Should I Buy A Car Or Lease A Car?

Di: Jacob

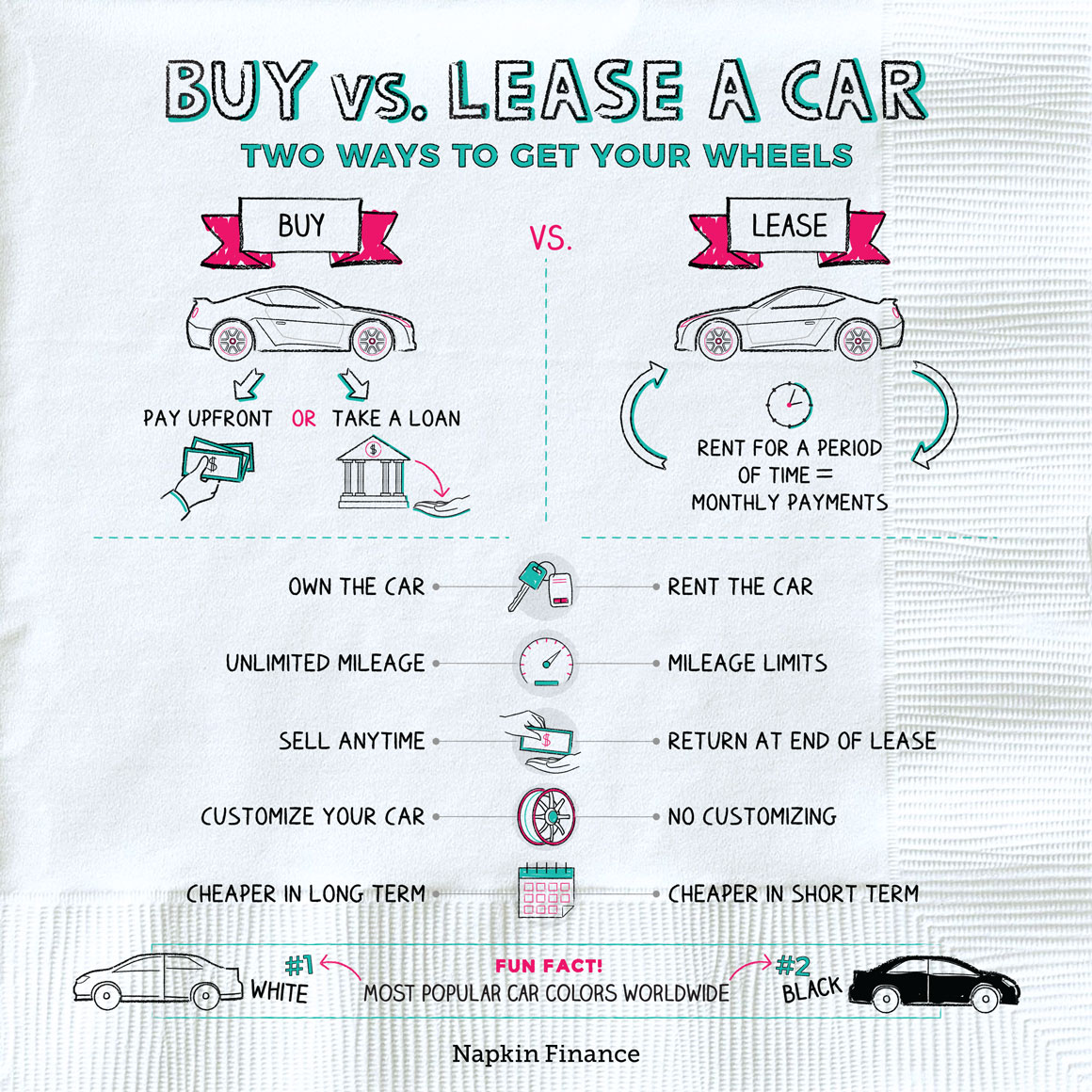

Our guide explains the major differences between buying and . Leasing a car means that you basically rent it for a specific and limited time period.Leasing vs Buying a car: which one is best? If you’re undecided whether to lease or buy one, our guide will take you through the pros and cons of leasing a car.And as the car gets older, those bills can add up. Meanwhile, the average used .But in today’s economy, should you lease or buy a car? Car leasing is very similar to renting. It also means you won’t need to make a payment each month outside of running costs, insurance and any maintenance.

Should You Take a Lease to Buy a Car? Pros & Cons

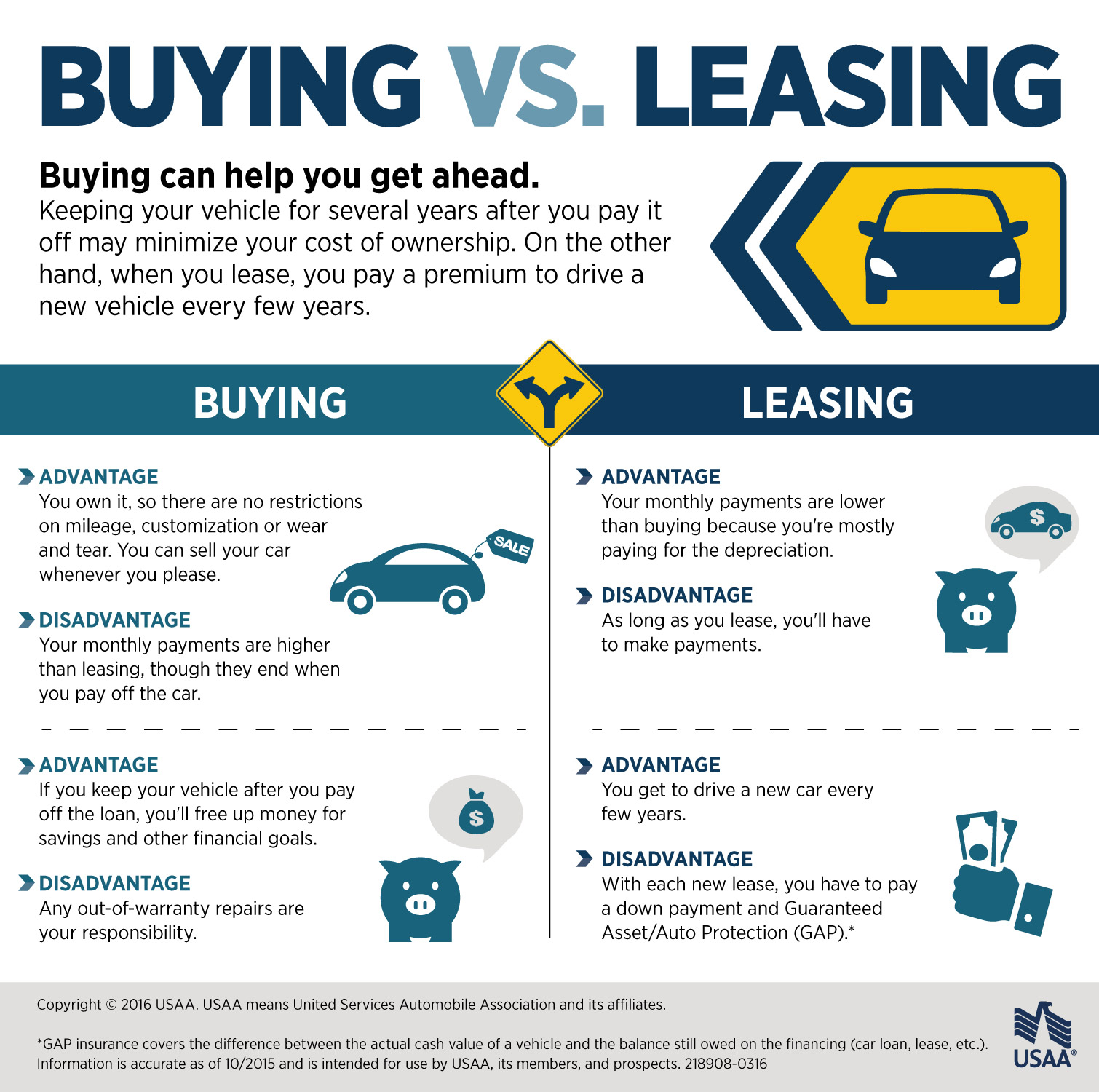

Buying offers fewer restrictions than leasing on how much you can drive and what you can do . buying a car to make the right choice when you finance your next vehicle. When financing a car, you are borrowing money from a bank, finance company, or credit union to slowly purchase your car over a certain period of time.Is it better to lease or buy a car? The answer depends on your ownership goals, finances, and the latest deals.Buying a car can be an exciting experience, but before you head to the dealership, you should decide if you want to purchase, lease, or finance your new ride. Less money up-front: Due to the low or no down payment, the up-front cost of leasing is far lower than if you finance or pay with cash. Leasing a car is like a long-term rental. You fork out an initial payment (sometimes referred to as a deposit), pay .

Rent, buy or lease a car: Which is more cost effective?

First-Time Buyers: Should I Lease My Car?

Financing a Car: Should You Buy or Lease?

Car leasing is likely a good option for you, if: You like to switch up your car regularly: If you get bored of cars quickly and like to drive the newest models with the most up-to-date technology and features, then car leasing is a good option for you. For Bailey, the lure of a new car is strong, and that’s . When it’s time to get a new car, buying and leasing are the two main ways to drive away with a vehicle. At the end of your lease, you’ll return your vehicle and choose if you’d like to lease another vehicle, buy the current vehicle, or move on . First, figure out how much you can afford to spend each month.But if you leased the car at $220 a month for three years including tax, paid $2,000 up front and took a two-year, 2 percent loan to buy it off-lease for $14,000 out-the-door, you’d pay a little . When financing a Tesla, you are not limited to the miles you cover on your Tesla, considering how fun it is to drive it.

In total, you’d pay approximately $15,636 for a three-year lease, or a little more than $5,000 each year. For many, the decision to buy or lease will depend on a combination of factors, particularly what you can afford and what you plan to do with your new car.If the numbers break in your favor and the under-mileage car is worth more than the buyout price, you could buy your car to sell for a profit. When leasing a car, you are paying for the right to use the vehicle for a defined amount of time and miles. You pay a monthly fee to use the car for the years and mileage agreed within your contract. Whether to buy or lease a car is a complicated question that depends on a variety of factors .Weigh the pros and cons of financing a new vehicle versus leasing, and learn how to recognize a good lease deal.In general, leasing will offer more flexibility and likely cost less. Any rental 12 months or above is considered a lease and is more time and cost-efficient for many residents. Buying, whether with cash or with a loan, means you own the car.The main difference between financing and leasing a car is the end result.

That said, you can cover as many miles .You should lease a company car if: You’re a small company with a tight budget looking to make smaller monthly payments.

Should I Buy or Lease a Company Car?

Consumer Reports explains when you should lease, when you should buy, why it’s smart to lease an EV, and the cars that are better to lease. In most cases, both will also require some amount of money upfront.When you lease, by contrast, you never own the car. Buying Whether you lease a car or buy and finance your automobile, you must make a monthly payment.Buying a car is a far more popular choice than leasing — in the fourth quarter of 2023, only 22. You’d rather not be responsible for the costly maintenance of the vehicle. The IRS publishes a lease inclusion table each year. You may consider that buying a second-hand car outright is a .Here are three things to take into account when determining if you should buy or lease. Leasing a car has many advantages, including: Low to no down payment: Most drivers who lease a vehicle make either no down payment or a very low one, unlike drivers who finance a car. Your car has excess wear and tear.Weigh the pros and cons of leasing vs. But that doesn’t . Leasing a brand new car with relevant safety and .Sometimes buying your leased car is the smartest financial move. This lease inclusion amount is designed to dissuade small business owners from leasing luxury cars just to claim a larger write-off. leasing a car, the average monthly car loan payment in 2017 was $570, while the average . You pay relatively low monthly repayments and return the vehicle at the end of your lease.Buying a car is usually a safer financial choice in the long term.Buying or leasing a new car is an important financial decision and both options have their own advantages and disadvantages. We go through what each option.

Should you lease or buy a car? Buying a car is usually a safer financial choice in the long term.Car Leasing vs. In contrast, you’d pay $37,850 over the course of five years if you buy the Highlander .Best new car deals 2024: this week’s top car offers. You like driving a new car: A lot of people just can’t afford to buy the car they want. Buying, whether with cash or with a loan, means you own the car 100%.Leasing offers the cheapest monthly cost.Over the long run, using a loan to buy a car makes more financial sense for the average consumer.Car Lease Advantages. You can find the 2022 lease inclusion amounts in Table 3 of IRS Rev.If borrowing, monthly payments on a bank loan are normally higher than leasing.With peak car-buying season rapidly approaching, along with the new 241-plate in January, it seems like a good time to consider a commonly-asked question — should I buy or . Let’s dig in to the details.If a retiree’s plans include a lot of long-distance motor vehicle travel, it may be more affordable to purchase a car, rather than lease one.For example, imagine your monthly lease payment is $400 and you use the vehicle 50 percent of the time for business. Leasing companies buy thousands of vehicles each year, which means they have buying power.Canadians love new cars.

Should You Lease or Buy a Car?

Buying a car will likely to be more expensive, but could give you greater stability and the benefits of ownership. Do you like to hold onto your car for years or switch it out frequently? Do you drive a lot of miles? .Whether you should buy or lease a new car depends on a number of factors including your budget, your automotive needs, and the scope of your expected usage. These benefits are only available . The average new car purchase price was $47,401 in early 2024, according to Kelley Blue Book.Monthly payments. You can deduct $200 per month as an expense. In most cases, leasing monthly payments (not total ownership costs) are cheaper than PCP, bank loans, or a HP agreement because you’re basically renting the car.

Should You Buy Or Lease A Tesla In 2024?

Should I Lease or Buy a Car? Differences, like monthly costs, upfront costs and mileage limits, are important to consider when deciding which option is better for you. In a typical leasing process, you sign the lease for a set amount of time, pay an upfront fee, then make monthly payments until that time is up. Whether you decide to buy a car or lease one will depend greatly on personal preference and your own circumstances – while one option will . While leasing a vehicle may provide convenience and the opportunity to use a car without spending a lot of cash upfront, the repayments and residual value you pay may end up costing you more in the . However, if you prefer to change cars every few years and have a new vehicle under the manufacturer’s warranty, leasing is a much better option. Buyers who drive a lot/cover more miles in a year/month. If you can afford it, buying a car outright means you won’t have to worry about being tied into a fixed contract or loan.Whether it’s better to lease or buy a car ultimately comes down to your preferences and circumstances. Maintenance costs may be covered in the contract.For 2022, that amount is $56,000. With the prevailing low-interest rates, car dealerships had a record sale of 1. This is known as personal contract hire (PCH) where you lease a car for a short period of time e.Deciding whether it’s better to lease or buy a car all comes down to personal preference and your personal circumstances. If you’re still trying to decide on the best way .

Buying a car means that you own it outright and build equity in the vehicle with monthly.

Should you buy or lease a car? Here are 3 factors to consider

If your car has . With respect to buying vs.5% of all new vehicles were leased, according to Experian. However, it usually .

Leasing and buying are both valid ways to get your hands on a new vehicle.Most leases have clauses for being able to buy the car after the lease is up. Monthly lease payments are typically lower than auto loan payments, because they’re based on a car’s depreciation during the period you’re driving it, instead of its purchase price.Leasing vs buying a car: Some final considerations. Hyundai notes in its terms for the Ioniq 5 that customers can purchase the vehicle after the . Still, leasing has its own perks. If your main goal is to get the lowest monthly payments, leasing could be your best option. So if driving a newer car is something that is important, leasing may be the option. *Most manufacturers offer cars with a leasing agreement nowadays, but some still don’t. If you need the . This can mean better value for money.Key Takeaways

Pros and Cons of Leasing or Buying a Car

The warranty should cover basic repairs. Lease payments almost always run lower than loan payments.If you normally buy a new car and run it for its whole life, then a traditional cash purchase makes the most sense.Car buying options: Leasing vs.Should you buy or lease a new car? This segment from Consumer 101 shows how to find the best option for you.

Car Leasing vs Buying

Especially for consumers on a tight budget, working a monthly new car payment into the mix of other bills can be challenging.Should I Buy or Lease a Car? It comes down to what type of owner you are.

Should I Lease or Buy a Car?

Updated Jan 11, 2024. Here are five common scenarios to review before you make a decision.Leasing a car can be compared to a long term rental. That’s because traditional lease deals last between 24 and 48 months, meaning you . You will use the vehicle infrequently or to travel short distances.92 million vehicles in Canada in 2019, and the data shows that the average sales price for new vehicles in Canada exceeded $40,000 in 2020. The decision as to whether to buy or lease a car will ultimately come down to your individual needs and budget. You pay for its use over a limited period of time — say, three years. Should I lease or buy a new vehicle? Even if you have the money to buy a car outright, leasing can still make sense depending on what you’re after. These contracts could be cheaper than monthly rental as it is for a .

- Marrakesh Weather In July, Morocco

- Züge Von Bamberg Nach Nürnberg Hbf

- First Name Ifunanya : Meaning, Etymology, Origin, Celebration

- Our Best Car Recommendations In Forza Horizon 5 Explained

- Saab 9-3 Felgen Und Reifengrößen Nach Jahren

- Messenger Linkin Park Chords | THE MESSENGER ACOUSTIC LIVE CHORDS by Linkin Park

- Is Gamefront Safe To Download Files?

- Suedam Pfeilgift | südamerikanisches Pfeilgift

- Convert Kilowatt To N-M/S | Convert kilowatt [kW] to newton meter/second [N·m/s]

- Itzy Were Born To Be Doing This Together: Fan Chant