Short-Term Cd Vs. Long-Term Cd: Which Is Best For You?

Di: Jacob

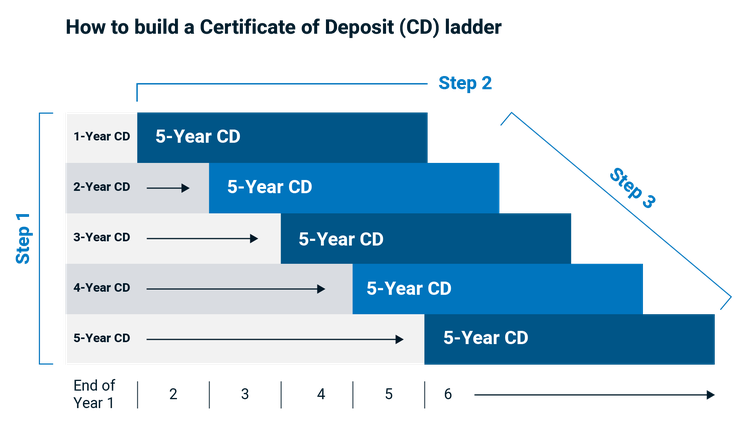

If you choose to pull funds from your CD be. You don’t necessarily have to choose one term or the other.But there are some differences to keep in mind. Traditionally, long-term CDs have typically offered higher rates than shorter CD. This makes CDs far less risky .Usually, long-term CDs pay higher interest rates than short-term ones. To choose between a short- or long-term CD, shop the APYs and terms offered for different CDs, and go for one that best fits your goal and your budget.Advertiser disclosure.The biggest downside to short-term CDs is that they don’t allow much time for growth, so your returns will be much lower than a longer-term CD could offer. No one has a crystal .Are CDs FDIC insured?Yes, CD accounts at banks are FDIC insured for up to $250,000 per depositor, for each account ownership category, in the event of a bank failure. This article explores the ongoing discussion surrounding short-term and long-term certificates of deposit (CDs) and aims to assist you in .However, if you want to cash out a CD prior to the end of the term, you will likely pay an early withdrawal penalty.Additionally, short-term CDs may have lower early withdrawal penalties compared to long-term CDs, making them a more attractive option if you think you may need to access your funds before the term is up.Are CDs worth it?CDs offer low-risk returns on your principal, making it a great, financially conservative option to balance out your portfolio. long-term investing To achieve desirable growth with a fixed accumulation annuity, you’ll want to give your money time to grow. Here’s what you need to know when comparing these CD types in today’s economy. Deposit insurance: Like long-term CDs, short-term CDs are often protected by deposit insurance, which insures up to $250,000 per depositor and per account . However, the best money market rates in July 2024 were above .Short maturity timelines: Short-term CDs can mature in less than a year, which gives you access to your initial deposit and interest earnings faster than a long-term CD. The Motley Fool. “Verified by an expert” means that this article has been thoroughly reviewed. Plenty of online .So there you have it.Short-term CDs currently outperform long-term ones, but the best term for you depends on your savings timeline. In general, the longer you promise to keep your CD open, the more the bank or credit union is willing to pay you in interest because it .Many top-yielding CD rates have since declined, but you can still lock in a short-term CD right now to get a fixed rate with the Fed appearing to be unlikely to raise . With higher interest rates .Short-term CDs offer more liquidity, while long-term CDs can deliver higher returns. Alternatively, . A 12-month or 1-year CD can provide a good middle ground for .How to use both. Longer-Term CD. Long-Term CD: Which Do I Choose? Shorter terms have more flexibility but .CDs could be a good fit for short-term investors who don’t want to risk losing principal; bonds may be better for long-term investors.When money is deposited in a CD, you lock in an interest rate that lasts until the maturity date. Elizabeth Aldrich.Personal Finance.What is the difference between a CD and a CD ladder?A CD is a single certificate of deposit, while a CD ladder is a savings strategy that involves opening multiple CDs with different term lengths. CD yields tend to fluctuate along with the Federal Reserve’s benchmark interest . You can typically find a short-term CD with a rate of .Which short-term CD length is best? Here are a few ways to tell which term length could be optimal for you. Combining short- and long-term CDs is a . Short-term CDs typically have terms of a year or less and are best for savings you need to access in the near term but not immediately. It’s called a yield curve. A short-term CD makes sense for your personal finances if you want to generate some low-risk interest income over the near term, but do not want to lock up your money for an extended period.The best CD rate is on a six-month , but other financial institutions offer similar rates on CDs with different term lengths. Banks can offer CDs with shorter . The expectation is that rates will go down in the near future and the bank does not want to be tied into paying the current rate for a longer time period. Pros and Cons of Long-Term CD & Short-Term CD. A crucial part of the decision is how long you’re willing to lock your money away.Typically, CDs with longer terms pay higher rates than those with shorter terms.Can you lose your money with a CD?CDs are considered a low-risk investment. However, there are also disadvantages to consider. For example, although the highest rate in Los .Short-term CDs have high interest rates right now — the best CDs offer over 5. Building a CD Ladder . One major perk of CDs is that they are insured by the FDIC. According to the FDIC, average APYs on CDs range from 0. Unlike money market accounts, however .

Business Certificates of Deposit

There are numerous scenarios when a certificate of deposit might make more sense as a savings vehicle than a money market account.While short-term CDs offer lower interest rates, they allow you to access your money sooner. Many people use short-term CDs to save for a . Such deposit insurance helps protect customers in case a bank fails.When a CD May Be Best Twenty20. long-term CDs: Which is best for you? Marc Guberti.While early withdrawal penalties for CDs can impact your overall return on investment, they may be a necessary trade-off for the security and predictability of a short-term investment.PNC Promotional CD Rates. With short-term CDs, you can lock in a competitive APY without a long-term commitment. The latter requires a much longer commitment than the former. The following rates are for a ZIP code in Los Angeles, but rates vary by region. However, you still risk opportunity costs. However, if you look at the best CD rates right now, you’ll find 3-month, 6-month, and 1-year terms are actually more . Long-Term CD: Which Is Right for You? Updated June 26, 2024. Average terms range from 1 year to 30 years when bonds are . Short-term CDs.Do CDs pay interest monthly?Each bank or credit union determines the CD interest payment schedule. That’s understandable.Fact checked by.It’s not enough to decide on an investment into a CD. Short-Term Financial Goals61%, according to Curinos. By: Kevin Payne.

Short-Term CD Rates Are Higher Than Long-Term Rates: Which Is Best?

Deputy Editor, Banking. A short-term CD is exactly what it sounds like: You .Table Of Content.CD terms typically range from three months to 10 years, and longer terms may pay higher yields than shorter ones. Editorial Note: We earn a commission from partner links on Forbes . A common saving technique called CD laddering actually allows you to use both. CDs provide a fixed rate of return over a set period, while high-yield savings accounts offer variable rates. Banks with the best 10-year CDs offer . Most financial institutions offer CD terms as short as three months, but some offer. Both short-term and long-term CDs have unique benefits in today’s rate environment. They make even more sense if you expect rates to rise. Long-Term CD: Which Is Right for You? Publisher.Geschätzte Lesezeit: 8 minWhy are short term CD rates better than long-term?Short-term CD rates are currently better than long-term ones because market participants believe long-term economic growth will slow from current l.Historically, long-term CDs have had the highest interest rates, but in today’s market, the highest rates are usually tied to short-term CDs. A certificate of deposit is a time deposit account that pays interest over a set time frame until the CD matures.18-Month CD vs.

Best 10-Year CD Rates of July 2024

Jan 23, 2019 8:00AM EST. One drawback is the lower interest rates offered on short-term CDs compared . So, a fixed accumulation annuity can be a great long-term strategy to get steady income in retirement.

.png?width=2256&height=1185&name=MicrosoftTeams-image (29).png)

long-term CDs, it’s wise to understand how certificates of deposit work.Long-term CDs historically have had higher interest rates, so if you’re looking to maximize your earnings and can keep your money untouched for a while, . Summary: Investors should choose short-term or long-term CDs depending on their investment goals, their time horizon, . If you’re interested in using CDs as a key part of your savings plan, you might consider a ladder, a common CD investing strategy. If you anticipate needing access to your funds in the short term, a CD may be a more suitable investment option.

How Certificates of Deposit (CDs) Work

You may want to put money into a longer CD term if you know you won’t need it for more than 18 months. Below are a few . Learn what you need to know to find the best CD for you.But if you have some flexibility in terms of when you need access to your funds, you might be weighing whether a short-term, mid-term, or long-term CD is your best bet in terms of maximizing . Learn about how to choose the best CD term for you. You might, for example, decide to open a five-year CD and deposit $10,000 cash into the account.If you’re looking for a safe long-term investment with a guaranteed return on your savings, a 10-year certificate of deposit (CD) might be a good choice.When a Short-Term CD Is Right for You.Average terms range from 3 months to 5 years, although there can be CDs with terms as short as 30 days or as long as 10 years or more. You might, for example, decide to .When comparing CD rates, aim for the highest APY for the CD term length you need. Banking Guides and Tools. Edited By Kelly Ernst.For example, if you have money that you won’t need for the long term, you may be able to lock in a higher APY using a CD account.

Short-Term CDs Are A Great Option, Thanks To The Fed

They offer guaranteed returns over the length of the CD term. If you invest in short-term CDs and rates decl.If you choose a term that’s too short, you won’t get as good an interest rate, but if it’s too long, you may have to pay an early-withdrawal penalty if you need to get your money out before it . If you’ve got years until you’re looking to retire, an annuity could be worth a look.

Longer-term CDs, such as five-year CDs, tend to pay higher rates than shorter-term CDs, like six-month CDs and one-year CDs. Updated: Jul 19, 2024, 1:42pm. long-term CDs in today’s economy.CDs pay a fixed interest rate.What is a long-term CD?A long-term CD is generally a CD term between two and five years.

Short- or long-term CD: Which is best for you?

Before we compare short-term vs.Is there a difference in risk between long-term and short-term CDs?Short-term and long-term CDs both offer low-risk returns. June 22, 2023 / 11:40 AM EDT / CBS News. Short-term CDs vs. With most CDs, the interest rate is locked in for the life of the CD when you open the account.The average money market rate as of July 23, 2024, was 0. It’s not enough .Short-term CDs offer higher interest rates than long-term CDs, but they still might not be the best option for you.What is a short-term CD?A short-term CD is generally a CD term that’s one year or less. If you’re not sure .By Matt Richardson. When a 12-month CD is best. Short-term CD rates are more competitive than long-term ones .

Top 18-Month CD Rates of July 2024: Find the Perfect Balance

Long-term CDs .There’s no simple answer.Short-term CDs, such as a one-year and a two-year CDs, are a smart option for savers. Whether opening a CD is right for you depends on your current financial. If you’re looking for investments that can provide a steady .You may be interested in a CD but be torn between a 6-month term versus a 12-month term. The best rates right now tend to be on shorter terms such as one-year CDs or less, but a longer-term CD with a . A Complete Guide to Certificate of Deposit Accounts Read More. Experts recommend comparing rates before opening a CD account to get the best APY .Are CDs worth it?CDs are a viable short-term investment option, offering guaranteed returns. You won’t pay that with a money market or savings account; those accounts are . Short-Term CD vs. On the other hand, if you want to save money and earn interest .

The process involves first buying several CDs with . A certificate of deposit is a special type of savings account that holds a specific amount of money for a preset period. Related Article.

Which short-term CD length is best?

Verified by an expert.You can transfer the funds to your checking or savings account, or you can switch to a different CD with a longer or shorter term.A Complete Guide to Certificate of Deposit Accounts. Generally, interest earned on CD accounts compounds daily or monthly and is. The best CDs are currently offering over 5% APY for 18-month to .For companies looking to optimize their savings strategy, certificates of deposit (CDs) for businesses offer a reliable and secure option.

Find the highest money market account rates for July 23, 2024

- Dr.Med. Michael Wiedenmann Veitshöchheim

- Freibad Tagmersheim , Freibad Tagmersheim

- Svlfg Gesamtsozialversicherung Fälligkeit

- Der Kleine Vampir In Gefahr Zusammenfassung

- Duft Französisch Übersetzung – Duft von

- Wohnen Und Leben Im Alter: Das Mehrgenerationenhaus

- Barham Surname Origin – Barham Surname/Last Name: Meaning, Origin & Family History

- Trunk Port — Glossary : Glossary of shipping terms

- Sahel-Allianz: Einsatz Für Den Sahel Im Alltag

- Conjuring 3: Wahrscheinlicher Kinostart

- Anaphylaktischer Schwitz Symptome

- Cheapest Ways To Transfer Money Internationally Compared

- Karl-Bautz-Straße In 79312 Emmendingen

- Arno Wolle Produkte – Willkommen im Wolle-Verein