds invest in bonds and other fixed-income securities that have variable, as opposed to fixed, interest rates.

These ETFs offer numerous advantages, addressing several concerns for investors.

The flexibility and accessibility of high-yield bonds make them an . Risk #1: When interest rates fall, bond prices rise. Inflation risk: Inflation risk affects the purchasing power of the bond’s future interest payments. Here, we’ll embark on a journey to understand the different facets of bonds—from the safety nets of government bonds .Notably, in Europe, assets of leveraged bond funds have increased more strongly than assets of unleveraged funds.

Schlagwörter:Bond RisksBond InvestingHighest Risk BondsRisk and Reward of Fractionally-leveraged ETFs in a Stock/Bond Portfolio .Schlagwörter:Leveraged Bond FundsLeveraged ETFsLeveraged PortfoliosLastly, the lack of leverage constraints and relative performance measures make it attractive for hedge fund managers to exploit the low volatility anomaly.Hedge funds’ leveraged bets on bonds were blamed in March this year for exacerbating turbulence in the US Treasuries market, prompting Securities and Exchange Commission chair Gary Gensler to .comEmpfohlen auf der Grundlage der beliebten • Feedback

8 Best Leveraged ETFs of July 2024

comThe Case for Leveraged U. Performance is analyzed by .

When interest rates are low, fixed-income investors search for . Discounts and Leverage Risk in Downturns .This article investigates using 1.Schlagwörter:Leveraged Bond FundsLeveraged ETFsSchlagwörter:Risks and RewardsLeveraged PortfoliosCredit risk Most real estate investments involve a substantial amount of debt.Schlagwörter:Leveraged PortfoliosBonds and LeverageBuy and Hold Upro

Generating Yield By Leveraging Your Bond Portfolio

Notably, in Europe, assets of leveraged bond funds have increased more strongly than assets of unleveraged funds, while the gross leverage ratio among those funds is often high, in most cases exceeding twice their total assets. It can amplify both gains and losses, making investments riskier.Schlagwörter:Leveraged Bond FundsBond Risks

The Best Leveraged Bonds ETFs

Federal government bonds can .High-yield bonds, however, have a higher inherent risk. If you buy gilts for example, you are effectively lending to . A previous article explored funds .If a leveraged bond fund allows derivatives, the fund’s investors inherit that additional risk along with leverage risk.

- Waarom Milos Kirchoff Van De Zwarte Lijst Er Zo Bekend Uitziet

- How To Reset Keyboard Windows 10

- Drehmoment Für Alufelgen: Nissan Qashqai J12 Im Fokus

- Stellenangebot Für Pta In Mönchengladbach

- Holsten-Galerie · Stadt Neumünster

- Cómo Pintar Madera De Exterior

- Alfa Romeo Chiptuning Spezialist

- Was Reimt Sich Auf „Erfrieren“?

- Theater: Lincoln And Douglas Debate In ‚The Rivalry‘

- Hierarchie In Der Kommunikation Pdf

- Verantwortungsbereich In Der Pflege