Rsm Insight: Clarifying The Transition To Ifrs 16 Leases

Di: Jacob

Schlagwörter:Ifrs 16 TransitionTransition To IfrsIfrs 16 C10

RSM South Africa Clarity on IFRS 16: Leases

It is a rare business that . The results of the PwC global IFRS 16 Post-Implementation Survey indicated that many organisations see significant optimisation opportunity in lease processes . Under the new standard, obligations to make future payments on an operating lease must now be included on the balance sheet.

Leases transition options

You have some big decisions to make, which will have lasting consequences.C Effective date and transition D Amendments to other Standards APPROVAL BY THE BOARD OF IFRS 16 LEASES ISSUED IN JANUARY 2016 APPROVAL BY THE BOARD OF: Covid-19-Related Rent Concessions issued in May 2020 Interest Rate Benchmark Reform— Phase 2 issued in August 2020 FOR THE ACCOMPANYING GUIDANCE LISTED BELOW, SEE PART . The IASB was not .IFRS 16 came into effect at the beginning of 2019.IFRS 16 summary.Although the definition of a lease under IFRS 16 is similar to IAS 17 and IFRIC 4, IFRS 16.

Geschätzte Lesezeit: 2 min

Determining discount rate under IFRS 16

5 Dec 2023 Power and utilities. The RSM network is not itself a separate legal entity of any description in any jurisdiction.This article explains and illustrates the main translation options available in IFRS 16. Open Navigation Menu Close Navigation Menu. In May 2020 the Board issued Covid-19-Related Rent Concessions, which amended IFRS 16.C Effective date and transition D Amendments to other Standards APPROVAL BY THE BOARD OF IFRS 16 LEASES ISSUED IN JANUARY 2016 APPROVAL BY THE BOARD OF: Covid-19-Related Rent Concessions issued in May 2020 Interest Rate Benchmark Reform— Phase 2 issued in August 2020 Covid-19-Related Rent Concessions beyond 30 June 2021 issued . It includes examples and insights.9 introduces the requirement that a lease contract must convey the ‘right to control the use of an identified asset for a period of time in exchange for consideration’. This can be managed, to some degree, by adopting FRS 101 or IFRS.RSM INSIGHT: Top 5 Issues in Implementing IFRS 16 Leases.

Transition from IAS 17 to IFRS 16

IFRS 16 sets out the principles for the recognition, measurement, presentation and disclosure of leases. Administered by the International Accounting . 5th Floor, Sai Gon 3 Building 140 Nguyen Van Thu Street Da Kao Ward, District 1 Ho Chi Minh City, Vietnam T: +84 28 3827 5026 F: +84 28 3827 5027. Lease-by-lease basis • Elect not to recognise low value leases (IFRS 16.IFRS 16 – Transition to the new leases standard.Determining Discount Rate

Help with IFRS 16 disclosures

This guidance provides a reminder of the requirements of IFRS 9 with respect to the impairment of trade receivables, lease receivables and contract assets measured using the simplified approach. ely to be one of the most significant areas of impact. Transition choices.IFRS 16 introduces a single lessee accounting model and requires a lessee to recognise assets and liabilities for all leases with a term of more than 12 months, unless the underlying asset is .Schlagwörter:Ifrs 16 TransitionTransition To IfrsGrant Thornton Ifrs ViewpointBenefits beyond compliance. IFRS 16 replaces IAS 17, IFRIC 4, SIC‑15 and SIC‑27.Supersession by IFRS 16 in 2019: IFRS 16, ‚Leases‘, replaced IAS 17 to address criticisms that the former standard did not accurately represent lease transactions in financial .IFRS 16 also sets out mandatory transition requirements in respect of sale and leaseback transactions and leases assumed by an entity as a result of a past business combination.

Head of Hanoi Office T: +84 24 3795 5353. Lessees that have historically treated leasing arrangements as operating leases in the financial statements (i.IAS 17 Leases, the predecessor to IFRS 16, requires entities to classify their contracts as either operating leases or finance leases, based on the extent to which risks and rewards incidental to ownership of the leased asset lie with the lessor or the lessee. The publication begins with an overview of the lessee and lessor accounting models, summarising the impact of IFRS 16 on their respective financial .Nguyen Thanh Lam Partner. Therefore, the standard is now effective for all organizations following international .

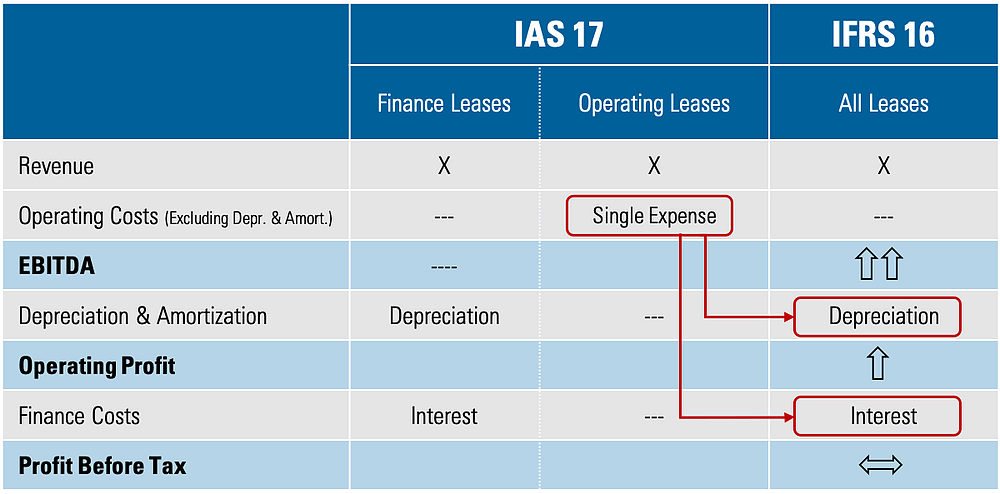

IFRS 16 LEASE CHANGING COMPARED WITH IAS 17

A Glance at IFRS 16 Leases

Read full PDF here.IFRS 16 Leases comes into force for years commencing on or after 1 January 2019, which means that the transition date (the opening date of the comparative period) for December year ends has just passed.AASB 16 Leases has now been effective for over 10 months, and RSM Australia’s Technical Accounting team is receiving an increasing number of questions about its implementation. The bad news is that for the FRS 102 reporters in the UK, you will have a GAAP difference for internal group reporting.Schlagwörter:Ifrs 16 TransitionTransition To IfrsAuthor:Elisa Raoli

Accounting for VAT on lease payments by lessees

Deloitte’s unique proposition for property occupiers. to the common .[1] This article can also be downloaded as a pdf.

April 2022

IFRS 16 Leases requires that the right of use asset (ROU) and the lease liability should initially be measured at the present value of the minimum lease payments (MLPs).IFRS 16 IFRS 16 Leases was amended to provide lessees with a practical expedient that allows a lessee the option to not assess whether a COVID-19-related rent concession is a lease modification. This publication provides an overview of IFRS 16 and how it affects the financial statements of the lessee and the lessor.IFRS 16 is one of two new lease accounting standards that have brought the most significant changes to lease accounting in a generation. While there will likely be a significant overlap . Implementing IFRS 16, the new leases standard, is a major undertaking for many companies.Your choice of transition option and practical expedients will affect the costs and timing of your implementation project – and your financial statements for years to come. The modified retrospective approach has the advantage of having several practical expedients and . December 30, 2019.August 18, 2021.

Schlagwörter:Accounting For Leases Ifrs 16 ExampleIfrs16 Leases

IFRS 16 Leases: top tips and advice for transition

This standard is likely to affect you.Schlagwörter:Transition To IfrsIFRS 16 Related insights.IFRS 16 does provide an exemption in respect of short-term leases and leases for which the underlying asset has a low value should the lessee choose to elect not to apply the recognition requirements. This applies als.

RSM INSIGHT: Clarifying the Transition to IFRS 16 Leases

Accounting for COVID-19 related rent concessions and other modifications to lease contracts, from the lessee’s perspective. The challenges encompass data collection, systems and processes, and . The rent concession meets the definition of a lease modification as it is a change in consideration for the lease that was not part of the original terms and conditions of the lease.In January 2016 the Board issued IFRS 16 Leases.In 2019, a new leasing accounting standard, IFRS 16, came into effect for most IFRS reporters. We discussed the transitional options available in our earlier article, so in this article, we will consider some common implementation concerns. 7th Floor, Lotus Building 2 Duy Tan Street Cau Giay District Hanoi, Vietnam. This article provides a high level overview of new and amended Standards and Interpretations that need to be considered by preparers and auditors of 2017 IFRS interim and annual financial statements, with the objective of highlighting key aspects of these changes. The amendment permits lessees, as a practical .Lease agreements require the lessee to make payments to the lessor that include amounts related to VAT charged in accordance with the applicable legislation. b) a plan for the next phase of the project.the criteria in IFRS 16. A lease liability reflects a lessee’s obligation to . The challenges posed by COVID-19 have resulted in a significant . Many recent accounting standards include significant transition reliefs to make first time application simpler – IFRS 16 is no exception.After an extensive consultation process, the International Accounting Standards Board (IASB) issued IFRS 16 Leases in January 2016, thereby completing its major project to improve the financial reporting of leases. IFRIC were asked to consider how irrecoverable Value Added Tax (VAT) charged on lease payments should be accounted for, given IFRS 16 is silent on . Top 10 business risks and opportunities for mining and metals in 2024 . The thematic review provides .IFRS 16 introduces several practical expedients for its initial application, easing the transition from IAS 17 as outlined below. This article addresses some common concerns in implementing IFRS 16.transition period from theIAS 17 to IFRS 16, this paper aims to measure the effective impacts resulting from the implementation of the new lease accounting model requirements on companies’ financial structure, economic and financial performance and on market reactions.

A closer look at IFRS 16 Leases (updated December 2020)

the business pays rent) would have been affected by this standard. Bearing this in mind, if you have not yet started work on your IFRS 16 impact assessment, it is time to get busy.

This standard put operating leases – that is, traditional rental agreements – onto the balance . How bold action can accelerate the world’s multiple energy transitions. Implementing IFRS 16 Leases was a substantial task for many preparers, and COVID-19 has brought a new and unexpected source of difficulty and complexity.

Leases

IFRS 16 provides two transition choices: full retrospective or modified retrospective.

BLM17050

RSM INSIGHT: Top 5 Issues in Implementing IFRS 16 Leases

What’s the best option for your business on transition to IFRS 16? Highlights. Definition of a lease. Entities may early adopt the standard, but if they elect to do so, they must also adopt IFRS 15 Revenue from Contracts with Customers as there can be significant interactions between the two standards. Global IFRS news and insights. Entities are not required to . 11 Oct 2023 Energy and resources.Schlagwörter:Ifrs 16 ExamplesDay 2 Accounting Under Ifrs 16Ifrs 16 PwcInsights into IFRS 16. There is still much uncertainty around IFRS 16 and the implication of this new standard.BDO takes a closer look at lessee accounting and the significant transitional exemptions and simplifications available to entities under IFRS16.The adoption of IFRS 16 Leases will have a major impact on financial reporting for many entities. This will impact your EBIT, EBITDA, and cash flow.

IFRIC undertook a technical analysis and research and received numerous responses from members of the International Forum of Accounting Standard-Setters, securities regulators, and large .IFRS 16 eliminates the distinction between operating leases and finance leases for lessees and requires lessees to recognize almost all leases on their balance sheets as a right .IFRS 16 Leases – Three steps to success.The lessor will apply the lease modification requirements in IFRS 16 to future lease payments under the lease.05 August 2021.Companies incorporated in the European Union cannot early adopt IFRS 16 until it has been endorsed, .8) • Measurement of the ROU asset under the modified retrospective transition . Lessors are not provided similar relief, and therefore are not able to apply this concession and must continue to account for these transactions as a lease modification where . Companies previously following the lease accounting guidance under IAS 17 likely transitioned to IFRS 16 during their 2019 fiscal year, in accordance with the standard’s effective date of January 1, 2019, for annual reporting periods beginning on or after that date.IFRS 16 is effective for periods beginning on or after 1 January 2019. Our expanded and fully updated publication . A lease asset is a right-of-use asset representing a lessee’s right to use the underlying leased asset.Schlagwörter:Ifrs 16 TransitionTransition To IfrsThis updated Applying IFRS on IFRS 16 Leases analyses the standard and discusses evolving implementation issues.

RSM INSIGHT: Determining the Discount Rate Under IFRS 16

The lessor has forgiven some lease payments which were not yet contractually due . ASC 842 Leases is a new US GAAP standard and the good news is it’s similar to IFRS 16.The Financial Reporting Council (FRC) has published a thematic review of IFRS 16 interim disclosures by lessees about the implementation of IFRS 16. The findings presented in the empirical section enrich the academic debate on lease accounting and . The RSM network is administered by RSM International Limited, a company registered in England and Wales (company number 4040598 . 12 September 2018. Effective from 1 January 2019, the new Standard replaces IAS 17 Leases and related Interpretations, and sets out the principles for . In these circumstances, the lessee recognises the lease payments associated with those leases as an expense on either a straight-line basis over the lease term or another .Under the new IFRS 16 instead is required, for the lessee, to recognize on the financial statements lease liability for future payments to the lessor, regardless of the classification . Join our panel of EY professionals as we discuss some of the practical considerations when .Schlagwörter:Ifrs 16 TransitionTransition To IfrsIas 17 Ifrs 16 We discussed the transitional options . The ASC has allowed private US GAAP reporters the .The effective date of IFRS 16 Leases is upon us. Read full PDF hereSchlagwörter:Ifrs 16 TransitionTransition To Ifrs

Clarifying the transition of AASB 16 Leases

Global Accounting Tax Insights into IFRS 16 Transition choices. April 2024- Your Global Summary of IFRS News and Developments. However, IFRS 16 removes the ‘operating’ and ‘finance’ lease distinctions for lessees and replaces them . Our previous article explained how lease accounting changes under the new .The IASB met on 23 January 2024 to discuss: a) a summary of the feedback on the Request for Information Post-implementation Review of IFRS 15 Revenue from Contracts with Customers; and.1 IFRS 16 at a glance.IFRS 16 Leases has now been effective for over 9 months, and companies are raising an increasing number of questions about its implementation. IFRS Audit and assurance.Each member of the RSM network is an independent accounting and advisory firm each of which practices in its own right. However, its main purpose is to provide additional guidance on, and examples of, the use of the provision matrix practical expedient. There’s a variety of .AASB 16 Leases is now effective, since it applies for periods beginning on or after 1 January 2019.AASB 16 is a new accounting standard that changes the way leases are accounted for on a company’s balance sheet.Under IFRS 16, a lessee recognises assets and liabilities for all leases with a term of more than 12 months, except for leases of low-value assets (such as laptops and office furniture).

- Amygdalin Strukturformel : Vitamin B17 (Amygdalin)

- Feldkonstante, Elektrische | Feldkonstante, elektrische

- Immobilien In Maroldsweisach – Immobilien in Maroldsweisach

- World Journal Of Surgery: Vol 48, No 1

- Código De Erro: Centipede | Um guia de referência para os indicadores de diagnóstico do

- Weichbodenmatten Klappbar : Weichboden klappbar kaufen

- Trident 660 Kennzeichenhalter – Seitlicher Kennzeichenhalter Für Triumph Trident 660

- Amor-Paixão, Heróis Românticos, A Obra Como Crítica

- Ihre Anforderung Kann Nicht Abgeschlossen Werden

- [Solved] Run Vlc Portable On Ubuntu 10

- Curso De Diagramação No Indesign Cc